What is Amibroker and How Does it Work?

Amibroker is a consumer trading software package for technical analysis, charting and backtesting. It is a trading software platform that is designed to help traders analyze market trends, test trading strategies, and optimize their trading systems. It is popular among both professional traders and individual investors and is probably best known for its advanced charting capabilities, powerful and fast backtesting features, and user-friendly interface. Amibroker is a desktop application that you install on your PC rather than cloud-based software.

Amibroker is a Windows-based software program that runs on your computer. It is used to analyze and trade financial markets, including stocks, futures, options, and forex. It allows you to create custom charting and analysis tools using its proprietary programming language called Amibroker Formula Language (AFL). You can use these tools to identify trading opportunities, backtest your trading ideas, and optimize your trades for maximum profitability.

In addition to its powerful analysis tools, Amibroker also offers a range of features that help traders manage their portfolios and execute trades such as its built-in portfolio manager that allows you to track your positions and manage your risk.

Overall, Amibroker is a powerful and versatile trading platform that is suitable for both experienced traders and those just starting out. It offers a wide range of features and capabilities that can help traders analyze markets, test and optimize trading strategies, and execute trades with confidence.

Primary functions and capabilities of Amibroker

Amibroker is a comprehensive trading software platform that offers a range of functions and capabilities to help traders analyze markets, test and optimize trading strategies, and execute trades. Some of the primary functions and capabilities of Amibroker include: Charting, Scanning, Backtesting, Optimization, Signal Generation and Walk Forward Analysis.

Charting in Amibroker

One of the key features of Amibroker for discretionary trading is its advanced charting capabilities. It offers a range of customizable charting tools, including line charts, bar charts, candlestick charts, and point and figure charts. You can use these charts to visualize market data and identify trends, patterns, and trading opportunities. It is also simple to overlay technical analysis indicators on price charts or plot indicators above/below the price chart through Amibroker’s ‘drag and drop’ interface.

In Amibroker charts it is possible to select a range of timeframes. Intraday traders can configure custom time intervals in addition to the standard hourly charts. Positional trading is made easy with daily, weekly and monthly charts at the click of a button. These same timeframes can also be used in the analysis window during backtesting.

In addition to its standard charting tools, Amibroker also offers a range of advanced charting features for discretionary trading, such as:

- Overlays: You can overlay multiple chart studies or indicators on a single chart to get a more detailed view of market trends and patterns.

- Custom indicators: You can create custom indicators using Amibroker Formula Language (AFL) or import pre-built indicators from the Amibroker community.

- Drawing tools: You can use a range of drawing tools, such as trend lines, Fibonacci retracements, and Gann lines, to analyze market trends and patterns.

- Chart types: Surprisingly the chart types that Amibroker can display are limited to line charts, traditional bar charts and candlestick charts. It cannot do complex chart types like point and figure or Renko charts (although Ranko charts can be programmed in Amibroker)

Overall, the charting features of Amibroker are comprehensive and flexible, allowing you to create custom charts and analysis tools that suit your specific trading needs.

Finding Patterns And Signals With The Amibroker Scan Function

In addition to its charting capabilities, Amibroker Scan also offers powerful tools that allow you to quickly and easily identify trading opportunities. You can use these tools to scan for specific patterns and signals in the market, such as breakouts, reversals, and trend changes.

Amibroker scan functionality allows you to create custom scans using its proprietary Amibroker Formula Language (AFL). You can use these scans to search for specific patterns and signals in real time, or you can save them and run them at a later time.

Using Amibroker Backtesting To Validate Trading System Ideas

One of the most important capabilities is Amibroker backtesting. This gives you the ability to backtest trading systems, determine how profitable they are and optimize/improve trading system performance. Amibroker backtesting is a true portfolio backtest which is able to simulate the performance of a trading system that manages a portfolio of positions and calculate position size and allocates capital correctly between trades just as you would in real-time trading.

Amibroker backtesting allows you to test trading algorithms against historical market data to see how they would have performed in the past. This can help you determine the viability and profitability of your trading algorithms before risking real money on them. Of course, past performance is not a guarantee of future profitability, however when done correctly (as taught in The Trader Success System), backtesting gives a high degree of confidence in your trading strategy’s performance.

You can use this backtesting engine to test your trading strategies on different markets, timeframes, and historical data sets. You can also customize all of the backtesting settings, such as trade sizes, position sizing, position score (trade ranking), entry/exit prices, stop loss levels and many more, to see how they affect the performance of your system.

In addition to its backtesting capabilities, Amibroker also offers a range of performance statistics and graphical outputs that allow you to evaluate the results of your backtests. These tools include equity curves, trade statistics, and risk analysis reports, which can help you understand the performance of your system and identify areas for improvement. The video below demonstrates how to use the Amibroker backtest report to evaluate trading system profitability:

The performance metrics from an Amibroker backtest are very thorough as you can see from the image below, and if you would like additional performance metrics these can be added by coding them in Amibroker AFL.

In addition to the Amibroker backtest performance statistics you also get graphical illustrations of the performance which include:

- Portfolio equity curve

- Underwater equity profile (Drawdown)

- Monthly profit table

- Profit distribution

- Max adverse excursion

- Max favourable excursion

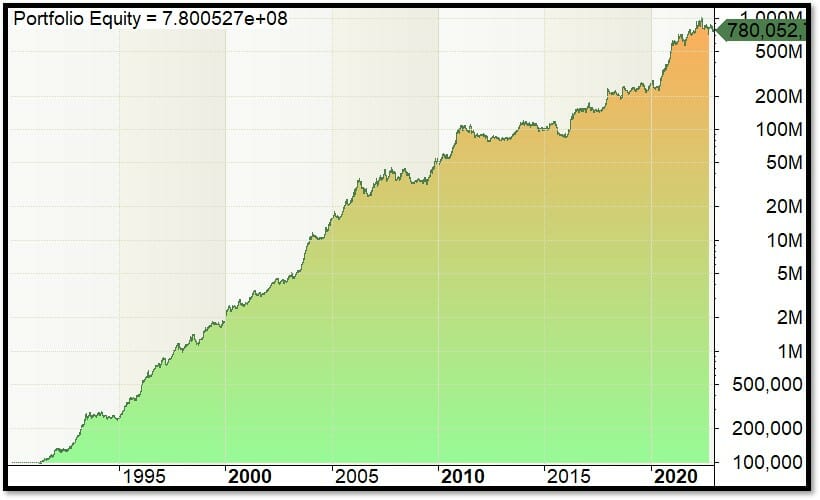

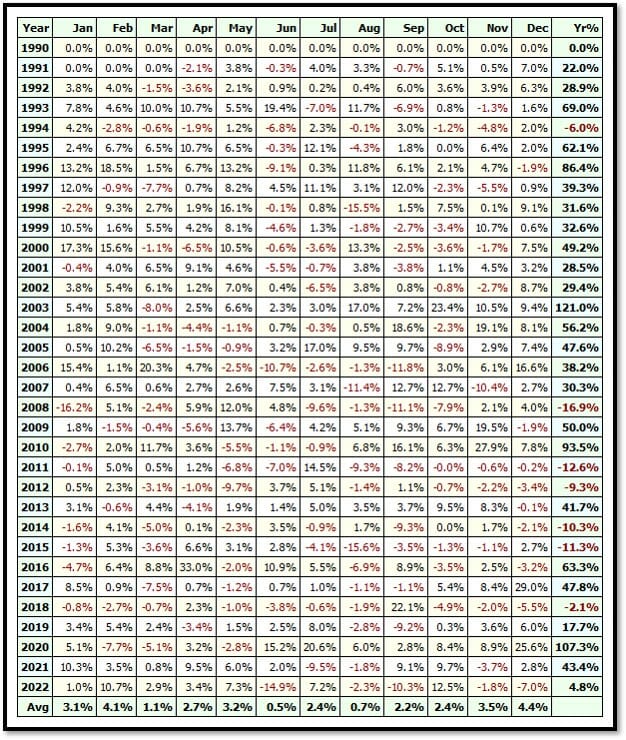

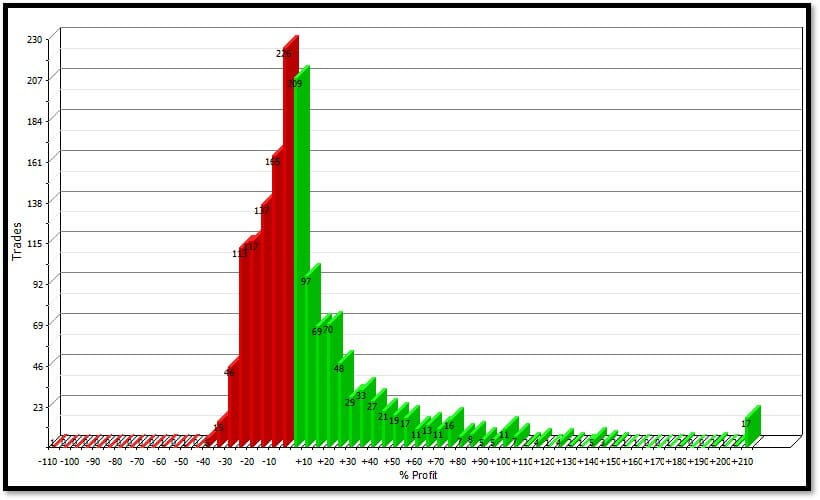

The images below are an example of each from a trading system for the Canadian market called the High Roller that is included in The Trader Success System…

Portfolio Equity Curve:

Underwater Equity Profile (Drawdown):

Monthly Profit Table:

Profit Distribution:

Max Adverse Excursion / Max Favourable Excursion:

Optimizing trading systems in Amibroker

Once you have backtested a trading system idea and identified areas for improvement, Amibroker’s optimization tools can help you fine-tune your system to achieve better results. Optimization involves adjusting various parameters of your trading system to find the optimal combination that results in the best performance.

Amibroker has a built-in optimization engine that allows you to optimize your trading systems based on various performance metrics, such as net profit, compound annual return, drawdown, CAR/MDD, risk-adjusted return or any other performance metrics from the backtest report. You can use this engine to explore different parameter combinations and see how they affect the performance of your system.

The video below (and this blog post on Amibroker Optimization) demonstrate how to optimize a trading system in Amibroker:

One of the best things about Amibroker is the power and speed of the backtesting software. Optimization is extremely fast and you can quickly evaluate the performance of your trading strategy over a wide range of parameter values.

In addition to its optimization capabilities, Amibroker also offers a range of analysis tools that can help you understand the results of your optimization runs. These tools include trade statistics, risk analysis reports, and 3D optimization charts, which can help you visualize the performance of different parameter combinations and identify the optimal settings for your system.

For example, the image below shows a 3D Optimization chart from an Amibroker optimization which allows you to see the interaction between two parameters when you optimize them simultaneously:

Signal generation in Amibroker

Amibroker also offers a range of signal generation tools that can help you identify trading opportunities and execute trades with confidence. These tools include alerts, which can notify you when a particular market condition or signal is triggered, scans to find your desired conditions, explorations to find more complex setups, and the trading system backtest, which can be used to generate the next day’s trades.

My preference for signal generation for EOD trading systems is to use the backtest because this insures we adhere to the timeless system trader wisdom:

Test What You Trade

AND

Trade What You Test

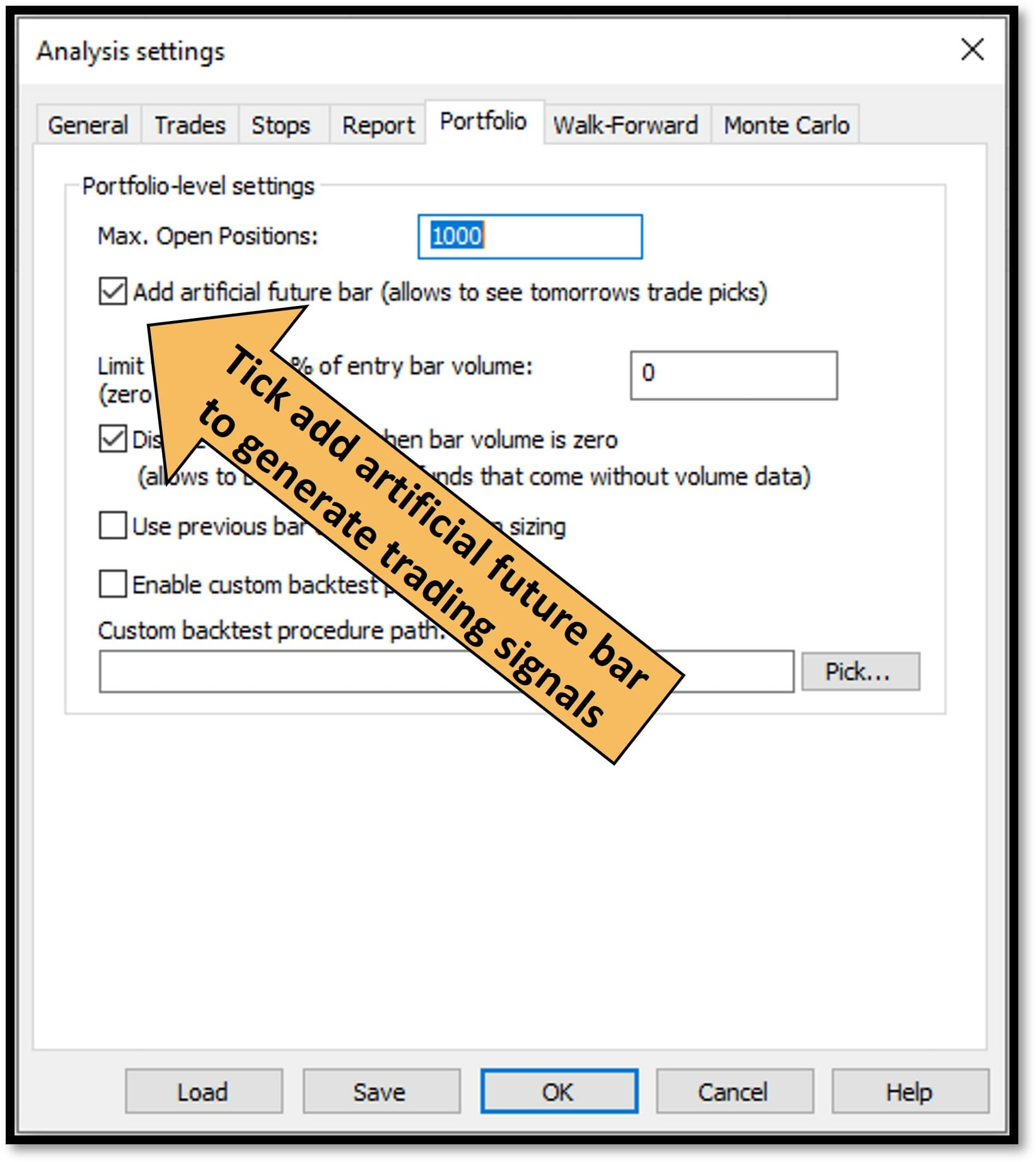

In order to generate trading signals using the backtest in Amibroker you need to “Enable Artificial Future Bar” in the analysis settings as illustrated below:

Once you have ticked the add artificial future bar to see tomorrow’s trade picks, run the backtest with a future date and you will see the new trades at the bottom of the trade log that you need to take as signals (both entries and exits).

You can use Amibroker’s alert system to create custom alerts based on various market conditions, such as price movements, indicator crossings, and chart patterns. These alerts can be triggered in real-time or on a scheduled basis, and can be configured to send notifications via email, SMS, or pop-up window.

Overall, Amibroker’s signal generation tools are powerful and flexible, allowing you to create custom alerts and trading systems that suit your specific trading needs.

Which Markets Can You Analyze With Amibroker?

Data vendors that can be easily integrated with Amibroker include:

- Norgate Data (For each US Stock Exchange, Australian Stock Exchange, Toronto Stock Exchange, Futures & Forex Currency Pairs)

- Metastock Data (For any major or minor stock exchange globally)

- IQ Feed

- eSignal

Amibroker also comes with a DDE Universal Data Plugin and an ODBC/SQL Universal Data plugin. Between these plugins, it is possible to get data from just about any financial market globally into Amibroker for analysis. This includes stocks, futures, mutual funds, forex and cryptocurrency markets.

It is also possible to use data for crypto currencies by importing CSV format data using the import wizard. I have successfully used crypto currency data from Brave New Coin, Binance, Kucoin and Kraken in Amibroker using this method.

For Amibroker users wanting to trade crypto currencies, our trading course called The Crypto Success System includes a custom-built data downloader that automatically downloads and imports crypto prices and full historical data from Binance, Kucoin and Kraken into Amibroker.

Advantages and disadvantages of using Amibroker for technical analysis and backtesting

Amibroker is a powerful and versatile trading platform that offers a range of advantages for traders who use it for technical analysis and as a backtesting platform. Some of the key advantages of using Amibroker include:

- Advanced charting capabilities: Amibroker offers a range of advanced charting tools that allow you to visualize market trends and patterns in great detail. You can create custom charts and indicators using its proprietary Amibroker Formula Language (AFL), or import pre-built indicators from the Amibroker community.

- Powerful scanning tools: Amibroker’s scanning tools allow you to quickly and easily identify trading opportunities in the market. You can create custom scans using AFL or use its built-in scanner to search for specific patterns and signals in real time.

- Comprehensive backtesting engine: Amibroker has a built-in portfolio-level backtesting engine that allows you to test your trading system ideas against historical market data. You can customize various backtesting settings and use its analysis tools to evaluate your back-test results.

- Optimization capabilities: Amibroker’s optimization tools allow you to fine-tune your trading systems to achieve better results. You can explore different parameter combinations and use its analysis tools to understand the results of your optimization runs. Optimization within Amibroker is extremely fast

- Signal generation tools: Amibroker offers a range of signal generation tools, including alerts, scans, explorations and backtesting your trading systems, that can help you identify trading opportunities and execute trades with confidence.

- Free trial available: users can download a free trial from the Amibroker website to try it out and get a feel for the software before purchasing

- Multiple EOD data sources: Many end-of-day data sources can be used with Amibroker including Norgate and Metastock formats which are the two providers I use for stock trading

However, there are also some disadvantages to using Amibroker for technical analysis and backtesting. Some of the key drawbacks of Amibroker include:

- Complexity: Amibroker is a powerful and feature-rich platform, which means it can be complex and overwhelming for beginners. It takes time and effort to learn how to use its various features and capabilities effectively. Amibroker formula language is a bespoke language and while not complex (as far as coding languages go), there is a learning curve.

- Cost: Amibroker is a paid software platform, which means you will have to purchase a license in order to use it. While it is outstanding value considering the features it offers, a paid version is required.

- Limited real-time data: While Amibroker has real-time data feed integrations with various exchanges, the quality and availability of this data can vary. Some traders have reported issues with data lags or gaps, which can impact the accuracy of their analysis and trades.

Overall, the advantages and disadvantages of using Amibroker for technical analysis and backtesting will depend on your specific trading needs and goals. It is a powerful and feature-rich platform that offers a range of capabilities to help traders analyze markets, test and optimize trading strategies, and execute trades with confidence. However, it can be complex and costly, and may not be suitable for all traders.

Limitations of Amibroker: Mostly NOT Showstoppers

There are a number of limitations of Amibroker which are worth noting just in case these are important to you:

- Single System Backtesting: While the backtesting platform in Amibroker is excellent for testing single instrument systems and portfolio systems, it is not capable of backtesting a portfolio of trading systems. For this, you will need Realtest or TradingBlox.

- AFL Coding Language: Amibroker has its own native coding language called Amibroker Formula Language (AFL for short). This requires some learning but is fairly easy to get a basic understanding of AFL and use it for simplified trading strategies. However, for some complex trading strategies, a custom backtest is required which is much more difficult to code.

- Market Depth: There is no way to view market depth within Amibroker. When I want to see the market depth for a stock I am analysing I open Interactive Brokers and get it from there.

- Clunky Automation: I have read many complaints about the automated trading capabilities that are built into Amibroker. I think this is a real weakness as it is only really capable of doing very simple automation. For my own automated trading, I have opted for a custom-built API that manages Amibroker and communicates with Interactive Brokers to place orders and manage trades.

- Automated Trading Instructions: The documentation that is included in the Amibroker User Guide for automation is complex and assumes a high degree of coding knowledge. These automated trading instructions are simply not accessible to the general user and so native automation is basically out of reach for all but the most avid programmers.

- Separate Databases By Source: The database folder allows you to have multiple databases, each with different database settings which is great, however, each database can only hold instruments from a single data source or format. At times I have wanted to backtest trading strategies using tickers from multiple stock markets around the world (that I get from Metastock data) alongside forex and futures data (that I get from Norgate) and Cryptocurrency data (that I get via CSV downloads from the exchanges). However, because each data source has its own database folder and database settings these cannot be mixed. This means that if you want to backtest a system across a group of instruments, all of those instruments must come from the same data source.

- Chart Pattern Detection: there is minimal chart pattern detection capability built into Amibroker. If you are looking for automated support and resistance lines, trend lines, or scans to find ascending triangles or head and shoulders patterns you will be sorely disappointed. Chart pattern detection is possible provided you can code your chart patterns into an AFL exploration or backtest… but this is no easy task.

How to Get Started with Amibroker: A Quick-Start Guide

If you want to take the slow route 😉 and try to learn yourself, here are a few steps to get you started:

- Purchase a license: First, you will need to purchase a license for Amibroker in order to use the software. You can purchase a license online from the Amibroker website. I use the Professional version.

- Install the software: Once you have purchased a license, you can download the software and install it on your computer. Make sure to follow the installation instructions carefully and ensure that you have the necessary system requirements. It is a native Windows application so just follow the prompts. I recommend you install it in the default location.

- Familiarize yourself with the interface: Amibroker has a user-friendly interface that is organized into various windows and tabs. Take some time to familiarize yourself with the layout and functionality of the different windows and tools.

- Import data: In order to use Amibroker for technical analysis and backtesting, you will need to import market data into the software. You can import data from a variety of sources, including CSV files, text files, and real-time data feeds. My preferred data source for Australian, US and Canadian stocks is Norgate data, for other markets I use Metastock data(these are affiliate links so I will get a small commission if you purchase through them). Amibroker also has a built-in data import wizard that can help you set up and configure other data sources. For instructions on setting upNorgate data in Amibroker click here.

- Create charts: Once you have imported your data, you can use Amibroker’s charting tools to visualize market trends and patterns. You can create custom charts using its various charting options, such as line charts, bar charts, and candlestick charts. You can also add indicators and overlays to your charts to get a more detailed view of market trends and patterns.

- Complete the tutorial in the Amibroker user guide which can be found here. Especially focus on learning basic Amibroker AFL (Amibroker Formula Language) as this is required for backtesting your trading system ideas.

- Backtest trading system ideas: Purchase or find a trading system that you want to test, convert the code to Amibroker AFL and perform your first backtest. This can be tricky to get all of the coding rights and is something I cover extensively in The Trader Success System

- Optimize your trading systems: If you want to improve the performance of your trading systems, you can use Amibroker’s optimization tools to fine-tune your systems. You can explore different parameter combinations and use its analysis tools to understand the results of your optimization runs.

- Generate signals and alerts: I suggest you use the backtest to generate your trading signals as mentioned above (providing your system is a ‘next bar on open’ system). If you are entering using limit orders then you will need to code an exploration to find your signals, which can be easily added to the end of your trading system code.

- Continue learning: As you become more familiar with Amibroker, you can continue to explore its various features and capabilities to discover new ways to analyze markets, test and optimize trading strategies, and execute trades with confidence. There are many resources available to help you learn Amibroker, including the tutorials and blog posts on the Enlightened Stock Trading website I have listed below.

Backtesting with Amibroker

Backtesting is the process of testing a trading system against historical market data to see how it would have performed in the past. It is a valuable tool for traders because it allows them to evaluate the viability and profitability of a particular trading system before risking real money on it. Making informed trading decisions by using backtested trading strategies is a much more reliable approach than most discretionary trading methods.

Amibroker has a built-in backtesting engine that allows you to backtest your trading system ideas with ease. As a backtesting platform, Amibroker is quite strong. Backtesting is extremely fast compared to many of its competitors (Including Tradestation, Metastock, WealthLabs, TradingBlox and Multicharts). The way the Amibroker backtesting software is designed allows it to perform true portfolio backtesting which Tradestation and Metastock cannot do. However, it is limited to backtesting a single system at a time and cannot perform the multi-system backtesting process that is available in RealTest and TradingBlox.

Here is a guide to backtesting with Amibroker:

To backtest a trading system in Amibroker, you will first need to create a trading system using its proprietary Amibroker Formula Language (AFL). This involves writing a set of rules and conditions that define how your system should buy and sell assets based on market conditions.

Here are some steps to follow when coding a trading system in AFL:

- Define your entry and exit rules: First, you will need to define your entry and exit rules, which determine when your system should buy or sell assets. These rules can be based on a variety of factors, such as price movements, indicator values, and chart patterns.

- Set your position sizing and risk management rules: Next, you will need to define your position sizing and risk management rules, which determine how much of your capital to allocate to each trade and how to manage risk. These rules can help you manage your risk and optimize your trades for maximum profitability.

- Set up your backtest parameters: First, you will need to configure your backtest parameters, such as the market data to use, the time frame to test, and the initial capital for your backtest. You can also customize various backtesting settings, such as trade sizes, position sizing, and stop loss levels.

- Configure the analysis settings: Once you have coded your trading system, you can use the analysis window to select the markets and timeframe you wish to test it to see how it performs.

- Run your backtest: Once you have set up your backtest parameters, you can run your backtest by clicking the “Backtest” button in Amibroker. The software will then simulate your trades based on your system rules and the historical market data, and generate a report with the results.

- Evaluate the results: After your backtest is complete, you can use Amibroker’s analysis tools to evaluate the results. These tools include equity curves, trade statistics, and risk analysis reports, which can help you understand the performance of your system and identify areas for improvement. There are detailed instructions on evaluating the performance of your trading system in Amibroker here.

- Optimize your system: If you want to improve the performance of your trading system, you can use Amibroker’s optimization tools to fine-tune your system’s parameters. This involves adjusting various settings, such as trade sizes and stop loss levels, to find the optimal combination that results in the best performance. You can use Amibroker’s analysis tools to understand the results of your optimization runs and identify the optimal settings for your system. Read my blog post explaining the right way to optimize a trading system in Amibroker.

Advanced Amibroker Features and Techniques

Amibroker is a feature-rich trading platform that offers a range of advanced features and techniques to help traders analyze markets, test and optimize trading strategies, and execute trades with confidence. Some of the key advanced features and techniques in Amibroker include Monte Carlo Analysis and Walkforward optimization.

Monte Carlo analysis in Amibroker

Monte Carlo analysis is a statistical method that involves simulating market conditions and evaluating the performance of a trading system under different scenarios. Amibroker’s Monte Carlo analysis tools allow you to perform Monte Carlo simulations on your trading systems and evaluate the robustness of your system under different market conditions.

For example, the image below is the Monte Carlo compound annual return from my TSX High Roller Trading system that is included in The Trader Success System. This curve is generated by simulating 1000 equity curves by reshuffling (random selection with replacement) the daily percentage change in the backtested equity curve. This output shows that 50% of the runs had an annual return of 32% pa or better!

The Amibroker Backtest gives you Monte Carlo outputs like this for final equity, annual return, drawdown and lowest equity.

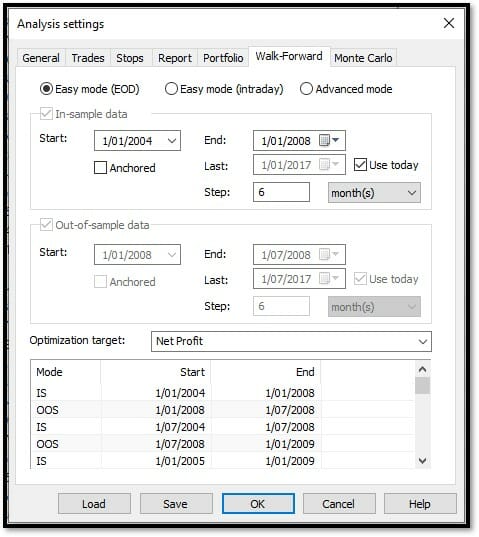

Walkforward optimization in Amibroker

Walkforward optimization is an advanced optimization technique (invented by Robert Pardo and explained in detail in his fantastic book Evaluation and Optimization of Trading Strategies). Walkforward optimization involves optimizing a trading system on a rolling basis, rather than on a fixed time period. This allows you to take into account changing market conditions and optimize your system for the current market environment. Amibroker’s walkforward optimization tools allow you to perform walkforward optimization on your trading systems and evaluate their performance over time.

Walkforward optimization is beyond the scope of this blog post, however, members of The Trader Success System receive comprehensive training on how to employ this powerful backtesting technique to design their trading systems.

Overall, these advanced features and techniques can help you get a deeper understanding of your trading systems and improve their performance.

Amibroker vs. Other Technical Analysis Tools

Amibroker is a popular technical analysis platform that offers a wide range of features and capabilities to help traders analyze markets, test and optimize trading strategies, and execute trades with confidence. However, it is not the only technical analysis tool available, and traders may want to consider other options as well.

Here is a brief comparison of Amibroker with some other popular technical analysis tools:

Amibroker vs Tradestation:

Tradestation is another popular technical analysis platform that offers a range of charting, analysis, and trading tools. It is known for its powerful charting capabilities, automation and simple coding language called EasyLanguage. Tradestation has substantially better automation capabilities built-in compared to Amibroker, but that is where the advantages end.

Tradestation limits users to the markets they support as you must use their own data, and Tradestation is a 32 bit platform that is dramatically slower than Amibroker for backtesting and optimization. The Tradestation backtester is also a single instrument backtester compared to Amibroker’s portfolio backtester. This gives Amibroker a distinct advantage as you can develop and backtest a much wider range of trading systems using Amibroker compared to Tradestation.

However, as an algorithmic trading software designed with automation in mind, Tradestation is much better at automation than Amibroker because it is built into the platform. So while Amibroker has many advantages over Tradestation, algorithmic traders are likely to prefer Tradestation because of its more streamlined automation capabilities.

Amibroker vs Metastock:

Metastock is a technical analysis platform and charting software that offers a range of charting, analysis, and trading tools. It is known for its extensive market data coverage and powerful charting functionality, screening, and filtering tools. Metastock is more powerful for charting and discretionary technical analysis compared to Amibroker, however, Metastock’s is a single instrument back tester and so is limited in capabilities compared to Amibroker. Metastock is also more expensive than Amibroker.

If you want real-time charting capabilities then Metastock is more feature rich than Amibroker. So if you are after charting and discretionary technical analysis then Metastock is a better pick, but if you want to eliminate the discretion, and reduce the time your trading takes with algorithmic trading strategies then Amibroker is the superior choice.

Amibroker vs TradingView:

TradingView is a web-based technical analysis platform that offers a range of charting, analysis, and trading tools. It is very well known amongst technical traders and has excellent charting functionality. TradingView users also get access to a huge range of markets for a very small investment.

This is all great for charting and discretionary technical analysis; however, for systematic trading, TradingView is vastly inferior to Amibroker.

Amibroker vs Realtest:

Realtest is a relatively new backtesting platform developed by Market Wizard Marsten Parker. Compared to Amibroker, Realtest is much easier to program, backtests faster and is able to perform multi-system backtests and generate orders across multiple systems in a single step. This is a significant advancement compared to Amibroker. Unfortunately, Realtest has more rudimentary charting functionality and technical analysis capabilities as it is designed primarily for algorithmic trading strategies.

Overall Realtest is worth a look and is competitive with Amibroker, though ultimately many traders may use multiple platforms depending on their need (I use Amibroker and Realtest).

How to learn Amibroker: Tips and Strategies to shorten your learning curve

If you are new to Amibroker and want to learn how to use it effectively, here are some tips and strategies to help shorten your learning curve:

Start with the basics: If you are new to Amibroker, it is important to start with the basics and learn how to navigate the software, import and organize your data, and create charts.

Practice and experiment: The best way to learn Amibroker is to practice using it and experiment with its various features and tools. You can use sample data to try out different charting, analysis, and trading techniques and see how they work in different market conditions. This will help you get a feel for the software and understand how it can be used to analyze markets and trade with confidence. Download the free Amibroker resources from Enlightened Stock Trading here to get access to a code library and trading system template to save you some time developing your first system.

Take advantage of online resources: There are many tutorials and articles available online, but if you start with the articles listed below from Enlightened Stock Trading you will find they are much better quality than most online video tutorials about Amibroker.

Purchasing a training course to shorten your learning curve: If you want more structured learning, you may want to consider purchasing a training course and a community of Amibroker users. The Trader Success System gives you everything you need to master Amibroker, Systematic Trading and Trading Psychology. You even get a diversified portfolio of trading systems for a variety of markets, strategies and timeframes all precoded in Amibroker AFL!

Overall, learning Amibroker can be a challenging process, but with the right approach and resources, you can shorten your learning curve and become proficient with the software more quickly.

Links to Amibroker Tutorials and articles on Enlightened Stock Trading

- The Ultimate Free Amibroker Tutorial Guide

- How to Set Up Norgate Data with Amibroker

- How To Set Up Your Amibroker Trading Software & Metastock EOD Data

- Why You Have to Set the Add Artificial Future Bar in Amibroker to Generate Your Signals from The Backtest

- Position Sizing In Amibroker With SetPositionSize Function

- Backtest Stop Loss Orders with Amibroker

- How to use the Amibroker backtest report for your trading system

- Using the Amibroker backtest and optimization Reports to improve your trading systems

- Optimizing an Amibroker trading system the right way

- Visualise Amibroker Optimization Results – 3D Optimization Chart

- How to deal with outlier trades in Amibroker Backtesting

- How does Amibroker measure the maximum historical drawdown of a trading system in the backtest?

- How to export the portfolio equity curve from Amibroker to Excel

- Amibroker Tips: Stop The Price Data Window Disappearing

- Amibroker Tutorial – Using TimeframeSet & TimeframeRestore to apply Weekly Indicators in a Daily Trading System

- How to show current trade arrows on an Amibroker chart

- How To Backtest a Single Instrument System on Multiple Tickers Simultaneously Using Amibroker

- How To Think About Your Base Currency When Position Sizing in Amibroker

These tutorials and articles provide valuable information and insights on how to use Amibroker effectively for technical analysis and backtesting.

Other Amibroker resources to help you

- Amibroker’s official website

- Amibroker’s official documentation and user guide

- Amibroker’s official forum (WARNING: This is not the nicest place on the internet. Users are generally rude and abrasive as well as condescending and disparaging towards new users. If you want the most friendly and supportive Amibroker community online then join The Trader Success System)

These resources provide valuable information and support for Amibroker users, including documentation, tutorials, tips, and insights on how to use the software effectively.

Books on Amibroker and Amibroker code

- ‘Introduction to AmiBroker: Advanced Technical Analysis Software for Charting and Trading System Development’ by Howard B. Bandy

- ‘Foundations of Trading: Developing Profitable Trading Systems using Scientific Techniques’ by Howard B. Bandy

- ‘The Ultimate Algorithmic Trading System Toolbox’ by George A. Pruitt

- ‘Beginner’s Guide To AmiBroker AFL Programming’ by AJAN K K

- ‘Mean Reversion Trading Systems, Practical Methods for Swing Trading’ by Howard B. Bandy

- ‘Modeling Trading System Performance: Monte Carlo Simulation, Position Sizing, Risk Management, and Statistics’ by Howard B. Bandy

- ‘Quantitative Trading Systems: Practical Methods for Design, Testing, and Validation’ by Howard B. Bandy

These books provide valuable information and guidance on how to use Amibroker for technical analysis and backtesting, including tips, tricks, and insights on how to use the software effectively.

Conclusion: Is Amibroker Right for You?

Amibroker is a powerful and feature-rich technical analysis platform that offers a range of tools and capabilities to help traders analyze markets, test and optimize trading strategies, and execute trades with confidence. It is a versatile and customizable platform that is suitable for a wide range of traders, from beginners to advanced users.

If you are interested in technical analysis and backtesting, and you want a platform that is easy to use and offers a wide range of capabilities, Amibroker may be the right choice for you.

If you are already using Amibroker and want to shorten your learning curve and get access to precise step-by-step training on how to develop, backtest, optimize and implement profitable trading systems then click here to learn more about The Trader Success System – The most comprehensive systematic trader mentoring program on the market.

Frequently Asked Questions about Amibroker

Is AmiBroker free?

AmiBroker isn’t free, but it does offer a fully functional free trial that you can download from their website. This trial is a great way to explore the platform and see if it suits your needs before committing to a purchase.

The paid version of AmiBroker is excellent value for money considering its features, but it does cost a few hundred dollars. If you’re just starting out, I’d recommend focusing on learning how trading systems work and how to backtest first, rather than jumping straight into buying the software. Programs like the System Trader Launchpad can guide you through the basics and help you get comfortable with systematic trading before you invest in tools like AmiBroker.

How much does AmiBroker cost?

AmiBroker has three main editions with different price points:

- Standard Edition: $279

- Professional Edition: $339

- Ultimate Pack Pro: $449

For most traders, I recommend the Professional Edition. It includes features like Maximum Adverse Excursion (MAE) and Maximum Favorable Excursion (MFE) statistics, which are invaluable for analyzing the efficiency of your entries and exits. It also supports 64-bit processing, which significantly speeds up backtesting and explorations.

If you’re just starting out, you can download a fully functional free trial from the AmiBroker website to explore its features before committing to a purchase

What is the difference between AmiBroker and Tradingview?

The difference between AmiBroker and TradingView boils down to their focus and capabilities:

- Backtesting and Systematic Trading: AmiBroker is vastly superior for systematic trading and backtesting. It can test trading systems across an entire universe of stocks with decades of data in under a minute, providing detailed performance stats and equity curves. TradingView, on the other hand, can only backtest a single instrument at a time, which makes it far less effective for systematic traders.

- Charting and Discretionary Analysis: TradingView excels in charting and discretionary technical analysis. It’s web-based, user-friendly, and offers excellent charting tools with access to a wide range of markets for a relatively low cost. If you’re focused on drawing lines, adding indicators, and analyzing individual instruments manually, TradingView is a great choice.

- Speed and Data Handling: AmiBroker is lightning-fast for backtesting large datasets, while TradingView’s backtesting engine is much slower and limited in scope. AmiBroker also allows for portfolio-level backtesting, which TradingView cannot do.

- Automation: TradingView is better for automation if you’re using its built-in tools to connect with brokers. AmiBroker’s automation capabilities are clunkier and require more effort to set up.

Ultimately, if you’re serious about systematic trading, AmiBroker is the clear winner. But for charting and discretionary analysis, TradingView is a solid option.

Is AmiBroker fully automated?

AmiBroker can be automated, but it’s not fully automated out of the box. It’s designed to generate trading signals based on your system rules, which you can then manually execute through your broker. However, automation is possible with some additional setup and coding. For example, you can add code to your Amibroker Formula Language (AFL) scripts to generate orders, which can then be sent to your broker using tools like Interactive Brokers’ API or third-party software.

That said, automation introduces complexity. You’ll need to monitor the technology closely – ensuring APIs are functioning, the broker platform is logged in, and everything is running smoothly. For beginners, I always recommend starting with manual execution to build confidence in your system and avoid unnecessary headaches. Once you’re comfortable, you can explore automation to streamline your process.

What computer is best for AmiBroker?

To run AmiBroker effectively, you don’t need a super high-end computer, but there are a few key specs to focus on:

- RAM: The more, the better. Backtesting can be memory-intensive, so having plenty of RAM will make the process faster and less frustrating. If you’re buying a new computer, prioritize this.

- Processor: While not as critical as RAM, a faster processor will help speed up calculations, especially for large datasets.

- Windows OS: AmiBroker is a Windows-based program, so you’ll need a Windows computer. If you’re a Mac user, you’ll need to run Windows on your Mac using Boot Camp, Parallels, or similar software.

- Cloud Option: If you’re considering automation or want to avoid hardware limitations, a Virtual Private Server (VPS) in the cloud might be a better choice. This setup is reliable and ensures your trading systems run smoothly without being tied to your home computer.

You don’t need to overthink this – any modern Windows PC with decent specs will handle AmiBroker well.

What is the cheapest data for AmiBroker?

The cheapest reliable data source for AmiBroker is the MetaStock data feed, which costs $39.95 per month. This subscription gives you access to end-of-day data for ALL STOCKS GLOBALLY. That is literally tens of thousands of stocks across all regions (Americas, Europe, or Asia) for one monthly subscription. It’s excellent value for money because it provides clean, validated data that’s adjusted for stock splits, consolidations, and other corporate actions. This ensures your backtesting results are accurate and trustworthy.

While free data sources like Yahoo Finance exist, they often come with significant issues like bad ticks, unadjusted splits, and inaccuracies. These problems can lead to incorrect backtesting results, which is why I strongly recommend investing in a paid data source like MetaStock. It’s a small price to pay for the confidence and reliability it brings to your trading systems.

If you’re just starting out, you can also explore free trials of data services to test the waters before committing to a subscription.

Which is better Metastock or AmiBroker?

The choice between MetaStock and AmiBroker depends on your trading style and priorities:

- Systematic Trading and Backtesting: AmiBroker is the clear winner here. It allows for portfolio-level backtesting, meaning you can test strategies across multiple stocks simultaneously, and it’s lightning-fast. MetaStock, on the other hand, is limited to single-instrument backtesting, which makes it less suitable for systematic traders.

- Charting and Discretionary Analysis: MetaStock shines in this area. It offers robust charting tools, screening, and filtering capabilities, making it a great choice for discretionary traders who rely on visual analysis and manual decision-making.

- Cost: AmiBroker is more cost-effective. It’s a one-time purchase (plus optional upgrades), whereas MetaStock requires an ongoing subscription, which can add up over time.

- Data Integration: MetaStock has excellent market data coverage and integrates seamlessly with its own data feed. AmiBroker, however, is more flexible – you can use various data providers, including MetaStock’s data, to suit your needs.

If you’re focused on systematic trading and backtesting, AmiBroker is the superior choice. But if you’re more into discretionary trading and need advanced charting tools, MetaStock might be better.

Which coding language used in AmiBroker?

AmiBroker uses its own proprietary coding language called AmiBroker Formula Language (AFL). It’s specifically designed for creating trading systems, backtesting, and analyzing market data. AFL is relatively easy to learn, especially if you’ve worked with spreadsheet formulas before – it’s kind of like a more advanced version of that.

With AFL, you can:

- Write custom indicators and trading systems.

- Perform backtesting and optimization of strategies.

- Generate trading signals and alerts.

If you’re new to coding, don’t worry – it’s very beginner-friendly, and you can build up your skills step by step. Many traders who’ve never coded before have successfully learned AFL and used it to create profitable trading systems.

How do I install AmiBroker?

How do I install AmiBroker?

To install AmiBroker, follow these steps:

- Purchase a License: Head to the AmiBroker website and purchase a license. I recommend the Professional version for its advanced features, but you can start with the Standard version if you’re just getting started.

- Download the Software: After purchasing, download the installation file from the AmiBroker website. If you’re not ready to buy, you can also download the free trial version to explore the platform first.

- Install the Software: Run the installer and follow the prompts. AmiBroker is a native Windows application, so the installation process is straightforward. I recommend installing it in the default location to avoid any issues later.

- Familiarize Yourself with the Interface: Once installed, take some time to explore the layout and tools. AmiBroker has a user-friendly interface, but it’s worth getting comfortable with its various windows and tabs.

- Import Data: To start analyzing and backtesting, you’ll need to import market data. AmiBroker supports various data sources, including CSV files and real-time feeds. If you’re unsure about data providers, I recommend Norgate Data for Australian, US, and Canadian stocks, or MetaStock data for other markets.

How do I create an indicator in AmiBroker?

To create an indicator in AmiBroker, you’ll need to use the AmiBroker Formula Language (AFL). Here’s a step-by-step guide to get you started:

- Open the Formula Editor: In AmiBroker, go to the menu and select Analysis > Formula Editor. This is where you’ll write your AFL code.

Write Your Code: Start by defining the logic for your indicator. For example, if you want to create a simple moving average (SMA), you can use the following code:

Plot(Close, “Close”, colorBlue, styleLine); // Plots the closing price

Plot(MA(Close, 50), “SMA 50”, colorRed, styleLine); // Plots a 50-period SMA

- This code plots the closing price and a 50-period SMA on the chart.

- Save the Indicator: Once you’ve written your code, save it by clicking File > Save As. Save it in the Custom folder under AmiBroker’s Formulas directory for easy access.

- Apply the Indicator: To see your indicator on a chart, open a price chart, right-click, and select Insert Indicator. Choose your saved indicator from the list.

- Test and Refine: Adjust the parameters or add more logic to your code as needed. For example, you can add conditions for buy/sell signals using logical statements like AND or OR.

If you’re new to AFL, but want to learn systematic trading fast, join The Trader Success System to get complete step by step instructions and a collection of 20+ trading strategies coded in Amibroker AFL.

How does AmiBroker work?

AmiBroker is a powerful trading software designed for technical analysis, backtesting, and optimizing trading strategies. Here’s how it works:

- Charting and Analysis: AmiBroker allows you to create custom charts using various types like line, bar, candlestick, and more. You can overlay technical indicators or plot them separately to analyze trends and patterns.

- Backtesting and Optimization: One of its standout features is portfolio-level backtesting, which lets you test trading strategies across multiple stocks simultaneously. You can also optimize strategies by tweaking parameters to find the best-performing combinations.

- Signal Generation: Using its proprietary AmiBroker Formula Language (AFL), you can write rules to generate buy/sell signals. These signals can be used for manual trading or integrated into automated systems with additional setup.

- Data Integration: AmiBroker supports multiple data sources, including Norgate and MetaStock formats. You can import data for end-of-day or real-time analysis, depending on your trading needs.

- Portfolio Management: It includes tools to track your positions, manage risk, and monitor performance, making it a comprehensive platform for systematic traders.

AmiBroker is incredibly versatile but does have a learning curve, especially with AFL. It’s ideal for traders who want to build and test systematic strategies.

How to set up AmiBroker database?

To set up an AmiBroker database, follow these steps:

- Create a New Database:

- Open AmiBroker and go to File > New > Database.

- Name your database and choose a location to save it. Once created, the name cannot be changed.

- Configure Database Settings:

- Go to File > Database Settings.

- Set the Data Source to match the type of data you’re using (e.g., MetaStock, Norgate, or CSV files).

- Disable Local Data Storage if you’re using external data sources like Norgate or MetaStock.

- Set the Number of Bars to a value like 10,000 to ensure sufficient historical data is loaded.

- Link to Data Source:

- Under Database Settings, click Configure and ensure the directory path matches the folder where your data is stored. For example, if you’re using Norgate or MetaStock, point to the exact folder containing the updated data files.

- Verify Data:

- After setup, check if data is loading correctly by opening a chart for a stock you know has data. If no chart appears, double-check the folder path and ensure the data is updated.

- Test the Setup:

- Run a simple backtest or scan to confirm the database is functioning properly.

If you’re using Norgate Data, their plugin simplifies this process significantly.

Hi Adrian,

Thanks for this .

I am making my way through TSS ( having joined pre covid and priorities changed) . Now making my way through through TSS again but do enjoy the summary and interesting blogs that your social system sends . I thought the explore function has the ability to generate signals, however with EOD signals with Norgate do you prefer the method detailed above .

Thanks

Hi Adam,

Yes the explore can generate signals, however this disconnects the signal generation from the backtest which can be a problem. For example in backtest mode regular, the backtest will only take the first buy signal and will ignore any other buy signals until it finds a sell signal… but the explore will just find any bar on which the buy conditions are true. this results in quite different results in real time trading. I prefer to match the backtest, so I use the backtest to generate the signals as much as possible.

Adrian