“I don’t need a trading plan, I know what to do”… perhaps one of the most common and deadly thoughts a trader can have. Most of us just want to get started and make some money without worrying about laboriously documenting everything – Right?

But trading without a plan is just like parking your car on the railway tracks and taking a nap – just not very smart, and frankly, it is kind of dangerous!

When I was learning to trade I tried lots of different methods, I read a huge number of books and attended numerous trading courses. But it wasn’t until I really understood the importance of a well-executed trading plan, combined with a trading system that fit my personality and objectives, that my trading results really took off and I finally became a consistent trader.

Believe me when I say that this is one of THE BIGGEST determinants of success in trading.

If your plan is not documented, you will not succeed in the long term

Novices that fail and lose money almost never have a proper trading plan, but wealthy and professional traders do. That was enough justification for me, but if you need more, let me explain why having a written trading plan is so powerful.

Trading is challenging, and the markets have no regard or care for you, your positions, your opinion or your stress levels. No matter how you trade, the market will find a way to cause you stress.

And we all know that when we are stressed, we make bad decisions.

The reason why is actually really interesting. It is because of the natural human ‘fight or flight’ response which we all have.

This evolved early in human history when stress from the environment (such as facing a large predator) required a huge burst of physical exertion to protect ourselves.

Adrenalin gives us this burst of power. During stress the body releases adrenalin which makes us physically strong and instantly prepares the muscles for action…

…so what does this have to do with trading?

EVERYTHING!

When we are stressed, adrenalin causes blood to be diverted to your muscles to get you ready for action – to run or to fight for survival. This means less oxygen to the brain and that lowers our intelligence.

Under intense stress, human IQ drops dramatically – That’s why a written trading plan saves your account!

You guessed it! Lower IQ means stupid decisions and wallet punishing trading mistakes!

Unexpected Event >> Stress >> Reduced IQ >> Mistakes >> Losses

A written plan solves this problem because it captures what you will do under a wide range of scenarios in advance so that you don’t have to decide what to do in the heat of the moment. Pre-deciding what action you will take gives you a huge advantage in the markets.

Unexpected Event >> Consult Trading Plan >> Good Decision >> Stock Trading Profits!

If you don’t already have one, writing your plan is probably the number one priority to improve your trading and generate consistent, profitable results.

Why You Need a Detailed Trading Plan

It’s a common misconception that drafting a detailed trading plan is a mere formality, with many eager to dive directly into trading in hopes of immediate profits. This mindset, unfortunately, aligns with the 95% of traders who ultimately face failure.

Writing your trading plan is one of THE BIGGEST determinants of success in trading. If your plan is not documented you will not succeed long term. Don’t be one of the 95% of traders that lose money – write a good trading plan and watch how much clarity you gain.

Trading is one of the most challenging professions you could pursue. Traders that survive and prosper over the long term are prepared for any eventuality. When something happens in the market that they have not previously experienced, they already know how they will react to protect their account and generate a profit.

A comprehensive plan should encompass responses to a myriad of market scenarios. Absence of such a plan can lead to decision-making in uncertain situations during live trading sessions. This is perilous for system traders, as the likelihood of making suboptimal decisions escalates under extreme conditions.

While these intense situations might be extremely infrequent, enduring traders will inevitably encounter them eventually. It’s our hope that you are equipped with a meticulously documented plan, enabling you to not only weather but also capitalize on these challenging circumstances.

8 Components of a Complete Trading Plan

Just as a robust business plan is pivotal for a traditional business’s success, a well-defined trading plan is crucial for a trader. Without it, both businesses and traders are set up for failure.

Recognize that crafting your trading plan is a journey, not a destination. While these 8 components of a trading plan might seem overly extensive, you’re not expected to tackle them all immediately. The key is to understand the significance of having a written strategy and to start writing it.

Your plan should cover every aspect of your trading business: from trade generation and order placement to contingencies for market upheavals or unforeseen events. In more extreme considerations, it might even provide guidance for your heirs, ensuring they can seamlessly continue and profit from your trading legacy.

This document should be dynamic, designed to adapt and expand with your experiences. In its final form, it should be comprehensive enough that someone else could step in and operate your trading business by merely following it. Every potential market situation should be anticipated and addressed.

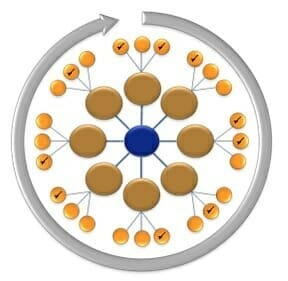

The diagram below illustrates the 8 components of a complete trading plan.

The 8 Components of a Complete Trading Plan

Let’s bring these 8 components of a complete trading plan to life with some example questions under each topic.

1. Personal Context and Capabilities:

- What is my ideal life and what will your trading bring me?

- What skills do I bring to my trading business?

- What is my personality profile and how will it impact my trading?

- What are my reasons for trading?

- What trading restrictions do I have to consider?

- …

2. Financial Resources:

- What is my financial situation and how does trading fit into this?

- How much risk capital can I devote to my trading business?

- How will trading fit in / interact with my other investing activities?

- …

3. Trading System:

- What are my personal goals for my trading?

- What Trading Strategy best suits me?

- What are my Trading Rules?

- Which time frames will I apply these rules to?

- …

4. Money and Risk Management:

- What is my overall risk appetite and how does this impact my trading approach?

- What is my risk tolerance for each trade, and the account as a whole?

- How much drawdown am I comfortable with?

- How will I determine the position size for each trade?

- How many trades will I have open at any one time?

- How will I allocate capital across my portfolio of systems?

- How will I manage overnight risk?

- …

5. Cash Flow Management

- Do I need to take regular cash flow out of my trading account?

- How will I manage any expenses relating to my trading activity?

- How will I add cash to my trading account?

- …

6. Extreme Events:

- What will I do if I have a personal traumatic experience?

(e.g. birth / deaths / marriages / losing your job / sickness / car accident etc) - What should happen if I suffer death or permanent incapacity?

- What will I do if a war breaks out?

- What market environment will I NOT trade in?

- What additional risks do I need to manage?

- …

7. Trading Infrastructure

- What trading system software will I use to develop and optimize my trading systems?

- What market data service will I use? What backup provider will I use?

- What computer and other hardware will I use to run my trading program?

- …

8. Self-Management & Activity Checklist

- How will I assess my mental state before making any trading decisions?

- What will I do if my mental state is not strong and positive?

- What is my daily trading routine?

- Which trading skills do I need to focus on and develop?

- …

While I certainly haven’t provided all the questions that need to be answered, this list provides a good starting point for you to think about what should go into your written plan. Don’t worry if this seems too overwhelming, we offer a Trading Plan Workbook that makes developing a Professional Plan as quick and painless as possible.

7 Steps to Writing a Perfect Personalized Trading Plan

Writing a personalized trading plan is not difficult or time-consuming if you follow the right process. If you don’t follow the right process, then chances are that you will have a much harder time creating your trading plan.

1. Get A Good Trading Plan Template

Writing a trading plan starting from a blank sheet of paper is slow, difficult and frankly pretty silly. There are many profitable traders who have come before you and thought about what needs to be included in creating a trading plan.

Of course, you need to include questions that address your own specific circumstances, but this does not mean you need to do all the thinking yourself. It is much more efficient to use a good trading plan template that gives you all the major components that you need to cover and then add your additional specific considerations in at the end.

A good trading plan template will cover all 8 components of a complete professional trading plan as illustrated below:

There are eight components to a complete trading plan, and coincidently 8 steps to writing a trading plan!

2. Sweep Through and Complete What You Can Quickly

Once you have your trading plan template, the first step is to sweep through it and complete all the areas you can without further work or research. This gives you an immediate sense of progress and gets you into the right frame of mind. Do this quickly and skip over any sections for which you do not have an immediate answer.

Sweep through the trading plan template quickly and complete what you can first.

Try not to labour over your answers initially because this will slow you down. Writing a trading plan should be done iteratively because otherwise, you risk getting bogged down in minor details when there is a massive gaping hole in the next section that you have not completed yet.

The additional benefit of sweeping quickly through the entire trading plan template is that it puts the entire thing into perspective for you. For example, there will probably be questions in the trading plan workbook that you have never considered, so reading through it will give you a whole new perspective and elevate your trading potential by raising your awareness of these issues to consider.

This really is a case of you don’t know what you don’t know…so your sweep through the entire trading plan template will make a big difference to the quality of your trading decisions.

3. Identify And Prioritise Gaps

Now that you have worked through the whole template and completed the areas you already know, you can identify and prioritise the gaps.

Remember that writing a trading plan is an iterative process, so you may refine or expand your plan in different areas over time. The trick to getting it done is not to get bogged down on any one section.

All gaps in your trading plan are not necessarily of the same importance. For example, you would probably want to complete your entry/exit and stop loss rules and your position sizing rules before you worry about some of the detailed activity steps and extreme scenario testing. So when you prioritise, be pragmatic and get the important things done first. Keep sweeping through your gaps and gradually close them all.

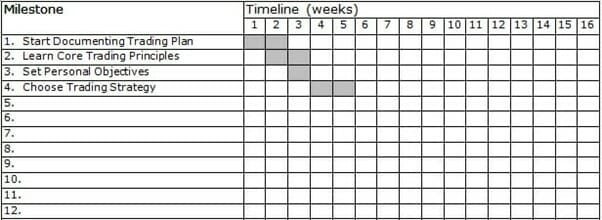

4. Set Timelines To Close Gaps

When you first learn to trade, develop a systematic approach, and start writing a trading plan, some of the gaps you have will take some education or coaching to close. This is a natural part of learning to trade (or learning any worthwhile skill, for that matter).

If you were learning to be a brain surgeon, you would expect that it would take some time. You wouldn’t just walk into an operating theatre off the street and expect to cut open someone’s skull. The great news is that learning to trade does not take that long, but there is still a learning curve. This means you will need to give yourself some time to learn how to close the gaps in your trading plan.

Allocate time to close your trading plan gaps

Now lots of people will be tempted to skip this and just get started, but your gaps will get closed in one of two ways, whether you like it or not. You will either close them by:

- Learning hard lessons in the markets (a.k.a. losing money); or

- Learning the right skills and developing your plan

I can tell you from experience that the first way (that most people choose) is more expensive, more frustrating and ultimately more time-consuming. Do it right – save yourself the time, hassle and expense.

It is far more efficient to identify your gaps and find the right education or coaching to close them before you get started with real money. So set yourself a reasonable timeline to close your gaps and avoid the stupid and expensive trading mistakes people make when they rush in and start trading without a plan.

5. Address Knowledge Gaps & Populate

When you are addressing your knowledge gaps, there are many approaches you can use depending on your budget and timeframe. At some point, most successful traders will use a combination of trading books, original research, courses/seminars and coaching to address their knowledge gaps.

Take action and seek specifically what you need. There is a lot of information out there, and one of the big mistakes I made when I first learned how to trade was taking the ‘scatter gun’ approach. I read everything I could and bought a huge number of trading books. This was great for my knowledge but was terrible from a time and effectiveness point of view.

This is why I am suggesting that you sweep through the entire trading plan template so that you know what you don’t know – you identify what you need to learn. This way, you can target your learning on your specific gaps and be far more effective than I ever was.

Trading coach interactions typically consist of a combination of teaching, coaching and mentoring. It also makes writing a trading plan much faster.

The great thing about this approach is you will make fast progress, and you will waste very little time

Make sure you continue to populate your trading plan as you learn; this way, you will know when you have enough understanding to move on to the next area. The great thing about this approach is that you will make fast progress and waste very little time.

6. Review, Scenario Test And Adjust

If I have learned anything, it is that my trading plan is a living document – and yours should be too. It is not something that you write once and put away, never to be seen again.

I suggest that you critically review your plan and even get an external review done to ensure what you have written is clear and that you have not missed any big gaps. You will be really grateful you have done this when the pressure is on, and you are under stress because of what is happening in the market. The clearer your trading plan is, the more effective your actions will be in the markets and the more profitable you will be.

One of my favourite secrets to success is scenario-testing of my trading plan. There are just so many things that backtesting a trading system can’t show you. For example, think about some of the following scenarios and ask yourself whether you have a solid plan to deal with them:

- Your broker goes under, and your account is frozen

- One of the stocks you are holding is suspended and then announces bankruptcy

- The entire stock market drops suddenly 15-30% overnight

- You get hit by a car, and you can’t think about your trading for 8 weeks while you recover in

- intensive care in the hospital

- You go on holiday, and you unexpectedly have no internet access for 2 weeks

- And many more…

Ensuring that your trading plan covers you and deals with this sort of scenario is one of the biggest secrets to long-term success that I can share with you!

7. Execute & Monitor The Plan

When it is time to start trading, the trading plan you have written is the document that you need to follow.

Plan the trade, Trade the plan!

When writing a trading plan, you have put in all your energy and quality thinking in when you are calm and rational, so these are the instructions and steps you should follow in the market.

Just remember, when emotion is high, intelligence is low…this is why we have a trading plan to follow in the first place.

When emotion is high, trading intelligence is low

If you find yourself wanting to do something that is not in your trading plan – DON’T.

At least not until you have tested and worked through it out of market hours. Then once you have added to or modified your trading plan, you can take that action, but not before.

Part of writing a trading plan is the trading goals that you specify for your trading system. The final step in writing a trading plan is to monitor your results against these objectives and how well you followed your plan. If your plan and trading system are well designed, you should achieve your objectives provided you follow your plan.

When monitoring continuously, you may become aware of conditions outside your normal operating range. This is when you have to determine whether something is wrong and if you have to adjust your trading plan or system (or even stop trading).

Monitoring also extends to yourself. Every time I have to take an action in the market, I observe my emotional response to that action. This is how you improve your trading psychology! If I am consistently uncomfortable, not sleeping well, or tempted to skip steps, then it is time to reassess my mental state and ensure that I am fit for trading. If I am uncomfortable with my trading plan, it is time for a review and a challenge!

5 Critical Factors to Consider in Your Trading Plan

Your trading plan is the equivalent to the business plan that you would have if you were running a traditional business…only it is far more useful!

A good trading plan covers everything that you will do to profit from the financial markets.

In fact, one of the biggest differences between losing novice traders and profitable, sustainable traders is that successful traders almost always have a written trading plan.

The markets are a difficult and stressful environment, and without a plan to guide everything that you do, you will be left to make decisions in the heat of the moment under stress. And one thing I know for sure is that when you make decisions under stress, you almost never make the best decision possible.

A great trading plan will guide you, give you solid trading discipline and keep you consistent when things are going wrong. It does this because you have thought through all of the different considerations and documented what you will do in your trading plan in advance. This means when something goes wrong, you already know what you will do to address the situation!

Creating a trading plan that wraps around your complete, backtested trading system is the best thing you can do to push you towards consistent and profitable trading. Without a trading system AND a trading plan, you will eventually fail and lose money – and you will certainly not make as much money as you could with a well-designed trading plan to guide you.

Do you want to trade stocks but are unsure what your stock trading plan should include? The basic format and requirements for your stock market trading plan are the same as those for any trading plan (forex trading plan, futures trading plan or options trading plan); however, for each different market, there are some specific considerations that you must incorporate into your plan.

1. Liquidity

No matter whether you trade stocks, futures, forex or options, liquidity can always become a problem. When you trade stocks, however, this is a very serious issue that needs to be addressed because so many small stocks have very low liquidity.

Many traders eliminate this issue by only trading large stocks in a major index (like the S&P500). This generally eliminates the liquidity problem, but it severely limits the number of opportunities you have to capture huge moves in price, which more often occur in smaller capitalisation stocks.

Rather than sticking to the constituents of a major index, I prefer to trade all stocks but to filter out those stocks that do not have a high enough daily turnover for me to get in and out of the market easily. You can do this by only trading stocks with an average daily turnover, say 10-20 times the size of the position you want to take. This can easily be programmed into your backtest so that you know the effect of your liquidity filter.

Doing this allows you to trade a much wider universe of stocks than just the major index constituents and also allows you to backtest reliably without worrying about which stocks were in the index 5 or 10 years ago like you would have to if you just traded stocks from the S&P500 index.

2. Volatility

You define this in your complete trading strategy rules (which sit within your stock trading plan). The primary areas that I believe volatility should be considered are the trend filter, the initial stop loss and the trailing stop (if you use that style of exit).

The trend filter should consider volatility because, let’s say, you have a very volatile stock, and its price is just above the 200-day moving average. This could be considered to be an up trend, but it is not as strong an up trend as a low volatility stock that is significantly higher than its 200-day moving average. One of the most powerful things you can do is to adjust your trend filter for the volatility of the stock – you may be amazed at how effectively this works!

One of the most powerful things you can do is to adjust your trend filter for the volatility of the stock.

The initial stop loss should consider the stock’s volatility because the idea is to give all trades an equal potential to succeed. Linking the initial stop to the volatility of the stock does this because higher volatility stocks have wider initial stops, and lower volatility stocks have narrower stops. This means all trades are equally likely to get stopped out.

Finally, if you are trend-following stocks, the trailing stop exit should generally be linked to volatility. The argument is similar to that used in the volatility-linked initial stops – you want to give all trades an equal chance to succeed. If you used a fixed 25% trailing stop, for example, on a volatile stock and on a low-volatility stock, the volatile stock is much more likely to get an exit signal than the low-volatility stock. Linking the trailing stop to some measure of volatility like ATR or standard deviation resolves this problem and gives all trades equal opportunity to succeed.

3. Stock Specific Risk Management

Individual stocks can go bankrupt or be taken over at a premium…but wheat or oil can’t go bankrupt. Sure, all asset classes can have sudden price shocks, but bankruptcy is something specific to stocks.

Corporate bankruptcies are rare, but they do happen, so your risk management rules should consider what you will do if it happens to a stock you are holding and how you position yourself in advance to ensure that if one of your stocks does goes bankrupt it doesn’t destroy your trading account.

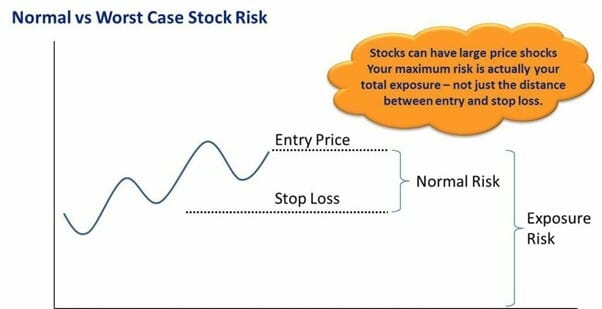

The way I think about stock-specific risk in my stock trading plan is on two dimensions:

- How much is at risk according to my position size and the distance to my stop loss

- How much is at risk because of my total exposure to the stock if things get really bad

A stock trading plan should consider the normal risk levels and the total exposure risk of the stock (Catastrophic stock specific risk).

The first is important because you need to know your theoretical risk per trade. This number should be a very small percentage of your account. Also, remember that if the stock gaps down through your stop, you could lose several times what you initially intended.

The second number is important because if something happens and the stock goes bankrupt, it is the total exposure to the stock you lose, not just the distance to your stop loss. My stock trading plan ensures that the total exposure I carry to any individual stock is not large enough to devastate my account should the worst happen… believe me, it does happen, so you better prepare for it by limiting your exposure!

Limit your total exposure on any one stock to a percentage of your account that you are happy to lose if the worst-case scenario happens.

4. Correlation Between Stocks

One of the interesting things about the stock market is that you can get a lot of diversification value by holding many different stocks in your portfolio; however, when it comes to an extreme event like a market panic, pretty much everything seems to be highly correlated.

This means that your stock market trading plan needs to consider the increased correlation that occurs between stocks in extreme conditions. My trading plan limits my total exposure across all stocks so that I will be able to keep trading should an extreme event impact my stock trading systems.

Stock correlation increases in market extremes.

The amount of leverage you use in the stock market is a particular consideration here – if you use aggressive leverage and take on a lot more exposure than you have equity, then you may find yourself in trouble in an extreme event.

5. Correlation Between Market Sectors

For example, stocks within the same industry group may tend to be highly correlated. This is not a rule that I use; however, there are many traders and investors I know who do limit the total exposure they have to a particular sector.

Trading Plan vs Trade Plan – The Critical Difference

“Why should I care about a trade plan or a trading plan?” I hear you ask…well if you want to lose money, you shouldn’t worry about either. But if you actually want to make money in the markets, both are critically important.

Both are important but totally different in nature and focus. I like to think about the difference with the following analogy:

- Trade Plan: This is like a single tree. Each tree in the forest must be managed and nurtured so that it can grow and survive. Your trade plan does this for each individual trade. This is the micro plan which is usually a subset of your overall trading plan

- Trading Plan: This is like the entire forest. The entire forest must be managed as a collective with the overall objectives of the forest in mind. Each tree on its own matters little, but they matter a lot together! Your trading plan is the overall plan that guides all your trading activities

Your Trade Plan is like a single Tree; your Trading Plan is like the whole forest. If you don’t have either of them, all you will grow in your trading account is weeds!

It is important to understand the difference between the two types of plans – both are important but totally different in nature and focus. It is best to consider the trade plan as the micro plan and the trading plan as the macro one. I explain each concept further below.

A trade plan is your plan for exactly how you will manage an individual trade that you have in the market. Before you make any trade, you must have a plan for exactly how you are going to manage that one trade from start to finish.

Your trade plan will tell you how you are going to enter the trade, what you will monitor when the trade is open and how you are going to exit the trade. If you are a systematic trader like me, then every plan is exactly the same – it is the combination of your entry, initial stop loss and exit rules.

If you are not a systematic trader, you will need to write down your plan for each trade you make so that you know exactly how you will manage the trade for its entire life.

Your plan will typically be pretty simple…you may want to include:

- Your entry criteria / entry rules

- The date you entered

- Your initial stop-loss

- Whether your stop is in the market or a mental stop

- How often will you monitor the position

- How you will exit (including each of the different exits you will use, such as trailing stop, profit target, and any indicator-driven exits, for example)

- How you will add to the position if relevant

- How will you scale out of the position if relevant

Once you have done this, you will know exactly how you are going to manage the trade. This trade plan will ensure you take the right actions at each point in the life of the trade.

The trade plan is a small part of the overall plan that all traders need – the trading plan.

Note also that the trade plan is different than your trading diary (also known as your trading journal), which is the document you should maintain to capture your thoughts and observations about the markets, yourself as a trader, your rules and evaluations of trade results. Over time your trading diary will become an indispensable resource to improve your trading performance in all market conditions… All you have to do is read trade journal entries from your trading diary to learn from your past trading mistakes and find ways to improve.

Frequently Asked Questions About Trading Plans

When Should You Document Your Plan?

Developing your plan is an ominous task if left till after all of your research and trading system development is done.

When traders leave documentation of their plan till late in the process, they feel like the documentation step is stopping them from making money, so they never document their plan – BIG MISTAKE!

Traders who don’t have a written plan

are unlikely to make money in the long term

The solution is to build your plan as you go and add to it over time. We suggest you start now and progressively add to and refine your trading plan as you learn more and refine your trading system.

What is the best way to develop a trading plan?

As indicated above, the best way to develop a written plan is to build it progressively and iteratively as your learning and research progress.

For example, in your first weeks of trading system development, you will likely not be able to document what you will do in the case of a natural disaster or civil war, nor will it seem as important as writing down your new entry and exit rules.

Over time the detail beyond the trading system rules, such as the extreme events, will become more and more important (particularly as your account size grows). As you grow in your trading you will realize that survival is almost always the first priority, after all…

You can’t win the trading game if you don’t stay in the game

So my strong suggestion is to start a written plan NOW. Document what you know so far about your approach and build on this.

What is the easiest way to write a trading plan?

There are a number of resources that can help you build a solid plan.

We have developed a trading plan template that accelerates the process of building your own written plan by clearly laying out each section with the right questions and some thought prompts to get you started.

The Trading Plan Workbook shows you what the completed document should include as a minimum. You can fill in the gaps as you build your well-rounded trading strategy and understand yourself better. This accelerates the process dramatically and will improve the quality of your plan.

It also poses many scenarios that can and do happen, even though the novice trader may dismiss them as unlikely. Thinking through extreme scenarios dramatically improves the stability and performance of your trading business and improves your chances of staying in the game.

How do you know if your trading plan is sufficient?

This is a very important question to understand. We have found that as you trade, you will come across situations that are not covered in your plan. Whenever this happens, you must determine what is missing and add to your trading plan to improve it. The next time you encounter that situation, you will already have your response documented, so you will know what to do.

This progressive approach is fine in the early stages, but what if one of the things you come across for the first time is a market crash that is not covered in your plan? What if you come across this market crash and you are highly leveraged and 200% long?…this would likely wipe out your account and take you out of the game. This is an expensive way to build your trading plan!

Therefore we suggest you find a trading mentor with the experience to review your plan and challenge it based on their experience. This will help you think through and document how you will act in situations you have not yet experienced.

Having developed and refined our own plans over many years, we are in a good position to support you with a detailed review and challenge of your trading plan.

Conclusion For Your Trading Plan

While a stock market trading plan is largely the same as a trading plan for other asset classes, such as futures, forex, or cryptocurrencies, there are several factors specific to stocks that you should take into account. The stock liquidity, volatility, stock-specific risk and correlation between stocks and within sectors are all factors to consider when writing your stock trading plan.

Including these 5 additional factors in your personalized trading plan greatly improves the results from your trading journey and help you eliminate emotional decisions which hurt your results.

Just by writing a proper trading plan and following the 8 steps described above, you will put yourself far ahead of most other traders. Give yourself the best chance of making money and being a successful trader – you certainly deserve it!

If you haven’t already got a trading plan or a fully backtested trading system, I recommend you learn more about The Trader Success System. In The Trader Success System you will learn how to create a rock-solid trading plan that fits you; you get access to over 18 different trading systems AND learn how to backtest and build confidence in those systems for yourself! Click the button below to learn more about The Trader Success System!

Share This

Share this post with your friends!