Global Stock Market Update – 25 November 2023

Interesting week in the markets this week with some quite positive areas but also a lot of weakness lurking below the surface. Make sure you read this whole update so you know what is working in the markets right now. Looking at US Stock indices and sectors in the table below we can see that the leader this week, and over the last year is, by far the Nasdaq 100. Large tech is the story of the moment with incredible AI developments being released on a weekly basis. The capabilities of AI are already mindblowing:

- I have an AI that helps me write that has been trained on my writing so it sounds like me (though most of what I do is written by me)

- AI can produce illustrations better than graphic designers in seconds

- I have an AI which is a quantitative analyst and does all sorts of calculations and analytics for me

- It is getting hard to tell the difference between AI and real voices

- AI Videos are almost realistic and will soon be difficult to distinguish from real ones

- Complex processes such as coding are handled with ease by AI already

And we are only just getting started! This revolution will change the world more than the internet. There is little wonder big tech is leading the markets right now!

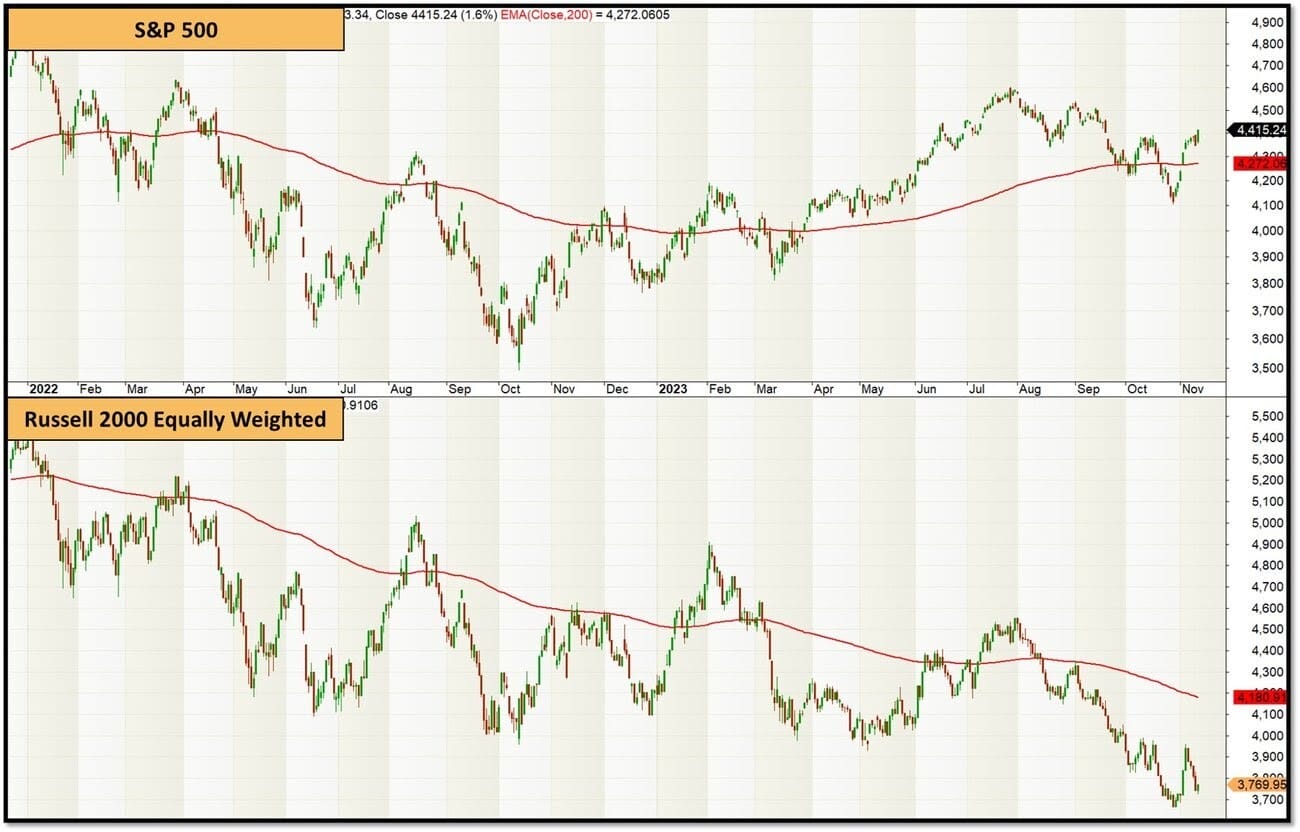

Outside of the tech sector, it is more of a mixed bag with most other sectors essentially flat. An interesting observation, though is that the small-cap stocks in the US are not doing well at all. The Russell 2000 equal weight had a 4.3% decline this week showing that the strength in the US is very much at the big end of town and concentrated in tech as we said above. The relative weakness of the equally weighted Russell 2000 is starkly illustrated in the comparison chart below. the market clearly doesn’t think now is the time to hold small cap stocks!

Volatility has also fallen this week as the market rallied with the VIX sitting just above 14. While this is not low by long term historical standards, it is certainly not flashing warning signs like it was in 2022 when it touched levels above 30. Not a lot of reason for fear here, especially as the S&P has just made a new higher high – The big end of town might have just started a new up leg – we will have to wait a few more weeks to see if this is confirmed with a higher low as well.

From my perspective though the most interesting thing that is happening in the markets right now is the rally in cryptocurrencies. As you can see from the chart below, Bitcoin has had a big week and has rallied over 7% (39% over the last 4 weeks). This alone indicates that the bull market in crypto is probably back on.

But what is even more intersting is that the smaller cap cryptocurrencies have rallied even more. The S&P Cryptocurrency Excluding Mega Caps index has rallied even more (up 16.9% for the week). and is up 45% over the last 4 weeks. When the smaller capitalization tokens rally faster than Bitcoin we can see some really huge gains. The systems from The Crypto Success System have been showing this capturing some nice gains recently and are performing beautifully.

Take advantage of the diversification potential and strength in the crypto market and join The Crypto Success System today before you miss out on the next bull market!

Market Curiosity

Unfortunately I didn’t get any replies to my market curiosity last week about the fatness of the tails in daily price changes being a useful regime filter. Let’s try something less esoteric this week – Hopefully you will test this and report back. I was reading an interesting article this week about how the Australian stock Indices perform worse than the US because Australian companies have a high dividend payout ratio due to the desire for franking credits by shareholders. For my non-Australian friends: Franking credits, also known as imputation credits, are a type of tax credit in Australia that accompany dividends paid by Australian companies. These credits represent the tax already paid by the company on its profits, which can be passed on to shareholders to avoid double taxation. When shareholders receive dividends with franking credits, they can offset these credits against their income tax liability, potentially leading to a tax refund if the credits exceed their tax payable. The implication of this is that Australian companies are incentivised to pay out more of their earnings as dividends than US companies. So here is my market curiosity for the week…:

“I wonder if stocks that pay dividends in Australia perform worse in trend following systems than stocks that do not pay dividends”

This challenge is easy to test if you have Norgate data – just add a rule that specifies no dividend using the norgate function

NorgateDividendYieldTimeSeries() and specify this equals Zero for non-dividend payers and greater than zero for dividend payers. Backtest both and compare. Please do the test and let me know the result. I will share the best response in next week’s newsletter.

Trading Tip of The Week

The rally in Crypto over the recent weeks has clearly shown one very important trading lesson – KEEP FOLLOWING YOUR SYSTEMS! (unless you are turning them off permanently) Traders who lost interest in crypto because the market was depressed for so long have really missed out recently. The trouble when you stop following a system is that you are never really sure when to turn it back on again and this hesitancy leads to massive opportunity cost because you tend to miss the first section of the new bull market. The trouble with missing the first section of the bull market is you don’t recover the drawdown from the bear market nearly as quickly compared to if you had just continued trading all the way though. This is another reason why trading automation is so powerful – you don’t have to decide every day whether to trade, your computer does it for you regardless of how you feel!

Member of the Week

My Trader Success System member of the week this week is Frank… My coaches told me this week that after building confidence through backtesting and paper trading Frank has gone live and is in the market systematically for the first time. Well done Frank – keep up the great momentum! I look forward to hearing about your successes as you continue to grow and diversify your account.

News From EST

We are just 5 days away from Trader Acceleration Week!

Trader Acceleration Week is a FREE event where I will be going live and teaching for 60 minutes each day for 5 days. During the week I will be covering the five stages of The Enlightened Stock Trader Journey, allowing you to transform from a novice to master trader. You will learn:

- Day 1 – Trading System Basics Start your journey with a strong foundation in systematic (algo) trading.

- Day 2 – Backtesting and System Validation Gain the confidence you need to navigate the markets by learning how to validate your trading systems.

- Day 3 – Portfolio Diversification Maximize your profits by understanding the power of trading across multiple systems and markets.

- Day 4 – Mastering Automated Trading Discover how automation can free your time and improve your trading efficiency.

- Day 5 – Becoming a Trading Master Unlock advanced techniques for sustained success and stay tuned for an exclusive announcement!

We already have over 135 registered for the event so jump on board and join this awesome group of traders during Trader Acceleration Week!

On the Home Front

I am super proud of my kids right now (always… but lots of great things going on for them). Our eldest, who has moved out of home is doing great in her career and just has fantastic self awareness. We had a great conversation with her and her partner over dinner this week and it is just a pleasure to see her ‘adulting’ with such confidence. Our son just got his year 11 results and is doing brilliantly and has launched into his final year of school with gusto. He is working on a fascinating major work for Design and Technology that I can’t wait to see emerge over the next few months and has just selected his research project for extension history which also promises to be fascinating. Can’t wait to read it! Our youngest (Year 8 in the Australian curriculum) has just completed her IGCSE examinations for maths. She worked incredibly hard to prepare for the 4 hours of exams over 2 days and came out of the exams feeling very confident. Outside of being a proud parent this week the garden is growing nicely – I have started picking tomato and radishes and will soon have pumpkin, capsicum (peppers for my American friends), and chillis. I can’t tell you how good the tomatoes taste straight from the garden!!!

Time for me to sign off – I have some preparation to do for Trader Acceleration Week and we have a ton of family stuff going on this weekend. Have a great day – and don’t forget to register for Trader Acceleration Week! Remember – You’re only one system away!

Adrian Reid

Founder – Enlightened Stock Trading