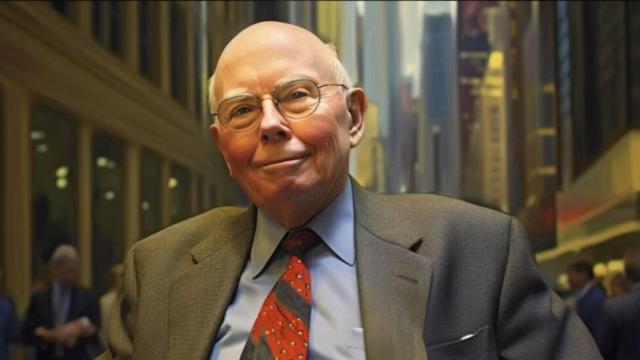

Introduction to Charlie Munger

Charlie Munger is not just an investor; he’s a profound thinker whose sharp wit and robust investment philosophy have profoundly shaped the investment landscape. Best known as Warren Buffett’s right-hand man at Berkshire Hathaway, Munger’s approach—emphasizing the importance of mental models and a multidisciplinary framework—has made him a legendary figure in the investing world.

Brief Bio of Charlie Munger

Born on January 1, 1924, in Omaha, Nebraska, Charles Thomas Munger is a revered investor, businessman, and philanthropist. He studied mathematics at the University of Michigan before attending Harvard Law School, where he graduated magna cum laude with a J.D. Munger’s professional life spans law, real estate, and investments, culminating in his role as vice chairman of Berkshire Hathaway, where he has served since 1978. Charlie died November 28, 2023.

- Twitter Profile: Charlie Munger

Education

Charlie Munger completed his undergraduate studies at the University of Michigan and later graduated from Harvard Law School with a Juris Doctor degree.

Quotes by Charlie Munger

Books by Charlie Munger

Charlie Munger, the longtime partner of Warren Buffett at Berkshire Hathaway, is highly respected for his wisdom and investment philosophy. While he hasn’t authored many books himself, his thoughts and philosophies are well-documented in a few key publications. Here are some essential books by and about Charlie Munger that you can explore:

These books provide not just a look into Charlie Munger’s investment strategies but also his broader thinking, making them valuable for anyone interest

Trading History

Munger’s investment career began in earnest when he founded and managed the investment partnership Wheeler, Munger, and Company from 1962 to 1975, achieving substantial returns. His partnership with Warren Buffett at Berkshire Hathaway has been marked by significant acquisitions and investments that reflect a deep commitment to value investing.

Trading Strategy

Charlie Munger is well-known for his deep association with Warren Buffett and Berkshire Hathaway, bringing to the table a unique investment philosophy that has significantly influenced modern investment thinking. Munger’s strategies, while intertwined with Buffett’s, showcase his distinct approach to investing. Here’s a closer look at his investment strategies, risk management practices, and adaptability:

Investment Strategy

- Value Investing: At the core, Munger is a value investor who seeks to buy securities at prices significantly below their intrinsic value. He focuses on companies that have understandable business models, a durable competitive advantage, and competent management.

- Quality over Quantity: Unlike some investors who diversify broadly, Munger prefers a concentrated portfolio. He believes in the philosophy of “putting all your eggs in one basket and watching that basket closely,” implying a deep understanding and confidence in the few investments he makes.

- Long-Term Hold: Munger advocates for a long-term investment horizon. He believes that the best returns are achieved by holding onto investments for extended periods, allowing the companies to grow and compound their successes.

Risk Management Practices

- Intrinsic Value and Margin of Safety: Munger emphasizes the concept of “margin of safety”, which involves buying securities when there is a substantial difference between the price and the intrinsic value. This gap provides a buffer that helps protect against downside risks.

- Avoiding Leverage: Munger warns against the use of significant leverage. He believes that while leverage can amplify gains, it also increases the potential for catastrophic losses, particularly during market downturns.

- Circle of Competence: Munger, along with Buffett, often stresses the importance of operating within one’s circle of competence. By investing in businesses that they thoroughly understand, they minimize the risk of surprises related to business fundamentals.

Adaptation to Changing Market Conditions

- Economic Moats: Munger looks for companies with strong economic moats (a term he helped popularize). These are competitive advantages that are sustainable and protect the company from the erosive effects of competition, which is crucial in changing market environments.

- Skeptical of Market Trends: Munger is known for his skepticism regarding market trends and fads. His strategy involves sticking to the fundamentals of investing rather than getting swayed by market euphoria or panic.

- Learning and Adapting: While Munger has a set of core principles, he is also open to learning and adapting. He has incorporated ideas from various disciplines into his investment philosophy, such as psychology, to better understand market behavior and biases.

Notable Achievements

- Instrumental in guiding Berkshire Hathaway’s investment strategy, leading to multibillion-dollar investments in companies like Coca-Cola, Apple, and See’s Candies.

- Known for his philanthropic efforts, Munger has donated millions to universities and schools, promoting physics and the liberal arts.

Personal Insights

Munger is an avid reader and thinker, known for his quick wit and often acerbic commentary on investment trends and economics. He believes in the value of multi-disciplinary learning and has a keen interest in physics, biology, and psychology.

Philosophy and Values

Munger’s investment philosophy can be summarized as rigorous discipline, patience, and a strong ethical compass. He believes in the value of lifelong learning and has a profound respect for the laws of economics and business.

Impact and Legacy

Charlie Munger’s impact on the world of investing is immense. His emphasis on mental models and a multidisciplinary approach to investment has influenced countless investors. His speeches and talks are often quoted for wisdom and insight into the nature of business and investing.

Interview with Charlie Munger:

Watch Legendary Investor Charlie Munger’s Final Interview With CNBC

Charlie Munger’s advice on investing and life choices that make a person wealthy

Warren Buffett & Charlie Munger: 100 Years of Financial Wisdom in 4 Hour – Investing/Market Analysis

Note: All information sourced from public domain websites on a best efforts basis. For any corrections, additions, or to request this profile be removed please contact [[email protected]](mailto:[email protected]).

Detailed Profiles of Famous Traders & Famous Investors

Click here to find a complete list of the famous traders and famous investors we have profiled. This is a valuable resource of trading wisdom and inspiration for all traders showing what is possible in this industry.