Swing trading is a strategy that works because markets trend, and within those trends price regularly swings above and below the primary trend. These swings are tradable moves which allow the trader to profit multiple times within the one primary trend.

This works in most asset classes, however it is most profitable where prices trend but also move materially up and down around the primary trend. The intention is to capture quick profits out of the trend by benefiting from these intermediate swings. It is a shorter term trading strategy than trend trading. It is therefore a more active form of trading. It should, however, still be possible to swing trade successfully using end of day data while working full time.

Swing Trading Can Require A High Level Of Activity:

This is a very simple and robust trading strategy. With a good trading system and sound money management it is certainly possible to make very high returns on your account with swing system. As with everything in trading (and life) there are trade-offs to consider.

The primary trade-off for this trading strategy compared to trend trading is that it takes more activity by the trader to generate each dollar of profit. The entry and exits may also require you to look at intraday prices to make your entry / exit decisions depending on your system.

The primary benefit of trading price swings (compared to trend trading) is that trades turnover more quickly, there is generally less profit that you give back at the end of the trade before you close it out. This can be psychologically gratifying, but it doesn’t necessarily mean you will make more money than trend following. Only your trading system development efforts will determine that.

Depending on the trading signals used, swing trading systems may have a higher reliability than trend following systems. This means you get to be right more often, but the average profit per trade will be smaller than with typical trend following systems.

Swing systems can generally be made to be mechanical, however discretionary systems can also be very profitable. For the beginning trader we favour mechanical trading systems because it takes the emotion out of trading and, provided you follow your rules, reduces mistakes caused by emotions and psychological biases.

Components Of A Swing Trading Strategy:

Similar to trend trading, these strategies can be applied across multiple markets with minimal, if any modifications. This is because most markets move in a primary trend and also oscillate above and below that trend over time. It is these oscillations above and below the primary trend that a swing trading strategy seeks to capture.

The basic components of the swing trading strategy are:

- A way to identify when a trend is in place

- A low risk entry point at to start of an intermediate move

- An initial stop loss to get you out if you are wrong

- An exit rule that gets you out near the top of the swing move

There are a number of differences between a swing trading strategy and a trend trading strategy because the moves you are trying to capture are different. Each component is explained in the following four paragraphs highlighting the differences that are most relevant.

The definition of a trend being in place will be similar to that used in trend trading, however, you may seek to identify trends with wide ranging swings rather than smooth, stable trends.

The entry point needs to be at the beginning of, or in anticipation of an intermediate term move in the direction of the primary trend. This means after a correction has slowed or the move in the direction of the primary trend has just commenced. It is important not to wait for too much confirmation here because the swing move is relatively small and so a timely entry will help ensure your system captures sufficient profits.

The initial stop loss is often tighter than in long term trend following because it is important to keep losses small relative to the size of average gains. Average gains are smaller than long term trend following because you are only seeking to profit from intermediate term moves rather than the entire primary trend. This means you will need a tighter stop compared to a trend trading strategy.

The exit rules are extremely important to maintain profitability. In swing trading you do not have the luxury of letting your profits run for an extended period as you would with a wide trailing stop in a trend trading strategy. Instead the strategy seeks to exit at or near the top of the swing move. This can be done by using some combination of a profit target, exiting based on projected price levels, a time based exit or a tighter trailing stop.

If your trading strategy has all of these components, combined with good risk management rules, then you have a good chance of being able to develop a profitable trading system. (Of course you will need to undertake the correct trading system development for yourself to be sure as there are no guarantees your rules will be profitable).

Which Markets Do Swing Trading Systems Work For?

It is possible to trade price swings effectively in the stock market, futures and commodity markets and in forex/currency trading. The differences between these markets are less significant than for trend trading because the duration of trades is shorter, however many of the same issues apply as are discussed here.

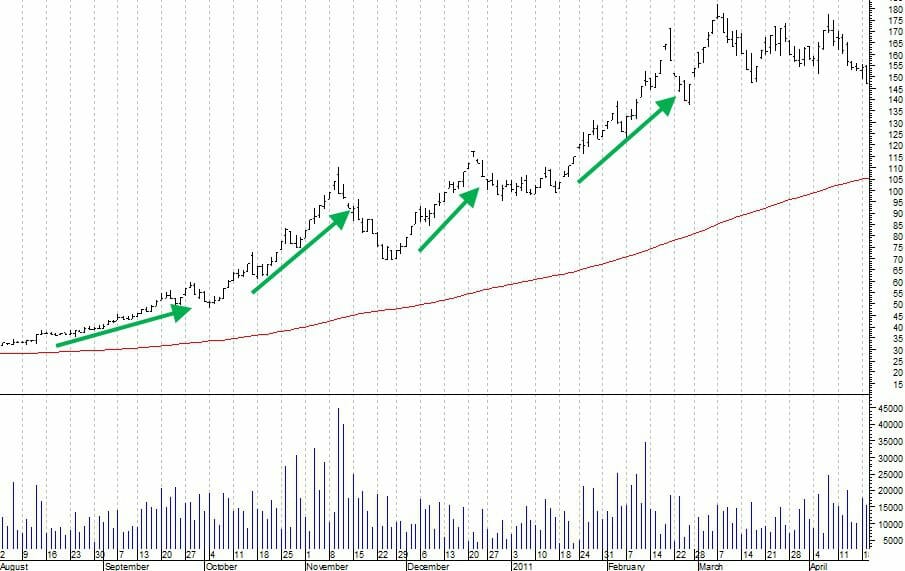

The following charts illustrate the type of moves you may seek to capture.

Stock Swing Trading:

The chart of ANZ bank below illustrates the primary up trend from late 2011 to mid 2013. Within this trend there were three major swing moves which could have been extremely profitable with the right trading system.

Stock Price Swing Example: ANZ Bank (ANZ:ASX)

Stock swing trading systems intermediate price swings in the direction of the primary trend. Within this trend there were three tradeable swing moves within the primary trend.

These intermediate term price swings lasted several months each. It is not necessary to always look for swings of this magnitude. Shorter term systems are possible; however, the average profits will be smaller as you reduce the trade duration.

In our trading systems section you will see that these price swings can be identified and exploited using simple mechanical trading systems which look only at price data – it is not necessary to do hundreds of hours of fundamental research to identify a stock that has tradeable price swings above and below the primary trend and profit from it.

Futures Swing Trading:

Futures price trends are frequently punctuated with sharp retracements as illustrated in the Cotton chart below.

The extremely patient trader may apply a trend trading strategy which benefits from the entire primary trend, while the nimble swing trader may move in and out of a trend like this several times as illustrated by the arrows on the chart.

Both strategies can be profitable, however the duration and average profit per trade are both significantly shorter for the strategy that trades price swings.

Futures Price Swing Example: Cotton

The benefit of the shorter term moves in the swing trading strategy is that you can keep your capital tied up for a shorter period before moving on to the next trade. If you have a profitable swing system this may allow you to compound your returns more efficiently than a longer term system provided the average profit per trade is high enough and transaction costs don’t hurt performance too much. This is particularly powerful in the futures markets which give good diversification – magnifying the impact of the faster compounding.

Forex Swing Trading:

Similar to futures, many primary forex trends are punctuated with sharp retracements as illustrated in the USDGBP chart below. The chart below shows at least 5 swing moves that could have been captured during the down trend of the USDGBP currency pair during 2006-2007.

Forex Price Swing Example: USDGBP

PlayPrevious2/3Next Futures price trends can be punctuated with sharp retracements. The patient trader may apply a trend trading strategy which benefits from the entire primary trend, while the nimble swing trader may move in and out of a trend like this several times.

If you have difficulty holding onto trades for the entire duration of the primary trend and prefer to bank smaller profits regularly you can see how trading this type of move may appeal.

Can A Swing Trading Strategy Fit In With A Day Job?

YES! This is a form of trading that can be learned and can fit in easily with whatever else you have in your life at the moment provided you select your trading timeframe to allow this. Trading off daily price bars will work with a day job, but using hourly or 4 hourly price bars for your swing trading system will make trading with a day job difficult.

Swing systems require very little time each day (or week) to execute and can be run while you still have a full time job.

Once you understand the concepts and codify them into a mechanical trading system it becomes a matter of simply running your system scans each day and executing to the rules. Your trading strategy can be designed to eliminate any form of judgment, so assuming everything is documented properly in your trading plan the decisions are very quick to make on a day to day basis.

What Swing Trading Software Do You Need?

To develop a profitable swing trading system, you will need a charting package, daily market data covering the markets you intend to trade and trading software capable of backtesting and optimizing your trading system. If you are planning to trade shorter term swings than those illustrated above you may need to use an hourly chart to time your entries and exits effectively. However, we suggest that in the first instance new traders stick with the daily bar chart because trading on daily bars gives the best lifestyle flexibility, reduces the need to look at the computer screen during the day and keeps your costs low (intraday data is more expensive than end of day data). If you are just getting started you do not have these packages, we recommend you look at the following:

- Amibroker to display your charts and backtest your trading strategy

- Norgate Data to provide the historical market prices to backtest your trading strategy for the ASX, US and Canadian markets

This combination will allow you to cost effectively get started and develop your own trading system (this will also cover trend trading and mean reversion, chart pattern trading and various other end of day trading systems).

Frequently Asked Questions About Swing Trading

Is swing trading really profitable?

Swing trading can absolutely be profitable, but like any trading strategy, its success depends on having a solid system, disciplined execution, and proper risk management. Here’s why swing trading works and what you need to consider:

- Profit from Market Oscillations: Swing trading takes advantage of the natural up-and-down movements (swings) in the market. Stocks rarely move in a straight line, so swing traders aim to capture these intermediate moves within a larger trend.

- Higher Win Rate: Compared to trend following, swing trading systems often have a higher reliability (win rate), which can be psychologically satisfying. However, the average profit per trade tends to be smaller since you’re not holding for the entire trend.

- Faster Turnover: Swing trading generates trades more frequently, which means you can compound your returns faster. But this also requires more activity and attention to the market, which may not suit everyone.

- Risk and Reward: Swing trading typically uses tighter stop losses and shorter holding periods, which can limit losses but also requires precise entries and exits to capture profits effectively.

- Backtesting and Discipline: The key to profitability is developing and backtesting a robust swing trading system. This ensures your rules are based on sound market behavior and gives you confidence to stick to the system during losing streaks.

If you’re considering swing trading, make sure it aligns with your personality and lifestyle. It’s more active than trend following but can be very rewarding if done right.

What is an example of swing trading?

Swing trading involves holding a stock for a few days to a few weeks to capture short- to medium-term price movements. Here’s a simple example:

- Setup: Let’s say you’re watching a stock that’s been trending upward and recently pulled back to its 50-day moving average – a common support level.

- Entry: You notice the stock bounces off the 50-day moving average and forms a bullish candlestick pattern (e.g., a hammer or engulfing pattern). You enter the trade as the price breaks above the high of this pattern.

- Stop Loss: You set a stop loss just below the recent swing low to limit your risk if the trade goes against you.

- Exit: You aim to exit when the stock approaches a resistance level or shows signs of reversing, such as hitting a prior high or forming a bearish pattern.

For instance, if you bought a stock at $50 with a stop loss at $48 and a target at $55, your risk is $2 per share, and your potential reward is $5 per share. This gives you a reward-to-risk ratio of 2.5:1, which is favorable.

Swing trading works well when you have a clear system to identify setups, manage risk, and exit trades.

Is swing trading for beginners?

Swing trading can be a good choice for beginners, but it depends on your personality, time availability, and willingness to learn. Here’s why it might work for you:

- Simpler Than Intraday Trading: Swing trading doesn’t require constant monitoring of the market like day trading does. You can make decisions based on end-of-day data, which is less stressful and more manageable for beginners.

- Higher Reliability: Swing trading systems often have a higher win rate compared to trend-following systems. This means you’ll experience more winning trades, which can help build confidence as you’re starting out.

- Mechanical Systems Are Beginner-Friendly: For new traders, mechanical swing trading systems are ideal because they remove emotional decision-making. You just follow the rules, which reduces mistakes caused by psychological biases.

- Faster Feedback: Swing trading provides quicker results than long-term trend following. You’ll see the outcomes of your trades within days or weeks, which helps you learn and improve faster.

However, it’s important to note that swing trading still requires a solid system, proper risk management, and discipline. Beginners should focus on developing and backtesting a system before trading live.

What is the secret of swing trading?

The “secret” of swing trading lies in mastering a few key principles that allow you to consistently capture profits from short- to medium-term price movements. Here’s what makes swing trading work:

- Understanding Market Swings: Markets naturally oscillate above and below their primary trends. Swing trading focuses on capturing these intermediate moves, which occur within the larger trend. This works across various markets like stocks, forex, and futures.

- Timely Entries and Exits: Success in swing trading depends on entering trades at low-risk points (e.g., after a pullback in an uptrend) and exiting near the top of the swing move. This requires a system that identifies trends, spots corrections, and uses clear rules for entry and exit.

- Tight Risk Management: Swing trading involves smaller moves than trend following, so keeping losses small with tight stop losses is critical. This ensures that your average gains outweigh your losses over time.

- Mechanical Systems: For beginners, mechanical systems are ideal because they eliminate emotional decision-making. By following predefined rules, you reduce mistakes caused by psychological biases and improve consistency.

- Backtesting and Discipline: The real “secret” is testing your strategy thoroughly before trading live. This builds confidence in your system and helps you stick to it during tough periods.

Swing trading isn’t magic – it’s about having a robust system, managing risk, and staying disciplined.

What is the 1% rule in swing trading?

The 1% rule in swing trading is a risk management guideline that limits the amount of your account equity you risk on any single trade to 1%. This ensures that even if the trade goes against you, the loss is small and manageable. Here’s how it works:

- Risk Per Trade: You calculate 1% of your total account equity. For example, if your account is $10,000, 1% risk means you’re willing to lose $100 on a trade if it hits your stop loss.

- Position Sizing: Based on your entry price and stop-loss level, you determine how many shares to buy so that the total potential loss equals $100. For instance, if your stop loss is $1 below your entry price, you’d buy 100 shares ($100 ÷ $1 = 100 shares).

- Why It’s Important: The 1% rule protects your capital during losing streaks. Even with 10 consecutive losing trades, you’d only lose 10% of your account, which is recoverable. Risking more, like 5% or 10%, could lead to catastrophic losses and wipe out your account.

This rule is particularly useful for swing trading because it balances risk with the opportunity to capture medium-term price movements.

Which timeframe is best for swing trading?

The best timeframe for swing trading generally depends on your personal preferences, lifestyle, and the specific strategy you’re using. However, daily charts are often considered ideal for swing trading. Here’s why:

- Balance of Activity and Stress: Daily charts provide enough price movement to capture meaningful swings without the stress of monitoring intraday fluctuations. This makes them manageable for most traders, even those with full-time jobs.

- Robust Backtesting: With daily charts, you can access decades of historical data, allowing for thorough backtesting and higher confidence in your system’s performance. This isn’t as feasible with shorter timeframes like hourly or minute charts.

- System Longevity: A well-designed system on daily charts can remain effective for years, as it’s less sensitive to short-term market noise compared to intraday systems.

- Lifestyle Fit: Swing trading on daily charts typically requires only 20-30 minutes of work per day, making it a great fit for those who want to trade without it taking over their lives.

If you’re new to swing trading, starting with daily charts is a solid choice. They strike a great balance between capturing profitable moves and keeping trading manageable.

How do I become a swing trader?

Becoming a swing trader involves a mix of learning, planning, and disciplined execution. Here’s a step-by-step guide to get you started:

- Understand Swing Trading Basics: Swing trading focuses on capturing intermediate price moves within a larger trend. You’ll trade less frequently than day traders but more actively than long-term investors, typically holding positions for days to weeks.

- Learn to Identify Swings: Study how markets trend and oscillate. Swing trading works by profiting from these oscillations above and below the primary trend. You’ll need to recognize when a trend is in place and spot low-risk entry points.

- Develop a Trading System: A good swing trading system includes:

- Rules to identify trends.

- Entry and exit criteria (e.g., after a pullback or near the top of a swing).

- Stop-loss levels to manage risk.

- Profit targets or trailing stops to lock in gains.

- Backtest Your Strategy: Test your system on historical data to ensure it’s profitable. This builds confidence and helps you refine your rules before trading live.

- Start with Daily Charts: Daily timeframes are beginner-friendly, require less screen time, and fit well with a full-time job. They also allow for robust backtesting and lower costs compared to intraday trading.

- Practice Risk Management: Use the 1% rule to limit your risk per trade. This protects your capital and ensures you can survive losing streaks.

- Stay Disciplined: Follow your system’s rules without deviation. Emotional trading is one of the biggest pitfalls for beginners.

Swing trading is a skill that takes time to master, but with the right system and mindset, it’s absolutely achievable.

Can I do swing trading for living?

Yes, you can absolutely do swing trading for a living, but it requires preparation, discipline, and the right systems in place and a significant amount of capital. Here’s what you need to consider:

- Build a Profitable System: You’ll need a swing trading system that has been thoroughly backtested and proven profitable. This includes clear entry/exit rules, risk management, and position sizing. Without a solid system, consistent profitability is unlikely.

- Start with a Strong Capital Base: To trade for a living, your account size must be large enough to generate sufficient income while keeping risk per trade low (e.g., 1% of your account). The exact amount depends on your living expenses and the returns your system generates.

- Risk Management is Key: Even with a great system, losing streaks happen. Managing risk ensures you can survive these periods without blowing up your account. The 1% rule is a great starting point.

- Lifestyle Fit: Swing trading is ideal for those who want to trade part-time while maintaining a balanced lifestyle. It typically requires 20-30 minutes a day, making it manageable and freeing up time for other pursuits.

- Patience and Consistency: Transitioning to full-time trading takes time. Many traders start by trading part-time alongside a job until their trading income consistently covers their expenses.

If you’re serious about this, I’d recommend starting with a program like The Trader Success System to build the skills and confidence needed to trade for a living.

How much money needed for swing trading?

The amount of money you need for swing trading depends on the market you’re trading and your goals. Here’s a breakdown:

- Minimum Capital: In markets like Australia, the minimum trade size is $500. However, starting with just one trade is risky because a loss could wipe out your ability to continue trading. A better starting point is around $10,000 so you can diversify across multiple trades simultaneously.

- Diversification: To trade effectively and reduce risk, you’ll need enough capital to diversify. For stocks, $10,000 is a good starting point to achieve sufficient diversification across multiple trades.

- Brokerage Costs: In markets with no minimum trade size and low brokerage fees, you can start with less – potentially a few hundred dollars. This is more common in markets like the U.S. with fractional shares or low-cost brokers.

- Scaling Up: If you’re aiming to trade for a living, you’ll need significantly more capital. For example, with $100,000 and a 20% annual return, you’d generate $20,000 per year, which may or may not cover your living expenses depending on your lifestyle. A buffer is also essential to handle drawdowns and bad years.

You can use the Enlightened Stock Trading – Trading For A Living Calculator to calculate how much capital you need to trade for a living. The key is to start with enough to trade seriously but not so much that you’re overly stressed.

Which is better swing or day trading?

Swing trading is generally better than day trading for most people, especially beginners, and here’s why:

- Lower Stress and Time Commitment: Swing trading requires far less screen time. You’re holding trades for days or weeks, so you only need to check the markets once a day, which is perfect if you’ve got a job or other commitments. Day trading, on the other hand, demands constant attention and can be mentally exhausting.

- Fewer Mistakes: With swing trading, you make fewer trades, which means fewer opportunities to mess up. Day trading often leads to “death by a thousand cuts” because mistakes can compound quickly when you’re making multiple trades a day.

- Less Competition: Day trading puts you up against hedge funds, algorithms, and professional traders with massive resources. Swing trading, with its longer timeframes, faces much less competition, giving you a better chance to succeed.

- Easier to Learn: Swing trading is more forgiving for beginners. You have more time to analyze your trades, reflect on mistakes, and refine your strategy. Day trading’s fast pace makes it harder to learn and recover from errors.

That said, if you’re someone who thrives on fast decision-making and can handle the stress, day trading could work. But for most people, swing trading is the smarter, more sustainable choice.

Why do most swing traders fail?

Most swing traders fail for the same reasons many traders in general struggle – poor preparation, lack of discipline, and inadequate systems. Here’s a breakdown of the key factors:

- No Proven Trading System: Many traders jump into swing trading without a well-tested system. They rely on gut feelings or untested strategies, which leads to inconsistent results. A profitable system requires clear entry/exit rules, risk management, and thorough backtesting.

- Emotional Decision-Making: Fear, greed, and overconfidence often lead traders to deviate from their plans. For example, they might hold onto losing trades too long, hoping for a reversal, or exit winners too early out of fear of losing profits.

- Poor Risk Management: Swing traders often risk too much on each trade, which can lead to devastating losses during inevitable losing streaks. Without strict position sizing and stop-loss rules, it’s easy to blow up an account.

- Unrealistic Expectations: Many traders expect to get rich quickly, leading to overtrading, excessive leverage, or abandoning strategies too soon. Trading is a long-term game, and success comes from consistency over months and years, not days.

- Lack of Adaptability: Markets change, and strategies that worked in one environment may fail in another. Traders who don’t adapt or refine their systems struggle to stay profitable.

Swing trading success requires preparation, discipline, and a focus on process over profits.

Why is swing trading risky?

Swing trading carries risks, like any trading approach, and understanding these is crucial to managing them effectively. Here’s why swing trading can be risky:

- Market Volatility: Swing traders hold positions for days or weeks, exposing them to unpredictable market events, such as earnings announcements, geopolitical developments, or economic data releases, which can cause sudden price swings.

- Overnight Gaps: Unlike day traders who close positions daily, swing traders face the risk of overnight price gaps. These gaps can lead to larger-than-expected losses if the market moves significantly against your position while you’re not actively monitoring it.

- Emotional Challenges: Holding trades for longer periods can test your emotional resilience. Watching a trade move against you temporarily can lead to panic decisions, like exiting too early or abandoning your strategy altogether.

- Lack of a Proven System: Many swing traders fail because they don’t have a well-tested system. Trading without clear rules for entries, exits, and risk management increases the likelihood of losses and emotional trading.

- Leverage Risks: Swing trading often involves leverage, especially in markets like forex. While leverage can amplify gains, it also magnifies losses, making risk management even more critical.

The key to mitigating these risks is having a robust, backtested trading system and sticking to it with discipline.

Is swing trading a strategy?

Yes, swing trading is absolutely a strategy, and it can be effective one when done right. The core idea behind swing trading is to capitalize on the natural oscillations in price that occur within a broader trend. Markets don’t move in straight lines – they swing above and below the primary trend – and swing traders aim to profit from these intermediate moves.

Here’s how it works as a strategy:

- Market Behavior: Swing trading is based on the hypothesis that prices trend and oscillate around those trends. This creates opportunities for nimble traders to capture profits multiple times within the same trend.

- Shorter-Term Focus: Unlike trend trading, which holds positions for months or years, swing trading focuses on shorter-term moves, typically lasting days to weeks. This makes it a more active trading style.

- Key Components: A swing trading strategy includes:

- Identifying trends with wide-ranging swings.

- Entering trades at low-risk points after corrections.

- Using tighter stop losses to manage risk.

- Exiting near the top of the swing move with profit targets or tighter trailing stops.

Swing trading can be applied across multiple markets – stocks, forex, futures – because most markets exhibit these oscillations. It’s a versatile and accessible strategy, especially for traders who want a balance between activity and lifestyle flexibility.

How long should you hold a swing trade?

Swing trades are typically held for a few days to a few weeks, depending on the market conditions and the specific strategy you’re using. The goal is to capture a significant portion of a price swing within a broader trend.

For example:

- If the market is trending strongly, you might hold a trade longer to ride the momentum.

- In choppier markets, you might take profits sooner to avoid reversals.

The exact duration will also depend on your system’s rules. A well-tested swing trading system will define when to exit, whether it’s based on hitting a profit target, a trailing stop, or a reversal signal. Without these rules, it’s easy to hold too long and give back profits or exit too early and miss out on gains.

If you’re just starting out, focus on daily charts – they’re less stressful and give you a clearer picture of the market’s swings.

What is the simplest swing trading strategy?

The simplest swing trading strategy is a mean reversion strategy using the Relative Strength Index (RSI). It’s straightforward, effective, and works well for beginners. Here’s how it works:

- Identify the Trend: Use moving averages (e.g., 200-day and 20-day exponential moving averages) to determine the primary trend. If the short-term moving average is above the long-term moving average, the trend is up. If it’s below, the trend is down.

- Look for Overbought/Oversold Conditions: Use a 2-period RSI to spot short-term extremes. For an uptrend, look for the RSI to drop below a specific oversold level (e.g., 1.7 or 1.8). For a downtrend, look for the RSI to rise above an overbought level (e.g., 96).

- Enter in the Direction of the Trend: In an uptrend, buy when the RSI signals oversold. In a downtrend, short-sell when the RSI signals overbought. This aligns your trades with the broader market direction.

- Exit After the Snapback: Hold the trade for 1-5 days or until the price moves back toward the trend. Use a profit target or trailing stop to lock in gains.

This strategy is simple but powerful because it combines trend-following with short-term mean reversion. Just remember to backtest it thoroughly and apply strict risk management.

How do I choose a stock for swing trading?

Choosing the right stock for swing trading is all about finding opportunities that align with your strategy and offer the potential for profitable price swings. Here’s a step-by-step guide:

- Trend Identification: Look for stocks that are trending clearly – either up or down. Use moving averages (e.g., 20-day or 50-day) to confirm the trend direction. Swing trading works best when you’re trading in the direction of the broader trend.

- Volatility: Focus on stocks with sufficient volatility. For mean reversion strategies, you want stocks that bounce around a lot, as these provide better opportunities for quick profits. A good rule of thumb is to look for stocks where the Average True Range (ATR) is greater than 6% of the closing price.

- Liquidity: Ensure the stock is liquid enough to avoid slippage. A general guideline is to look for stocks with an average daily turnover (price × volume) of at least $500,000 but not excessively high (e.g., below $2.5 million), as overly liquid stocks may not respond well to swing trading strategies.

- Support and Resistance Levels: Identify key levels where the stock has historically reversed or paused. These levels can act as entry or exit points for your trades.

- RSI or Other Indicators: Use tools like the Relative Strength Index (RSI) to spot overbought or oversold conditions. For example, in an uptrend, you might enter when the RSI dips below a certain level, signaling a temporary pullback.

By combining these factors, you can filter for stocks that fit your swing trading system.