Global Stock Market Update – 02 June 2023

Welcome to this week’s The Enlightened Trader newsletter. The markets have been following the same pattern as we discussed last week – weakness across the board other than the big end of the Nasdaq exchange. One interesting thing to note that I have not mentioned for a while is that the Hong Kong market decline has been accelerating. Finally, at least one of the markets seems to have picked a direction.

I know down is probably not the direction you wanted, but I am happy with any direction, to be honest, and my short side system in HK was up about 12% last month, so that is certainly welcome!

The drill-down charts of the different US exchanges look exactly the same as they did last week. Nasdaq is slightly stronger and toying with breaking through a resistance level, but other than that, nothing has really changed.

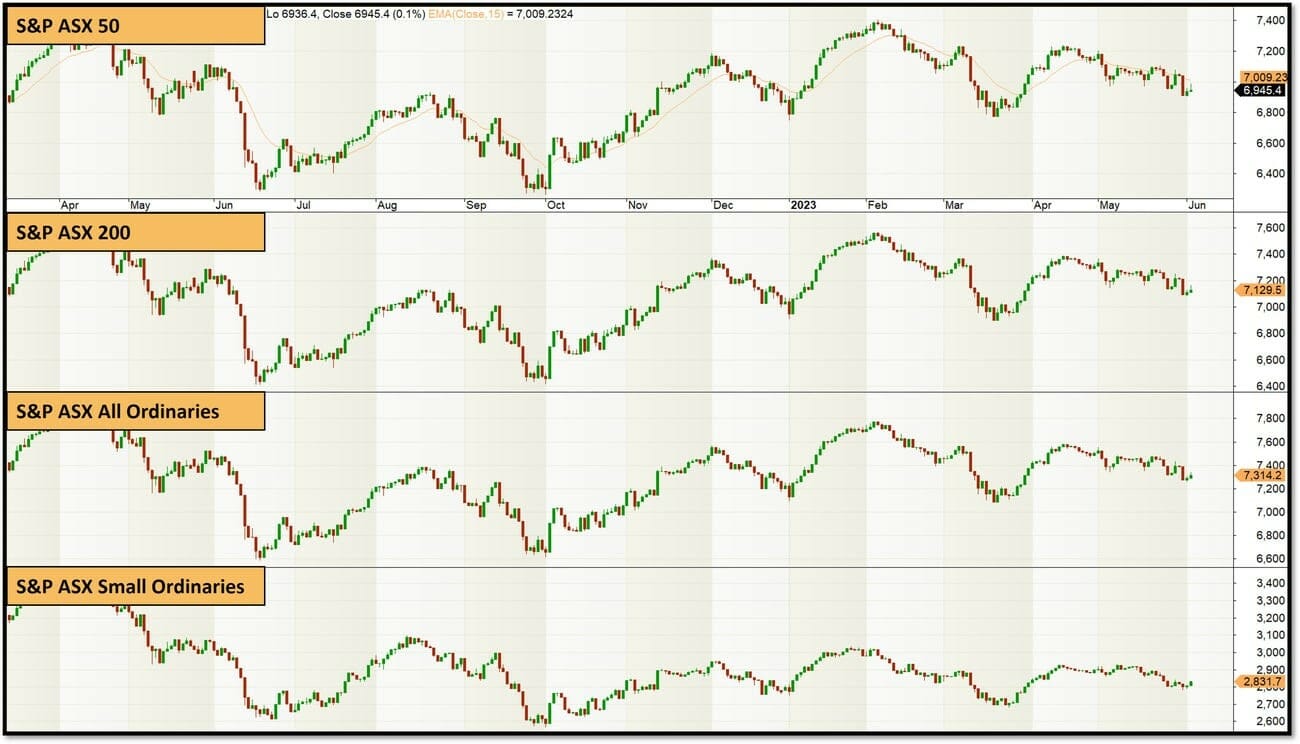

There is an interesting contrast between the Australian market and the US markets that is worth pointing out though. Below is a comparison of different sizes of companies on the ASX – at the top is the ASX Top 50, then ASX 200, then All Ordinaries (broad-based index), then Small Ordinaries (broad-based small cap index)… As you can see, these charts are almost identical.

What does this mean?

Well, unlike the US, where a small number of large stocks are driving the market higher while everything else lags, the Australian market is pretty much weak across the whole range of market capitalisations. (I might look at the different sectors next week and let you know what that looks like).

I am also tempted to say that in the US, small caps look much weaker than in Australia, even though the S&P 500 looks more positive than the ASX 200.

Again as traders, we need to be careful to look beneath the surface and not just compare our returns to the main indices… though I did learn a valuable lesson in the last 12 months… I have generally avoided the biggest companies in preference for the larger moves that are available in the small cap market. When this works it is great, but when it doesn’t I have been less than satisfied. I plan to rectify this in my own portfolio to allow more balance across the different sizes of companies in each of the markets I trade.

Backtesting & Trading System Development Tip

I thought I would try something new for you this week, so I have recorded a video trading system development tip for you… if you get value out of tips like this please give the video a thumbs up and leave me a comment on YouTube so I know to make more. This is an experiment as I have not done this in my newsletter before… if I get enough 👍🏽👍🏽👍🏽 and comments, I will put one in my newsletter every week. Click here or on the image below to watch.

Trading Tip of the Week

I know you know it is important, but diversification is so much more important than even you probably think it is!

You are not diversified if…

- you hold 20 stocks from the one market in your portfolio

- you are long only

- you only trade one strategy (e.g. trend following)

- you only trade a single timeframe (e.g. long term systems on daily bars)

- you have 5 systems but they all have a correlation coefficient of >0.7

If you are only trading one market (e.g. ASX Stocks or US Stocks), then at some point, when that market is underperforming compared to other markets, you will regret it!

Last week I mentioned that I have had a few big regrets that have cost me big time in my trading journey… don’t let this happen to you!

In The Trader Success System, I have built-in diversification for you with:

- Systems for multiple markets (US, ASX, TSX, Hong Kong, Europe, London)

- Systems that cover different strategies (Trend Trading, Mean Reversion, Rotational, Seasonality, Short side)

- Systems for different timeframes (Intraday, Daily, Weekly, Monthly)

Want a ready-made and diversified portfolio of trading strategies?

Click here to find out more about The Trader Success System.

Student of the Week

My student of the week is Marcel.

Marcel is a long-time member of the Enlightened Stock Trading community and is a master of systematic trading. I often bounce ideas off Marcel to get another perspective and to brainstorm ideas that I may not have thought about myself.

So this week, when I was playing with ideas for a new system, I reached a point where the system was profitable and looking good, but I felt it needed a burst of external creativity, so I sent it to Marcel to get some ideas and got some really elegant suggestions back that will make a big difference.

Thank you Marcel, for being part of the EST Community and for supporting other traders in the community with your years of trading wisdom!

This is actually one of my favourite parts of running Enlightened Stock Trading – having a community of systematic traders around me that all talk the same trading language and are all so helpful and fun to work with… it really was one of the main reasons I started helping traders succeed to begin with, to build my community.

As you are probably aware, trading can be a lonely game… Do you have a trading community to work with? If not, send me a message, and I’ll tell you a little more about our community and how it might help you.

News from EST

The Stock Automation Engine is just weeks away! If you want to be the first in to fully automate every aspect of your trading, from updating the data to signal generation in Amibroker, position sizing, exposure management, order placement, and reporting, then CLICK THIS LINK to be the first to be notified and receive an early bird special of 20% off when we launch.

On the Home Front

My fish (told you about them last week) are not eating… I am worried I am going to have 30 starvation deaths on my hands. I am told it might be because they are cold, so I bought them a pond heater. Hopefully, that gives them their appetite back?!?! Are there any experts in Aquaponics out there?

In other pet care news, we were a bit remiss and didn’t do a great job brushing our puppy Gizmo’s coat. He had this beautiful poodle fur on his ears that I just loved, but when he went to the groomer last week she said they were so matted underneath that she had to shave them off. Now he looks like Dobby, the House Elf from Harry Potter…

Needless to say, I am a bit gutted… I used to have a cute Poodle puppy (actually, he is a Shih Tzu x Toy Poodle, but he looks like a Poodle)… and now I have a house elf (and he can’t do magic, he just has big bald ears).

I am sure they will grow back, but in the meantime, he looks pretty funny. 😂

Are you ready?

Do you want a diversified portfolio of trading systems that is ready to go? Just comment on this newsletter with the words “Diversify”, and I’ll organise to show you what you get in The Trader Success System.

Hope to hear from you soon!

Adrian

Founder & Master Coach, Enlightened Stock Trading