TLDR – Trading Courses Summary

- Not all trading courses are equal: Many cheap courses rely on high pressure upsells and hidden fees such as expensive commissions from the recommended broker, leaving you exposed to high ongoing costs without delivering real value.

- Avoid Coursera trading courses: These courses often provide only surface level of knowledge with no mentorship or actionable systems. Many are even created by AI without any real substance, resulting in costly mistakes in your trading.

- Forex and day trading courses are traps: They lure you in with fancy marketing and low initial tuition fees but upsell you to expensive programs, and the educator often profits by referring you to brokers which pay them huge commissions and kickbacks on your trading activity.

- Systematic trading is a proven approach: It eliminates emotional decision-making by relying on data-driven, backtested systems with clear buy/sell rules for consistent results.

- End-of-day trading is perfect for busy professionals: It requires less than 30 minutes a day, removes the stress of short-term market fluctuations, and gives a high probability of success when you follow systematic rules.

- Forget “get rich quick”: Systematic trading focuses on steady, sustainable growth, with realistic annual returns of 10%-30%, which, when compounded, build wealth over time. There is no way to get rich quick, so stop chasing products that falsely make these claims

- Systematic trading = Your Independence: It allows you to take control of your financial future and decisions with confidence, reducing reliance on fund managers and advisors while giving you the freedom to trade with confidence.

- Private traders have flexibility over mutual funds: You can go to cash during downturns, invest in smaller companies, and diversify globally – advantages that institutional traders don’t always have. This is why private traders can out perform funds.

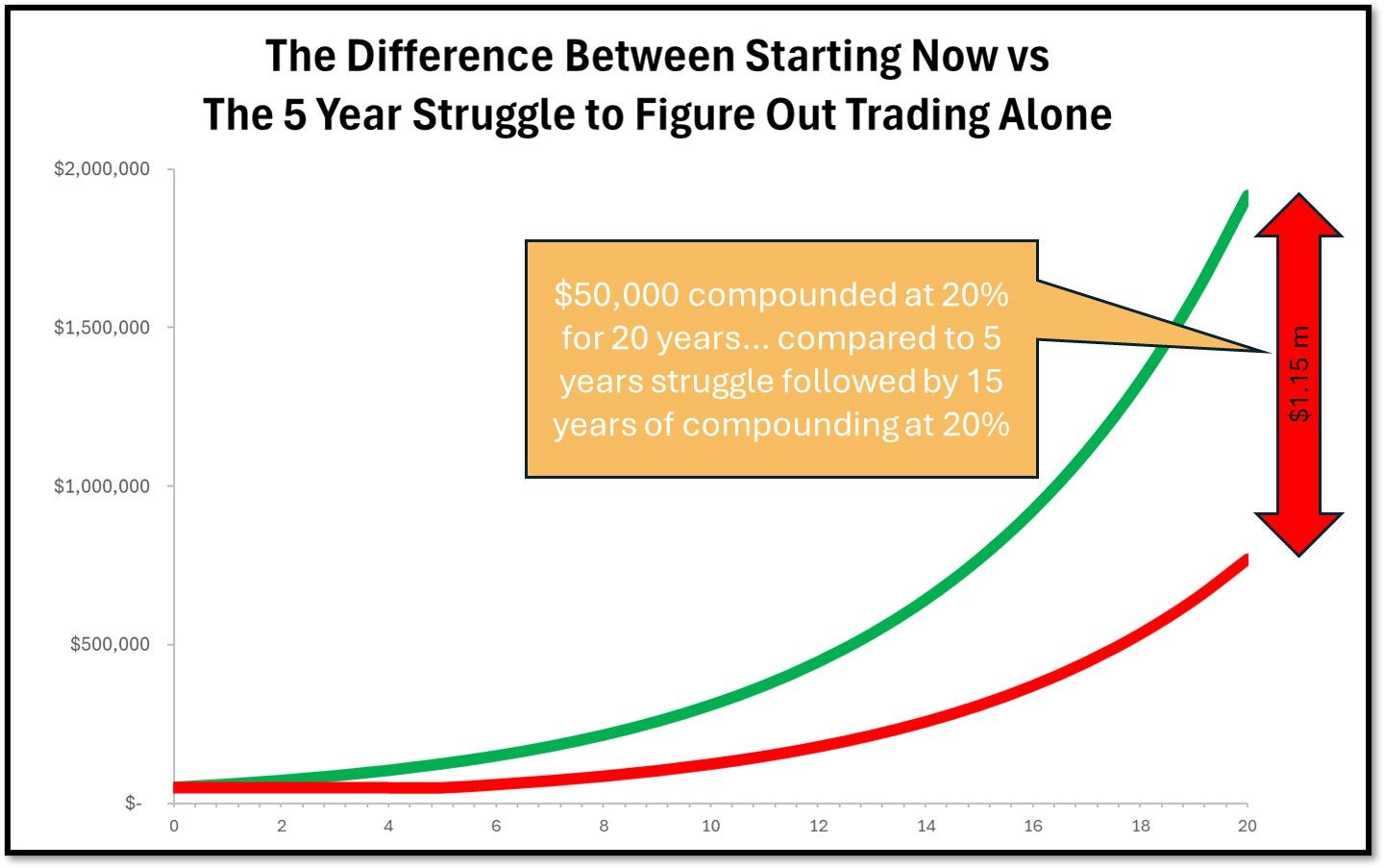

- Compounding is key: Starting systematic trading early helps you benefit from compounding returns, making a significant difference in long-term wealth growth.

- Global reach: Systematic trading works across international markets, allowing you to diversify and exploit opportunities globally for smoother equity growth.

- Mentorship and lifetime access matter: Courses like The Trader Success System offer comprehensive guidance, personal support, and lifetime access to all materials, ensuring long-term success.

- Courses that deliver results: Like The Trader Success System provide complete systems, mentoring, and proven strategies for profitable, consistent trading success.

Introduction: Why Investing in the Right Trading Course Matters

Not all trading courses are created equal. While some offer a quick, low-cost entry into the world of trading, they often leave you chasing after the next big secret, trapped in a cycle of upsells and vague promises. Cheap or free trading courses may look appealing at first glance, but they rarely provide the depth and clarity needed to achieve real, sustainable success in the markets.

Many beginner courses will lure you in with low prices, only to hit you later with aggressive sales tactics to get you to upgrade. After you’ve paid for the “introductory” course, they offer you the “real” tools you need to succeed – often at a much higher price. Before you know it, that $50 course has turned into a $25,000 tuition fee.

I have heard countless stories of traders who have taken a cheap introductory forex trading course who have then been pressured into the $25,000 tuition fee for a mentoring program where they will learn the ‘real secrets’ of successful trading. Unfortunately this too is an illusion and these traders have been left frustrated and out of pocket, still unable to trade profitably after spending tens of thousands on poor quality trading education.

If you’re serious about trading and want to avoid years of frustration and wasted money, you need a proven, systematic approach – one that provides clear, actionable steps without relying on luck, gut feelings, or endless upgrades. Choosing the right course from the start can set you on the path to consistent, confident trading success.

In this article, we’ll show you why systematic stock trading, and The Trader Success System especially, stands head and shoulders above day trading, forex, and beginner courses that only scratch the surface. You’ll learn how to choose the right trading course – that focuses on reproducible, testable strategies and gives you everything you need upfront, without hidden costs or gimmicks.

Trading Courses You Should NOT Invest In

When it comes to choosing a trading course, it’s easy to be swayed by flashy adsm aggressive marketing and bargain prices. However, not all courses deliver what they promise. Some lure you in with low prices, introductory offers or huge claims, but in reality, they often lack the substance needed to truly succeed in the markets. Let’s look at two common traps you should avoid.

Why Coursera Trading Courses Are Not the Bargain They Appear to Be

At first glance, Coursera share trading courses seem like a great deal. They’re inexpensive, often coming in at a fraction of the cost of more specialized programs. But the truth is, cheap doesn’t mean effective.

- Lack of Depth and Mentorship: Coursera’s share trading courses tend to offer surface-level knowledge in trading, often focused on broad concepts instead of actionable, real-world strategies. Many of these trading courses have even been 100% produced by AI and lack any real world experience. You may get an introduction to trading, but without personal mentorship or proven, backtested systems, you’re left on your own to figure out the critical details and are hugely likely to pay the price when you start trading for real.

- Misleading Price Tags: While the initial price may seem like a steal, these courses frequently require additional tools and guidance down the road. Suddenly, what seemed like a small investment turns into a costly journey as you search for more advanced training or software to apply what you’ve learned.

If you’re serious about trading, you need a course that goes beyond theory and provides proven, actionable systems that can be applied to real markets—not just general concepts or academic overviews. The Trader Success System does this – it is the last stock trading course you will ever need (and ideally you should do it first to avoid years of frustration and wasted money).

The Hidden Costs of Cheap Forex and Day Trading Courses

Forex and day trading courses are often sold with bold promises and eye-catching price tags. But dig deeper, and you’ll find hidden costs that can make these courses a poor investment for most traders.

Don’t Get Fooled by the “Beginner Course” Trap

The forex and day trading space is filled with courses that seem affordable—$50 – $500 to get started. But here’s the catch: these beginner courses are designed to upsell you into much more expensive programs.

- Upselling Tactics: After completing the initial course, you’re told that you need the “advanced trading techniques” to really make money and get the experience you need to succeed – I have heard of these ‘next level’ programs going for $25,000 or more. By the time you realize you’re locked into a cycle of expensive upgrades, you’ve spent far more than you ever anticipated and you still haven’t learned to secrets to successful trading.

- Commissions Over Your Success: Many forex and day trading educators make money from broker commissions. They tell you they have a special deal with the best broker and you need to use them to get all the benefits of the course and the best results. What they really mean is they get a cut of the commissions you will pay to that broker, so they profit hugely whether you win or loose… provided you make lots of trades and use lots of leverage… that is why they are teaching daytrading and forex! This misalignment of incentives puts your success at risk, as the educator’s true focus is on keeping you trading (and paying commissions), not on helping you succeed long-term.

These cheap courses are often designed to keep you hooked and constantly seeking the next big secret—without delivering consistent, reproducible results.

Why Forex and Day Trading Are Not Built for Success

Forex and day trading might seem like exciting, fast-paced ways to make money, but they come with significant downsides, especially for beginners.

- Broker Manipulation: Forex brokers can manipulate spreads and trade execution in ways that make it hard for traders to consistently profit. In many cases, brokers profit from your losses, making the playing field anything but fair. I have heard of many unscrupulous behaviours which these brokers engage in on a regular basis. Many of them don’t even bother to place your trades in the underlying market, they just take the other side of your trade and bet against you. As soon as you start winning they widen your spreads so you lose (and they win).

- Constant Attention Required: day trading requires you to monitor the markets constantly, leaving little time for anything else in life. This leads to burnout, stress, and an increased risk of making emotional, impulsive decisions.

- High Leverage = High Risk: Forex trading often involves high leverage, which can magnify gains, but also significantly amplifies losses. For beginners, this is a dangerous combination—what might look like a big win can quickly turn into a devastating loss, leaving you worse off than when you started.

- Short Term Trading = Losses: The vast majority of short term traders lose money. It is the hardest way to trade. Being a profitable trader is tough enough, why make it harder by trying to scrape out tiny profits on a 5 minute chart? Longer term trading is easier, more profitable, less stressful and give you a much higher chance of success.

Instead of getting caught in the forex or day trading trap, it’s better to invest in an end of day systematic trading course that offers long-term, reproducible success with far less risk.

9 Attributes of a Great Trading Course

When choosing a trading course, it’s crucial to know what separates a great course from one that will leave you frustrated and confused. A good course should be more than just a collection of random tips or a vague outline of how to trade.

A great trading course has the following essential elements:

- Proven, Reproducible Systems with Clear Buy/Sell Rules

- Comprehensive support from a mentor with over 20 years of success.

- Lifetime access with no hidden fees

- Clear focus on risk management and capital preservation.

- Offers complete systems, not just checklists.

- Includes a portfolio of pre-coded trading strategies that you can backtest.

- Empowers you to test and create your own systems.

- Forum-based support so you can ask questions and get real-time help.

- Live Group Mentoring so you can real time interactions with experts.

Proven, Reproducible Systems with Clear Buy/Sell Rules

The cornerstone of any successful trading course is the provision of proven trading systems with clear, repeatable rules. These systems must offer unambiguous entry and exit signals so you’re never left guessing when to buy or sell. Without these clear rules, you risk relying on emotion or intuition—two things that lead to inconsistency and losses.

One of the biggest problems with most trading courses is that the rules are subjective and require a lot of experience to correctly apply them. This is doomed to failure because when you are starting out you cannot possibly make this work.

A much simpler and faster path to success is to learn absolute, objective rules that you can apply with 100% confidence and zero subjectivity. With the trading rules we provide in The Trader Success System, you can get the same signals as we do from day 1, regardless of your level of experience. This is the power of a purely systematic trading approach.

Comprehensive Support from a Mentor with Over 20 Years of Success

Learning to trade requires guidance. Look for courses that offer direct mentorship from an experienced trader who has been through the ups and downs of the markets. A mentor with 20+ years of trading experience will provide invaluable insights and help you avoid common pitfalls. Personal support can make the difference between floundering and thriving as you learn the ropes of systematic trading.

It is no good learning from a trader who has been in the market for 2-3 years who has made money from the recent bull run in tech stocks. You have no idea how their strategies will perform when the inevitable downturn happens. You deserve to have experience on your side, don’t settle for inexperience. It is just not worth risking your future wealth on someone with less than 20 years of trading experience.

After all, you need this much trading experience to learn the lessons from multiple bull / bear market cycles!

Lifetime Access with No Hidden Fees

The right course should offer lifetime access to the learning materials because you will want to come back to them in the future. At Enlightened Stock Trading we have a 6 month mentoring program where you get access to our live mentoring sessions and a huge library of bonus mentoring content while you are in the program, but after your mentoring program is complete you get to keep all of the core training materials so that you can revisit them in the future to brush up your skills or dive deeper. A high-quality course gives you everything upfront, ensuring you have full access to the tools and education you need to succeed.

Clear Focus on Risk Management and Capital Preservation

Too many trading courses focus on the returns you can make and just don’t mention the downside. If you want to WIN the game of trading, you have to STAY IN THE GAME. There is no point making 100% return this year if you lose all of your account next year!

I have never blown up an account, and neither should you!

No trading strategy is complete without a solid approach to risk management. The course you choose should focus heavily on capital preservation, teaching you how to protect your account during both market highs and lows. A robust risk management framework ensures that you survive tough markets and continue growing your wealth over time.

This means risk management and capital preservation are the most important things you need to learn. That is why in The Trader Success System we put risk management front and centre in your learning journey. We have dedicated courses on risk management and all of our trading systems come with conservative risk management rules built in to keep you safe.

Offers Complete Systems, Not Just Checklists

The best trading courses provide complete, detailed systems (a portfolio of them, not just one ‘magic’ system), covering a variety of different market behaviours and strategies. You need a portfolio of systems because no one trading system can make money all of the time.

These systems must be complete – this means they must objectively define every action you need to take in the market. It’s not enough to get a checklist of discretionary rules to apply; you need objective rules that define each step, from identifying trades to executing them, all based on specific rules and strategies that are 100% reproduceable by you regardless of your level of experience.

Includes a portfolio of pre-coded trading strategies you can backtest

When you think about systematic trading / trading strategies / algo trading (all the same thing by the way), you are probably thinking first you will have to learn to code, then you will need to learn technical analysis, then you will need to find some rules that work… etc etc… right?

The trouble is this is slow and difficult.

Instead, a great trading course should come with pre-coded, ready to trade, backtest-able trading systems that you can use immediately.

At Enlightened Stock Trading our approach is to give you quality trading systems that are ready to go. But we don’t stop there. We also give you the skills to test and validate those systems yourself so that you can deeply understand them and build confidence for yourself.

In essence, we remove the ‘trust us it works’ factor.

We don’t want you having blind faith in us or anyone else, so we give you great systems and show you how to test and validate them yourself.

That is what gives you the confidence you need!

With The Trader Success System you get a portfolio of over 25 fully coded and backtested trading systems that you can test on historical data to validate for yourself before risking your money.

Pre-coded systems save you time and give you the confidence that you’re following strategies that have been proven to work in real markets.

Empowers You to Test and Create Your Own Systems

A top-notch trading course doesn’t just give you fish—it teaches you how to fish. The course should empower you to test and create your own trading systems, providing you with the tools and knowledge to build confidence in your strategies. At Enlightened Stock Trading, we don’t just hand you systems—we show you how to backtest them yourself, so you fully understand their strengths and weaknesses. Plus, you’ll learn how to develop your own systems, giving you ultimate control over your trading success.

By ensuring your trading course has these attributes, you’ll be equipped with the knowledge, tools, and support you need to become a consistently profitable trader. Don’t settle for anything less than a comprehensive, proven course that sets you up for long-term success.

Forum-Based Support so You Can Ask Questions and Get Real-Time Help

Trading can be a solitary endeavour, but having access to a community of traders and a forum where you can ask questions in real-time and get support from friendly, helpful people that care about your growth and development is invaluable. Look for a course that offers forum-based support, allowing you to connect with coaches and other traders, share insights, and get feedback from both peers and mentors as you refine your skills.

Please note this does NOT mean a Discord group. These always devolve into distracting chats and inevitably contain scammers and individual agendas. The forum we run for The Trader Success System is moderated by Adrian and his educational support team plus our Community Manager to ensure all questions are answered and to manage the tone and quality of all interactions.

Too many online trading communities are rude and obnoxious. Enlightened Stock Trading prides ourselves on our friendly, supportive community and, to be blunt, our ‘no dickheads’ policy.

Live Group Mentoring so you can real time interactions with experts

Live group mentoring is a powerful element of any trading course because it provides real-time access to expert guidance. When you’re learning to trade, having the opportunity to ask questions and receive immediate answers can drastically accelerate your understanding. Instead of second-guessing your strategies or delaying your decisions, live sessions allow you to clarify concepts, troubleshoot issues, and receive feedback directly from those who’ve successfully navigated the markets. The ability to interact with experts not only boosts your confidence but also ensures that you can avoid costly mistakes before they happen.

With The Trader Success System, you gain access to regular live mentoring sessions designed to keep you on track and help you implement your trading systems effectively. This isn’t just about learning theory—it’s about having a trusted advisor by your side to ensure you’re building wealth and trading confidently every step of the way.

Why Systematic Trading is the Path to Reproducible, Testable Results

The key to long-term success in trading isn’t luck, intuition, or spending endless hours glued to your screen. It’s about using proven trading systems that remove the guesswork and allow you to make consistent, fact-based decisions. Systematic trading offers a clear path to reproducible and backtestable results, no matter your experience level. Here’s why this approach outshines discretionary trading…

The Power of Proven Systems

In systematic trading, your decisions aren’t based on hunches or emotions—they’re guided by proven, backtested systems. These systems are built on rules and logic, ensuring that every trade you make is rooted in data, not guesswork. Here’s how systematic trading puts you on the fast track to profitability:

- Eliminates Emotion from Trading: Emotional decisions, driven by fear or greed, lead to inconsistent results. Systematic trading removes this risk by sticking to clear, rule-based strategies that are grounded in facts.

- Backtested Strategies Offer a Reliable Edge: By using backtested strategies, you gain the confidence that your trading decisions are backed by historical data. This gives you a reliable edge in the market, regardless of whether you’re a beginner or a seasoned trader.

- Avoid Trial and Error: Instead of spending years experimenting with different approaches, systematic trading helps you start profiting sooner by providing you with systems that have already been tested and proven to work. You skip the painful learning curve that most traders face.

The Advantage of Trading Systems Over Discretionary Trading

While discretionary trading might seem appealing with its promises of big wins through gut instincts, it’s inconsistent and nearly impossible to replicate over time. In contrast, systematic trading follows clear, repeatable rules, giving you the advantage of consistency and precision in every trade.

- Consistency is Key: Discretionary traders often struggle to repeat their successes because their decisions are based on intuition or market sentiment. Systematic traders, however, know exactly when to buy and sell based on well-defined rules. This eliminates the uncertainty and variability that plague discretionary traders.

- Spend Less Time Trading: With systematic trading, you can spend as little as 20-30 minutes a day managing your trades. The automation and clarity of the systems mean you don’t need to watch the markets all day long—perfect for busy professionals who want to trade but don’t have hours to dedicate each day.

Data-Driven, Not Emotion-Driven

One of the biggest advantages of systematic trading is that it allows beginners to benefit from data-driven decisions without needing years of experience. Even if you’re new to trading, a well-designed system levels the playing field, giving you the same tools that seasoned traders use.

- Proven Systems for Beginners: Beginners often struggle with emotional decision-making and inconsistent results. Systematic trading bypasses these issues by relying on backtested, proven systems that allow even new traders to follow a structured, reliable process.

- Consistency and Confidence: Backtested systems bring consistency to your trading. You know that the rules you’re following have been proven to work over time, and this provides the confidence you need to stick with the system through market ups and downs.

In summary, systematic trading offers a clear, reproducible, and testable path to success. By relying on proven systems, you can eliminate emotions, trade with consistency, and reduce the amount of time you need to spend managing your portfolio. Whether you’re a beginner or a seasoned trader, systematic trading gives you the tools you need to achieve reliable results.

Plus, the great news is that good trading systems are simple and easy to understand. You do not need to be a coding genius or have years of technical analysis experience to make this work for you!

Why End of Day Systematic Trading? (and not Day Trading)

You are busy right? We all have busy lives, that that shouldn’t mean you can’t build your wealth through trading. But the idea of sitting in front of multiple screens all day, anxiously monitoring every market tick, simply isn’t realistic for most people. That’s why end-of-day trading is the ideal solution—it provides all the benefits of systematic trading without the time commitment that comes with day trading.

You may also be looking for ‘swing trading’, ‘position trading’ or ‘trend following’ trading strategies. These all come under the end of day banner.

Systematic Trading is Ideal for Busy Professionals

- Manage Trades in Just 30 Minutes: With end-of-day trading, you only need to check the markets once a day—typically after the close. You can quickly review your system’s signals and place your trades for the next day in just 30 minutes or less. This is perfect for professionals who don’t have the luxury of spending their entire day glued to a trading platform (or the interest in doing that) .

- No Stress Over Short-Term Fluctuations: Day trading requires constant monitoring of the market’s every move, leading to stress and potential emotional decision-making. In contrast, end-of-day trading frees you from worrying about the intraday noise, letting you focus on the bigger picture.

- Follow Systematic Rules with Confidence: With a systematic trading approach, you know exactly when to act—based on clear, predefined rules. This eliminates the need for emotional decision-making, allowing you to trade with confidence while maintaining a busy lifestyle. End-of-day trading fits seamlessly into your routine, freeing up your time and reducing stress.

A Reality Check… What is Actually Possible

(Forget “Get Rich Quick”—Think Sustainable Growth)

The allure of fast profits and get-rich-quick schemes can be tempting, but the truth is, long-term trading success is built on consistent, reliable growth. Systematic trading offers just that – predictable, sustainable progress over time.

Realistic Expectations

- No Overnight Riches: Systematic trading is not a path to immediate wealth, but neither is day trading or any other type of investing. Systematic trading is a methodical, proven approach that aims for steady growth rather than explosive, short-term gains. Chasing quick wins often leads to large losses—systematic trading helps you avoid this trap by focusing on long-term profitability.

- 10%-30% Annual Returns are possible: With a well-executed portfolio of systems, you can achieve 10%-30% annual returns. Of course we can’t guarantee that because it depends on so many factors, but this is a far more realistic target than the wild promises often made by “get-rich-quick” schemes. These returns, while modest at first glance, are highly powerful when compounded over time.

- The Power of Compounding: Compounding is the real secret to building wealth over time. Even with modest annual returns, your investment grows exponentially when allowed to compound for years. Success in trading requires discipline and long-term thinking, not overnight wins. By staying committed to your system, you’ll see your wealth build steadily.

How To Take Control of Your Financial Future (Systematic Trading = Independence)

Taking control of your financial future means more than just picking stocks or following market trends. It’s about having a clear, proven trading strategy that allows you to make decisions with confidence. Systematic trading provides that path to independence.

Systematic Trading = Independence

- Full Control Over Your Investments: With systematic trading, you’re not reliant on fund managers or advisors to make decisions for you. You have the power to make informed choices about your money, and you can manage your investments according to your own goals and risk tolerance.

- Eliminate Guesswork: Using proven systems eliminates the guesswork that plagues many traders. Instead of relying on gut feelings or tips, you follow rules that have been tested and shown to work over time. This brings confidence and clarity to your financial decisions.

- Replace or Supplement Your Income: Over time, systematic trading can do more than just achieve capital growth – it can replace or supplement your income. Whether you’re looking for financial freedom or just want more flexibility in your life, systematic trading provides a clear path to achieving those goals.

By taking control of your financial future through systematic trading, you can build long-term security and gain the independence to pursue the lifestyle you truly desire.

Why You Should Learn To Trade (…and not leave it to the “professionals”)

Many people believe that trading is a game best left to hedge fund managers and investment management professionals. But the truth is, anyone with the right tools and mindset can succeed in the markets. In fact, there are significant advantages to learning to trade for yourself – especially when using systematic trading.

Trading Isn’t Just for Hedge Fund Managers

You don’t need to work on Wall Street or have an MBA to become a successful trader. Systematic trading provides a clear, structured approach that anyone can follow. With the right systems in place, you can make confident, data-driven decisions, regardless of your background. Systematic trading breaks down the complex world of financial markets into a series of rules that are easy to follow and implement.

Private Traders Have More Flexibility Than Mutual Funds

Private traders have a number of advantages over institutional traders, like mutual fund managers, that allow them to navigate the markets with more agility:

- No Need to Stay Fully Invested: Mutual funds often have mandates requiring them to stay fully invested, even during market downturns. As a private trader, you have the freedom to go to cash for safety when the market conditions are unfavorable, helping you protect your capital.

- Benefit from Growth in Smaller Companies: Large funds are often limited to investing in big, well-established companies due to their size. But as a private trader, you can capitalize on the growth potential of smaller companies and emerging markets—opportunities that larger funds simply can’t access.

- More Nimble and Diversified: Private traders aren’t constrained by the rules and red tape that limit mutual funds. This means you can be more nimble, adjusting your portfolio quickly to take advantage of market changes. You can also diversify more broadly, tapping into a wide range of assets and strategies that may not be available to institutional traders.

By learning to trade systematically, you gain the flexibility and control that professionals in the finance industry often envy, allowing you to make decisions that align with your own financial goals.

Why You Should Start Today—Speed Matters in Trading Education

When it comes to trading, the sooner you start, the greater your potential for long-term success. Time is one of the most powerful factors in wealth building, and learning systematic trading early can make a significant difference in your financial future.

The Power of Compounding

The earlier you begin trading, the more you can take advantage of compounding—the process where your profits generate more profits over time. Compounding accelerates your wealth growth, but only if you get started quickly.

- The Sooner You Learn, the More You Benefit: Becoming profitable sooner allows you to harness the power of compounding earlier. For example, if you start learning systematic trading now and earn a 10% annual return, your $10,000 investment could grow to $67,275 in 20 years. But if you wait five years before starting, that same investment would only grow to $40,000—a significant difference.

- The Earlier You Start, the Greater the Long-Term Benefit: Time in the market is more important than timing the market. The earlier you start trading, the more you benefit from long-term market growth. Starting today means giving your money more time to compound, resulting in much larger returns down the road.

By learning systematic trading today, you not only gain control over your investments, but you also start benefiting from the compounding power of time—a crucial factor in building long-term wealth. Don’t wait—start now, and let time work in your favour.

Learn to Trade International Stock Markets (Not Just Your Home Market)

One of the greatest advantages of systematic trading is its flexibility—it can be applied to markets all over the world. Whether you’re interested in the share markets like ASX, US, TSX, Hong Kong, or even the cryptocurrency markets, systematic trading provides a framework that works across a wide range of markets, helping you diversify and seize global opportunities without ruining your lifestyle.

Systematic Trading Can Be Applied Globally

The beauty of systematic trading is that the same rules-based approach can be used across multiple markets. Whether you’re trading the Australian Stock Exchange (ASX), US markets, Toronto Stock Exchange (TSX), or cryptocurrency markets, the principles remain the same. The systems are built on data, patterns, and backtested strategies, which means they can be applied anywhere. Of course different markets have different behavioural characteristics, so systems may vary from market to market, but the core principles remain the same.

This global applicability allows you to trade wherever the best opportunities arise, giving you the flexibility to take advantage of different markets based on current conditions.

International Diversification Helps Smooth Equity Growth Over Time

One of the key principles of successful trading is diversification—spreading your investments across different assets and markets to reduce risk. By trading both international and local markets, you can smooth out the inevitable ups and downs of any single market.

- Market Independence: When one market is struggling, another might be thriving. For example, while the US share market may be in a downturn, the Australian or Canadian markets could be rising. By diversifying internationally, you’re not dependent on the performance of one market, which helps create more consistent returns.

- Reduced Volatility: International diversification can help reduce overall portfolio volatility. Different markets are influenced by different factors—political events, economic cycles, and currency fluctuations—so by spreading your investments, you lower your exposure to these risks.

This is why in The Trader Success System we give you a large number of different trading systems which cover US, ASX, TSX, Hong Kong and London stock exchanges. Plus we show you how to adapt these systems to other markets should you wish.

Exploit More Opportunities by Trading Both International and Local Markets

When you limit yourself to just one market, you’re also limiting your potential opportunities. Systematic trading allows you to expand your scope, so you can tap into the best opportunities wherever they are, both locally and globally.

- Broaden Your Portfolio: By trading international markets, you gain access to a broader range of assets and economies, from emerging growth companies to established global giants. This enhances your portfolio’s resilience, as different markets often move independently of each other.

- Add Resilience to Your Portfolio: The ability to trade both international and local markets makes your portfolio more resilient. You’re not putting all your eggs in one basket, which means you can better withstand market downturns, maintain growth, and safeguard your capital over time.

By learning to trade systematically across international markets, you not only increase your potential for profit but also build a portfolio that is better equipped to handle the inevitable fluctuations of the global economy.

Why Do People Choose to Study with Enlightened Stock Trading?

When it comes to learning how to trade systematically, share traders around the world choose Enlightened Stock Trading, and The Trader Success System in particular, because of its proven track record, comprehensive support, and commitment to long-term success. Here’s why our students see Enlightened Stock Trading as the best choice for mastering the markets.

Proven Success and Trading Mentorship

At Enlightened Stock Trading, we don’t just teach theory – we back everything with over 20 years of systematic trading success. Our founder, Adrian Reid, is a professional trader who has been trading profitably for decades, using the same proven systems that are shared with students. This extensive experience forms the backbone of the education you’ll receive.

- Comprehensive Mentorship: You’ll get direct access to mentors and coaches who have not only survived but thrived through the ups and downs of global markets. Whether you’re a beginner or have some experience, personal guidance makes all the difference.

- Community of Like-Minded Traders: You’re not on this journey alone. As a student, you’ll be part of a community of like-minded share traders who share your passion for systematic trading. This provides ongoing support and motivation as you work towards your goals.

- Supportive environment: We price ourselves on maintaining a safe and Supportive environment for your trading education. We believe that our students need to feel safe to ask any questions and know that they will receive an honest and helpful answer. This is exactly what we provide in our learning environment.

The results speak for themselves. Real testimonials from our students highlight the rapid learning and real-world success they’ve achieved after joining Enlightened Stock Trading.

We Empower You to Be Independent

One of the key goals of Enlightened Stock Trading is to empower you to become a confident, independent trader. Instead of simply handing you strategies, we teach you how to test and evaluate trading systems for yourself. This ensures you fully understand how the systems work, why they succeed and allows you to modify and adapt them to suit you.

- Trade with Confidence: Our course provides the tools and knowledge you need to trade profitably without second-guessing your decisions. By the end of the program, you’ll have the skills and confidence to follow your trading systems with absolute confidence.

- Data-Backed Approaches: Blind faith has no place in systematic trading. Our strategies are built on proven, data-backed methods that have been thoroughly tested. This eliminates guesswork and ensures you’re making informed decisions based on evidence.

We give you the power to trade with confidence, backed by data and experience, so you’re not relying on anyone else for your financial future. You will learn how to build wealth and also trade in a way that allows you to extract additional income from the financial markets.

Online Trading Courses with Lifetime Access

Unlike many other online courses that provide temporary access or charge extra for additional materials, Enlightened Stock Trading offers a complete solution with lifetime access to our core all course content. This ensures that as markets evolve and your skills grow, you’ll always have access to the tools and resources you need.

- Revisit and Deepen Your Knowledge: As you advance in your securities trading career, you can return to the course materials whenever you need a refresher or want to dive deeper into advanced topics. This flexibility allows you to continuously improve and adapt your trading strategies as new opportunities arise in the markets.

Just to be clear, our mentoring is a subscription obviously, but you keep the core course material for life.

A Complete Solution for Long-Term Success

The Trader Success System is designed to guide you along the entire Enlightened Trader Journey from beginner to advanced levels, with trading videos covering everything from the basics of systematic trading to complex strategies that allow you to succeed in a wide range of market conditions.

- Comprehensive Education: Whether you’re just starting out or looking to refine your skills, you’ll receive a complete education that covers every aspect of securities trading-stock selection, system testing, backtesting, execution and more.

- Adapting to Market Changes: Markets evolve, and so should your strategies. With lifetime access to our course materials, you can continuously adapt your approach to stay ahead of market trends, ensuring long-term success.

At Enlightened Stock Trading, we don’t just give you the tools to trade—we equip you with the knowledge and support to thrive in the markets for years to come.

The Trader Success System: Your All-in-One Solution

For traders who want a comprehensive, long-term solution, The Trader Success System provides everything you need to master systematic trading, from beginner to advanced levels. It’s a complete package that includes mentoring, proven strategies, and lifetime access to resources.

The Trader Success System is perfect for:

- Beginners who want to commit to mastering systematic trading fast

- Intermediate traders who want to accelerate their journey

- Advanced traders who want to tie all the loose ends together

- Expert traders who want to diversify quickly and automate a portfolio of trading systems covering different strategies / markets / timeframes

Shorten Your Learning Curve

The Trader Success System helps you bypass the years of trial and error that most traders endure.

- Get You Started Fast: The System Trader Launchpad program is included with The Trader Success System so if you are just getting started you will get everything you need including all of the practical trading skills required on a day to day basis. Get your first trading systems and build a rock solid trading plan that will keep you in the game.

- Complete Blueprint for Success: The course offers a step-by-step guide to developing and executing systematic trading strategies. This covers all of the trading knowledge, from choosing and backtesting systems to setting up your trading platform and optimizing your portfolio. We also cover all of the advanced trading lessons you need including Monte Carlo Analysis, Walk Forward Optimization, Capital Allocation and more.

- Mentoring and Community Support: One of the standout features of the Trader Success System is the direct mentoring and support from experienced traders. You also get access to a community of like-minded individuals who share their insights and experiences, helping you accelerate your learning curve.

- Trading Psychology Development: Inside the Trader Success System you will also find training to understand and strengthen your trading psychology. We build trading psychology into our trading courses and also run live trading psychology workshops to ensure you are rock solid and ready to go.

Value vs. Cost: Why Starting Right Saves You Money

While forex and day trading courses appear cheap at first, they typically upsell aggressively, driving up your total cost significantly.

- No Hidden Fees: The Trader Success System gives you everything upfront—lifetime access to core course materials, 6 months of mentoring, and a diversified portfolio of 25+ trading systems to choose from. You won’t be hit with additional upgrade options to learn ‘the real secrets’ in the next level program. The Trader Success System contains everything you need.

- A Complete System: From beginner to advanced trader, this course covers it all. It’s a one-stop solution that will save you both time and money in the long run, as there’s no need to purchase additional training or coaching later on.

The Trader Success System is the last stock trading course you will ever need!

Crypto Success System: The Best Cryptocurrency Trading Course

The Crypto Success System is designed for traders who want to enter the lucrative but volatile world of cryptocurrency with the confidence of knowing they have proven strategies in place. Crypto trading doesn’t have to be a gamble when you have a systematic approach.

Why Systematic Trading Beats “Hype” in Crypto

Crypto markets are filled with promises of quick riches, but the reality is that most traders fail without a structured system. The Crypto Success System teaches you how to trade crypto the right way – systematically.

- Avoid Emotional Decisions: Cryptocurrencies are notoriously volatile, and without a system in place, traders often make emotional decisions that lead to losses. With the Crypto Success System, you follow proven, reliable systems that remove emotion from the equation.

- Proven Systems, Not Hype: The course focuses on trading strategies that have been thoroughly backtested and proven to work in real-world crypto markets. You’ll learn how to trade with discipline, avoiding the hype that traps so many crypto traders.

Diversify and Build Wealth Faster

Cryptocurrency markets offer enormous potential, especially for systematic traders who know how to capitalize on the volatility.

- Volatility as an Advantage: While volatility is often seen as a risk, for systematic traders, it can be a significant advantage. The course teaches you how to exploit market movements to maximize returns while managing risk.

- Building Wealth Through Crypto: By trading crypto systematically, you can avoid common pitfalls and take advantage of the market’s rapid fluctuations. This approach allows you to build wealth faster than traditional buy-and-hold strategies, without falling prey to the emotional rollercoaster that plagues many crypto traders.

The System Trader Launchpad, The Trader Success System, and The Crypto Success System are all designed to provide you with the knowledge, tools, and support you need to succeed and achieve your trading goals. Each course offers a structured, systematic approach to trading, empowering you to trade confidently and profitably.

Frequently Asked Questions about Our Trading Courses

When considering systematic trading, many beginners have common concerns. Here are answers to some of the most frequently asked questions:

Do I need to learn technical analysis before I learn to trade systematically?

No, you don’t need to worry about learning technical analysis before starting with systematic trading. Systematic trading eliminates the need for manual chart reading – our systems are designed to handle all the technical analysis for you. By following the predefined rules of the system, you can trade with confidence, knowing the analysis has already been factored in.

Do I need to learn to code before learning to trade systematically?

No coding experience is required to learn to trade systematically. Our systems come fully coded and ready to use, meaning you can focus on trading without worrying about programming. While knowing how to code can be a bonus, it’s not necessary to get started. Everything you need is provided in a simple, user-friendly format that allows you to get started immediately and learn what little coding you need as you go along.

Can I learn to trade systematically?

Yes, absolutely! Systematic trading is designed to be accessible to traders of all experience levels. Our step-by-step guides walk you through the entire process, ensuring that even beginners can follow along and succeed. With the right support and resources, you’ll be trading systematically and confidently in no time.

Don’t Waste Time and Money - Start Systematic Trading Today

The world of trading is full of noise – from day trading promises to flashy forex advertisements. However, true success lies in proven, systematic approaches. Don’t fall for the traps of endless upsells or courses that leave you guessing and uncertain.

- Skip the noise: Day trading and forex courses may seem enticing, but they often lead to frustration and losses. With systematic trading, you get a clear, repeatable approach that’s been tested and proven.

- Everything Upfront: Courses like The Trader Success System provide everything upfront – no hidden sales tactics, no extra purchases needed.

- Start Now: Don’t waste years struggling with trial and error. By starting now, you can avoid common pitfalls and begin trading successfully within just a few weeks.

Conclusion

Investing in a high-quality trading course is about more than just learning—it’s about getting results. Systematic trading provides the tools and confidence you need to trade effectively, without falling into the traps of forex and day trading hype.

By choosing a course like The Trader Success System, you’re not just buying lessons—you’re investing in a complete system that offers everything upfront and sets you on the path to long-term success. With proven strategies, lifetime access, and extensive mentorship, you’ll be equipped to trade profitably, confidently, and systematically. Don’t wait – start your trading journey today and take control of your trading future.