RealTest vs MultiCharts: Comparing Backtesting Software for Systematic Trading

RealTest vs MultiCharts at a Glance

Short on time? Here’s how RealTest and MultiCharts compare side by side.

| Feature | RealTest | MultiCharts |

| OS Compatibility |

Windows (64-bit); Mac via Parallels/Bootcamp |

Windows only |

| Pricing |

One-time US$389 + optional $159/yr updates |

Subscription or Lifetime license (Free trial available) |

| Scripting Language |

Rule-based syntax (clear, declarative) |

PowerLanguage (EasyLanguage-compatible), .NET, C++ |

| Portfolio Backtesting |

Full multi-system, multi-symbol portfolio simulation |

Symbol-level; portfolio backtesting supported but complex |

| Optimization |

Brute-force, variation testing with realism |

Brute-force, walk-forward, genetic optimizer |

| Charting & Scanning |

Basic, functional |

Advanced, multi-timeframe, professional-grade |

| Execution |

Exports orders (e.g. to IBKR) |

Full multi-broker integration |

| Documentation and Support |

Clear, modern, actively maintained |

Fragmented, more technical |

Platform Overview, Cost & Compatibility

RealTest runs on 64-bit Windows and works seamlessly via virtual machines on macOS (Parallels/Bootcamp). Wine is not recommended. You pay once (US$389) with optional annual updates at US$159, and you own the license. No forced data packages, no platform lock-in.

MultiCharts is also Windows-based and doesn’t officially support macOS. It uses a subscription or lifetime license model. A free trial is available, but you’ll typically pay either monthly or up-front (US$1,497 for the lifetime license, as per their website).

If you’re cost-sensitive and want clean ownership without data dependencies, RealTest offers better value for the serious system trader.

RealTest Main View:

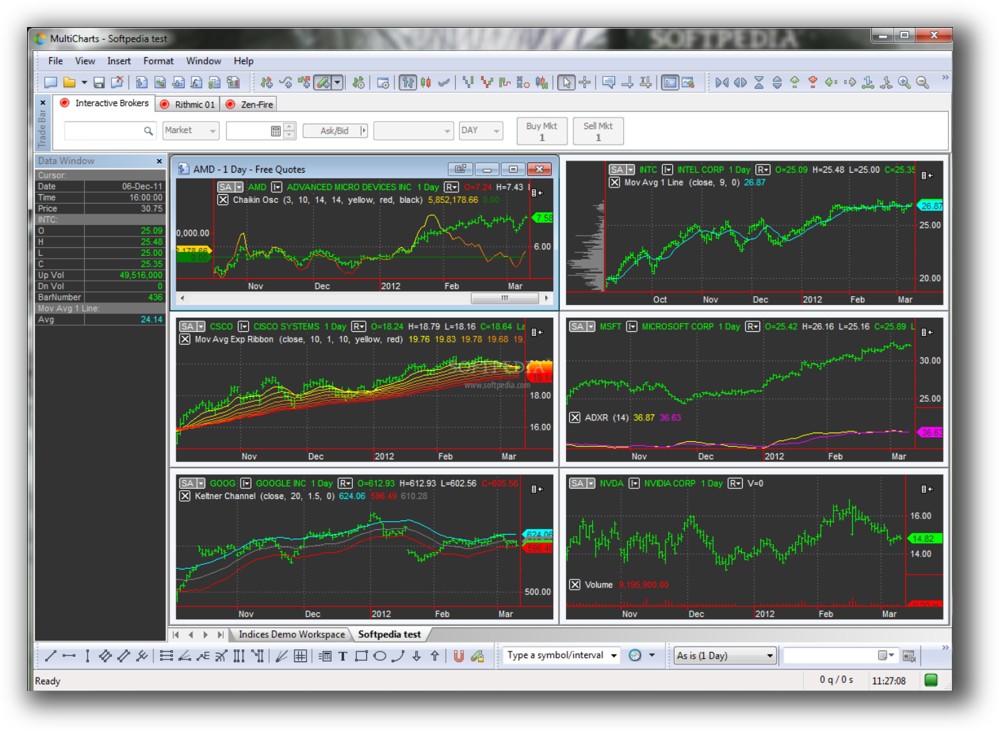

MultiCharts Main View:

Market Access & Data Support in RealTest and MultiCharts

RealTest gives you total control over data. It works with Norgate, Yahoo, or custom-formatted CSVs. You can trade stocks, ETFs, indexes, or crypto (with the right data), and you’re not tied to any one broker or feed.

MultiCharts connects to dozens of brokerages and data feeds, including Interactive Brokers, CQG, and Barchart. This is ideal for traders looking to route live orders or scan markets in real time, but can be overwhelming for newer traders or those who just want to backtest.

If you’re focused on backtesting logic and want to avoid vendor lock-in, RealTest is the simpler and more flexible option.

RealTest Backtesting Interface:

MultiCharts Backtesting Interface:

Building & Customizing Trading Strategies

RealTest was designed for logical, analytical traders — the kind of people who think clearly, prefer structure, and want their trading rules to make sense. Its custom scripting format reads like a set of trading instructions, not a programming project. You won’t need loops or deep coding knowledge, which means less frustration and far more clarity.

MultiCharts supports PowerLanguage, which is compatible with EasyLanguage (used in TradeStation). It also has APIs for advanced users in C++ or .NET. This is powerful, but it demands more technical skill and debugging time – which slows down the workflow for non-coders.

If you want to test strategies fast and adjust with ease, RealTest’s rule-based logic is far more efficient.

Check Out: Trading System Development

RealTest Code Editor:

MultiCharts Code Editor:

Backtesting Performance, Speed & Realism

This is where RealTest is unmatched.

It supports:

- True portfolio-level simulation

- Multiple strategies at once

- Realistic execution timing

- Position sizing and capital constraints

Your backtests reflect how real portfolios behave – including slippage, capital allocation, and competing trades.

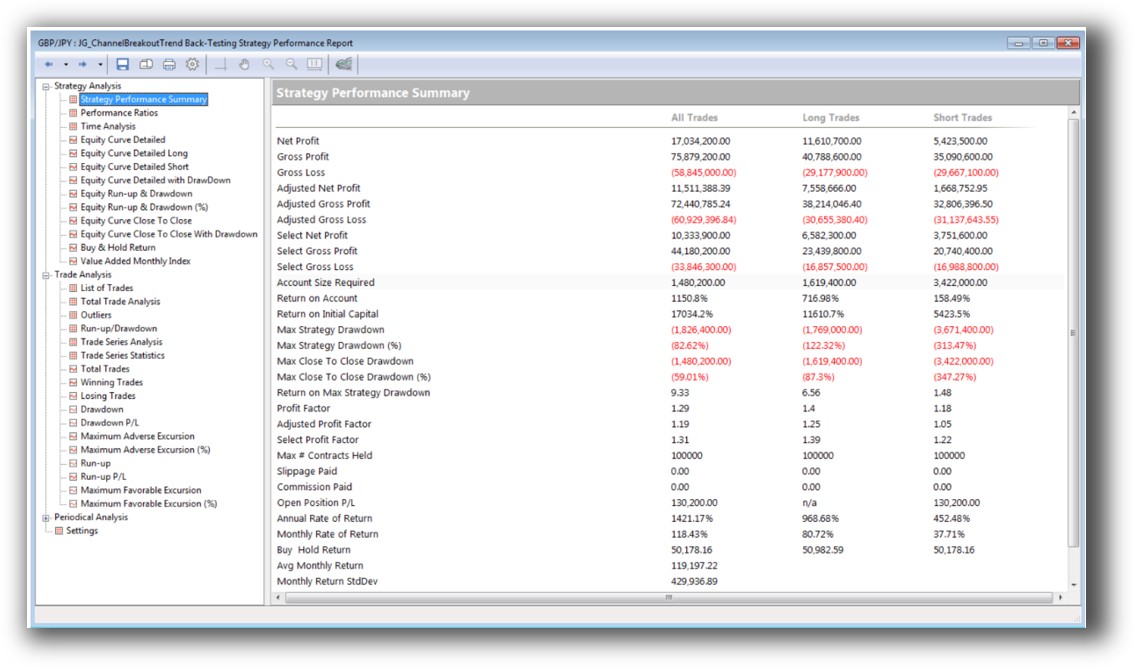

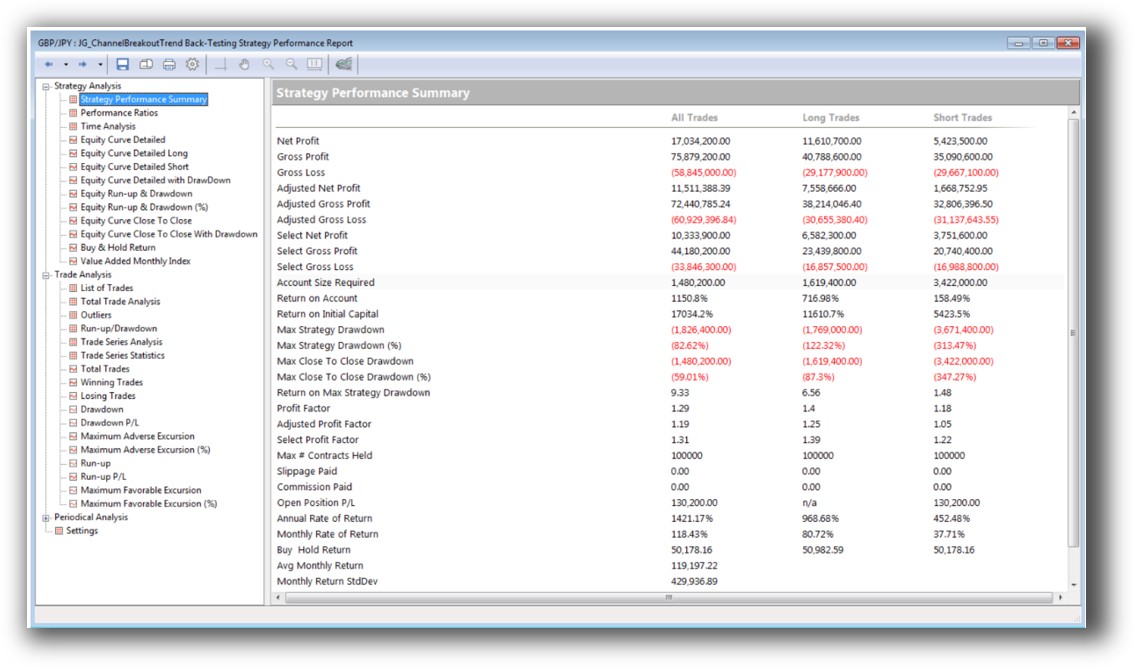

MultiCharts does offer portfolio backtesting, but it’s a bolt-on feature. Most users operate symbol-by-symbol, and portfolio realism depends on how well you script and integrate the logic. It’s more complex and prone to silent inaccuracies if you’re not careful.

For systematic traders who care about realism and reliability, RealTest delivers the edge.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

MultiCharts Backtest Report:

Strategy Optimization & Stress Testing Tools

MultiCharts includes a powerful optimizer with brute-force, walk-forward analysis, and genetic algorithms. This can be helpful – but also dangerous if you’re not disciplined. Overfitting is easy, and automation doesn’t always mean robustness.

RealTest takes a logic-first approach. You define variations or rule tweaks manually. This might seem basic, but it forces you to think clearly and focus on robust systems – not just good-looking equity curves.

If you’re building serious, long-term systems, RealTest helps you stay grounded in logic and data integrity.

Check Out: Trading System Optimization

RealTest Walk-Forward:

Charting Features, Signal Exploration & Live Execution

MultiCharts dominates in this area. Its charting engine is professional-grade, with:

- Multi-timeframe overlays

- Indicator libraries

- Drawing tools

- Live scanning and signal generation

If your workflow is chart-centric or you like to scan the market for setups visually, MultiCharts will feel familiar and rich.

RealTest, by contrast, includes basic charting – just enough to validate trade entries and exits. It’s not designed for scanning or real-time execution dashboards. Instead, you export trade orders for execution through brokers like Interactive Brokers, or automate externally.

For traders who separate research from execution and want a distraction-free testing tool, RealTest keeps the focus where it should be – on the strategy.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

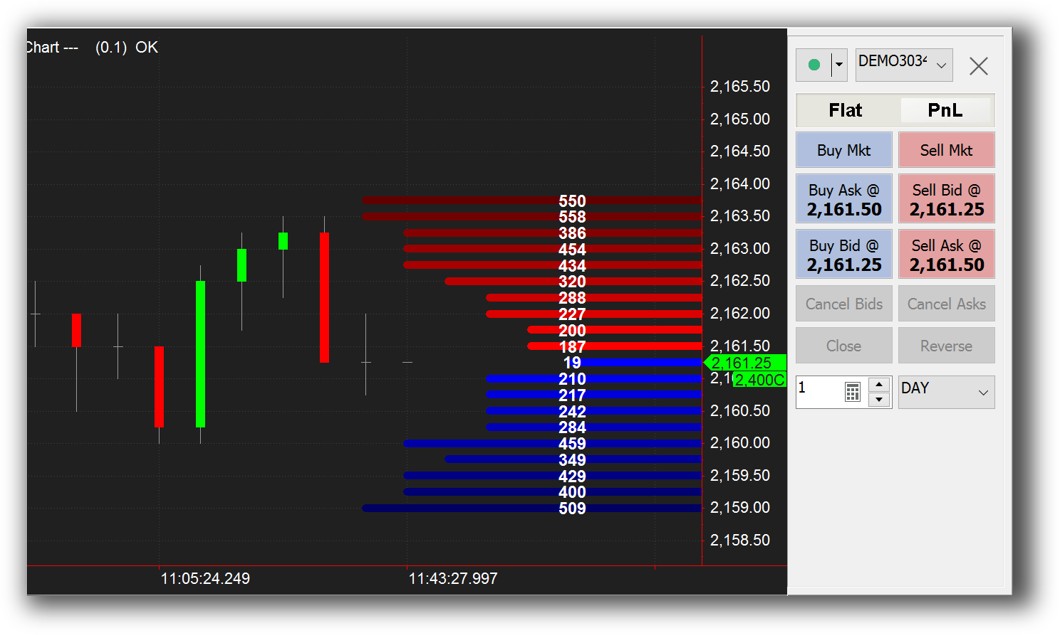

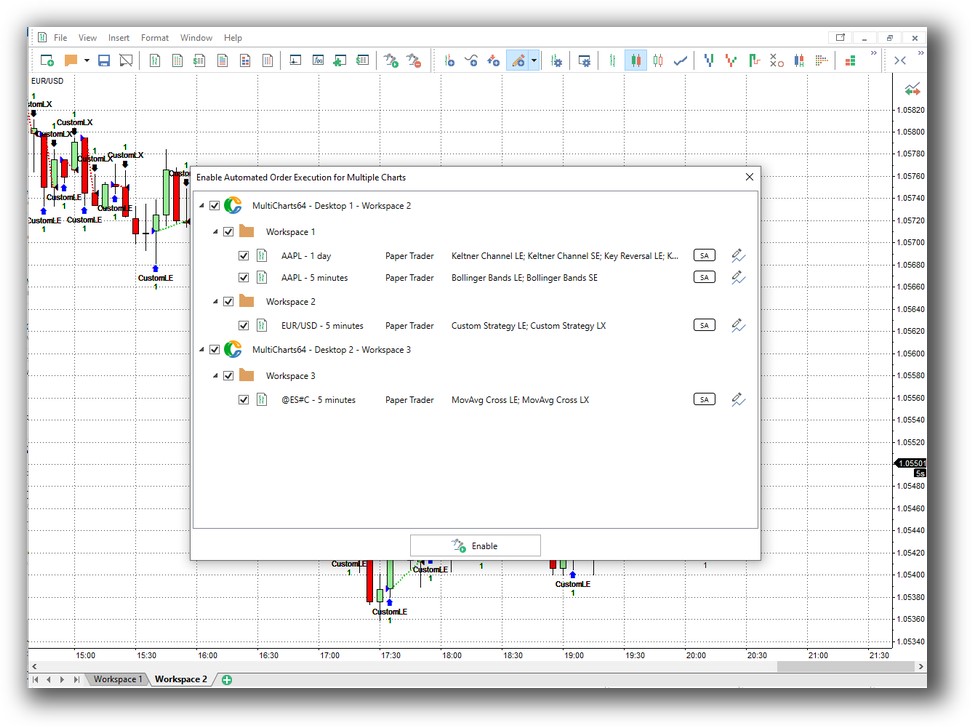

MultiCharts Automation Set Up:

Support, Documentation & Learning Resources

RealTest offers clean, modern documentation and active support directly from its developer, Matt Radtke. You’ll find clear explanations, real examples, and practical FAQs.

MultiCharts has extensive documentation, but it’s fragmented across PowerLanguage references, forum posts, and older developer guides. It can take time to find exactly what you need.

If you’re focused on clarity and quick learning, RealTest will help you get up to speed faster.

RealTest Forum is illustrated down below:

MultiCharts Forum is illustrated down below:

RealTest vs MultiCharts: Which One Should You Use?

If your goal is systematic trading – testing rule-based strategies, managing a portfolio of systems, and refining logic with minimal distraction – RealTest is the better backtesting software.

It’s faster, simpler, and laser-focused on the features that matter most for serious traders who want consistent results and internal alignment.

MultiCharts is excellent for visual traders, discretionary workflows, and those who want everything (backtesting, scanning, charting, and execution) in one place. But that integration comes at the cost of simplicity, clarity, and speed.

Our Recommendation

At Enlightened Stock Trading, we mentor traders who are tired of guessing, gambling, and wasting time. We teach you how to trade with confidence using proven systems, backed by clean data and clear logic.

That’s why we recommend RealTest.

- It matches how analytical traders think.

- It simplifies the backtesting process.

- It accelerates your journey to consistency.

If you’re a thoughtful, motivated trader who’s tired of inconsistent results, RealTest helps you break out of that cycle and build a systematic approach that finally fits your goals and lifestyle.

Want the Rest of the Puzzle?

Backtesting software is just one tool in your trader’s toolbox.

To trade with confidence and control, you need:

- A clear trading plan

-

A proven system (or multiple)

- Risk management frameworks

- Automation (where it makes sense)

- Mentoring and accountability

That’s what we deliver inside Trader Success System, the complete roadmap for serious traders who are ready to win.