I had an interesting session recently with a discretionary trader who was looking for ways to improve his trading. He was making money but returns were quite volatile. Because of this he was considering changing strategies and looking for something ‘better’.

I asked a bunch of questions about how he was trading and found some interesting things worth sharing…

While this trader was profitable overall (just), it was not clear what was giving him the profits and what actions were holding him back.

As I dug into his discretionary trading technique I found that he had quite a few different approaches going on and didn’t know the profitability of each of them on their own.

For Example:

- He had trades in currencies / stock indices / gold but had not analysed how well his approach worked in each asset class

- He always placed wide stop losses, but when sitting at his computer he managed trades and often exited early if they broke support between the entry price and his lower stop loss

- He has an approach that he feels works well in trending markets but uses that approach whenever a signal is generated

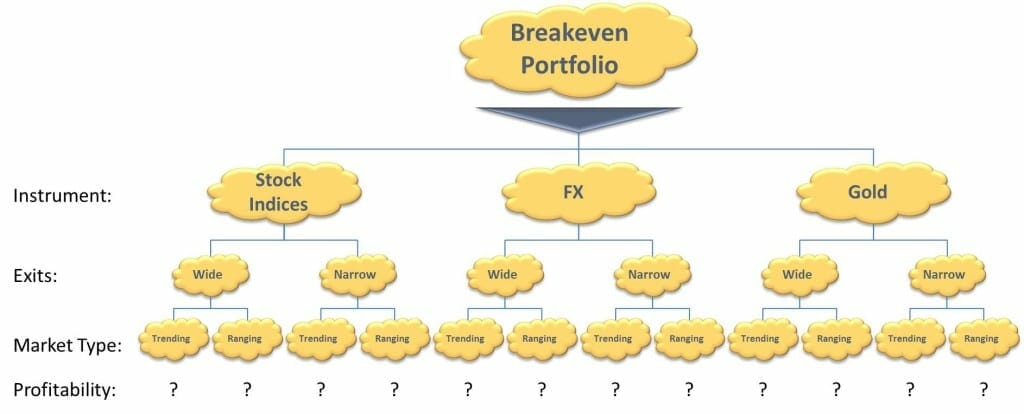

So while this trader was doing just a little better than break-even, as shown by the diagram there are 12 different combinations of conditions that lead to the overall portfolio result…but none of these had been analysed independently.

Example of breaking down a discretionary trading approach to understand profitability of each trading strategy

Luckily this trader has fantastic records, so figuring out which conditions give him profit and which give losses is an easy situation.

The great news is that for him to be break even, there must be at least one of the 12 combinations above that we’re giving him exceptional profits…so it is just a matter of finding which one and focusing on that!

The next bit of great news is that for most traders in this situation, is that in most cases like this there are 1-2 situations that are really loss making. This is great because as soon as you identify them, you can stop taking these trades and your profits increase immediately!

The Big Challenge For Discretionary Stock Traders

From my point of view this points to one of the big challenges for discretionary traders – Understanding which actions are profitable and which actions are not.

If you are a discretionary trader and want to improve your profitability, this is often a case of just stopping the things that don’t work and doing more of the things that do work.

The way you figure out which is which is by recording everything about each trade you make, and then analyzing the profitability of your decisions under each scenario.

Once you do this, often there are a couple of clear activities that lose you money that you should stop, and a couple of things that are working that you should do more of…and then your profitability improves!

Conclusion and Next Steps

Analyzing profitability in detail like this can be quite a challenge, especially if you are a discretionary trader with several different approaches.

From my experience helping several clients with this problem I have 4 recommendations:

- Measure your profitability:

Many traders have not even measured their overall expectancy. If you don’t know this, calculate it now to make sure you are actually making money - Use all your information:

Use everything you know already to measure profitability at a more detailed level - Collect more information about your trades:

The more you know about the conditions your trades are taken in and what decisions you made, the better you can measure your profitability at the detailed level - Consider using a trading system:

If your profitability is really poor then it may be easier just to step back and create / test a profitable trading system which will make you money consistently.

There is no single right way to trade. Stock trading systems can work and discretionary stock trading can work. Whichever you choose, you need to measure performance and understand profitability.

I love working through challenges like the above and helping traders identify what is working and what is losing money. It is one of the quickest and most powerful ways to help traders make more money.

Losing Money Trading? Need Help Fast?

Contact me here if you need help analyzing your trading performance OR if you want to learn how to create your own stock trading system.

Share your Experience!

Have you experienced something like this with your trading? Comment below and let us know what you found so we can all learn from each other.

Share This

Share this post with your friends!