This blog post is based on a presentation delivered at the Australian Technical Analysts Association Annual Conference. The video presentation is available below and the blog post that follows is a text version of the video presentation.

Would you like to make money more consistently, no matter what the market or economy is doing? I want you to learn that no global and local economic shock, specific instrument shock, or strategy drawdown/breakage will materially hurt you or your portfolios.

Have you ever heard of the quote, “Diversification is the only free lunch in the market”? It means that diversification is the only free lunch in the market. Traders need to take more advantage of diversification. You have this available, and eat this for lunch and leave something on the table.

How do we use diversification? How do we improve our trading with some of these concepts? On the image below, I’ve got the ‘Trader Acceleration Model’ that I use with some students. There are three primary components to accelerating your trading results and moving forward to the results you want.

The first one is that you’ve got to protect your capital above all else, then within protecting capital, you’ve got to have the proper daily process, manage your risk, and eliminate your mistakes. The second major component in grey is ‘Systemize’. Systemizing means having objective rules that you follow time after time. This gives you huge benefits in your trading because it shrinks the amount of time you have to spend, reduces the ambiguity, allows you to measure your performance, allows you to test your results and all sorts of great things.

Let’s discuss diversification and how increasing this can help you navigate an uncertain world with your trading and continue to find profitable trading opportunities.

Methods Of Diversifying to Improve Your Trading Results

In order to diversify your portfolio effectively, you need to diversify in three different ways:

- Strategies

- Markets

- Timeframes

Each of these three methods of diversification are discussed in the sections below. Implementing all three will dramatically improve your trading performance and your portfolio stability.

Diversifying Trading Strategies to Take Advantage of Market Uncertainty

For common trading strategies, I want to give you a flavour of how I think about this. Trend following is buying something when it’s going up and holding it until it starts going down and making a big chunk out of the middle. This is a very easy way to trade mechanically but not so easy psychologically. ‘Short selling‘ can be trend following, momentum, or mean reversion. It can be a range of strategies to short-sell stocks. However, if you’re buying something when it’s high, selling it when it’s lower, or buying something when it’s high and buy it back when it’s lower.

To illustrate the rest of my points and diversification, you can see below a trend-following system in case you don’t have one, so you know what it looks like. This is not an exciting system, and I don’t recommend you refrain from trading it. But it works and is profitable, but there are better systems to make money.

A simple trend following system example is select low-volatility stocks because they move smoothly. Ensure they’re liquid so you can get in and out without much slippage. Buy it when it has a new 200 bar highest close and sells it on a close below a 20% trailing stop. What that’ll do is find a stop that’s moving up smoothly, you’ll buy it, it’ll keep going up, and when it turns around and starts going down materially, you’ll get out. It’s not impressive, but it’s profitable. We have way better systems. If you’ve never traded trend following, here’s an example shown above.

The problem with just using trend following is you can get triggered when you get a pullback. You can also get stressed, emotional, and impatient because most trades are lost. You have got to have faith that it will come out of that drawdown.

In school, we weren’t trained to be wrong all the time. We were trained that getting 95% right was good, got rewarded and stood on stage with a merit certificate. As for me, I got trained that being 30% right was a failure, and I was a hopeless student. I did pretty well as a student and took a mindset shift to get comfortable with trend following.

Another problem is that you take your profits too soon. Although you can take profits too soon, you also need to think about your portfolio and your equity curve; if you’re only trend following, what problems do you have in your equity? What does the shape look like?

The maximum drawdown could be tremendous. There are a couple of other problems when the bull market ends; you often have a lot of give back. It can feel amazing when the market is hammering, and the market turns down, and you say, “Oh, what happened?” That can be gut-wrenching if you’re not prepared for it or if the drawdown is more significant than your maximum tolerance. You can also have long flat spots. Post 2008, when the market came down, one of my trend-following systems was out for nine months. Every day, I had always to check the rules, and there were no signals because I was out of the market.

It takes an intense amount of patience to deal with that. You also have to miss part of the recovery. You don’t have to, but sometimes you do because you’re waiting for confirmation that the bear market is over. You’re waiting for the market and the stocks to start trending up, and then by then, you’ve already missed 20% of the move, and you’ve got to get in and make money. Trend following, on its own, has some problems. Therefore, some of those problems might be solved on the short side by adding something to your portfolio. For a short selling system, in case you don’t have one, shown below is a simple illustration of one that works. You short the stocks that are trending down when the index turns down. You select high volatility stocks because they tend to collapse quickly, and you want them to be liquid.

The short side can be dangerous, and you want to avoid being stuck in a short squeeze. You want stocks that trade many volumes, so you’re a small fish, and you can’t get hurt. Once you’ve entered, when the market is going down, and your stocks are also going down, they’re highly liquid volatility stocks, place a profit target, and the volatility and the momentum of the market should drive most of those stocks down to the profit target, provided a profit target is not too wide.

If the bear market doesn’t continue and it rallies back up, you want to exit quickly when the index or the stock turns around. Some moving average crossover or something like that is an exit. This is a stylized example of a short-selling system in my portfolio. The equity curve, done by Amibroker, is on the right-hand side of the chart. There are several problems with short selling, and with this style, shown below is a couple of them. There are very few opportunities to short. How many bear markets have we had in our lifetime? We’ve had a few. However, we have to wait a fair amount of time in between, so we only have a little data to generate and backtest those systems. Therefore, we’ve got to be quite cautious.

This system shown above, it’s only been turned on a couple of times in its entire history. Thus, we have to be careful. We also have a problem with shortable stocks. Not all stocks are shortable, particularly in Australia, that’s painful. In the US, it’s much more manageable. Hence, we can only take some signals and patience is required. You have to know that this system is in your portfolio. You must be willing to keep checking that system and stay up to date through three or five years of a bull market. Then finally, it turns on, and you’ve got to have the conviction to take the trades because the bear market is here, and now you’ve got to put those trades on, and you haven’t done anything with that system for three years.

There’s a sizable drawdown, or the potential for a sizable drawdown if the market does rally hard, which can happen sometimes. Both trend following and short selling have some problems. If we combine them, there will be some benefits. If we combine long and short systems in the same market, it can solve some drawdowns because the trend following system is in a drawdown, and the short system will start making some money. We will also have fewer flat periods because when the trend following system is out, the short system will be in and vice versa. Therefore, we will have more potential for growth in our portfolio. We’ll also be in potentially more of the time. You must be prepared for being long and short simultaneously because you have the position of being either long or short.

This could be both an advantage and a disadvantage. You may be long and short simultaneously, which is beneficial, particularly in the case of sudden and unexpected shocks.

What problems remain when we combine long and short systems in the same market?

- You could lose on both and you want to have high conviction in those systems.

- More work to do. 20-30 minutes more work but it depends on how you trade. I trade systematically, so adding a system doesn’t add that much more work. It depends on how you make your decisions, but valid point.

If you’re long and short in the same market simultaneously, you’ve limited the profit potential of one of those directions. Primarily about stocks where I wouldn’t be long, the same stock I am short. However, if we’re talking about a market like an index, that might be more problematic. It solves some problems, but some problems remain. The biggest problem remains. We covered all of the ones it solves, but the biggest problem when you have a long and short system in the same market together is that at the market transitions, both systems are outside their prime profit-making territory. At the market’s peak, what happens to the trend following system is that you’re going to drawdown.

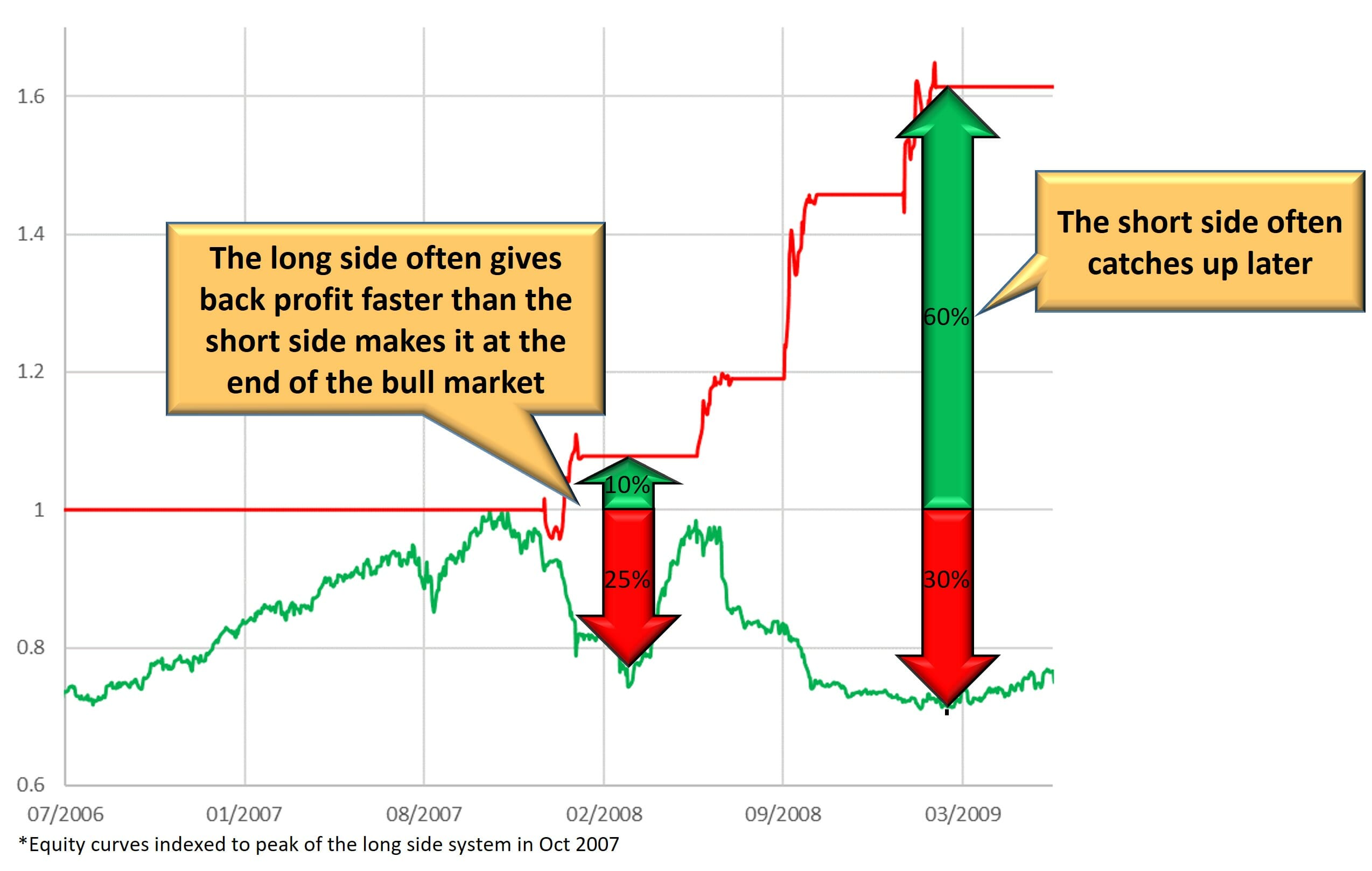

As the market is turning, the short system needs to be turned on, because you’re waiting for confirmation. Thus, the trend following system is drawing down, and the short system is waiting. The trend following system keeps drawing down, and then eventually, the short system turns on and starts buffering some of the losses from the trend following system. Then, the equity curve becomes smooth, and you start making money again. What I’ve done, as shown below, is I’ve backtested the long and short system, and I’ve indexed the equity curve to the peak of the long system right here. The red line is the short systems equity curve. The green line is the long systems equity curve.

There’s a problem that combining these two systems creates. The problem is that the long side gives back profit far faster at the beginning than the short system makes it because it’s going into drawdown. It’s got momentum down, and your short system starts to come on, and it doesn’t offset your losses at the turning point immediately.

Later, the short system has the potential to catch up and make back those losses and push your equity curve, your overall portfolio, into profits. However, the delay in the market transition is the problem. The overarching problem is that making money in bull and bear markets is easy. It’s the turning points that cause grief in the portfolio. It’s the turning point where there are sudden global shocks or events and local shocks or events, where these shocks or events suddenly affect the stock price.

Those turning points are the problem for making money consistently in an uncertain world. The more uncertain the world is, the more the market turns, and we are in pretty uncertain times. Some big gyrations are going on in most markets. Therefore, we must understand what we can do about these transition points.

Diversifying Markets to Reduce Transition Risk

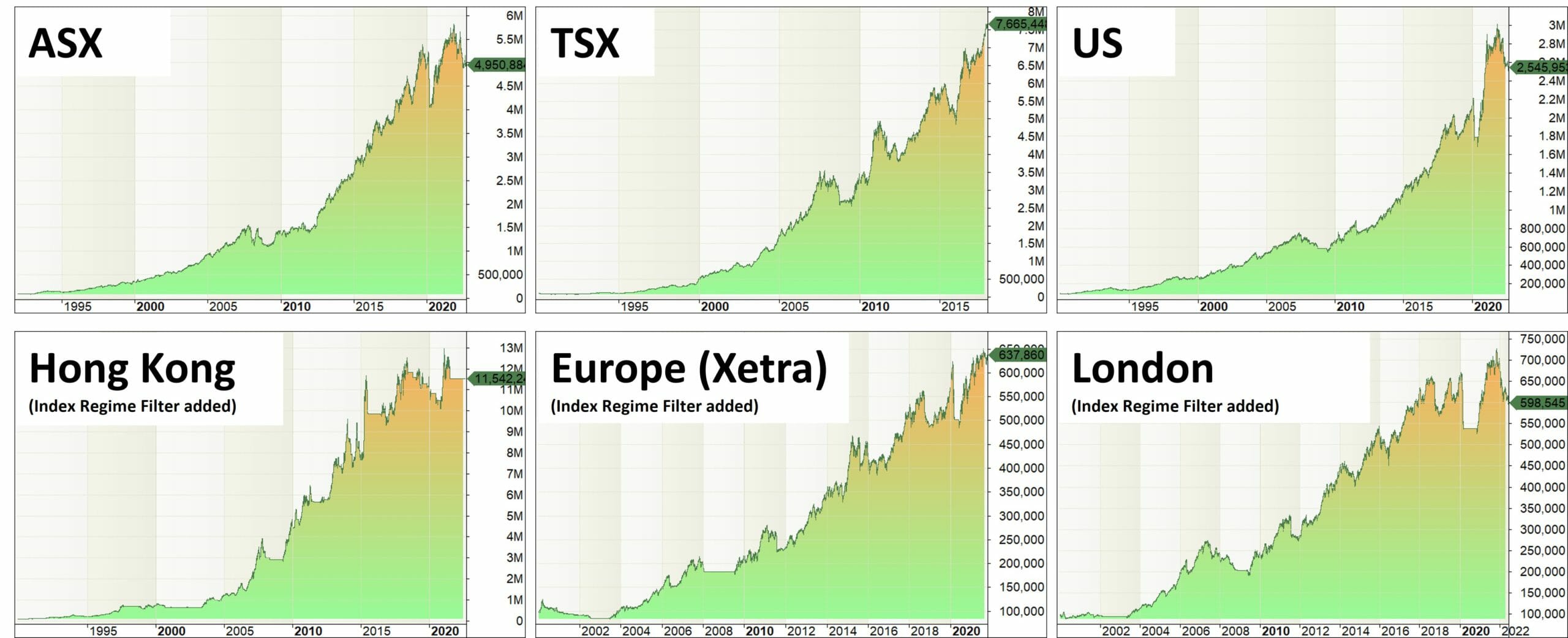

That trend-following system, which I gave you as an example, might work in more than just the Australian stock market.

It works in Australia, Canada, US, and with a slight adjustment, it works in Hong Kong and Europe on the Xetra exchange and the London Exchange. None is amazing, but this is a simple set of trading rules. The hypothesis that trend following around the world works is valid. However, no matter what market we’re in, we have this problem of the turning point.

On the short side, that same system might work in other markets. It works in Australia, Canada, US, and Hong Kong. There are many markets where you can’t short stocks. These markets are probably the easiest. Australia is the hardest out of all of these. But TSX, US and Hong Kong markets are very shortable. Stocks are very shortable, thus, you can use that same strategy in multiple different markets in which it would be useful because that diversification is going to help at the turning points.

The chart below shows the Australian long trend following the system equity curve and the Hong Kong long equity curve. You don’t see the years before this when the Hong Kong system made a ton of money, but no need to worry about that. I’ve indexed it to the peak of the Hong Kong market to show that the turning points in the different markets occur at other times. It’s tempting to say, “Oh, it’s a global economy. Everything is so correlated. When fear goes up, the correlation of everything goes to one.” And it’s true. It’s true of all things that are still strong, but sometimes there’s a weak market before the rest of the world, and this is what happened in Hong Kong.

The Hong Kong system peaked, drew down a bit, and went to cash. Meanwhile, the Australian system peaked several months later. On the other hand, the Hong Kong system entered short mid-November and started making money. The Australian system entered short around January 2022. However, it entered short several months later.

A portfolio of Long / Short systems on multiple markets smooths impact of market transitions because the drawdowns and equity highs are staggered as shown in the diagram below using the long and short systems in Australia and Hong Kong.

The transition was smooth because the Hong Kong market was weak very early when all of the crazy stuff started happening worldwide, and people were panicking along with the Australian and US market. The Hong Kong system already had shorts fully loaded in the portfolio. That global uncertainty after this market turned and we went short was actually to our benefit. Thus, the long and short diversifying markets are the key because markets will turn at different times, and systems will turn on and off at other times.

If you combine multiple long and short markets, the uncertainty starts to matter less and less. In my personal opinion, I like having a portfolio that’s at least half full of shorts when there’s a panic in the US overnight. I wake up and go, “Oh, cool, what’s going to happen today in my portfolio?” I don’t wake up and go, “Holy crap, what’s going to happen in my portfolio?” It’s just like Friday night. Well, Friday was fun in Australia since markets were strong, but then Friday night could have been more fun in the US. But when I look at my account on Saturday morning, all the shorts were already on. That’s what this diversification of long and short strategy and multiple markets will do.

The less correlated the markets are, the better this works, in which Australia and Hong Kong are great examples. Australia and US is slightly fewer benefits. However, they are much better even if you add crypto because these markets tend to turn at different times and rates.

The short systems will turn on at slightly different times, so if you can have multiple long and short strategies, markets, and asset classes, even global shocks matter far less. I like to sleep well at night, and I want to wake up comfortably I’m okay no matter what happened overnight in the US. Thus, the more you diversify long and short across different markets, the lower the strategy and market correlation. The less those market transitions will hurt your portfolio and affect your wealth, and that’s what we’re all about. This is about trading in uncertain times but still having the opportunity to trade and profit.

If you’re trading more than two long and short markets simultaneously in your portfolio, you can take advantage of this diversification to benefit your future wealth; this is my main message. I’m trying to show you a path to implement it in a relatively simple way that I know everyone can do because I’d love you to sleep better at night while making money.

It can be easy to make excuses for not trading more markets because it can feel overwhelming or difficult. However, if you trade with Interactive Brokers, you can get access to the most important markets around the world all from one account and you can readily get data to backtest these trading systems on all of these markets from Norgate data and/or Metastock data. If you have an Interactive Brokers account, you’ve got access to fantastic data while doing the trading. You can get ASX, the US and now Canada from one excellent quality source, which is fantastic. We’ve got data sources that can give you access to the data for most other markets. It’s possible because it just takes a little work to implement.

Most new traders are concerned about short selling because of the possibility of unlimited losses. If you are short of stock at a hundred, it can only go to zero, but it could go to infinity. The challenge is the theoretically unlimited loss potential. There may be some regulatory assistance to stop that. But the fact remains that you can lose more money than you can gain on the short side, which can be scary.

However, if you have a strategy that gets you in and out and is a fail-safe type of strategy. A ‘fail-safe strategy’ is you will not continue holding that stock forever while it keeps moving against you to infinity. So an exit rule must get you out and cut that infinite potential loss short. There must be that in your short system. Thus, you must have a fail-safe mechanism. Far more than the long side because on the long side, if the stock goes to zero, the pain stops.

You’ve got to have a strategy as well designed. You’ve got to make sure you’ll get out if it keeps moving against you and if the market turns around. However, the infinite loss potential is nowhere near as big of a deal if you stick to highly liquid stocks and have a fail-safe strategy. If you are shorting penny stocks that WallStreetBets is talking about, you could be in trouble, but don’t do that. It’s talking about big stocks, massive liquidity, and multimillion dollars per day turnover is what I’m talking about. And that risk goes away.

Diversifying Timeframes to Reduce the Impact of Market Uncertainty

What we’ve done is that we’ve got long and short, and reduced the flat spots, improved our equity curve, increased the amount of money we make over time, but we still suffered with the transition points in the market. Then we added more markets — giving us different timings of those transition points to smooth the portfolio, yet there’s more we can do. We can trade multiple timeframes, daily, weekly, and intraday charts. We can even trade longer term if you’d like. However, these are the three that I do. I have yet to extend my patience to monthly charts, but it’s possible. When you have different timeframes that your systems are based on, market turning points happen at other times or are obvious at different times. Therefore, your ability to go long and short and smooth those transitions, even more, is dramatically improved. We know that diversification, multiple uncorrelated strategies, and going long and short helps but we must do more.

One trend following strategy is great as long as you are patient, happy with big drawdowns, and so glad to sit on your hands for months on end waiting for the market to turn around. One short strategy is great if you’re happy to make money in a bear market and then wait five years for the next bear market. However, you got to combine more of these things, the more markets and strategies you combine, the smoother the equity curve, the better you sleep at night, and the lower the catastrophic risk potential in your portfolio.

When you trade multiple timeframes, you diversify against the risk of trend changes even further, which is helpful. How can we do that? Sit and stare at the screen only during the day. I don’t want to do that, but I still want to trade intraday.

Here’s an example on how to do it. Find very liquid stocks that are in an uptrend. Wait for them to drop into ‘oversold’ like they’ve gone down heavily. Then, place a limit order below that, and the stock’s going up. It starts going down; place a limit order. If it goes down the next day and triggers your limit, you get in and out at the close. Daytrade system makes money. There are a few around, and you’ve seen examples on various people’s websites, but it’s quite profitable. The equity curve looks good. This is an example from my portfolio.

The image above is a backtested equity curve generated using Amibroker for this day trading strategy. As you can see, the equity curve is stable and smooth and makes consistent returns over time, making it an excellent addition to a portfolio of longer term systems.

How Does Adding a Day Trade System Help Diversify a Portfolio of Trading Systems

First of all, let me stress that this is a ‘day trade’ system, it’s in and out in one day, and there’s no overnight risk. However, it’s not a day trade system as in “buy, sell, buy, sell, buy, sell” because I don’t want to do that. That doesn’t work for my lifestyle since I’m a 20 to 30 minutes a day max kind of person and that’s all I want to do in my trading. How does it help? The first thing is that it’s a day trade system, it only uses the capital during the day. Thus, you’ve got money left on the sidelines from your other strategies.

In that case, you can deploy it in the day trade system, and it doesn’t take away from the ability of those different strategies to take new positions because you didn’t have any. You had cash sitting there that the other system wasn’t using. You can use the day trade system for the day, and then tomorrow, if the cash is still there, you can use it for the day trade system. Then the next day, if it’s taken up because there’s a new position in the short system, you don’t use that cash. Therefore, capital utilization allows you to add it to the portfolio nicely, which is good diversification.

Secondly, a day trade strategy like this doesn’t have a big drawdown in a catastrophic event because they don’t take an overnight risk, so there are no overnight shocks. There’s much less in the way of new shocks. Thus, adding this to the portfolio doesn’t add much catastrophic risk; it just gives you the ability to profit another way.

The third benefit is that it is instant off. If you have and trade a trend following system, one of the problems is, you get in and the market’s going up. You’re feeling good, and you’re making money and then it starts going down, you’re feeling less good, and then eventually your drawdown gets to the point where the system starts closing out positions, and you go to cash, hopefully. However, it’s not instant off; you must go through that drawdown first.

Whereas with this system, if the market regime filter turns off, as in the market is no longer going up, it’s going down. Thus, you don’t want to trade on the long side. The system’s off instantly, and there’s no delay or lag. Therefore, you don’t have that transition drawdown that you would in a trend following or traditional multi-day short system.

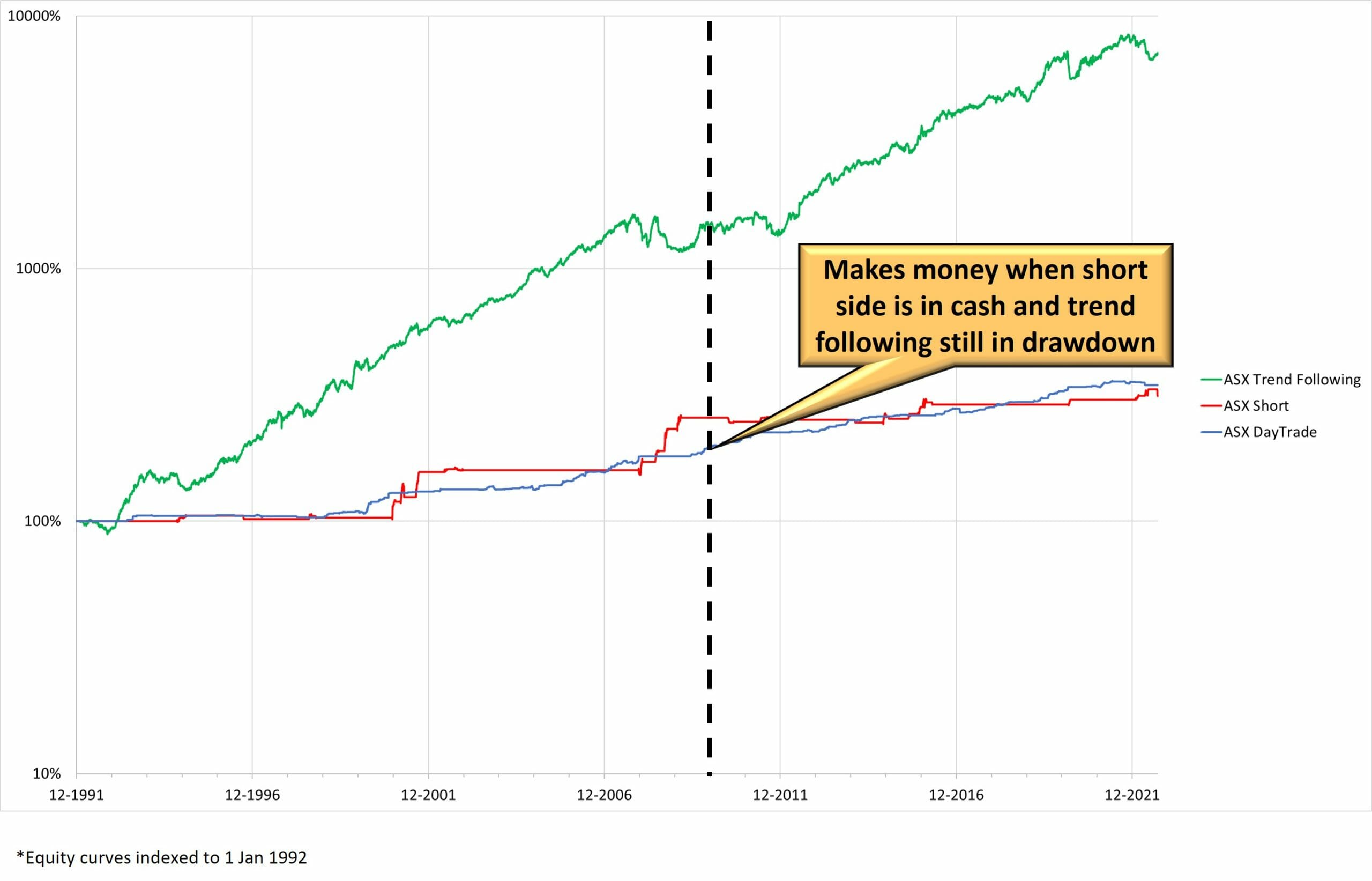

It’s nice because it makes money differently. This is why multiple uncorrelated strategies are added to the portfolio works. The plot of the different equity curves and the smooth blue line is shown below. However, this is the “why.” Since some of us can, we can only trade 50, 80, or 100 strategies in a hedge fund style. But if you do four or five of these in three or four markets, there is a dramatic improvement. We can all do that.

Finally, this system style can make money when the short side’s in cash and the long side is still drawing down to the point where the trend following system turns off. Therefore, it still makes money in other market behaviours at different times, which is very useful.

You can take capital that is not deployed in your long side trend following and not deployed in your short system, and you can slot it into the day trade style of the system whenever it’s there, whenever it’s free in which it’s like an extra return. You can also take a slice of your capital, allocate it to day trade systems, and have a portion of your capital to trend following and a piece of your capital to short various ways to do it. You can see how adding long, short, different markets and now different timeframes completely change the profile of how your portfolio is affected by a sudden shock, either globally, locally, stock-specific, or system specific. If you had this going, it wouldn’t be a big concern.

You’ve got so many other things, and each position is pretty small. If your positions are small, you don’t have to worry about catastrophic risk. If you’re only long and you’ve only got ten positions in your portfolio, you’ve got to worry about stock-specific and market catastrophic risks since it’s a big problem. However, if you’re long and short, in multiple markets and timeframes, the impact of all of those risks is massively reduced.

Summary Of How to Structure Your Portfolio to Maximize Opportunity and Manage Risk In An Uncertain World

All you have to do is reduce the impact of market uncertainty by trading multiple long and short strategies across various markets and numerous timeframes. That’s all you have to do. You saw from the systems that those could have been better, but with a few minor tweaks, they can very well become great systems.

With a small amount of work, you could take those ideas, turn them into great systems, combine them into a portfolio, and the impact of market uncertainty is dramatically reduced, and if not, become an advantage to you in your portfolio. I love it when the S&P drops 3% or 4%; that is pretty exciting because I’ve already got shorts across multiple markets, and some of those markets are weaker than the US. That’s an excellent, powerful position to be in. I know my wife likes it when I wake up and go, “Hey, cool,” as opposed to years ago when I was like, “Oh, shit. What happened overnight?” therefore, that’s an excellent position to be in.

How To Evolve as A Trader to Maximise Opportunity and Manage Risk

What does it have to do with trader evolution? Here is the typical evolution that I’ve seen. Stock picking, tips, and signals moving up to discretionary technical analysis can be helpful. It can reduce some mistakes, limit our losses and so on. However, discretionary takes much time. Moving up to systematic trading, rules-based or algorithmic, where you know exactly where you’re going to get in and out. It takes even less time to execute and you can have more positions and more diversification without killing your lifestyle.

You are then moving up to a portfolio of trading systems, multiple systems uncorrelated, which further smooths your returns. However, if you take the final step on the right-hand side of this chart, a portfolio of trading systems across different strategies, markets, and timeframes, you can still do this in 20 to 30 minutes daily.

You can sleep well at night while making money, but not quite. No matter what the market is, the more strategies you have and the better the market, the better the strategy is, almost no matter what the market is doing. It takes investment upfront in terms of time, energy, and learning. However, the great thing is, you can do this in 20 to 30 minutes a day once you’ve done the learning and implementation, gone systematic and done the diversification.

Most traders need to be more diversified. You can diversify much more broadly if you trade systematically because it doesn’t take much time. I get one of the significant objections: “Oh, I don’t know that market, what those companies do, and what the regulations are in Hong Kong. I’m not comfortable.” It’s true, but if you trade purely systematically, none of that matters; that’s all out the window because you’re trading based on price movements, strategies, markets, and timeframes. Intraday trading doesn’t mean you have to stare at the screen all day, you can diversify a way down in the timeframes, not kill your lifestyle, and get all the benefits.

How To Implement a Globally Diversified Portfolio In 30 Minutes A Day

How about we do this in 30 minutes a day? First, you have to eliminate discretionary trading because it will not make a happy life. Suppose you’re doing discretionary analysis on the ASX, Hong Kong, Canada, and the US, and you’re worried about your long and short positions. In that case, you’re tracking them all discretionarily, and it will be a nightmare. You’ll make many mistakes, and you’ll be better off with one basket and one egg, observing it.

However, if you’re not discretionary and have systems and objective strategies that drive all your decisions, this is possible in very little time. The first step is to eliminate discretionary strategies and trading. The second step is to buy or build. Both can work, a portfolio of long and short strategies across multiple markets, designs, and timeframes. You should do more than just buy a strategy and use it.

Why You Shouldn’t Buy a Strategy and Just Start Using It

It’s not yours, and it might not work. You don’t have confidence in it for all sorts of reasons. Thus, you have to backtest, analyze and investigate it. Some people subscribe to a signal service or buy a set of rules, start trading, and say, “Yeah, I’m a trader.” No, you’re not; you’re just taking your agency and giving it to someone else, saying, “Make me profitable.” But if you buy or build a system and you backtest, analyze, and build confidence in it, then it’s yours, and you are the trader.

I use Amibroker, Norgate Data, and Metastock data because I want access to more markets. I use Metastock data for the Asian markets, for instance. Backtesting is a skill to be learned just like any other. There’s lots of material out there to understand that. However, once you’ve backtested and built confidence in those systems, the next step is to run the backtest, extract the equity curves, evaluate how they work together, and develop the right weights so that your portfolio gives you the suitable risk returning characteristics that you want.

There are lots of different ways to do it since there are some online tools. I do it in a spreadsheet and have a complex mechanism to do that. It’s about how diversified they are and how much weight I need to smooth the transition points in this globally uncertain environment. You’ve got to have the systems, test them, build confidence, and assign them weights in your portfolio. Once you’ve done all that, it is an easy execution. To find your signals every day, you run the backtest, it spits out what trades the system will take today, you place the orders, and you are done. That takes two to three minutes per system on average.

This is how you can trade a globally diversified, long-short portfolio of multiple strategies in 20 to 30 minutes a day across multiple timeframes. Most of this can be easily automated with some effort. I still need to automate fully now, but certainly moving in that direction. My trading truly takes up to five to ten minutes a day, then thirty minutes on a busy day when I’ve got lots of signals to put in. However, that’s across several different markets and only a few strategies, many systems and timeframes. Analytical people and traders tend to fall into the trap of overanalyzing and taking a long time to think, “I’ll think about that, I’ll work on it, and I’ll research the backtest for the next 15 years.” You wouldn’t notice that you’re still backtesting many years later.

However, don’t overanalyze, don’t procrastinate, and don’t make excuses since there is value in this. It’s like you’re trading trend following in another market. You’re shorting in Australia and in another market, you’re doing analysis once a day, and analysing a different timeframe. This can all be primarily automated or made into an easy step-by-step process, everyone could do this.

Common Trading Questions About Global Diversification

Could you diversify even more by not using stocks or ETFs and inverse ETFs?

Diversification with ETFs is valuable in that you are holding more stocks. Your stock-specific risk decreases, but your market risk stays up. You now have one position representing the whole market, which is much less volatile, it won’t make you as much money as the best stocks, and you’ll still have the market level of drawdown. While ETFs are a great instrument to reduce stock-specific risk, I don’t trade them so much because they need to reduce the catastrophic market risk.

Can you swap between a positive and a negative ETF? Yes, it can help. I prefer stocks because the upside is better than the ETF, and the downside is mitigated because you’re getting out and holding many stock positions. You’ll get out progressively, but it’s a valid strategy. It’s just not one that I use.

What data source is best for intraday?

I don’t use intraday data because my intraday system is designed and tested on daily bars. If you want to design a system like what I illustrated below, I will use Norgate for Australia, US or Canada or your preferred data source for other daily bars, Metastock, JustData or others. For intraday data, as in you want 30-minute bars or five-minute bars, I can’t recommend it.

When allocating capital among different strategies, how often do you recalibrate, and what data history do you base that allocation on?

My allocation works because I take my total capital daily and divide it between all of my strategies according to a set percentage. I look at the exposure I’ve got for every single strategy and day. That tells me, do I have spare capital in that strategy today? If spare capital is available in that strategy, I’ll run the strategy and see if I’ve got new signals. If I’ve got new signals, I’ll take them, but I’ll stop when my allocated capital for that system is full.

That means I’m checking every day whether I’ve hit that strategy’s capital or allocation limit. If a strategy does well, it can overshoot, which could be a problem. You can scale down weekly or monthly, but I don’t. I let it run because that’s when you’re getting the super profits. Then when those trades that generate the super profits close out, that capital gets redistributed amongst everything else, and I let that flow through naturally.

Conclusion:

As you have seen, in order to improve your returns and reduce risk, in particular the risk of market transitions. As traders, we need to diversify across different strategies, markets and timeframes. This is a powerful method of improving any systematic trading portfolio. The more markets we trade, long and short, and the more strategies and timeframes we include into our portfolio— the smoother our terms, the lower the risk, the higher confidence we can have about our trading profits, and the more soundly we traders can sleep at night.

If you want to learn how to implement a globally diversified portfolio of strategies, markets, and timeframes in your trading, then click this link to learn more about the Trader Success System. In the Trader Success System, you’ll get a ready made portfolio of trading systems that cover different strategies, markets and timeframes to allow you to implement all of the principles in this article and manage your entire portfolio in just 20-30 minutes a day. If that sound like something you would be interested in, then click the button below to learn more about the Trader Success System.

Share This

Share this post with your friends!