The Importance of Keeping a Trading Journal

Trading in the financial markets can be a rollercoaster ride. Whether you’re a novice or an experienced trader, the key to consistent success lies in systematic and disciplined trading. And one tool that can significantly enhance your trading game is a trading journal.

Effective trading starts with a journal – an absolute must for traders, even as a beginner or expert. It’s your guide for navigating the complex world of trading, and it’s not just about keeping records, but it’s your groundwork for experimenting with different strategies and fine-tuning your trading game.

Your trading journal is your trusty companion for recording all your trading activities, and it serves as the perfect testing ground for trying out various trading plans and strategies. Notably, trading journals are your secret weapon for uncovering your trading style’s hidden strengths and weaknesses.

Embrace the power of journaling, and you’ll be well on your way to discovering the mysteries of trading success.

Understanding the Basics

What Is a Trading Journal and Why Do You Need One?

A trading journal is a documented record of your trading activities. It’s more than just a ledger; your trading journal offers valuable insights into your decisions, strategies, and performance. In other words, it’s like your trading diary that you write to every day.

But why is it crucial? Trading journals serve as invaluable tools for self-evaluation, allowing traders to analyze their past trades and identify areas for improvement. These journals serve a dual purpose, not only as a record-keeping method but also as a means of enhancing your trading prowess.

You can easily tell the difference between a trader who keeps a trading journal versus who doesn’t:

Can you tell the difference between the two? Having a trading journal is a deciding factor in whether you’ll become a consistently profitable trader or not.

Creating Your Trading Journal: Template and Tools

To get started, you need a structured approach. Consider using a trading journal template or specialized software. These tools provide predefined categories for key trading metrics such as entry and exit points, position size, risk management, and emotional state.

You also need to know what information you want to track and input in your trading journal, such as the instrument you are trading, whether it is long or short, the date of the trade, commissions paid, the strategy or system used, reward to risk, successful or unsuccessful.

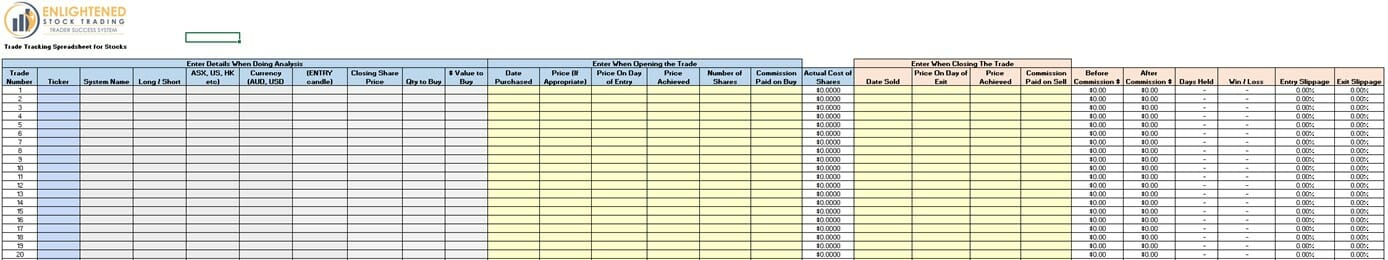

Here is an example of a trading journal template:

Once you’ve established your stop losses and take profits, the next step is to document your trades in your journal every day. It would be best to consistently and diligently write your trading journal.

Following this, it’s essential to check and review your performance, whether daily, weekly, or monthly. During your review sessions, you can check and analyze your trades to extract valuable insights or devise plans to improve your trading.

Trading Journal Excel vs. Online Apps: Which Is Right for You?

Evaluate your preference for recording and analyzing your trades. Some traders swear by Excel spreadsheets for their flexibility, while others prefer the convenience of online trading journal apps. Make the choice that aligns with your trading style.

I use Microsoft Excel, and it works wonders for me – it is flexible and allows you to adapt and change as your needs evolve. I think that the additional cost of a paid online trading journal app is unnecessary in most cases.

Utilizing the Best Trading Journal Tools

Exploring Trading Journal Software: Features and Benefits

Trading journal software typically includes features like trade analysis, performance metrics, and reporting tools. These can save you time and provide in-depth insights into your trading patterns, especially if you are a discretionary trader. If you use trading systems, it is important to analyze your system performance using backtesting in addition to recording trades in your journal.

A comprehensive trade journal should encompass crucial elements such as trade entry and exit points, reasons for the trade, risk management strategies, and emotional notes. Let’s dive into each of these components to understand their significance. This list of potential features and benefits will help you choose the right trading journal software.

- Trade Entry and Management: The ability to swiftly enter and manage trades is at the heart of any trading journal software. When you choose your trading journal platform, ensure it provides intuitive interfaces where you can input essential trade details such as entry and exit points, position size, and trading instruments.

- Trade Analysis and Performance Metrics: One of the standout features of trading journal software is its ability to analyze your trading performance comprehensively. It provides valuable metrics and insights, including profit and loss summaries, win-loss ratios, and drawdown analysis. When deciding on your journal platform, compare what performance metrics are available and whether these can be customized. If you choose Excel, you can easily add any performance metrics you want.

- Customization and Flexibility: No two traders are exactly alike, and your trading journal software should recognize this fact. Ideally, it will allow for high levels of customization to suit your unique trading style and preferences.

- Risk Management Tools: Effective risk management is the cornerstone of successful trading, and some trading journal software comes equipped with tools to help you manage risk if you are a discretionary trader. If you are a systematic stock trader like me, incorporate risk management into your trading system rules rather than the journal.

- Performance Analytics and Reporting: Your trading journal software shouldn’t just collect data; it should transform it into meaningful insights through performance analytics and reporting features. In some online trading journals, you can generate comprehensive reports highlighting your trading trends over time.

- Trade Journal Automation: To save time and minimize the risk of oversight, many trading journal software options offer automation features. They can include importing trade data directly from your brokerage accounts, reducing manual data entry, and ensuring that your journal remains current.

- Cloud-Based Accessibility: Cloud-based trading journal software ensures that your data is securely stored, eliminating the risk of data loss and offering the convenience of remote access.

- Trading Psychology Insights: Beyond the technical aspects, some trading journal software includes features that delve into the psychological aspects of trading. Given that I use Excel for my trade recording, there is not a huge opportunity to capture the psychological aspects of trading, so I combine my Excel trade log with a written trading journal in Microsoft OneNote, which allows me to capture my psychological evaluations, ideas, mistakes and learnings at the portfolio level.

- Security and Privacy Measures: Security is paramount, given the sensitive nature of trading data. Leading trading journal software providers should also employ robust encryption and security measures to safeguard your trading information, ensuring your data remains confidential.

In terms of the benefits of selecting the right trading journal (and maintaining it), here are some:

- Enhanced Trading Discipline

- In-Depth Self-Analysis

- Continuous Learning

- Decision-Making Confidence

- Risk Mitigation

- Accountability and Accountability

- Goal Tracking

- Time Efficiency

- Data Security

- Performance Benchmarking

As you navigate your trading journey, consider embracing the power of trading journal software, and you’ll find yourself on the path to becoming a more proficient and successful trader.

Practical Trading Journal Tips

How to Prepare a Trading Journal: Step-by-Step Guide

Providing a step-by-step guide on how to prepare and maintain a trading journal can be immensely helpful. Include tips on data collection, record-keeping, and regular reviews.

- Select your preferred method of keeping your trading journal: pen and paper, Excel, online note-taking software such as OneNote, trading journal software, or some combination of the above

- Decide what information you are going to track:

- Trade Date and Time

- Trading Instrument (Stock, Forex Pair, Cryptocurrency, etc.)

- Entry and Exit Prices

- Position Size or Quantity

- Stop-Loss and Take-Profit Levels

- Trading Strategy or Plan

- Risk-Reward Ratio

- Notes on Trade Rationale and Emotions

- Create your template in your journal.

- Record every trade. Consistency and discipline are needed to track every trade you make.

- Analyze trades regularly.

- Review your performance and make room for improvement.

How to Keep Your Trading Journal Consistent and Effective

- Consistency and discipline are key, and it starts with daily commitment. Treat it as a non-negotiable task in your trading routine, just like analyzing charts or placing orders. The more consistent and extensive the information you add to your journal, the better the insights you will gain from it in review, and the easier it will be to identify improvement opportunities and review trade data to improve future trade setups.

- Leverage technology to your advantage. Using digital trading journal software or an Excel spreadsheet, take advantage of features that allow quick and easy data entry. Many platforms offer templates and automation options to streamline the process.

- Never skip recording a trade, no matter how insignificant it may seem. Even small trades can reveal valuable insights over time. Whether it’s a winning or losing trade, record it promptly.

- Ensure that your entries are comprehensive and specific. Include all relevant details such as trade date, time, trading instrument, entry and exit prices, position size, stop-loss and take-profit levels, and the reasoning behind the trade. The more detailed your entries, the more informative your journal becomes.

- Don’t overlook the emotional aspect of your trades. Note your emotional state before, during, and after each trade. Capturing your emotional state can help you identify behaviour patterns that might affect your decision-making.

- Your trading journal should reflect your trading plan and strategy. Regularly review your entries to ensure you adhere to your predefined rules. If you deviate from your plan, note it and analyze the reasons behind the deviation.

- Set a schedule for reviewing your trading journal. This could be daily, weekly, or monthly, depending on your preference and trading frequency. During these reviews, analyze your trades, assess your performance metrics, and look for patterns or trends.

- Use your journal as a tool for ongoing learning. Reflect on your wins and losses. What worked well, and what didn’t? Identify areas where you can improve. The goal is not just to document trades but to gain insights that lead to better decision-making.

- Acknowledge your successes and achievements in your trading journal. Celebrating wins can boost your confidence. Similarly, don’t shy away from documenting mistakes and losses. They are valuable learning opportunities.

- Be objective when reviewing your journal. Avoid assigning blame or making excuses. Instead, focus on facts and data. This objective approach can help you make informed decisions.

- As your trading skills and strategies evolve, adapt your journal accordingly. Please update it to reflect changes in your trading plan, risk management techniques, or goals.

- Ensure that your trading journal is securely stored and backed up. Loss of trading data can be detrimental. Use cloud storage or multiple backups to safeguard your records.

Consistency is an ongoing commitment. Even during challenging periods or when motivation wanes, stick to the habit of maintaining your trading journal. It’s during these times that journaling can be most beneficial.

By following these steps, traders can maintain a consistent and effective trading journal that is a powerful tool for self-improvement and enhanced decision-making in the trading world.

Real-World Examples

Trading Journal Example: A Case Study

I’ve been using a trading journal since I started trading. Using a trading journal has significantly enhanced my trading experience and bolstered my profitability.

The trading journal has empowered me to make informed decisions, keep a close eye on my performance, monitor my trading psychology, and identify areas for improvement. It’s not merely a record-keeping medium but a compass that has guided me towards a more successful trading path. My consistent use of a trading journal has been a huge factor in my increased profitability as a trader.

Stock Trading Journals: Learning from Successful Traders

Many successful traders have credited trading journals as a key part of their success. It is broadly accepted that meticulous record-keeping is a common practice among top traders. Here are a few examples:

- Jesse Livermore: Touted as one of the most legendary traders in history, Livermore was known for keeping detailed records of his trades. He emphasized recording entry and exit points, sizing, and market conditions. His book “How to Trade in Stocks” provides insights into his trading approach, highlighting the value of record-keeping.

- Ed Seykota: A successful trend-following trader, Seykota is famous for his exceptional returns. He’s known for meticulously tracking his trades and for the saying, “In order to win, you must be willing to be wrong for a while.” Keeping records helped him stay disciplined and stick to his trading system.

- Paul Tudor Jones: The famous billionaire hedge fund manager is known for keeping journals of his trades. He stresses the critical importance of learning from mistakes and evolving as a trader, which is easier when you have a record of your past decisions.

- Linda Bradford Raschke: A prominent trader and author, Raschke emphasizes the significance of journaling in her books. She highlights the value of recording your thoughts and feelings during trades to improve self-awareness.

- John Bollinger: The creator of the popular Bollinger Bands indicator advocates using journals to track trading strategies. He believes it’s essential for traders to review and learn from their past trades.

They’ve succeeded remarkably by keeping trading journals and learning from their experiences. If it is good enough for these well-known and respected traders, it is also good enough for the rest of us!

Going Digital with your Trading Journal

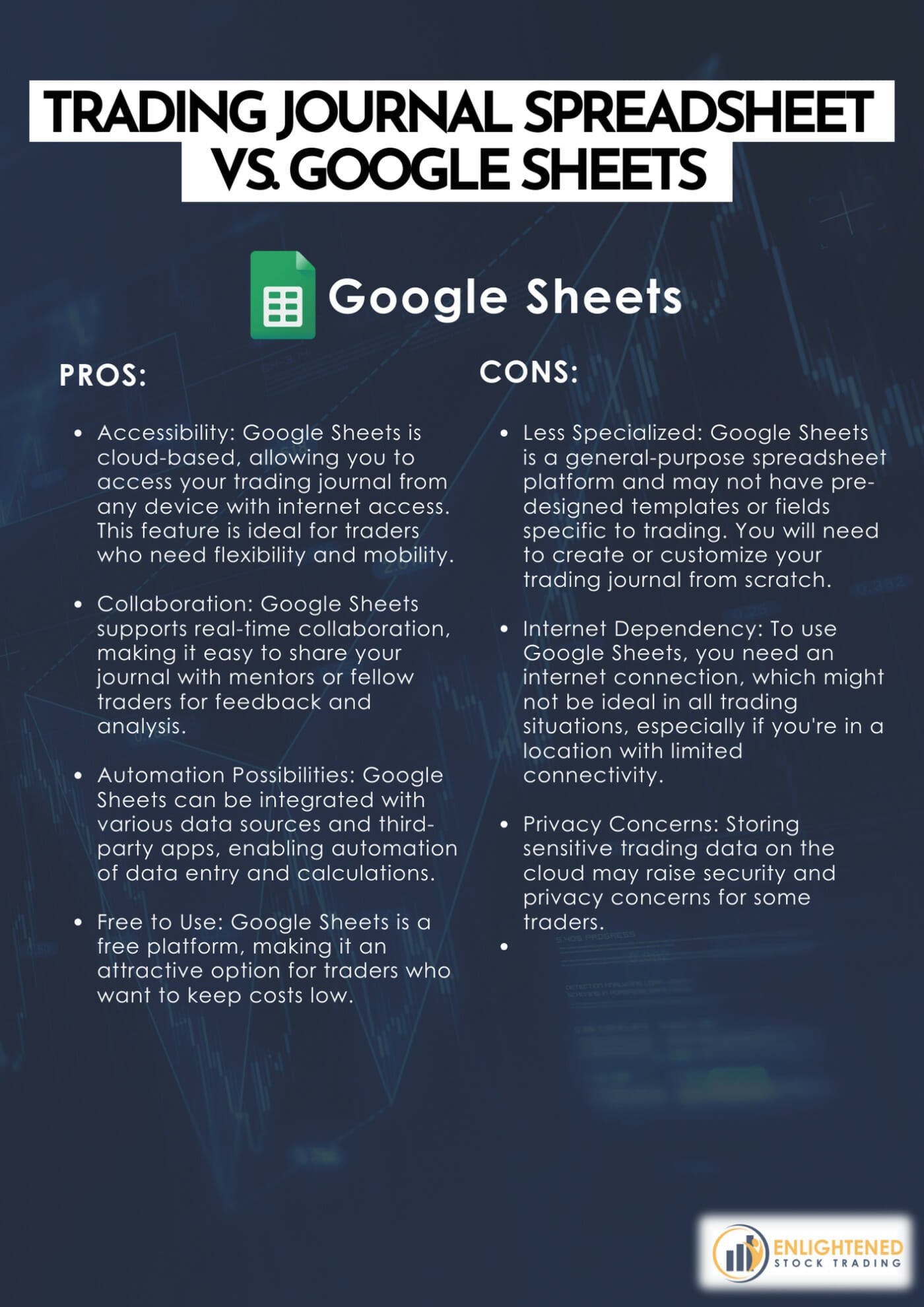

Excel Trading Journal Spreadsheet vs. Google Sheets: Pros and Cons

When maintaining your trading journal, you can choose between using a specialized trading journal spreadsheet and utilizing Google Sheets, a popular cloud-based spreadsheet platform. Each option has its own set of advantages and disadvantages. Let’s compare the pros and cons of using an Excel trading journal spreadsheet versus Google Sheets to help you make an informed decision:

The choice between an Excel trading journal spreadsheet and Google Sheets ultimately depends on your preferences and requirements. I love Excel, and others I know prefer Google Sheets. A trading journal spreadsheet may be your best bet if you prefer a specialized tool with pre-built trading-related features and don’t mind manual data entry. On the other hand, if you value accessibility, collaboration, and automation possibilities and are comfortable with customization, Google Sheets could be the right choice. It’s essential to consider your trading style, preferences, and need for specialized trading features when deciding.

Discovering the Best Trading Journal App for Your Needs

Before starting the selection process, you must understand why a trading journal app might be your best ally in trading success. Here are some factors you should consider when choosing the ideal trading journal app: Accessibility, automation, organization, analytics, and security.

There are several trading journal apps available for traders to choose from. Here are a few popular ones:

Tradervue: Tradervue is a comprehensive trading journal and analytics platform that supports stocks, options, futures, and forex. It offers trade tagging, performance analytics, and integration with various brokerage platforms.

Edgewonk: Edgewonk is a powerful trading journal and performance analysis tool designed to help you improve your trading skills. It offers many features, including trade import, advanced statistics, and journaling.

My Trading Journal (MTJ): MTJ is a user-friendly trading journal app that allows traders to record their trades and analyze their performance. It provides customizable fields, charts, and reporting tools.

R-Trader: R-Trader is a trading journal app focusing on risk management and performance analysis. It offers features like trade import, risk-reward analysis, and psychological analysis tools.

TradeBench: TradeBench is a useful free online trading journal that provides trade analysis, performance tracking, and risk management tools. An added benefit is that it is accessible from any online device.

TradingDiary Pro: TradingDiary Pro is a trading journal software for stocks, options, futures, and forex traders. It offers many features, including trade analysis, risk management, and reporting tools.

AlphaTrade: AlphaTrade is a trading journal and analytics app for stock and options traders. It includes features like automatic trade importing and performance analysis.

Evernote: While not specifically a trading journal app, Evernote is a versatile note-taking and organization app that some traders use to create their trading journals. It provides flexibility in formatting and organizing trade records.

Microsoft OneNote: Similar to Evernote, it is a general purpose not taking application that synchronizes across multiple platforms. I use OneNote for the trading psychology side of my trading journal. It is easy to use and customizable.

TradingView: TradingView is a popular charting platform that also offers journaling features. Traders can create trading notes and track their ideas directly on the platform.

Remember that the best trading journal app for you will depend on your specific needs and preferences. It’s important to consider factors such as the assets you trade, your desired level of customization, and your budget when choosing a trading journal app.

Expert Advice

Tips from Seasoned Traders: How They Use Their Trading Journals

As many experienced traders will tell you, trading is as much about strategy as it is about reflection and continuous improvement. When it comes to using trading journals, seasoned traders have developed a holistic approach that goes beyond merely recording trades. They leverage their journals to track performance and cultivate insights, using different tools and techniques to enrich their trading journeys.

- Trade Recording Mastery

One fundamental aspect of a trading journal is the meticulous recording of trades. This method serves as a historical archive, allowing traders to revisit their past decisions and track their progress. Seasoned traders prefer spreadsheets, as they offer a structured and easily navigable format.

The trade recording process typically involves categorizing trades by strategy and market. By doing so, traders can discern which strategies yield favorable results and which ones require adjustment. This categorization is like a roadmap guiding them through their trading landscape.

- Cultivating Ideas and Self-Analysis

However, trading journals offer more than a record-keeping function; they become a canvas for generating ideas, introspection, and self-analysis. Seasoned traders recognize that success in trading extends beyond the numbers; it hinges on a deep understanding of oneself and the market.

As mentioned above, I use Microsoft OneNote, and this versatile platform allows for freeform writing and organization. I create dedicated sections within OneNote to capture the essence of my trading experiences:

Trading Ideas: In this section, I jot down my innovative trading concepts, strategies, and potential opportunities. It’s a repository for inspiration and new horizons. It is important to capture ideas when inspiration strikes so they are not lost!

Learning from Mistakes: A crucial part of trading is learning from errors. I use this space to dissect my missteps, ensuring the lessons are not forgotten. Each mistake becomes a stepping stone to progress in my trading.

Self-Reflection and Analysis: This is where my inner dialogues come alive. It’s a space for introspection, where I ponder my emotional state during trades, analyze their decision-making process, and set personal development goals.

System Investigations: Traders often investigate their trading systems to optimize their strategies. This section is dedicated to delving into the mechanics of my trading methodologies and exploring areas for refinement.

The beauty of using tools like OneNote is its flexibility for deep exploration. It encourages traders to engage in thought-provoking and soul-searching exercises, fostering personal growth alongside trading acumen.

Ultimately, the trading journal becomes more than just a ledger; it transforms into a comprehensive guide through the intricate world of trading. The process of recording trades, scrutinizing strategies, and engaging in reflective introspection becomes a cornerstone of success. It’s a journey that seasoned traders undertake with the utmost dedication, as they know that the true mastery of trading lies not just in numbers but in understanding oneself and the ever-evolving market dynamics.

What Is the Best Trading Journal?

The truth is, there’s no one-size-fits-all answer to this question. The choice of a trading journal is a highly personalized decision that depends on the trader’s individual preferences, trading style, and lifestyle. It’s like choosing the perfect tool for the job; the best tool varies from trader to trader.

If you’re a trader who appreciates simplicity and prefers to keep things straightforward, your best trading journal might be an Excel spreadsheet or good old-fashioned pen and paper. These methods are tried and true, offering a no-frills approach to record-keeping. They provide the freedom to structure your journal in a way that resonates with your trading style.

On the other hand, if you’re searching for advanced features and sophisticated journaling tools, trading journal software emerges as the optimal choice. These software solutions offer a comprehensive suite of tools to cater to traders with diverse needs. They often include automated data entry, performance analysis, risk management tools, and customizable fields. This level of sophistication is well-suited for traders who require in-depth insights and a systematic approach to managing their trades.

So, in essence, determining the best trading journal boils down to a ‘case-by-case’ basis. It hinges on your specific requirements and objectives as a trader. It’s about aligning your choice with your unique trading journey.

To choose your best trading journal, start by considering your trading objectives, the level of detail you want to maintain, and the tools that complement your trading style. Some traders may find that a basic journal suits their needs perfectly, while others might benefit from the robust capabilities of trading journal software. Remember, it’s all about what works best for you and supports your path to trading success.

In conclusion, there’s no universally ‘best’ trading journal. Instead, the best trading journal for you is tailored to your preferences, goals, and approach to the trading world. Embrace the freedom of choice, and select the journal that empowers you on your trading journey.

Conclusion

In conclusion, a well-maintained trading journal is your secret weapon for achieving trading success. It’s not just a record of your trades; it’s a guide to your strengths, weaknesses, and opportunities for improvement. Start your journey to trading excellence today by setting up your trading journal.

Remember, you are only one trading system away from reaching your financial goals.

Frequently Asked Questions About Trading Journal Softwares

What is trading journal software?

Trading journal software is a tool designed to help traders systematically record, analyze, and improve their trading performance. It goes beyond a simple ledger by offering features that provide deeper insights into your trading habits, strategies, and results. Here’s what it typically includes:

- Trade Entry and Management: Allows you to log essential details like entry and exit points, position size, stop-loss and take-profit levels, and the rationale behind each trade.

- Performance Metrics: Provides detailed analytics, such as profit and loss summaries, win-loss ratios, drawdowns, and risk-reward statistics. These metrics help you evaluate the effectiveness of your strategies.

- Risk Management Tools: Some software includes features to track and manage risk, which is critical for discretionary traders. For systematic traders, risk management is often built into the trading system itself.

- Psychological Insights: Advanced tools may include sections for journaling emotions, mindset, and psychological factors that influence trading decisions.

- Automation and Integration: Many platforms allow you to import trade data directly from your broker, reducing manual entry and ensuring accuracy.

- Cloud-Based Accessibility: Ensures your data is securely stored and accessible from multiple devices, so you can review and update your journal anytime.

Trading journal software is invaluable for traders who want to refine their strategies and improve discipline. Whether you prefer a simple Excel setup or a sophisticated platform, the key is consistency in maintaining it.

What is the best journal for trading?

The best trading journal depends entirely on your trading style, preferences, and goals. There’s no one-size-fits-all solution, but here’s how you can decide:

- For Simplicity and Flexibility: If you prefer a straightforward approach, an Excel spreadsheet is a fantastic option. I personally use Excel to log trades, including details like entry/exit points, position size, commissions, and notes. It’s highly customizable and lets you adapt as your needs evolve.

- For Psychological Insights: If you want to capture emotions, ideas, and learnings, tools like Microsoft OneNote or Evernote are excellent. I use OneNote for this purpose – it’s accessible across devices and allows free-form journaling, which is great for reflecting on trading psychology and strategy.

- For Advanced Features: If you’re after automation, performance analytics, and risk management tools, dedicated trading journal software like Tradervue, Edgewonk, or TradingDiary Pro might be ideal. These platforms often include trade imports, detailed metrics, and reporting features, which can save time and provide deeper insights.

Ultimately, the best journal is the one you’ll use consistently. Whether it’s a simple spreadsheet or a sophisticated app, the key is to track every trade, review regularly, and use the insights to improve.

What is the best free trading journal?

The best free trading journal really depends on your needs, but here are some solid options to consider:

- Excel or Google Sheets: These are fantastic free tools for creating a fully customizable trading journal. You can track everything from entry/exit prices, position sizes, and commissions to emotional notes and strategy performance. I personally use Excel because it’s flexible and allows me to adapt as my trading evolves. Plus, it’s free if you already have access to it.

- TradeBench: This is a free online trading journal that provides trade analysis, performance tracking, and risk management tools. It’s accessible from any device with an internet connection, making it a convenient option for traders who prefer a structured platform.

- Google Docs or OneNote: If you’re looking for something more free-form, Google Docs or Microsoft OneNote are excellent for journaling your trading psychology, ideas, and lessons learned. I use OneNote myself because it syncs across all my devices, so I can jot down thoughts wherever I am.

While free options like these are great, the key is consistency. No matter which tool you choose, make sure you log every trade and review your journal regularly to extract insights and improve your trading

What is the best trading journal for TradingView?

If you’re using TradingView, the best trading journal might actually be built right into the platform itself. TradingView offers a feature where you can create trading notes and track your ideas directly on the charts. This can be super handy for discretionary traders who want to document their thought process and strategy adjustments in real-time while analyzing charts.

However, if you’re looking for something more comprehensive, you might want to pair TradingView with a dedicated trading journal. Here are a few options that work well:

- Excel or Google Sheets: These are great for flexibility and customization. You can manually log trades from TradingView, including entry/exit points, reasons for the trade, and performance metrics. It’s simple, free, and adaptable to your needs.

- Tradervue: This platform integrates with various brokers and allows you to import trade data for detailed performance analysis. While it doesn’t directly integrate with TradingView, you can manually input trades or export data from your broker.

- Edgewonk: Another powerful option for performance analysis and journaling. Like Tradervue, it doesn’t connect directly to TradingView, but you can manually input your trades for deeper insights.

Ultimately, if you’re using TradingView primarily for charting and analysis, combining it with a flexible tool like Excel or a dedicated journal like Tradervue or Edgewonk will give you the best of both worlds.

What is an example of a trade journal?

A trade journal example would include a structured format to record all the critical details of your trades. Here’s a simple template you can use, based on what I’ve found most effective in my own trading:

- Date: The date you entered and exited the trade.

- Instrument: The stock, ETF, or other asset you traded.

- Direction: Whether it was a long or short trade.

- Entry Price: The price at which you entered the trade.

- Exit Price: The price at which you exited the trade.

- Position Size: The number of shares or contracts traded.

- Stop-Loss and Take-Profit Levels: The predefined levels for managing risk and locking in profits.

- Strategy Used: The trading system or strategy you followed for this trade.

- Reward-to-Risk Ratio: The potential profit compared to the risk taken.

- Outcome: Whether the trade was successful or not (profit/loss).

- Notes: Your rationale for taking the trade, observations during the trade, and emotional state before, during, and after.

For example:

- Date: Oct 20, 2025

- Instrument: AAPL

- Direction: Long

- Entry Price: $175

- Exit Price: $180

- Position Size: 100 shares

- Stop-Loss: $170

- Take-Profit: $185

- Strategy Used: Breakout strategy

- Reward-to-Risk Ratio: 2:1

- Outcome: Profit of $500

- Notes: Entered after a breakout above resistance. Felt confident but nervous about market volatility.

This format ensures you capture both the quantitative and qualitative aspects of your trades, which is crucial for learning and improving over time.

Do you need a trading journal?

Absolutely, you need a trading journal. It’s not just a “nice-to-have” tool, it’s an essential part of becoming a consistently profitable trader. Here’s why:

- Self-Evaluation: A trading journal helps you analyze your decisions, strategies, and performance over time. It’s like a mirror for your trading, showing you what’s working and what’s not.

- Learning from Mistakes: By documenting your trades and emotions, you can identify recurring mistakes and patterns. This is crucial for improving your trading process and avoiding costly errors in the future.

- Tracking Progress: A journal allows you to measure your growth as a trader. You can see how your strategies evolve and whether you’re sticking to your trading plan.

- Psychological Clarity: Writing down your thoughts and emotions clears your mind, helping you focus and make better decisions. It’s a powerful tool for managing the mental side of trading.

- Continuous Improvement: A journal isn’t just about recording trades, it’s about refining your approach. By reviewing your entries, you can tweak your strategies and improve your overall performance.

Without a journal, you’re essentially flying blind, unable to pinpoint what’s driving your results. It’s a game-changer for anyone serious about trading success.