The 10 Commandments for Profitable Stock Trading

- 1st Commandment: Learn The Language Of Stock Trading

- 2nd Commandment: Use A Trading System

- 3rd Commandment: Use An Approach That Suits YOU

- 4th Commandment: Trade With Positive Expectancy

- 5th Commandment: Preserve Precious Capital

- 6th Commandment: Reduce Your Risk

- 7th Commandment: Write Your Trading Plan

- 8th Commandment: Diversify Multiple Ways

- 9th Commandment: Eliminate Trading Mistakes

- 10th Commandment: Stop Searching

The 10 Commandments Of

Enlightened Stock Trading Explained…

1st Commandment: Learn The Language Of Stock Trading

1st Commandment: Learn The Language Of Stock Trading

Summary:

The most important thing you can do if you are new is learn the language of trading.

Do this and your rate of learning skyrockets, you can spot the scams and you won’t be bamboozled with BS.

Robert Kiyosaki says that one of the key differences between rich and poor people is the language they use.

So to become a great trader quickly – learn the language of trading!

Complete Explanation:

Have you ever tried to open a book in a foreign language and read it?

You would probably consider this a pretty silly idea, because after all, you don’t speak the language! But this is exactly what most people do when they try to teach themselves stock trading (Don’t worry, I did too – Duh!)

Picking up trading and investment books can absolutely feel like a foreign language when you are starting out. It is no wonder that most people describe trading books as boring, dry, complicated – reading a book in German is pretty boring too if you have to struggle over what every word means!

Anyway, an idea occurred to me when helping my daughter with her reading when she was in Kindergarten…the way they were teaching her to read was to start with what they call the ‘Golden Words’. You see, in English there are 100 frequently occurring words that make up HALF of the words used in general reading and writing. This means that after my daughter learned these 100 words she could basically understand at least 50% of any book!

Learning stock trading is challenging if you don’t understand the language

So how do I apply this to trading? Well what if you learned and really understood all the common trading terms before you even picked up a book? How much easier would it be to understand what the book was talking about? How much more quickly could you learn?

Do it first so that you will learn 10 times faster in the beginning than if you had to figure out all the trading terms as you go. Another advantage of this is you won’t get bamboozled with BS when you go to seminars, speak to brokers, advisors or educators – you will be in control!

Robert Kiyosaki says that one of the key differences between rich and poor people is the language they use. So to become a great trader quickly – learn the language of trading!

Related Topic: https://enlightenedstocktrading.com/learn-stock-trading/

2nd Commandment: Use A Trading System

2nd Commandment: Use A Trading System

Summary:

Humans are emotional animals, there are no two ways about it. The problem with this is emotions and trading decisions just don’t mix.

So unless you are a robot, the quickest and easiest way to make your trading profitable is to use a system to guide your decisions.

Why does this work? Because it takes your emotions out of your trading so you can make objective decisions and make money!

We humans are emotional animals; there is no doubt about it. The problem with this is emotions and trading decisions just don’t mix. As soon as our emotions go up, our ability to make good decisions drops – In the markets this means losses!

Just think of the last time you were stressed or angry… Did you make the smartest decisions you could have made? I would be willing to bet you didn’t!

So unless you are a robot, the quickest and easiest way to make your trading profitable is to use a system to guide your decisions. This works because it takes your emotions out of your trading so you can make objective decisions that make money!

Stock trading systems are simple sequences or rules that you follow to guide

your trading decisions and make money by removing emotion and judgement.

Stock trading systems are simple sequences or rules that you follow to guide

your trading decisions and make money by removing emotion and judgement

Establishing a trading system is an excellent way for most traders to ensure they have a profitable approach to the markets and reduce their mistakes to the point that they can be consistently profitable.

In Curtis Faith’s outstanding book “Way of the turtle” he talks about the many biases that people have which make them lose money trading. There are many things we learn through our upbringing, our education system and in our professional lives that make most people terrible traders. Even human nature makes people terrible traders because our ability to make good decisions goes down when emotions go up.

When I started trading I did what most people do – I used a whole host of information sources and made discretionary (gut) trading decisions based on what I thought all that information meant.

I realised early on I had two choices:

A) Spend years working on my psychology, or

B) Remove myself from the equation

I took the simpler and quicker option and decided to build a trading system and I never looked back!

The Trader Success System takes you through the entire process of selecting the right trading strategy for you, as well as testing and optimising your trading system. If this is of interest to you watch my free webclass to learn more.

Related Topic: https://enlightenedstocktrading.com/best-trading-system/

3rd Commandment: Use An Approach That Suits YOU

3rd Commandment: Use An Approach That Suits YOU

Summary:

The main obstacle between you and consistent profits in the stock market is…you!

Your trading system may be the best system in the world, but if you don’t follow it consistently then YOU WILL LOSE MONEY!

The best way to ensure you follow your trading system is to ensure it totally fits your personality, goals and ideal lifestyle.

So your system must fit you for you to make money long term.

Something that I learned from Richard Weissman’s fantastic book “Mechanical Trading Systems” is that your trading system must fit you. Every trader has a different personality, different objectives and a different ideal lifestyle. It is also clear that different trading strategies have different psychological challenges which make them suited to different types of people.

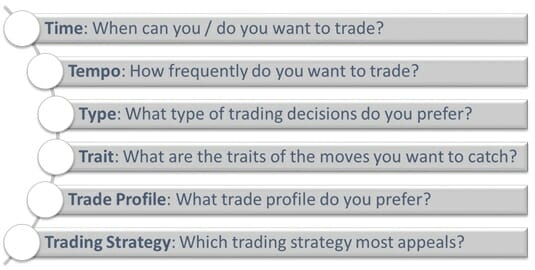

That is why I created my T6 Trader Blueprint Model. It isolates the 6 most important factors you must understand to match your trading approach to your personality

T6 Trader Profile – Find Your Trader Profile!

For example, let’s say you are the sort of person who likes action, you like rapid fire decisions, you keep your focus by opening and closing many trades each day, you like to bank your winners quickly and move on, and most of all you love watching the markets, so you look at the screen constantly when your markets are open.

You may have a great system and you may make tons of money, but if you gave that system to me I could not trade it – I would make mistakes and lose money. Why? Because I am pretty much the opposite of everything that I described above! It would not work for me, I would find it stressful, I would hate waking up in the morning and I would not be able to follow the system consistently.

Your approach must match your T6 Trader

Profile for you to make money consistently

I have tried many systems, most of which should have been profitable, but only the ones that fit my Trader Profile have ever made money for me consistently.

One of the exercises I run with my coaching clients and traders in The Trader Success System is a simulation of different styles of trade profiles to ensure you are totally comfortable that your trading system fits your personality. The great thing about this is you know that you will be able to follow it consistently because it fits you.

If you are already trading but feel stress or don’t follow your rules consistently then there is a good chance your system doesn’t fit your Trader Profile in some way.

Related Topic: https://enlightenedstocktrading.com/best-trading-system/

4th Commandment: Trade With Positive Expectancy

4th Commandment: Trade With Positive Expectancy

Summary:

Too many traders use a method that doesn’t even make money in the long run…and the worst thing about it is they don’t even realise.

Just because an indicator or system is published in a book doesn’t mean it is profitable – Most are terrible!

Positive expectancy means you expect to make a positive return for each dollar you risk over many trades.

If you don’t know, you need to find out before you risk any more money in the markets!

Complete Explanation:

In “Trade your way to financial freedom” Van Tharp explains that for any approach to make money in the markets it must have a positive expectancy. Put simply, expectancy is the amount of money you expect to make per dollar that you put at risk over the long run.

Too many newbies use a system or set of indicators blindly without even knowing if they make money. I have lost count of how many popular indicators I have tested that just don’t work – Test everything yourself!

Here is how you calculate expectancy:

Get a sample of at least 30 (preferably over 100) trades generated by your trading system or your actual live / simulated trading, and then follow these 4 steps:

- Calculate the risk per contract for each trade (Entry Price – Initial Stop Loss)

- Calculate the return per contract for each trade (Exit Price – Entry Price)

- Divide the return per contract by the risk per contract to get the R-Multiple for each trade

- Average all R-Multiples to get the expectancy

If your expectancy is negative after accounting for the cost of slippage and commissions then you will lose money in the long run and you should not trade with that approach. The larger (positive) the expectancy, the more money you expect to make for each dollar that you risk, and the more profitable your system or approach should be.

Many people who trade based on intuition or gut feel have no idea what their expectancy is, and therefore do not know whether they will ultimately make money or not. There is no excuse for this.

If you do not know the expectancy

you are taking a huge gamble!

Take some time now and calculate your expectancy if you haven’t already – you will not succeed in the long run if you have a negative expectancy.

There are a small number of issues that cause most traders to have negative expectancy in their approach. If you don’t already have a positive expectancy in your trading system then chances are one of these factors is at play for you. The great news is that it is straightforward to determine how to make your approach profitable. So if you don’t have a positive expectancy trading system then The Trader Success System will help you take the step to profitable trading while keeping you in control and empowering you to be an independent trader who does not rely on anyone. Watch my free webclass to learn more.

Related Topic: https://enlightenedstocktrading.com/trend-trading/

5th Commandment: Preserve Precious Capital

5th Commandment: Preserve Precious Capital

Summary:

You can’t win the trading game if you are not in the trading game!

Your first priority must always be to protect your capital so you can keep trading.

This means keeping drawdowns low so that you can always recover, and avoiding high risk situations that could destroy your account.

Warren Buffet has said that the two rules for investing are:

- Never lose money

- Never forget rule number 1

Obviously not every trade will be profitable, because every trader has losses. So how do Mr Buffet’s rules apply to traders? We have to think beyond individual trades to our overall account.

The key insight is that the more you lose, the harder it is to recover. For example, if you lose 10% of your account you need to make 11% to recover, but if you lose 50% of your account you need to make 100% to recover.

Small drawdowns are much easier to recover from than large drawdowns!

Keeping maximum drawdowns low makes consistent profitability easier to achieve.

The diagram below shows how it becomes increasingly difficult to recover from large losses. At the extreme end, if you lose 10% of your account you then need to make 11% to recover, but if you lose 60% then you need to make 150% to recover!!! Recovering from a 60% drawdown in your account is extremely unlikely.

So the lesson for traders in this is to ensure your maximum drawdown (the percentage drop from your highest account balance to the next low in equity) remains small so that it is easier to recover to make new equity highs.

So if you have had drawdowns in your trading of more than about 20% you are at risk…remember your biggest drawdown is always ahead of you! This is why in the optimization section of the Enlightened Stock Trader Development Program I focus a lot on the shape of your equity curve and the amount of drawdown you are producing in your backtests.

Related Topic: https://enlightenedstocktrading.com/how-to-survive-and-profit-trading-stocks-in-a-bear-market/

6th Commandment: Reduce Your Risk

6th Commandment: Reduce Your Risk

Summary:

The biggest killer of new (and experienced) traders is taking too much risk on a trade.

No one trade will make you rich, but it would kill your account if you are wrong.

This means you must make the risk on each trade low (<1% of your account) so no trades or string of losing trades will wipe you out.

Most outstanding trading authors devote a lot of effort to explaining how to manage risk. Van Tharp, Curtis Faith, Jack Schwager, Thomas Stridsman and many others all stress low risk per trade as a critical ingredient to long term trading survival.

Poor risk management is probably the

biggest killer of novice trading accounts!

The only safe way to trade is to ensure you are in the ‘safety zone’ for your approach. This means risking less than is historically optimum. This is important because the market shifts over time and what was optimum yesterday will not be optimum tomorrow. You need to ensure that market shifts do not push you over the precipice into the red zone. The only trouble is you won’t know till it is too late, so you need to risk less than the historical optimum.

Relationship between risk per trade and expected profit…risk too much and you go over the edge!

The higher your level of risk per trade, the greater your chances of losing all or most of the money in your account. In the vast majority of cases this is how I think about risk per trade:

- Risking >10% of your account on each trade is guaranteed suicide

- Risking 5-10% of your account on each trade is really wild trading

- Risking 1-5% is still too much for most traders!

- Risking <1% of your account is likely to keep you safe

In my own trading I risk much less than 1% on each trade! Stay in the game – keep your risk low to ensure you don’t get wiped out!

Risking too much without realising it can absolutely take you out of the trading game and wipe out your trading account far quicker than you might think. That is why in the Enlightened Stock Trader Development Program I devote a whole module to understanding and managing risk. This takes you from being dangerous in your trading to controlled and deliberate in your risk management.

So if you have experienced volatility or large drawdowns in your account you need to learn how to backtest your trading system and vary the risk per trade to ensure you get drawdowns which are tolerable. The Trader Success System will show you exactly how to do this as well as give you 15+ complete trading systems to work with. Watch my free webclass to learn more.

Related Topic: https://enlightenedstocktrading.com/how-to-make-money-trading-stocks-in-the-current-difficult-bear-market/

7th Commandment: Write Your Trading Plan

7th Commandment: Write Your Trading Plan

Summary:

The market has a way of challenging us. Unexpected challenges cause our stress levels spike…this leads to poor decisions…this leads to losses.

The solution is to have a written plan to follow so that you know exactly what to do and exactly when to do it.

Writing a great trading plan will set you apart from the 95% of traders who ultimately lose money and quit. This is probably the single biggest difference between successful and unsuccessful traders.

A good written trading plan makes a huge difference to your chances of success because it helps you plan for many different outcomes so that you know what you will do in advance and are not making decisions in the heat of the moment.

A great trading plan should cover the following 8 areas:

The 8 components of a complete trading plan.

No matter what stage you are up to in your trading, if you do not have a written trading plan, creating one should be very high on your priority list. The only things I consider to be more important are ensuring your position sizing is not too aggressive and having a positive expectancy trading system.

Related Topic: https://enlightenedstocktrading.com/trading-plans/

8th Commandment: Diversify Multiple Ways

8th Commandment: Diversify Multiple Ways

Summary:

Diversification is the only free lunch in the markets. You should get as much as you can.

This is more than holding multiple stocks…it is multiple systems, markets, directions, strategies etc.

What happens when your trading system has a period where it loses money? With just a single system you have to trade through it and wait until your system returns to profitability. These drawdowns are part of trading any system, so how can we get around it and improve the consistency of our profits? Diversification is the answer!

Diversification is far more than just holding more than one stock. In fact, there are at least 6 levels of diversification that traders can use to improve their profitability and consistency:

There are at least 6 different levels of diversification!

You can diversify:

- Instruments: Having multiple instruments in your portfolio (not just trading one stock)

- Parameters: Use several different parameter settings for the same system simultaneously

- Systems: Use multiple different trading systems

- Direction: Trading both Long and Short

- Timeframes: Apply trading systems to different timeframes e.g. Intraday and long term

- Profit Drivers: Systems that profit from different conditions e.g. long / short / volatility

The key is to realise that while all systems have drawdown, these drawdowns don’t always occur at exactly the same time. If you add a second trading system that behaves slightly differently to the first, then the second may be making money when the first is losing money.

The second system may be a variation on your first system, or it could be trading a totally different strategy. The less correlated the system equity curves are, the more benefit you will get from combining the systems.

If you have a profitable long side system and you combine it with a profitable short side system then you should notice some fairly significant smoothing in your overall equity curve. Even if you have a long term trend following system and you combine it with a swing trading system or a mean reversion system which trades the same portfolio you will find some significant benefits.

Short systems also have the added advantage that they benefit from market crashes. I find that having some short exposure helps me sleep better knowing that if there is an extreme event, I have some positions in the market that should benefit.

If you are already trading, but want to improve your returns, you need to diversify by adopting several uncorrelated trading systems into your trading. This is why I have included 15+ trading systems in The Trader Success System so this diversification can happen quickly and easily.

Related Topic: https://enlightenedstocktrading.com/mean-reversion/

9th Commandment: Eliminate Trading Mistakes

9th Commandment: Eliminate Trading Mistakes

Summary:

Trading Mistakes are extremely expensive.

In fact, just a few mistakes repeated could cause you to lose money with even the best system.

Identify and eliminate mistakes and watch your trading profits soar!

A trading mistake is anything you do that is not consistent with your trading plan or that costs you money.

The impact of mistakes on your profitability can be severe. You can even lose money with a profitable system if you make too many trading mistakes. The trouble is the cost of mistakes also compounds over time…in the wrong direction! Even infrequent mistakes can stunt your account growth as illustrated below:

Mistakes severely impact your profits. The compounded impact over time is HUGE!

Below is a list of common trading mistakes. I hope that in reading this list you will start to identify and eliminate some of your own trading mistakes and thereby improve your profitability. Each mistake has been grouped with other similar mistakes under specific headings. Note that this list is not exhaustive and many traders seem to make up new and ever more creative trading mistakes to limit their profitability.

Trading Mistakes Link : https://enlightenedstocktrading.com/trading-mistake/

Related Topic: https://enlightenedstocktrading.com/trading-mistakes/

10th Commandment: Stop Searching

10th Commandment: Stop Searching

Summary:

Searching for the Holy Grail is a waste of time.

There is no perfect system or indicator, so stop looking. The key is to use a profitable system that suits you, use your risk control and position size to meet your objectives and your trading plan to guide you.

So forget the search for the perfect tool, and work on yourself as a trader instead.

So many traders get caught up the search for that one secret method that will make them a huge fortune as quickly as possible. The trouble is the search for the perfect method leads to nothing but losses.

There is no one secret trading method that will make you rich. Anyone who claims to have THE SECRET METHOD is nothing but a scam or a con artist. Successful traders such as those profiled in the excellent Market Wizards series of books all approach the market differently, but they do so in a way that suits them completely.

What this means for you is simple – there are lots of ways to make money in the financial markets, so stop looking for the secret method that will make you a fortune, and design a profitable trading approach that fits your Trader Profile (Like we discussed in the 3rd Commandment).

Successful traders are totally clear on what methods suit them and they apply them consistently with confidence.

Too many traders try a new method they ‘discover’ from some guru only to get frustrated with initial loses and switch to a new method several months later. These traders are doomed to keep losing money as shown in the diagram below. Not because the methods are flawed, but because they have not given them time to work AND / OR because the methods don’t fit their personality.

Most trading methods lose money at the start. If you keep switching methods you will keep losing money and miss out on all the upside because you gave up too quickly.

For example, trend following is profitable. There is absolutely no question about this because I have used it for over 10 years in many markets with great success. However, when you first start trading with a trend following system there is always a drawdown. It does not matter when you start; you will have a drawdown because you will always go through a bunch of losing trades while you wait for a winning trend to come along. When the winning trend comes along it makes up for all those loses and more, but you have to stomach the drawdown first.

Many people are not prepared for this drawdown and give up before the equity curve comes back to break even and heads for the stars. The people who are too impatient, or can’t stomach the drawdown, never get to the point of profitability and give up…and so they throw away that strategy and continue on their search for the holy grail (and keep on losing).

When I teach traders in my Enlightened Trader Development Program, I always start by understanding the person first. I do this by identifying their T6 Trader Profile so we can design an approach that fits your personality. The great thing about that is if it fits you, you will be comfortable trading it. This means you will not feel the need to switch methods and continually search for the Holy Grail trading system or indicator…because you will have YOUR HOLY GRAIL – a trading system that works for YOU!

If you find yourself switching trading methods and continually searching for something better (all the while losing or going sideways), then you need to adopt a trading system that fits your personality, objectives and lifestyle… then build the confidence to follow that system.

Why I wrote this post…

I have been a profitable systems trader for over 15 years and starting with just a small amount of capital <$10,000 plus savings over time, I have made over a million dollars trading my own account. But I have never worked for an investment bank, never been a trader for a hedge fund, never worked for a broker and I have never been an ‘insider’.

I realised on my journey was that you don’t need insider secrets to make money trading. All you need is the determination to succeed and the willingness to learn and grow.

In particular I realised that what we need most as traders is the ability to learn about ourselves. This is more important than you can imagine because the secret to making money in the markets of not on the charts, it is between your ears.

There are lots of ways to make great returns in the markets, but unless you understand and manage what is going on in your head, and match your stock trading approach to your personality, work preferences and the lifestyle you really want. Without really getting this critical point it doesn’t matter how great a stock trading system you have, you will be on the verge of success and you will find some way to mess it up.

There are countless people out there selling trading systems and peddling different trading methods. But unless you really understand yourself and learn how to get past your fears and personal junk, they will never work for you, you will find trading Stressful and you will never going to make money consistently.

You can spend months and months researching methods and testing ideas, but if you don’t win the game between your ears then you will never make money consistently – This is what Enlightened Stock Trading is about…YOUR journey to profitable trading.

During my trading journey I have read over 150 trading books. There is a lot of fantastic information out there, but there is a lot of garbage too. I wrote this report to save you a bunch of time, and give you the lessons that will make the biggest difference right away…Learning fast and making progress is hugely valuable to your confidence and success as a stock trader. This report will give you a turbo boost and get you started on the right track.

It took me years to understand and master the 10 Commandments that I’ve captured here – I don’t want that for you. I want you to get the essentials fast so that you can get on with the fun business of making money and building your future.

The ultimate goal of profitable stock trading is to improve your lifestyle, generate financial freedom and improve your life by allowing you to focus on the things which are really important to you. The best stock trading tips are not about which stock to buy or sell – they are trading words of wisdom that last a lifetime. Click here to read the stock trading tips from some outstanding Enlightened Stock Traders.

I trust this information will help you reach this ultimate goal sooner