RealTest vs BeyondCharts: Comparing Backtesting Software for Systematic Trading

If you’re deciding between RealTest and Beyond Charts as your backtesting software, here’s the direct answer:

RealTest is the better choice for serious, systematic traders who want fast, realistic portfolio-level backtesting, a clean scripting workflow, and modern documentation.

Beyond Charts is more chart-centric and visually oriented, and can be useful for indicator research and discretionary workflows — but it is not designed primarily for rigorous system testing.

If your goal is consistency, confidence, and repeatability, RealTest gives you the strongest foundation.

RealTest vs BeyondCharts at a Glance

Short on time? Here’s how RealTest and Beyond Charts compare side by side.

| Feature | RealTest | Beyond Charts |

| Operating System | Windows 64-bit; Mac via VM | Windows only; Mac via emulation |

| Pricing | One-time license + low annual maintenance | Paid license (~AUD $595 incl. GST) |

| Brokerage Integration | Partial (order export to IB) | None mentioned |

| Programming Language | Clean, purpose-built scripting | BCFL + Windows-style UI |

| Backtesting | Portfolio-level, realistic | Formula-level indicator testing |

| Charting | Basic | Strong charting and panels |

| Documentation | Modern, structured | Getting Started, Panels guide, BCFL manual |

Platform Overview, Cost & Compatibility

RealTest runs on Windows 64-bit and works reliably on Mac using Parallels or other VMs.

It uses a one-time license (US$389) with an optional low-cost annual update plan.

This pricing model appeals to systematic traders who want predictable cost and lifetime ownership rather than ongoing subscriptions.

Beyond Charts is Windows-only, with Mac usage requiring emulation or virtualization.

The software uses a traditional paid license model (~AUD $595 including GST), with a 21-day trial available.

It’s positioned more as a charting and indicator development environment than as a full institutional-grade backtesting engine.

RealTest Main View:

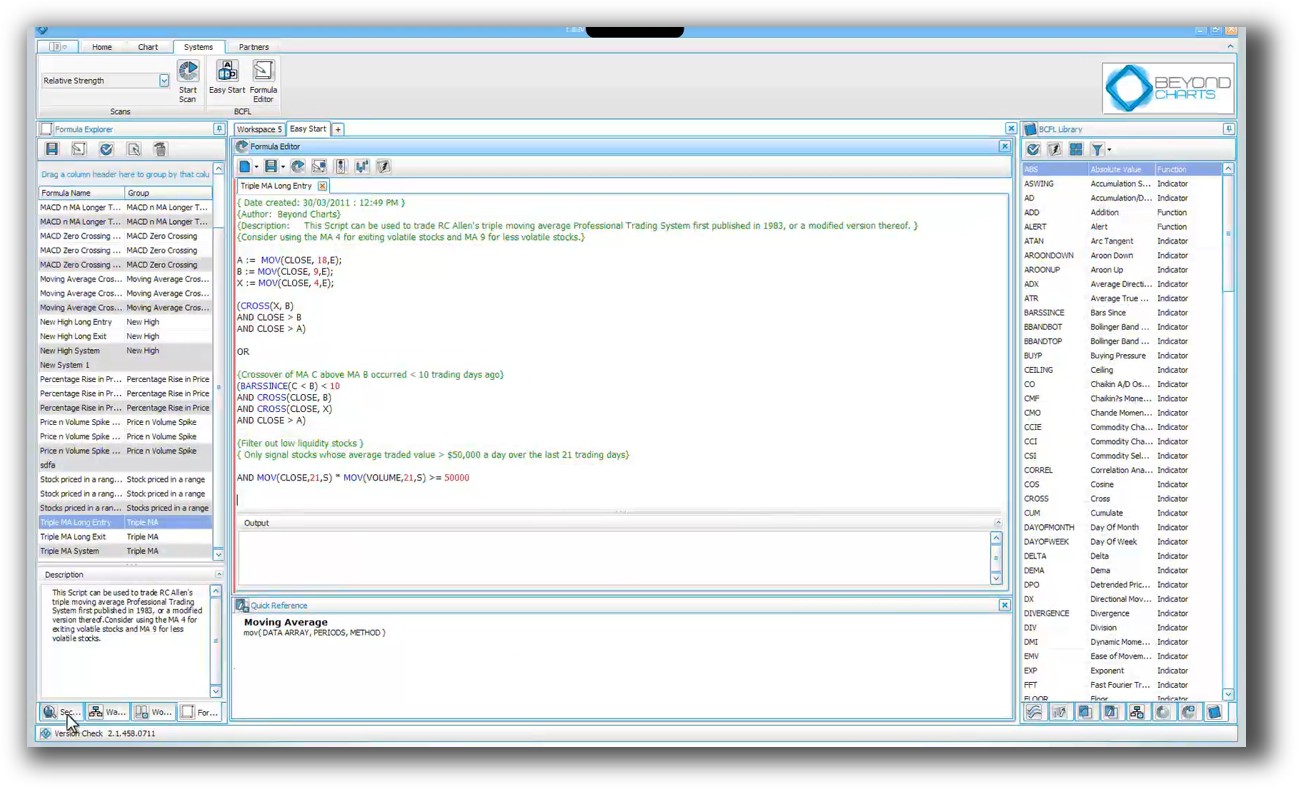

Beyond Charts Main View:

Market Access & Data Support in RealTest and MultiCharts

RealTest

- Works seamlessly with high-quality EOD data sources such as Norgate Data

- Accepts structured custom data

- Designed for research-first workflows

RealTest keeps data management simple and transparent — essential for traders who want reproducible system results.

Beyond Charts

- Supports internal data formats and user-imported data

- The platform architecture is designed around charts, panels, and formula-based indicator development

It’s suitable for discretionary or hybrid traders but does not position itself as a dedicated research engine.

RealTest Backtesting Interface:

Beyond Charts Backtesting Interface:

Building & Customizing Trading Strategies

RealTest uses a clean, readable scripting syntax that feels like filling out a strategy specification form.

This dramatically reduces complexity, especially for users who are:

- Non-programmers

- Moving away from discretionary trading

- Trying to adopt consistent systematic rules

RealTest’s workflow supports full system structuring, including entries, exits, filters, ranking, position sizing, and portfolio rules.

Beyond Charts uses BCFL (Beyond Charts Formula Language) along with a Windows-style, panel-based UI.

It is built primarily for:

- Indicator creation

- Chart overlays

- Visual exploration of markets

This can appeal to visually oriented traders, but it does not provide the same structured, system-oriented workflow that RealTest is built for.

Check Out: Trading System Development

RealTest Code Editor:

Beyond Charts Code Editor:

Backtesting Performance, Speed & Realism

RealTest offers:

- Fast backtesting

- Realistic execution modeling

- Portfolio-level simulations

- Native support for multi-system portfolios

The engine is designed to answer the only question that matters to systematic traders:

“What would my full portfolio have actually experienced?”

This realism is what helps traders finally break out of the discretionary loop and trust their system with confidence.

Beyond Charts focuses on:

- Indicator formula evaluation

- Chart-based exploration

- Panel-driven analysis

While it offers backtesting in the sense of formula testing, it lacks the deep portfolio simulation capabilities expected from dedicated backtesting software.

For serious systematic traders, RealTest’s engine is in a different category.

Check out: Backtesting | Drawdown

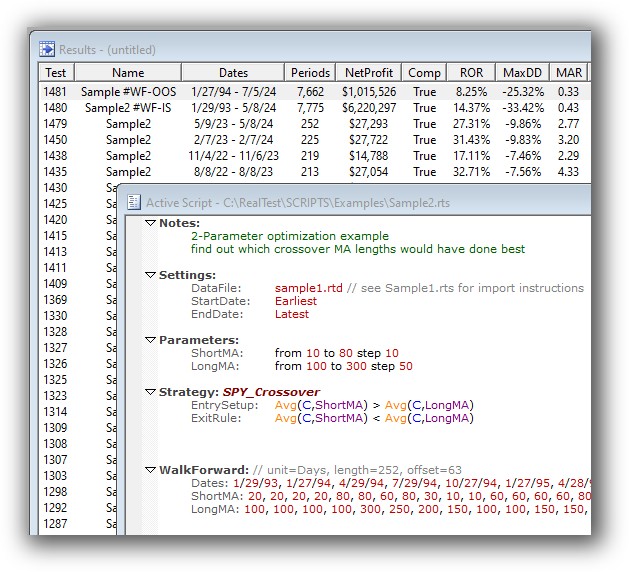

RealTest Backtest Report:

Beyond Charts Backtest Report:

Strategy Optimization & Stress Testing Tools

RealTest supports:

- Parameter sweeps

- Scenario-based testing

- Flexible scripting to run robustness-style analyses

Its design philosophy aligns with Enlightened Stock Trading:

Robust systems outperform optimized systems.

BeyondCharts:

The Excel file’s comparison shows no explicit optimization or robustness framework beyond BCFL-driven formula experimentation.

It allows you to create and compare indicators, but not to perform structured robustness workflows across portfolio-level systems.

Check Out: Trading System Optimization

RealTest Walk Forward Testing:

Charting Features, Signal Exploration & Live Execution

RealTest strengths:

- Offers simple charts for verifying trades

- Provides scanning via scripts

- Supports order export to Interactive Brokers

RealTest’s charts are intentionally minimal.

They prevent you from falling back into the discretionary trap.

Charting is where Beyond Charts excels:

- Strong, flexible charting system

- Panels and custom layouts

- BCFL-based indicator definitions

- Visual market exploration

If you need advanced charts, Beyond Charts can complement RealTest — similar to how some traders pair RealTest with AmiBroker or TradingView for visualization.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

Support, Documentation & Learning Resources

RealTest provides:

- A modern User Guide

- Clear, topic-based documentation

- Practical tutorials

- A focused community of systematic users

It has no legacy clutter, no obsolete references, and no overwhelming menu sprawl.

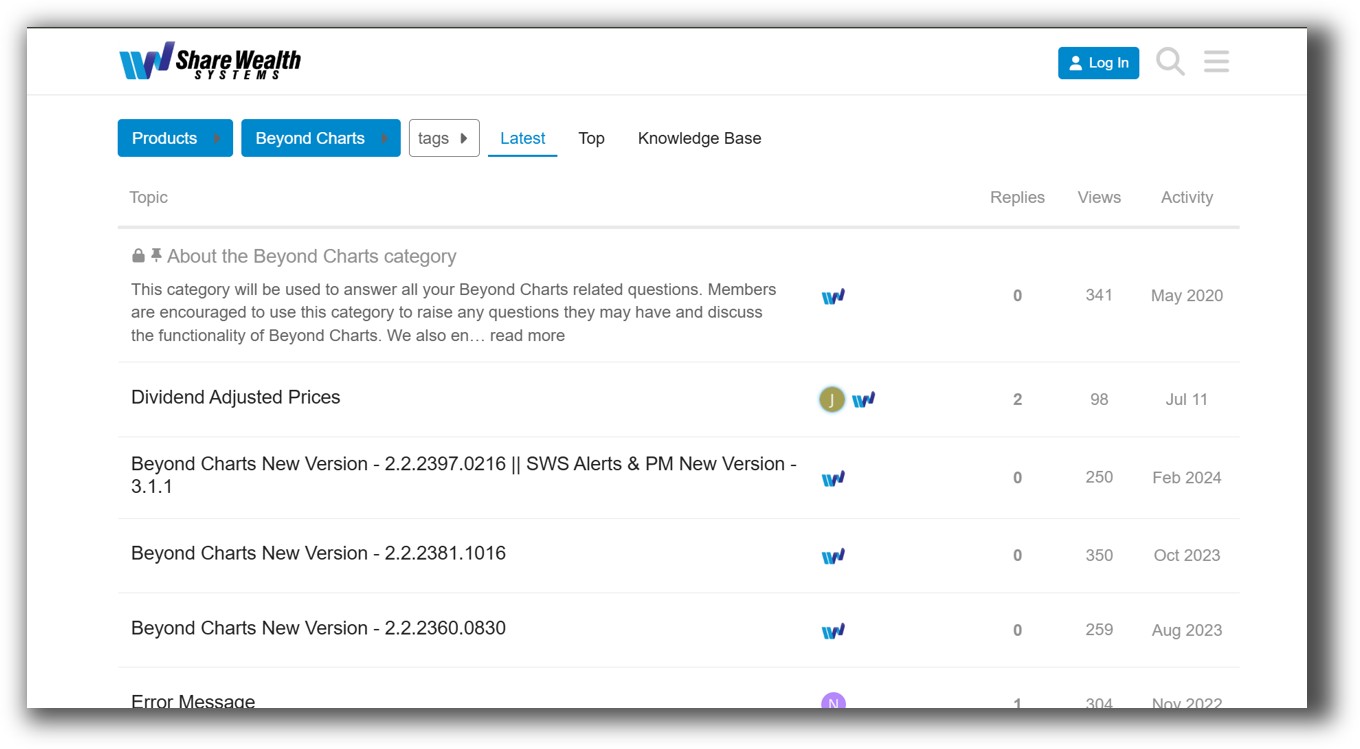

Beyond Charts includes:

- Getting Started guides

- Panels usage documentation

- BCFL reference manual

- A forum community

The focus is more on charting and panel features than systematic system-building.

Its documentation is helpful but less aligned with full-system development compared to RealTest.

RealTest Forum is illustrated down below:

BeyondCharts Forum is illustrated down below:

RealTest vs Beyond Charts: Which One Should You Use?

If your goal is:

- Building systematic trading systems

- Running realistic portfolio-level backtests

- Reducing discretionary noise

- Speed, clarity, and clean scripting

- Becoming a consistent, rule-based trader

RealTest is the clear winner.

If your priority is:

- Beautiful charts

- Visual exploration

- Indicator experimentation

Beyond Charts can be a useful secondary tool, but not your primary research engine.

Our Recommendation

For the vast majority of traders wanting consistent, rules-based results, RealTest is the superior backtesting software.

Its speed, realism, and modern workflow make it ideal for traders transitioning out of the emotional rollercoaster of discretionary decision-making.

Beyond Charts can complement RealTest if you need stronger charting or visual analysis — but it should not be the foundation of your system design.

Want the Rest of the Puzzle?

Backtesting software is only one part of consistent, confident trading.

Most traders struggle because they lack:

- A complete system-building framework

- Clear entry/exit rules

- A portfolio-level view

- Internal alignment with their method

That’s why we created The Trader Success System— the complete blueprint for building profitable, systematic trading habits.

If you want to stop guessing and start trading with structure and confidence, this is your next step.