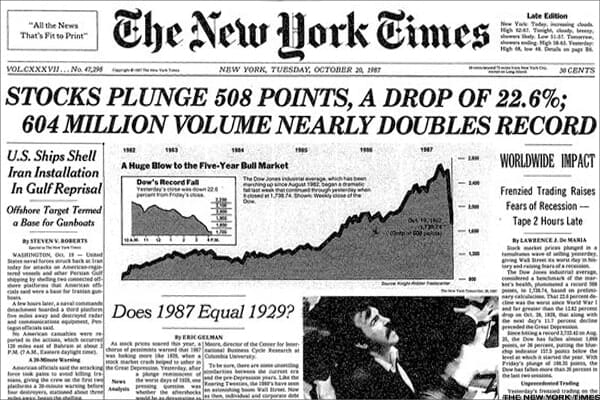

Black Monday is the name given to the stock market crash of 1987. The crash occured on Monday 29th of October. On Black Monday of 1987, the Dow Jones Industrial Average (Dow) fell 508 points (22.6%), accompanied by a crash in the futures exchanges and options markets. In percentage terms, Black Monday in 1987 was the single worst trading day experienced by the American stock market in recorded history of the Dow.

Image: Cover of the New York Times newspaper from the stock market crash in 1987. Image courtesy of Thestreet.com

Image: 1987 stock market crash chart of the DOW. Chart shows the 22.6% one day drop that occurred in the stock market crash of October 1987.

Before the stock market crash in 1987, the market had been in a massive expansion since 1982, which was the most significant post-war expansion cycle. Stock market trading in 1987 started no differently with the longest winning streak in recorded history. The Dow Jones Industrial Average rose by over 250% in the five years leading up to the crash.

Massive amounts of sell orders placed before the open on Black Monday 1987 cause a large gap down at the open. Continued selling created massive price declines throughout the day, particularly during the last 90 minutes of trading. All major indices fell precipitously:

- The Dow fell 22.6%

- The S&P 500 Index dropped 20.4%, falling from 282.7 to 225 points

- The NASDAQ lost 11.3%

Interestingly, the NASDAQ only dropped less because the NASDAQ market system failed throughout the day. Flooded with sell orders, many stocks on the New York Stock Exchange (NYSE) faced trading halts and delays throughout the day and of the 2257 NYSE-listed stocks, there were a total of 195 trading delays and trading halts reported during the day.

The strength and duration of this preceding bull market and the crash are illustrated in the chart below:

Image: Weekly chart showing the 1982 – 1987 bull market in the DOW leading up to the stock market crash in 1987. This 1987 stock market crash chart also shows the 40% overall decline that occurred over just a handful of wild trading days.

While Black Monday of 1987 (29th October) was the most important day, the crash of October 1987 was not just a one-day event. The stock market suffered rapid declines during the prior week. In the week leading up to the crash the Dow fell 11.5% in three days. At the time this was the largest three-day decline since May 1940, when Germany invaded France.

There was heavy selling on both 6th and 14th of October setting consecutive record daily plunges in percentage terms (3.47% & 3.81% respectively) all culminating in the ideal panic conditions for the Black Monday in 1987 crash.

The Dow fell a total of just over 40% from peak to trough in nine weeks with the single largest daily decline of 22.61% occurring on 19th October 1987. In contrast with more recent history, during the 2020 Coronavirus Crash, the Dow fell ~38% in just under seven weeks with the single largest daily decline of 12.93% occurring on 16th March 2020.

The 22.61% one day decline from the stock market crash of 1987 is still the largest one day drop in the stock market crash history! (So far…)

Table 1 – Five Largest Daily Percentage losses – Dow

Stock Market Crash History – Why did the stock market crash on Black Monday of 1987?

The stock market crash in 1987 has been described mainly as a “trading event” rather than being the direct result of any single fundamental or economic event. This is significant compared to such crashes as 1929 (the great depression) and 2008 (global financial crisis) which each had a precise series of economic catalysts and a much longer duration.

The 1987 stock market crash was also different to the declines of 1929 and 2008 because it was significantly shorter-term and more catastrophic. The Dow bounced back and recovered 288 points of the 508 lost on Black Monday 1987 within just a few trading days. By September 1989, less than two years afterwards, the market had fully recovered all of its losses.

So why did the market actually crash?

What caused Black Monday is likely one of the most controversial and contested issues in stock market crash history, with as many attempting to justify the crash as a rational response to economic news as others describing it as a purely psychological event.

One would expect that a 22.6% single-day decline requires something cataclysmic; however, no single significant event preceded the crash, nor did any prolonged economic suffering linger afterwards. As such, it is more likely that multiple factors came together as a perfect storm or ‘confluence of events’.

As Scott Nations, president of NationsShares and author of “A History of the United States in Five Crashes” states,

“Raiders had come to understand the unseen value in some companies, then bid them beyond the sustainable value of their cash flows. Leland and Rubinstein had created portfolio insurance, and O’Brien had sold it despite its inherent weaknesses. The market had rallied as the economy improved, and interest rates had come down…The trade deficit got out of hand and the dollar got crushed, and the House Ways and Means Committee decided to kill hostile take-overs.”

Contribution of Portfolio Insurance to the stock market crash of 1987

Portfolio insurance became increasingly popular by 1987 with many institutional investors. The market had rallied strongly in the four and a half years before 1987, and that year itself was bellowing. In summary, institutions who bought the product engaged in an agreement to sell short S&P 500 futures if the stock market fell by a certain amount. They obligated to “sell into a falling market” due to their portfolio insurance agreements. However, portfolio insurance played a role, most likely as an accelerant rather than a causal factor.

In June 1987 Hayne Leland, who designed Portfolio Insurance based on the Black Scholes’s model, had calculated that in certain circumstances a market drop of just 3 percent would require that Leland O’Brien Rubinstein (LOR) sell S&P futures contracts in an amount that would be the equivalent of an entire average day’s trading on the NYSE. By October 1987, LOR had $5 billion they were protecting directly and $45 billion through arrangements that allowed licensees to use their methodology. Another $40billion was protected by similar products offered by other providers. The only human involvement was recognizing what the ‘model’ said to do and placing those sell orders.

It wasn’t only the sheer quantity of institutional investments covered by portfolio insurance which was the problem, it was that institutional investors were investing much more of their portfolios in stocks than they otherwise would have due to the perceived protection it afforded. When the upward movement of stock prices reversed, these excess funds invested in stocks were ‘programmed’ to leave the market all at once due to the insurance model. This caused a flood of selling much larger than it would have been if portfolio insurance was less widely adopted.

On 25th August 1987, the Dow closed at an all-time-high (2722.42) which was a gain of 43.6% year to date. As soon as the Dow started to slide the portfolio insurance selling kicked-in, accelerating the decline.

Economic Factors That Contributed Black Monday in 1987

At the start of 1987, the yield on long-term bonds was just 7.5%, less than half of what it was back in 1981 and the trade deficit reported in November 1986 had set a record level, eight times higher than it was in 1981.

The trade deficit set a new record in the first quarter of 1987 and subsequently in the second quarter weakening the dollar further. On 2nd September 1987 the value of the dollar fell to another new low and calls for the Federal Reserve to help the dollar began to overpower those worried that higher interest rates would spark a recession. On 4th September, the Fed raised the discount rate by 0.5%, to 6.0% which was the first rate increase since 1981.

Alan Greenspan, Federal Reserve chairman, warned on 4th October that another rate increase might be needed, this was followed by the Dow having its worst point drop ever (91.55 points) to date just two days later on Tuesday 6th and as bond interest rates reached their highest level in nearly two years. The drop amounted to 3.5%, compelling the mechanical models of portfolio insurance into action, prompting heavy selling to begin to overpower buyers.

Much of the damage on 6th October was due to hedging from portfolio insurance which arguably could have been started by the warning and interest rate hike from the Fed.

Corporate Raiders, and the Proposed Tax Bill

Perhaps one of the more significant factors which played a role in the crash of 1987 was a proposed bill introduced by the House Ways and Means Committee. This proposed bill came about due to the highly leveraged mergers and acquisitions environment at the time.

The 1980’s began the era of the leveraged (and hostile) buyout, where investors could commit a small amount of capital and borrow the rest to attempt an on market take-over. Many of the acquisition companies become known as “Raiders”. This name was given because their intention was to intimidate management and force them to stop the take-over, by re-purchasing the raiders shares at an inflated rate (known at the time as ‘greenmail payments’) and of course to the significant profit of the Raider.

Ninety minutes after the close on Tuesday, 13th October, Democrats in the House Ways and Means Committee met and agreed to a series of tax increases including a range of new taxes aimed at Raiders. The agreement included proposals that would frustrate ‘friendly corporate take-overs’ and ultimately kill ‘hostile take-overs’ by eliminating the deductibility of interest payments on the debt, including junk bonds. It also proposed creating a “Corporate Raider Tax,” a 50 percent non-deductible excise tax on greenmail payments.

This cause the worst three days fall since the 1940’s heading into the weekend before Black Monday in 1987.

Crashes are not usually caused simply by bad earnings or lower economic growth, while possibly lead to recession, they typically do not cause crashes. The only thing that can cause a crash of Black Monday of 1987’s significance is “forced selling”.

It was the bill out of the House Ways and Means Committee that was widely seen as the catalyst that sparked the crash. Because of the bill, many previously announced take-over deals and rumoured deals completely collapsed the next day forcing Raiders to sell the stock they were accumulating in their take-over targets.

The Guru’s who predicted the Black Monday in 1987

Robert Prechter

Robert Prechter won the 1984 USA trading championship (using an audited, real-money account) and was well known for several high-profile predictions.

On the morning of 6th October 1987, just two days after the Fed’s warning, Prechter published his popular newsletter the ‘Elliott Wave Theorist’ which included the unnerving warning, “Both investors and traders should sell now.”

Paul Tudor Jones

The infamous documentary ‘Tudor: Paul Tudor Jones (1987)’, filmed prior to the crash, Tudor Jones explains how he and his research director Peter Borish were using an analogous model developed from the 1929 crash. In the documentary, Tudor Jones and Borish explain the analogy between the models signified “an event” in early 1988.

However, Tudor Jones had in-fact initiated a large short position in the market prior to October 1987!

In an interview with Jack Schwager for Market Wizards, Stanley Druckenmiller, manager of George Soros’s famous Quantum Fund, received a copy of Tudor Jones’s study the Friday before the crash, where he had just initiated a significant long position and reversed his position immediately.

William Eckhardt

William Eckhardt, a systematic trader and business partner of Richard Dennis, also famous as one of the mentors for ‘The Turtles’, is also quoted in Market Wizards as being short the S&P 500 heading into 29th October 1987.

Based on the Turtles Donchian (20 & 55 days) breakout entry, it’s not surprising as to why – this system would have taken a short position due to the decline leading up to the crash.

Although I have been unable verify this, in an article on “Moneyness, blog of JP Konin”, Konin states that “on the morning of the crash, the Wall Street Journal published a chart of stock price in 1987 superimposed on stock prices leading up to the crash of 1929. News of the analogue was spreading across Wall Street, and by Monday, 19th October, enough momentum may have built for the analogue to self-realize itself.”

Day by Day Events & in the stock market crash of 1987

The crash began Wednesday, 14th October 1987 as news of the Ways and Means Committee’s agreement to the take-over tax proposals became far reaching headlines causing the Dow to fall. It dropped 95 points (3.81%) on Wednesday, another 58 points (2.4%) on the Thursday, down over 12% from the 25th August all-time highs.

Then Friday came. When nothing had come from Washington to indicate they would hold off on the committee’s bill, the selling further accelerated. Many of the take-over stocks fell sharply on Friday, liquidity was diminishing, and risk arbitrage firms could not meet their margin calls by only selling the take-over stocks. Therefore, these firms had to sell ‘anything’ they could. The Dow fell another record 108.35 points (4.6%) to close at 2,246 but this time with record trading volume.

Over $400 million of futures remained in the arguably weak hands of opportunistic traders who’d bought them from portfolio insurers from Wednesday 14th to Friday 16th, most of whom had not yet managed to offset their position. There was significant selling pressure on the market when it opened on Monday.

Furthermore, as the Dow had lost 10.4%, causing portfolio insurer models to dictate that a minimum $12 billion of futures should have been sold, yet less than $4 billion had actually been sold. The markets knew that the portfolio insurers had another $8 billion in futures left to sell which was more than the average traded volume for an entire day!

Overseas markets were reportedly in a panic, as they saw what happened to the US market on Friday and Americans, waking on the morning of 19th October 1987, were also alerted to news of a skirmish in the Persian Gulf with Iran, thinking they were finally at war.

By the time US investors went to work on Monday, global markets were in incredibly bad shape as liquidity continued to fall. Risk arbitrages had to continue selling whatever they could and mutual fund redemptions were about to hit the markets in a major way due to “forced” selling. All of this selling pressure was building and the portfolio insurance players hadn’t even gotten started selling their index futures yet!

The New York Stock Exchange (NYSE) opened the Designated Order Turnaround (DOT) system (which was the NYSE’s electronic system) an hour early so brokerage firms would have plenty of time to enter orders. It received four-to-five times the normal order flow.

At the opening bell, DOT reportedly had orders to sell a total of 14 million shares, worth about $500 million.

The total sum of sell orders was so great that nearly 200 stocks on the NYSE failed to open anywhere near the scheduled open. An hour later, at 10.30am, 175 stocks including some of the largest (IBM, Exxon, Sears and Roebuck) hadn’t traded a single share and 8 of the 30 stocks making up the Dow hadn’t managed to open due to the flood of sell orders.

Black Monday in 1987, as it became to be known, was the single worst day in the Dow’s history:

- The Dow lost 508 points (22.6%) which nearly doubled the worst daily performance to date, which was the 12.8% loss on 28th October, 1929 (the two-day decline for October 28/29, 1929, was 23%).

- 604 million shares worth $21 billion had traded on the NYSE, again nearly doubling the previous record.

- Only 52 stocks that trade on the NYSE finished the day higher (mostly gold and silver miners which were seen as a safe-haven), while the remaining approximately 2000 stocks fell.

- From close of trade on Tuesday, 13th October, before the anti-takeover-tax proposal, to the close on Monday, 19th October, the Dow had declined by nearly one third, and total stock market losses equalled $1 trillion.

- On Black Monday 1987, portfolio insurers had sold 33,000 S&P 500 futures contracts worth approximately $4 billion, and billions more in outright stock holdings.

- Black Monday in 1987 caused fortunes and livelihoods to be lost, traders were seen openly crying in the trading pits.

The biggest challenge was that losers in the S&P futures had to pay the winners which on a normal day the losers would owe the Chicago Mercantile Exchange (CME) clearinghouse about $250 million, with winners obviously in-turn owed the same amount. On the Tuesday morning, the total was $2.5 billion and some were simply unable to pay. The biggest question was ‘if’ the CME would open and whether the system would continue to function.

Fortunately, the Federal Reserve stepped in with a statement “consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system”. The CME opened.

Tuesday was more of a roller-coaster day with wild swings in the Dow ranging approximately 20%, again as a result of delayed stock opens and late reporting of the Dow followed by extreme levels of selling. Throughout Tuesday, the CBOE suspended trading, the CME suspended trading and the NYSE threatened to follow suit until one brave, and now infamous trader, notices that the Major Market Index (MMI) futures were still trading (and at a historical discount) on the CBOT.

When the family that controlled the Dow Jones empire balked at licensing the Dow for a futures contract, the CBOT instead launched the Major Market Index (MMI) futures, based on an index of twenty blue-chip stocks very similar to the Dow. By 1987, the MMI, as it had come to be known, had lost the fight for institutional investor attention to the S&P 500, but the MMI futures were still a credible if not somewhat less impressive presence on the CBOT floor.

At 11.15am when the CME closes, where the MMI is already trading at historical lows, they plunge even further as the CBOE closes, yet the CBOT remains open and the MMI futures are still trading. Blair Hull (Hull Trading Company) personally enters the CBOT pit and starts to buy, he is the only person in the pit actively buying, initially 150 contracts of the MMI. With an influx of buyers for MMI contracts, which is so thinly traded, the price soars and at that point in time the MMI is the only major index still trading. Since the MMI constituents are largely made up of Dow stocks, this caused all stocks to re-open and rally. Initiating a cascade of larger corporation’s to commence ‘buy-backs’ recognizing that their own share prices at massively discounted, this has very a large impact and by day’s end, the Dow actually closed 102 points up which was yet another new record for the Dow and the crash officially comes to an end.

How long was the recovery from the stock market crash of 1987?

The 1987 stock market crash recovery was much faster than you might expect for such a significant event. As mentioned above, the Dow had actually recovered 288 points of the 508-point loss on Black Monday 1987 within just a few trading days in early November 1987. Then by September 1989, less than two years after the crash, the market had made back all of its losses from the previous all-time highs of 25th August 1987. Thereafter the Dow marched upwards with a strong bull market lasting another decade before the subsequent crash.

Why is it called Black Monday 1987?

Black Monday was the name attached to global, severe and largely unexpected stock market crash of 1987 on October 19th.. In Australia and New Zealand, the day is called Black Tuesday due to the time zone differences. Interestingly, the term Black Monday was also given to stock market crashes that occurred on three other Mondays namely, 28th October, 1929, the market correction of 24th August, 2015, and 9th March, 2020 although I doubt whether any others will have the sizeable impact as the 29th October Black Monday of 1987. Curiously, there appears to be no connection the Black and Scholes’s model which formed the basis of portfolio insurance.

Black Monday 1987 effects on the market and economy

In the aftermath of the 1987 stock market crash, portfolio insurance had been recognized as a total disgraced product, whilst the House Ways and Means Committee reversed its plans to kill take-overs.

Additionally, the US economy didn’t suffer any lasting damage. That’s due in large part to immediate intervention from the Federal Reserve, which cut interest rates and stabilized the financial markets.

Needless to say, the lessons for investors were valuable and lasting. “Flash crashes” like the single-day collapse of the Dow on Black Monday 1987 effects taught investors to spread portfolio risk and highlighted the goal of building an investment portfolio that could withstand the extreme conditions investors experienced in October 1987.

What changed after Black Monday 1987?

Following the 1987 crash, stock exchanges worldwide implemented “circuit breakers” that temporarily halt trading when major stock indices declined by a specified percentage.

For example, if the S&P 500 Index falls by more than 7% from the previous day’s closing price it trips the first circuit breaker, halting stock trading for 15 minutes. The second circuit breaker is triggered if there is a 13% drop from the previous close index. A 20% decline triggers the third circuit breaker level which halts trading for the remainder of the day. Some of these circuit breakers were triggered in the March 2020 crash/correction.

The purpose of the circuit breaker system is to try to avoid a large market “panic” where investors just start recklessly selling. It is also believed that such “general panic” is blamed for much of the severity of the Black Monday crash. The temporary halts in trading that occur under the circuit breaker system are designed to give investors time to catch their breath and hopefully, take the time to make rational trading decisions thus avoiding further panic selling.

Shorter-term fixes like the circuit-breaker led to stronger, sustainable fixes. For example, program trading was reined-in and more regulated. Derivative heavy portfolio insurance programs were also moderated.

Further, the introduction of volatility skew was an outcome of the crash. Volatility skew describes the observation that not all options on the same underlying and expiration have the same implied volatility assigned to them in the market. For stock options, skew indicates that downside strikes have greater implied volatility that upside strikes, a possible indicator that downside protection was more valuable than upside speculation in the options market.

Will stock market crash again?

Almost all traders will have asked themselves the question “Will the stock market crash again?” at some point in their trading career. While some gurus have predicted stock market crashes in the past, it is fair to say that the vast majority of traders will not be able to predict the next crash… but there is a chance that the stock market will crash again at some point in your trading career.

So armed with the knowledge that it could happen and we don’t know when, the best action you can take is to trade stocks systematically in a way that will help you survive anything that happens in the markets. This means:

- Use little to no leverage because this will decimate your portfolio if there is a crash

- Use small position sizes so you can get out of your trades easily

- Use stop losses to get you out if the market starts collapsing

- Trade long and short so that you can profit from a crash

- Backtest your trading systems with as much data as you can to understand their performance during a stock market crash

Will the stock market crash again – Yes probably at some point. The more important question is will you survive the next stock market crash trading the way you are trading today?

If you fear the answer might be no, then check out The Trader Success System to learn how to backtest your trading systems and diversify your trading with access to over a dozen trading systems, long and short for different stock markets around the world.

Trading lessons from the stock market crash of 1987?

Many lessons can be taken away from the 1987 Black Monday crash however, from the learnings I have gathered putting this article together, a number of very pertinent points stand-out. Interestingly, these same lessons largely form the reasons I have been drawn to systematic trading and entering into a mentorship with Adrian (The Founder of Enlightened Stock Trading).

The standout lessons I have identified as follows:

- The systematic traders were well positioned as their ‘systems’ triggered short entry conditions based solely on price action unrelated to the market sentiment at peak of the bull run.

- The crash was not a single-day event as it would initially appear. The market structure provided plenty of cause for concern and therefore opportunity for those who are positioned to act without bias or emotion.

- The ‘fear and panic’ that gripped the market provided further insight to the depth that psychology plays part in trading actions undertaken by human beings. The fear spread rapidly which lead to liquidity vanishing. The ability to remove those highly emotional responses can lead to more pragmatic and intelligent decisions as shown by Blair Hull.

- Systematic trading provides solutions to the emotional turmoil that occurs in these circumstances with the ability to create systems that navigate tumultuous market conditions and also stand aside to protect capital. Trading systemc can also capitalize on the fear and panic buy buying at the extremes.

- Lastly, the significance of diversification stands-out as critical as shown by the attempts of the fund managers to “hedge” using portfolio insurance actually, in-fact, contributed to the acceleration of the losses. Diversification of trading systems across a broad range of markets and market behaviours clearly stands out as a far superior methodology.

About The Author:

Adam Felsman is an Engineering and Design Manager having a background in the design, construction and commissioning of mineral processing plants for over 20yrs. Adam commenced trading at the beginning of 2018, following the same long and arduous road to consistency as most other traders. Finding ‘trending following’ and a mentor to guide him in November of 2018 he has since seen consistent trading results from mid 2019 to the present day.

Beginning early 2020 Adam has in-turn decided to pay-it-forward by mentoring over 10 individual traders and a group of four apprentices. With a busy work-life family mentoring commitments Adam began to recognize the continued challenges and limitations that come with discretionary trading.

Turning towards systematic trading, and finding Enlightened Stock Trading at the end of 2020, has been the shining light at the end of a very long tunnel. Adam leapt at the opportunity to be further mentored by Adrian, taking to the Enlightened Stock Trading course material, Amibroker coding and system evaluation like a fish to water. Adam went live with his stock trading system in early 2021 and is quickly progressing towards a portfolio of stock trading systems.

Will Your Trading Survive The Next Crash?

Complete the form below to download ‘The 10 Commandments For Profitable Trading’ & ensure you survive! (It’s FREE!)

References:

- https://en.wikipedia.org/wiki/Black_Monday_(1987)

- The Balance – Black Monday

- The real cause of the 1987 crash, as told by a trader who lived through it

- Black Monday – Overview, How It Happened, Causes

- https://money.usnews.com/investing/buy-and-hold-strategy/articles/2017-10-12/30-years-ago-lessons-from-the-1987-stock-market-crash

- http://jpkoning.blogspot.com/2013/10/fama-vs-shiller-on-1987-stock-market.html

- The Telegraph: Black Monday 25 years on: in pictures.

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation, by Scott Nations.

- Market Wizards, Jack Schwager

I lived through the 1987 crash, and it is vivid in my memory still.

I had a price monitoring device at the time, and when I looked at it in the morning I could not quite grasp why the Dow had a 1 in front of the number instead of the 2 it had yesterday.

I was fortunate that I was short 3 contracts of the Australian SPI, which at that time was 4 times the size of the current contract. Unfortunately, I thought I was smart, and tried to trade the extreme volatility that happened over the next few weeks, instead of just walking away until the dust settled, so gave a lot back.

Hi Bob,

That is a fantastic story – thank you for sharing!! I would love to hear how your trading has evolved since that time… What is your approach for trading in bear markets and market shocks now days?

Adrian

Nice one Adrian – I do remember it but had no idea how to understand what had happened at the time. I remember the Today Show kept playing Moneys Too Tight to Mention by Simply Red into the ad breaks…

Yes I am in much the same boat as you… I remember hearing about it from my dad at the time, but I was not really focused on the markets back then… much more on my BMX, skateboard and exploring with mates 😉