Fair warning, this is a long post, but it is critical information for your trading health in this new bear market and it is absolutely worth your time to read it!

It is Adrian here, and as I write this (19th March 2020) we are in the middle of the Corona virus / Oil Price Crash induced bear market. Now I promise that is the last time I will mention the virus because if you are anything like me your inbox and social media are packed full of that hysteria.

Instead, I want to focus on how you can position your trading and your trading systems to make the most of the current market conditions. The first step is to see things exactly as they are, not better than they are with excess optimism, and not worse than they are.

Image: S&P500 Index as at 18 March 2020

People who are seeing things better than they are right now will be saying something like:“This is way overdone and all of these stocks down 30-50% are an absolute bargain… I will make a killing when these recover over the next few weeks so I have to buy now!”

People who are seeing things worse than they are will be saying something like:“This is going to be the next great depression, stocks are going down another 50% from here and I better short everything because this is going to collapse real soon!”

Contrast this with the stock trader who sees things exactly as they are who says something like:“The S&P500 index is now down 32% from its highest point in the bull market and volatility is at an all time high. My account is in a 25% drawdown and my long exposure is 15% and my short exposure is 30% or my account.”

As traders we have to start with the current FACTS in a calm and emotionless way. With so many people running around in a bear market losing their head, only the calm can survive and profit!

No matter how clever we are as traders, we can’t predict the future. All we can do is position ourselves for likely outcomes and then respond to what the market does. No matter how high our conviction is we can never be 100% certain what outcome we will end up with. Because of this the best way to think through market turmoil is using scenarios.

In The Trader Success System I use a great framework called the Market System Map to think through the possible market scenarios. Here it is summarised into a single image:

The Market System Map © 2020 Enlightened Stock Trading

According to The Market System Map, there are 9 behaviours the market can exhibit… no matter how crazy the world seems or what is happening in our account, there are only 9 possible behaviours.

As a trader, I find this simple realisation very calming and empowering because it means we don’t have to anticipate what crazy things are going to happen out there in the real world… all we need to do is prepare for the market behaviours that occur as a result.

So where are we and what can happen?

Well it is safe to say we are in a Bear Market.

This means that there are 3 possible scenarios from here:

- The bear market continues and prices fall further

- There’s a shock against the bear market which then continues

- The trend can change to either:

- A sideways, probably volatile trend

- The trend reverses and we have a rapid recovery

Now depending on what you believe, each of these scenarios has a different probability of occurring. However we just don’t know which will happen next.

AS TRADERS WE MUST BE PREPARED FOR ANY OF THESE POSSIBLE OUTCOMES

In The Trader Success System one of the things you learn is how to create a portfolio of trading systems that will profit from many different market behaviours like the scenarios above.

The more market behaviours you can profit from the less it matters what the market actually does!

So how do you profit from each of these scenarios?

What can you actually do?

It is OK to go to cash and wait till things calm down!

If you have never sold stocks short, never traded options, bought / sold futures then it is probably not sensible to start now unless you have a solid backtested trading system to guide you.

The most important message I can give you is don’t take any knee-jerk reactions.

Calm. Considered. Systematic actions are best for this type of market… or to simply stand aside.

Assuming you want to trade, how can you profit from each of these scenarios:

Scenario 1:

The bear market continues and prices fall further

If the bear market continues and you want to trade profitably then you need a trading system that shorts individual stocks or ETFs.

When shorting individual stocks or standard long side ETFs a good system usually enters short after a small rally in anticipation of the down trend continuing… this sort of system should typically have a wide stop loss because bear market rallies can be quite steep.

These systems can exit with either a profit target or a trailing stop. Despite the fact that bear markets are quite steep trailing stops usually don’t work that well and I usually combine them with a profit taking exit which covers my short when the position has quickly moved in my favour. This is important because the next rally (remember, they are steep and fast) could wipe out all your profits and hit your stop leaving you with a big loss.

Risk management on these systems is critical, particularly if you are shorting individual stocks. Apart from the usual risks that a position can go against you, as the bear market continues there is an increasing risk that cashed up companies go bargain hunting and if you are short a stock that receives a takeover offer that can be very painful financially. In 2008 I had this happen and lost 200% on my position and there was nothing I could do about it.

This means you need to make your positions SMALL!

I would say any single short should definitely be less than 5% of your equity because then if it goes wrong it can’t hurt you that much. There is also a big risk of overnight gaps (up and down) in these markets because things are changing so quickly as the global situation unfolds (I promised I would not mention the virus again)

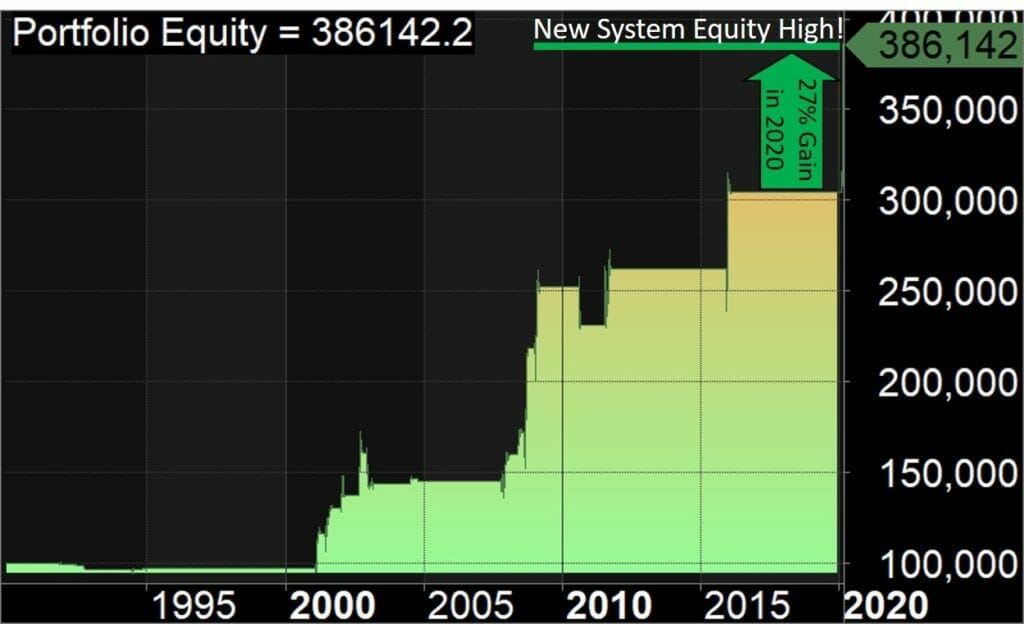

A great example of a trading system like this is The Slippery Dip which is included in The Trader Success System. Below is the backtested equity curve using rules which were developed and optimised more than a year ago.

It is a little hard to see because it happened so quickly, but at the far right of the chart, the equity jumps from just over $300K to $386K in a single month (that is now!)

The system actually returned 26.9% in March… so it is one of my favourites right now 😉

Backtested equity curve of The Slippery Dip short trading system to March 18 2020

Of course the past performance is no guarantee of future profits, so you should remember there is a risk of loss and conditions can change. I just share this with you to show you the power of a well designed short-selling system in a market like this!

Another way to profit from a down market like this is to use a trading system that buys instruments that are negatively correlated to the stock market index. These could be things like inverse ETFs, Bond ETFs, Stocks that are benefiting from the current global environment.

While most stocks move broadly in line with the index, there are a small number of stocks or instruments that move in the opposite direction. You can profit from a system that identifies stocks like this and buys them when they are rallying as the stock index falls.

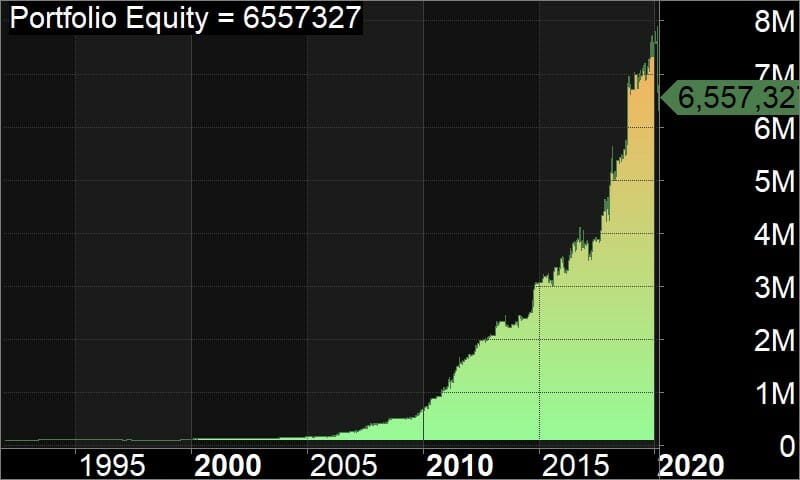

I do everything systematically, so I have created a complete stock trading system that does exactly this. It is called the Bear Defiance system and it is also part of The Trader Success System. The concept is to look for instruments that are actually negatively correlated (as opposed to those you think SHOULD be negatively correlated) and buy those and hold them while the index is declining.

This last point is important because many people cling to beliefs that may not be true in all cases. One such belief is that gold is a good hedge when the market is panicking so in a bear market buy gold and gold stocks… but as the chart below shows, the spot gold price has fallen a lot since this whole thing started. So if you had bought gold assuming it would be a good hedge, you would be disappointed!

Traditional hedges don’t always work – The gold price has fallen in line with the stock market over the last few weeks!

So a system like this needs to check for current and historical correlation and only buy instruments which have this negative correlation in tact.

The bear defiance system does exactly this, but it has not yet kicked in because it is designed for long term bear markets (this one has only been going a couple of weeks).

If the decline continues, then it will start up and has the potential to make good profits in this environment.

The critical message I need you to hear is that if you trade on the short side, do not put all of your capital at risk because things change quickly and if you run into a strong market rally then you could dig yourself an even bigger hole… but the profit potential is definitely there if the market continues to fall.

Scenario 2:

There is a shock against the bear market trend and then the bear continues

The next scenario is that there is a shock against the trend before the trend continues. This would look like a big rally which could come on the back of some very positive announcements that get the markets all optimistic again.

HOWEVER, this is a very dangerous situation if the bear market remains in tact because as you have seen, the down swings in a bear market are incredibly fast and viscous… so if you buy to profit from the rally and don’t get out in time your positions will get crushed.

So how can you profit from a big rally in a bear market?

If you are still holding some long side positions that are discretionary then a big rally could probably be a good time to lighten / close them down to protect your portfolio from the next down leg. Yes if you are wrong and the trend actually changes to a new bull market (unlikely) you may miss out on some upside, but you need to really ask yourself what is more important for you right now – protecting from further downside OR catching all possible upside IF the trend reverses.

If you are a systematic trader (and still have faith in your system, it is behaving correctly and has not failed because of the high volatility) then you would just continue to follow the system rules ad exit when you get an exit.

If you have a long side trend following system and you still have some exposure then these positions will benefit from the rally and you may be able to exit them at a better price. If you have a mean reversion system on the long side, then the rally will give you your profit taking exits.

When you get exit signals on your long side mean reversion system in a bear market, make sure you take them as soon as they are signalled, because any profits can rapidly evaporate as the rally fails and markets collapse to new lows.

As the bear market progresses, your long side stock trading systems should close out all of their positions (if they haven’t already) and so this becomes less of a concern.

Personally I don’t like the idea of buying bear market rallies in a discretionary manner because they are really hard to time and the chances of you catching a falling knife are high. If your mean reversion system does it that is ok… but keep your position size and total system exposure small as a total percent of your account.

Just remember though that this scenario might not happen, so if you are holding on hoping for a rally just remember it could get worse before there is a real rally… hope is not a stock trading strategy.

SO either you still have faith in your long side system and you are going to follow the rules, or the system has broken the max historical drawdown by a wide margin and you are have decided to liquidate and go to cash and wait… only you can make that choice but whatever you do, caution and low risk are the order of the day.

If you decided to halt a trading system that is in a drawdown then you stop the pain, but stand by that decision with conviction… don’t spend the next 3 weeks watching your old positions with a mixture of pain / regret / remorse / guilt / relief.

I have said it to many of my students and others – there is no shame in going to cash if the market is behaving crazy and your systems are more volatile than you are comfortable with.

LIVE TO TRADE ANOTHER DAY

The most important message for bear market trading

If you are going to suspend a trading system or close discretionary trades that are not performing the way you expect under the current market conditions then do it and move onto the debrief and investigation about how to make it better for the future.

When the shock against the bear market (ie. The step, sharp FOMO inspiring rally) fails and rolls over, your short system (for example The Slippery Dip) should kick in and make you money on the next down leg.

Scenario 3a:

The trend changes to a sideways, probably volatile trend

The next possible scenario is that the down trend stops and converts to a volatile sideways ranging market. This could happen as the market digests everything that happens and discounts a series of positive and negative events / announcements over the coming months that essentially net each other out.

In a sideways volatile ranging market like this a mean reversion system can make you some good profits. Ideally the mean reversion trading system that you use should trade long and short because this will protect you if the market decides to pick direction and trend for a while. However, if it is just a long side system then keep your position size and overall exposure low.

Mean reversion is a fantastic trading strategy when it works, because it gives you great profits very quickly, and you get to close trades at a profit after just a couple of days… this starts to make you feel like a super trader after a while, but please don’t believe your own hype. The downside with mean reversion systems is that if the market takes off in a trend in the opposite direction then you will find yourself in a drawdown.

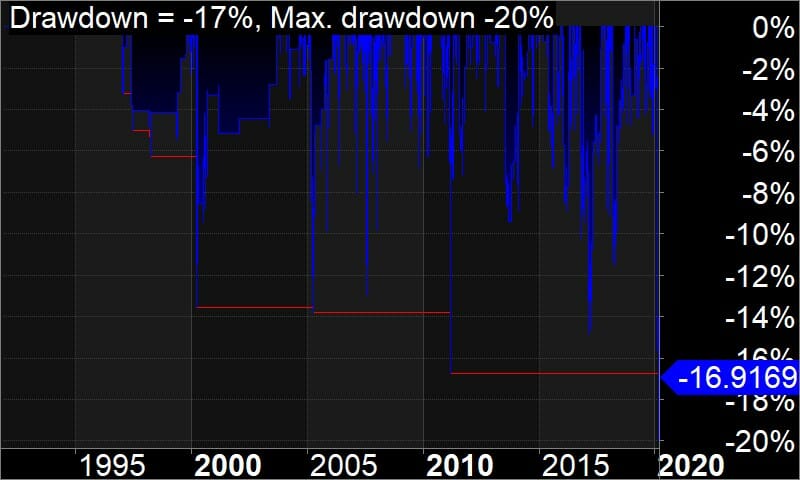

Here is the equity curve of one of my long only mean reversion systems:

As you can see the curve is extremely smooth, but it does hide a pretty rapid drawdown that I am in with this system at the moment. You can see the drawdown on this underwater equity chart below.

This drawdown is bigger than the previous maximum historical drawdown, but I have not suspended the system because it has done pretty well considering how suddenly the market collapsed, and it has very little exposure in the market right now.

If the market does turn into a sideways volatile market then this system will continue to profit… if the market continues down then it will likely not generate any more long signals because the trend filter will keep the system mostly in cash.

Mean reversion trading systems often perform better without stop losses. This means that if the market turns down then your trades can move a long way against you. There are several ways to counter this which your mean reversion systems should include (just like the ones in The Trader Success System):

- Limit the total exposure you allow your mean reversion trading system to take to a small percentage of your total trading capital. For example I only give mine up to 30% of total capital… even this may be too high so consider a 15-30% allocation for example depending on what other stock trading systems you have in your portfolio.

- Ensure your position size is small. For mean reversion I like to use Percent of Equity position sizing so all positions have the same exposure. That way I don’t get hurt by a large position that craters from bad news. I can’t stress enough how important small position sizes are in volatile markets like this! They are easier to exit, they won’t hurt you as much if there is an extreme move and you will sleep better at night.

- Ensure your system will close losing positions eventually. As I said above, many mean reversion systems don’t have stop losses. This actually helps performance in the long run… This is a bit hard to believe because we all get the importance of stop losses drummed into us from early in our trading career, now Adrian is telling me mean reversion systems are better without stops…WHAT?!?

The reason mean reversion stock trading systems work is that they buy on extreme fear and then sell after the rally. You are buying in the middle of the fear, so chances are the stock will fall further after you buy while you are waiting for the rebound… if you have a stop that gets hit then you won’t be there for the rebound.

But you have to stop the bleeding eventually… else you could end up in a world of hurt! That is why in my mean reversion trading systems I include a time stop to close out all trades that have not triggered an exit after a certain number of days. This will stop the losses eventually because if the it hasn’t reverted to the mean in a few days it is not going to, so you should get to safety

This is exactly what the mean reversion systems in The Trader Success System do!

Yes they might be in a drawdown right now because we are in a bear market, so everything on the long side is in a drawdown (yep – sorry to say this is all just part of the game).

But if the market turns into a sideways volatile market then these systems should start making money for you again.

Scenario 3b:

The trend reverses and we have a rapid recovery

The final scenario is the fairy tale… we all wake up from this bloody nightmare and realise that social media has whipped the whole world into hysteria and the market has crashed for no good reason

Hey… I guess it is possible right. But I do think this is unlikely.

If the market does decide to bottom and recover then you have a lot of ways you can profit, but my favourite way to profit from a new bull market is to buy stocks that are leading the recovery using a specially designed trend following system.

In The Trader Success System I have included a trend following system called “Lift-Off” which is designed to do exactly this.

As soon as there is some evidence that the market has started to rally in a sustainable way, the Lift-Off stock trading system buys the strongest stocks that are leading the recovery and holds them while they continue to trend upwards.

The important thing here is to enter the market after there is some evidence of a SUSTAINABLE change in trend. I would suggest it is probably unwise and risky to buy stocks while the market is falling or even in a small rally… but after the indices have moved above some key levels and stayed there you can start to go long stocks that have started trending.

Again I would suggest you don’t allocate 100% of your capital to a trading system like this because if the change in trend fails you don’t want to be fully invested on the long side!

Conclusion

There are ways to profit systematically no matter what the market is doing. In a bear market it can be more difficult because the volatility is higher, we can be suffering from large drawdowns as our long positions fall and it is a much more stressful experience than trading in a bull market.

HOWEVER, as you have seen above there is a lot you can do!

If you want to take this further and really develop your systematic trading skills, learn to backtest systems and make money in all different market conditions with backtested trading systems then click here to find out more about The Trader Success System.

I have mentioned just a few of the 18 different stock trading systems you get in The Trader Success System.

A solid, diversified portfolio of trading systems really helps you survive markets like this, but that alone is not enough…

… you need the knowledge to understand yourself as a trader and match every aspect of your trading plan to your personality, objectives and lifestyle

… you need to build unshakeable confidence in your trading systems by rigorously backtesting them using a proven process

… you also need the ability to manage your risk and ensure so you remain afloat no matter what happens in the markets

… you need the tools and community of successful systematic traders to support you on your journey.

I would love to help you on your trading journey in these volatile times!

Safe Trading

Adrian Reid

Founder – Enlightened Stock Trading

Share This

Share this post with your friends!