You are new to trading, you bought a bunch of stocks with what sounded like good stories and sound fundamentals…

…But a few months later everything is against you and you are wondering what happened to all your stock trading account. Panic starts to set in… “Should I sell everything? Is it too late – do I just hold forever and hope it goes back up?”

Sound familiar at all?

If this sounds like your situation then read on because this practical guide will show you how to stop the bleeding and position yourself to recover.

What Happened to My Stock Trading Account?

Many people I work with and coach come to me with an existing stock portfolio wondering what happened to their account. The challenge is when you don’t have a clear stock trading system or trading plan, your portfolio can quickly turn into a big mess.

Stocks that were once market darlings can fall, incorrect position size decisions can haunt you when the stock turns down and those losing trades you are still holding on to (hoping for a recovery to former glory) just get more and more painful.

Sound Familiar?

If so then here are a 6 simple steps to clean out your stock trading account, stop the losses and get you back on track!

6 Simple Steps to Turn Around Your Stock Trading Account

-

Step 1: Deep Breath

-

Step 2: Accept Being Wrong…So You Can Be Right

-

Step 3: Close the trades that are going against you

-

Step 4: Put in Stop Losses For Remaining Trades

-

Step 5: Correct Your Exposure

-

Step 6: Plan Your Exits

Step 1: Deep Breath

You can do this! I know that it can be scary clearing making the hard decisions to sell stocks that are losing you money. But a big part of succeeding is accepting that those losing trades are never going back to their former glory.

For me the key thing to realize is there is absolutely no reason that stock you are holding onto should give us back the money it took from us. If you are still holding onto a $0.10 stock that you bought at $1.00 you are down 90% on that trade. The chances of it getting back to $1.00 are close to zero…so you may as well accept the loss and find a better stock to put the remaining money into!

So take a deep breath, accept that the attachment to your losing stocks is just an emotional response.

Step 2: Accept Being Wrong…So You Can Be Right

We all like to be right. This is why it is so hard sometimes to accept a loss and close a losing stock trade. But here is the thing – being right (on a trade) and making money (on the portfolio) are two different things!

Rather than judge your ‘rightness’ on each individual trade, I prefer to reframe this and think about the objective you are actually trying to achieve.

Your overall objective is probably to make money from your stock trading account right?

So in the process of making money in your stock trading account you will have many trades, some of which will lose money and some of which will make money.

BUT in order to make money overall you have to CLOSE THE LOSING TRADES so that you can use that money to find some wining trades.

You will have losing stock trades – that is unavoidable…but you can be right overall and make money by closing those losing trades so you can take more trades (some of which will be winners).

If you insist on holding onto your losing trades then eventually your whole stock trading account will be full of losing trades…and you will lose a truck load of money…and fail to achieve your objective of making money overall.

So accept being wrong on your losing trades so you can be right and make money on your overall portfolio.

Step 3: Close Trades That are Going Against You

Trades that are not moving in the right direction are like a cancer on your net worth. It is time to cut them out to save your financial future!

So how do you decide which trades are going against you? I have two simple suggestions:

1. 200 day moving average:

If the stock is below the 200 day moving average then it is going down and you should close the position

2. The across the room test:

Print out the 2 year chart and stick it on the wall…then walk across the room to the other side and look at the chart. If it looks like it is going down then you should close the position.

Don’t agonize over it – just do it. That capital can be much better used to open new positions in stocks that are actually moving in the right direction.

The 200 day moving average keeps you out of trouble in the stock market. Don’t take any stock trade on the long side when the share price is below the 200 day moving average.

Step 4: Put in Stop Losses For Remaining Trades

All remaining trades should be ones that look like they are going up. But that could change at any time, so step 4 is to put in stop losses to get you out if these trades start moving in the wrong direction.

Profitable stock traders ALWAYS have a stop loss for every trade they make. So let’s get in the habit and start NOW!

There are 3 common ways to set your stop loss:

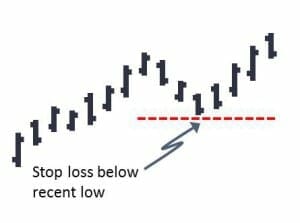

Chart Based Stop Loss

For a chart based stop loss, pick the low of the most recent turning point on the chart and set your stop just below that level.

These are easy to calculate and the stop loss price is relevant to each stock. Unfortunately they often don’t work as well as volatility based stop losses.

Volatility Based Stop Loss

A volatility based stop loss is placed a certain number of Average True Ranges (ATRs) below the current share price.

Take the current price and subtract X times the Average True Range (ATR) to determine the stop price.

X = 2 – 3 for a tight stop

X = 4 – 6 for a loose stop

Some calculation is required but volatility stop losses work very well.

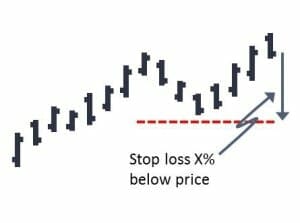

Percentage Based Stop Loss

For a percentage based stop loss, take the current share price and subtract a certain percentage and set the stop at that level. This could be 5-10% for a tight stop, and 15-25% for a loose stop. These are simple and can work but they are blunt and do not adapt well to different levels of volatility.

Step 5: Correct Your Exposure

The biggest killer of stock trading accounts is taking positions that are too big. When big positions go wrong it really hurts your account.

To stop this you need to risk a constant and small percentage of your account on each trade. If you have a small account (<$10,000) then you will probably have to risk about 2% on each trade… For bigger accounts this should usually be less (say 1%).

The smaller the risk per trade is, the less each bad trade hurts you and the easier it is for you to take a loss.

Now you need to calculate how many shares you SHOULD be holding.

You will need to know:

- The current share price

- Stop loss price

- Your account equity

- Your chosen risk per trade (1% in this example)

Here is the process:

Position Size Formula

Here is a worked example to demonstrate the process. First identify the current share price and your stop loss level:

Example Position Size Calculation – Step 1: Determine your risk per share

Then use the position size formula above to calculate the number of shares you SHOULD own:

Finally if you are holding more shares than you should be according to this calculation you should sell part of your position to reduce your risk.

Once you have done this, any position you are holding that goes against you will only result in a loss of 1% of your stock trading account. This is basically now like you have just started trading and these are all new positions. This will prevent any further dramatic losses in your account.

Step 6: Plan Your Exits

The final step to turning around your stock trading account is to plan your exits. You must know how you are going to exit each position. Pre-planning your exit makes it easier to pull the trigger when it is time.

If you are holding your stock portfolio for long term growth then the best way to do this is to use a trailing stop. A trailing stop is simply an exit point that ‘trails’ up behind the share price. If the share price goes down to the trailing stop level then you get out, no questions asked. It looks like this:

The simplest way to implement a trailing stop is to say if the stock drops by 25% from the highest price since entry then you get out. This will let you ride a big trend up and will get you out once the tend turns down at the end.

Note: Volatility based trailing stops tend to work a little better than percentage based trailing stops, however I have gone with the simpler of the two for this discussion.

One Last Thing…

6 Rules to Keep You Out of Trouble in Future

Now that you have turned around your stock trading account, here are 6 simple rules that I teach all my students that will help keep you out of trouble in the future:

1. Always use a stop loss

2. Never buy something that is below its 200MA

3. Don’t average down

4. Risk small % per trade

5. Don’t trade new issues (I know it is tempting… But it is just too uncertain!)

6. Develop a simple stock trading system to ensure you remain profitable

The concepts covered in this article are just a small sample of what I teach in my Enlightened Stock Trader Development Program. If you are keen to learn more about how to improve your stock trading and how my programs can help, just enter your details and I’ll get in touch with you.

Even if you just have a bunch of trading questions that you need answered, just enter your details below and I’ll give you a FREE 30 minute coaching session to get your questions answered!