Trade the US Markets with Confidence Using a Proven Portfolio of Systems

A diversified set of 7 rigorously tested trading systems built to deliver consistent performance across stocks, ETFs, volatility, and gold.

- Diversified across multiple markets and strategies for smoother results

- Transparent rules and backtests included for objective decision-making

- Easy to use with TradingView or your broker — no special software required

- Step-by-step instructions with code provided for actionable execution

5.0 Rating

4.2Rating

7 Systems in One Portfolio

Backtested across 25 years of market history

21% Annual Return 17% Max Drawdown

Trade the US Markets with Confidence: 7 Proven Systems, No Software Required

21% Annual Return | 17% Max Drawdown | 7 Systems in One Portfolio

A complete portfolio of 7 rigorously tested trading systems for US Stocks, ETFs, Volatility & Gold – designed to deliver consistent profits in any market condition.

✅ Diversified across Stocks, ETFs, Volatility & Gold

✅ Proven strategies: trend following, mean reversion & breakout

✅ Transparent rules & backtests included

✅ Easy to trade with TradingView or your broker (no software required)

✅ Amibroker & RealTest code included (not required)

📈Backtested | ⚙️Transparent Rules | 🎯25+ Years of Experience

Introducing The US Edge System Portfolio

Most traders struggle because they chase tips, follow their gut, or rely on one fragile strategy. The US Edge System Portfolio changes that. With 7 complementary trading systems, you’ll have rules for every type of market, from roaring bull runs to sudden panics and everything in between.

By trading this portfolio you get:

-

Diversification by design: Stocks, ETFs, Volatility, Gold

-

Multiple strategies: Trend following, mean reversion, and intraday breakouts

-

Ease of use: No special software needed – just a free TradingView account or your broker

-

Proven results: 22% compound annual return with just 12% max drawdown (historical tests)

- Transparent: Fully disclosed rules & step by step instructions (RealTest & Amibroker code also provided)

There are two major leaps that successful traders make.

1. From Discretionary to Systematic Trading: Transitioning from discretionary trading to systematic trading eliminates emotional decision-making by relying on predefined, objective rules. This shift allows traders to achieve consistency and scalability, avoiding the psychological pitfalls of subjective judgments.

2. From Single System to Portfolio of Systems: Evolving from trading a single system to a diversified portfolio of systems across strategies, markets, and timeframes smooths returns and reduces risk. This approach enables traders to profit in varying market conditions while minimizing the impact of individual system drawdowns.

The US Edge System Portfolio does BOTH of these for you!

The 7 Systems Inside

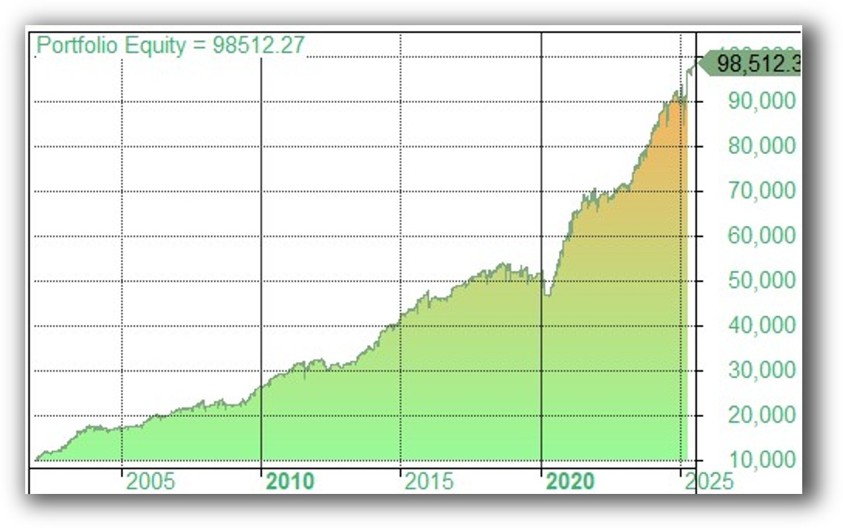

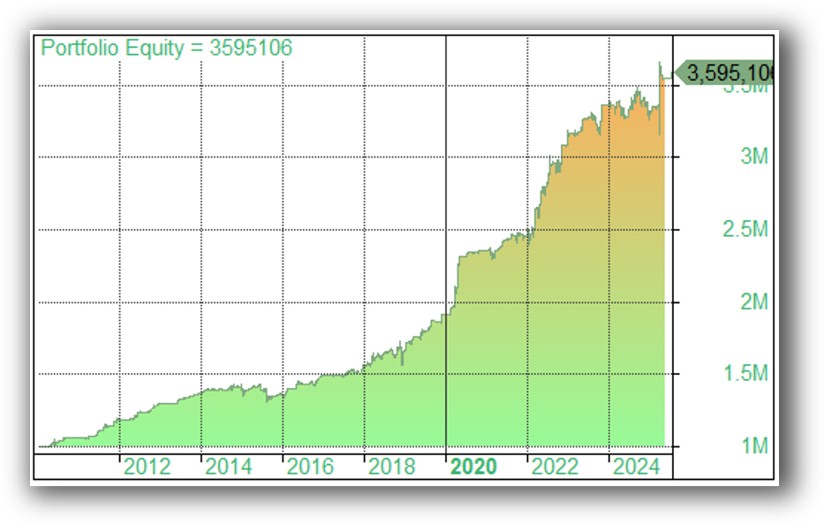

Nasdaq Snapback

This system catches short term bounces in highly liquid, but oversold stocks for smooth consistent returns.

- Strategy: Mean Reversion

- Market: Nasdaq 100 Stocks

- Return: 10.1% Compound Return (CAR)

- Exposure: 18.2%

- Max Drawdown: 13.8%

- Percent Winners: 68.6%

- Average Bars Held: 6

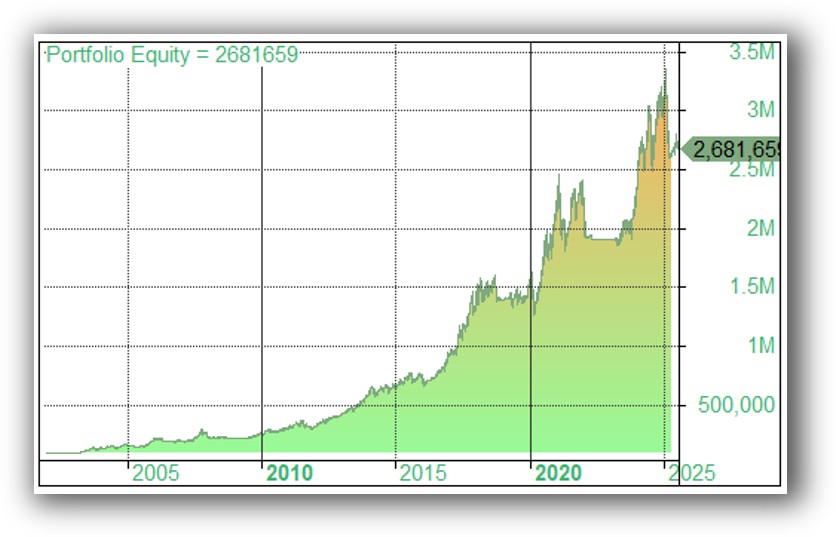

Nasdaq Flow

This system catches long term trends in market leading stocks in the Nasdaq 100 stock index.

- Strategy: Trend Following

- Market: Nasdaq 100 Stocks

- Return: 14.9% Compound Return (CAR)

- Exposure: 70.5%

- Max Drawdown: 26.7%

- Percent Winners: 54.5%

- Average Bars Held: 176

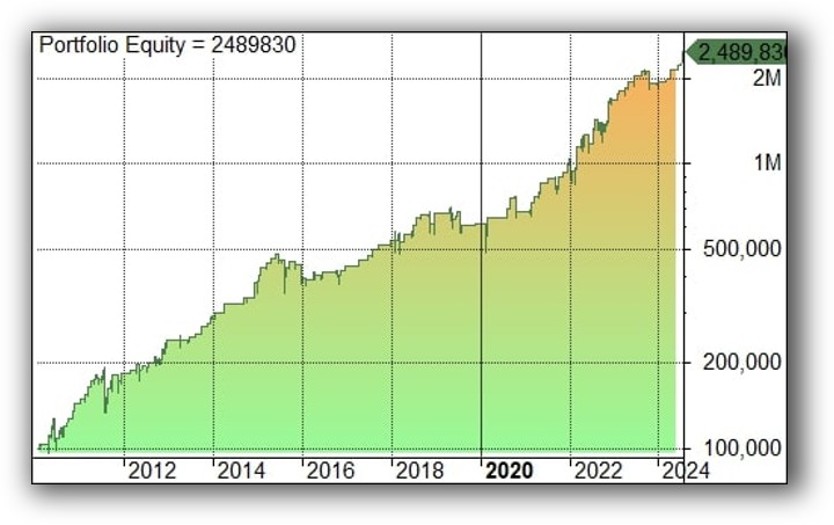

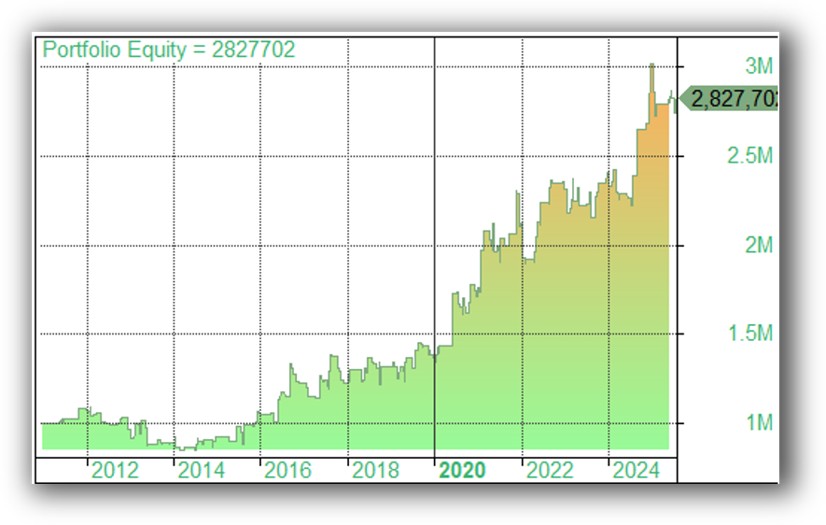

Q Bounce

Bank lightening fast profits in the Nasdaq 100 ETF (TQQQ) by buying dips and selling the recovery.

- Strategy: Mean Reversion

- Market: Nasdaq 100 ETF (TQQQ)

- Return: 24.8% Compound Return (CAR)

- Exposure: 12.7%

- Max Drawdown: 30.5%

- Percent Winners: 77.6%

- Average Bars Held: 4

Retirement Manager

Long term trend following system for the SPY ETF to capture the growth in the broader US stock market with lot effort and activity.

- Strategy: Trend Following

- Market: S&P500 ETF (SPY)

- Return: 11.3% Compound Return (CAR)

- Exposure: 78.3%

- Max Drawdown: 19.4%

- Average Bars Held: 60

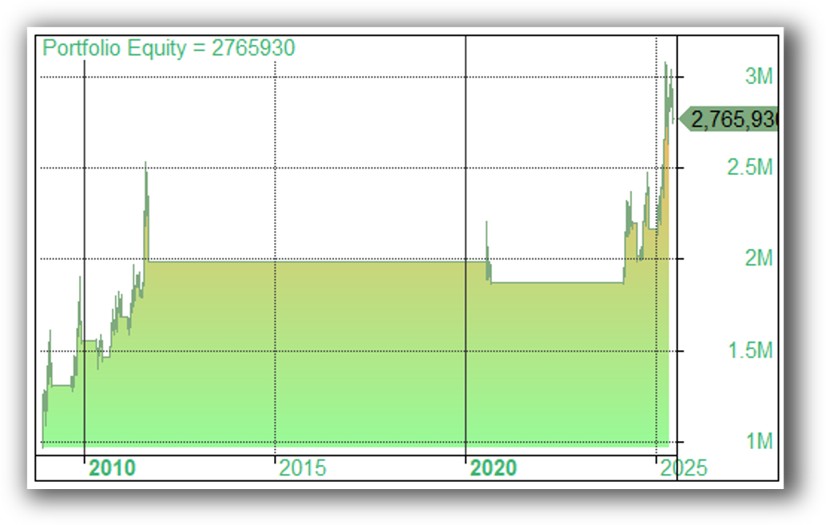

Daybreak

A high-octane intraday breakout system built for traders who want to capture explosive moves in leveraged ETFs.

- Strategy: Intraday Breakout

- Market: US Listed Leveraged ETFs

- Return: 8.6% Compound Return (CAR)

- Exposure: 7.9%

- Max Drawdown: 9.8%

- Percent Winners: 60%

- Average Bars Held: 1

Daybreak – VIXY

Profit from intraday panics and sudden dips in the US Stock Market to generate negative correlation profitable return stream to smooth your portfolio.

- Strategy: Intraday Breakout

- Market: VIXY (VIX ETF)

- Return: 7.3% Compound Return (CAR)

- Exposure: 6.8%

- Max Drawdown: 22.4%

- Percent Winners: 47.4%

- Average Bars Held: 1

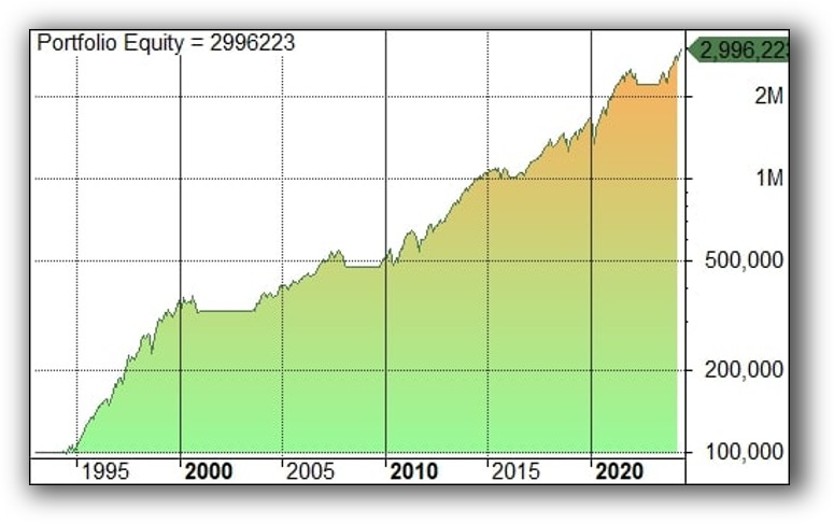

Gold Rush

A powerful yet incredibly simple way to trade gold’s biggest moves. This provides your portfolio with a powerful inflation and panic hedge which smooths returns and protects your portfolio.

- Strategy: Trend Following

- Market: Leveraged Gold ETF

- Return: 6.2% Compound Return (CAR)

- Exposure: 15.4%

- Max Drawdown: 26.3%

- Percent Winners: 72%

- Average Bars Held: 60

Why This Portfolio Works

Markets change. Bull markets soar, bear markets grind portfolios down, and panics strike without warning. Relying on one approach is a gamble. That’s why this portfolio blends 7 independent, profitable systems.

-

Bull Markets → Nasdaq Snapback, Nasdaq Flow, Q Bounce, Retirement Manager thrive.

-

Sideways/Volatile Markets → Snapback, Daybreak VIXY & Q Bounce shine.

-

Bear Markets → DayBreak & DayBreak VIXY profit.

-

Panic & Crashes → DayBreak VIXY captures surges in volatility.

-

Inflationary Periods → Gold Rush protects and grows wealth.

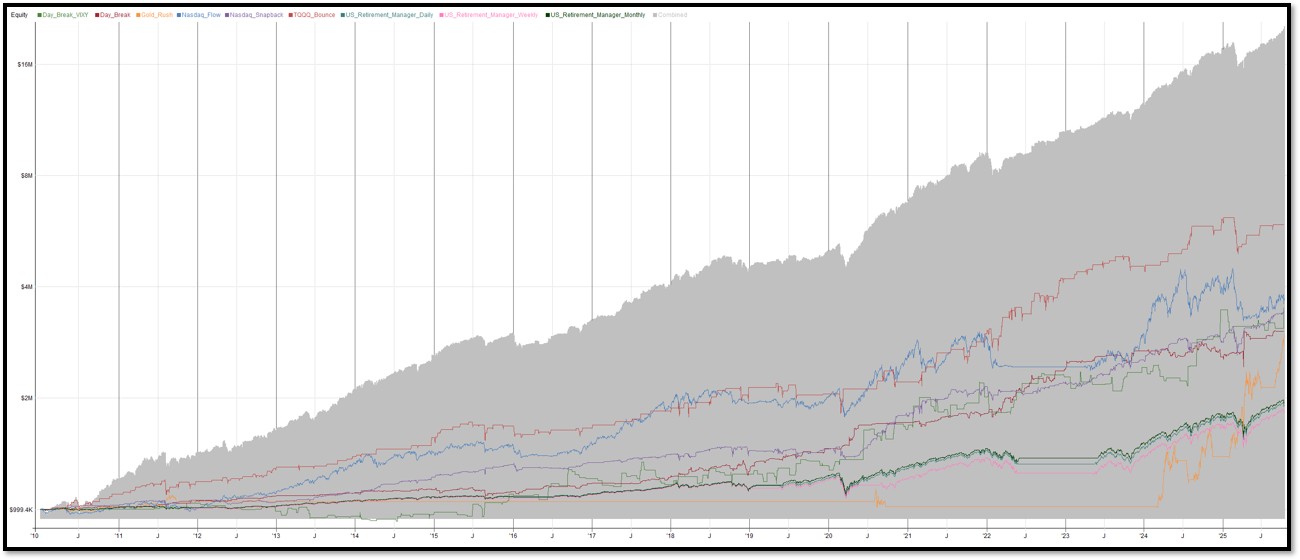

By equally weighting these systems, you smooth out the ride and maximize growth. The result is a powerful 21% historical CAR with just 17% max drawdown.

Ease of Use

You don’t need to be a programmer or buy expensive platforms. Every system comes with:

📖 Plain English explanation of the strategy rules

🧑💻 Step-by-step TradingView instructions

🧑💻 Full Amibroker AFL code & RealTest code

⚙️ Optional full automation with our Smart Stock Automation Engine

Your job is simple: Follow the rules, place trades, and manage your portfolio. No guesswork. No emotional second-guessing.

Who Is This For?

✅ New traders who want a proven, rules-based approach to enter the US markets

✅ Experienced traders who want to diversify rapidly with tested strategies

✅ Busy professionals who need clarity and confidence without full-time screen-watching

✅ Traders who don’t have specialist software and data subscriptions

✅ Small account holders who want capital efficient diversification with ETFs

Your Investment: Only $497 AUD (~$330 USD)

Risk-Free Next Step

The US Edge System Portfolio is based on 25+ years of experience, rigorous testing, and the same principles taught in The Trader Success System. Every system is transparent, rules-based, and practical to trade.

Don’t waste years trying to figure it out alone. You are only one trading system away.

Do I need special trading software to use these systems?

No. You can run all systems with a free TradingView account or your broker platform. AFL code for Amibroker and RealTest code is included.

Can I automate the systems, or do I need to place trades manually?

You can do either. You can trade manually using TradingView or your charting platform, you can trade them with Amibroker or RealTest if you have it or fully automate with the Smart Stock Automation Engine if you have Amibroker.

How many systems are included in the portfolio?

7 complete systems are included in The US Edge System Portfolio (Nasdaq Snapback, Nasdaq Flow, Q Bounce, Retirement Manager, DayBreak, DayBreak VIXY, and Gold Rush).

What markets do these systems trade?

The systems in The US Edge System Portfolio trade US stocks and ETFs.

What kind of returns can I expect?

Historical backtests show a 21% compound annual return with a maximum drawdown of around 17% when the systems are equally weighted. However these are based on a historical backtest and future returns may differ and are not guaranteed.

How much time does it take to trade this portfolio?

Very little. These systems can be managed in under 30 minutes a day, and some (like Retirement Manager) only require monthly attention.

Is this suitable for beginners?

Yes. The portfolio is designed for traders at all levels. Step-by-step instructions are provided in plain English, and no coding experience is needed.

What account size do I need to start trading these systems?

You can start small – even a modest account can implement these systems, as position sizing and capital allocation guidance are included.

Can I trade these systems with a large amount of capital?

Yes, these systems trade highly liquid instruments. Of course you should monitor your slippage and execution accuracy to ensure you are getting good fills.

What happens if market conditions change? Will this portfolio still work?

Yes. The portfolio is diversified by strategy, market, and instrument, so provided you allocate capital across each of the strategies you will have a solid likelihood of making money in bull markets, bear markets, sideways periods, panics, and inflationary environments.

Returns are not guaranteed and your capital is at risk.

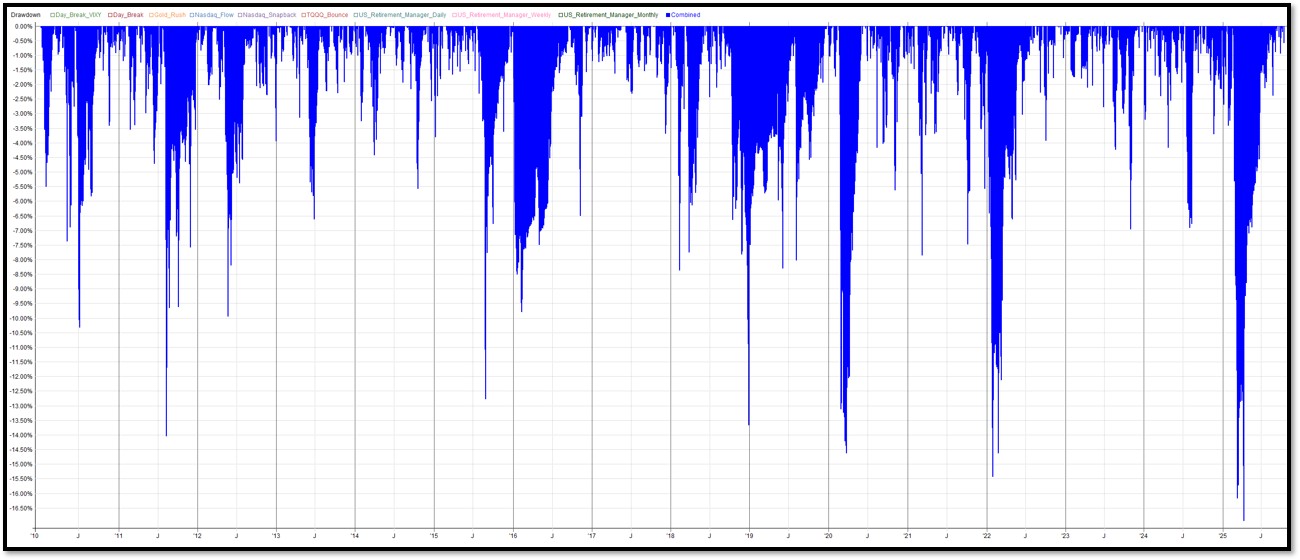

How can we see the combined performance statistics of the 7 systems?

The combined equity curve is illustrated on the page above. The CAGR of the combined strategies from 2010 – 2025 are:

- Compound Return 21%

- Maximum drawdown of ~17%

- MAR Ratio 1.24

- Number of trades 3170

- Percent Wins 62.7%

- Expectancy 1.87%

- Average Win 5.2%

- Average Loss 3.7%

- Profit Factor 2.13

- Sharpe 1.36

- Average Exposure 54%

- Max Exposure 127%

Is there a money-back guarantee or refund policy?

There are no refunds. All sales are final and no refunds can be given as you will have full access to the system rules and code immediately upon sale.

What is the minimum recommended account size to realistically run all 7 systems?

Given it is possible to trade fractional shares on the US Stocks and ETFs this portfolio trades, the minimum capital required is quite small. I would expect that a $10K account could manage these strategies.

How many trades per month should I expect across the whole 7-system portfolio?

This will very quite a lot over time depending on which systems are active (they are not active all the time). However on average across the entire backtest period there were an average of 19 trades per month.

Please note that there may be more ORDERS place than this as for the Nasdaq Snapback and the Daybreak system there are orders placed more frequently but they are not all filled.

How many positions might be open at the same time?

This will vary quite a lot over time depending on which systems are active (they are not active all the time). At MOST in one day there could theoretically be up to 28 positions at a time but in practice there will be much fewer than that and the portfolio will sit in cash between signals.

Could you share the combined portfolio equity curve with performance metrics?

The combined equity curve is illustrated on the page above. The CAGR of the combined strategies from 2010 – 2025 are:

- Compound Return 21%

- Maximum drawdown of ~17%

- MAR Ratio 1.24

- Number of trades 3170

- Percent Wins 62.7%

- Expectancy 1.87%

- Average Win 5.2%

- Average Loss 3.7%

- Profit Factor 2.13

- Sharpe 1.36

- Average Exposure 54%

- Max Exposure 127%

Was this backtested with slippage/commission assumptions?

Yes absolutely. All systems from Enlightened Stock Trading are backtested with realistic slippage and commission assumptions.

Are the TradingView scripts delivered as open Pine code or invite-only indicators?

These systems use free public indicators. Instructions are provided how to scan to find your signals using these free tools.

Can I place conditional orders with my broker so I don't have to wait for the market to open?

Yes. All orders can be placed any time between the market close and the following open.

What ongoing support do you provide if I face issues?

The US Edge System Portfolio includes forum based support in case you have any questions about these strategies.

Are system updates included if a strategy is retired or modified?

Yes. If the included systems are updated or changed you will receive the updates in your members area.