As a systematic trader, you make all of your buy and sell decisions in the market using backtested trading systems. Trading systems give you objective entries and exits that you can backtest on historical data to ensure they are profitable, stable and robust.

Implementing my first trading system changed my trading dramatically for the better. As soon as I made the leap into systematic trading my returns improved, my stress levels dropped, the amount of time my trading took dropped substantially and my confidence increased.

Everything about my trading improved.

As soon as I went live with my first system I immediately started trying to make my trading system better. My thought process at the time (15+ years ago) was that I was making good money with my system, so I could make even more money if I could find a way to make my system better.

This though lead me into a trap that many systematic traders fall into. Spending months or even years endlessly tinkering with your trading system trying to extract additional profits by optimizing, filtering or changing the rules.

I worked on that first system on and off for several years trying to make it better. Every now and then I made a discovery which improved it, however, progress was at best incremental.

When I look back on those early years of my systematic trading journey 15 years later, I now know that I left a huge amount of money on the table because I was focusing on the wrong things.

Tinkering with my system took all of my focus and energy but gave me very little in return. There is a much more powerful way to achieve step change improvements in your trading results.

How to achieve a step change in risk adjusted returns

When you have a trading system that is already profitable, any improvements you find from then on are good, but as I found in my early years, they are mostly incremental. The challenge is that one trading system can only perform well in certain market conditions. You can make it perform better, but you are limited because one trading system can only do so much.

If you want a step change in your trading performance, you need to move beyond the one trading system you have been tinkering with, and consciously diversify so that you can make money from different types of market behavior.

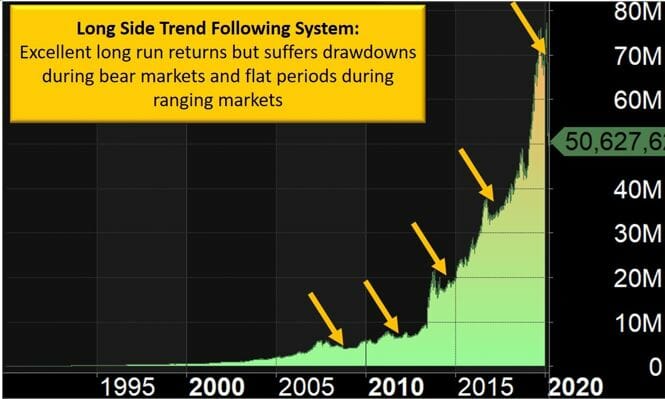

If you only have a long term trend following system, you will make great returns in the long run, but these will be punctuated by periods of reasonably large drawdowns as you have seen in my previous articles. Below is the backtest equity curve of a typical trend following system that I trade in my portfolio.

Long Side Trend Following System

As you can see it makes excellent returns in the long run but is punctuated by drawdowns and flat spots when the market is ranging or trending down.

So we can incrementally improve this system to reduce the drawdowns and flat spots, or we could instead improve our results dramatically by diversifying our trading to include systems that make money when this system is not profiting.

By adding different systems to the portfolio that profit from different market behaviors we are able to more dramatically improve our risk adjusted returns.

Note I am talking about risk adjusted returns here because we generally see the benefits of diversification in the form of lower drawdown and smoother equity curves rather than increased absolute returns. Though you can convert this smoother equity curve to higher returns through the use of increased leverage if you wish.

So what can you do to diversify your systematic trading portfolio?

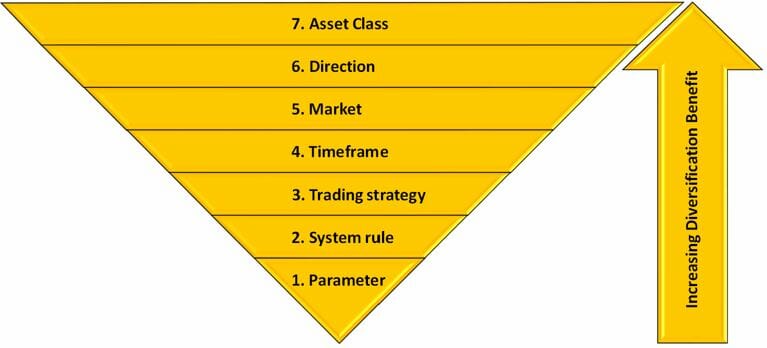

The 7 Levels of Trading System Diversification

7 Levels of Trading System Diversification

1. Parameter set diversification

This is where you have one trading system but you trade several different versions of the system to smooth out the results and protect against the possibility of curve fitting. The rules of the system variations are the same, but the input parameters are different.

A good example is a trend following system with two different widths of trailing stop loss – one wide and one more narrow. This can reduce your drawdown at the end of the trend because half of your position would be exited more quickly. This form of diversification is very easy to implement for all systematic traders.

2. System rule diversification

This is when you change rules of the system using different indicators or patterns giving you multiple versions to share your capital between. For example, imagine two versions of a trend following system, one that enters on a breakout and the other that enters on a pullback. Both follow the trend, but timing of entries is different and thus provides some diversification benefits.

A second example of system rule diversification could be trading two versions of a trend following system, one with a long term moving average crossover exit and another with a volatility based trailing stop exit. These would get you out of the market at slightly different times and so provide some diversification benefits.

3. Trading strategy diversification

This is when you have multiple trading systems based on different strategies. For example if your first trading system is a trend following system, then adding a mean reversion or a swing trading system can provide good diversification benefits.

The reason multiple trading strategies can improve your portfolio’s performance is that each trading strategy profits from different market behavior, and so makes money and goes into drawdown at different times. This is what we are looking for when we combine trading systems – profits and drawdowns which typically occur at different times.

4. Timeframe diversification

This is when you have trading systems that operate on different timeframes, and so profit from different durations of market moves. This may mean they operate on different chart periodicity (intraday / daily / weekly / monthly), but it can also simply be systems with different average trade duration (long term trend following / short term mean reversion both on daily charts). Timeframe diversification is important because it reduces your susceptibility to market shocks.

For example I have two long side systems – one that has an average trade length of over 12 months, and another that has an average trade length of just a few weeks. The shorter term system gets out of the market and stops signaling new trades much more quickly than the longer term one. This provided a huge benefit in the recent Covid-19 related market panic because the shorter term system was already out of the market when the worst of the crisis hit. This dramatically reduced the amount of drawdown that I incurred in the downturn.

5. Market diversification

This is when you trade and spread capital across multiple stock markets around the world to benefit from the diversification between markets. While there is a high level of correlation between markets, I have found this diversification to be extremely powerful because regional economies do tend to behave differently, and each market also has it’s own ‘personality’ so the system rules you use in each market typically vary.

The key to market diversification is to check there are actually diversification benefits from the markets you are choosing. This is not always the case so analysis is required to confirm each additional market is worth the complexity. Check this by backtesting your trading systems in each market and then calculate the correlation of the daily returns in each market. Choose markets which give you the lowest correlation in daily backtested returns.

My approach is to keep my trading life as simple as possible while still getting maximum diversification benefits. Be wary of adding too many markets or trying to trade in timezones that are not practical for your lifestyle. You don’t want to have to be awake at 3am every day to place trades in a foreign market!

6. Direction diversification

Perhaps one of the biggest leaps you can make as a stock trader is to not simply trade long only. While trading the long side (systems which profit as markets go up) is the easiest way to trade and make money, as we have seen with the recent Covid-19 market panic and also back in 2008 which many traders will still remember, long only systems can have large drawdowns in bear markets.

Adding a system that profits from market declines offsets this drawdown and puts you in a much stronger position when the next bull market emerges. Shorting systems won’t perfectly offset the drawdown in your long systems every time, but what you are looking for is profits when your long systems are losing money or flat. When you combine systems like this your portfolio equity curve will improve.

7. Asset Class diversification

The final level of diversification for your trading systems is asset class diversification. This simply means trading systems which use different asset classes. If you trade stocks then this could mean adding Commodities, Forex, Bonds or other markets. The reason this is valuable is that different markets tend to give the highest degree of diversification because they are usually unrelated.

Be wary though of assuming you have perfect diversification if you are long only across multiple asset classes. In an extreme market dislocation many assets classes also become highly correlated. In the 2008 bear market there were times when there were basically only two groups – the “Risk On” assets and the “Risk Off” assets.

A Pragmatic Approach to Diversification

There is clearly a lot you can do to diversify your portfolio of trading systems, however, you don’t need to do everything to make a lot of money trading. My intention with this article was to present the alternatives so you can see what is possible.

A pragmatic approach would be to start trading with a single system. This is most commonly a long side system in your home market. This would form the foundation of your systematic trading portfolio.

Adding a second long side system that operates on a different timeframe is easy to manage and provides substantial diversification benefits. These two trading systems will provide diversification under ‘normal’ market conditions which smooths your equity curve, but they will be highly correlated during a market panic, so it is important to go one step further.

The next stage of a pragmatic approach would be to add a system that profits when the market goes down. This could be a system which shorts individual stocks or ETFs, or it could be a system that buys instruments that rise when the market falls (like Inverse ETFs / VIX ETFs / Bonds for example).

If you want to take it one step further within the equities world then you would look for markets which have different economic drivers to your home market. As a final step consider looking at systems for different asset classes. When you trade systematically, spreading your capital between multiple diverse systems like this is quite easy to manage and has the potential to smooth your returns and reduce your drawdowns substantially.

This article was written by Adrian Reid, Founder of Enlightened Stock Trading and was first published in Your Trading Edge Magazine