Trading in cryptocurrency markets is probably the best diversification step conservative stock traders can make. In this article I will explain why and how you can do it. In my last article I presented the Trader Acceleration Framework as a model to improve your trading. Shown below there are three areas you can focus on to quickly improve your trading. One of the most effective methods of improving your returns and reducing your risk is through diversification into different markets.

In my years of trading and working with traders, one of the most common observations I have seen that holds traders back are statements like “I trade Australian stocks”, “I trade US stocks” or “I trade ETFs”.

This type of statement holds you back because your self-concept as a trader is linked to the market you trade. The trouble with that is it limits your willingness to branch out into other markets to improve your results.

Another limiting label many traders give themselves is “I am a conservative trader”.

When I talk about cryptocurrency trading, I often hear traders say “I am conservative, so I don’t trade crypto because it is too… (volatile / risky / scary / you fill in the blank)”.

When I talk about cryptocurrency trading, I often hear traders say “I am conservative, so I don’t trade crypto because it is too… (volatile / risky / scary / you fill in the blank)”.

My goal in this article is to show you that even conservative stock traders should consider trading cryptocurrencies because the portfolio benefits of diversification into this relatively new market are immense… and to put you on the right path so you can do it safely.

Why stock traders need to diversify into other markets

Trading stocks systematically is a great way to build your wealth. The difficulty is that there is a high degree of internal correlation within the stock market. When the markets are strong this works in your favor and it is relatively easy to make money, provided you have a profitable trading system. However when the markets are falling this works against you.

Of course in a falling market you can trade stocks from the short side and make money, but many conservative stock traders are not comfortable short-selling due to the high levels of risk compared to the long side. So unless you are willing to sell stocks short, you are very much at the mercy of the broader market conditions.

Being reliant on a bull market in stocks to make money is a very risky scenario – bear markets can last several years putting a real drag on your ‘conservative’ long only trading results.

So what can you do about this whilst keeping the conservative stance in your portfolio?

One option is to diversify into international stocks, however bear markets in stocks are generally global in nature, so this won’t save your portfolio.

The best option is to look outside stocks into other, uncorrelated markets that you can trade in a low risk way and still profit handsomely. As you will discover in the rest of this article, trading cryptocurrency systematically just might fit the bill – giving you much needed diversification at lower risk than you thought.

Why conservative traders incorrectly avoid trading in Cryptocurrency markets

I have found that most conservative traders who have so far avoided crypto trading have similar arguments:

- “The crypto market is too volatile”

- “Government regulation could hurt the market”

- “I am worried about being scammed”

- “The market is too new and there is not enough data to make decisions”

- “I have missed the big moves – it is too late to get in now”

Fear and lack of knowledge is what drives each of these comments, so lets tackle them one at a time:

“The crypto market is too volatile”

While it is absolutely true that the cryptocurrency markets are generally more volatile than stocks, this in and of itself should absolutely not be a deterrent for conservative traders.

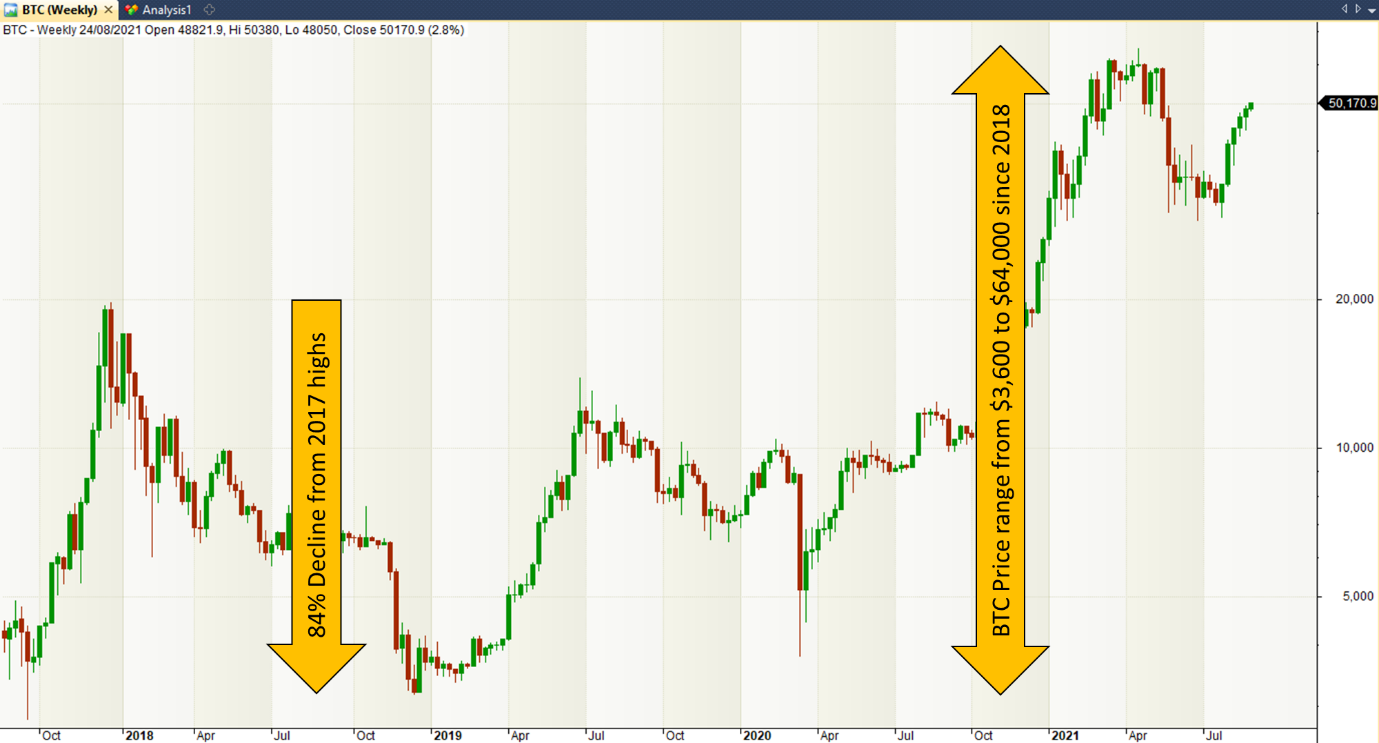

As shown in the weekly chart below, the price of Bitcoin has moved from a low of ~$US 3,100 in 2018 to a recent high of just over ~$US 64,800. Bear markets in Bitcoin are steep and fast, illustrated by the 84% decline from 2017 highs to 2018 lows.

With such wild fluctuations, I am sure you are wondering how I can say it is a great market for conservative traders. The key realization here is that this market is like the stock market amplified. The bull markets are bigger and faster, and the bear markets are shorter and deeper.

This means that the potential to profit is much higher than stocks, assuming you have a profitable trading system (which do exist for cryptocurrencies). This is where the conservatism comes in – you can trade cryptocurrencies with a very small allocation of capital compared to your stock portfolio and still have a significant impact on your overall portfolio simply because the price moves are so large.

My own cryptocurrency trend trading system for example generates returns that are an order of magnitude higher than my trend following system for stocks. That means that even if I only applied this system to 10% of my whole portfolio, it would make as much as the rest of the portfolio combined.

Trading a volatile market like cryptocurrencies with a profitable system and a small amount of capital is low risk. Even in the absolute worst case scenario, you don’t actually have that much money exposed to the market. This gives you the opportunity to dramatically enhance your portfolio returns using an uncorrelated market.

“Government regulation could hurt the market”

Government regulations have evolved rapidly in the cryptocurrency space. The biggest fear investors have is governments banning crypto assets. However, the market has now evolved to the point that this is unlikely, particularly since Bitcoin has been around since 2009. Most developed countries now have tax rulings in place governing how crypto transactions and investments are to be taxed. Crypto exchanges have implemented rigorous ‘know your customer’ processes to meet government regulations.

So while there is a chance of new regulation impacting the crypto market, the chance of a catastrophic regulatory change happening overnight is very low.

So how can the conservative trader mitigate this low risk?

Simply, by NOT adopting a blind ‘buy and hold’ investing strategy in crypto assets. A trading system that allows you to participate in the upside of the markets and goes to cash (real cash) during the down trends will keep you out of trouble if regulations start to hurt the cryptocurrency market. Buy and hold in this market is risky, but as a trader you probably know better than to blindly buy and hold anyway!

Also, allocating a small portion of your portfolio to crypto assets will mean that even a sudden unexpected shift won’t hurt you enough to worry about, and you can still participate in the upside and achieve excellent diversification.

“I am worried about being scammed”

It is true that there are a lot of crypto scams and a risk of theft. However, most of this is within your control. If you trade on a reputable exchange that is regulated in a major developed country you are unlikely to have problems unless your own internet security is poor.

But if your internet security is poor then even your bank account could be in trouble so you better get it fixed quick smart! There are several non-negotiable security measures that you should put in place to protect yourself:

- Only use a major regulated exchange with high volumes and a good reputation

- Withdrawal password on your account different to your login password

- Unique complex passwords

- 2 factor authentication

- Good quality, paid subscription to antivirus / anti-malware – do not rely on cheap / freeware

- Scan regularly for viruses / malware

- Don’t click on strange links or visit dubious websites & always validate sender email addresses

If you have these measures in place and you allocate a small amount of capital to crypto assets then the risk is certainly manageable.

“The market is too new and there is not enough data to make decisions”

The market is certainly new compared to stocks, and there are fewer tradeable assets than there are in stocks. The major crypto exchanges can have up to several hundred tradeable crypto assets compared to many thousands of listed stocks. So, there is definitely less data available than for stocks when it comes to backtesting our trading systems.

However, even though the market is just a few years old, it has already been through around 4 complete bull / bear cycles (depending on exactly how they are defined). This means there is enough data to develop a profitable trading system that profits hugely from the upside and keeps you out of trouble on the downside.

I have developed several crypto trading systems that work on daily bars and have been enormously successful. You just need to be careful to keep your trading rules simple (so you don’t curvefit them to the limited data you have) and tailor them to the way cryptocurrency prices move.

“I have missed the big moves – it is too late to get in now”

I have heard this from a lot of traders, fearing the best is behind us, they stand on the sidelines kicking rocks at a perfectly good tradeable market. Yes there have been massive moves in the last few years, but even in 2021 there have been large, very profitable price trends for traders with the right systematic approach to the crypto market.

Of course we would all like a time machine, but this market is still maturing, mainstream adoption and institutional money is only now starting to take off, so the amount of money that will flow into the cryptocurrency market over the next few years is likely to be significant.

All of this buying pressure should be extremely profitable for traders with a good system which rides the uptrends and stands aside in the down trends. In fact 2021 has been immensely profitable for my crypto trading systems and for my students!

No doubt there are other stories traders tell them selves to avoid entering this new market, but all of them can be mitigated, and none of them outweighs the vast potential.

How even conservative stock traders can benefit from trading in cryptocurrency markets

So, if you have been cautious about looking further into this market, hopefully you have now seen that many of the doubts can be mitigated with a few simple measures and capital allocation. One technique I have used with my students is to ask them how confident they are in dollar terms to start up a new system or enter a new market…

Ask yourself “How much money would you be comfortable to allocate to trading cryptocurrencies once you have a profitable trading system?” Even if it is only 5% of your total portfolio, the potential returns could certainly make that diversification worthwhile!

This would be similar to the Barbell investment strategy where you have a small amount of capital allocated to volatile assets and the majority in lower risk, stable assets. The outsized returns from the higher volatile assets helps the whole portfolio without putting very much of the portfolio at risk.

Next steps to get started

So if you are ready to seriously look into trading cryptocurrencies as part of your diversified portfolio, here is what you need to get started:

- Backtesting software like Amibroker and end of day data for cryptocurrencies

- Robust trading systems that will allow you to profit and keep you safe no matter what happens in the market

- Open an account with one of the largest, well regulated exchanges

- Allocate an amount of capital that keeps you comfortable while still being able to participate

Do NOT just open an account and start trading whatever ‘looks good’ or what people are talking about on social media – that is just gambling. Like all markets, you need a solid, backtested systematic approach.

The vast majority of crypto traders don’t have a systematic approach, so for those of us who do, it is relatively easy pickings due to the lack of sophistication of the majority of players

If you want help to get started trading cryptocurrencies the right way, join The Crypto Success System and we will have you up and running with a diversified portfolio of crypto trading systems in a matter of weeks.

About The Author:

Adrian Reid is the founder of Enlightened Stock Trading and co-creator of The Crypto Success System. He has over 18 years of trading experience and has been a profitable systematic trader for over 15 years. He trades for a living and spent most of 2019 traveling with his wife and two kids and trading from the road. He is the founder and trading coach at Enlightened Stock Trading where for the last 5 years he has been mentoring stock traders globally.

Your Next Step:

If you are ready to learn how to trade cryptocurrencies systematically, so you can avoid the emotion and trade with a diversified portfolio of proven crypto specific trading systems, your next step is to join the Crypto Success System. Click the link below to discover how you can become a profitable, systematic cryptocurrency trader in a matter of weeks!