When you first learn stock trading, drawdown and trading profits are easy to be overly optimistic about. One of my Private Email Coaching Clients recently asked:

“What are reasonable MAR, CAGR and Drawdown % values for a long only,

trend following daily bar trading system over the long term?”

Two quick definitions first:

- MAR: MAR the CAGR divided by the maximum historical drawdown (MDD)

- CAGR: CAGR is short for compound annual growth rate. It is simply the average percentage profit you make each year.

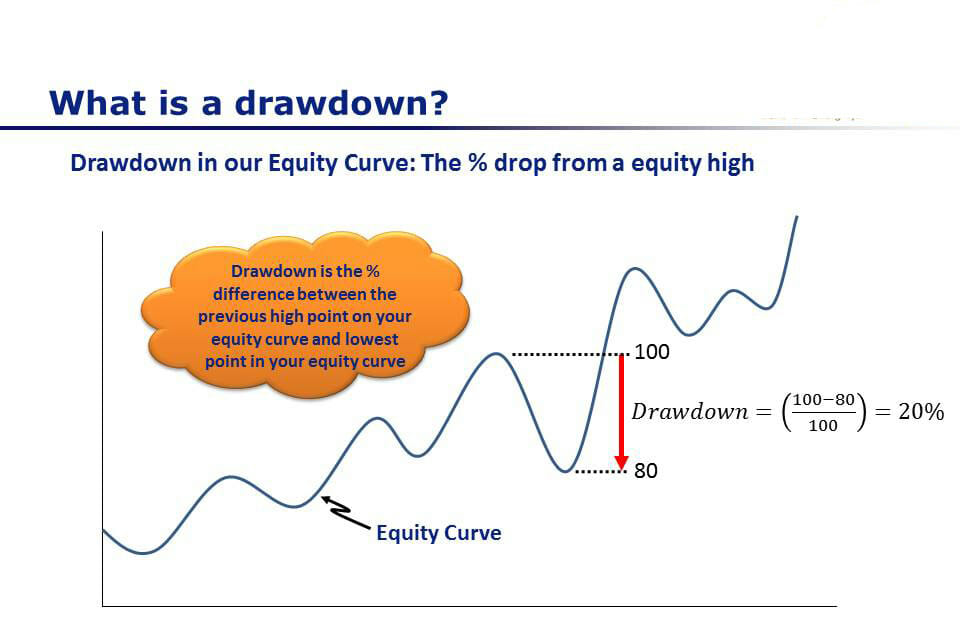

- Drawdown: Is the percentage drop from the previous equity high to the current following low point in the equity curve. (Illustrated below)

Drawdown is the percentage difference between the previous equity high and the subsequent equity low from your stock trading system.

This is a great question which very much illustrates the importance of setting your trading goals up front before you start your trading system development journey.

Determine Your Maximum Drawdown (MDD) First

The first trading goal I like to set is the maximum drawdown because this is the limit at which I am psychologically comfortable to keep trading. Sitting through a 30% decline in your equity is pretty tough for most people (myself included) so this number should be fairly conservative for most people.

When setting the maximum trading drawdown that you are willing to tolerate it is also important to remember that the decline you see in your backtest is probably less than your maximum will be in real life trading. I like to be comfortable with 1.5 x maximum the backtest drawdown, because that is probably what you will face in real time trading at some point.

So if your maximum equity drop before you start to feel really nervous and uncomfortable is 30%, then you should aim for a system with a backtested maximum drawdown of 20% to give you some room to move.

Remember that larger equity declines are exponentially harder to recover from, so keeping your drawdowns low is one of the keys to profitable stock trading.

Aim For A Respectable MAR Ratio

In his outstanding book ‘Way of the turtle’, Curtis Faith presents the performance figures for quite a few trading systems using a diversified basket of futures contracts. Many of these systems have a MAR ratio between the range of 1.0 – 1.3 in backtesting. The MAR level that is classified as ‘good’ is a bit subjective because it really depends on the style of system you are trading.

If you are using a stock trading system and are trading from the long side only, then a MAR of 1.0 would be a pretty good target because there are periods like the Global Financial Crisis and the 2000 bear market where these systems will have pretty significant equity declines. This makes a MAR higher than 1.0 fairly hard to achieve in real life (you can get higher back tests pretty easily if you have curve fitted your parameters too much during your trading system development process, but this is not the way to get good REAL trading results!)

If you are trading long / short on a diversified basket of instruments then you can aim for a slightly higher MAR…but you still need to be wary of curve fitting.

Determine Your Trading Profit Goal Based On Max Drawdown MDD And MAR Target

Now that you have your max drawdown and your MAR target, it is a simple matter to combine the two to get your trading profit target in CAGR (compound annual growth rate) terms.

MAR Ratio = Annual Growth (CAGR %) / Maximum Drawdown (%)

I really prefer to approach the setting of trading goals from the downside first – by setting my maximum equity decline and then calculating what CAGR I should aim for. This is important because it prevents you from becoming too aggressive and optimistic since your focus is fairly and squarely on capital preservation and risk management FIRST…and one of the keys to surviving in this game is preserving your capital by managing risk.

The worst numbers you should consider for MAR / CAGR / Drawdown is pretty hard to answer. Realistically if your returns are half your maximum equity decline (MAR <0.5) then your system is not very good and you should probably keep looking or improving your trading system. I would generally throw a trading system away if I can’t make the MAR better than 0.75 in backtesting UNLESS it is very different from what I am already trading.

Improve Portfolio MAR And Reduce Drawdown By Adding Uncorrelated Trading Systems:

Once you have one trading system up and running with a respectable MAR (say around 1.0 in a backtest), then you can improve your portfolio MAR by adding uncorrelated trading systems or different types of markets (like forex and futures). Just as the illustrative chart below shows – adding uncorrelated trading systems improves MAR and while achieving the same level of return.

Trading system diversification reduces drawdown and improves the smoothness of returns.

This is a far better approach than tweaking the one trading system to improve the MAR because every change you make to your trading system increases the risk that you are just curve fitting to past data.

Adding a second or third system to your portfolio is more about the portfolio MAR than it is the individual system MAR. For example, if you have one stock trading system with a MAR or 1.0 and you build a second stock trading system with a standalone MAR of 0.5, but when you combine the two trading systems into a portfolio you get an overall MAR of 1.75 then you would be VERY EXCITED!

You would probably not use the second trading system on its own, but in the portfolio it is a fantastic addition.

Conclusion About MAR, CAGR and Maximum Drawdown

An outstanding MAR for any long only stock trading system would be anything higher than 1.0 provided you are including data from the last 15-20 years in your backtest. The bear markets that we have had in this time cause the MAR to drop.

If you are only using data from a bull market (which I do NOT recommend) then your MAR would be much higher than that in your backtest – but your real time performance will not be that good when the next bear market comes along.

When you add a short side system, or additional markets like futures and forex then a portfolio MAR of 1.5 or more would be very good and more than enough to make you a lot of money if your systems are designed well and you do not over optimize your trading systems.

If you have an existing trading system that is giving you a CAR/MDD which is too low, or a drawdown that is too high, use these tips to understand why and reduce the drawdown in your system.

- Learn 4 Causes of drawdown & 5 ways to reduce maximum drawdown in your trading

- Stock Trading Systems: What Are Reasonable Cagr And Drawdown Targets?

- How to Manage Initial Drawdown – Two methods to start a new stock trading system

Thank you very much, for this articel.

FOr 3 Month i start algo trading with stocks / amibroker. Bevor i trade intraday strategies for 5 Years and now i i would like to trade stocks too.

I have search for a rule of tumb what a good stock trading/rotation system is, or what “numbers” a good system have.

Now i know 0.75-1 car/mdd ist a good system. Sure it depens on Timeframe, of Backtest Time hoirzon (10-15-25 Years) and so on.)

If you can more spezifie the Numbers that would be greate. But this info ist normaly very dificult to find online, even if i calculate it by my self if found a system that get offer by someone.

Therefore Thank Adrian!

Hi Stefan,

Thanks for your comment, I am glad my posts are helping you with your trading. There is not really any specific benchmarks you need to adhere to. My suggestion is that you focus on getting a number of ‘good’ (not excellent or perfect) systems and trade them as a portfolio. The diversification across multiple systems will really help. The Trader Success System gives you a diversified portfolio of systems that you can backtest and use in your own trading if you need a shortcut (https://enlightenedstocktrading.com/learn-stock-trading-with-the-trader-success-system/).

Start with 1 good system… it must be profitable, have a relatively stable equity curve and have drawdown that is within your tolerance… then find another system that has a low or negative correlation to the first system… and repeat.

You should be constantly seeking new systems which have low correlation to the existing systems in your portfolio – this is more important than the individual performance stats of each system in isolation.

Adrian