Countless traders are out there scouring the internet to find the best indicators or signals hoping to achieve trading success. Unfortunately, even if they find a great indicator that gives reliable signals, that is only a very small part of the equation. In this article I will present a more holistic framework to accelerate your trading success. No matter how established you are as a trader this framework can help you improve and gain more momentum.

My goal with this framework is to help you build momentum in your trading towards high reward, low effort trading.

This is not a magic cure, but it is a complete framework to show you what you need to work on to achieve this attractive goal.

The Pathway To Trading Success

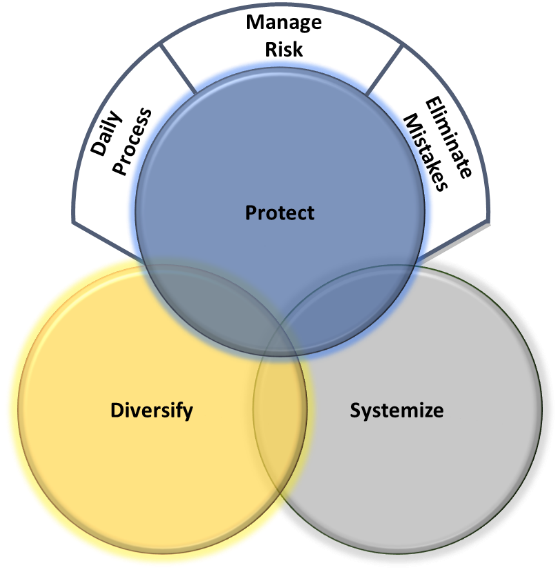

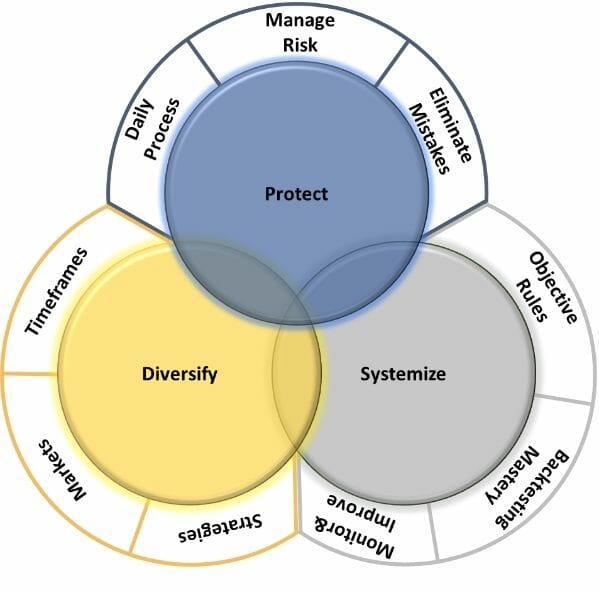

At a high level, as a trader who wants to achieve a high reward / low effort balance in your trading you need to do three things:

Protect: Firstly, you need to protect your capital to ensure that you don’t just take one step forward and two steps back. This is about more than just risk management as you will see shortly.

Systemize: Secondly, the key to making anything consistent is to systemize it. Motor vehicle factories don’t build cars a different way each time, they systemize their process so it is consistent, and you should too.

Diversify: Thirdly, is to diversify. Again, this is so much more than just holding 5 or 10 stocks in your portfolio. You need strategic diversification to get you the results you want.

Let’s look at what happens if you don’t have each of these components in place…

If you protect your account and systemize but fail to diversify properly, then you will have limited growth potential for your trading.

If you systemize your account and diversify but don’t protect your account, then you will have inconsistent results and likely blow up your account.

If you protect your account and diversify but don’t systemize, then you will end up in a high stress and effort situation which will be difficult to maintain.

However, if you do get all three components in place correctly your trading will generate much higher rewards with less effort than what you are probably experiencing now.

How to implement this framework and achieve high reward, low effort trading

At a high level the framework will probably be self-evident to most traders with at least some experience in the markets. What is less obvious is how can you go beyond the superficial high level and implement this into your trading to make a real difference?

As shown in the next diagram below, there are a total of 9 trading accelerators that when implemented help to accelerate your trading success. Three for each of Protect / Systemize / Grow.

In future articles I will dive into these areas in more detail, however I will summarize each here so that you can start building momentum now.

Trading Accelerators To Protect Your Account

The first step to protect your account is to have a consistent Daily Process to follow. Airline pilots don’t just jump into the cockpit and start flying, they go through their pre-flight checklists to make sure everything is in order. Trading is the same – you want to follow the same process each time so you have consistency and don’t miss anything.

The second step is to Manage Risk so that nothing can cause you to blow up your account. There is zero point making $1million dollars this year if you lose it all next year! Risk management is about more than risking 2% on each trade (and even that is too much risk by the way). You need to think about your normal trade risk, your stock specific catastrophic risk and your market catastrophic risk and manage your risk at those three levels. That way no one trade or market event can wipe you out.

The third step is to Eliminate Mistakes. The challenge here is that you probably have little or no visibility of the mistakes you are making, otherwise you would stop making them! I developed a trading mistakes cheat sheet that you can download to help with this (see end of the article for details). Eliminating trading mistakes is a constant process of identification and elimination. Dr Van Tharp defines a trading mistake as anything that is not consistent with your trading plan… so most traders are probably making a huge number of mistakes!

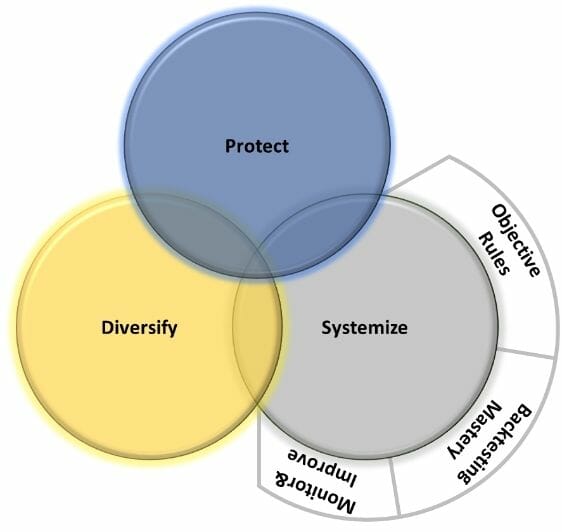

Trading Accelerators To Systemize Your Account

To systemize your trading you need to first create a set of Objective Rules. This is important because any subjectivity in your trading rules will lead to inconsistency and more mistakes. You need to follow the rules consistently so that you can measure and improve your performance.

Once you have objective rules, the next step is to develop Backtesting Mastery. This will tell you whether your rules are truly profitable and how stable and consistent the edge is over time. The beauty of backtesting is that it shows you what you might expect from your trading rules. Without backtesting your trading rules you are trading on blind faith, just hoping that you are going to make money. At the risk of sounding cliché, hope is not a strategy! Learn how to backtest your rules so that you can be sure they are genuinely profitable.

Finally, once you have objective, backtested rules in place, it is time to Monitor & Improve the rules. Done correctly, this will give you a constant stream of improvement ideas to test, as well as advance warning if something starts to go wrong so you can take action before it is too late.

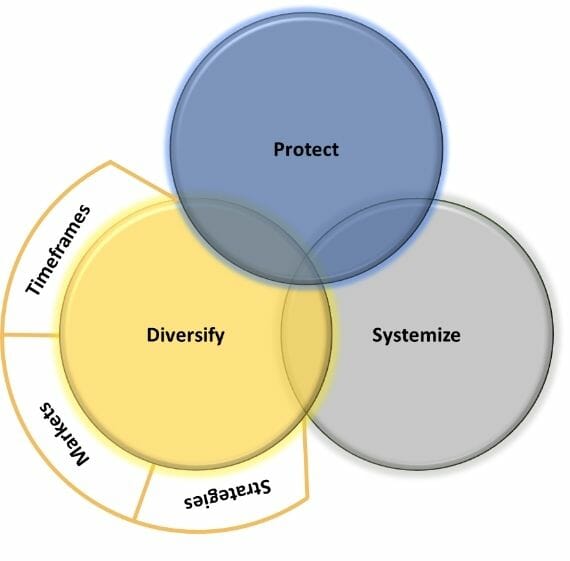

Trading Accelerators To Diversify Your Account

Now that you have protected and systemized your account, your next task is to diversify. This will allow you to make money in many different market conditions and protect yourself from shifts in the markets which could otherwise wipe you out.

The first step in diversification is to implement multiple Strategies. If you have a single trend following system then you will make money in a strong bull market, but you will lose money in a volatile / sideways / bear market. Implementing multiple strategies gives you a chance to make money in more market conditions.

The second step to diversify your account is to diversify Markets. Too many traders stick to their home stock market. The result is they are at the mercy of that one market’s behavior. If you trade multiple markets and asset classes then your account is less subject to the whims of any one market. This means you can make money more of the time if you trade more markets!

The final step in diversification is to trade multiple different Timeframes. I see many traders say things like “I trade the 4 hour chart” or I trade the “30 minute chart”. There is a huge benefit in timeframe diversification – a combination of hourly / daily / weekly systems will be better and more consistent than sticking to a single timeframe.

Conclusion

Every trader has the ability to improve by using the PSD Trader Acceleration Model (©Enlightened Stock Trading) to Protect, Systemize and Diversify their portfolios.

Even accomplished traders will find opportunities to increase returns and reduce the time / effort / stress they experience by digging more deeply into each of the 9 trading accelerators in the PSD Model.

So, if you want to accelerate your trading, start with this model and using the order I outlined in this article, rate your current performance on each of the 9 trading accelerators. This will show you where you need to focus to accelerate your trading!

This article first appeared in Your Trading Edge Magazine. To learn how to become a successful systematic trader, enter you name and email in the box below to get access to the 10 commandments of profitable trading and free video training.

Share This

Share this post with your friends!