Stock dividend aristocrats are an elite group of companies that have increased their stock dividends for at least 25 consecutive years. These companies are held up as the best of the best dividend paying stocks because of their financial stability and strength plus their focus on paying income to their investors.

It is important to note that some of these so called stock dividend aristocrats do fall from grace. Over the years there have been over 170 stocks from the S&P500 index which have made the dividend aristocrat list, but they don’t all stay in the list forever. According to Norgate Data, as at April 2025 there are 67 stock dividend aristocrats in the S&P500 index. These include:

- ABBV – Abbvie Inc Common

- ABT – Abbott Laboratories Common

- ADM – Archer-Daniels-Midland Co Common

- ADP – Automatic Data Processing Inc Common

- AFL – Aflac Inc Common

- ALB – Albemarle Corp Common

- AMCR – Amcor PLC Common

- AOS – A O Smith Corp Common

- APD – Air Products and Chemicals Inc Common

- ATO – Atmos Energy Corp Common

- BDX – Becton Dickinson and Co Common

- BEN – Franklin Resources Inc Common

- B – Brown-Forman Corp Class B Common

- BRO – Brown & Brown Inc Common

- CAH – Cardinal Health Inc Common

- CAT – Caterpillar Inc Common

- CB – Chubb Ltd Common

- CHD – Church & Dwight Co Inc Common

- CHRW – CH Robinson Worldwide Inc Common

- CINF – Cincinnati Financial Corp Common

- CL – Colgate-Palmolive Co Common

- CLX – Clorox Co Common

- CTAS – Cintas Corp Common

- CVX – Chevron Corp Common

- DOV – Dover Corp Common

- ECL – Ecolab Inc Common

- ED – Consolidated Edison Inc Common

- EMR – Emerson Electric Co Common

- ESS – Essex Property Trust Common

- EXPD – Expeditors International of Washington Inc Common

- FRT – Federal Realty Investment Trust Common

- GD – General Dynamics Corp Common

- GPC – Genuine Parts Co Common

- GWW – WW Grainger Inc Common

- HRL – Hormel Foods Corp Common

- IBM – International Business Machines Corp Common

- ITW – Illinois Tool Works Inc Common

- JNJ – Johnson & Johnson Common

- KMB – Kimberly-Clark Corp Common

- KO – Coca-Cola Co Common

- LEG – Leggett & Platt Inc Common

- LIN – Linde PLC Common

- LOW – Lowe’s Companies Inc Common

- MCD – McDonald’s Corp Common

- MDT – Medtronic PLC Common

- MKC – McCormick & Company Inc Non-Voting Common

- MMM – 3M Co Common

- NDSN – Nordson Corp Common

- NEE – Nextera Energy Inc Common

- NUE – Nucor Corp Common

- O – Realty Income Corp Common

- PEP – PepsiCo Inc Common

- PG – Procter & Gamble Co Common

- PNR – Pentair PLC Common

- PPG – PPG Industries Inc Common

- ROP – Roper Technologies Inc Common

- SHW – Sherwin-Williams Co Common

- SJM – J M Smucker Co Common

- SPGI – S&P Global Inc Common

- SWK – Stanley Black & Decker Inc Common

- SYY – Sysco Corp Common

- TGT – Target Corp Common

- TROW – T Rowe Price Group Inc Common

- WBA – Walgreens Boots Alliance Inc Common

- WMT – Walmart Inc Common

- WST – West Pharmaceutical Services Inc Common

- XOM – Exxon Mobil Corp Common

To invest in stock dividend aristocrats there are several alternatives. There are several ETFs that focus on these high performing dividend stocks. One of which is NOBL – ProShares S&P 500 Dividend Aristocrats ETF. Unfortunately investing in this ETF since inception would actually have underperformed investing in the SPY ETF (The largest S&P500 ETF) with very similar volatility as shown on the chart below. This chart shows the total return (growth plus dividends) indexed to inception of NOBL. The total return for NOBL was 153% while the total return for the SPY was 169%. The volatility of NOBL is slightly lower than the SPY with the standard deviation of daily price changes at 4.13% and 4.35% for NOBL and SPY respectively.

This does not necessarily mean that investing in the dividend aristocrat stocks is a bad idea, because there are other ways to do it, but this ETF certainly does not seem to provide any meaningful benefits over buy and hold in the SPY.

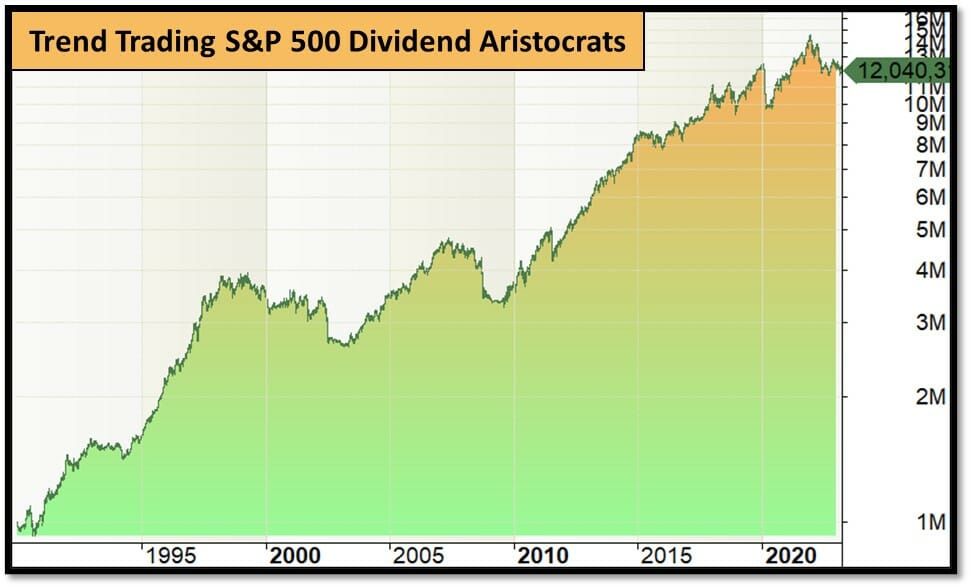

Another strategy to benefit from the dividend aristocrats could be to use the stocks in the list as the universe to apply a trading system to rather than applying the system to a broader index like the S&P500. To test this idea I have used a simple trend trading system with the following rules to compare trading just the dividend aristocrats vs all stocks in the S&P500 Index.

Trend Trading System rules:

- Buy the stock if it makes a new 200 day highest close AND it is a member of the Dividend Aristocrats Index on the day of the breakout

- Sell the stock if it closes below a 25% trailing stop loss OR it drops out of the Dividend Aristocrats Index OR the day before delisting

- Allocate 5% of capital to each stock

- If there are more signals than you can take then rank trades based on the percentage change in stock price over the last 200 trading days

- Slippage and commission allowance of 0.25% per side

- The same system was also applied to all stocks in the S&P500 Index for comparison

From 1990 to April 2023, here are the results:

As you can see the Trend Trading system applied to the stock dividend aristocrats outperformed Buy and Hold in the S&P500 Index, but it significantly underperformed the same system applied to all stocks in the S&P500 index. These figures include dividends as the historical data used for backtesting from Norgate was adjusted for dividends.

The equity curve of our simple trend trading system applied to the stock Dividend Aristocrats and separately applied to the stocks in the S&P500 index are shown below.

As you can see below, the trend trading system applied to the broader index is smoother and generates a much higher ending capital.

Based on this analysis I can’t see any advantage of limiting my trading to stock dividend arostocrats.

Conclusion on the Stock Dividend Aristocrats

Based on the buy and hold analysis of the Stock Dividend Aristocrat ETF compared to buy and hold in the SPY and also based on the application of a simple trend trading strategy to the stocks in the dividend aristocrat list compared to the stocks in the S&P500 index, I do not see any benefit in focusing on stock dividend aristocrats over a broader market focus.

This finding may upset some dividend enthusiasts, but the reality is there just does not seem to be a benefit to using the dividend aristocrat criteria as a stock selection tool.