Global Stock Market Update – 29 September 2023

I haven’t given you a detailed market update for a while, so I figured it was time… plus I have a new tool that I am pretty excited to share with you. I have long been keen to develop a dashboard to show what is happening in all of the global markets. This week I produced version 1… I will refine it with your feedback – so please comment on this article and let me know what you would like to see.

Ok, on to the markets.

US Stocks

Of course as you will be aware, the US markets are up pretty strongly this year largely due to the mega tech stocks benefiting from the AI goldrush. This strength seems to have started to come off though with the Nasdaq peaking in July and the most recent rally failed to make new highs… so now we have a lower high and a very slightly lower low (shown below)

There are no guarantees of course, but the probability certainly looks to be towards a downside move in the medium term. I am certainly prepared for (and maybe even looking forward to) a strong downside move.

Remember, as a systematic trader, I don’t try to predict what is happening in the market, I just let my systems do the work. I have one short side system (The Waterfall Strategy) which shorts weak stocks all the time, so that will benefit if the market collapses… and I have a short system (The Slippery Dip) which trades bear markets that is already short in Hong Kong and will turn on in the US if things get much worse.

Looking at the US Sector ETFs in the table at the top you can see that Utilities and Energy were at the two extremes. Utilities were hammered this week so I had a look through the charts to see which stocks were to blame. A big obvious move was Nextera Energy (NEE) which was down from $67.22 at the start of the week to $57.08 at the close of trade Thursday (-15%), but this is quite a broad based route with many utilities stocks selling off sharply.

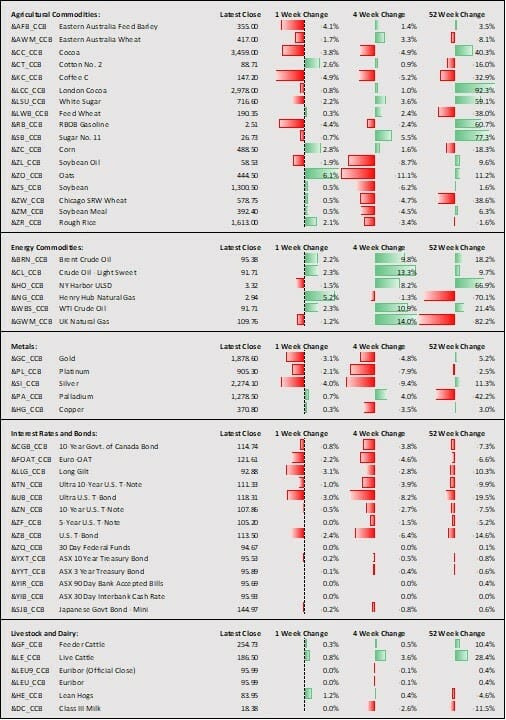

The strength of the energy sector has been driven by the continued strength in energy commodity prices (see below). This just shows that you can’t afford to get too myopic about tech stocks – broad diversification is certainly helpful, as is the willingness to go short.

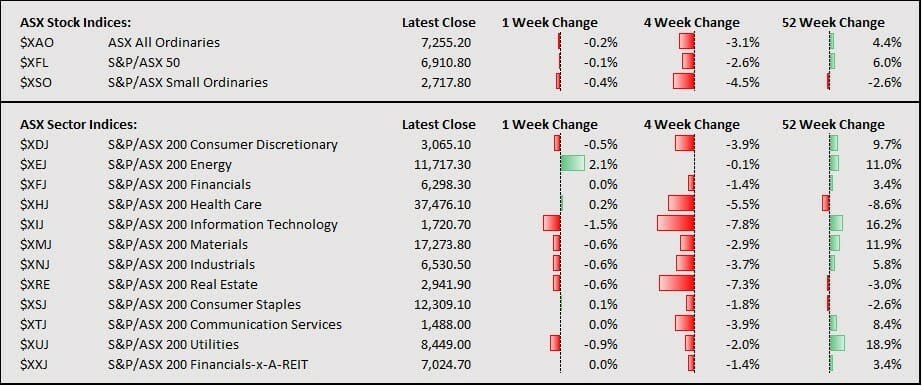

The Australian market continues to underwhelm overall (see below). Energy stocks of course made a bit of headway this week, but all other sectors are pretty lacklustre.

To be honest, it is just more of the same sideways action that we have had since March this year. I am not going to get too excited about the Aussie market until we see a move in the All Ordinaries above 7,700 or below 7,100… everything in between is pretty much the same wide trading range we have been stuck in for months.

Globally stock investors have had a pretty sad month with red essentially across the board. Don’t be fooled by the 2.3% rain in the Russian Trading System – this is a tiny blip compared to the hammering it has taken. The RTS is down ~48% since it’s peak in October 2021. I guess the market doesn’t like a botched war 🤣🤣🤣 though the RTS does appear to have found a solid base and has made several higher lows, so there may be a chance of recovery from here if you were a risk-oriented thrill seeker (I am not).

Looking at the currencies (including crypto), we can see Crypto and the USD are the standout performers. As an Aussie I am cringing every time I buy something online with the Aussie Peso… it is a bit of a ‘double-whammy’ when combined with the inflation we are already experiencing. I am certainly glad to have at least some assets in USD (But kicking myself for not having more!)

The Bitcoin chart is looking pretty solid having retested support in the 25,000 area and starting to rally. We are certainly not in a full on bull market, but don’t take your eyes off Crypto! I know it has been a painful, difficult ride in the last 2 years, but that is the thing about the crypto markets… the bear market tends to last until everyone has given up on Crypto and then the bull comes roaring back.

Again, I don’t predict, but I am certainly not pulling my cash out and giving up because you never know what could happen next and the crypto bull markets are always so fast you don’t want to miss it if it happens.

Don’t fall asleep on the job here traders!

If ever I needed a kick up the backside as a trader it is to expand my trading in commodities (Futures). I have done this in the past but more recently I have focused on stocks and crypto in line with what I teach at Enlightened Stock Trading. I have committed to myself to get back into systematic trading of futures and I am looking forward to that.

In the table below you can certainly see what has been driving the XLE (US Energy ETF) up this month! I am not going to talk about commodities too much, but needless to say there is opportunity in the area for systematic traders and I am going after it… watch this space.

Trading Tip of the Week

Be open to learning at every stage of your journey!

This week I had several great conversations with one of the members of The Trader Success System about Monte Carlo Analysis and the question that came up was ‘Wouldn’t it be best to use the Monte Carlo analysis as your optimization objective rather than just compound annual return or CAR/MDD?’

My answer was yes but Amibroker doesn’t give you that as a performance metric – it only gives you the Monte Carlo charts.

But I was wrong!

It turns out you can very easily add the Monte Carlo results to your backtest and optimization reports, thereby enabling them to be used as your objective function!

I had just assumed it would be difficult and so never bothered to investigate… but now on my optimization reports I look at the 10th Percentile Compound Annual Return, the 10th Percentile Max Drawdown and the CAR10/MDD10… and it is a really powerful way to optimize because maximising for that is closely correlated to a really nice looking equity curve.

This was my reminder to be open to learning and not assume something is hard without looking into it.

So what are you assuming is hard without actually trying it first?

Along these same lines, every morning I am reminded of the power and impact of automation on my trading as I review the trading report that lands in my inbox after all of my trading has been done for me.

If you are trading manually because you think Automation is beyond your reach, think again! Automation is absolutely achievable for your stock trading (if you use Amibroker and Interactive Brokers) if you join us with The Smart Stock Automation Engine… Now is a great time to do it because we will be having another automation workshop coming up in the next couple of weeks so we can get you up and running fast!

Member of the Week

My member of the week this week is Adam… Adam is the one who inspired my win in putting the Monte Carlo Objective function in place for my optimizations. He has also been powering through the course material and asking some killer questions showing a rapidly increasing mastery of systematic trading.

One other member of note this week is Allyse who has taken the leap and started the paper trading phase of her Trader Success System journey. Well done Allyse!

News from EST

Two big things this week…

Firstly – Click the image below to watch the video to find out about my new course called RealTest Launchpad ⬇️⬇️⬇️

Secondly – I have decided to do a new experiment to help share more of the process and challenges of systematic trading with you live. I am shortly going to open 3 new accounts with real money and start sharing the entire journey with you.

But why 3 accounts?

Because I want to show you what systematic trading looks like for several different groups of people:

- A $25K account which will be Long / Short in one market

- A $100K account which will be Long / Short multiple markets

- A $200K account which will be a Long Only cash account to represent what systematically trading a retirement account might look like

This way you can see how it might work for you depending on your situation!

These will be real money accounts and I will share the whole process from systems to capital allocations, to automation and monitoring. I thought it might be fun to share this process and how I manage them on an ongoing basis along with the results.

I am assuming people will be interested in this, but I want to make sure I am not wasting my time, so if you are interested in this please comment below with the words “Real Money” and I will keep you up to date as the challenge unfolds.

On the Home Front

Here are a couple of highlights about what is going on outside my trading world…

School holidays is on right now and my youngest daughter has been away on camp for a week in country Victoria so I am about to drive to the airport to pick her up so I am looking forward to that.

My son just finished year 11 and did a stellar job on his exam preparation and is now taking a well-deserved break before they start their year 12 classes in a couple of weeks.

My aquaponics garden is growing well but I think my fish have turned into cannibals because I keep finding dead fish with small fish-sized bites taken out of them in my tank. Not entirely sure what to do about this so if you have any advice please let me know!!!

Do You Want More Trading Systems?

You may have noticed that I launched The Trading Strategy hub with my first two strategies (The T3 Strategy and The Waterfall Strategy). If you haven’t checked them out then take a look as they could be great diversification for your portfolio.

In addition to these, I will shortly be launching a US Mean Reversion system which has been performing extremely well along with a Seasonality System which I am quite excited about.

If you are looking for a particular trading strategy please comment and let me know and I will see if it is something I can create and add to The Strategy Hub.

My goal with the Trading Strategy Hub is to make good trading systems accessible to everyone at reasonable prices. I don’t believe you should pay thousands (or even a thousand) of dollars for a single trading system.

But I also don’t want you to buy cheap shitty systems that are over-optimized and publish results that don’t even include an allowance for slippage and commissions.

So in The Trading Strategy Hub, I am trying to strike this balance – solid quality systems and great value.

Happy to hear your feedback on this idea – shoot me a note and let me know what you think.

That is all for today, I am off to enjoy the 2.5-hour drive to Newcastle Airport to pick up my daughter. This is probably the only downside of living in Port Macquarie – the flights to our local airport are pretty infrequent so sometimes we need to fly in/out of Newcastle which is a bit of a hike from here.

Have an amazing weekend all. Remember you can only WIN the game if you are IN the game!

Trade Safe

Adrian

Founder, Enlightened Stock Trading