When you first learn stock trading, drawdown and trading profits are easy to be overly optimistic about. One of my Private Email Coaching Clients recently asked:

“What are reasonable MAR, CAGR and Drawdown % values for a long only,

trend following daily bar trading system over the long term?”

Two quick definitions first:

- MAR: MAR the CAGR divided by the maximum historical drawdown (MDD)

- CAGR: CAGR is short for compound annual growth rate. It is simply the average percentage profit you make each year.

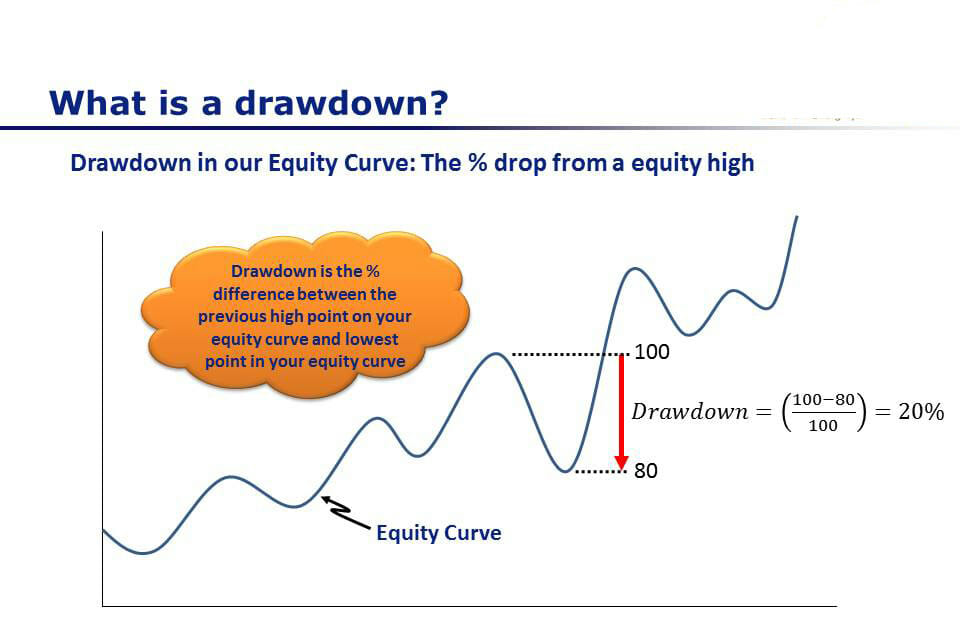

- Drawdown: Is the percentage drop from the previous equity high to the current following low point in the equity curve. (Illustrated below)

Drawdown is the percentage difference between the previous equity high and the subsequent equity low from your stock trading system.

This is a great question which very much illustrates the importance of setting your trading goals up front before you start your trading system development journey.

Determine Your Maximum Drawdown (MDD) First

The first trading goal I like to set is the maximum drawdown because this is the limit at which I am psychologically comfortable to keep trading. Sitting through a 30% decline in your equity is pretty tough for most people (myself included) so this number should be fairly conservative for most people.

When setting the maximum trading drawdown that you are willing to tolerate it is also important to remember that the decline you see in your backtest is probably less than your maximum will be in real life trading. I like to be comfortable with 1.5 x maximum the backtest drawdown, because that is probably what you will face in real time trading at some point.

So if your maximum equity drop before you start to feel really nervous and uncomfortable is 30%, then you should aim for a system with a backtested maximum drawdown of 20% to give you some room to move.

Remember that larger equity declines are exponentially harder to recover from, so keeping your drawdowns low is one of the keys to profitable stock trading.

Aim For A Respectable MAR Ratio

In his outstanding book ‘Way of the turtle’, Curtis Faith presents the performance figures for quite a few trading systems using a diversified basket of futures contracts. Many of these systems have a MAR ratio between the range of 1.0 – 1.3 in backtesting. The MAR level that is classified as ‘good’ is a bit subjective because it really depends on the style of system you are trading.

If you are using a stock trading system and are trading from the long side only, then a MAR of 1.0 would be a pretty good target because there are periods like the Global Financial Crisis and the 2000 bear market where these systems will have pretty significant equity declines. This makes a MAR higher than 1.0 fairly hard to achieve in real life (you can get higher back tests pretty easily if you have curve fitted your parameters too much during your trading system development process, but this is not the way to get good REAL trading results!)

If you are trading long / short on a diversified basket of instruments then you can aim for a slightly higher MAR…but you still need to be wary of curve fitting.

Determine Your Trading Profit Goal Based On Max Drawdown MDD And MAR Target

Now that you have your max drawdown and your MAR target, it is a simple matter to combine the two to get your trading profit target in CAGR (compound annual growth rate) terms.

MAR Ratio = Annual Growth (CAGR %) / Maximum Drawdown (%)

I really prefer to approach the setting of trading goals from the downside first – by setting my maximum equity decline and then calculating what CAGR I should aim for. This is important because it prevents you from becoming too aggressive and optimistic since your focus is fairly and squarely on capital preservation and risk management FIRST…and one of the keys to surviving in this game is preserving your capital by managing risk.

The worst numbers you should consider for MAR / CAGR / Drawdown is pretty hard to answer. Realistically if your returns are half your maximum equity decline (MAR <0.5) then your system is not very good and you should probably keep looking or improving your trading system. I would generally throw a trading system away if I can’t make the MAR better than 0.75 in backtesting UNLESS it is very different from what I am already trading.

Improve Portfolio MAR And Reduce Drawdown By Adding Uncorrelated Trading Systems:

Once you have one trading system up and running with a respectable MAR (say around 1.0 in a backtest), then you can improve your portfolio MAR by adding uncorrelated trading systems or different types of markets (like forex and futures). Just as the illustrative chart below shows – adding uncorrelated trading systems improves MAR and while achieving the same level of return.

Trading system diversification reduces drawdown and improves the smoothness of returns.

This is a far better approach than tweaking the one trading system to improve the MAR because every change you make to your trading system increases the risk that you are just curve fitting to past data.

Adding a second or third system to your portfolio is more about the portfolio MAR than it is the individual system MAR. For example, if you have one stock trading system with a MAR or 1.0 and you build a second stock trading system with a standalone MAR of 0.5, but when you combine the two trading systems into a portfolio you get an overall MAR of 1.75 then you would be VERY EXCITED!

You would probably not use the second trading system on its own, but in the portfolio it is a fantastic addition.

Conclusion About MAR, CAGR and Maximum Drawdown

An outstanding MAR for any long only stock trading system would be anything higher than 1.0 provided you are including data from the last 15-20 years in your backtest. The bear markets that we have had in this time cause the MAR to drop.

If you are only using data from a bull market (which I do NOT recommend) then your MAR would be much higher than that in your backtest – but your real time performance will not be that good when the next bear market comes along.

When you add a short side system, or additional markets like futures and forex then a portfolio MAR of 1.5 or more would be very good and more than enough to make you a lot of money if your systems are designed well and you do not over optimize your trading systems.

If you have an existing trading system that is giving you a CAR/MDD which is too low, or a drawdown that is too high, use these tips to understand why and reduce the drawdown in your system.

Frequently Asked Questions about Stock Trading Drawdown and CAGR Goals

What is CAGR in trading and why does it matter?

CAGR, or Compound Annual Growth Rate, is a crucial metric in trading that represents the hypothetical rate at which an investment would have grown if it had increased at a steady rate over a specific period. It’s usually expressed as an annual percentage growth rate .

Here’s why it matters:

- Performance Measurement: CAGR provides a clear picture of an investment’s performance over time, smoothing out the effects of volatility and giving a more accurate reflection of growth compared to simple average returns .

- Comparative Analysis: It allows traders to compare the performance of different investments or trading strategies on a like-for-like basis, regardless of the time frame or volatility involved. This is particularly useful when evaluating the effectiveness of various trading systems or portfolios .

- Decision-Making: By understanding the CAGR, traders can make more informed decisions about where to allocate their capital, ensuring they choose strategies that align with their financial goals and risk tolerance .

In essence, CAGR is a powerful tool for assessing and comparing the growth potential of investments, helping traders optimize their strategies for long-term success.

What is drawdown in a trading strategy?

Drawdown in a trading strategy is a critical measure of risk, reflecting the decline in your account equity from a peak to a subsequent low before it recovers to a new high. It’s essentially the percentage drop from the highest point on your equity curve to the lowest point following that peak .

Here’s why it matters:

- Risk Assessment: Drawdown helps you understand the potential downside risk of your trading strategy. A large drawdown indicates significant risk, which can be emotionally challenging and financially damaging if not managed properly .

- Recovery Challenge: The deeper the drawdown, the harder it is to recover. For example, a 10% drawdown requires an 11% gain to recover, but a 50% drawdown needs a 100% gain to get back to the original level .

- System Evaluation: By analyzing drawdowns, you can evaluate the stability and risk of your trading systems. Consistent and low drawdowns are ideal, as they indicate a stable system with manageable risk .

Understanding drawdown is crucial for developing robust trading strategies and ensuring your trading system aligns with your risk tolerance and financial goals .

How much drawdown is considered acceptable in trading?

The acceptable level of drawdown in trading really depends on your personal risk tolerance and trading strategy. Here’s how to think about it:

- Personal Tolerance: Your comfort with drawdown levels is crucial. Some traders might be okay with a 20% drawdown, while others might start feeling uneasy at 10%. It’s important to assess how you feel about different drawdown levels and adjust your strategy accordingly .

- Risk Management: Keeping drawdowns low is essential for recovery. A 10% drawdown requires an 11% gain to recover, but a 50% drawdown needs a 100% gain, which is much harder to achieve .

- System Consistency: Your trading system should align with your drawdown tolerance. If you’re comfortable with a 15% drawdown, ensure your system is designed to stay within that limit. This helps maintain confidence and discipline during tough times .

- Conservatism: It’s wise to set your drawdown tolerance a bit lower than what you think you can handle, as real money trading often feels more stressful than simulations or games .

Ultimately, the key is to find a balance that allows you to trade confidently and consistently without exceeding your comfort zone .

What does it take to recover from a 30% drawdown?

Recovering from a 30% drawdown requires a strategic approach and a solid understanding of risk management. Here’s what you need to consider:

- Percentage Recovery Needed: To recover from a 30% drawdown, you need to achieve approximately a 42.9% gain on your remaining capital. This is due to the asymmetry of returns—losing 30% means you have to make more than 30% to get back to your starting point .

- Risk Management: It’s crucial to reassess your risk management strategies. Ensure your position sizes are appropriate and that you’re not overexposing yourself to further losses. Keeping your risk per trade low can help prevent future drawdowns from becoming unmanageable .

- Diversification: Consider diversifying your trading strategies. If you’re heavily focused on one type of strategy, adding others like mean reversion or seasonal strategies can help stabilize your returns and reduce the impact of drawdowns .

- Emotional Discipline: Drawdowns can be emotionally taxing. It’s important to maintain discipline and avoid making impulsive decisions that could exacerbate losses. Stick to your trading plan and make adjustments based on data, not emotions .

- Continuous Learning: Use the drawdown as a learning opportunity. Analyze what led to the drawdown and adjust your strategies accordingly. This might involve backtesting new strategies or refining existing ones to better handle market volatility .

By focusing on these areas, you can work towards recovering from a 30% drawdown and building a more resilient trading approach .

Is 12% CAGR a good return for a trader?

A 12% CAGR can be considered a solid return for a trader, depending on the context and the risk taken to achieve it. Here’s why:

- Risk-Adjusted Return: It’s important to look at the risk-adjusted return, which considers the amount of risk taken to achieve that 12% CAGR. If the drawdown is low and the strategy is stable, then 12% is quite attractive .

- Market Conditions: The return should be evaluated in the context of the market conditions during the period. If the market was generally flat or declining, a 12% CAGR would be impressive. However, in a booming market, it might be less so .

- Comparison to Benchmarks: Compare the 12% CAGR to relevant benchmarks like the S&P 500 or other indices. If it outperforms these benchmarks, it’s a good sign .

- Consistency: Consistency of returns is key. A steady 12% CAGR over many years is more valuable than a volatile return that averages 12% .

Ultimately, whether 12% is “good” depends on your personal goals, risk tolerance, and the strategy’s consistency and risk profile.

Is 25% CAGR a good return for a trader?

A 25% CAGR is indeed a very strong return for a trader. Here’s why:

- High Performance: Achieving a 25% CAGR consistently is impressive and indicates a highly effective trading strategy. It’s well above average compared to many benchmarks and typical market returns .

- Risk Consideration: It’s crucial to consider the risk taken to achieve this return. If the drawdowns are manageable and the strategy is stable, then a 25% CAGR is not just good, but excellent .

- Consistency: The key is maintaining this return over the long term. Consistent high returns with controlled risk can significantly compound wealth over time, which is the ultimate goal for most traders .

- Comparison to Benchmarks: When compared to major indices or other investment vehicles, a 25% CAGR would typically outperform them, making it a desirable target for many traders .

Ultimately, while a 25% CAGR is fantastic, it’s important to ensure that the strategy used to achieve it aligns with your risk tolerance and trading goals.

How do you calculate and use CAGR to forecast trading performance?

To calculate the Compound Annual Growth Rate (CAGR) and use it for forecasting trading performance, follow these steps:

- Calculation:

- Formula: CAGR = [(Ending Value / Beginning Value) ^ (1 / Number of Years)] – 1

- Example: If you start with $100,000 and end with $200,000 over 5 years, the CAGR would be [(200,000 / 100,000) ^ (1/5)] – 1 = 14.87% .

- Use in Forecasting:

- Performance Benchmark: CAGR provides a smoothed annual growth rate, which helps in setting realistic performance benchmarks for your trading strategy .

- Risk Assessment: Compare CAGR with the risk taken (e.g., drawdowns) to ensure the returns justify the risks .

- Strategy Evaluation: Use CAGR to evaluate different trading strategies over the same period to identify which one offers the best risk-adjusted returns .

- Considerations:

- Market Conditions: Remember that past performance, as indicated by CAGR, doesn’t guarantee future results. Market conditions can change, affecting future performance .

- Diversification: Use CAGR in conjunction with other metrics like drawdown and exposure to ensure a well-rounded evaluation of your trading strategy .

By understanding and applying CAGR, you can better assess and forecast the potential of your trading strategies, ensuring they align with your financial goals and risk tolerance .

What is the relationship between drawdown and CAGR?

The relationship between drawdown and CAGR (Compound Annual Growth Rate) is crucial for evaluating the performance and risk of a trading strategy. Here’s how they interact:

- Risk-Return Balance: Drawdown measures the peak-to-trough decline in your trading account, while CAGR represents the average annual growth rate. A higher CAGR is desirable, but it should be achieved with a manageable drawdown to ensure the strategy is sustainable .

- MAR Ratio: The MAR ratio, which is the CAGR divided by the maximum drawdown, is a key metric. It helps assess the efficiency of a trading system by showing how much return is generated per unit of risk. A higher MAR ratio indicates a more efficient system .

- Capital Preservation: Managing drawdown is essential for capital preservation. If drawdowns are too high, it becomes exponentially harder to recover, which can negatively impact the CAGR. Therefore, keeping drawdowns low is a priority to maintain a healthy CAGR .

- Psychological Comfort: The drawdown level you can tolerate affects your ability to stick with a trading strategy. If the drawdown is too high, it might lead to abandoning the strategy, which would impact the long-term CAGR .

In essence, a well-balanced relationship between drawdown and CAGR is vital for a robust trading strategy.

How can traders set realistic CAGR and drawdown goals?

Setting realistic CAGR and drawdown goals is crucial for developing a sustainable trading strategy. Here’s how traders can approach this:

- Determine Maximum Drawdown (MDD): Start by identifying the maximum drawdown you’re comfortable with. This is the limit at which you can continue trading without feeling overly stressed. For instance, if a 30% decline makes you nervous, aim for a system with a backtested drawdown of 20% to allow some buffer .

- Aim for a Respectable MAR Ratio: The MAR ratio, which is the CAGR divided by the maximum drawdown, should be a key target. A MAR of around 1.0 is a good benchmark for long-only stock trading systems, considering historical market downturns .

- Set Trading Profit Goals: Based on your MDD and MAR target, calculate your trading profit goal in CAGR terms. This approach ensures that capital preservation and risk management are prioritized over aggressive profit targets .

- Diversify Trading Systems: Improve your portfolio’s MAR and reduce drawdown by adding uncorrelated trading systems. This diversification smooths returns and reduces the risk of large drawdowns .

- Consider Market Conditions: Remember that past performance doesn’t guarantee future results. Market conditions can change, affecting your strategy’s performance, so be prepared to adjust your goals as needed .

By focusing on these elements, traders can set realistic CAGR and drawdown goals that align with their risk tolerance and trading objectives.

What does a 10% drawdown mean for your portfolio?

A 10% drawdown in your portfolio means that your account equity has decreased by 10% from its peak value. Here’s what that entails:

- Recovery Requirement: To recover from a 10% drawdown, you need an 11% gain on the remaining capital to get back to your original equity level. This is due to the asymmetry of returns, where a smaller percentage gain is needed to recover from a loss .

- Risk Management: A 10% drawdown is generally considered manageable, especially if it aligns with your risk tolerance. Keeping drawdowns low is crucial because larger drawdowns require exponentially higher returns to recover, making it harder to regain your original account value .

- Emotional Impact: Even a 10% drawdown can be emotionally challenging, affecting your decision-making process. It’s important to ensure that your trading strategy and risk management practices are designed to keep drawdowns within your comfort zone .

- Strategy Evaluation: Regularly assess your trading strategy to ensure that drawdowns remain within acceptable limits. If a 10% drawdown is within your tolerance, it can be a part of a healthy trading system, provided the overall strategy is profitable and aligns with your goals .

Understanding and managing drawdowns is essential for long-term trading success.

Can you achieve 30% annual returns consistently in trading?

Achieving a 30% annual return consistently in trading is a challenging but not impossible goal. Here’s what you need to consider:

- Risk and Drawdown: To aim for a 30% return, you must be willing to accept a significant level of drawdown. Typically, the drawdown might be around the same percentage as the return you’re targeting. So, if you’re aiming for 30%, be prepared for a drawdown in that range .

- Diversification: A diversified portfolio of trading strategies can increase your chances of achieving high returns. By combining different systems, such as trend following, mean reversion, and rotational momentum, you can smooth out your equity curve and reduce the risk of large drawdowns .

- Systematic Approach: Consistency in achieving high returns often comes from a systematic trading approach. This involves setting objective rules for entry, exit, and position sizing, and rigorously backtesting these rules over historical data to ensure their effectiveness .

- Market Conditions: Remember that market conditions can vary significantly, affecting your ability to achieve consistent returns. It’s crucial to adapt your strategies to changing market environments and be prepared for periods of underperformance .

While a 30% annual return is ambitious, with the right combination of strategies, risk management, and market awareness, it can be within reach.

- Learn 4 Causes of drawdown & 5 ways to reduce maximum drawdown in your trading

- Stock Trading Systems: What Are Reasonable Cagr And Drawdown Targets?

- How to Manage Initial Drawdown – Two methods to start a new stock trading system

Thank you very much, for this articel.

FOr 3 Month i start algo trading with stocks / amibroker. Bevor i trade intraday strategies for 5 Years and now i i would like to trade stocks too.

I have search for a rule of tumb what a good stock trading/rotation system is, or what “numbers” a good system have.

Now i know 0.75-1 car/mdd ist a good system. Sure it depens on Timeframe, of Backtest Time hoirzon (10-15-25 Years) and so on.)

If you can more spezifie the Numbers that would be greate. But this info ist normaly very dificult to find online, even if i calculate it by my self if found a system that get offer by someone.

Therefore Thank Adrian!

Hi Stefan,

Thanks for your comment, I am glad my posts are helping you with your trading. There is not really any specific benchmarks you need to adhere to. My suggestion is that you focus on getting a number of ‘good’ (not excellent or perfect) systems and trade them as a portfolio. The diversification across multiple systems will really help. The Trader Success System gives you a diversified portfolio of systems that you can backtest and use in your own trading if you need a shortcut (https://enlightenedstocktrading.com/learn-stock-trading-with-the-trader-success-system/).

Start with 1 good system… it must be profitable, have a relatively stable equity curve and have drawdown that is within your tolerance… then find another system that has a low or negative correlation to the first system… and repeat.

You should be constantly seeking new systems which have low correlation to the existing systems in your portfolio – this is more important than the individual performance stats of each system in isolation.

Adrian