What is Short Selling of Stocks and How Does it Work?

Short selling of stocks refers to the practice of selling stocks that the investor does not own with the intent of repurchasing them at a lower price in the future. Short selling of stocks allows the trader to profit from stock price declines and make money during bear markets.

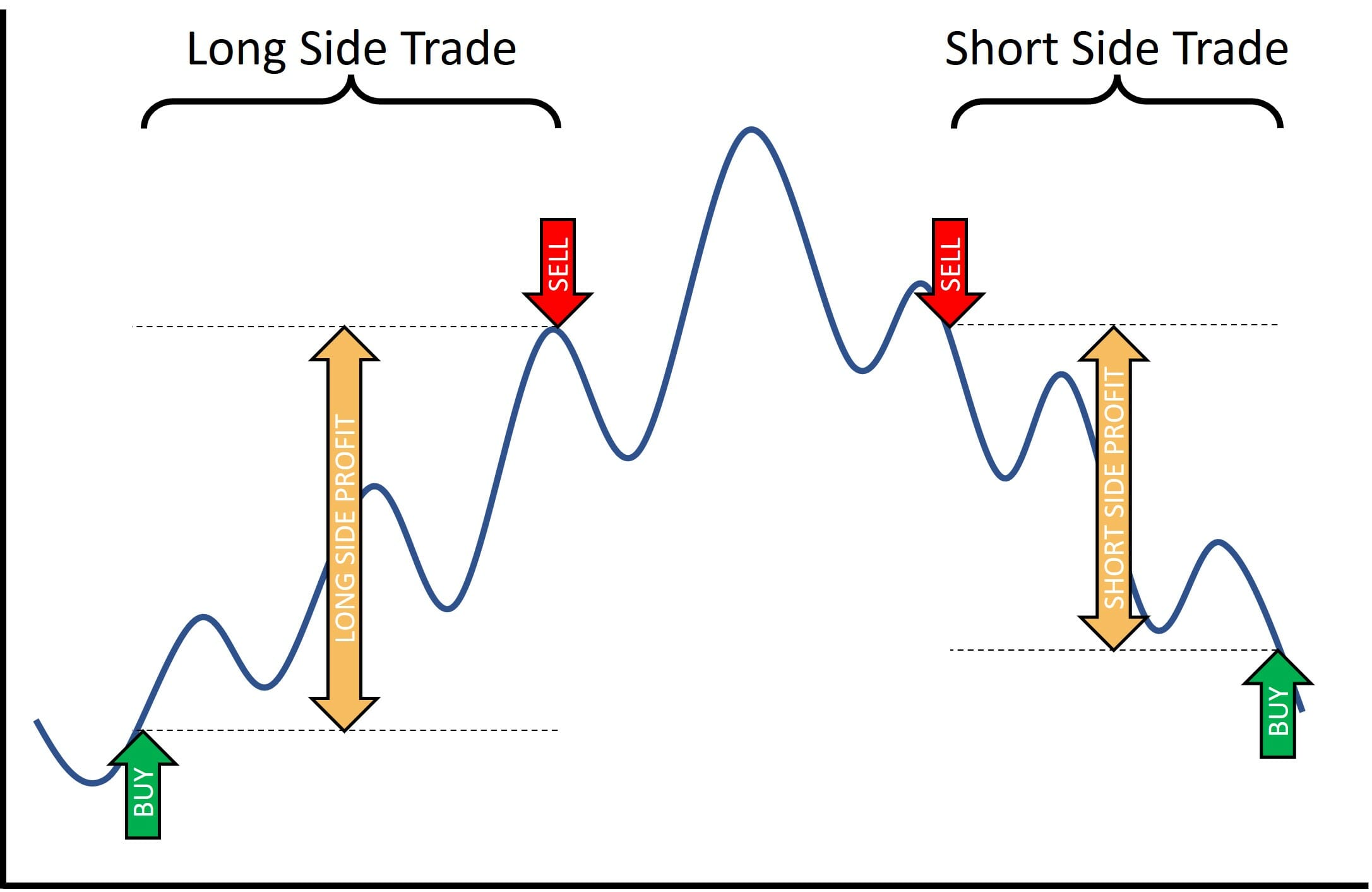

Traders often talk about making money trading by “Buying Low and Selling High”, typically this is done by first buying and then selling… but when you short sell a stock, you sell high first and then buy it lower later (hopefully). So the mathematics of making a profit is the same as a regular long-side stock trade; it is just the sequence of events that is different, as illustrated in the diagram below:

For short selling of stocks to be possible, a trader first needs a broker willing to lend the stock to them. The trader then sells the borrowed stock on the open market and receives the proceeds from the sale. If the stock price decreases as the trader hopes, they can repurchase the stock at the lower price, return it to the lender, and pocket the difference as profit. If the stock price increases, however, the investor will incur a loss when they repurchase the stock at a higher price and return it to the lender.

When the trader is short selling a stock, they incur the normal commission/brokerage in addition to a stock borrow fee which is a percentage of the value borrowed, charged per day. The trader is also liable to pay any declared dividends in cash to the original owner of the stock they borrowed.

In practice, your broker handles this whole process automatically and seamlessly. Brokers typically have arrangements with large shareholders who receive a portion of the stock borrow fee in exchange for allowing the broker to loan their shares to traders who wish to sell them short.

Why is Short Selling an Important Trading Strategy

Short selling is an extremely important strategy for all systematic traders to learn. Let’s take a look at the S&P 500 chart below to illustrate why. You can see in the chart of the S&P 500 all the way back to 1995 that there is an upward bias in the market – Prices tend to rise over time, however the steady upward drift is punctuated by very large bear markets with pullbacks of 20 to 50% or even more over several years.

If you’re a buy-and-hold investor or a long-only investor during these times you will either sit around on your hands in cash waiting for the market to recover or if you are invested, you’ll be losing money waiting for the market to recover. The trouble is, it could be for years you could be sitting around waiting to get back to your previous equity highs because a bear market could wipe 50% off the value of the share market, and it takes several years to recover to former highs.

So how should we deal with this as traders and investors?

Short selling is a great strategy to help you make money during these bear markets. When you’re shorting the market, what you’re doing is you are selling a share that you don’t currently own, expecting that it will fall in price. So you can buy it back later at a lower price and make a profit. But how does that work because you’re selling something you don’t own?

Shorting a Stock – How To Sell Something You Don’t Own

Since you don’t own the shares currently and you want to sell them first (short selling) so that you can profit from the decline and buy them back later, you need to borrow the shares from your broker.

Let’s say you think ABC stock is going to decline in price, and it’s currently trading at $100 per share. So you go to your broker, borrow ABC stock, and then sell it immediately at $100 per share. Later on, the market has fallen, let’s say it’s fallen to $50 per share. You buy it back and return those shares to your broker. You sold it at $100; you bought it back at $50. That $50 per share was the profit that you made.

But where does the broker get the shares from?

The broker doesn’t just make these shares up out of thin air; they’ve got to come from somewhere. The broker has arrangements with large shareholders and funds to borrow their shares in exchange for a fee, and that’s called the stock borrow fee (more on that later).

When you go into your broker account, and you open an order ticket to sell on a share that you don’t own, you are effectively setting up a short sell trade, the broker automatically goes to these partners that he’s got relationships with, borrows those shares, loans them to you, and then you sell them. This all happens instantly and seamlessly. You don’t usually have to do anything other than create an order to sell the stock.

Every day you have that position open, you must pay the broker a stock borrow fee. The broker then keeps some of that and gives some of it to the original beneficial owner of the shares. That’s their fee for lending the shares to you. That’s a service that they’re providing for you in order for you to trade short. It’s short because you know you are short of that stock; you borrowed and got rid of it. You owe that stock back to the original owner. That’s why it’s called short selling or shorting a stock.

You make money in a bear market by borrowing a stock, selling it short at a high price, and then later on covering (buying it back) at a low price and delivering it back to the broker, so you are closing out your position at a profit. However, if the market goes against you, let’s say you short ABC stock at $100 a share, and the price jumps to $150 a share, you buy it back and deliver it back to the broker. Now, you’ve got a $50 per share loss, so you sold it at $50 but you bought it for $150. The difference is your profit or loss. In this case, you lost $100 per share.

Let’s have a look at another example, a real example from one of my trading systems in the Trader Success System. This was a trade that was kicked up in late 2008 in AIG stock. In 2008, during the financial crisis, most of the banks and most of the insurance companies were getting hammered and AIG is one of those stocks, declining from very big highs. Way up above here, 640 or something on the left-hand side of this chart. You can see my system sold this stock short here in September at $202.25 per share. AIG was shorted at $202.25 cents per share, and the next day the system covered this stock or bought the share back at $95.05.

Here’s how the trade played out:

- You sold a hundred shares short at $202.25

- You bought them back one day later at $95.05

- The profit per share is the difference between those two. In this case, $107.20

- If you sold short a hundred shares, the total profit on that trade is $10,720

Therefore, that’s how shorting works: You borrow shares from your broker; you sell them on the market at a high price. Later on, hopefully, you buy them back at a lower price so you’ve got a profit, and then you return them to your broker.

What Are Short Sellers

So now you know what short selling is, who are the “Short Sellers” that the media always talks about? Have you ever heard the media talk about how a share price dropped because the short sellers pushed it down? Who are these short sellers? Are they some big demon in the market? Is it the evil hedge funds?

Short sellers is just a generic term for anyone who sells stocks short. Short sellers are not evil, they’re not unethical traders, and they are not all predatory hedge fund managers trying to drive companies out of business. They are just people who sell stocks short.

Selling short or short selling stocks is not an unethical, illegal practice. It’s an integral part of the market and how it works, so short sellers are the people who do that. Shorting is when you borrow stock from your broker, sell it at a high price, buy it back, hopefully later, at a lower price, and make the difference as profit.

Short sellers are just normal traders, some hedge funds or many hedge funds do sell short, and yes, some hedge funds are predatory in their trading behaviour and try and use shorting to push the price down and cause trouble for a company. Still, short sellers are just everyday traders like you and me, there is nothing to get excited (or ashamed) about. It’s just one of those terms the media likes to throw around to make themselves sound smart and point the finger to blame at someone else.

Shorting is entirely ethical, in fact at the points of maximum fear when all hell is breaking loose in the markets, it is often the short sellers who step in to cover their position and provide buying pressure when everyone else is selling. Without short sellers many market panics could have been a lot worse (but you don’t hear the media talk about that do you?!?)

Don’t be afraid of short selling. This is a brilliant strategy, mainly when there’s a bear market, and to smooth your equity growth over a long period, you need to make money when the markets go up and when the market goes down. If you’re not a short seller currently, then this is a trading strategy you should think about learning.

The Risks and Rewards of Short Selling a Stock

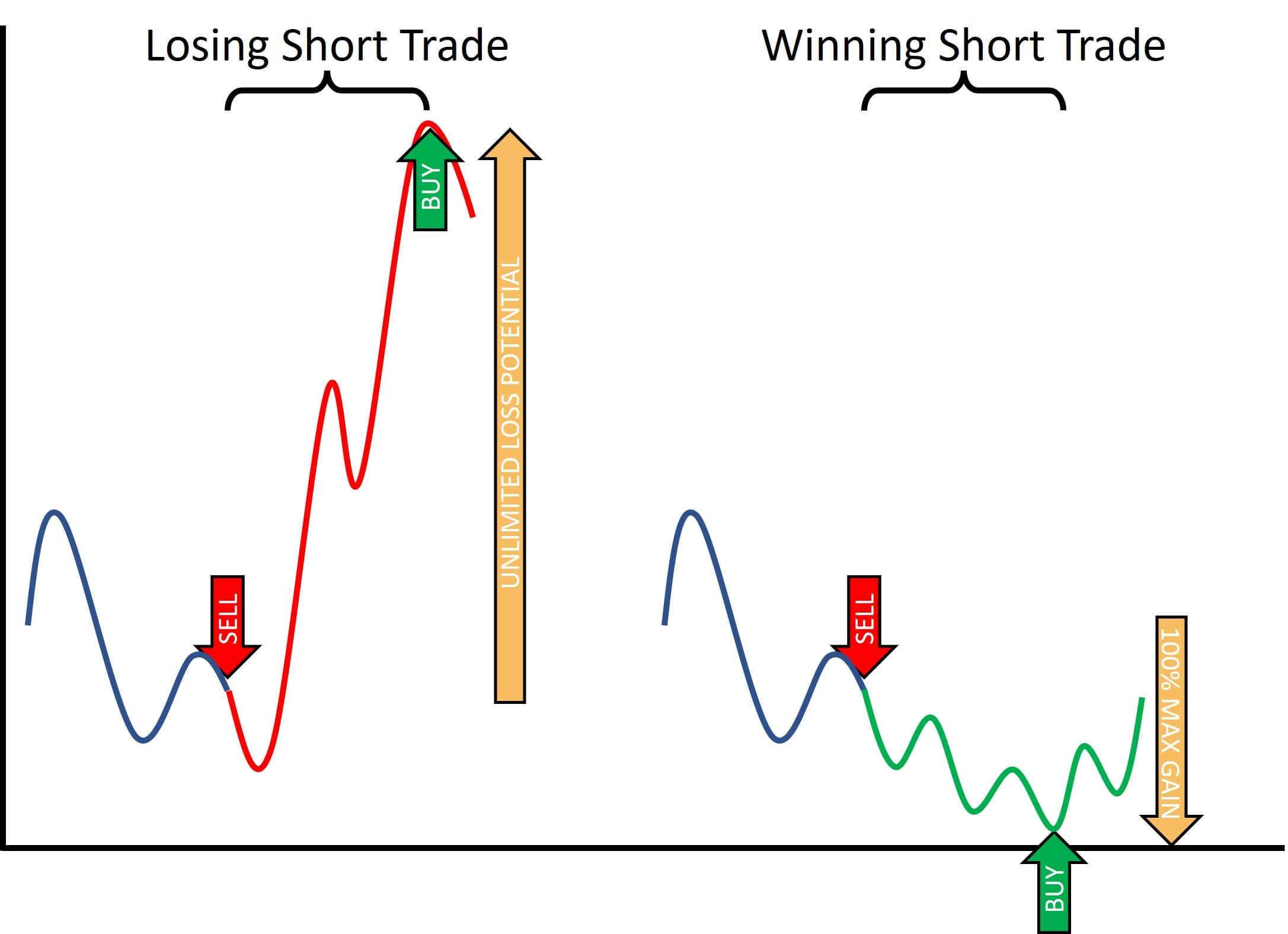

One of the main risks of short selling is that the potential loss is theoretically unlimited. If the stock price rises dramatically, the trader will have to pay the difference out of their account when they repurchase the stock and return it to the lender. For example, If you open a short position by short selling a stock at $10/share, there is a possibility that the stock could go up to $20, $50 or $100 or more, losing you large sums of money.

In contrast, the best you can do when short selling a stock is to have the price go to zero. For example, if you open a short position by short selling a stock at $10/share and the company announces bankruptcy and ceases trading forever, then you have made a 100% profit on the stock. This is the absolute best you can do when short selling a stock!

The loss and gain potential when short selling a stock are illustrated in the diagram below:

Because of the asymmetry of the potential gains and losses, short selling a stock is much riskier than buying a stock on the long side. It is important to have defined exit points and a stop loss to protect you from the unlimited loss potential. When short selling a stock, you must not let losses get out of control because they can mount up to be many times larger than your initial investment.

Downside Risks of Shorting Stocks

In this section, I will explain the downside risks of shorting a stock, whether or not, and how to mitigate those risks so you can trade on the short side without losing sleep at night. There are three real scenarios or events that you need to be concerned about:

- Overnight Gaps against your position

- Acquisition of a stock you are short

- Short Squeeze

The first one is overnight gaps. If you are short of stock, the worst thing that can happen is that the stock gaps up, as in moves against you overnight when there’s no chance to get out, no chance for your stop loss to get you out to safety. The second scenario, after gap ups, is acquisitions. This manifests in the same way when a company you are short is acquired or a takeover is announced.

Typically, that happens after market hours, and the following morning, the stock price will gap up to the price or to just under the price of the takeover offer. Both scenario one and scenario two, the gap up and the acquisition manifest similarly. A significant gap against you overnight causes you to lose money. The third scenario that can be a massive problem in short selling a stock is when you get stuck in a short squeeze. If you’ve been trading for a while, there was a huge short squeeze in GameStop, a US stock that skyrocketed. Many hedge funds were short this stock, and many retail traders banded together and manufactured a short squeeze, pushing the price up, which hit some stop losses and caused the hedge funds to buy back their short position.

In a short squeeze, the share price skyrockets quickly. As a short seller, getting out without losing much money is easier. They’re the three things that you have to worry about the most in terms of downside risk when you’re shorting a stock.

How can we manage these risks?

Are short-selling stocks safe when these risks are hanging over us?

Yes, you can short sell without losing your shirt, without blowing up your account.

Let’s have a look at the Gamestop short squeeze and see what risk management lessons it gives us…

Example of a Short Squeeze: GME Stock

Another risk of short selling is the possibility of a “short squeeze,” in which the stock price increases rapidly due to a lack of supply, forcing the investor to repurchase the stock at a higher price and resulting in a significant loss. A notable recent example of this occurred with a US stock called Gamestop, which was the subject of a coordinated short squeeze by a large group of retail traders through a Reddit group. Here is what happened:

A trader whom was short GME going into the short squeeze could easily have blown up their account if they were not watching the market and didn’t exit their short trade in time!

There were a lot of hedge funds, and so on that were short this stock, was heavily shorted. This movement started to gain traction about forcing a short squeeze on GameStop. The reason this happened is there was a very high short interest in this stock. That means it was ripe for a short squeeze situation. As it started to happen, the price edged up and edged up, but then it took hold, and the stock ended up going from just around a dollar, and it peaked at over $120 as you can see in the chart above.

If you were short GME with all of those hedge funds, were completely asleep at the wheel, you didn’t get out, you didn’t have a stop loss then you could have lost a huge, huge amount of money!

The short squeeze is dangerous if you’re not attentive to your positions. Even if you are, you can see some of the overnight gaps like when GME closed at $36.99 on the 26th of January and on the 27th of January, it opened at $88. They’re the gaps that you want to worry about.

Why am I telling you about this when discussing position sizing? Lets have a look at 5 risk management strategies for short selling.

Short Selling Risk Management Strategy 1: Small & Equally Sized Positions

Imagine you had a short position in a stock like that that ended up in a short squeeze with huge overnight gaps and a big run-up. If you’re in a large position and were being aggressive on that particular stock because you thought it was a dud stock and it was going down, then your potential loss is huge. However, if you have very small, equally sized positions, and many of them, you’re shorting lots of different stocks. The downside risk of those short squeezes and the overnight gaps is much more contained.

Because of the risk of gaps up and short squeezes, you want to ensure every position is small. I wouldn’t have any short position bigger than 5% of my account in terms of exposure (in practice I have even smaller positions than this!). I would also have a stop loss that would limit my average risk to much less than my total exposure to the stock. 5% of equity position sizing is aggressive when you look at how GameStop moved.

Importantly I don’t use risk-based position sizing on the short side.

Risk-based position sizing is where you have your entry price and your stop loss, and you use that distance as in your normal risk (your 1-R risk in Van Tharp speak) to size your positions to risk 1% of your account on that trade. I don’t do that because if your stop loss is too tight, you end up with a large position which can really hurt you if there is a gap through your stop loss.

On the short side, the severe damage is done by the total exposure of your trade, not the distance to your stop. This is because large overnight gaps can occur as we saw in the GME situation. If you have a big position, even if your stop loss is small and that big position gaps against you, your loss is way bigger than what you expect. This is why I position size based on exposure, not stop loss.

Short Selling Risk Management Strategy 2: Always use a Stop Loss

Of course I use a stop loss on the short side, but your position sizing needs to think beyond the stop loss because a stock can blast through your stop if it gaps up overnight.

When you’re on the short side, the risks are very high if the stock continues to move against you if something happens to you. At the same time, you are short; like let’s say you get rushed to the hospital, have a car accident, get sick, or are just distracted. You want to have a stop in the market because the damage to your account can be so big.

On the long side if you buy a stock at $100 a share; what’s the worst that can happen? The worst that can happen on the long side is the stock goes to zero, so you lose your $100 a share.

On the short side, if you short a stock at $100, the worst that can happen is uncapped. It can go to 200, 300, or 500; as you store in GameStop, a dollar stock can end up over 100 in the right conditions.

You want to have a stop loss in the market just in case something happens to you so that you don’t suffer unlimited losses. You don’t need to be scared as a trader of the unlimited loss of trading on the short side; you need to be diligent, have a good system, be backtested, have a stop loss, and have small, equally sized positions.

Short Selling Risk Management Strategy 3: Only Trade Highly Liquid Stocks

To manage your risk, the third thing you should do is on the short side is only trade highly liquid stocks. It’s very tempting to see some small cap crappy companies where the share price is trending down, and you want to short them, but this is a mistake.

The risk of shorting a small cap stock is far higher than a highly liquid stock because in small cap stocks a small price announcement or a takeover announcement can push the price a long way against you.

On the short side, I’m looking for very high liquidity (average daily stock turnover) because that helps you mitigate the downside. This is because a large-cap blue chip company won’t tend to double, triple, quadruple overnight, but a penny stock can very easily, and it happens quite often. I wouldn’t want to be short; small cap stops like that, so I only short highly liquid stops.

Short Selling Risk Management Strategy 4: Focus Shorting on Bear Markets

The next thing I do is, emphasize the short side when the broader market is going down. Most of my short-selling systems turn on only when we’re in a bear market. That means typically when the broader index is below its 200-day moving average. This is a powerful rule because bad things tend to happen below the 200-day moving average. Good things happen above the 200-day moving average.

If you want to reduce your risk of getting whacked by an adverse move and tilt the odds in your favour when trading on the short side, then think about using a regime filter that keeps you on the short side only in a bear market. In a bull market, it keeps you out.

In a bull market, the money is made on the long side. You can make money short, but you must be much more nimble, aggressive and short-term in your trades. In a bear market, you can short-falling stocks, hold them for a couple of weeks, set a profit target, and typically make very good money, so index regime filters are the final strategy that you can use to manage your risk on the short side and manage your downside risk is to use system diversification.

Short Selling Risk Management Strategy 5: Trade Multiple System Variations

No system is perfect, and no parameter values you select for one system are perfect. If you’ve got a backtested trading system for the short side, and let’s say you chose a 200-day moving average and a 40-day breakout and a 30% stop loss and so on.

It’s great if it backtests well, but having a few variations of that trading system is also a really good idea because the one parameter set that you’ve chosen from the past and backtested is not likely to be the best parameter set in the future.

I like to diversify on the short side, diversify my parameters in my systems to make sure that if the market in the future is a little bit different than it is now, then I’ve got a variation of my system that might give me a chance to make more money. I don’t want to rely on just one set of parameters for my short selling strategy.

Just like I don’t want to expose myself too much to any one stock. I want in lots of small, equally sized positions. I always use a stop loss. I trade highly liquid stocks and primarily on the short side when the broader index is heading down.

You can do those things to mitigate the downside risk in trading short. I don’t want you to be afraid of short selling. It is something, a strategy that adds huge value to the portfolio because you can make great money in a bull market. In a bear market, you can scratch out some returns on the long side, but you’ll do far better overall if you can make money in a bear market and a bull market. The best way to make money in a bear market is to have a short strategy that gets you in when the market turns and rides the market down, takes profit at the bottom or near the bottom, and then you go back in on the long side.

That’s a great way to smooth your equity curve, diversify your account, and head some of your longs that you’re still long as the bear market starts to emerge. That’s how I think about the downside risks and mitigating them in a bear market for short selling of stocks.

Why Take The Risk: The Rewards of Short Selling

Despite the theoretically unlimited risk, short selling of stocks can be a very profitable strategy, especially in a bear market. Fast profits are possible on the short side because when stocks fall, they tend to fall much quicker than they rise. As the saying goes:

The stock market goes up the stairs… and it goes down the elevator shaft

Short selling of stocks in a bull market is risky and challenging, and traders will have much greater chances of success if they limit shorting to bear markets. One of my favourite stock trading systems, called The Slippery Dip, is a system that makes money by short selling of stocks on the US stock market when it is in a bear market. It finds weak stocks and shorts them when the US stock index falls into a bear market. The Slippery Dip is available to all members of The Trader Success System.

Here is a backtested equity curve of The Slippery Dip trading system that was produced using Amibroker with Norgate data, including delisted stocks back to 1990:

Notice that the significant gains for this system that short sells stocks occur during the major bear markets, including the 2000 tech bubble burst, the 2008 Global Financial Crisis, the Covid Crash of 2020 and the 2022 bear market.

The backtested equity curve above is precisely why short selling of stocks is such a powerful trading strategy to add to your portfolio because it makes money when long-side trading systems are losing money or are sitting in cash.

The 3 Major Costs of Shorting a Stock

In this section, I will discuss the three major costs of shorting a stock. You should take these costs into account with any short side trading strategy. The three major costs of shorting a stock are: Brokerage / Commission, Stock Borrow Rate, and Dividends.

1. Brokerage or Commission

Commissions are the same as when you’re trading on the long side. You’ve got to pay your broker to place the trade for you. Sometimes you can get commission-free arrangements depending on what market you’re in and what broker you use, but if you don’t have commission-free trading, you will have to pay a brokerage to place your trade, which is the same as a long side.

2. Stock Borrow Fee

The stock borrow fee is the fee you pay the broker to borrow that stock for the duration of your trade. You have to do that because someone is lending you the shares, and in exchange for lending you the shares, they expect to get some compensation, some income for that. It’s a great way for fund managers, hedge funds, and large shareholders to earn extra income on long-term holdings they don’t intend to sell. They give their shares to the broker, the broker lends them to you, and you pay a stock borrow fee in exchange.

What is the stock borrow fee? How much do you have to pay? It depends on how easily shortable the stock is, how liquid it is, and how many shares the broker has available. The more difficult to borrow the stock, the higher the stock borrow fee will be. Conversely, the easier to borrow the stock, the lower the stock borrow fee is going to be.

If you use Interactive Brokers, you can use the stock borrow fee tool to look up the fees for any short-able stock globally. This tool is part of Trader Workstation. When you want to go short, you open the stock borrow fee tool, which tells you how many shares are available to short and the fee rate. When I recorded the video above, there were at least 274 million shares of Apple stock available to short, and the fee rate was 0.25%. This is a very easy-to-borrow stock, but what does the 0.25% mean?

This is like an interest rate per year. If you short that stock and you held it for a year, you would have to pay 0.25% of your position to the original owner of the stock in exchange for borrowing it. However, if you only hold it for one day, you’ll pay 0.25% divided by 365 for the per day rate for your stock borrow fee. This is proportional to how long you hold the stock. Generally, it’s a low number for highly liquid stocks, but it really can be a high number for low liquidity stocks.

On the same day as Apple’s stock borrow fee was 0.25%, GameStop had 706,000 shares are available to short and the fee rate was 8.94%. That means if you short this stock and you held it for a whole year, you would have to pay the original owner through your broker 8.94%.

If you do the calculation on that, let’s say you’re going to have a $20,000 position. We multiply that by 8.94, then divide it by 100 for percentage, so that is $1,788 per year that you would have to pay to hold it. We divide that by 365, and it’s $4.89 per day. It’s a short $20,000 of GME today at that fee rate, then it would cost you $4.90 per day to hold the position. Whereas in Apple, it cost you almost nothing.

Before you go rabidly shorting anything in the market, check out the fee rate and ensure that it’s not so high that it will kill the profitability of your trading system

The fee rate is a cost, which you do have to take into consideration because it can be very high for low liquidity, hard-to-borrow stocks. I’ve seen fee rates as high as 100% or more for low-liquidity stocks.

3. Dividends

You can borrow stock because fund managers, hedge funds, and large shareholders hold these big blocks of stock that they have no intention of selling. To earn extra income, they’ll loan them to you through the broker and take a fee for the stock borrow fee, as we just discussed. Because they don’t intend to sell that stock, they have that as part of their portfolio; they also want to take advantage of the dividends that the stock declares. If you short a stock, you’ve borrowed it from your broker, you’ve sold it short, and a dividend is declared and paid, the owner of those shares is going to expect you to pay them the dividend that they’re missing out on because you’ve borrowed and sold the stock short.

One way to mitigate this is if a stock is a dividend-paying stock when it’s coming up to its dividend date, you can close your short position, wait till the dividend is paid, and then open your short position again if it’s still valid. That way, you don’t have to pay the dividend because you weren’t short the stock when the dividend was paid. You don’t have to pay like you can avoid it, but you’ve got to manage that actively. Therefore, you need to be careful.

The three costs for shorting a stock are the brokerage or commission, the stock borrow fee, and dividends. If you want to make the most out of your short-side trading, consider all those when designing your trading strategy; the stock borrow fee is probably the most significant because it can be high. I trade mostly large liquid stocks on the short side because the stock borrow fees are smaller. You want to be careful if you’ve got a very high-paying dividend stock. You don’t want to end up having to put your hand in your pocket to pay the dividend because that could also kill your system’s profitability if it’s a short-term system.

When Do Short Sellers Have to Cover Their Position?

There are three reasons why you would want / need to cover your position as a short seller:

- You receive an exit signal from your trading system

- Your stock gets called back by your broker

- You receive a margin call

The first and most common reason is when you get an exit signal from your trading system. If you are a systematic trader like me, you will get a signal to enter your short trade. Then, you will get a signal to exit your short trade. That might be an exit in profit, or it might be exiting by hitting your stop loss. Either way, it’s like a systematic signal to get out of your trade. For example, my main short system, Slippery Dip, available to my students in the Trader Success System, enters weak stocks when the market declines. It sets a profit target so that when the stock collapses, you get out quickly with a profit, and it has a stop loss so that if it moves significantly against you, you get out, too. That’s the first reason a short seller would have to cover their short position, if you get a signal to exit from your trading system.

The second reason you might have to cover your short position is if your stock gets called back. When you are selling stocks short, you borrow them from your broker, and the broker gets them from fund managers or other big shareholders, other large traders on their books with whom they’ve got arrangements. They borrow them and give them to you, then you short sell them. However, if the owner of those stocks wants them back, they can call them back, and you have to buy those stocks and then give them back to the broker, who gives them back to the original owner.

Just because the person you borrowed them from wants them back doesn’t mean you necessarily have to cover your short position and give them back because as soon as they notify the broker they want their shares back, the broker will try and borrow those shares from somewhere else for you, so that you don’t have to cover your short position. But sometimes, it does happen. Your shares get called back, and you do have to close the position. That’s the second reason you might have to cover your short position.

The third reason you might have to cover your short position is only if you need to manage your risk properly. This is if you get a margin call. For example, suppose your position moves against you a long way, the stock you’ve shorted goes up, or some of your other positions move against you. In that case, you might get a margin call and be forced to cover your position to reduce the risk in your account to bring your margin requirement back in line with the equity in your account.

In conclusion, there are three main reasons why you might have to cover your short position. In my trading, the systematic approach that I teach in the Trader Success System, the primary reason you’re generally going to be covering your shorts is that you get a signal from your trading system to exit that trade. Therefore, you buy it back, close the position, and you’re done.

Finding the Best Broker for Short Selling of Stocks

When selecting a broker for short selling of stocks, there are several important considerations:

- You must qualify for a margin account to start short selling in stocks

- You want a broker with the broadest range of stocks to sell short

- You also want your broker to charge the lowest possible stock borrowing fees

I use Interactive Brokers, however, other brokers can also facilitate the short selling of stocks in your account. Of course, it is also essential for you to choose a reputable broker regulated by a major financial authority (Eg. In the US, Australia or Canada… NOT Cyprus 😂🤣).

Famous Examples of Short Selling in Action: Successes and Failures

There have been many famous examples of successful and unsuccessful short selling of stocks. One notable example of a massively successful short sale was during the subprime mortgage crisis in 2007 when Michael Burry (and others) made large profits by short selling of stocks from companies that were heavily invested in subprime mortgages.

A famous example of a large short sale of stocks that went wrong was in 2001 when short seller James Chanos lost billions of dollars by short selling the stock of Enron, which ultimately filed for bankruptcy due to accounting fraud.

Frequently Asked Questions about Short Selling

What is short selling?

Short selling is a trading strategy in which a trader sells a stock they do not own by borrowing it from their broker or another party and selling it on the market to repurchase it at a lower price in the future so they can return it to the owner. The difference between the price the stock was sold at and the price it was purchased back by the trader is the profit/loss realized by the trader.

What are the risks of short selling a stock?

The primary risk of short selling a stock is the price rise. The challenge with short side trading is that the stock price can theoretically increase to any level, so the loss on a short trade is theoretically unlimited. This can lead to significant losses if the trader is not attentive and does not have a stop loss to prevent the losing trade from getting out of control.

What are the benefits of short selling a stock?

Short selling of stocks can make money exceptionally quickly under the right market conditions. For example, short selling was highly profitable during the bear market of 2008 and the Covid crash of 2020. The other benefit of short selling in stocks is that the profits correlate negatively with most long side trading strategies. Thus combining a profitable short selling strategy with a long side trading system dramatically improves your risk-adjusted returns and reduces drawdown.

Can short selling be used for market manipulation?

Yes, short selling can be used for market manipulation if a group of investors coordinate to short sell a stock in large volumes. This can drive the stock price down, which triggers the stops of long-side traders, causing even more selling pressure to drive the stock price down further. This is known as “bear raiding” and is illegal (but it could still happen in theory).

Is it possible to short sell a security that is not publicly traded?

Technically it could be possible to short sell a stock that is not publically traded, but this would be very difficult and risky to accomplish in practice. Moreover, the lack of liquidity in stocks that are not publically traded makes this a dangerous and challenging strategy that is likely not worth the effort.

Can I short sell an index or ETF?

Yes, you can short sell indices or ETFs. Most major ETFs are shortable, have high liquidity, and plenty of stock to borrow for short selling. Indices can be short sold using the ETFs such as the QQQ or SPY or sold short in the futures market. The benefit of short selling a highly liquid ETF is that while there is theoretically still unlimited loss potential, an index is highly unlikely to increase in price so dramatically that it would cause a significant problem for the trader.

Is short selling of stocks riskier than trading on the long side?

Short selling is riskier than trading stocks on the long side because the potential loss is theoretically unlimited, and the maximum profit potential on the short side is only 100%. This is the inverse of trading on the long side, where the worst possible loss is 100%, but the upside is theoretically unlimited. Additionally, short selling requires a margin account, which means the trader is exposed to the potential for margin calls and liquidation if their account collateral drops below the minimum margin requirement. In contrast, buying stocks on the long side (without leverage) carries the risk of loss that only extends to the size of the initial investment.