PROBLEMS MOST STOCKTRADERS FACE

After coaching and mentoring many traders in different markets, I realized and noticed most problems traders face. They are categorized under the following:

Overload of Information

There is much information in the market nowadays; data feeds, real-time newsfeed, analysts’ report, broker recommendations,signal services, websites, blogs, chat forums,and Facebook; many information sources arealmost impossible to collate, assimilate andunderstand.

Traders are overloaded and need a way tocut through decisions with confidence andtake on the trades without second-guessing,

hovering over the buy button and wondering ifthey are putting their financial life at risk. Wemust eliminate this information overload andthis eBook will show you how.

Conflicting Information; Bull or Bear Market

There’s a bearish argument for every bullish argument; for every bearish view, there are three bullish arguments. It is almost impossible to find a consistent message through all the market noise.

Thus, traders need to create objective rules to drive their decision making and ignore all of the market noise. Having a trading system withcomplete rules that tell you when you get inand out of the market is a critical part ofbuilding unshakeable confidence. Becauseonce you have Confidence in your system,that’s what will guide you, allowing you toignore conflicting information. You will learnhow to do exactly that in this eBook.

Inconsistent Decision Making

It is tough and almost impossible to make decisions consistently if you are a technical trader or if your trading is based on recommendations or tip services, newsletters, or even on a combination of technicals, fundamentals, and outside sources. When you have inconsistency in your decision-making process, you also get inconsistency in your trading results. Thus, putting the right systems in place and building confidence in those systems eliminates the inconsistency due to the fact we have objective rules to follow. Our trading becomes a step-by-step repeatable process. You will start making money far more consistently if you make systematic decisions like this.

Friction between the Trader and their Rules

Another problem prevalent with many traders is the friction between you (the trader) and the rules you follow. This is especially a problem when you don’t match the system correctly to your personal situation and lifestyle. The friction that the system causes you to second guess your decisions, lose confidence, and even quit. Traders might have a great system in reality, but if it doesn’t fit their personality/objectives/lifestyle it will cause friction… and losses. Thus friction is oneof the big problems traders face.

Not Knowing Whether Your Trading Rules are Profitable

Another challenging situation is when traders don’t know if their trading rules are even profitable. If you have a set of trading rules and you think they would work, you read them in a book; they sound good. Maybe you got them from a famous trader’s blog, and they look good, but you are just trusting with blind faith they are actually profitable. While these are making money it is easy to remain confident, but as soon as you go into drawdown you will quickly lose confidence blind faith is not a solid foundation to trade with.

If you are trading a set of rules that you haven’t tested for yourself and you go into drawdown, all of a sudden, the uncertainty builds, the stress and the emotion increase, and it becomes far more difficult to follow those rules consistently.

But if you have a trading system that you have absolute confidence in, because you have tested it yourself, this challenge disappears you you can instead trade consistently.

Not Knowing if the Maximum Drawdown will be Tolerable

Similarly, another major problem I see with traders is that they don’t know how significant their the maximum drawdown will be and whether they will be able to tolerate it. As the drawdown grows you start to ask yourself; how bad is this going to get? How much of my capital am I going to lose? Am I going to walk away with anything or am I going to lose everything? These sorts of questions undermine our confidence and must be eliminated by learning to backtest and evaluate trading strategies for yourself.

Not Comfortable with the Trading Process

What’s more, you might also not be comfortable with the daily trading process you are following. Every aspect of your daily trading process must come naturally and work smoothly or else mistakes and losses will inevitably happen.

Lack of Systems to Profit from Different Market Behaviours

Finally, too many traders are only able to make money in a very narrow set of market conditions (like a roaring bull market). But when those market conditions change you are left with losses and uncertainty about whether you will ever recover your capital. Suppose you have a system that profits in a bull market, but you don’t know what to do in a bear market or don’t know what to do in a volatile sideways market. Your confidence is undermined because you know that eventually your are going to hit a massive drawdown and not know whether you willrecover.

PAGE

5 PRINCIPLES FORUNSHAKEABLE TRADINGCONFIDENCE

All the problems listed above can be eliminated with the following 5principles:

- Use Complete Trading Systems

- Ensure Your System Fits You

- Backtest Your System Correctly

- Mental Preparation

- Profit From Different Market Behaviors

1. Use Complete Trading Systems

The Use of Complete Trading Systems is the first principle you can use tobuild Unshakeable Confidence. I can’t tell you how many traders I havespoken to that think they have a Trading System but when I look into therules, they are not complete… maybe there is a setup or a buy trigger or aloose set of trading rules, but not a complete system.

A complete system should define everything that you do in the markets -every action.

Subjectivity in Trading Systems:

If you have a trading system (or even just a checklist of rules) that allows forsome subjective decision making, here is the problem:

How would it feel if you could eliminate all of the judgment and subjectivity from your trading and finally, have a set of rules that you can follow with confidence?

This is what a complete Trading System does for you!

Complete Trading Systems takes away all of the discretion and tells you exactly what to do and exactly when to do it.

Hence, if you don’t have a complete Trading System right now, if you have to look at the charts and judge any of the following then your rules are too subjective for you to be consistent long term:

- Should I place the trade?

- How many shares should I buy?

- Should I buy it today, or should I wait for a little bit longer?

- Should I raise my stop to breakeven or leave it where it is?

Subjectivity like this creates uncertainty and variations in your tradingprocess and produces inconsistent results. You must use completeobjective trading systems if you want to be profitable and consistent in thelong term.

A complete Trading System includes:

- Setup: This specifies the conditions under which you will take an trade

- Entry Trigger: This is the precise moment you will enter a new trade

- Initial Stop Loss: This will keep you safe and also get you out if the moves too far against you

- Exit Rules: These tell you precisely when to get out, hopefully with a profit once the move is over

- Pyramiding Rules: (optional) These show you how to scale into your position if you want to add more size as it moves in your favor

- Risk Management: In addition to all of the technical rules, you also used your portfolio management, risk management and position sizing rules. A complete Trading System includes:

Together these rules will eliminate all of the subjectivity in your trading decisions and allow you to confidently take every signal.

2. ENSURE YOUR TRADING SYSTEM FITS YOU

The second principle critical for building Unshakeable Confidence in your trading is to ensure that your trading system fits you. You need to understand who you are as a trader so that your system will serve you. trading system needs to feel natural for you and your personality.

One important aspect of your trading personality is trade duration. How long are you comfortable to patiently wait for your trades to play out? Do you want to be in and out in a day or two, and start to get ‘itchy feet’ after one or two days in a trade, or are you a patient person who is happy to sitback and let a trade play out for months as it continues to move in yourfavor? These sorts of things will tell you a lot about what type of system isright for you.

If you are the sort of trader who is comfortable sitting back and letting thetrade do its thing as it moves in your direction then trend trading is likelythe best trading strategy for you. However, if you want more action andquick feedback then mean reversion trading is more likely suited to you.

Trade frequency is also a significant contributor to your trading personalitybecause some people like a lot of action and activity, trading all the time,while other people like to trade infrequently and very selectively. If you likelots of activity, you will need a system that will trade very regularly andgive you lots of signals so that you have a lot of that activity to keep youfocused, interested and on task. But if you want to be more consideredand have fewer trades, less activity, then you need a slower system.

There is no one best trading system, however, there are definitely strategies that may be better or worse for you! If you get this choice wrong then that will cause stress, frustration, and mistakes and ultimately lead to losses.

The final consideration in your trading personality is the trade profile. When you think about the profile of winning trades and losing trades, if you like lots of small winning trades with the occasional larger loss, or prefer lots of small losing trades but occasional big wins. You can make money with either of the profiles, but some people are comfortable with one and not the other.

The Need to Understand Yourself with the Trading System:

Understanding yourself will help you choose a system that will give you a profile of trade outcomes that will help you remain comfortable. Imagine if you are satisfied with the frequency and duration of your trades, the size of the wins, and the size of the losses; if you are comfortable with these, it will be much easier to keep following the system. This is why personality is important. Start by understanding yourself and then find the strategy that suits you; that way, the process will cause less friction and fewer losses.

The Need to Align the Trading System with Your Objectives:

It’s not just personality that is important, but also objectives. Your TradingSystem has to give you what you want in terms of drawdown tolerance, and rate of return. These two are tightly linked, and it is tempting to say that I want no drawdown, I like huge profits, and I want to double my account every year. Sadly this is unrealistic.

There are always drawdowns, we can’t avoid them, but we all have our own drawdown tolerance. Some people are comfortable with a 10-15 % drawdown; some people are comfortable with a 30-40% drawdown, provided the returns are there to compensate them for the risk that they are taking.

Drawdown is just the percentage drop in your account from the peak to the lowest equity level before you start making returns again. I find that when the drawdown of a system exceeds the trader’s tolerance, the stress levels go up immediately. At this point, you start second-guessing the system, and manually overriding the trade signals or skipping trades. This behavior destroys profitability and puts your account at risk so must be avoided at all costs.

Even the very best trading strategy or system will be ruined bytradingmistakes if it does not fit you:

Matching your objectives is a critical part of trading system selection so you can avoid crippling mistakes. A system that makes 30, 40% return per year is impressive. But if it has a drawdown that you are not comfortable with, you will start making mistakes, and you can lose even more money when the drawdown comes. Thus, you have to understand both the return and risk parts of the equation and make sure that the system fits you. That way, it will cause less friction, have fewer losses, and then make more money as a result.

The third part of fitting the Trading System to you is that it will work with your lifestyle. I learned the hard way in my initial start that if a Trading system doesn’t fit your life, it will be hard to follow it consistently and accurately. An excellent trading strategy has wins and losses, but if you make mistakes and degrade the win/loss profile, even the best trading strategy can be ruined by trading mistakes.

The biggest cause of trading mistakes is when the Trading System does not fit your personality, objectives, and lifestyle.

Here are some tips to avoid systems that don’t fit you:

- Don’t use a Trading System that requires you to stay awake until 2:00 AM in your time zone to place the trades in another time zone.

- Don’t use a Trading System that requires you to be at the job or the computer all day if you have other appointments.

- Don’t use a Trading System that needs you to make decisions that stress you out.

- Don’t use a System that trades short-term moves if you are more comfortable with long-term activities and vice versa.

- Don’t use a system with many small wins and a few large losses if that causes you to lose sleep at night.

- Don’t use a system that trades a mean reversion if you are more comfortable with trend following.

You certainly don’t have to review the whole universe of profitable trading methods to find the perfect one for you, but it is important to ensure you select a strategy that will work for your Personality / Objectives / Lifestyle.

As we conclude this section of the eBook, here are some questions for you to answer:

- Do I feel calm and comfortable executing my trading system?

- Can I follow it consistently and efficiently every day?

- Can I operate my trading system without friction from other areas of life?

If you can honestly answer yes to this question, then you probably have the right system for you.

3. BACKTEST YOUR SYSTEM CORRECTLY

The third area for you to build Unshakeable Confidence in your stock trading is to Back-Test your system correctly.

The first issue for consideration is the issue of data mining. Data mining means sifting through the data with lots of mathematical rules, throwing a whole lot of ideas out, and hoping that one of them will appear profitable. You can find Trading Systems that appear worthwhile quite easily through data Mining, but the question is if it is a real edge. The most important question to ask is will it continue to make money in the future?

Examples of Poor Practice in Backtesting:

- The stochastic crossing below 18 generates buy signals on XYZ stock.

- The 17-day moving average crossing above 41 is a profitable signal on ABC stock.

- Find a strategy in a forum and optimize it.

- Brute force optimization to find the best parameter values every indicator in your system.

The above examples are common practices that will not result in future trading profits. You need a different approach if you want unshakeable confidence in your stock trading.

So what is Good Practice? Instead use a strategy that is based on real, observable market behavior. For example:

- Observe that stocks tend to have long trending periods

- Observe that small caps trend better than Large caps

- Observe that stocks tend to rally on certain days of the month

- Observe that stocks that are trending and have a sudden setback tend to rally soon after

More so, a vital question you should ask is, do my trading rules capture profits from real observable market behavior, and can I explain my Edgesimply to someone else?

If you can explain your edge simply in 30 seconds so someone else can understand how your approach generates profit from the market then you are probably on the right track. If you can’t, chances are it’s not a real edge, and any profits in your backtest are probably just due to data mining. Answer this question for yourself, and you will find that you are either on the path to having unshakeable confidence in your stock trading… or not.

The Real Purpose and Impact of Optimization:

The next thing I want you to think about is the real purpose of optimization.Nowadays we have powerful trading software that we can use to optimizeour trading rules and find the best indicators and parameter values. But thetrouble is that the software setup is driving unprofitable behavior.

We need to do something more to find the best indicators and parametersin our backtest. We need to find rules and parameter values that arestable and likely to continue to work in the future.

If you optimize your trading system and choose the best parameter value(like in the image below), you will be left wondering why you are notmaking as much (or any) profits in real time trading.

The real purpose of optimization is to check if our system is stable over a wide range of parameter values. Optimization shouldn’t be used to find the best parameter value; it should be used to find an area of stable performance so that you know your system will continue to work in thefuture even if the market shifts a bit. Hence, it’s rethinking how you useoptimization in your trading software.

So the reason we optimize is to find stability, not maximum profits. This is amindset shift on how you use the software to Back Test and optimize yourTrading Systems, and it makes a huge difference to how well your systemwill perform in the future.

Ask yourself this question, are my trading rules profitable over a wide range of parameter values, or is it a particular combination of parameters that produces a profit in my backtest?

If it’s profitable over a wide range of values, then you can have a greater level of Confidence that you will make money in the future in real-time trading. But if it’s one precise combination of parameter values, the profits and everything else fall apart; then, you don’t have Confidence because the market will indeed shift in the future.

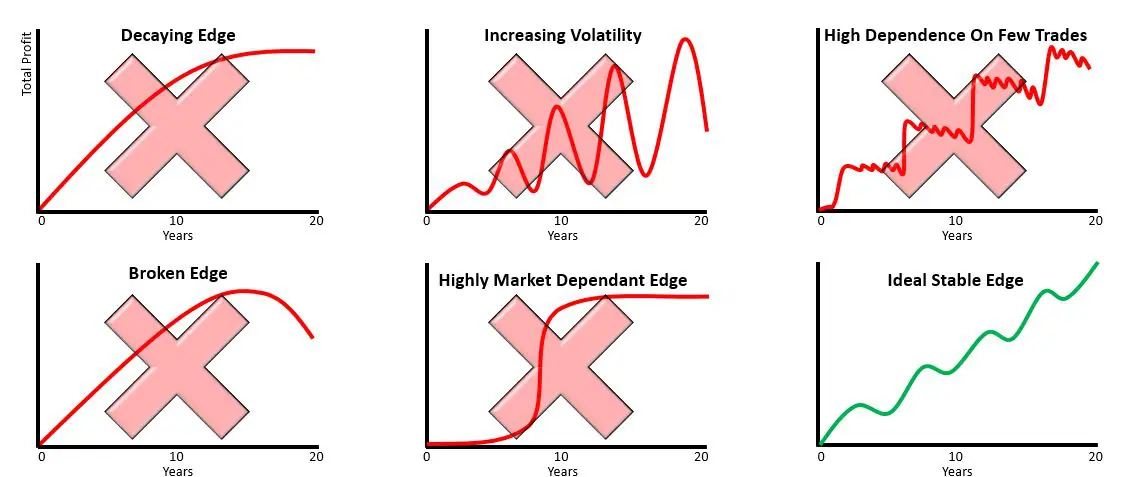

Using the Backtest to Ensure your Edge is Stable:

The next part of backtesting is to use it to ensure your Edge is stable. It’s really easy to get excited by great-looking backtest results. However, you should step back from that excitement and ponder more deeply how stable the Edge is in your trading system.

One of the problems is that we tend to look at our backtest on a compounding basis because we all like to see how much money we will make. However, we need to run a different type of backtest with constant position sizing over time to remove the impact of compounding to see if the edge in the system is stable.

The great thing about doing this is you can tell if your edge is stable or decaying. If your backtest equity curve is in drawdown at the end of your test and is having its largest drawdown ever, then the chances are the edge is broken.

The next pattern that is a real concern for trading systems is increasing volatility in the equity curve. What you see often is a system that is making money, it keeps making you equity highs, but the drawdowns are getting bigger over time. When that happens, it’s just a matter of time before you get a big drawdown that will wipe you out.

This is a problem because you are never sure how big the next drawdown is going to be and if you will be able to tolerate it (or whether it will blow up your account). Thus, you don’t want a backtest that has increased volatility in the equity curve.

You also don’t want to see a backtest where the edge is highly dependent market conditions. I tend to avoid Trading Systems that have a highlymarket-dependent edge. I want to see more consistent profits over time.

Finally, the last one to avoid is systems or equity curves with a very highdependence on a small number of trades.

To maximize our confidence we need to aim for a stable edge with an equity curve that moves from the bottom left to the top right. When you find a system that has that, you can be much more confident that the edge is stable and it’s likely to continue to keep working in the future.

Thus, ask yourself this question, does my backtest look stable?

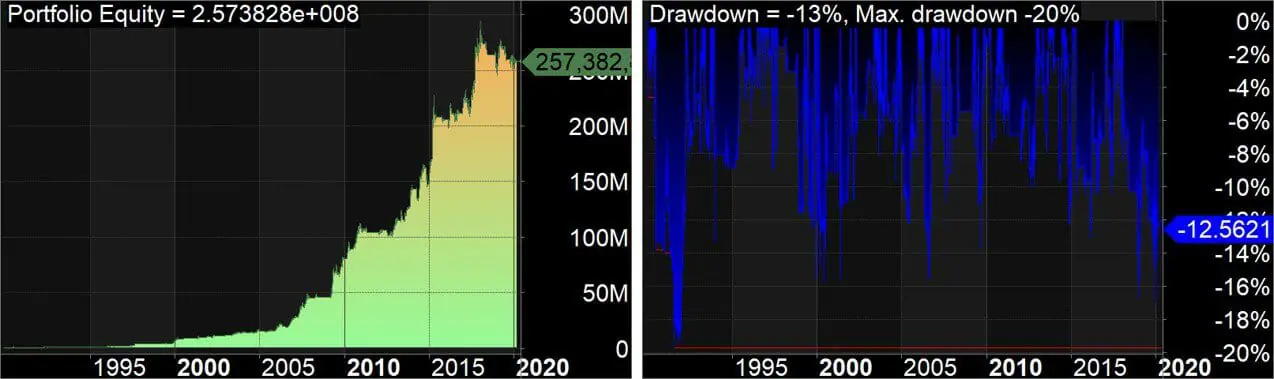

Meanwhile, if you haven’t backtested your system, now is the time to start. You do this by putting your rules into some trading software like AmiBroker ,learn how to backtest it correctly and backtest over 20-30 years of history.Then you can check if your edge is stable. If it is not then you might needto stop trading and find a system that is.

A Counterintuitive Way to Approach Back testing:

The next way to use backtesting is counterintuitive and the opposite of what most traders do. When we sit down with our trading software, the impulse is to keep adding rules to try to improve the profitability of the backtest. If you keep stacking rules on top of each other it quickly becomes a complicated mess.

You don’t want highly complicated, multi-variant, 10, 20 parameter systems because they won’t make money in real-time, even if they look amazing in the backtest.

Making your system simpler is the path to profit and having confidence in your Trading System. What you should do is invest more time simplifying your rules than testing additional rules. Seek the simplest way to capture your ideal move and use extra filters and rules very sparingly. The more you can do this, the more you will likely generate a trading system with consistent profit over the long term.

4. MENTAL PREPARATION

The next part of building Go Live Confidence is Mental preparation. It will ensure you trade without being surprised, shocked, or getting put in a situation you didn’t anticipate. Mental preparation is critical for you to build unshakeable confidence in your stock trading.

Paper trading is an important part of your mental preparation which most traders underestimate.

The Major Things to Focus On During Paper Trading

Simulate the process exactly to build confidence

When paper trading you should simulate the process and discipline exactly as you would if real money were on the line. This will ensure you have any process issues ironed out before you go live; so you can put the money into the market with confidence and become a trader because you know deep down you can do it.

You should generally not Paper trading for 6 or 12 months; you are doing it for just long enough to identify and eliminate any issues and build confidence with the process. If it takes longer for you to build your capital, then keep paper trading and get better at it. Just remember you are not paper trading to test if your system works, that’s not what backtesting is for. Paper trading is all about ensuring the daily process is smooth and stress-free.

If you haven’t backtested your system but you think it’s profitable because you have just paper traded it for a while and it made money, then the badnews is that you are at risk; because you can’t paper trade for longenough to get sufficient information to have unshakeable confidence inyour strategy because you would need to paper trade for many years tosee how it performs in bull, sideways and bear markets.

Thus, get the confidence that your system is profitable through backtesting, then paper trade for a short period to iron out all the kinks in the process, get comfortable, and then Go Live for real. This is the right path to trading profitably with unshakeable confidence.

If you are making mistakes, if you are fumbling over your trading, if you are not sure exactly what to do every moment, you have to practice that process and iron out the wrinkles so that you can follow that consistently and easily. That’s why paper trading is useful.

Understanding the Equity Curve

Studying the Equity Curve closely and at a more detailed level than most systematic traders do is another way to build your confidence. If you go into a drawdown and don’t know how long it will last, then it’s very hard to maintain confidence that your system will come out the other side of it. Thus, study the daily equity movements, and the daily changes in your equitycurve, and visualize it happening in your account. Get prepared that it’s going to go up and down because it will. Get prepared that you will make new highs, and then you are going to go into a drawdown. Pay particular attention to the depth and duration of the drawdowns.

It is pertinent to pay attention to the return side of the equation and the drawdown side and be honest with yourself about how comfortable you are with this level of drawdown. If you are not, then adjust the system, the risk, and the leverage to get that drawdown in the backtest to a level that you are comfortable with.

If you know that the drawdowns from your system are within levels that you will be comfortable then you can better follow that system and trade through the drawdown out the other side to make new equity heights.

The Monthly and Yearly Distribution of Returns;

You might have some days, weeks, months, or even some years that are not profitable with one particular system, but if you study it and you are prepared for it then you can survive it. You get this data from the monthly table of performance when you backtest your system.

The image below shows the monthly return distribution from a stock trading systemthat was generated by backtesting in Amibroker. Studying these monthly returns and annual returns gives great insight into what you will need to cope with once you go live with your trading system.

An important part of building Unshakeable Confidence in your TradingSystem is studying the monthly and annual performance so you knowwhat’s possible… That way you won’t be caught by surprise and panicwhen you have a couple of down months in a row because you know it isperfectly normal.

You need to be comfortable and prepared for the depth, duration andvariation of returns that your approach gives you. Armed with thisknowledge you are on the path to having that Unshakeable Confidence.

If you haven’t done this yet then it’s time to do the backtesting andinterrogate those results a little more closely!

Studying what your system will do in different marketbehaviors;

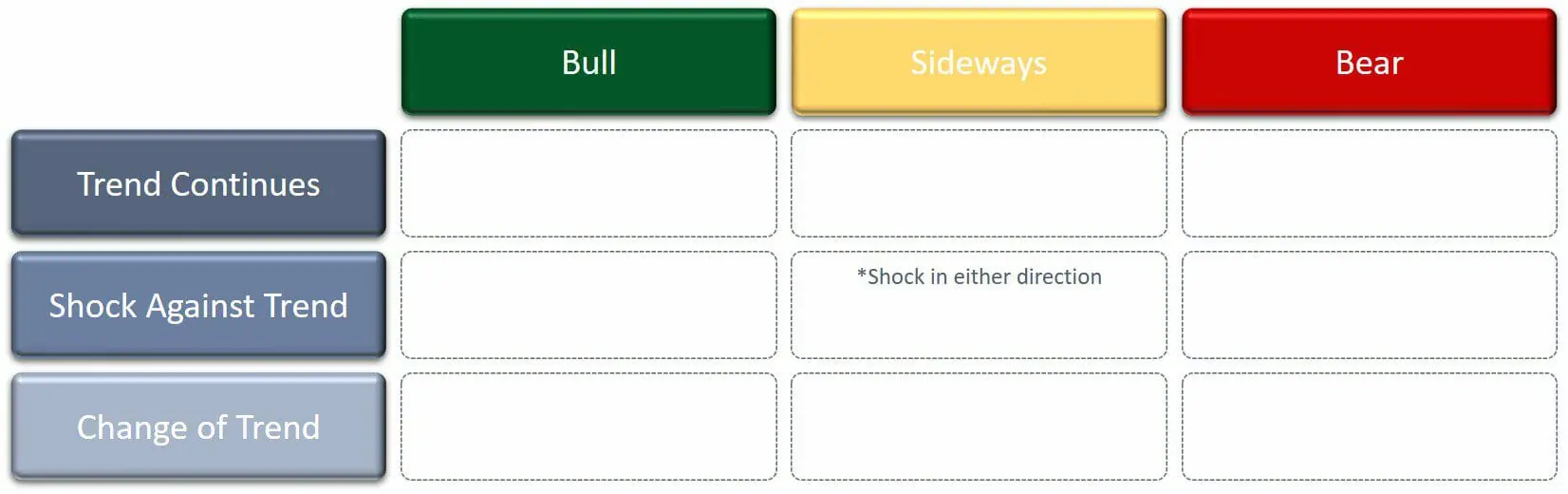

It’s the next part of being prepared mentally. I created a framework called Market System Map, and it tells us that there are nine different behaviors that the market can exhibit as illustrated in the diagram below:

There are three primary directions in the market can move in – You can have a Bull Market, Sideways Market, or a Bear Market. Within each of thesemarkets, three things can happen; the trend can continue, there can be atemporary shock against the trend before it continues, or the trend canchange direction and move into one of the different primary trends. Threeand three give nine combinations. If you look at your trading method, whatyou need to think and ask is how this method will perform in each of thesenine types of market behaviors?

It’s not necessarily about changing the method; it’s about knowing what toexpect. If you have a trend following system on the long side and arehighly leveraged, you will make a ton of money when there is a strong BullMarket. But as soon as the market turns, you better prepare for the bigdrawdown that is going to follow. If you don’t expect that drawdown tocome, as soon as your account starts falling, your emotions are going tocome up. Your stress level is going to come up, and you will start makingmistakes. But suppose you are prepared for what is happening. In thatcase, you know what to expect under different market conditions, it’smuch easier to stick to the plan, follow the system, or adjust the plan in thesystem so that what could happen will be what you are comfortable with.

You need to think through all these nine areas of the Market System Map.What will happen to my system if the market keeps going in the currentdirection? What will happen to my system if there is a temporary shockagainst the current trend? What will happen to my system if the markettrend changes? Being able to answer these questions will give youConfidence to follow your system because you know what’s coming. Youalso know when to turn your system off.

Are you prepared for what will happen in all different market behaviorswith your system? The key is being mentally prepared for what will happenso that you don’t freak out and have to bail out.

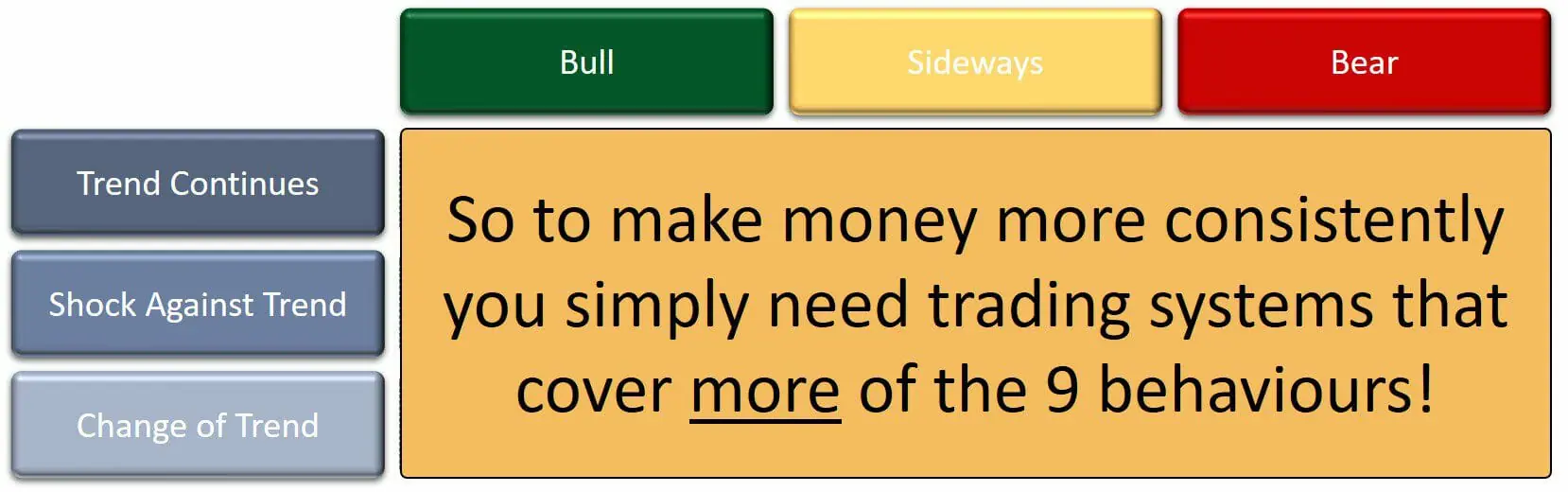

5. PROFIT FROM DIFFERENT MARKET BEHAVIORS

The last part of building Unshakeable Confidence in your stock trading is to be able to profit from different market behaviors. If you have been in the market for a while, you would have noticed amazing strong bull markets, volatile sideways markets, and hugely volatile bear markets. If you can only profit from one type of market behavior then we will suffer much of the time we spend in the markets!

As traders, we have a lot to worry about:

- What if the Coronavirus comes back?

- What if there is another financial crisis?

- What if there is a war?

- What if there is a bear market?

- What if another bank falls?

There is always something worrying that could happen in the world, but the market can only do one of nine things, as shown in the Market System Map below. The market can be in a bull/sideways/bear market and within those markets, that trend could continue/experience a shock against the trend/change trend. Thus the market can only do one of nine things!

To make money more consistently, you need Trading Systems that cover more of the nine behaviors. If you have a long side trend following system, and that is all you have, you will not make much money (if at all) in a bear market. So you need to diversify, to have systems and rules that make money in different market conditions. The more market conditions you can profit from, the less it matters what the market does.

This is a way of building your confidence because you don’t have to worry about a market crash if you know you are going to profit from the market crash.

For bull markets, you need long-side trend-following systems to profit when the market moves up strongly. The way you profit from this is with systems like “The Freight Train”.

Freight Train System

The Freight Train is part of my Trading System collection that my students get when they join the Trader Success System. It makes money by buying stocks that have entered strong trending periods. It buys strongly trending, low volatility stocks that are moving up consistently, and it holds them until the trend has changed and turned down. There is a clear edge that is profitable and stable when you follow trends in a bull market. The FreightTrain makes money because it lets the profit run, you stay in the trendingstock, and the profits keep growing the longer the trend continues.

Long-side trend-following systems typically makes strong profits in the following behaviors defined by the Market System Map:

If you are holding a stock that stops trending up and starts falling, the losses get cut quickly. So you have large profits and small losses. This system requires patience because you are letting the move play out so that you can profit from the long-term trend. This is an example of how you profit on the long side with the system. However, you also need trend-following systems for down-trending markets, which is slightly different. For a down-trending market, you need a system more like The Slippery Dip.

Slippery Dip System

This is another system in the Trading System collection that my students get. The Slippery Dip shorts the market, and shorts the weakest stocks when the market turns down. Like when the Coronavirus hit, causing the market to fall in early 2020. The whole index went down and most stocks started to godown with it. The Slippery Dip turned on; it shorted the weakest stocks in the market and rode those down. When then they hit the profit target, it closed all the positions and went to cash.

It took a great slice of profits out of the decline because it capitalized on the downward momentum of the market which impacted the majority of stocks. It exits quickly if the market rallies again. Thus, this is a good way to make money in a bear market.

Wait till the market turns down, you short the weakest stocks; as soon as you have a decent chunk of profit, you close these positions before the market rallies again. If you wait too long in a bear market and the marketstarts to rally, most of your profits are going to disappear quickly. Short sidesystems like this make money in the following stock market conditions:

Mean Reversion System

In addition to long-term trend-following and a short side trend-following, you also need a Mean Reversion System to profit from dips in the Bull and sideways markets. A Mean Reversion System is a system that finds a stock that is going along either in a trend or sideways that has a temporary shock, like a rapid shock against the trend; usually, when that happens, it bounces back quite quickly. Fear Harvester is an example of a system that I use on the Australian market to catch stocks that have been suddenly penalized by the markets. The share price has taken a sudden dip. You buy those stocks, and they typically bounce back within one to three days, and you sell to catch a small profit.

Systems like this are profitable on the vast majority of trades (70% or more of trades are profitable), but they are small profits. Every now and then, a trade follows through to the downside and it hits your stop loss, and you get out, so you end up with a slightly larger loss; however, lots of small profits offset the occasional larger loss. This is an example of how to profit from the temporary corrections or shocks against the market trend.

Long-side mean reversion trading systems are generally profitable in the following market conditions:

WHAT SHOULD YOU DO NEXT TO IMPROVE YOUR TRADING RESULTS?

Do you have trading systems that profit from different market behaviors?

If your answer is no, then it’s time to enhance your portfolio with some different systems. That way, no matter what happens in the markets, you have a strategy that could give you some profit.

Chances are you might need a little help to fully understand and implement the concepts covered in this eBook – That’s why we created Trader Acceleration Week!

Trader Acceleration Week is a high-impact, 5-day LIVE online training program that brings clarity and structure to your trading journey.

For 1 hour each day, we will be focusing on one of the five stages of TheEnlightened Stock Trader Journey, allowing you to transform from anovice to master trader.

Why Should You Attend?

- Structured Learning: This isn’t another disjointed training course. We offer a step by step, 5-day curriculum that takes you on the journeyfrom launch to mastery.

- Expert Guidance: Learn directly from Adrian Reid, the Founder ofEnlightened Stock Trading who is a seasoned trader with over 20years of consistent trading success across multiple internationalmarkets.

- Proven Methods: We introduce you to systematic trading, algotrading, and stock trading systems that are based on objective rules,not emotions.

- Exclusive Tools & Resources: Get access to downloadablecheatsheets, calculators, and valuable insights to empower yourtrading decisions.

- Last Chance to Join: An exclusive membership announcement will bemade on the last day. Don’t miss this rare opportunity to join TheTrader Success System.