RealTest vs Wealth-Lab: Comparing Backtesting Software for Systematic Trading

If you’re choosing between RealTest and Wealth-Lab, here’s the short answer:

RealTest is the better backtesting software for serious, systematic traders who want fast, realistic portfolio simulations with a clean workflow and modern documentation.

Wealth-Lab is strong in charting, execution connectivity, and its C# ecosystem — making it useful for traders who prefer a more visual and broker-integrated environment.

Now let’s break down the details that matter for serious, motivated traders who are tired of inconsistency and want a system they can trust.

RealTest vs Wealth-Lab at a Glance

Short on time? Here’s how RealTest and Wealth-Lab compare side by side.

|

Feature |

RealTest |

Wealth-Lab |

|

Operating System |

Windows 64-bit; usable on Mac via VM |

Windows only; also usable on Mac via VM |

|

Pricing |

One-time license + low yearly maintenance |

Subscription-based |

|

Programming |

Clean, purpose-built scripting |

C# (WealthScript) + drag-and-drop builder |

|

Backtesting Speed |

Fast, highly efficient |

Fast, but more overhead due to .NET |

|

Portfolio Simulation |

Advanced, realistic, intuitive |

Good, but requires more configuration |

|

Optimization |

Robustness-first |

Traditional optimizers + extensions |

|

Charting |

Basic |

Strong, visual, extensible |

|

Automation |

Via exported orders |

Native broker automation via extensions |

|

Documentation |

Modern, clear, well-structured |

Large but sometimes fragmented |

Platform Overview, Cost & Compatibility

RealTest is built specifically for systematic traders.

It runs on Windows 64-bit and works well on Mac using Parallels. Wine is not recommended.

Its pricing is simple:

- One-time license

- Low annual maintenance for updates

This structure appeals to traders who hate recurring fees and want full ownership of their tools.

Wealth-Lab runs on Windows only, with Mac compatibility via VM.

Its pricing is subscription-based (monthly or annual), which can add up over time for long-term users.

Wealth-Lab’s ecosystem (extensions, components, community plugins) offers flexibility, though some traders find it bloated or inconsistent.

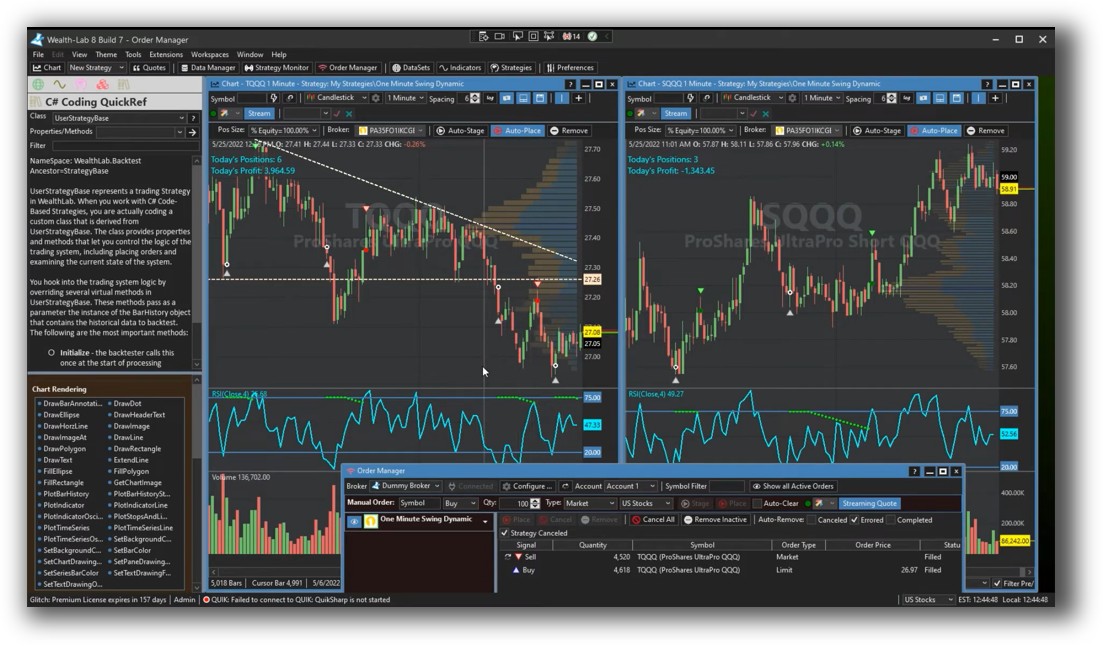

RealTest Main View:

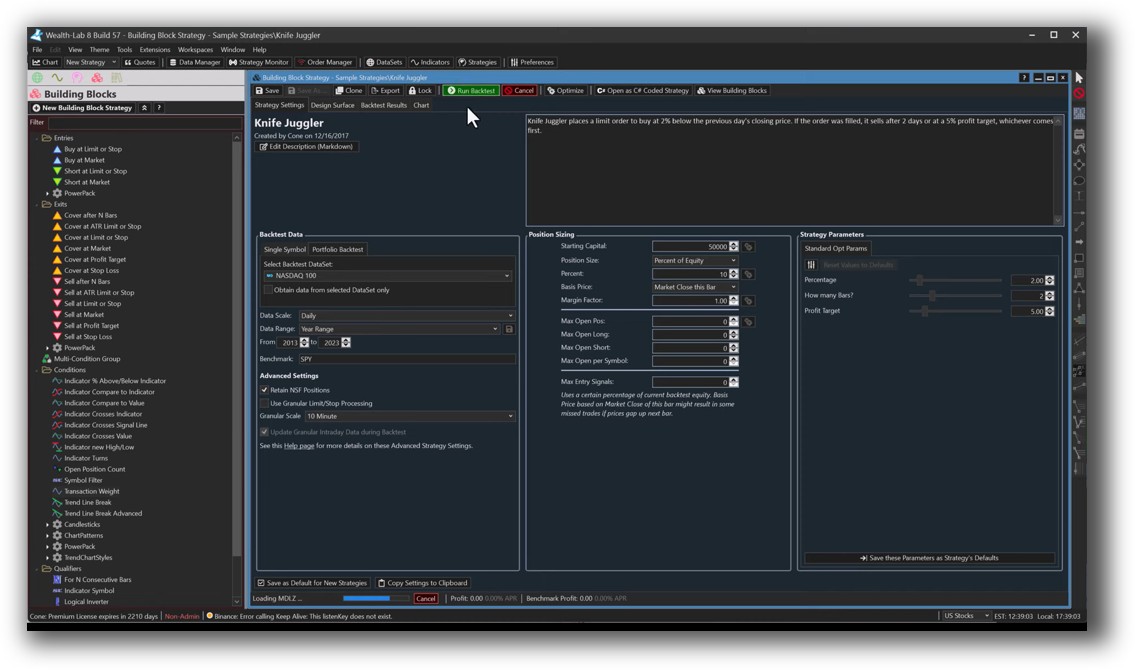

Wealth-Lab Main View:

Market Access & Data Support in RealTest and Wealth-Lab

RealTest:

- Accepts CSV or custom data sources

- Integrates seamlessly with Norgate Data

- Designed forEOD and portfolio system research

RealTest keeps data handling simple and transparent — ideal for traders who want repeatability without hidden transformations

Wealth-Lab:

- Supports multiple data feeds via extensions

- Broker data integration (IB, Tradier, etc.

- Good for traders who want an all-in-one platform (data + charts + automation

Because it relies on multiple external extensions, configuration can feel more complex than RealTest.

RealTest Backtesting Interface:

Wealth-Lab Backtesting Interface:

Building & Customizing Trading Strategies

RealTest uses a clean, English-like scripting language.

It’s not a programming environment — it’s a strategy specification environment, which drastically reduces cognitive load.

This matters for traders who:

- Don’t want to write C#

- Don’t want to manage complex class structures

- Want straegy code to match their mental model

Scripts in RealTest feel like “filling out a form,” which keeps your brain focused on the trading logic, not code architecture.

Wealth-Lab supports:

- Full C# scripting (WealthScript)

- A drag-and-drop Building Blocks system

This is powerful for coders but intimidating for non-developers.

The Building Blocks interface helps, but more advanced systems still require diving into C#.

If you enjoy .NET development, Wealth-Lab can feel like home.

If not, RealTest is far more accessible.

Check Out: Trading System Development

RealTest Code Editor:

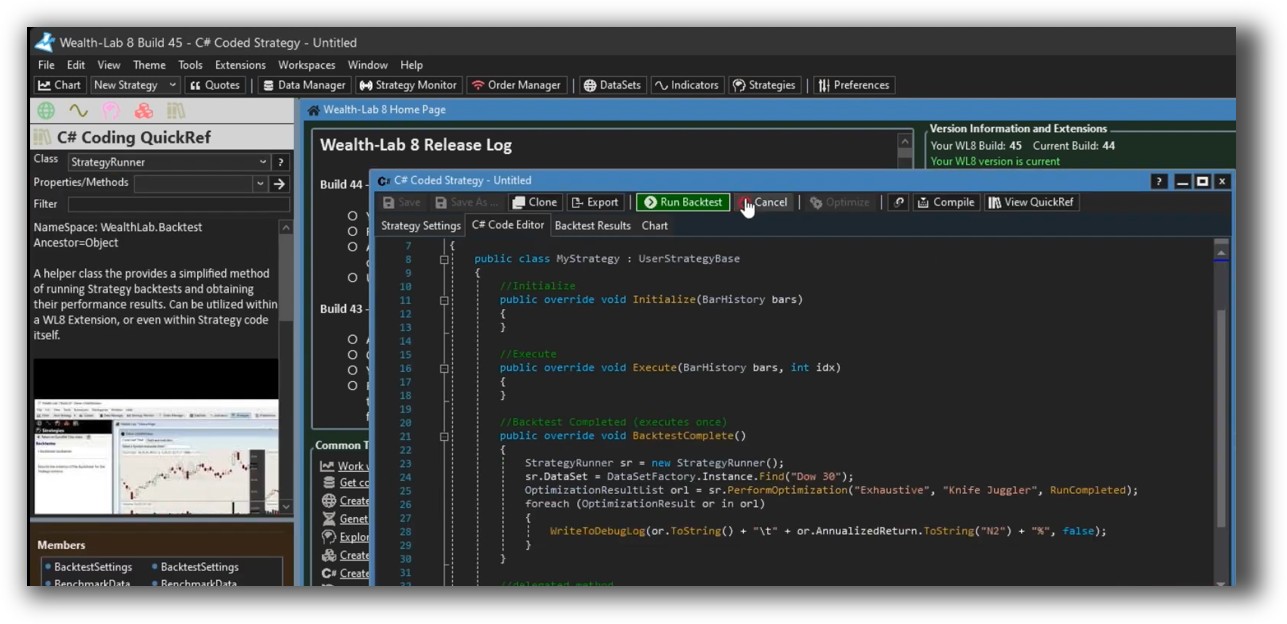

Wealth-Lab Code Editor:

Backtesting Performance, Speed & Realism

RealTest is built for speed, realism, and portfolio-level design:

- Extremely efficient engine

- Realistic order handling

- Natural support for ranking, position sizing, scaling in/out

- Multi-strategy portfolios

- Cross-sectional models

This is where RealTest separates itself.

Its portfolio engine gives you results you can trust — without the “black box” feeling.

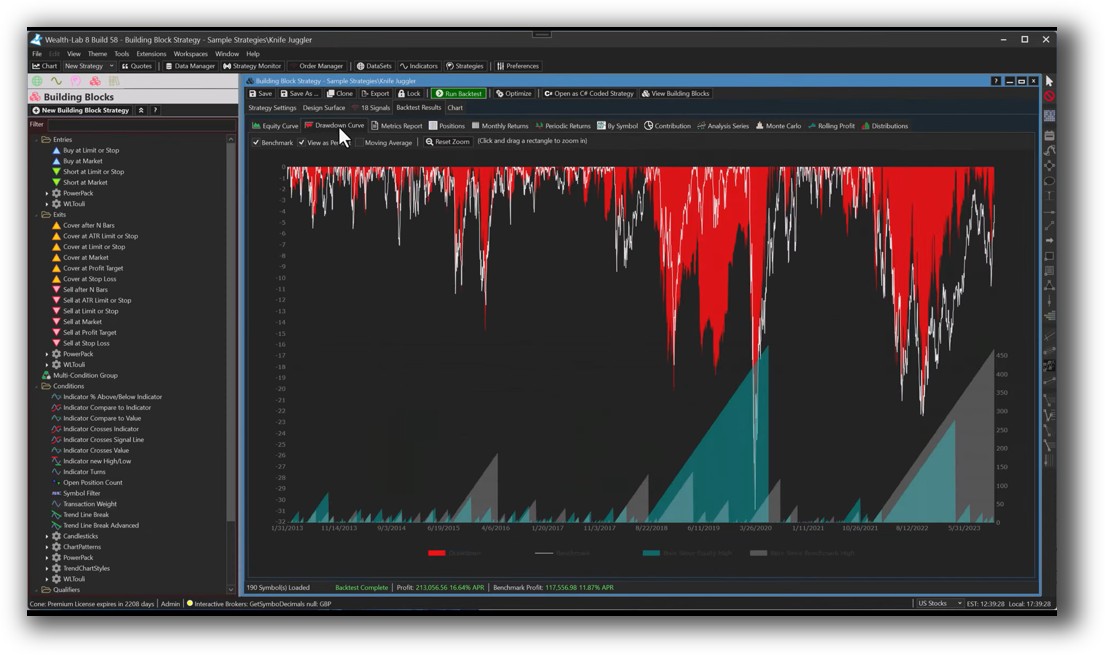

Wealth-Lab backtests are:

- Fast for single-symbol tests

- Flexible with C#

- Enhanced by many extensions

But because it’s built on .NET and designed to support many plugins, it can feel more fragmented.

Portfolio simulations work well, but they require more configuration and coding.

For realistic, multi-system, portfolio-level research, RealTest is cleaner and faster.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

Wealth-Lab Backtest Report:

Strategy Optimization & Stress Testing Tools

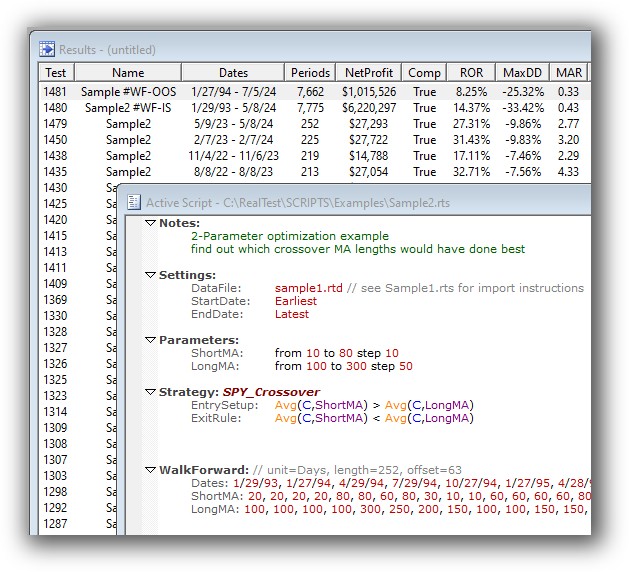

RealTest emphasizes robustness, not brute-force optimization:

- Parameter sweeps

- Walk-forward-style tests via scripting

- Easy scenario definition

Its philosophy aligns with systematic trading:

Robust > Optimized

Wealth-Lab Offers:

- Built-in optimizers

- Genetic algorithms (via extensions)

- Walk-forward analysis tools

More knobs, more levers — powerful, but can tempt traders into overfitting.

Check Out: Trading System Optimization

RealTest Walk Forward Testing:

Charting Features, Signal Exploration & Live Execution

RealTest offers:

- Basic charting (good enough for validation)

- Strong scanning via scripts

- Order export to Interactive Brokers (multipurpose workflow)

RealTest intentionally avoids turning you into a chart junkie.

Its visuals validate your system — they don’t distract you from it.

This is Wealth-Lab’s biggest strength:

- Beautiful, detailed charts

- Integrated scanning

- Native trade automation with multiple brokers

- Strategy-level live trading

If you need an all-in-one charting + automation platform, Wealth-Lab is excellent.

If your core need is research and backtesting, RealTest wins.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

Wealth-Lab Automation Set Up:

Support, Documentation & Learning Resources

RealTest’s documentation is:

- Modern

- Clear

- Well-structured

- Written with actual traders in mind

It has none of the legacy clutter found in older trading software.

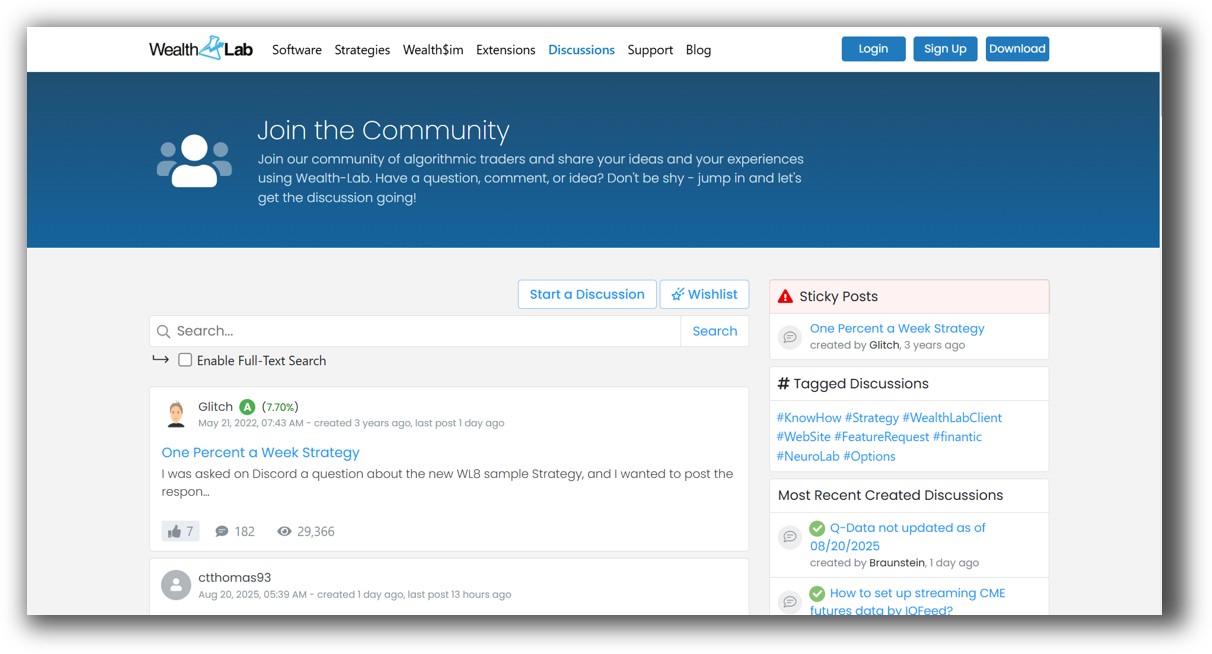

Wealth-Lab’s documentation is:

- Large and detailed

- Spread across the main site + forums + extension docs

- Sometimes outdated or fragmented

Still useful — but not as clean or focused as RealTest.

RealTest Forum is illustrated down below:

Wealth-Lab Forum is illustrated down below:

RealTest vs Wealth-Lab: Which One Should You Use?

If your priority is:

- Systematic trading

- Fast, realistic portfolio backtesting

- Simple, clean strategies

- Repeatability and robustness

- Clear documentation

RealTest is the superior choice.

If you need:

- Heavy charting

- Broker integration

- Automation

- C# extensibility

Wealth-Lab is a strong option.

Our Recommendation

For the vast majority of traders transitioning from discretionary confusion to systematic consistency, RealTest is the better backtesting software.

It’s faster.

It’s clearer.

It’s designed for how systematic traders think.

Wealth-Lab can still play a valuable role — especially if you want rich charting or automated execution — but it should not be your primary research engine.

Want the Rest of the Puzzle?

Backtesting software is only one piece of the trading puzzle.

Most traders fail not because of software, but because they lack:

- A complete system development process

- Clear rules

- Internal alignment

- Confidence in their execution

That’s why we built The Trader Success System — the missing framework that ties everything together so you can finally trade with consistency.

If you want to stop guessing and start trading like a systematic professional…

this is your next step.