RealTest vs Optuma: Comparing Backtesting Software for Systematic Trading

If you’re choosing between RealTest and Optuma for your trading and backtesting workflow, here is the direct answer:

RealTest is the superior backtesting software for systematic traders who want fast, realistic, portfolio-level simulations and a clean scripting workflow that eliminates unnecessary complexity.

Optuma, on the other hand, is an advanced charting and analytical platform built primarily for visualization, discretionary analysis, and institutional-level charting (not for deep portfolio backtesting)

If your goal is consistency, clarity, and a disciplined, rule-based system, RealTest is the better tool.

If you need institutional-grade charting, visualization tools, and custom analytics, Optuma can complement RealTest, but it should not replace it for systematic backtesting.

RealTest vs Optuma at a Glance

Short on time? Here’s how RealTest and Optuma compare side by side.

| Feature | RealTest | Optuma |

| Operating System | Windows 64-bit; Mac via VM | Windows desktop; Cloud/Web available |

| Pricing | One-time license + low annual maintenance | Subscription tiers (Trader, Professional, Institutional) |

| Brokerage Integration | Partial (exports to IB) | Full IB trade execution support |

| Programming Language | Clean purpose-built strategy scripting | Optuma Script Language (OSL) |

| Backtesting | Realistic, portfolio-level | Limited; chart-centric and study-driven |

| Charting | Basic | World-class institutional charting |

| Documentation | Modern, clear, structured | Extensive but complex, enterprise-oriented |

Platform Overview, Cost & Compatibility

RealTest runs on Windows 64-bit, and can run smoothly on Mac using Parallels or similar VMs (Wine not recommended).

Its pricing model is simple and transparent:

- One-time license

- Optional low-cost annual maintenance

This is ideal for traders who want to avoid accumulating subscriptions.

Optuma is a large, enterprise-level platform offering:

- Windows desktop software

- Cloud/web functionality via Optuma Enterprise

Its pricing is subscription-based with multiple tiers:

- Trader tier (~USD $810/year)

- Professional and institutional tiers with more advanced tools

Optuma is powerful but significantly more expensive for long-term use.

RealTest Main View:

Optuma Main View:

Market Access & Data Support in RealTest and Optuma

RealTest

- Integrates cleanly with high-quality EOD providers (like Norgate Data)

- Accepts custom data formats

- Built for robust, repeatable research workflows

Optuma

- Supports institutional datasets

- Broad data connectivity through its Professional and Enterprise tiers

- Designed to serve hedge funds, banks, and research desks

However, its primary orientation is toward analysis and visualization rather than systematic portfolio simulation.

RealTest Backtesting Interface:

Oputma Backtesting Interface:

Building & Customizing Trading Strategies

RealTest’s strategy workflow is:

- Clean

- Minimalistic

- Focused on full system definition

Its scripting language reads like a strategy specification, not a programming language.

This keeps traders focused on:

- Entries

- Exits

- Position sizing

- Portfolio rules

- Risk control

All without programming overhead.

Optuma uses its proprietary Optuma Script Language (OSL) to build studies and signals.

OSL is powerful, but it is designed primarily for:

- Custom indicators

- Chart-based rules

- Visual analytics

Full workflow system development is not the software’s core purpose.

Users often fall into the discretionary trap of visually validating ideas instead of building robust rules.

Check Out: Trading System Development

RealTest Code Editor:

Optuma Code Editor:

Backtesting Performance, Speed & Realism

RealTest is purpose-built for backtesting:

- Multi-strategy portfolios

- Cross-sectional models

- Realistic execution modeling

- Dry-run execution

- Scenario-driven testing

Its engine is extremely fast and optimized for large portfolios.

This is where RealTest outperforms almost every tool in its class.

Optuma includes scripting capabilities that allow some signal testing and rule evaluation, but:

- It is not designed as a dedicated portfolio backtesting engine

- It lacks RealTest’s portfolio simulation capabilities

- It is optimized for chart-based analysis, not research automation

For serious systematic trading, Optuma simply cannot replicate the precision or scale of RealTest.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

Optuma Backtest Report:

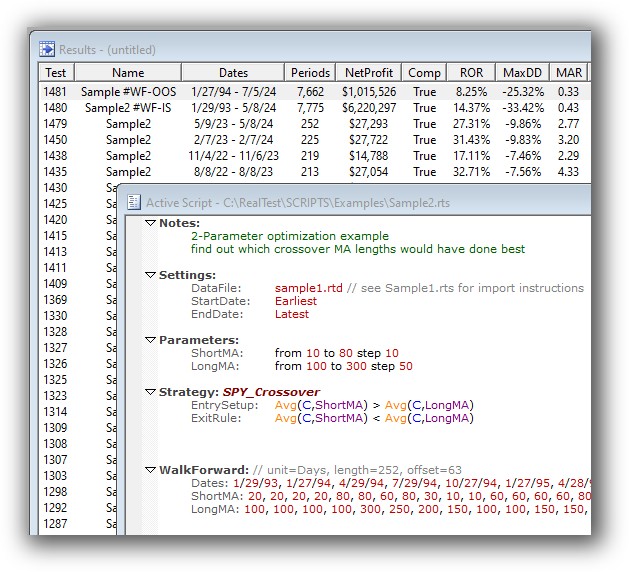

Strategy Optimization & Stress Testing Tools

RealTest supports:

- Parameter sweeps

- Walk-forward–style analysis via scripting

- Scenario-based robustness testing

- Multi-model experimentation

RealTest encourages robustness (a key Enlightened Stock Trading principle)

Optuma allows parameter testing for indicators, but:

- It is not designed for deep robustness testing

- It lacks RealTest’s portfolio-level optimization workflows

- Optimization is tied to chart studies, not portfolio simulations

Optuma is strong for discretionary signal exploration but not for robust systematic research.

Check Out: Trading System Optimization

RealTest Walk Forward Testing:

Charting Features, Signal Exploration & Live Execution

RealTest offers:

- Basic charting (sufficient for trade verification)

- Script-based scanning

- Order export to Interactive Brokers

It intentionally avoids deep charting to keep traders from drifting back to discretionary decision-making.

Charting is Optuma’s specialty:

- Institutional-grade charting

- Advanced studies and custom indicators

- Multi-timeframe visualization

- 3D charting

- Gann, Astronomical, and quantitative tools

- Professional-grade drawing tools

Optuma also supports Interactive Brokers for trade execution.

If your work depends heavily on charting, Optuma is one of the most powerful platforms available, but again, it is not a replacement for a true backtesting engine.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

Optuma Automation Set Up :

Support, Documentation & Learning Resources

RealTest

- Modern, clear, and logically structured documentation

- Strategy examples

- Tutorials

- Focused community with real systematic traders

It’s easy to navigate and free of legacy clutter.

Optuma

- Extensive documentation

- Large help center

- Webinars

- Enterprise-level support

However, the documentation is broader, deeper, and more complex, reflecting Optuma’s institutional scope rather than streamlined systematic development.

RealTest Forum Front Page:

Optuma Forum Front Page:

RealTest vs Optuma: Which One Should You Use?

If your goal is:

- building robust trading systems

- running realistic portfolio backtests

- ensuring consistency

- eliminating discretionary guesswork

- achieving repeatable results

→ RealTest is the better backtesting software.

If you want:

- advanced charting

- deep visual analysis

- custom indicators

- institutional visualization tools

→ Optuma is outstanding (but it should complement RealTest, not replace it)

Our Recommendation

Use RealTest as your primary backtesting and system development engine.

If you need world-class charting and institutional analytics, add Optuma as a secondary visualization tool, similar to how some traders pair RealTest with AmiBroker or TradingView.

But for building systematic, rules-based strategies that produce consistent results, RealTest is the clear choice.

Want the Rest of the Puzzle?

Choosing the right backtesting software is only one part of becoming a consistent trader.

Most traders fail because they lack:

- A complete system-building process

- Clear entries and exits

- Portfolio-level thinking

- Internal alignment with their trading approach

That’s why we created The Trader Success System, the complete framework that turns scattered knowledge into a confident, systematic trading practice.

If you want the full puzzle, not just the tools, this is your next step.