Welcome to my weekly market update… It is a big read this week, but I promise it is worth it. I am sharing lots of really interesting insights about what is happening with market correlations, which strategies are working, and I even want to share the realisation that I buried one of my trading strategies alive a few years ago… but I just dug it up and realized I made a terrible mistake.

Keep reading to hear all about it…

I am putting my Trading Tip of the Week first this week because it is so important, and more and more conversations I am having with traders are reflecting the same issues.

Trading Tip of the Week

I am hearing from more and more traders who are disillusioned, frustrated, or on the verge of giving up recently. This is not surprising because, to be honest, the stock markets have been pretty tough lately.

I am hearing more and more traders say things like, “I need to see a new equity high”, “It would be nice to make some money for a change”, or “I am just not sure trading is worth the effort with the markets the way they are”. These are all signs that many are being worn down by the indecisive and now negative market action, and they are getting disillusioned with the game.

This all comes from our conditioning in other areas of life that tell us if we put in the work, we should get paid. We are following the rules of our trading system; we should be making money. When the market does not deliver to these expectations, we get frustrated and disillusioned and start wondering if we are doing the right things.

The trouble is trading your own capital is not a job, and it is not like anything else we do in life. The markets constantly test us, attempt to shake us out and change over time – testing our resolve and confidence.

THIS IS WHY TRADING IS HARD, AND SO FEW ULTIMATELY MAKE IT!

The challenge for traders is the reward for our efforts does not come immediately as a result of our actions. This is because the markets will do what they will do, and our trading systems will respond to those conditions… but they will not make money in every market condition… sometimes they experience drawdown, volatility, and whipsaws… this is all normal, but it is frustrating as hell if you fight it or resist the reality that your daily trading efforts are not immediately and directly connected to your trading activity!

So how do you get past this?

After more than 20 years in the markets (and having been through several challenging times in my own trading), I find that the best way to deal with this is twofold:

1) Change Your Method of Scoring the Game

Most traders evaluate their performance by looking at their account balance – “I made money today, so I am a good trader” or, “I lost money today, so I am a bad trader”. This is a destructive way to evaluate your trading because the markets will wear you down and spit you out if all you do is think about the money.

A much more empowering way to evaluate your trading is to ask yourself, “Did I follow my rules today?” If you did, you traded well. If you lost money and still followed your rules, even better!

If you have a positive expectancy trading system (or better yet, a portfolio of diversified positive expectancy systems traded with defined capital allocations and tight risk control… automated to remove as much emotion as possible), then it is only a matter of time before your account balance reflects the fact that you followed your rules.

The kicker is that you may have to wait longer than you would like for your account to reflect the fact that you are trading well… That is the market testing you!

If you don’t currently have a portfolio of diversified positive expectancy systems traded with defined capital allocations and tight risk control, which are automated to remove as much emotion as possible, then maybe it is time you bit the bullet and joined The Trader Success System so you can finally get your trading on the path to success.

The moment I stopped thinking of my account balance as the measure of my trading performance, I felt an immense release from the stress of trading, and I started to just focus on executing well.

2) Get Curious About What is Happening

One of the most powerful psychological traits traders can have is curiosity. When something happens like a tough market, I suggest you use it as a trigger to get more curious… do more research… look at more charts… backtest more ideas… investigate what is happening.

I have had some of my best trading ideas when the markets have been tough, and this year is no exception!

Dig in and learn, research, read, speak with other traders and find things that are working. Find the gaps in your portfolio of systems and close them.

Curiosity is powerful – turn your frustration into curiosity and watch how your mindset, anxiety and level of patience improve.

To wrap up this week’s trading tip, I want to leave you with this one thought…

Good times create weak traders… hard times create strong traders

If you can just stay in the game, learn the lessons, and keep your account (and your dreams) alive, then your future self will be a dramatically stronger trader as a result of the difficult times.

Hang in there – It is worth it!!!

The Markets I Watch Closely

Let’s have a look at the markets and what has been happening in the markets this week…

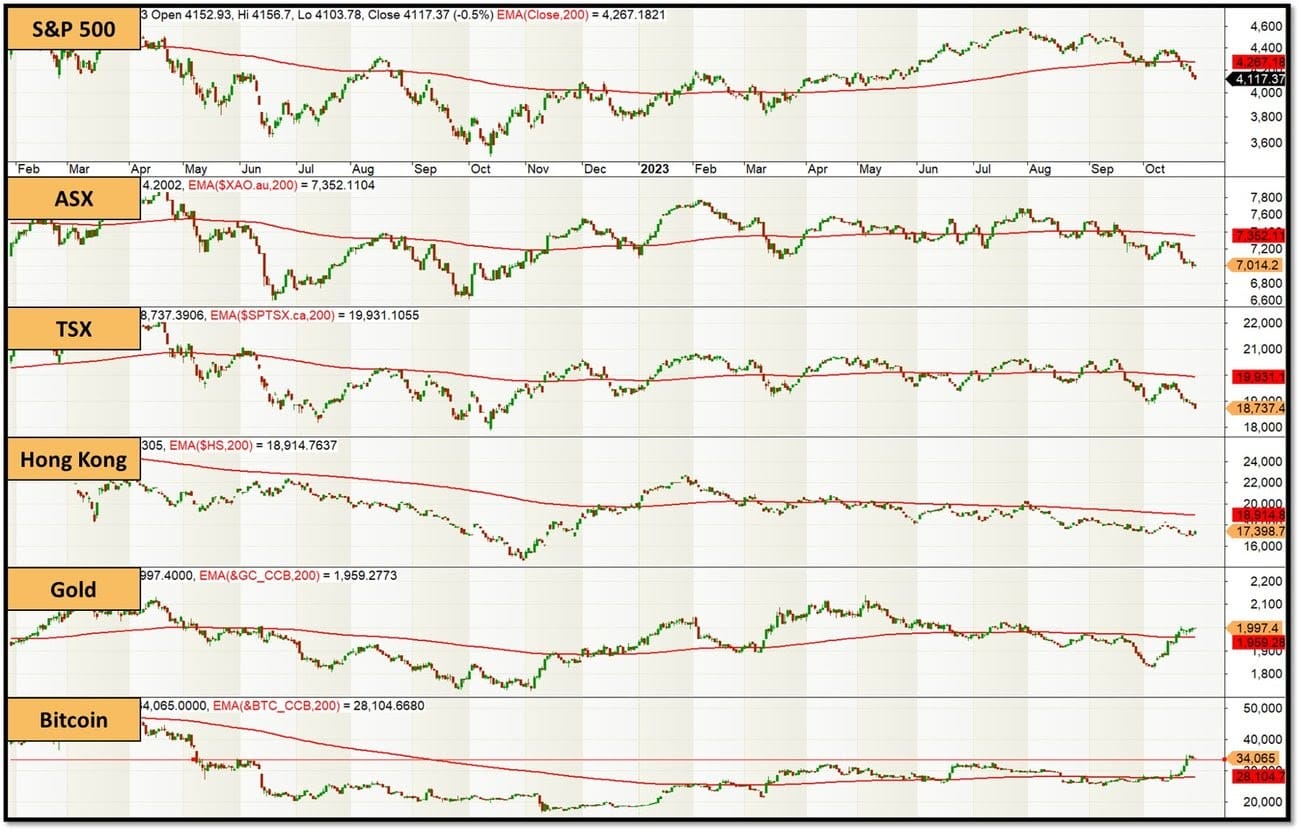

As you can see in the chart above, US, Canadian, ASX and Hong Kong stocks have all been weak over the last week – stocks tend to be highly correlated in a downtrend (more on this shortly), and most of the stock markets globally have been falling.

Both Gold and Bitcoin have been showing some strength, and you could be forgiven for thinking that Crypto may have found a bottom. However, in the wise words of EST Coach Adam, “I am lucky I don’t have to predict the market or try to determine whether crypto has bottomed – I just follow my systems”. This is exactly what we are about in EST. There is a lot of fear and emotion in Crypto… if you want to quickly rise about all of that emotion and learn how to safely stay in the game long term and trade crypto consistently well, then join this…

In my last update, I spoke about how the S&P rally had failed and to expect a significant down move if the price crossed below the 200 day EMA… this has happened. Unfortunately, my main short side system for US stocks enters on a failed rally BELOW the long-term moving average… so it is still in cash – GRRR… hang on… (*channels curiosity*)… I wonder if this system can be improved… See, my trading tip of the week really works!

Here though, is the perfect case for global diversification! Look at the chart of the Hong Kong market – it has been in a downtrend for much longer than the US Market, and so my short stock system in Hong Kong is already nicely positioned in case the markets really dump.

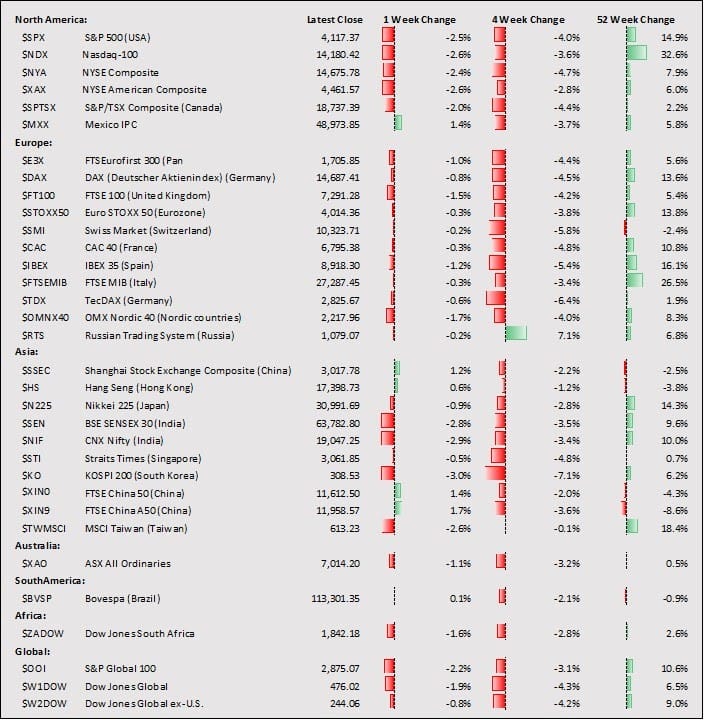

Let’s have a look at the global markets:

Ugly… and highly correlated!

One of the things I learned in the 2008 Financial Crisis and bear market was that correlations in extreme events tend to increase. Correlation between stock markets goes towards 1 in times of crisis.

That got me thinking – I wonder if market correlation would be a good regime indicator (there is the curiosity thing again… I will have to test that and report back). But for now, let’s have a look at a nifty correlation matrix of all of the global stock indices. Now I know this is too small to read as there is a lot of data on there, but let me explain what is happening.

The matrix at the top is the correlation between all of the major global stock indices over the last 30 days. The matrix at the bottom is the same calculation taken 12 months ago.

What I want you to do is look at the colours – green is a low or negative correlation (good), and red is high positive correlation (bad).

Compare the recent correlations (top matrix) to the bottom matrix from 12 months ago. The average correlation coefficient for all of these markets 12 months ago was 0.43, but now it is 0.70.

So what does this mean?

If you are a long-only stock investor, it really means there is really nowhere to hide, and even global diversification may not save you from a major down move. It also means that when you think about diversification, you need to think about more than just different stocks or different markets… you need different strategies, timeframes and asset classes as well.

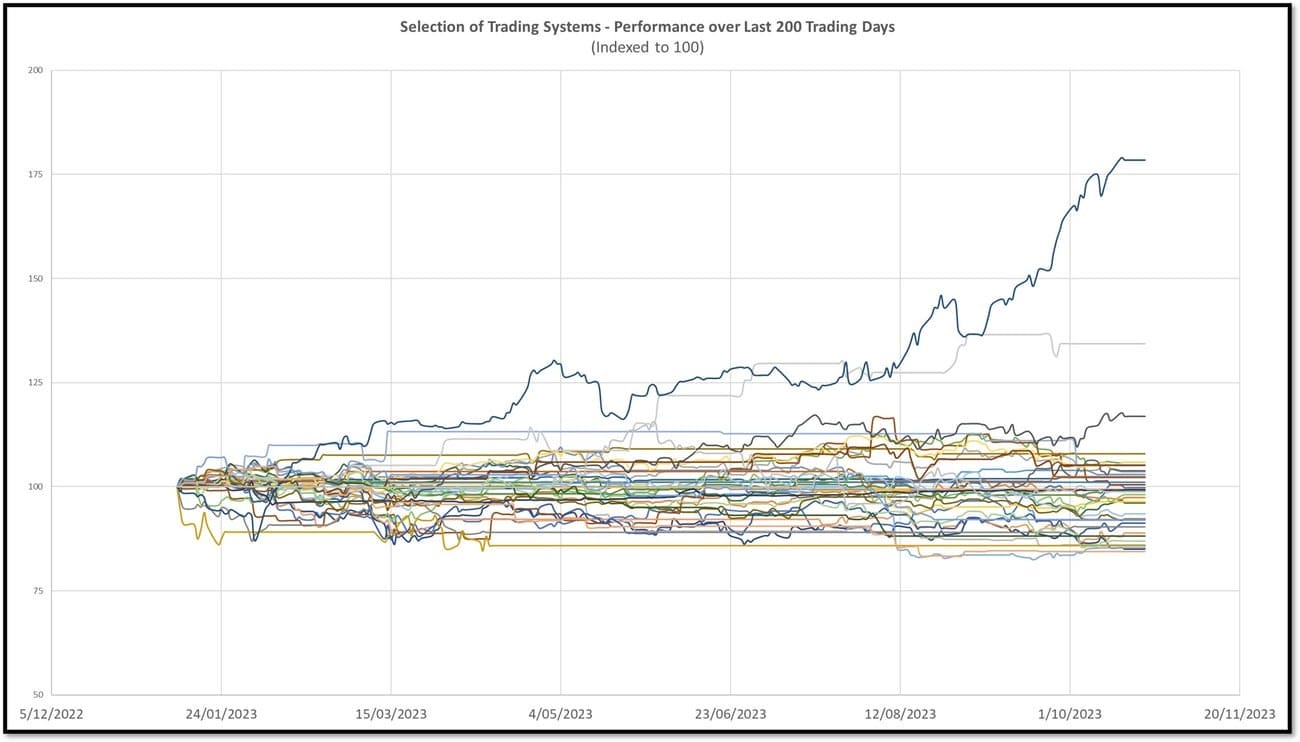

I have been building some new portfolios recently for my live portfolio project (I will be shortly launching 3 accounts which I will be sharing publically and talking about my progress). During the process of designing these portfolios, I have been looking at a number of my systems to see how they have been performing recently. Here are the equity curves for 40 different systems over the last 200 days. They have been indexed to 100 at the start of the period for comparison:

Again this chart is pretty small, but you can probably see that there are three groups here:

- The standouts that are working well in today’s market environment

- Those that are treading water and going sideways

- Those that are in drawdown

The standout performer at the top of this chart is The Waterfall Strategy which shorts failing stocks that have had a reverse stock split recently. These results are a little optimistic because some of the signals are in hard-to-borrow stocks with high stock borrow rates (I skip the trades if the borrow rate is above a certain level), but I have still had quite a number of good trades from the system recently. I have this strategy automated in my own account.

The second strategy is one that we will shortly be adding to The Trading Strategy Hub, which is based on a seasonality pattern that has been holding up extremely well despite the market weakness – I also have this strategy automated in my own account.

The third standout strategy that is ahead of the pack in recent weeks is one that will be included in the EST Signal Service that will be launched fairly soon (we are just sorting out the tech to make these signals quick and easy to deliver to subscribers). This will be part of my new accounts that I will be discussing publically… well, the results… not the rules 😉

So the message is that there are strategies that are clearly working now – all hope is not lost. If you are in a large drawdown, then have a look at your risk control and ensure your systems are stable and not broken.

Member of the Week

My member of the week this week is Phillip… Phillip is an extremely regular and dedicated member of the Trader Success System mentoring program. He has developed significantly as a trader this year and has built a very strong understanding of systematic trading, backtesting and performance evaluation – it has been a pleasure to watch.

Phillip also went live with 2 systems in Interactive Brokers in recent weeks and has been following them consistently. He is now looking towards further diversification opportunities.

Well done Phillip – Awesome Progress!

News from EST

I mentioned above that a few years ago, I buried a trading system alive.

Incidentally, being buried alive is my wife’s worst fear, so this is serious!

This system in question was a US Stock Mean Reversion system. Below is the equity curve and drawdown profile from 1990 till today:

In 2020, after a very sizeable and consistent drawdown, even blind Freddie could see that this system was broken. I suspended it a while before that event and was pretty happy I did.

Since then, it has gone from bad to worse… Clearly, it’s a dead strategy, ready to be buried… chalk it up to over optimization or changes in market conditions or something, right?

WRONG!

It turns out that despite this hideous-looking equity curve, and catastrophic 58% drawdown, this system was actually buried alive!

Wait, what?

Adrian must have lost his marbles; I hear you thinking!

After getting curious this week and digging into the performance of the system again, I found something amazing. Despite being buried and considered dead for several years, this system is really quite good.

Let me show you this next chart… I made one very subtle tweak to the system. I didn’t change the rules or reoptimize anything; all the parameters are exactly the same. I ran a backtest again after making this one subtle change, and this is what it looks like:

OMG!

Pick yourself up off the floor…

One simple change and it is alive and kicking… and I am kicking myself for not seeing it earlier because I left a lot of profit on the table when I buried this one a few years back.

If I didn’t change the rules or I didn’t reoptimize the parameters, what did I do? That is exactly what I will be sharing with my members of The Trader Success System mentoring program in our ‘System Builder’s Club’ meeting next week!

Needless to say, it is a HUGE learning with massive implications for the way I trade. Apparently, even after over 20 years in the game, there are things to learn… thankfully or else I would have quit from boredom years ago.

Systematic trading is never boring. There is always something to learn and I love sharing these learnings with the members of the TSS mentoring program!

Other News from EST

Next week we will be formally announcing a new initiative, Trader Acceleration Week, which is a FREE coaching week to accelerate your journey to trading mastery. Watch out for the announcements on 1 November, and get ready to register to transform your trading results!

On the Home Front

I have been focusing a lot on my own education recently – researching, trying new things in trading, and attending the ATAA Annual Conference (where I met John Bollinger, Darryl Guppy and a bunch of other great speakers). Next week I will be working on the business side to help me reach and help more traders…

Stephanie and I are attending Kerwin Rae’s 3 day intensive program called ‘Nail It & Scale It’.

If you are feeling stagnant, then dive into learning something you are interested in and see what happens. You would be surprised how many great trading ideas I have at business courses… and how many great business ideas I have at trading courses.

The weather is warming up and my garden is growing like crazy. My family used to joke that I had ‘black thumbs’ and I certainly didn’t inherit my mother’s ‘green thumbs’… but I have spent a lot more time in the garden recently and it seems to be paying off. We have tomato, pumpkin, strawberries, beans, radishes, leek, celery, beetroot, passionfruit, herbs and a bunch of other things taking off at the moment.

Anyway, I am off to work on the material for ‘Trader Acceleration Week’. Yes, it is Saturday, but I want to make this an awesome experience for everyone involved, so, Stephanie, myself and the EST Team are working really hard on it for you… watch this space!

Remember – You’re only one system away!

Adrian

Founder, Enlightened Stock Trading

Share This

Share this post with your friends!