What to do when your trading system hits your maximum historical drawdown?

One of my students recently asked me “What happens/what do you do, when you hit your max draw-down? Do you stop trading and take a break? Keep going?”

There is a common piece of conventional trading wisdom that says that when you hit your maximum tolerable drawdown your should take a break from trading and reassess. I remember learning this concept and even building it into my trading plan early on in my trading career. It is good advice if you are trading with a discretionary technical analysis approach.

Taking a break from trading if you exceed your maximum tolerable drawdown is good advice when trading with a discretionary technical analysis approach because you need a circuit breaker to tell you when you are out of sync with the markets. If you don’t have a circuit breaker like this then you could end up digging yourself into a huge hole you can’t get out of. This could be devastating to your account.

For traders using a trading system (as opposed to discretionary technical analysis) the answer to the question is quite different – taking a break from your trading system is not a good idea. You must take action, but the ideal approach is quite different.

Two Drawdown Considerations for Systematic Traders

When trading with a trading system the approach is a little different… and in fact the questions are different too. When thinking about your drawdown when you are using a trading system, you need to ask two questions:

- What is my maximum tolerable drawdown?

- What is my trading system’s maximum expected drawdown?

In order to be a successful systematic trader you need to know the answer to both of these questions. The first gives you your goal for your portfolio and the second gives you a benchmark to monitor your trading system against for stability.

If you have a drawdown tolerance of 30% but your system has a maximum historical drawdown of 40%, then you have a problem because eventually you will exceed your maximum comfortable drawdown. This doesn’t mean your system is broken, it just means you have a capital allocation problem or the system doesn’t fit you.

If you allocate all your capital to a trading system that has a larger drawdown than you are comfortable with then you will end up with an uncomfortable drawdown from what could be a perfectly good system. However there is no reason not to trade the system – you just need to allocate a smaller percentage of your account to that system so that the drawdown at your account level is within your tolerance. So trade that system with a lower capital allocation and add another (different) system to your account for the rest of your capital.

This is why it is so important for your trading system to fit you!

Similarly if you have a maximum drawdown tolerance of 40% and your system is in a 25% drawdown, it doesn’t mean your system isn’t in trouble. If your system’s maximum historical drawdown during backtesting was 15% and you are now trading live and suffering a 25% drawdown then something could be seriously wrong.

When trading systematically it is critical to monitor the system’s stability and drawdown against the system’s historical performance rather than just our own level of comfort.

Monitoring Maximum System Drawdown

One of the most useful pieces of trading wisdom I ever came across is this:

“Your maximum drawdown is always ahead of you”

This is critical for your trading survival and your ongoing sanity as a system trader.

When you backtest your trading system you can see the returns and historical drawdowns that it gave in the past. The maximum historical drawdown is useful as a measure to tell you when the system is approaching the point where it might be considered ‘broken’. Remembering the advice above, however, if the maximum historical drawdown is exceeded the system might not be broken – it could just be that the markets have shifted and the system didn’t perform as well as it did in the past.

When trading systematically you must monitor the drawdown of each system you trade, however if the historical maximum drawdown is exceeded it is not as black and white as just turning the system off and finding a new system.

Possible Outcomes When Maximum Drawdown Is Exceeded

When your system hits a new maximum drawdown it is not as simple as stopping the system. This is a much more complex question and the best approach is to bring out your inner Sherlock Holmes and start investigating.

There are four possible outcomes of your investigation:

- Continue trading without change

- Reduce the capital allocated to the system but don’t change the rules

- Modify the system rules based on new learnings

- Stop the system and perform a complete system review

A Structured Approach To Addressing Drawdown

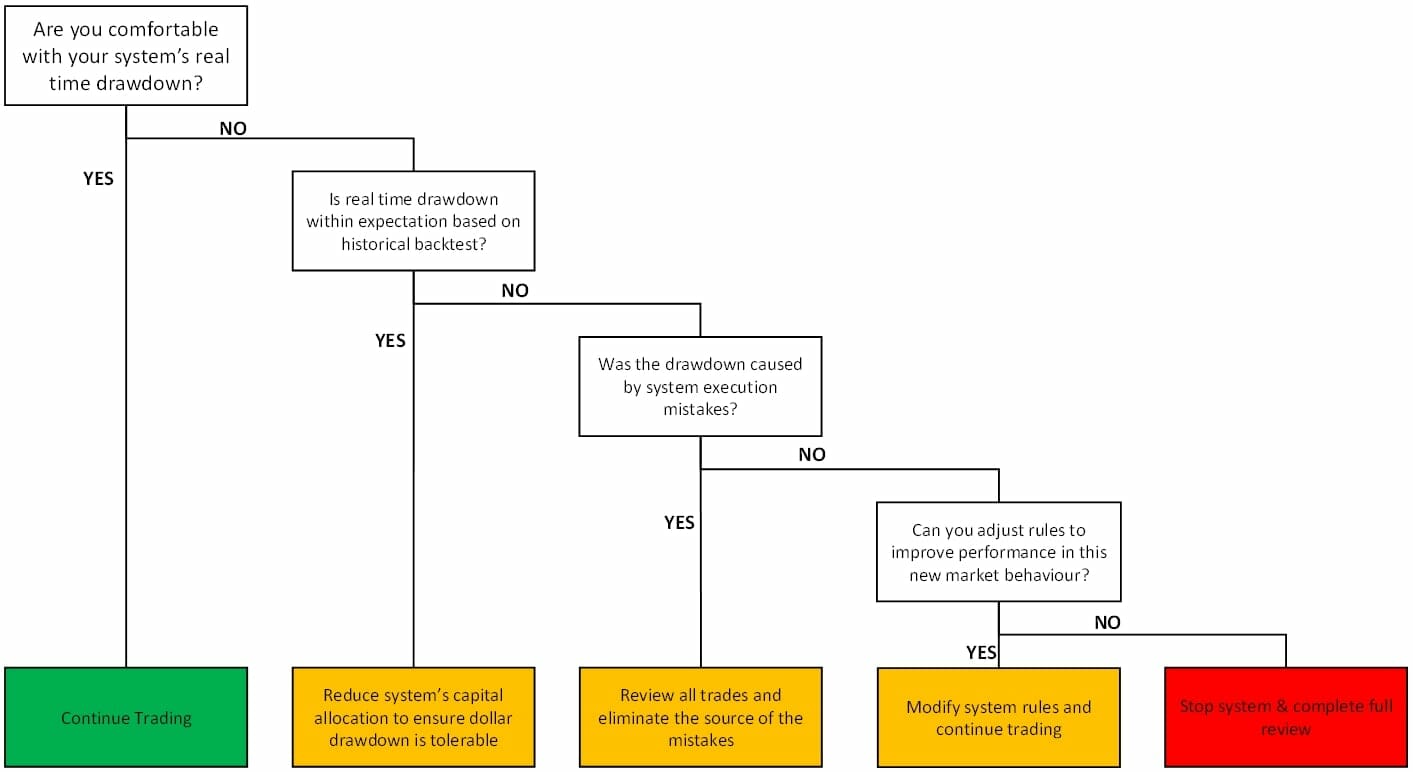

The flow chart below shows the logic required to work through these 4 possible outcomes:

Clearly if you are comfortable with your system’s performance there is no further to do so I will skip over this scenario.

If you are uncomfortable with the real time drawdown in your account but your backtest shows that the current drawdowns are within historically normal bounds then the best course of action is to reduce the amount of capital allocated to the system. This is because the system is not broken, it just has a bigger dollar drawdown than you are comfortable with. Allocating less capital to your system will reduce the potential dollar drawdown in your account so you can keep trading the system comfortably.

The great thing about this scenario is that it creates spare capital which you can then allocate to a different trading system that will provide you with additional diversification. The key to successful systematic trading is not having one perfect trading system, it is having a diversified portfolio of good trading systems that complement each other.

The real investigative work starts when the current drawdown is larger than the historically backtest showed when you designed the system. The first check you should do is on your execution of the system. Often times when traders have larger than expected drawdowns the cause of the drawdown is actually mistakes made in executing the signals from the trading system. There are literally dozens of common trading mistakes you could be making, but some of the most common which cause unexpected drawdowns include:

- Use of market orders leading to high levels of slippage and reduced profits

- Selectively skipping trading signals given by the system resulting in missing winning trades

- Banking profits too early leading to lower than expected average profit per trade

- Missing exit signals or letting losing trades drop past their stop loss resulting in large losses

The easiest way to check whether this is the problem is to re-run your backtest and compare your backtest performance with the performance of your actual trading account. Compare the entry and exit price for every trade and you will soon discover if you are making any execution mistakes. Eliminating any execution mistakes will get you back on track.

If your drawdown was not caused by execution mistakes, then there is some backtesting and system development work to do. The first step is to look at the recent market behaviour that caused the drawdown and determine whether that behaviour was represented in the data used to design the system.

It could be that the system is broken, or it could be system is fine and it just encountered a new type of market behaviour that it has never experienced before. In the case of the Covid decline in February / March 2020, the market declined from all time highs into a bear market faster than this has ever happened before. This would have caused many systems larger than expected drawdowns.

If this happened it could just be that your system’s maximum drawdown is actually higher than you thought it was (in line with the principle of ‘Your maximum drawdown is always ahead of you’). It could also be that the recent market behaviour has exposed a weakness in the system that needs to be addressed. For example, with the sudden market collapse in February / March 2020, some trend following systems that have very wide trailing stops suffered more than expected.

At this point you need to evaluate the logic of the system to see if the recent market behaviour exposed a gap in that logic… Maybe your exit was too slow, maybe you need to close positions when the market turns down, maybe you need to stop taking trades when the index is trending down etc. Look first for logic gaps which you can plug with the addition of a simple rule to your system. If you find a logic gap that the recent market behaviour has exposed, brainstorm adjustments to your trading system which would protect you should this market behaviour emerge again. These adjustments should be simple and not highly optimized. We are looking to plug a gap in the system’s logic, not reoptimize it to improve performance.

Once you backtest these new rules to see if any of them correct the performance of the system. Again I want to stress here that you are not reoptimizing the system to try to fine-tune the drawdown out of existence, you are simply identifying gaps in the system logic and coming up with rules to plug the gap. This process would only take a couple of hours of analysis and backtesting.

After this work if you have found an elegant solution then you can make the change and continue trading the system, however if you have not found an elegant solution to the drawdown at this point then there is a very real risk that the system is broken and you need to perform a full trading system review.

If you get to this point in the decision tree illustrated above and have not found a solution then you have no option but to pause trading in the system and complete a full and extensive evaluation of the trading system. This is beyond the scope of this article and would require substantial additional investigation and backtesting effort.

Conclusion

When you are trading systematically and suffer from a large than expected drawdown there are several actions you can take, and it is clearly not as black and white as having a break from trading to refresh yourself and get back in sync with the market. Having a structured plan to review your systems should this happen will greatly improve your ability to make the right decision and continue to trade profitably.

The key to all of this is that there are two things you need to separate:

- a) Your comfort with the drawdown the system gave you

- b) The magnitude of the drawdown compared to expectations from historical testing.

Remembering that your biggest drawdown is always ahead of you will help prepare you for when it comes, and having a methodical process to work through will greatly reduce the stress it causes when the drawdown finally comes.

This article was written by Adrian Reid and was first published in Your Trading Edge Magazine