Despite the strength in the global stock markets over the last few months, last week was a bit of a mixed bag, with a couple of surprising trends emerging… plus one trend which I am particularly happy about (more on that later).

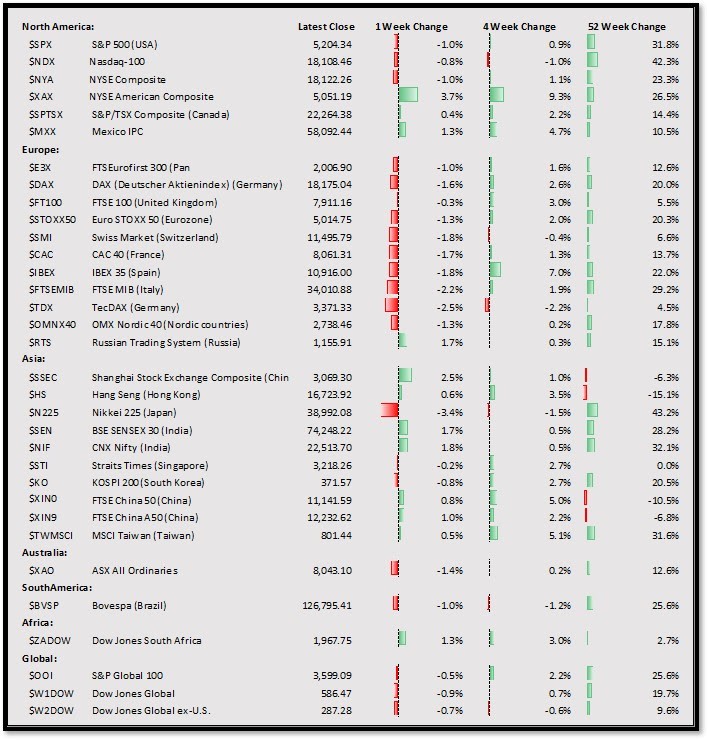

While most traders would consider that the Nasdaq exchange has been the market darling over the last 12 months (and it has really), I want to draw your attention to the Nikkei 225 which is up 43.2% in the last 12 months, or just a little more than the Nasdaq which is up 42.3%

I am certainly not suggesting that everyone should be in the Japanese market (which can be quite hard to develop good trading systems for), but I do always want to encourage you to look beyond the popular markets and indices that everyone looks at. After all the more markets you can profit from, the less susceptible you are to shocks or trend changes in any one of those markets.

SIDE NOTE: I have had a lot of people ask me how I am producing these awesome dashboards of stock market performance. I use the XLQ addin for Excel which allows me to pull a wide range of stock / index / commodity / forex and other financial data into Excel. The cool thing is it can pull data from Norgate Data into Excel(which is what I have used for the table above and others in this post) , Yahoo and a variety of other sources into Excel too. It is hugely useful for tracking your positions, open trade profits and a range of other reporting functions that traders need to do. Check out XLQ here and get a $50 discount.

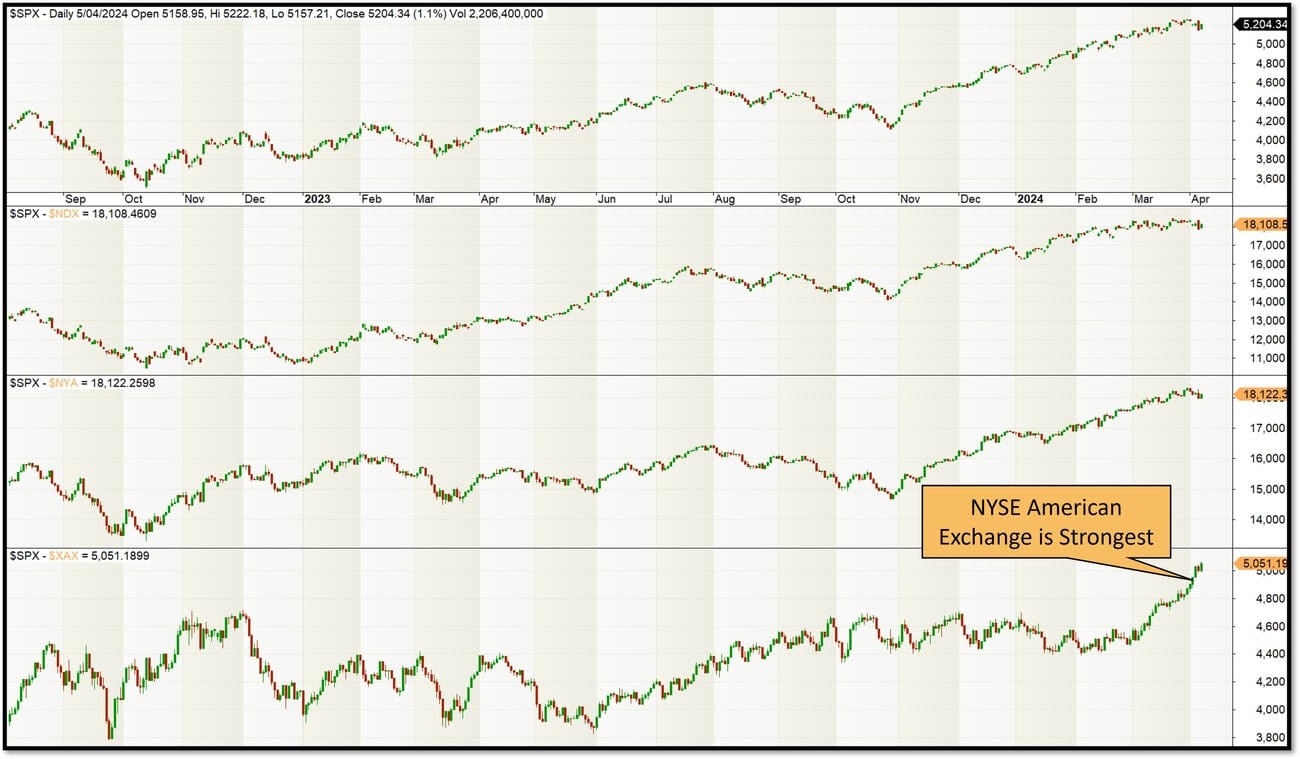

As you can see in the table above the major US indices all took a breather and dipped around 1% in the last week, but what is interesting is the NYSE American Composite is bucking the trend and is up 3.7% in the last week. The Amex exchange feels a bit like the poor cousin of the NYSE and Nasdaq, and seldom gets a lot of attention – this might be changing, will be interesting and useful to watch.

The chart below shows the acceleration in performance of the NYSE American Exchange in March and April 2024… I need to look more closely at what is driving this, but I would be happy to hear your thoughts – if you have a theory (or some analysis) on this please comment below and share your thoughts.

Interestingly I did some analysis for my Trader Success System members looking at the difference between the way certain systems perform when applied to Nasdaq vs NYSE vs Amex. What was fascinating is that stocks on these exchanges behave quite differently. The exchange a stock is listed on is a useful and underused factor for trading system development in US Stocks.

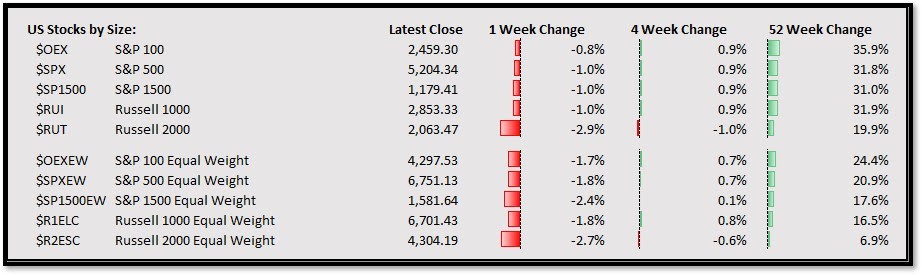

Something about the financial media that I really hate is the obsessive focus on the largest stocks on the market. I also don’t like the fact that most of the major indices that everyone watches are capitalization weighted.

I am continually fascinated by the difference in performance across the whole spectrum of stocks – from the large end of town to the small caps. Below I have shared the typical capitalization weighted indices that most people look at for the US market (S&P 100/500/1500, Russell 1000/2000). Underneath I have shared the equally weighted version of each of these.

Take a look at the 52 week change for the capitalization weighted vs equal weighted and you will see that the US market’s performance has only been driven by the largest stocks – The S&P100 is up 35.9% for the last 52 weeks, while the Russell 2000 equal weighted index is only up 6.9%

This difference is incredible and shows you that the market is not homogeneous. Large caps are in the spotlight right now, but this is not always the case. In fact the S&P500 is up 266% since January 2000, but the Russell 2000 Equal Weighted Index is up 356% in the same period.

So remember – don’t myopically focus on what is working well now and lose sight of the fact that markets change and large cap tech stocks don’t always lead. Make sure you have strategies for large cap tech as well as other sectors of the market and you will do much better long term

Here is the trend I am excited about – small caps on the ASX are out performing large caps! Not by a lot, but as the 52 week change in the table below shows small caps are leading on the ASX recently. I like this because when small caps are moving you can get some monster trades…. trades that change everything. If you are an Aussie stock trader make sure you consider more than just the ASX200 or you will miss out on this trend!

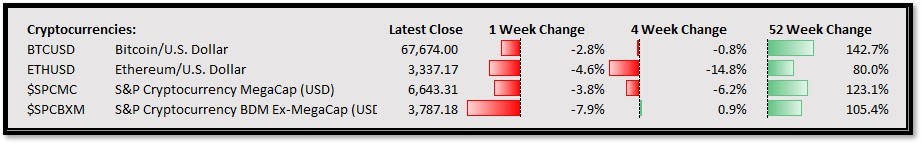

After the new all time highs in crypto, the markets have taken a bit of a breather with altcoins declining by quite a bit in the last week. The bull market is still in tact and I am expecting that the next leg up will be extremely beneficial for students of The Crypto Success System – We have some great systems that capitalize on the trends in crypto and the bull market returns are something to be seen.

If have been hanging on the sidelines wondering when to get into Crypto, now is the time. It is not ideal to enter a new market at all time highs, but now that we have had a pullback, the risk has come off and it is a good time to look at diversification into Crypto in my opinion.

Check out The Crypto Success System to get an instant portfolio of 9 different trading systems build specifically for the crypto markets (and yes we can even show you how to fully automate your crypto trading!

I would say that the biggest challenge traders have is dealing with the psychological effects of drawdown. After all most people come to the markets because they want to make money, but the hard reality is that most traders spend a lot more time in drawdown than they do at all time equity highs… even if you have a profitable system. Because drawdown is so poorly understood, and because it is one of the most important things for traders to understand and learn to cope with I have created this extensive article talking about drawdown which I hope will set your mind at ease and help you cope with drawdown in your trading:

Learn 4 Causes of drawdown & 5 ways to reduce maximum drawdown in your trading

This topic is so important I am spending 90 minutes on how to analyse and understand drawdown better in my Breakthrough workshop this week for members of The Trader Success System – I can’t wait!

Trading Tip

Because drawdown is on my radar at the moment, my number 1 trading tip is that you need to measure the performance of your trading with something other than profit.

Wait what?

Don’t we want to make money above all else here?

Yes, but let me explain. If you measure yourself on your trading profits every day, you will feel like you are a crappy trader most days, because most days you will have less money in your account than you did at your most recent equity high.

Then every now and then you will make a new equity high and you will feel like a genius… but then you will have a pullback (drawdown) and you will immediately feel like a crappy trader again.

So instead of just measuring yourself on your trading profits, try adding a few additional measures into the mix such as:

- Did I follow my trading rules today?

- Did I trade mistake free today?

- Did I monitor my trading system’s performance this week?

- Have I added a new system to diversify my portfolio in the last month?

- Did I capture new trading ideas in my journal and backtest them quantitatively this week?

If you start looking at measures like this, you will be moving in the right direction of becoming a better trader AND you will feel psychologically much better.

This is powerful – We want to make money trading, but in order to make money we have to focus on something other than making money.

Counter intuitive right?

Welcome to trading!

Member Wins

This week I want to call out one of our amazing Trader Success System members, Jen W, who is an analytical person fascinated by the markets and is an absolute gun of a student. Jen is powering through the program, asking outstanding questions, focusing on the right things.

I believe Jen will move from Launch to Mastery in record time because she has all of the right ingredients. Here is what makes her so amazing…

- She is fascinated by the markets

- She is comfortable with numbers, analysis and math (all of which is important in systematic trading)

- She is comfortable learning to code in order to backtest properly (we teach this critical skill in the Trader Success System – the key thing is she is comfortable learning it!)

- She understands that success requires effort and knows she is learning an ultra valuable life skill and not pursuing a get rich quick scheme

- She is confident enough to ask questions when she doesn’t understand something fully

- She wants to be in control of her wealth

- She understands that a repeatable, proven backtested strategy is the best way to win in the markets

Jen, it is an absolute pleasure having you in our community and I am certain that in a very short period of time you will be a fully confident, systematic trader with a diversified portfolio of strategies covering a range of different market conditions.

Well done so far and keep up the great momentum!

I know many of you have done other trading programs and been disappointed…

Here is my promise:

The Trader Success System is the last stock trading program you will ever need.

We empower you to become a master of systematic trading and after completing our program you won’t need any other course ever again.

If you think you are like Jen, have similar skills and you want to master systematic trading FAST, comment down below with the words “THATS ME” and I will talk to you about how The Trader Success System can help.

If you don’t want to learn fast, if you think you can get rich quick, if you don’t like math/spreadsheets/numbers/analysis, are scared of computers, are too embarrassed to ask questions or if you are not passionate about the markets The Trader Success System is not for you.

News and Announcements from EST

I have been working on an extended capital allocation tool for my Trader Success System members which I am really excited about.

This tool pulls in the performance and equity curves from 57 different trading systems (yes you read this right, 57 systems, many of which our members have access to!) covering a wide variety of strategies / markets / timeframes and allows you to investigate how to best allocate your capital between different trading systems.

Capital allocation is one of the most important drivers of trading performance and having a tool like this to combine so many different systems and see which systems work well together and which don’t is invaluable. I am super pleased with it and can’t wait to share it with our members.

On the Home Front

I made the mistake of planting a pumpkin vine at one end of my relatively small garden a few months back… I knew these grew big, but I didn’t realise it would take over the known universe!

The good news is I probably wont have to buy pumpkins again for the next 385 years… sometimes things just work. The vine is clearly in a spot that it loves with the right amount of sun and water and it is just THRIVING.

Kind of similar to trading systems – get the right system in the right market conditions and it feels stupidly easy to make money.

BUT remember everything has seasons and sometimes your garden (and your portfolio) won’t perform as well as you would like… but if you have a diversified portfolio of trading systems that make money from different strategies / markets / timeframes then you will have a better chance of catching conditions that just make you money.

This is what happens when it all falls into place..

That’s all for this week – Trade well… follow your rules… and most of all remember, if you spend all of your time measuring how much money you are making trading is a hard road, focus on becoming the best trader you can be and establishing a diversified portfolio of trading systems that cover a range of strategies / markets / timeframes and the profits will come.

Remember – You’re only one trading system away!

Adrian Reid

Founder – Enlightened Stock Trading

Share This

Share this post with your friends!