Reading a wide range of trading books focused on the style of trading that you are learning is the cornerstone of learning how to be a successful trader. If you are a systematic stock trading then read trading books about systems and algorithmic trading, if you are having trouble with your trading psychology then read trading psychology books.

I can’t stress this enough – FOCUS your reading! As soon as I decided I wanted to be a systematic stock trader and focused my reading on systematic trading books my progress and growth exploded.

There are a myriad of trading books available and there are a lot of extremely good ones you can use accelerate your learning. However, the challenge is to identify the few books that will really make a difference in your trading right now.

Like any topic, there is a lot of garbage available too – just look in the stock market section of any book store and you will see. The key for all stock traders, futures traders and forex traders is to select the right books which will accelerate your learning and avoid those with vague untested ideas.

I have read over 150 books on trading and skimmed many many more than that…Just like in trading results, 5-10 of those 150 books added the most value by far. Many more than that were total rubbish or even deceptive!

It is generally possible to find a few good nuggets of information or ideas you can use in most books on trading, but there are a few standout texts that should be included on EVERY trader’s bookshelf.

When you are looking for your trading books Amazon is the most logical place to go. We have provided links to some of the best trading books Amazon has to offer below.

The very best trading books are rich with insights that every trader or aspiring trader should be aware of. If you are new to trading and committed to your learning journey then we suggest you start growing your trading library.

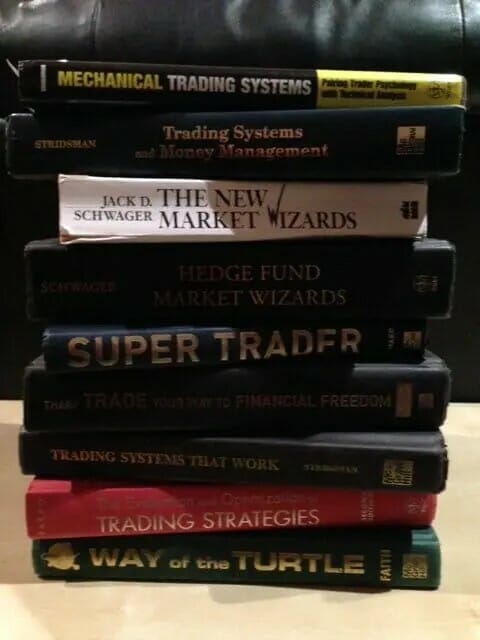

The best trading books make a world of difference…are your bookshelves filled with trading books like these?

There are thousands of trading books available, however there is a lot of low quality and unoriginal material which you need to sift through in most of these. The trading books that we have listed below are all extremely well written, thought provoking and present many original ideas. These are the best of the best and should be on the bookshelf of all serious traders, especially those who use a trading system.

On our bookshelves, these have been read and re-read, marked up, highlighted and are referenced regularly for inspiration and direction on our trading journey. In fact, some of these are so useful that they remain permanently on the desk rather than in the library because they are used so often.

Great trading books motivate, inspire and give hope to new and experienced traders alike. We have selected these books from the hundreds that we have read and skimmed. To Qualify for our ‘compulsory reading’ list these trading books have been instrumental in growing our understanding of the markets, ourselves, trading systems and ultimately our profitability.

The best trading books should be the primary focus of your self education efforts. The insights you will gain from these books is far more comprehensive than you could ever hope to gain from a $5000 seminar. If you are like us, you will read these again and again as your understanding of trading, the markets, trading systems and trading system development grows.

The books we recommend on our compulsory reading list will help propel you towards trading success and profitability no matter what trading strategy. It may take a while to get through them, but it will be well worth it and your understanding of the trading game will take an amazing leap forward as a result.

Systematic Trading Books

Title

Author

McGraw-Hill Education

Robert Pardo

Martin J. Pring

Curtis M. Faith

General Trading Books

Title

Author

Alexander Elder

Risk Management Trading Books

Title

Author

Technical Analysis Trading Books

Title

Author

Thomas Stridsman

David Aronson

Thomas K. Carr

Historical / Classic Trading Books

Title

Author

Fundamental Investing Trading Books

Title

Author

Art Collins

Simon & Schuster

Psychology Trading Books

Title

Author

Amibroker Trading Books

Title

Author

Howard B. Bandy

Howard B. Bandy

Howard B. Bandy

J B Marwood

There are trading book reviews which you can link to below. These book reviews highlight whether each should be compulsory reading and the key areas of value you can expect to find in the book.

Is there a great trading book that has really helped or influenced you? Tell us about it in the comments below.

Authors of Outstanding Trading Books:

There are quite a number of outstanding trading authors. I have listed the ones I consider to be the best below. You can follow the links to check out their books on Amazon. I recommend all of these authors depending on exactly which topic you are looking for.

Please add Trading in the zone, Momentum masters and Richard wykoff books.

Brilliant suggestions Gaurav – thank you for taking the time to comment!