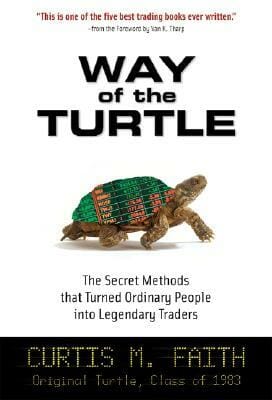

Trading Books: ‘Way of the turtle’

Author: Curtis Faith

Publisher: McGraw Hill

Year: 2007

Book Review Rating:

***** Highly Recommended

Topics Covered:

- Trading Systems

- Trading System Development

- Trend Trading Systems / Trend Following Systems

- Trading Psychology

- Trading Stories

- Back Testing Trading Systems

Click the image below to buy it now on Amazon:

Trading Book Review of by ‘Way of the turtle’ by Curtis Faith:

I recommend ‘Way of the turtle’ to everyone who wants to learn to trade. It is one of a small number of outstanding trading books that belongs on the bookshelf of every active trader.

Overall well worth reading.

Book Review:

In today’s book review, and today I’m talking about Way of the Turtle by Curtis Faith.

What’s great about this book is it’s a really great mix of trading psychology, personal story, wisdom and also trading mechanics. It does a really great job of blending those things together. Way of the Turtle also has a really pragmatic discussion on the different components of a trading system and how to build a trading system that’s robust so it will continue to work into the future.

What’s missing from the book is really a bit of diversity in the trading styles. Curtis Faith was a trend follower, and a lot of the book is focused on trend following and the stories and examples and so on are really based around that same strategy.

Probably one of the best insights that I got out of the book was that one of the big killers of trading systems is when they’re designed to a certain set of market conditions and it isn’t able to adapt when something fundamentally changes in the market. There’s a great section with good few pages that really explain how do you take this idea of a robust system that will continue to work into the future regardless of market changes and build that into your system so your system doesn’t self-destruct when a trading, when the markets actually change.

Overall, I give it 5 out of 5 and I think it’s something that every trader should have on their bookshelf and certainly something that I’ve read 3 or 4 times, and I certainly recommend that you do the same. I think there’s a lot of value that can be had from it, some real depth of wisdom in Curtis’ stories from his days as a turtle trader and I think all of us can benefit a lot from that, so I fully recommend it.

I think everyone who is actively trading in the market should have read this book.

Thanks again for listening. I hope you enjoyed that and I look forward to sharing some more reviews with you soon.

Share This

Share this post with your friends!