Despite all the hype and huge moves in the cryptocurrency markets, achieving long term success is very difficult if you don’t have all the right ingredients in place.

Most traders start off by using some combination of indicators, discretionary chart based approaches and news. The difficulty is that these approaches lead to a lot of uncertainty and it is impossible to know whether you really have an edge that is stable and will last the test of time. This is because there is huge variability in your decision making because of all the different factors that you are trying to take into account.

In cryptocurrency trading this is an especially difficult issue because of the following drivers that impact your ability to make consistent decisions:

-

- Huge volatility

- FOMO and social pressures to jump on the latest hot movers

- Sudden corrections and trend changes

- Difficulty making decisions in a 24/7 market

Huge Volatility

Huge volatility is a problem because it makes selecting consistent entry points difficult. If you are watching the charts waiting for a setup the volatility on some cryptocurrencies will give you a stomach ulcer! When prices are this volatile, discretionary trading decision will be fraught with danger because your emotions swing around with the price and it is virtually impossible to be consistent.

As the chart of Cardano (ADA-USDT) above shows, the daily candle wicks and the high to low range can be extremely wide. Watching these charts manually and trying to make discretionary trading decisions is difficult. This is especially true as large magnitude moves like this can happen in a matter of minutes. If you were looking at the chart at the time of the low on the big red candle in the middle of the chart you would be forgiven for thinking the end was near for ADA, but if you were looking at the same chart at the high of the same day you would have been looking at just a small pullback.

The best way to deal with these sort of challenging trading environments is to have a trading system that makes the decisions for you. You do the work upfront to design and backtest the system and then each day you just follow the rules. If you are following a trading system then the magnitude of these price fluctuations don’t influence your decisions because the system gives you the buy and sells.

FOMO and social pressures to jump on the latest hot movers

With the volume of social media chatter about the latest and greatest cryptocurrency token it quickly becomes a very noisy. It is hard to know whether you should be entering or standing aside after a sudden rally.

The masses of uninformed traders fall victim to fear of missing out (FOMO) after a bit up day resulting in a FOMO driven rally the following day. These rallies are frequently false and lead to a correction causing masses of traders to lose money after buying the highs.

Adopting a systematic approach to the crypto markets allows you to develop an objective approach which helps you stand aside, and even benefit from FOMO driven rallies like this. For example, some of my crypto trading systems buy into the market just after an uptrend starts and, in addition trailing stop exits to lock in profits as the trend progresses, they also have a wide profit target placed with the broker which would be triggered in the event of a FOMO driven rally like this capturing a handsome profit.

Knowing that you are going to profit from the FOMO of less informed traders certainly reduces the emotion and builds your confidence as a trader.

Sudden corrections and trend changes lead to difficult decisions

The crypto markets are notorious for sudden corrections and trend changes. One day everything is trending nicely and the next the Chinese Government makes an announcement about banning Bitcoin transactions and everyone panics. What do you do when this happens?

In reality the problem is not China or any individual government announcements, it is that the future of the cryptocurrency market is highly uncertain, so prices swing around dramatically on significant news announcements. How can you possibly judge what to do using a discretionary trading approach when such sudden market shifts occur?

The key is to build a trading system that has a market switch that turns the system on or off depending on what the market is doing. This could be as simple as if Bitcoin is below the 50 day moving average then don’t take any new long trades. The beauty of rules like this is they are absolute (no discretion), they keep you out of trouble (you won’t take any new trades if the correction does turn into the ‘cryptoppocalypse’) and they can be backtested.

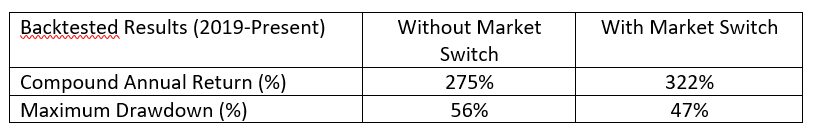

The index filter on one of my Crypto systems has a huge impact on performance. Backtesting over the last few years of data shows returns were greatly enhanced and the drawdown reduced by simply adding a rule to stand aside if the trend was not clearly up:

This system is quite aggressive, so the drawdown is still fairly high, but it is clear the impact adding simple backtested rules can have on your trading. Turning all of your trading decisions into systematic, backtested rules gives you confidence to take action despite the uncertainty caused by sudden corrections and trend changes in the market. In this case we can see that the system neatly sidesteps some major corrections with a simple, objective rule that we can easily backtest.

Uncertainty about how and when to make decisions in a 24/7 market

24/7 markets sound great in theory – trade whenever you want, no overnight gap risk, no weekend stress wondering what Monday morning will hold.

But the 24/7 nature of the cryptocurrency markets is a double edged sword. Most people just don’t have the time (or inclination) to monitor the markets 24/7. This naturally leads to the question “When should I trade?” and “How do I protect myself when I am not looking at the screen?”.

If you are looking at the markets when you happen to have spare time then you are highly likely to end up taking suboptimal trades because in the limited time you have available, you will be driven to take the best trades you can find rather than waiting for the perfect setup.

I have no interest in looking at the charts all day every day waiting for short term setups to appear. Instead I have developed my cryptocurrency trading systems on daily bars, and each day at exactly the same time I run my trading system rules and my decisions are made based on which tokens the systems tell me to buy or sell.

This once a day trading approach is highly profitable, and it eliminates the need to follow what the markets are doing intraday, because there are no decisions to make until the daily bar ticks over to the next day.

Most traders can manage the 20-30 minutes once a day to make their trading decisions in this manner. Some who are particularly time poor are better suited to weekly trading. This is also possible in the crypto markets – I have a system on weekly bars that is very profitable and only gets run once a week on a Sunday.

Traders struggling with the 24/7 nature of the cryptocurrency markets and wondering how to bring structure and consistency into their trading decisions will be well served to adopt a daily or weekly trading system to guide them.

Conclusion and Next Steps

The uncertainty generated by the huge volatility, FOMO from large price moves, social pressure, sudden trend changes and 24/7 trading make discretionary trading of the cryptocurrency markets extremely difficult and inconsistent.

Implementing trading systems to guide you eliminate this uncertainty, make your trading decisions consistent and give you a fighting chance at long term profitability.

Too many traders just open an account and start trading whatever ‘looks good’ or what people are talking about on social media – that is just gambling. Like all markets, you need a solid, backtested systematic approach or you will lose money.

Most crypto traders constantly fall victim to the volatility and uncertainty in the market and make losing trading decisions. For those of us who are systematic, our profitable edge keeps us alive and generates profits from the same moves that drive stress and uncertainty for non-systematic players.

About The Author:

Adrian Reid is the founder of Enlightened Stock Trading and co-creator of The Crypto Success System (see enlightenedstocktrading.com for more details). He has over 18 years of trading experience and has been a profitable systematic trader for over 15 years. He trades for a living and spent most of 2019 traveling with his wife and two kids and trading from the road. He is the founder and trading coach at Enlightened Stock Trading where for the last 5 years he has been mentoring traders globally.

To discover how you can enter the cryptocurrency market quickly, safely and profitably, just email Adrian on [email protected] with the word “Crypto” to find out more about the Crypto Success System.