If you have wondered what reverse stock splits are or how to profit from them, you are in the right place! In the dynamic world of stock trading, staying ahead and generating consistent returns requires not only positive expectancy trading systems and good position sizing, but also an understanding of various corporate actions and their implications. One such corporate action that has the power to significantly influence stock prices is the reverse stock split.

In this guide, we delve deep into the intricacies of reverse stock splits, helping you to navigate and profit from these market events. I also present the results from our Waterfall Trading System which shows you how to systematically profits from reverse stock splits.

Introduction to Reverse Stock Splits

In recent years, the stock market has seen a surge in the number of reverse stock splits. According to data from StockAnalysis.com, the year-to-date number of reverse splits in 2023 (at 9th September) is 324 while the full year 2022 have 324.

Understanding what a reverse stock split involves and how it impacts market dynamics can give you a unique edge that adds fantastic diversification to your portfolio. But before we reveal our reverse split trading strategy, let’s demystify reverse stock splits and explain exactly what they are and how they work.

What is a Reverse Stock Split? (Stock reverse split definition)

Having the stock reverse split definition clear is important so that you don’t get tripped up in your real-time trading. A reverse stock split is a corporate action where a company reduces the number of shares outstanding, thereby increasing the value of individual shares. It’s a strategy often adopted by companies to meet listing requirements or to make their stock more attractive to potential investors. Let’s delve deeper into why and how companies resort to this method.

Reasons Why Companies Opt for a Reverse Split of Stock

Companies might opt for a reverse split of stock for several reasons, including attempting to boost their stock price to avoid delisting from stock exchanges or attracting a different class of investors. If stock prices fall too far then trading the stock can become unattractive as many traders pay commissions on a dollar-per-share basis and low-priced stocks are unattractive when this is the case.

Many traders are also not willing to purchase “penny stocks” so as a company stock price falls towards penny stock status, a reverse split of stock can become necessary to maintain liquidity in the market. Most listed companies will seek to avoid penny stock territory if their stock price keeps falling, which is why some failing companies end up reverse-splitting their stock multiple times before their eventual demise.

Unpacking the Mechanics of Reverse Stock Splits

Grasping the mechanics of reverse stock splits is crucial so you don’t get confused if you end up holding a stock that undergoes a reverse stock split. The most important concept to understand is the stock split ratio.

Understanding Stock Split Ratios

At the heart of a reverse stock split is the split ratio. This ratio determines the number of new shares that an investor will get for their existing shares. Common ratios include 1 for 5, 1 for 10, 1 for 20, and 1 for 25, although the split ratio can theoretically be anything at all.

Understanding these ratios is essential to gauge the potential impact on stock value and market perception. Let’s illustrate how the split ratios work with some examples of how you can calculate the inpact of the split… then once you understand you can just use our handy reverse split stock calculator to save you time.

1-For-5 Stock Split

In a 1-for-5 reverse stock split, every five shares that you own will be merged into one share. If you initially have 500 shares priced at $10 each, on a split-adjusted basis , you would own 100 shares priced at approximately $50 each. The value of your investment remains the same, but the number of shares and the price per share have changed.

Before the Split

Number of shares: 500

Price per share: $10

Total investment: 500 shares x $10/share = $5000

After the Split

Number of shares: 100 (500 ÷ 5)

Price per share: $50 (5 x $10)

Total investment: 100 shares x $50/share = $5000

To calculate the impact on your stocks quickly and efficiently, try using our reverse split stock calculator.

1-For-10 Reverse Stock Split

Similarly, in a 1-for-10 reverse stock split, every ten shares are merged into one. For instance, if you own 1000 shares priced at $1 each, post-split, you will own 100 shares, but each will now be priced at $10.

Before the Split

Number of shares: 1000

Price per share: $1

Total investment: 1000 shares x $1/share = $1000

After the Split

Number of shares: 100 (1000 ÷ 10)

Price per share: $10 (10 x $1)

Total investment: 100 shares x $10/share = $1000

Other Reverse Stock Split Ratios

Some other common reverse stock split ratios are:

- 1-for-8 reverse stock split

- 1-for-10 reverse stock split

- 1-for-20 reverse stock split

- 1-for-25 reverse stock split

- 1-for-30 reverse stock split

- 1-for-40 reverse stock split

- 1-for-50 reverse stock split

- 1-for-X reverse stock split

All of these work the same way by consolidating every X shares into a single share. These types of splits are often utilized by companies looking to significantly increase their stock price.

To accurately calculate the changes in your shares during these more complex splits, head over to our reverse split stock calculator where you can input your specific share numbers, price, and split ratio to understand the full impact on your portfolio.

Remember, while the number of shares you hold decreases and the price per share increases, the total value of your investment remains roughly the same.

Final Note on the Impact of a Reverse Split

The effects of a Reverse Stock Split can influence both the stock value and the perception of the company among shareholders. The immediate effect is an increase in the stock price, but it also often leads to a decline in investor perceptions resulting in further declines in the stock price in the long term.

If you want a strategy that can profit from the market dynamics around reverse splits then scroll to the bottom of this page to learn about our Waterfall Trading Strategy.

Backtesting Trading Systems with Split Adjusted Data History

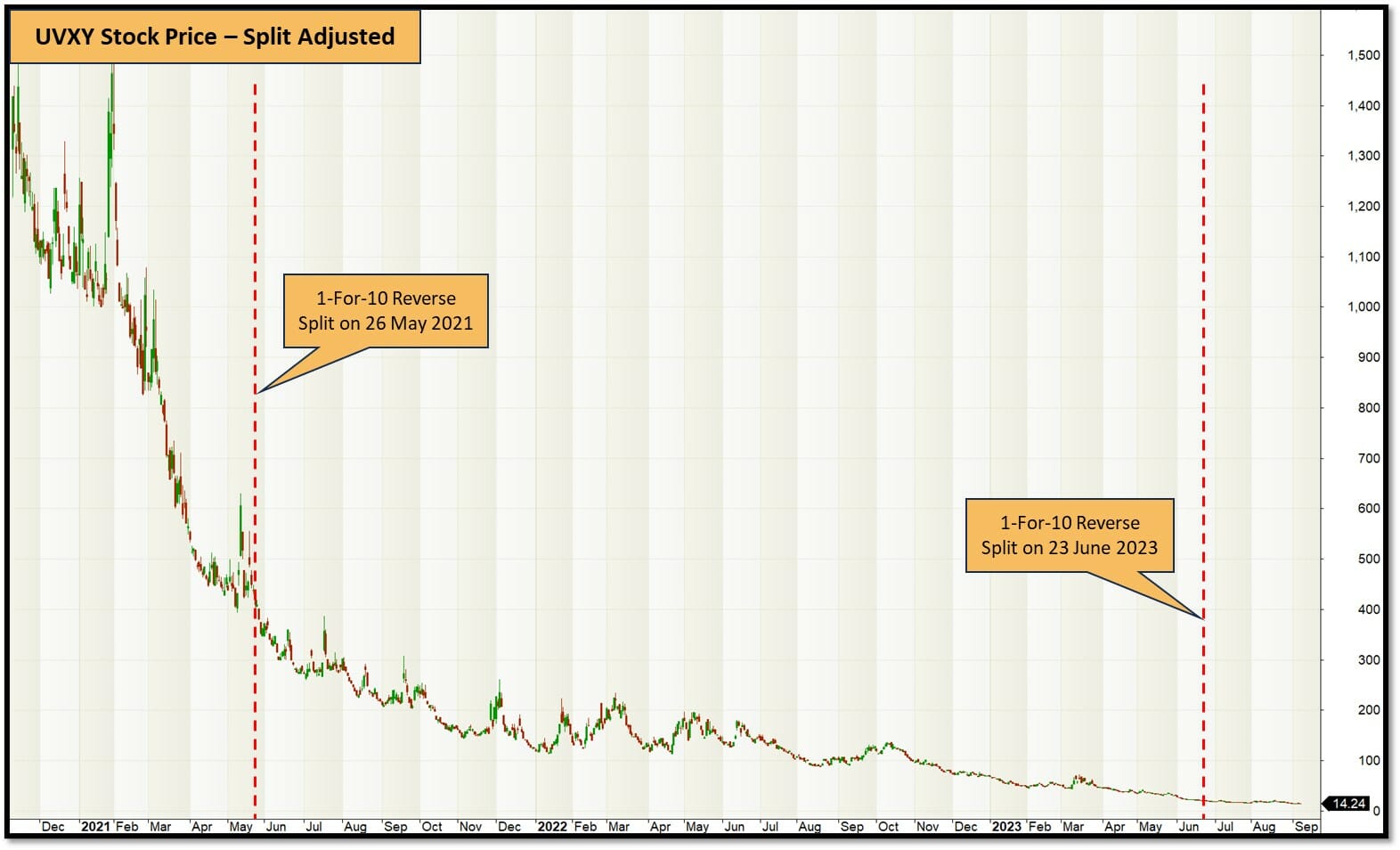

Stock splits and reverse stock splits change the share price of a stock by a large amount overnight. The raw stock price for a stock that undergoes a reverse split appears to have a large gap up as illustrated in the chart of the UVXY below:

A reverse split does not give shareholders a windfall gain as suggested by this unadjusted stock chart. Since for example in the 23 June 2023 1-For-10 Reverse split, the price went from $2 to $20 per share, however, the number of shares held by each shareholder was consolidated by 1/10th, so the total value of each position was not changed in dollar terms. Because the stock price changes but the position value does not, traders must perform their trading system backtests on split-adjusted data.

The way split-adjusted stock data works is that every day before the split, the price and volume are adjusted by the split ratio so that the stock price appears to be a smooth trend over time. This way when you backtest your trading system ideas the backtests give you results that are consistent with what you would have achieved in real-time trading. Below is the same UVXY stock chart but now adjusted for the two 1-For-10 Reverse Splits you see on the chart above:

As you can see, once you correctly adjust the stock price history for the splits the true trend of the stock becomes much more apparent. UVXY trends down over time because of the way the ETF is constructed (the derivatives used to create the leverage in this ETF lead to unavoidable time decay). This means that if you buy and hold UVXY for a long time the value of your holding very quickly erodes as you can see in the chart above. The ETF has no choice but to keep performing reverse splits to keep the stock price tradeable.

It is important to note that not all reverse splits occur because of financial engineering problems like this. Most are just companies that are either poorly managed or in financial trouble.

Historical and Recent Reverse Stock Splits

Investigating past and recent reverse stock splits, such as the notable GE reverse stock splits (see chart below), can offer insights into potential trends and patterns. The GE chart below shows how after the 1-For-8 Reverse split in August 2021 was followed by a significant decline in the stock price. However the much smaller 1000-For-1281 Reverse Split in January 2023 was followed by a rally.

In fact by looking at the long-term charts of many stocks that have undergone reverse splits, we came up with the Waterfall Trading Strategy which shows traders how to profit from these stocks in decline. By analyzing cases like this, it is possible to find market behaviour that you could profit from in the future. For example in observing the tendency for reverse split stocks to continue in a downtrend we designed the Waterfall Trading Strategy to short these stocks with very attractive short side returns.

The Pros and Cons of Reverse Stock Splits

Like any corporate action, reverse stock splits come with advantages and disadvantages.

Advantages of Reverse Stock Splits

- Meeting Listing Requirements: Companies can avoid delisting by maintaining a minimum share price.

- Attracting Institutional Investors: Higher stock prices can attract institutional investors, who might be restricted from investing in low-priced stocks.

Disadvantages of Reverse Stock Splits

- Potential Shareholder Distrust: Reverse splits can signal financial trouble, leading to investor scepticism and continued stock price declines.

- Reduced Market Liquidity: Fewer shares available can lead to decreased liquidity, making it harder to buy or sell large quantities of stock.

Upcoming Reverse Stock Splits

To stay ahead in the game, you may want to make yourself aware of upcoming reverse stock splits. Utilize tools and calendars available online to remain updated. Services like this Reverse Stock Split Calendar can help you see what is coming up for stocks you own.

FAQ About Reverse Stock Splits

What is a stock split vs. reverse stock split?

A reverse stock split is a corporate action where a company reduces the number of outstanding shares in the market, thereby increasing the price per share. It does not change the company’s market capitalization. In a reverse stock split, you will end up with fewer shares but each will be worth more. For example, in a 1 for 10 reverse split, 10 shares of stock valued at $1 each would become 1 share worth $10.

On the other hand, a conventional stock split is an action where a company increases the number of shares available in the market, which typically decreases the price per share. It is carried out to make the shares more affordable to small investors. In this case, the market capitalization remains unchanged. For instance, in a 1 for 2 stock split, 1 share of stock valued at $20 would become 2 shares valued at $10 each.

Both actions are strategies employed by companies to manage their stock price and market perception, albeit with opposite approaches.

What does a reverse stock split mean?

A reverse stock split is a corporate action that reduces the number of shares outstanding, thereby increasing the value of each share.

How does a reverse stock split work?

In a reverse stock split, a company consolidates its shares at a specific ratio, reducing the total number of shares and increasing the price per share so the total dollar value of each stockholder’s investment remains the same but the stock price increases.

Why do companies opt for a reverse stock split?

Companies undergo reverse stock splits to avoid delisting, attract institutional investors, or improve market perception.

How to calculate reverse stock split?

Calculating the effects of a reverse stock split is simple with our Reverse Stock Split Calculator. Just input the necessary details, and get the results in seconds.

Is reverse splitting good or bad for investors?

A reverse splitting can be both good and bad, depending on various factors like the reason behind the split, the company’s financial health, and market reactions. Typically a reverse stock split occurs because of a falling share price and the company needs to increase the share price so it can keep trading on the stockmarket.

The reverse stock split itself is not good or bad inherently, but the fact that the company is reverse splitting the stock is often a sign that the company is in trouble and can indicate the company has poor prospects for future performance that would elevate the stock price naturally.

Should I sell before a reverse stock split?

A reverse stock split will not change the long-term prospects of a company, so there is more than likely no reason to sell before a reverse stock split. However, there is a more important question which is, should you really be holding a stock that is performing so poorly that it needs to reverse split to increase its stock price?

Make sure you look at our Waterfall Trading Strategy for reverse stock splits to discover how you can make exceptional returns from trading this corporate action.

How often do reverse stock splits happen?

Reverse stock splits do not happen on a regular, predictable basis, as they are largely dependent on individual company circumstances and strategies. Generally, companies reverse split to increase their stock price and maintain compliance with stock exchange listing requirements or to improve market perceptions. These events can occur several times in a year across the market, but they are considerably less common than standard stock splits. Investors should always stay informed by checking recent news and announcements from companies and exchanges to keep track of upcoming reverse stock splits.

Is a reverse stock split a good thing?

Whether a reverse stock split is a good thing depends on the context and your perspective as an investor. Here’s the breakdown:

Potential Advantages:

- Avoiding Delisting: Companies often use reverse splits to boost their share price and meet minimum listing requirements for stock exchanges. This can keep the stock tradable and maintain investor confidence.

- Attracting Investors: A higher share price might appeal to institutional investors or traders who avoid penny stocks. It can also reduce trading costs for those paying commissions on a per-share basis.

Potential Disadvantages:

- Signal of Financial Trouble: Reverse splits are often associated with struggling companies. Investors may interpret them as a sign of weakness, leading to further declines in the stock price.

- Reduced Liquidity: Fewer shares outstanding can make it harder to buy or sell large quantities of the stock, potentially increasing volatility.

- Historical Trends: Many stocks that undergo reverse splits tend to continue declining over time. This is why strategies like the Waterfall Trading System focus on shorting these stocks post-split.

In short, a reverse stock split isn’t inherently good or bad – it’s a tool companies use to address specific challenges. For investors, it’s crucial to analyze the company’s fundamentals and the reasons behind the split before making decisions.

Is it legal to do a reverse stock split?

Yes, reverse stock splits are entirely legal. They are a common corporate action used by companies for various strategic reasons, such as avoiding delisting from stock exchanges or making their stock more appealing to institutional investors. The legality of reverse stock splits is governed by corporate laws and regulations, which vary by country, but as long as the company follows the proper procedures outlined in its jurisdiction, there’s no issue.

For instance, in the U.S., companies must typically get approval from their board of directors and, in many cases, a majority vote from shareholders before executing a reverse split. This ensures transparency and compliance with securities regulations.

If you’re holding shares in a company planning a reverse split, it’s worth understanding the implications for your investment.

What does 1 for 50 reverse stock split mean?

A 1-for-50 reverse stock split means that for every 50 shares you currently own, they will be consolidated into 1 share. Here’s how it works:

- Number of Shares: If you own 1,000 shares before the split, after the 1-for-50 reverse split, you will own 1,000 ÷ 50 = 20 shares.

- Share Price: The price per share will increase proportionally. For example, if the stock price was $2 before the split, it will become $2 × 50 = $100 after the split.

- Investment Value: The total value of your investment remains the same (ignoring market fluctuations). In this case, 1,000 shares × $2 = $2,000 before the split, and 20 shares × $100 = $2,000 after the split.

Reverse splits are often used by companies to boost their stock price, typically to avoid delisting or attract a different class of investors. However, they can also signal financial trouble, as companies in decline often resort to reverse splits multiple times.

If you’re holding a stock undergoing a reverse split, it’s worth understanding the company’s reasons and considering the potential long-term implications.

Do investors lose money in a reverse split?

No, investors don’t lose money directly from a reverse stock split itself. The total value of their investment remains the same immediately after the split – just the number of shares and the price per share change proportionally. For example, if you own 1,000 shares at $1 each (worth $1,000 total) and the company does a 1-for-10 reverse split, you’ll end up with 100 shares at $10 each, still worth $1,000.

However, the real concern is what happens after the reverse split. Here’s why:

- Market Perception: Reverse splits often signal financial trouble, which can lead to a loss of confidence among investors. This perception can cause the stock price to decline further over time.

- Historical Trends: Many stocks that undergo reverse splits tend to continue their downtrend. This is why strategies like the Waterfall Trading System focus on shorting these stocks post-split.

- Reduced Liquidity: With fewer shares outstanding, it can become harder to trade the stock, potentially increasing volatility and making it less attractive to investors.

So, while the reverse split itself doesn’t cause a loss, the underlying reasons for the split and the market’s reaction to it often lead to declines in value.

Do shareholders lose money in a reverse split?

No, shareholders don’t lose money directly from a reverse stock split itself. The total value of their investment remains the same immediately after the split. Here’s how it works:

- Share Consolidation: The number of shares you own decreases, but the price per share increases proportionally. For example, if you own 1,000 shares at $1 each (worth $1,000 total), and the company does a 1-for-10 reverse split, you’ll end up with 100 shares at $10 each – still worth $1,000.

However, the real concern is what happens after the reverse split:

- Market Perception: Reverse splits often signal financial trouble, which can lead to a loss of confidence among investors. This perception can cause the stock price to decline further over time.

- Historical Trends: Many stocks that undergo reverse splits tend to continue their downtrend. This is why strategies like the Waterfall Trading System focus on shorting these stocks post-split.

- Reduced Liquidity: With fewer shares outstanding, it can become harder to trade the stock, potentially increasing volatility and making it less attractive to investors.

So, while the reverse split itself doesn’t cause a loss, the underlying reasons for the split and the market’s reaction to it often lead to declines in value.

What is the purpose of a reverse stock split?

The purpose of a reverse stock split is typically to address specific financial or strategic challenges faced by a company. Here are the main reasons companies opt for this action:

- Avoid Delisting: Stock exchanges often have minimum price requirements. If a company’s share price falls too low, it risks being delisted. A reverse split boosts the share price, helping the company maintain its listing status.

- Attract Institutional Investors: Many institutional investors and funds have policies against investing in low-priced or penny stocks. A higher share price post-reverse split can make the stock more appealing to these investors.

- Improve Market Perception: A higher stock price can create the impression of stability or financial health, even if the underlying fundamentals haven’t changed.

- Reduce Trading Costs: For stocks priced very low, trading costs can become significant, especially for traders paying commissions on a per-share basis. A reverse split can alleviate this issue by consolidating shares.

While these are the intended benefits, reverse splits can also signal financial trouble, leading to skepticism among investors and potential declines in stock price over time.

Is a reverse stock split bearish?

A reverse stock split is often perceived as bearish, though it’s not inherently so. Here’s why the perception leans bearish:

- Signal of Financial Trouble: Companies typically resort to reverse splits when their stock price has fallen significantly, often to avoid delisting or to escape penny stock territory. This can signal underlying financial struggles, which raises red flags for investors.

- Historical Trends: Many stocks that undergo reverse splits tend to continue declining afterward. This is why strategies like the Waterfall Trading System focus on shorting these stocks post-split, as they often show a strong tendency to downtrend.

- Market Perception: Investors may interpret a reverse split as a desperate move, leading to reduced confidence in the company. This can result in selling pressure and further price declines.

That said, not all reverse splits are bearish. Some companies use them strategically to attract institutional investors or improve market perception, and in rare cases, this can lead to a rally. But generally speaking, the bearish sentiment dominates due to the reasons above.

If you’re trading around reverse splits, understanding these dynamics can give you an edge.

What is a 1 to 4 reverse stock split?

A 1-to-4 reverse stock split means that for every 4 shares you currently own, they will be consolidated into 1 new share. The share price will increase proportionally to maintain the total value of your investment. For example:

- If you own 400 shares priced at $2 each (worth $800 total), after the split, you’ll have 100 shares priced at $8 each. The total value of your investment remains $800.

The purpose of such a split is often to boost the stock price, typically to avoid delisting or improve market perception. However, reverse splits can sometimes signal financial trouble, which might lead to further declines in the stock price over time.

If you’re holding a stock undergoing a reverse split, it’s crucial to understand the reasons behind it and the potential market reaction.

Which is better stock split or reverse split?

It’s not really about one being “better” than the other – it depends on the context and the company’s situation. Stock splits and reverse splits serve very different purposes:

Stock Splits:

- Purpose: A stock split is typically a sign of strength. Companies split their stock when the price has risen significantly, making it more expensive for smaller investors to buy. Splitting reduces the price per share while increasing the number of shares outstanding, keeping the total value of the company the same.

- Market Perception: Generally viewed as a positive signal. It suggests the company is performing well, and the split can increase liquidity and attract more investors.

Reverse Stock Splits:

- Purpose: A reverse split is often a defensive move. It’s used to increase the stock price by reducing the number of shares outstanding, often to avoid delisting or improve market perception.

- Market Perception: Typically seen as a red flag. It can signal financial trouble, and many stocks that undergo reverse splits continue to decline afterward.

So, a stock split is usually associated with growth and optimism, while a reverse split often comes with concerns about the company’s health. If you’re trading, understanding the reasons behind the split is critical.

What is reverse stock split in simple words?

A reverse stock split is when a company reduces the number of its shares by combining them, which increases the price per share. For example, in a 1-for-4 reverse split, every 4 shares you own are merged into 1, and the price of that 1 share becomes 4 times higher. The total value of your investment stays the same – it’s just fewer shares at a higher price.

Companies usually do this to boost their stock price, often to avoid being delisted from stock exchanges or to attract investors who avoid low-priced stocks. However, it can sometimes signal financial trouble, so it’s important to understand the reasons behind it.

How do you profit from a reverse split?

Profiting from a reverse stock split often involves short-selling strategies, as reverse splits can signal financial trouble and lead to further declines in the stock price over time. Here’s how you can approach it:

- Understand the Pattern: Many stocks that undergo reverse splits tend to continue their downtrend. This happens because reverse splits are often a last-ditch effort by struggling companies to boost their stock price and avoid delisting, which doesn’t fix the underlying issues.

- Use a Proven Strategy: The Waterfall Trading Strategy is designed to profit from reverse splits. It identifies high-probability short-selling opportunities by targeting stocks that are reverse splitting and already in a downtrend. This strategy uses precise entry triggers, risk management rules, and exit techniques to maximize profits while protecting against downside risks.

- Backtest Your System: Before trading, ensure your strategy is backtested on split-adjusted data. Reverse splits can create misleading gaps in stock charts, so using adjusted data helps you see the true price trends and test your system accurately.

- Timing is Key: Don’t just short-sell immediately after the reverse split. Wait for specific signals or patterns that indicate the stock is likely to continue declining. This improves your odds of success and reduces unnecessary risk.

What is a 15 to 1 reverse split?

A 15-to-1 reverse split means that for every 15 shares you currently own, they’ll be consolidated into 1 single share. The price per share will increase proportionally to maintain the same total value of your investment. Here’s an example to make it clear:

- Before the Split: Let’s say you own 1,500 shares priced at $2 each. Your total investment value is 1,500 x $2 = $3,000.

- After the Split: Post-split, you’ll own 1,500 ÷ 15 = 100 shares. The price per share will rise to $2 x 15 = $30. Your total investment value remains the same at $3,000.

The key takeaway is that while the number of shares decreases and the price per share increases, the overall value of your holdings doesn’t change immediately. However, reverse splits often happen when a company is struggling, so it’s worth understanding the reasons behind the split and the company’s financial health.

If you’re curious about how to calculate this quickly, tools like a reverse split calculator can save you time.

Reverse Stock Split Trading Strategies

Armed with a deep understanding of reverse stock splits, it’s time to share the results of our Waterfall Trading Strategy. This trading strategy is based on the observation of hundreds of reverse split stocks which has shown a tendency for these stocks to continue their downtrend after a reverse split. Stock charts like the following are typical of reverse split stocks. Multiple MULN reverse splits over the years have lead to a long term downtrend in the stock. This observation has been made over and over on many charts, making it a solid foundation for a short selling trading strategy.

Developing a Profitable Trading Strategy for Reverse Splits

A trading strategy that finds stocks that are trending down, and having a reverse split has huge profit potential because if the company is reverse splitting then they more than likely don’t believe that the decline in the stock price will stop any time soon – this gives us an edge if we can safely short sell the stock.

How to Profit from Reverse Stock Splits

It is not enough, however, to find stocks that are reverse splitting and short sell them – on its own this is very risky. We can, however make a very appealing trading strategy by adding precise entry triggers, risk management and clever exits to our reverse split trading system.

Introducing The Waterfall Trading Strategy

The Waterfall Trading Strategy is an elegantly simple trading strategy that allows you to find high-probability short-side trades that are underpinned by reverse splitting of the stock. In addition to the reverse split signal, we have timing rules to get you into the short position at the highest probability moment as well as a combination of exit techniques to lock in profits and protect you from the downside and manage your risk.

Backtesting The Waterfall Trading Strategy over the last 30+ years using Norgate Data we get the following equity curve and drawdown profile:

The Waterfall Strategy – Backtested Equity Curve

The Waterfall Strategy – Backtested Drawdown Profile

The Waterfall Strategy – Annual Return Profile

The historical performance statistics from The Waterfall trading strategy are as follows (remembering this is a short selling strategy that makes money when stocks decline so it is most likely negatively correlated to your existing portfolio – this is super powerful!)

- Annual Return 17.05%

- Exposure 15.27%

- Risk Adjusted Return 111.65%

- Avg. Profit/Loss 2.96%

- Avg. Bars Held 6.8

- Max. drawdown -22.36%

- CAR/MaxDD 0.76

The Waterfall is a shorting strategy, and because of the risk of shorting and the occasional larger losses so this should be incorporated as part of a diversified portfolio at small position size rather than traded in isolation, for example, The Waterfall combined with our T3 Strategy and / or the systems in The Trader Success System would generate stronger returns than either of them individually.

For traders with long-biased portfolios, short-selling strategies like The Waterfall can provide extremely useful diversification when equities markets are weak.

This trading strategy has some unique features worth highlighting:

- Time: The Waterfall Strategy is simple to manage. You only need to start looking for trades after a reverse split occurs, once that happens, there are just 3 simple entry rules which you can see on any chart. (Or you can use your Trading Software to generate the signals quickly and easily)

- Software: Don’t want to learn or use trading software? No problem – You can easily implement the The Waterfall Strategy without software with any broker that enables shorting of US Stocks and has charting functionality.

- Coding: The trading rules are elegantly simple and the code has been done for you in Amibroker and is simple to convert to any coding language. The logic is 100% objective and can easily be seen on only chart. Of course I also give you the code for Amibroker so you can backtest for yourself😉

- Simplicity: The Waterfall Strategy capitalises on a clear edge in the market – Stocks that have a Reverse Split are likely to fall in price. The rules are simple and easy to understand.

- Experience: This is a shorting strategy so is not for brand new traders. Some experience is recommended and you must understand the risks associated with short-selling

- Capital: Since this is a portfolio system, and it trades up to 20 positions simultaneously, you need a reasonably sized account to trade the system. If you have less than $25k USD or equivalent this is probably not for you.

The Waterfall Strategy capitalizes on a persistent fundamental condition that potentially gives us a significant edge and the ability to profit on the short side regardless of whether it is a bull or bear market.

What could be better for diversification than an edge that profits on the short side in a range of market conditions?

Our backtesting demonstrates an impressive 17% compound annual return, investing only 15% of the time, and a maximum historical drawdown of 22.4%. With a very healthy Risk-Adjusted Return of 111%, this strategy is a great diversifying strategy.

Get the Waterfall Strategy and redefine your trading journey!

Here’s what you get with The Waterfall Strategy

1. Complete rules written in plain English

2. Instructions on how to run the strategy if you have no trading software

3. Code to run the strategy if you have Amibroker (Realtest coming soon – no additional cost)

4. Automation Code if you have the Smart Stock Automation Engine

Conclusion

In the challenging game of stock trading, having trading strategies that profit from a variety of market edges is a game-changer. With systems like The Waterfall Strategy you can diversify and enhance your portfolio… Embark on your journey to successful reverse stock split trading now.

I have had several debates with other investors/traders about this. And i’ve been doing quite a bit of testing on this also with various strategies. Most of the setups i’ve been testing were to the long side although a few were to the short side. Your waterfall strategy sounds interesting. I definitely want to check it out . My best setup was to just basically short just after the news was announced for the reverse split. Its nearly always a sign of trouble as you mentioned above.

Thanks for your great comment, it sounds like our research is aligned. The challenge is getting the data to backtest which is why I have used the actual split day which is visible in the data rather than the announcement of the split – I would love to have a data series of split announcements going back 20 years for all stocks to test that… have you done that?