Relative Strength Index (RSI) Introduction

RSI is short for Relative Strength Index. It is a trading indicator used in technical analysis (a Momentum Oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. The RSI is typically measured on a scale of 0 to 100, with the default overbought and oversold levels marked at 70 and 30, respectively.

An overbought reading on the RSI is typically used to indicate that the stock is over-extended and due for a correction, while an oversold reading indicates that the stock has sold off too heavily and is due for a rally. The RSI indicator is a popular indicator among technical traders and systematic traders and is very commonly used in mean reversion trading systems and strategies.

How do you read the RSI indicator

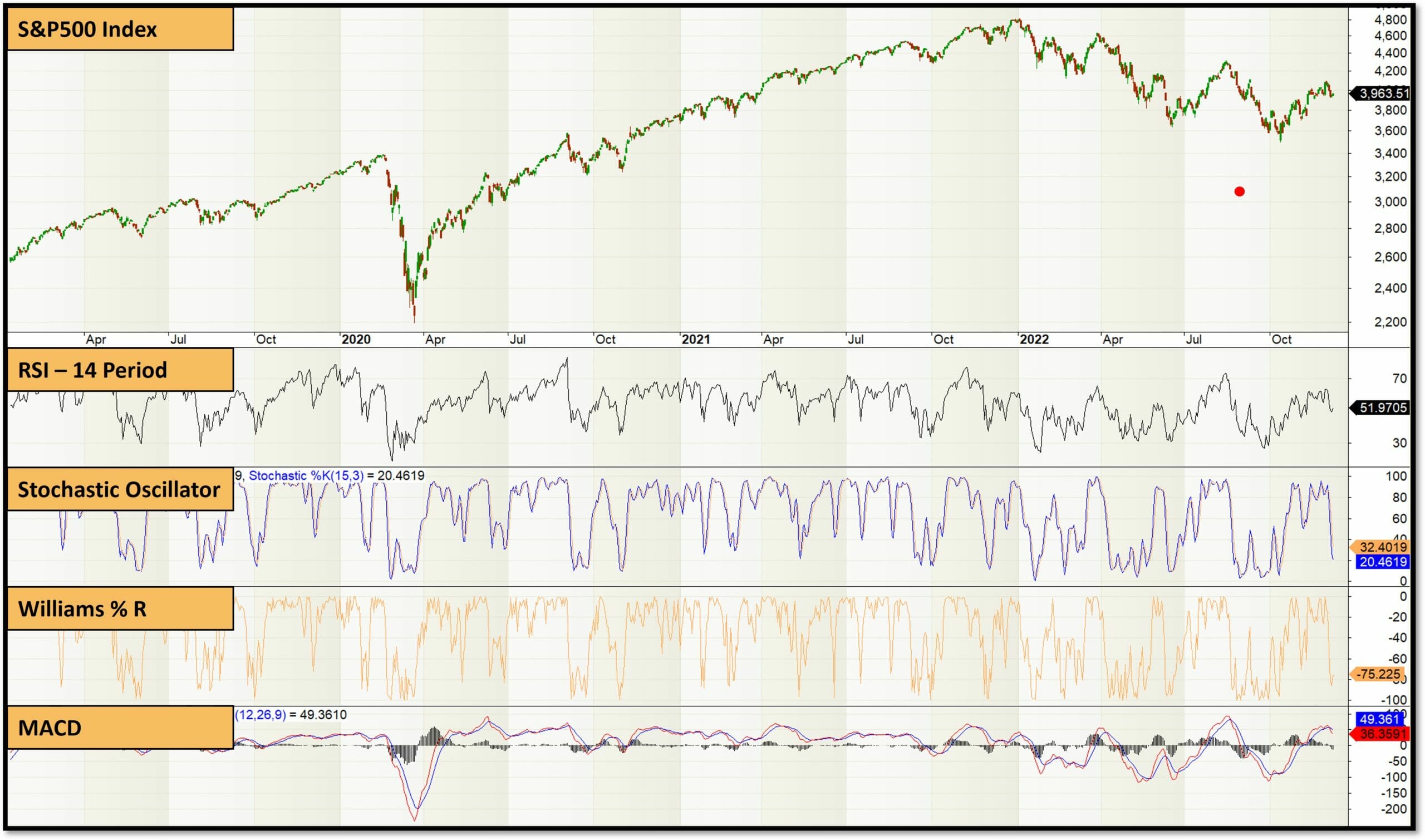

To read the RSI indicator, first look at the scale along the side of the chart. This ranges from 0 to 100. The RSI values can then be plotted on this scale, with values above 70 indicating that a stock is overbought and values below 30 indicating that it is oversold. The chart below plots the 14 period RSI indicator on the S&P500 Index.

As you can see the RSI oscilates from 0 when the stock is extremely weak to 100 when the stock is extremely strong. The extremes can give an indication that the stock is due for a reversal, however, like all indicators in technical analysis, these signals are not perfect.

What are the best RSI indicator settings

The best RSI indicator settings will depend on the individual trader or investor and their unique trading style and objectives. In general, the default settings for the RSI, which has a 14-day period, are considered to be a good starting point for most traders. However, some traders may find that shorter or longer periods work better for them, depending on the time frame they are trading in and the type of asset they are trading.

The overbought / oversold thresholds that you use in your trading strategy will depend the lookback period you use and how selective you want your trading signals to be. For longer lookback periods your overbought / oversold extremes should be set closer to the neutral level, while for shorter term RSI lookback periods like the 2 period RSI you would need much more extreme settings.

The 2 period RSI works well with a much more restrictive 95/5 overbought / oversold levels.

The standard 14 period lookback works reasonably well with the typical 70/30 overbought / oversold levels.

The much slower 30 period RSI oscilates much closer to the neutral 50 level and so oversold levels of 60/40 are a better starting point.

As discussed in this post on optimizing a trading system the right way (link: https://enlightenedstocktrading.com/optimizing-an-amibroker-trading-system-the-right-way/), you need to find the most stable and profitable parameters for your particular trading system. This can be done by optimizing your system in Amibroker, however you need to be careful to avoid overfitting (curve-fitting) your trading system to past data.

What indicators are good alternatives to the RSI

These indicators all measure the momentum of a stock or other asset, and they can be used to identify overbought and oversold conditions.

They each rise when the strength of the stock rises and falls when the stock declines, however, they each have their own unique calculations and interpretations, so it may be worth experimenting with a few different indicators to see which ones work best for your specific trading style and objectives.

I recommend you backtest different alternative indicators using Amibroker to determine which performs best in your market and trading system.

How is the relative strength index calculated

The Relative Strength Index (RSI) is calculated with the following formula:

RSI = 100 – (100 / (1 + (average of gains over n periods / average of losses over n periods)))

To calculate the RSI, first, the average gains and average losses over the desired period (n) are calculated. The average gains and average losses are calculated by taking the sum of the gains and losses over the specified period, and then dividing by the number of periods.

Next, the ratio of the average gains to the average losses is calculated. This ratio is then added to 1, and the resulting value is used in the final step of the RSI calculation.

Finally, 100 is divided by the result from the previous step, and then subtracted from 100 to give the RSI value. This value is then plotted on a scale from 0 to 100. As dicsussed above, a high RSI value above 70 indicates that a stock is overbought, while a low RSI value below 30 indicates that it is oversold.

Of course all good charting software have the RSI indicator built in so in practice you never have to calculate this manually by hand.

Who invented the RSI indicator?

The RSI indicator was developed by J. Welles Wilder, Jr. and introduced in his 1978 book, “New Concepts in Technical Trading Systems.” Wilder was a mechanical engineer and a pioneer in the field of technical analysis, and he is also known for developing other popular technical indicators such as the average true range (ATR) and the parabolic stop and reverse (Parabolic SAR). Since it was introduced by Wilder, the RSI has become a widely used indicator among traders and investors, and it continues to be a popular tool for evaluating the strength of a stock or other asset.

Does the RSI indicator work?

The RSI indicator is a popular technical analysis tool among traders and investors, but it is not a perfect tool and does not always provide reliable signals. As you can see in first image above, the RSI frequently indicates overbought during uptrends and frequently indicates oversold levels in down trends. The RSI can also produce false signals, particularly in choppy or sideways markets where prices are not trending.

Like all technical indicators, the RSI is based on past price data, and it cannot predict future price movements with certainty, however when used correctly as part of a complete trading system it can give profitable trading signals.

In general, the RSI can be a useful tool for traders and investors, but it should not be relied on exclusively when making trading decisions. It is important to use the RSI in combination with other filters and trading rules as part of a complete trading system that you have backtested to ensure it is profitabile.

When does the RSI Indicator fail

The RSI indicator can sometimes fail to provide reliable signals, particularly in choppy or sideways markets where prices are not trending. In these types of markets, the RSI can produce false signals, leading traders to take losing positions.

Additionally, the RSI can sometimes fail to capture important changes in the trend of a stock or other asset. If the stock changes direction without the RSI reaching an extreme then no signal will be given. Because the RSI is based on past price data, it cannot predict future price movements with certainty. This means that it can sometimes lag behind the market, missing key turning points and giving false signals.

Like all technical indicators, the RSI is just one tool among many, and it should not be relied on exclusively when making trading decisions. It is important to use the RSI as part of a complete backtested trading system.

When does the RSI indicator actually work?

What indicators should you combine with RSI to eliminate false signals?

Additionally, traders can use trendline analysis and chart patterns to help identify the overall trend of a stock and confirm signals from the RSI. For example, if the RSI indicates that a stock is overbought, but the trendline analysis and chart patterns show that the stock is still in an uptrend, the RSI signal may be false and should be ignored.

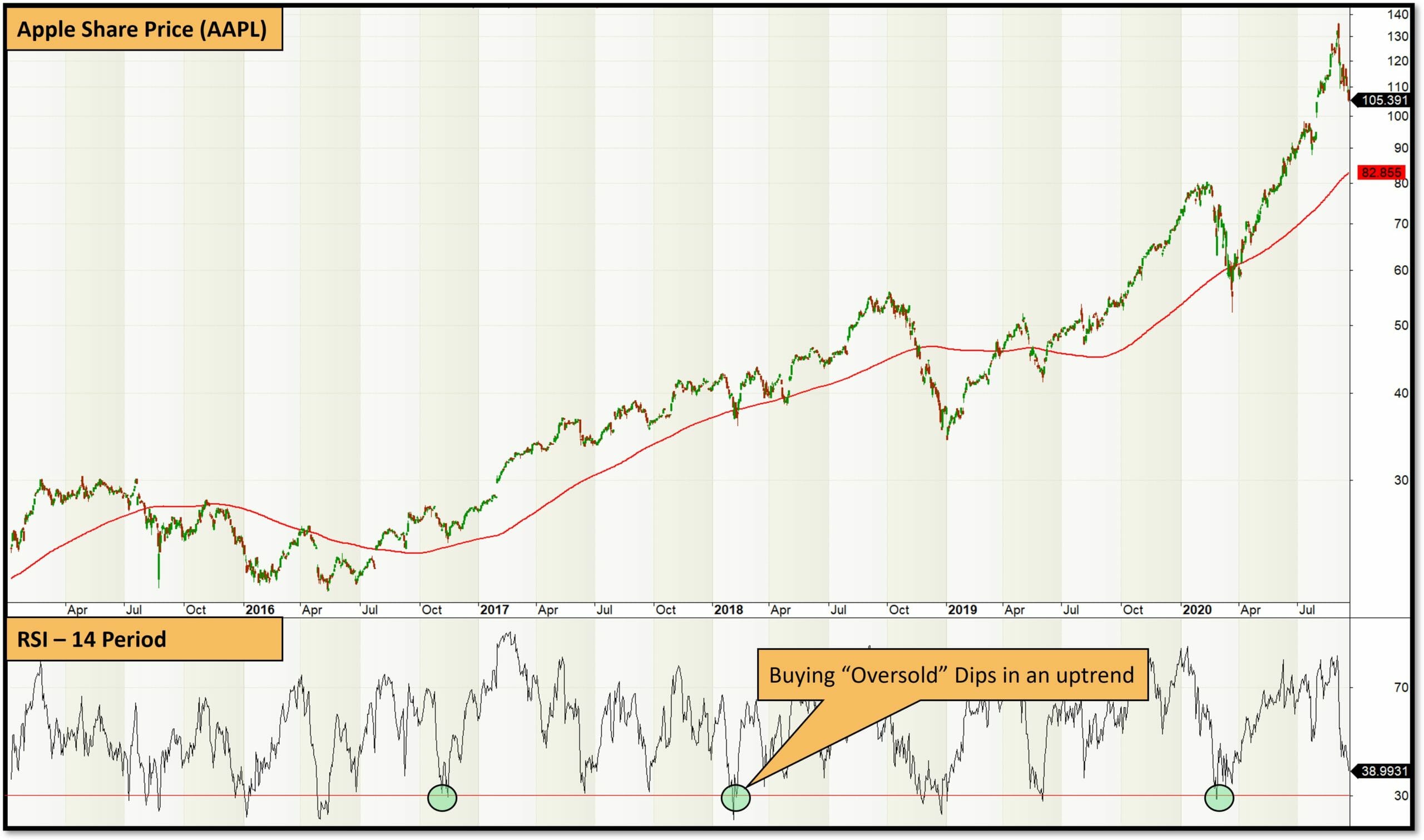

The chart below illustrates how the number of false signals can be reduced by only buying oversold dips in the RSI when the stock (Apple Stock (AAPL)) is trending up and is above it’s 200 day moving average.

Is the RSI a leading or lagging indicator?

Because the RSI is based on past price data, it tends to lag behind the market, reacting to changes in the trend of a stock or other asset after they have already occurred. This can be a disadvantage for traders, as it means that the RSI may not always provide timely signals for making trades.

In reality there are few (if any) real leading technical indicators, so traders shouldn’t discard any technical indicator just because it is lagging. The most important thing is to understand how it works, incorporate it into a trading system and backtest it thoroughly.

Does the RSI work on all markets

The RSI is a widely used technical analysis indicator that is applicable to many different markets, including stocks, commodities, currencies, and cryptocurrencies. However, the RSI may not work equally well in all markets, and its effectiveness can vary depending on the type of market being analyzed and the trader’s objectives.

In general, the RSI works best in trending markets, where prices are moving in a consistent direction over time. In these types of markets, the RSI can help identify overbought and oversold conditions, and it can be used to confirm other technical analysis signals.

However, the RSI may not be as effective in choppy or sideways markets, where prices are not trending consistently. In these types of markets, the RSI can produce false signals, and it may not provide reliable signals for making trades.

In summary, the RSI can be a useful technical analysis tool in many different markets, but its effectiveness can vary depending on the type of market being analyzed and the trader’s objectives. As always, it is important to use the RSI indicator as part of a complete trading system and backtest it on your markets of interest to ensure it is profitable.

How to use the RSI in a stock trading system

To use the RSI in a trading system, traders will typically look for overbought and oversold conditions in the stock or other asset they are trading and use these RSI signals as entry and exit levels. According to the default settings, an overbought condition is indicated by an RSI value above 70 would be a sell (or shorting) signal, while an oversold condition is indicated by an RSI value below 30 would be a buy (or cover short) signal.

In a trend following or swing trading strategy, traders will look for opportunities to sell or take profits when the RSI is above 70. This is because an overbought stock is thought to be ripe for a price correction, and traders may look to cash in on their gains before the stock’s price falls. Just a warning though, the market can remain overbought for a long time during a bull market, so just exiting when it is overbought may leave a lot of profit potential on the table.

When the RSI is below 30, traders may look for opportunities to buy the stock provided the stock remains in a long term up trend. This is because an oversold stock is thought to be undervalued, and traders may look to buy the stock in anticipation of a price increase.

Traders can use the RSI in combination with other technical analysis indicators and techniques to help confirm trade signals and make more informed trading decisions. It is important to remember that the RSI is just one tool among many, and it should not be relied on exclusively when making trading decisions.

How to use RSI in a trend following trading system

- Calculate the RSI for a given security or market index.

To do this, you will need to know the price data for the security, such as the closing price for a given time period (e.g. daily, hourly, etc.). You can use a spreadsheet or trading software to do the calculation. - Set a time period for the RSI calculation.

The default time period for RSI is 14 periods, but you can use a shorter or longer time period depending on your trading strategy. A shorter time period will make the RSI more sensitive to price changes, while a longer time period will smooth out the indicator and make it less sensitive. - Identify overbought and oversold levels for the RSI signals starting with the default settings discussed above.

In a trend following system, you would typically buy when the RSI falls below an oversold level (e.g. 30) in an up trend and then rises above that level, indicating that the security is starting to regain momentum. You would then sell when the RSI rises above an overbought level (e.g. 70) and then falls below that level, indicating that the security is starting to lose momentum. These values should be optimized for each trading system and market to maximise the performance of your trading system. - Use the RSI to generate buy and sell signals.

With your complete trading system you can generate your trading signals quickly and easily by running the backtest and mirroring the trades your backtest takes in your trading account.

It’s important to note that RSI is just one of many technical indicators that you can use in a trend following system, and it should not be used in isolation. It’s always a good idea to combine RSI with other indicators, such as moving averages or trend lines, to confirm the signals that it generates. Additionally, you should always use risk management techniques, such as stop loss orders, to limit your potential losses.

How to use RSI in a mean reversion trading system

The Relative Strength Index can also be used as the entry trigger or exit trigger in a mean reversion trading strategy. To use RSI in a mean reversion trading system, you would typically:

- Calculate the RSI for a given security or market index.

- Set a time period for the RSI calculation.

- Identify overbought and oversold levels for the RSI.

- Use the RSI to generate buy and sell signals. In a mean reversion system, you would typically buy when a stock first drops below the oversold level and sell when it raises above the overbought level.

Most mean reversion trading systems enter long on extreme oversold levels (such as a reading of 5 on the 14 period RSI) and exit quickly on a rally (such as a reading of 30 on the 14 period RSI). Additionally, you should always use risk management techniques, such as stop loss orders, to limit your potential losses.

Should you use a stop loss with an RSI based trading system?

Yes, it is generally a good idea to use a stop loss with an RSI-based trading system, particularly if you are using the overbought / oversold levels to enter in a countertrend fashion.

A stop loss is a risk management tool that helps to limit potential losses by automatically closing a trade when the price reaches a certain level. This can protect you from significant losses if the market moves against your position.

If you are using a mean reversion trading system it is critical that you don’t set your stop loss to close to the current price, because if you are buying weakness the price may continue to fall temporatily before rallying to your profit point. If your stop loss is set too tightly this will ruin your trading system’s profitability. As always, backtest the stop loss width in your trading system to ensure you are reaching the best tradeoff between cutting your losses short and getting hit too often.

There are different ways to use a stop loss with an RSI-based trading system. For example, you could set a stop loss at a fixed dollar amount below your entry price, or you could set a stop loss at a certain percentage below your entry price, or a certain number of Average True Ranges below your entry price. Alternatively, if you are using a trend following strategy you could use a trailing stop loss, which adjusts the stop loss level as the price moves in your favor.

By using a stop loss, you can limit your potential losses and ensure that you exit a trade if the market moves against you.

It’s important to note that a stop loss is not a guarantee that you will limit your losses. The market can gap or spike, and your stop loss may not be executed at the exact level that you set. It’s always a good idea to use a stop loss as part of a comprehensive risk management strategy, along with other techniques such as position sizing and risk management.

Are divergences in the relative strength index important

Divergences in the Relative Strength Index (RSI) can be an important signal for traders. A divergence occurs when the price of a security and the RSI indicator move in opposite directions. This can indicate that the current trend is losing momentum and may be due for a reversal.

There are two types of divergences in the RSI: bullish divergences and bearish divergences.

A bullish divergence occurs when the price of a security is making lower lows, but the RSI is making higher lows. This can indicate that the downtrend in the stock is nearing completion and may be due for a rally.

A bearish divergence is when the price of a security is making higher highs, but the RSI is making lower highs. This can indicate that the uptrend in the stock is exhausted and it is due for a correction. An example of a bearish divergence is shown on the chart of the Ford Motor Company (F) below:

It’s important to note that divergences in the RSI are not always reliable, and they are extremely difficult to code and identify in real time trading. Like most chart patterns in classical technical analysis, they are very easy to spot in the middle of the chart (in the past), but much more difficult tyo spot in real time trading on the hard right edge of the chart.

How to optimize the RSI indicator in your trading system

- The lookback period

- The oversold level

- The overbought level

- The number of days below the oversold level (or above the overbought level)

- Reducing the number of paramters you are optimizing is important becuase simple trading systems with fewer parameters tend to work better in real time trading than complex sytems with many highly optimized parameter values.

Using the RSI indicator for long term trading

While the RSI is commonly used for short-term trading, it can also be used for long-term trading. To use the RSI for long-term trading, you would typically:

- Calculate the RSI for a given security or market index.

- Set a long-term time period for the RSI calculation. The default time period for the RSI is 14 periods, but you can use a longer time period, such as 21, 25 or even 30 periods, to smooth out the indicator and reduce the number of false signals. A longer time period will make the RSI less sensitive to short-term price fluctuations and can help to identify longer-term trends.

- Identify overbought and oversold levels for the RSI as discussed earlier in this article.

- Use the RSI to generate buy and sell signals. In a long-term trading system, you would typically use the RSI to identify overbought and oversold levels and then wait for the price to reverse and confirm the signal. For example, you could buy when the RSI falls below an oversold level (e.g. 30) and then rises above that level, indicating that the security is starting to gain momentum. You would then sell when the RSI rises above an overbought level (e.g. 70) and then falls below that level, indicating that the security is starting to lose momentum.

Conclusion on The Relative Strength Index

If you would like to implement a complete portfolio of trading systems (including a variety of systems that incorporate the Relative Strength Index), learn how to backtest your systems to build confidence and establish a diversified portfolio of trading strategies across multiple markets and timeframes, then click the button below to learn more about The Trader Success System.

Frequently Asked Questions about Relative Strength Index

What is a good RSI to buy?

The “best” RSI level to buy depends on your trading strategy and the timeframe you’re working with. For mean reversion strategies, shorter-period RSIs like RSI 2 or RSI 3 are often used to identify oversold conditions for buying opportunities. Here’s how it typically works:

- RSI 2 or 3: A common rule is to buy when the RSI drops below a very low threshold, such as 5 or 10. For example, if the RSI 2 falls below 5, it signals that the price is extremely oversold and may be due for a bounce back.

- Longer-Term RSI (e.g., RSI 14): If you’re using a longer-term RSI, oversold levels are usually set at 30 or below. This is more suited for swing trading or trend-following strategies, where you’re looking for a reversal within a broader trend.

The key is to backtest these RSI levels on your specific market and timeframe to find what works best. Also, remember that RSI should not be used in isolation – combine it with other filters like trend direction or volatility to improve your edge.

What is a good RSI score?

The “good” RSI score depends on your trading strategy and market conditions. For mean reversion strategies, lower RSI values are typically considered good for buying opportunities, while higher values are better for selling. Here’s a breakdown:

- Oversold Levels (Good for Buying): An RSI below 30 is traditionally considered oversold, signaling that a stock might be undervalued and due for a bounce. For shorter-term strategies, traders often use an RSI 2 or RSI 3 and look for values below 5 or 10 for sharper oversold signals.

- Overbought Levels (Good for Selling): An RSI above 70 is considered overbought, suggesting a stock might be overvalued and due for a pullback. Again, shorter-term RSIs like RSI 2 or RSI 3 might use levels above 90 or 95 for more extreme signals.

The key is to backtest these levels on your specific market and timeframe. RSI settings and thresholds can vary depending on whether you’re trading stocks, forex, or crypto, and whether you’re using a mean reversion or trend-following approach.

How is the RSI calculated?

The Relative Strength Index (RSI) is calculated using a formula that compares the magnitude of recent gains to recent losses over a specified period. Here’s how it works:

- Calculate Average Gains and Losses:

- Over the chosen period (e.g., 14 days), calculate the average of all gains (days where the price closed higher than the previous day) and the average of all losses (days where the price closed lower).

- Determine the Relative Strength (RS):

- Divide the average gain by the average loss:

RS = Average Gain / Average Loss. - Plug RS into the RSI Formula:

- RSI = 100 – (100 / (1 + RS)).

- Plot the RSI:

- The RSI value is then plotted on a scale from 0 to 100. Values above 70 typically indicate overbought conditions, while values below 30 suggest oversold conditions.

Most charting software calculates this automatically, so you don’t need to do it manually. But understanding the formula helps you grasp how RSI reflects price momentum.

What does the RSI indicator tell you?

The RSI (Relative Strength Index) indicator is a momentum oscillator that tells you whether a stock or market is overbought or oversold by measuring the speed and magnitude of recent price movements. It oscillates between 0 and 100, with key levels at 70 (overbought) and 30 (oversold).

Here’s what it reveals:

- Overbought Conditions: If the RSI is above 70, it suggests the stock has experienced strong buying pressure and might be due for a pullback or correction. However, in strong uptrends, the RSI can stay overbought for extended periods.

- Oversold Conditions: If the RSI is below 30, it indicates heavy selling pressure, suggesting the stock might be undervalued and could bounce back. Again, this isn’t a guarantee, but it’s a signal to watch for reversals.

- Trend Strength: The RSI also reflects the strength of a trend. Higher RSI values indicate stronger upward momentum, while lower values show stronger downward momentum.

- Potential Reversals: Extreme RSI values (e.g., very close to 0 or 100) often signal that a reversal could be near, especially in mean reversion strategies.

It’s a versatile tool, but it works best when combined with other indicators or filters to confirm signals.

Should I sell when RSI is high?

Selling when the RSI is high can be a good strategy, but it depends on the context of your trading system and the market conditions. Here’s how to think about it:

- Overbought Signals: When the RSI is above 70, it indicates overbought conditions, meaning the stock has experienced strong buying pressure and might be due for a pullback. This can be a signal to sell or take profits, especially in mean reversion strategies where you’re expecting prices to revert to the mean.

- Trend Context Matters: In a strong uptrend, the RSI can stay overbought for extended periods. Selling just because the RSI is high might cause you to exit too early and leave profits on the table. In these cases, it’s better to combine RSI with other indicators or wait for confirmation, like the RSI dropping back below 70, to signal weakening momentum.

- Backtesting Is Key: The effectiveness of selling based on high RSI levels depends on the market and timeframe you’re trading. Always backtest your strategy to ensure it works with your specific system and objectives.

So, yes, selling when RSI is high can work, but it’s not a one-size-fits-all rule.

What if RSI is below 20?

When the RSI drops below 20, it signals that the stock or market is extremely oversold. This typically indicates heavy selling pressure and suggests a potential for a bounce or reversal, especially in mean reversion strategies. However, the context matters:

- Mean Reversion Opportunity: In mean reversion systems, an RSI below 20 is often seen as a strong buy signal, as it reflects extreme oversold conditions. For example, if you’re using a short-term RSI like RSI 2 or RSI 3, values below 20 (or even lower, like 5 or 10) can indicate a high probability of a price rebound.

- Trend Context: If the market is in a strong downtrend, the RSI can stay below 20 for an extended period. In such cases, buying just because the RSI is low might lead to premature entries. It’s crucial to confirm the signal with other indicators or filters, like trend direction or support levels.

- Backtesting Is Key: The effectiveness of using an RSI below 20 as a buy signal depends on the market, timeframe, and strategy. Always backtest this condition on your specific system to ensure it aligns with your objectives and risk tolerance.

What RSI is too high?

An RSI is generally considered “too high” when it exceeds 70, as this indicates overbought conditions. However, the exact threshold depends on your trading strategy and the market you’re analyzing:

- Default Overbought Level: An RSI above 70 is traditionally seen as overbought, suggesting the stock may be due for a pullback or correction. This is a common level used in both trend-following and mean reversion strategies.

- Extreme Overbought Levels: In shorter-term RSI settings (e.g., RSI 2 or RSI 3), traders often look for even higher levels, such as 90 or 95, to identify extreme overbought conditions. These levels can signal sharper reversals in mean reversion systems.

- Market Context Matters: In strong uptrends, the RSI can remain high (above 70 or even 80) for extended periods. Selling just because the RSI is high might cause you to exit too early, leaving profits on the table. Combining RSI with other indicators or waiting for confirmation (e.g., RSI dropping back below 70) can help refine your decisions.

Ultimately, “too high” is relative to your system and market. Backtesting is crucial to determine the optimal RSI thresholds for your strategy.

How to use RSI for day trading?

To use RSI for day trading, you need to focus on shorter timeframes and adapt the settings to suit the fast-paced nature of intraday trading. Here’s how you can approach it:

- Use Shorter RSI Periods: The default 14-period RSI might be too slow for day trading. Instead, consider using a 2-period or 5-period RSI to make the indicator more responsive to quick price movements. For example, a 2-period RSI with overbought/oversold levels set at 95/5 can work well in mean reversion strategies.

- Identify Overbought/Oversold Levels: In day trading, extreme RSI levels (e.g., above 90 or below 10) can signal potential reversals. These levels are more restrictive than the standard 70/30 thresholds and help filter out weaker signals.

- Combine RSI with Other Indicators: RSI works best when used alongside other tools, like moving averages or support/resistance levels, to confirm signals. For instance, if the RSI is oversold and the price is near a key support level, it could strengthen the case for a long trade.

- Backtest Your Strategy: Always test your RSI-based day trading strategy on historical intraday data to ensure it performs well in the markets and timeframes you trade. This helps avoid overfitting and ensures robustness.

What is the best RSI interval?

The “best” RSI interval depends entirely on your trading style, timeframe, and strategy. Here’s how to think about it:

- Default Setting (14-Period RSI): The standard 14-period RSI is a good starting point for most traders. It works well for identifying overbought (above 70) and oversold (below 30) conditions in medium-term trading.

- Short-Term Trading: For day trading or mean reversion strategies, shorter intervals like a 2-period or 3-period RSI are often better. These settings make the RSI more sensitive to quick price movements, allowing you to capture short-term extremes. For example, you might use a 2-period RSI with overbought/oversold levels set at 95/5 to identify sharp reversals.

- Longer-Term Trading: If you’re trading on higher timeframes, like weekly charts, a longer interval such as a 20-period or 30-period RSI can help smooth out the noise and focus on broader trends. In these cases, overbought/oversold levels might be closer to 60/40 instead of 70/30.

- Backtesting Is Key: The “best” interval isn’t universal – it depends on the market, timeframe, and system you’re trading. Always backtest different RSI intervals to find the one that works best for your specific approach.

Can RSI predict price?

The RSI doesn’t predict price in the sense of telling you exactly where it will go, but it can provide valuable clues about momentum and potential reversals. Here’s how it works:

- Momentum Indicator: RSI measures the speed and magnitude of recent price movements, giving you insight into whether a stock is overbought (above 70) or oversold (below 30). These conditions can signal that a reversal or pullback might be on the horizon, but they’re not guaranteed.

- Overbought/Oversold Signals: When RSI hits extreme levels (e.g., above 70 or below 30), it suggests the price may have moved too far, too fast. This can indicate a potential turning point, but the market can remain overbought or oversold for extended periods, especially in strong trends.

- Confirmation, Not Prediction: RSI is best used as part of a broader system. For example, you might combine it with support/resistance levels or trend indicators to confirm trade setups. It’s not reliable as a standalone tool for predicting price direction.

- Backtesting Is Key: The effectiveness of RSI depends on the market, timeframe, and strategy. Backtesting helps you understand how RSI behaves in your specific context and whether it adds value to your trading decisions.

What is the difference between relative strength and RSI?

Relative Strength (RS) and the Relative Strength Index (RSI) are two distinct concepts, though their names can cause confusion. Here’s the breakdown:

- Relative Strength (RS): This measures the performance of one stock or asset relative to another, typically a benchmark like the S&P 500. It’s calculated by dividing the price of the stock by the price of the benchmark over a specific period. If the RS value is increasing, it means the stock is outperforming the benchmark, and if it’s decreasing, the stock is underperforming. RS is often used in momentum strategies to identify strong-performing stocks relative to the market.

- Relative Strength Index (RSI): This is a momentum oscillator that measures the speed and magnitude of recent price changes to identify overbought or oversold conditions. RSI is calculated using a formula that compares average gains to average losses over a set period (commonly 14 periods). It oscillates between 0 and 100, with levels above 70 indicating overbought conditions and below 30 indicating oversold conditions. RSI is used to time entries and exits based on price momentum.

In short, RS compares performance between assets, while RSI analyzes momentum within a single asset. They serve different purposes, so it’s important to use them appropriately based on your trading goals.

What are examples of relative strength?

Relative strength (RS) examples typically involve comparing the performance of one stock or asset to another benchmark or index. Here are a few practical examples:

- Stock vs. Index: If you’re analyzing a tech stock like Apple (AAPL), you could compare its price performance to the NASDAQ Composite. If Apple’s price is rising faster than the NASDAQ, it shows relative strength against the broader tech market.

- Sector vs. Market: You might compare the performance of the Technology Select Sector SPDR ETF (XLK) to the S&P 500. If XLK is outperforming the S&P 500, it indicates that the tech sector is showing relative strength compared to the overall market.

- Rotational Momentum Systems: In a rotational momentum strategy, you could rank stocks or ETFs by their relative strength to identify the strongest performers. For instance, you might calculate the RS of several stocks against the S&P 500 and focus on the top-performing ones.

- Stock vs. Stock: Comparing two stocks directly, like Tesla (TSLA) vs. General Motors (GM), can reveal which one is stronger over a given period. If Tesla’s RS is increasing relative to GM, it suggests Tesla is outperforming.

Relative strength is a powerful tool for identifying leaders in the market.

The RSI, level, of 50, not widely discussed, but that is valuable, in its own right. Trending stocks, are defined by a series of higher highs and higher lows.The perceived problem, is determining when the counter trend, retracement, has finished. My own observation, shows that when the RSI(14), crosses up above 50, in an uptrend, this signals the end of the retracement and resumption of the main uptrend . I have not looked at stocks, in down trends, but logic, would dictate resumption of down trend, after a bear rally, when RSI, crosses below 50. As a general rule, stocks in an uptrend, spend most of the time above 50, with the occasional drop, below 50, caused by a sharp retracement.

Hi William – yes I absolutely agree this can be a very effective rule. Plus the added benefit is that it is so simple. I like to backtest this sort of idea over a wide range of parameter values to see how it performs. For example in this case I would vary the RSI lookback from say 10 to 100 and see how the cross above the 50 level performs over this full range. I would also love to investigate the price behaviour after the RSI cross above 50 over time… for example what is the average profit per trade if you hold for 5/10/20/50 bars. This then give us some useful information to help design a good exit to pair with the entry signal.

Great thoughts, thanks again for taking the time to comment.

Adrian