Introduction to Trend Trading Crypto:

In the fast-paced and ever-evolving world of crypto trading, where fortunes can be made and lost in the blink of an eye, the importance of a solid trading strategy cannot be overstated. Whether you’re just stepping into cryptocurrency trading and bitcoin or have been navigating its volatile waters for some time, the path to success can often seem elusive. Many traders are lured by the promise of quick riches, exotic algorithms, crypto trading bots, and complex tools, only to find themselves caught in a web of cognitive biases that hinder their progress… Trend Trading Crypto is one solid answer to these challenges.

Simple, works.

That two-word statement was the premise of a recent social media post I made, as with most of my posts, it was to attempt to engage ‘critical thinking’, to have people thinking differently to the ‘herd’ in the context of successful trading.

Many traders do not understand that most, if not all, of the advice distributed across crypto social media platforms is not accurate and certainly not verifiable. However, to understand my comment (Simple, works) we need to break down the allure and perceived complexity in crypto trading, we must first acknowledge and understand the cognitive biases that often cloud traders’ judgment. These biases are the hidden saboteurs of rational decision-making and significantly impact the success or failure of trading endeavours, even for those self-proclaimed or overnight gurus who are the loudest on social media.

Our journey through this article will delve into crypto trend trading, exploring the cognitive biases that crypto traders must overcome, dissecting the complexity bias in particular, and unveiling the power of simple trend-following techniques. We introduce you to the concept of challenging your thinking and the beliefs of those with the loud voices in the cryptocurrency world, shedding light on why you might have been searching for success in all the wrong places.

Cognitive Biases in Crypto Trading:

The following cognitive biases are a select example from a long list of biases that, as humans, we bring to the crypto markets that significantly impact a trader’s decision-making process, often leading to catastrophic outcomes.

Overcoming these biases and approaching trading with a clear and rational mindset is crucial for success in cryptocurrency markets.

- Complexity Bias: One of the most critical biases is the complexity bias, where traders believe that complex trading strategies, sophisticated tools, and intricate algorithms are the keys to success. This cognitive bias leads traders to overcomplicate their approach, ultimately causing more harm than good. It means traders will continue to look for the ‘Holy Grail’ or ‘secret sauce’, believing that successful traders hold these secrets behind closed doors. This continued and elusive search means that traders guru-hop, system-hop, or continue to chase their tails without ever finding true success.

- Overconfidence Bias: Overconfidence bias is the tendency of traders to overestimate their abilities and knowledge, leading them to take larger risks than they should or follow faulty logic and systems. This bias can result in impulsive trading decisions, overtrading, and substantial losses. Overconfident traders, usually brought about due to initial success or having read just a ‘few books’ or ‘watched a few YouTube videos”, give the trader false belief that they have what it takes to be successful and often believe they have a unique insight into the crypto markets, leading to unwarranted self-assurance. This is also known as the Dunning-Kruger effect.

- Confirmation Bias: Confirmation bias is the inclination to seek out and interpret information in a way that confirms pre-existing beliefs. Traders afflicted by this bias tend to focus on information supporting their existing trading beliefs or strategy while ignoring or dismissing contradictory, often verifiable, and validated information. This can lead to a lack of objectivity and an unwillingness to accept they need coaching or mentoring to achieve crypto trading profits and success over the long term.

- Anchoring Bias: Anchoring bias occurs when traders fixate on specific reference points, such as purchase prices or historical highs, as the basis for their trading decisions. This can cause traders to hold onto losing positions, hoping for a return to the anchor point, rather than objectively assessing the current market conditions and making rational decisions or ‘cutting your losses’.

- Loss Aversion: Loss aversion is the tendency to strongly prefer avoiding losses over seeking equivalent gains. Loss-averse traders may hold onto losing positions longer than they should because they are averse to realizing a loss or selling profitable positions too early, trying to lock in the minimum gain, fearing that it may become a loss. This can lead to missed opportunities and increased risk, as winning positions must be larger to overcome the inevitable losses. Further, holding on to a small losing position almost always results in accepting a larger loss later.

- Herd Mentality: Herd mentality, also known as the bandwagon effect, refers to the tendency of traders to follow the crowd and make trading decisions based on the actions of others. These ‘others’ in the crypto world are the false gurus, who usually appear to be the most confident and boisterous actors, who typically bully and overpower those with different beliefs. This Herd Mentality bias often results from a fear of missing out on potential gains (they believe others are achieving).

- Survivorship Bias: Survivorship bias is the tendency to focus on the individuals or entities that have survived or succeeded while ignoring those that have failed or become invisible. In the context of trading and investing, survivorship bias can lead to unrealistic expectations and misplaced confidence. When we hear about the incredible wealth amassed by successful buy-and-hold investors like Warren Buffett or a select few early adopters of Bitcoin, we fail to consider the countless others who did not achieve similar results.

Resolving Cognitive Biases Using a Trend Trading Strategy

While it can be shown, using validated performance track records, that trend trading (otherwise known as trend following trading) can outperform the markets over the longer term, it is lesser known or accepted as to why. The simple reason trend trading works is that using this systematic, objective, rules-based approach overcomes most, if not all, of the cognitive biases traders experience when approaching the cryptocurrency markets. This article would be extremely long if I were to demonstrate how trend trading achieves this, so I would like to focus on one in particular: Complexity Bias, by demonstrating that a very simple approach can best buy and hold, as was the basis of my initial social media post.

However, I need to debunk a second cognitive bias: Survivorship Bias. Because the fact remains that there is no simpler approach than buy and hold, and there will be some with the argument, why concern themselves with this term: Complexity bias?

The buy-and-hold myth suggests that anyone can achieve wealth by purchasing assets and holding onto them long-term. This myth often relies on examples of remarkably successful investors like Warren Buffett, who have indeed achieved exceptional returns through buy-and-hold strategies. However, survivorship bias plays a crucial role in perpetuating this myth.

The myth conveniently overlooks the vast number of individuals who tried the same approach and failed to replicate Buffett’s success. It disregards the countless investors who bought stocks that plummeted, companies that went bankrupt, or assets that never recovered their value. These “invisible” failures, concealed by survivorship bias, are inevitable in the investment landscape.

Warren Buffett’s success is exceptional precisely because it is not the norm. His extraordinary returns result from a unique combination of skills, insights, and a long-term perspective that few can emulate, combined with opportunities not available to most investors. By highlighting his success while ignoring the failures of countless others, survival bias creates a distorted perception that buy-and-hold investing is a guaranteed path to riches.

In reality, the buy-and-hold strategy carries significant risks and challenges (our cognitive biases). Crypto investors and crypto traders need to view this approach with a clear understanding of the survivorship bias and the acknowledgment that the road to financial success may not be as straightforward as the myth suggests. Simply put, there is no “exit rule” to this strategy, leading to a predominant failure mechanism due to our inherent emotions of fear and greed.

While pervasive in the world of crypto trading, the complexity bias is particularly intriguing when we consider its relationship with trend trading (trend following) strategies. Despite its simplicity, trend trading is a tried-and-true method that often gets overshadowed by the allure of more intricate (complex) techniques, usually based on some ‘prediction model’ (technical analysis or chart pattern analysis).

Trend following is based on the straightforward concept of identifying and trading in the direction of established market trends. Rather than relying on complicated algorithms and intricate tools, trend followers focus on capturing the momentum of assets using price-based statistical analysis. Complexity bias, however, leads traders to believe that only intricate strategies can yield substantial profits, thus diverting their attention away from the simplicity and more importantly, the effectiveness of trend following.

History of Trend Trading and Verifiable Track Records

The history of trend following in the trading world is a testament to its enduring success. It is a strategy that has weathered the storm of market volatility and economic uncertainties, consistently delivering profits to those who have embraced its principles over centuries. A couple of the earliest reported trend traders are David Ricardo, who coined the term ‘cut short your losses, let your profits run on”, cited in the 1838 book The Great Metropolis, Volume 2, and the infamous Jesse Livermore of Reminiscence of a Trader fame, of the early 1900s.

Michael Covel, a prominent author, has played a pivotal role in validating the trend trading strategy. His trading books, including “Trend Following” and “The Complete TurtleTrader,” have demonstrated the success of trend traders and the methodologies they employ. Covel sheds light on research that validates trend trading with many trend followers who have managed to build verifiable track records of success, which serves as a testament to the reliability of this approach. He is not shy in providing examples of these verifiable track records and highlighting a very important fact: the track records of other strategies, using technical analysis or chart patterns, are not there.

It is clear that many notable trend traders, such as John W. Henry, Tom Basso, Larry Hyte, Paul Mulvany, and David Druz, have consistently outperformed the market with their simple yet effective strategies. These traders have shown that you don’t need complexity to achieve substantial gains; rather, it’s about understanding the psychology of market trends and aligning your trading approach with them.

Famous Trend Followers in History:

Richard Donchian: Often considered one of the pioneers of contemporary trend following, Richard Donchian is known for developing the Donchian Channel, a technical indicator that helps traders identify and follow market trends. His work laid the foundation for many trend-following strategies used today.

Ed Seykota: a legendary trend follower, is famous for turning a $5,000 trading account into over $15 million in 12 years. His systematic approach to trading, which emphasized riding trends, became a hallmark of trend following. He was also one of the pioneers who used computer programs for backtesting his models (in fact using punch cards).

Michael Marcus: is renowned for turning an initial investment of $30,000 into over $80 million, primarily through trend following. His success showcases the potential for substantial returns when aligning with market trends.

Jerry Parker: known as one of the infamous “Turtle Traders,” Jerry Parker was part of a group of traders taught by Richard Dennis in the 1980s. His systematic approach to trend following and risk management led to impressive returns, further highlighting the effectiveness of the strategy, which remains intact to this very day through his fund Chesapeake Capital.

What are Trend Trading Crypto Strategies:

The traders above demonstrate that trend trading is not about predicting market movements but, instead, is about identifying and aligning with existing trends. It’s a strategy based on reacting to market realities rather than trying to forecast the future by using clear rules, employing risk management techniques, and sticking to their systems even in the face of adversity.

Several key elements characterize trend trading strategies:

- Identification of Trends: Trend traders focus on identifying existing market trends, whether they are uptrends or downtrends. They use technical indicators, long-term moving averages, or trendlines to recognize them.

- Riding the Momentum: Once a trend is identified, trend traders aim to ride the momentum by opening positions in the direction of the trend. They understand that markets have inertia, and trends can persist for extended periods. They then wait for that trend to end instead of taking profits early or trying to predict when the top may occur.

- Systematic Approach: Trend traders operate systematically, which means they have clear and objective rules for entry and exit, risk management, and position sizing. This reduces the role of discretion in decision-making. Relying on these predefined rules/strategies alleviates the cognitive biases raised in this article.

- Risk Management: Effective risk management is a core component of trend trading. This includes setting stop-loss orders, using trailing stops, managing position sizes, and diversifying the portfolio to minimize potential losses.

- Long-Term Perspective: Trend traders typically have a long-term perspective, allowing them to capture significant portions of a trend’s movement.

In essence, trend trading is about simplicity, discipline, and patience. It emphasizes the importance of aligning with market trends, irrespective of whether they are stocks, commodities, or cryptocurrencies. By focusing on this proven strategy with many verifiable track records to be shown, trend traders have consistently demonstrated that trading success can be achieved through this systematic and straightforward approach, which you can employ in cryptocurrency trading.

Back to Complexity Bias – Why “Simple” Trend Trading Techniques Succeed

The question arises: why do simple trend trading techniques succeed where complex techniques often fail? The answer lies in understanding the cognitive biases that plague traders, especially the complexity bias. Simple trend trading techniques emphasize clarity, ease of execution, and alignment with market realities. Furthermore, in their simplicity lies robustness leaning toward longevity that more complex or curve-fit strategies cannot attain. When prices break out to new highs, they show strength. Yet, almost all traders need help to conceptualize buying at these relatively high prices (anchoring bias), and therefore, the trading psychology of trend following can be difficult, which is another reason why it works.

In a world where information overload is the norm, especially on cryptocurrency social media platforms, trend following provides a clear, objective, robust, and systematic approach. It’s not about predicting the future but recognizing current trends and trading accordingly, i.e. it’s ‘reactive’, not ‘predictive’. This simplicity empowers traders to make decisions based on objective facts (i.e. the current price) rather than prediction, beliefs, news, or emotions, a crucial element for success in the volatile world of crypto trading.

In the pursuit of profitable crypto trading, the missing piece for many traders is internal emotional alignment and a systematic approach. The systematic, objective approach ensures that traders remain emotionally stable and do not act on their cognitive biases, and, as demonstrated via behavioural finance research, trend trading has proven to take advantage of those cognitive biases. Complexity bias and other cognitive biases often obstruct the path to success, leading traders down a convoluted route.

Beating Buy and Hold with Simple Trend Trading in Cryptocurrency

Circling back to the shared social media post perfectly exemplified the complexity bias and how it and other cognitive biases often hinder traders from achieving market success. Now, we will present you with statistical evidence showcasing why ‘Simple Works.’

We’ve already debunked the buy-and-hold strategy in previous articles, such as “The Two Biggest Mistakes Crypto Traders Make” and “20 Common Crypto Trading Myths Debunked.” We’ve also provided statistical evidence that Dollar Cost Averaging (DCA) is an unsuccessful methodology for crypto trading.

But what happens when we combine these two seemingly unconventional concepts into the simplest trend trading strategies? The results may surprise you. Even if you were one of the early adopters who purchased Bitcoin at less than $100 in 2014, this strategy can outperform the traditional ‘buy low, sell high’ philosophy.

The Simple Crypto Trading Strategy Rules:

Entry (Buy Signal):

Ensure the index is above 50 day exponential moving average (with Bitcoin serving as the proxy for the index) to ensure we trade in the direction of the primary trend.

Buy when the Close is at its highest ever.

Ensure that volatility does not exceed 20% (measured as ATR(4)/C).

Exit (Sell Signal):

Implement a 20% trailing stop loss.

Position Sizing:

Allocate 5% of your capital per position, with a maximum of 20 positions.

Test Data History:

We utilized Brave New Coin accumulated data dating back to 01/01/2014, including all known tokens, effectively eliminating any survivorship bias.

This system is incredibly straightforward, with only three entry rules and a single exit rule, making it one of the simplest strategies in the trading world. But can it be profitable? Many might argue that buying cryptocurrencies at all-time highs is a flawed strategy. After all, don’t we need to “buy low, sell high”?

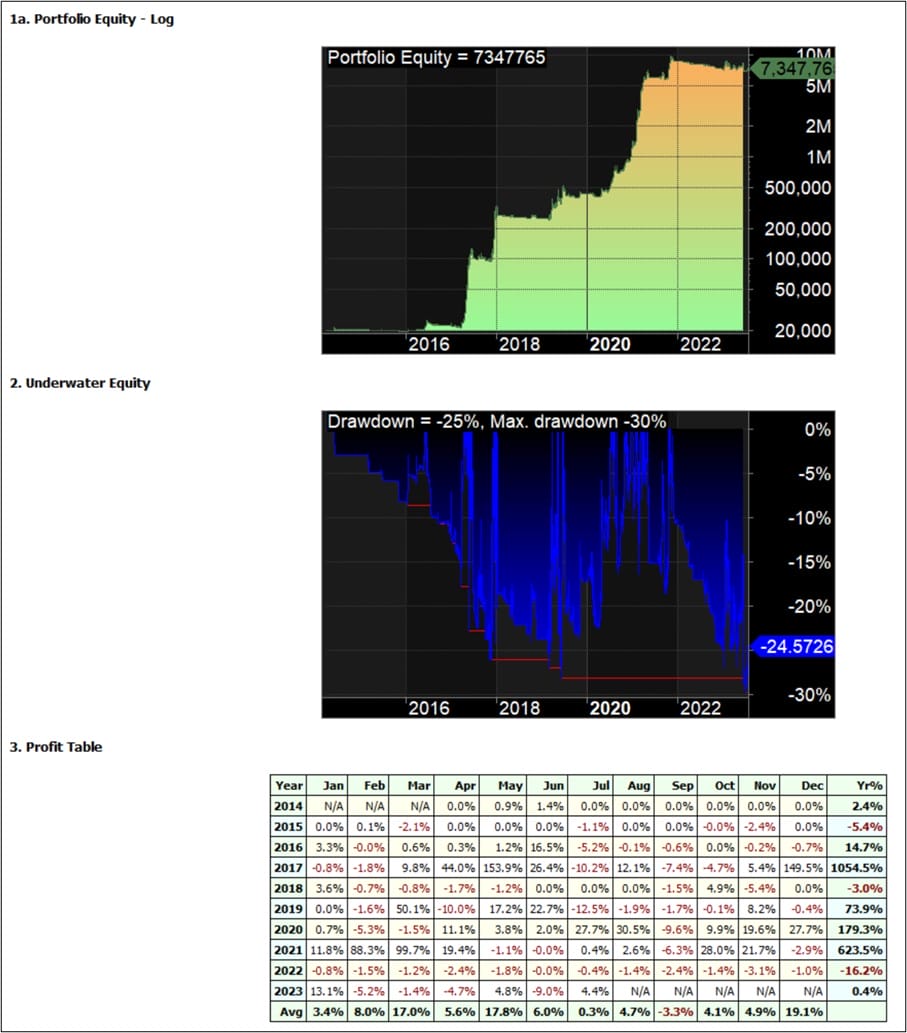

The Results:

Compound Annual Return (CAR): 88%

Risk-Adjusted Return (RAR): 330% (due to being in the market only 27% of the time)

Winning Percentage: 42.5%

Maximum System Drawdown: 29.80%

Based on a starting capital value of $20,000, your ending capital would be an impressive $7.34 million (excluding taxes). It’s worth noting that we factored in commissions at a rate of 0.25%, which is double the Binance trading fees.

Now, let’s compare these results to the buy-and-hold approach, assuming you held the dominant cryptocurrency, Bitcoin, as maximalists would recommend.

Buy and Hold Results:

Compound Annual Return (CAR): 55%

However, this approach would subject you to a maximum drawdown of 83% of your capital and enduring three other drawdowns of over 60%.

In simple terms, most investors find it incredibly challenging to weather such significant drawdowns, and they shouldn’t have to. The power of straightforward trend trading strategies is that they often outperform complex approaches.

Disclaimer: This example serves to demonstrate just how simple it can be to outperform buy and hold. However, we don’t recommend trading this strategy in its current form. Due to the cryptocurrency market’s volatility, consider implementing liquidity filters and additional safeguard exit rules.

In conclusion, after statistically demonstrating this elegantly effective strategy and sharing the rules and backtest results across three prominent cryptocurrency social media groups with a combined membership exceeding 300,000 individuals, you might wonder how many actively engaged in productive communication. The answer may surprise you: less than five. Why? The culprit is none other than complexity bias. Even when presented with solid evidence, many people struggle to accept that the answers can be this simple and that hidden secrets aren’t the key to success.

Debunking myths and overcoming cognitive biases and misconceptions about crypto is pivotal to unlocking genuine and substantial opportunities in trading cryptocurrencies the right way. Utilizing proven trading strategies that have been rigorously backtested across a broad spectrum of crypto tokens presents a significant opportunity in today’s market.

You can systematically make profits trading crypto, whether the market is rising or declining. A systematic trend trading approach is an excellent way to capture market movements and add diversification to your stock portfolio. Even if you’re not currently trading, venturing into the world of cryptocurrency with a systematic approach is a fantastic place to begin your trading journey or add diversification to your stock portfolio.

If you have more questions or concerns about cryptocurrency, please feel free to comment below, and I’ll be more than happy to assist you. If you’re ready to start trading cryptocurrencies profitably and consistently, consider joining The Crypto Success System, where a systematic approach is an absolute game-changer.