In this post you will learn what the Average True Range Indicator (ATR) is and 3 ways to use it in your stock trading systems. The ATR is an extremely versitily trading indicator which every trader should deeply understand. I use it in almost all of my trading systems. The slideshare contains a summary of the blog post and all of the details are explained below.

The average true range (ATR) is a measure of volatility

It indicates how much price moves from one bar to the next

ATR is the average (generally over 14 bars) of the true range indicator

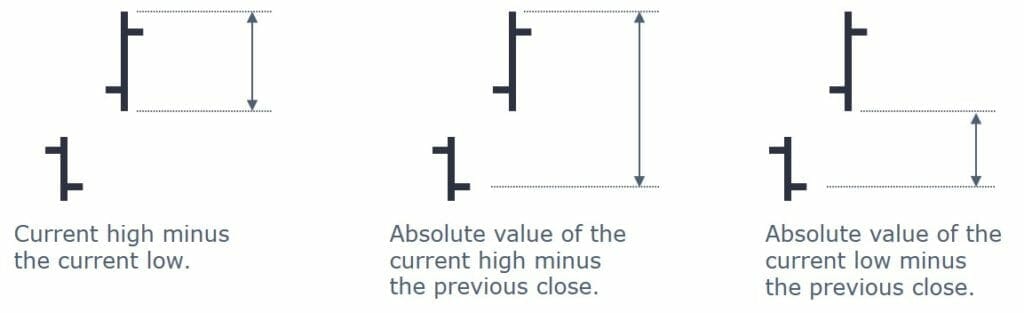

True Range is the max of:

-

- Current high minus the current low.

- Absolute value of the current high minus the previous close.

- Absolute value of the current low minus the previous close.

The Average True Range is the average of the True Range over several bars. The True Range is the maximum of the above three price movements.

Why is the Average True Range Useful?

The Average True Range is useful as a measure of volatility to select instruments of high or low volatility for several reasons:

- Adapts as the instrument behaviour changes

- Can be compared over time and between instruments

- Normalise between instruments by using ATR/Close

- Use as a stock filter to select either high or low volatility stocks

- High Volatility: ATR(14)/Close > 0.05

- Low Volatility: ATR(14)/Close < 0.05

How to Use Average True Range

When designing stock trading systems, it can be useful to have a normalised measure of volatility so you can compare between instruments. For example many mean reversion stock trading systems work best with high volatility stocks.

Mean reversion trading systems therefore should often have an entry filter which uses the Average True Range divided by the share price (Usually the close). The normalised ATR for mean reversion trading systems should be above a certain percentage. For example requiring the ATR/C to be greater than 0.05 will ensure you only enter high volatility stocks.

Trend following trading systems often work the best with low volatility stocks because they trend more smoothly than high volatility stocks. So profitable trend following systems will often work best when you filter out the high volatility stocks.

For your trend following systems you will often generate better returns when you add a trading rule like ATR/Close <0.05. The eliminates all of the high volatility stocks that gap up and down causing instability in your equity curve.

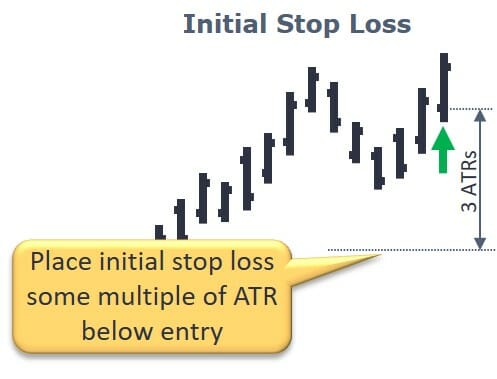

Using the Average True Range in Your Initial Stop Loss

The Average True Range can be used as in stop loss calculations to ensure the stop adjusts to volatility. This is important because a 10% initial stop loss on a highly volatile biotech stock will have a high probability of being hit, while a 10% stop loss on a bluechip utility has a low probability of being hit.

Average true range stop losses do not discriminate like this!

We want all of our trades to have a similar probability of success. Using an average true range stop loss based on volatility (using the average true range indicator to define the width of the stop), achieves this by adjusting the width of the stop to the volatility of the stock you are trading. The volatile biotech stock will have a wider stop and the blue-chip utility will have a narrower stop.

When you are backtesting your trading system with an ATR stop loss, you should vary the width of the stop loss by changing the multiplier you use with the Average True Range.

Using Average True Range in your initial stop loss calculations.

The width of the stop loss is specified in multiples of the ATR:

Narrow Stop Loss: 2 x ATR

Medium Stop Loss: 4 x ATR

Wide Stop Loss: 6 x ATR

You should always backtest your trading system over a wide range of parameter values and you stop loss is no exception.

In my early days of system trading I tried to limit my losses by using really tight initial stop losses so I didn’t lose too much on each trade. I used a 1.25xAverage True Range initial stop loss.

This felt like low risk for each trade I took, but the ultra tight stop loss was getting hit on the vast majority of my trades and I ended up with only about 18% winning trades because 82% of my trades were hitting the stop loss… so much so that I ended up with 27 losing trades in a row at one point – BRUTAL!

So don’t be fooled into thinking that a tight stop loss is low risk – often a wider initial stop loss will perform much better at a portfolio level.

Using the Average True Range as a Trailing Stop Loss

The Average True Range can also be used as a trailing stop loss to capture trends in your trend following trading systems.

A trailing stop loss is a stop loss that hangs below the highest price since you entered the trade, and as the trade moves up in your favour, the trailing stop also moves up. When your position moves against you the trailing stop holds constant, so if the stock keeps going down, it will hit your trailing stop and get you out with a profit.

Using Average True Range in your trailing stop loss calculations.

Trailing stops are powerful because they allow you to generate huge profits from strong trends by keeping you in the strongest moves for as long as they keep trending in the right direction.

Volatility based trailing stop losses adapt to the behaviour of the stock by widening when the volatility rises and narrowing when volatility falls.

The volatility component is recalculated on each bar of the trade, but the stop loss usually only moves UP until the stock price falls and touches the stop to trigger an exit.

Calculating the Average True Range Trailing Stop Loss.

ATR trailing stops work well because the same stop loss can be applied to any stock regardless of its volatility. The width of the stop loss is specified in multiples of the ATR:

Narrow Stop Loss: 2 x ATR

Medium Stop Loss: 4 x ATR

Wide Stop Loss: 6 x ATR

Average True Range trailing stops only move up for the life of the trade until it is triggered and the trade closed.

How to optimize the ATR In your Trading System:

- Change the number of bars used to average the true range

More bars >> Smoother

Less bars >> More Responsive - Change the multiple for initial or trailing stop

Higher Multiple >> Give trades more room to move

Lower Multiple >> Give trades less room to move

Summary of Average True Range Indicator

What is average true range? The average true range is a volatility indicator, it is a powerful indicator which can be used to calculate and normalise volatility between instruments. You can use the ATR in your entry filters to select high or low volatility stocks, in your initial stop loss calculations or in your trailing stop loss calculations.

Share This

Share this post with your friends!