We discover what makes great traders tick! My ‘Ten Trading Questions With…’ guest this week is Bob Pardo, trader, money-manger, consultant, entrepreneur and student of the markets and of man. Bob Pardo’s books have had a profound impact on my own trading and I am excited to share this interview with a brilliant and insightful trader.

What is it about trading that gets you up and motivated in the morning?

Bob Pardo – Head of Pardo Capital Management and Pardo & Company, Author of ‘The Evaluation and Optimization of Trading Strategies’ and creator of the XT99 Diversified program and the Renaissance Program.

There are too many things to mention in full. However, there are two that are more prominent.

I believe that the markets are a manifestation of what can be called the “group mind of humanity” and as such are never endingly fascinating. I believe that finding strategies that are profitable is equivalent to discovering one of the underlying principles that govern this group mind. I have been absolutely fascinated by this from the beginning of my career and remain as fascinated today. The other significant aspect is that the money is good!

However, I must also add, that managing money in “the post-Madoff and Crash of 2008 caused by the gross incompetence, greed and corruption of Wall Street” world today has become quite challenging and unfortunately is less and less related to performance as it was when I first became involved.

How did you first get involved with the financial markets?

That is a rather long story. Suffice it to say that there were three main impetus.

Early in my career I worked for two, as I found out later, very big cattle traders at the CME. When I found out how much money they made, I got very interested.

The second was when I came across an early edition of Perry Kaufman’s masterpiece then titled “Commodity Trading Systems and Methods” and at the time was only 404 pages. My mind swam with the possibilities. I was hooked.

The third was when I partnered with a CME floor trader to create what we then referred to as “scalping numbers” and later “signals.” Trust me, in those days, 1982, this was beyond state-of-the-art!

What was the turning point for your success?

There have been a lot of things. My software and consulting businesses provided me with a near exhaustive knowledge of technical analysis and trading strategies of that time as well as the expertise to accurately validate trading strategies (i.e., the creation of walk-forward analysis.)

I also have had the great fortune of running a trading program XT99 Diversified that was very profitable. I found that mastering all of the “tricks of the trade” necessary to run a professional trading program was very interesting and educational.

Moving on from XT99 Diversified to its far more sophisticated successor – Pardo Renaissance Diversified – has proven exceptionally educational once again and quite rewarding.

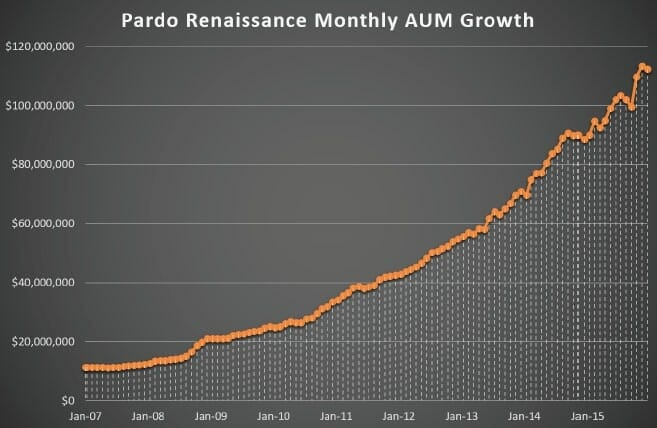

Pardo Renaissance Growth in Assets Under Management

All of these things taken together have formed the path that I currently “walk” in trading.

What are your personal trading goals?

The returns from XT99 Diversified placed it at the forefront of CTA programs. The pro forma returns of Renaissance are superior to those in every way – returns, risk and volatility. That being said, my research suggests that the upper limits of performance, in my opinion, have yet to be reached by anyone.

It is my goal to see exactly what the upper-limit of risk-adjusted returns is. In other words, I am very focused on pushing the returns “envelope” as hard as possible and to see where that takes me.

In a deeper sense, I personally believe that trading profits reflect the depth of ones understanding of what makes the markets “tick.” My goal is to understand all of the dimensions of market dynamics. It is beyond fascinating to me.

What trading mistake have you learned the most from?

There have been a lot of “educational events” in my trading career. I am not sure that I would call them mistakes as much as “floodlights” upon areas in our approach to trading, portfolio design and risk management that have room for improvement.

I am pleased to be able to say that I have never (fingers crossed it will continue!) made any of the trading mistakes which stem from ego and stubbornness. I have always enjoyed complete confidence in our strategies and the algorithmic approach to trading.

Rather, these events were the result of ignorance of one thing or another, typically subtle or non-obvious. One thing that trading has shown me is that there is always room for improvement. When we were running XT99 the sizing and risk management were provided by our joint venture partner. Posting gains of +142% in 2008, followed by a loss of 49% in 2009 and then a gain of 25% in 2010 was an eye-opener, to say the least.

We discovered in the work that led up to Renaissance that there is a better way. A loss like we experienced in 2009 is as close to impossible for Renaissance as it can be.

What main trading strategies & markets do you trade?

Renaissance has MANY strategies now and we have many multiples of that to add to it over time and as our assets grow. I do not see an end in sight anytime soon. They run the gamut from fast to slow and trend-friendly to those that benefit from mean reversion.

What 1-3 trading books should every trader read?

‘The Evaluation and Optimization of Trading Strategies’ by Robert Pardo. This is one of my favorite trading books of all time.

My approach is strictly algorithmic. I would never trade any strategy which was not exhaustively tested. My list reflects that bias. Forgive my immodesty by including my book.

- Reminiscences of a Stock Operator – Jesse Livermore

- Trading Systems and Methods – Perry Kaufman

- The Evaluation and Optimization of Trading Strategies – Robert Pardo

- Market Wizards – Jack Schwager

- When Genius Failed – Roger Lowenstein

If you had 1 minute with a new trader, what would you say?

I am reminded of a quote from Gann when he said, and I am paraphrasing, “Doctors and lawyers study for years to learn their professions. Why should a man who has $10,000 think that is enough to make money trading?”

If you really want to learn how to make money trading be prepared to study a GREAT deal. There is a LOT to learn.

More importantly and far more challenging, if you want to make money trading “know thyself.” There are few that have the discipline and honesty necessary to trade successfully.

Trading will expose all of your personal weaknesses and character flaws. Be prepared to see them all and then some.

To succeed at trading one needs to at least recognize where they are dangerous and to find a “work around.” Best of course, would be to see them clearly and to then overcome and eliminate them.

If you can’t face that, my advice would be forget about becoming a trader. Hire a professional.

What separates the average from the very best traders?

The very best traders have tremendous personal integrity and honesty, outstanding discipline, a relentless desire to understand trading, to grow, to excel and to continually improve their trading and themselves.

There is a reason for the saying “You are only as good as your last trade.”

How do you ensure your ongoing trading success?

There really is no way to guarantee that ones’ trading success will continue. One can never know the future.

However, the best way that I know of to encourage that ones’ trading will continue to be profitable is to relentlessly review your current trading program without end.

Hand in hand, with that is to continue to add new trading approaches and to also push to continually improve oneself.

Bonus Question:

If you were not a trader, what would you do?

That is a huge question. I have a lot of different interests. Being a trader really suits my entrepreneurial, independent nature.

That being said, I have a strong interest in helping others. I originally planned to be a professor of philosophy before I became disillusioned with the politics that I saw while in grad school.

I have an interest in medicine – as in maintaining health – and in psychiatry – as in helping people develop into the happiest and the best that they can be. I also really enjoy designing computer applications. I guess it would depend on the luck of the draw which direction that I would take . . .

Bob Pardo’s Bio:

Bob Pardo – Founder & CEO of Pardo Capital, Pardo & Company and pioneer of advanced trading system development.

Pardo Capital Limited is headed by Bob Pardo. Over the span of his career, Bob was a pioneering software developer of technical and algorithmic trading applications, a consultant to all types of traders and firms and an accomplished professional money manager. He is also the author of the definitive guide to computerized testing ‘The Evaluation and Optimization of Trading Strategies’.

As a software developer he created legendary trading applications such as Swing Trader, Advanced Trader and Blast which launched the genre of strategy development applications for the individual investor and provided comprehensive, top-quality yet affordable technical analysis for the individual trader thereby setting the standard for trading applications for over a decade.

He has consulted to global firms such as Goldman Sachs and Daiwa Securities of America and has completed projects for traders large and small validating strategies, providing trading support and creating trading programs.

As a money manager, he created and ran a celebrated program XT99 Diversified for over twelve years which produced an annualized rate of return of 19% and which earned top rankings by BarclayHedge and others on over thirty-five occasions. He has now created a yet more sophisticated program called Pardo Renaissance with a pro forma ARR of +29%.

Bob can be reached at [email protected], 847-657-7887 and his website is pardocapital.com.