This article will explain how you can learn stock trading and profit in the stock market with three simple secrets that most traders never understand. With these three secrets, you can become one of the small percentages of traders who win in the markets when you approach the stock market. Plus, have an advantage over the vast majority of traders who lose money.

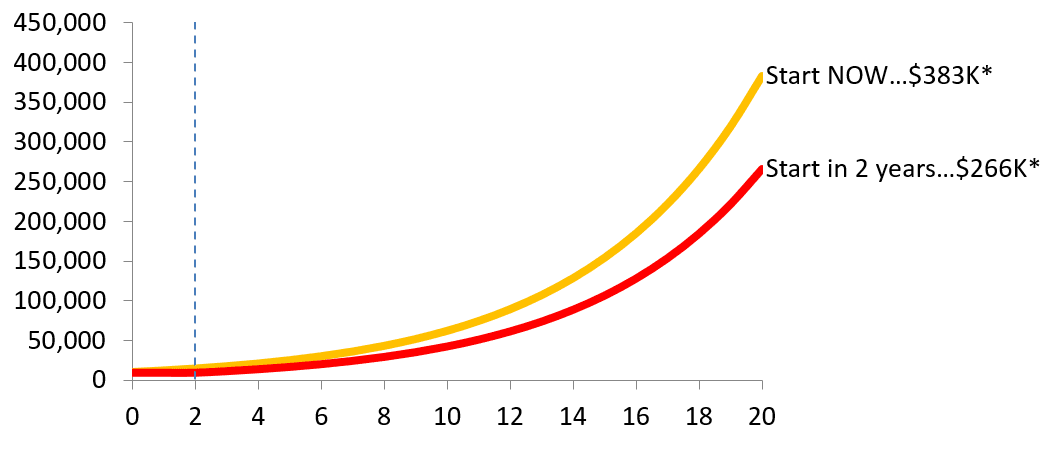

The first step to succeeding in the stock market is understanding that time is your most valuable asset. The vast majority of new traders spend years mucking around with different approaches, experimenting, and trying to learn things on their own. Those years that they spend learning are wasted compounding opportunities. If you can accelerate your learning in the stock market, you can dramatically improve your future wealth because you get more time for compounding. Take this simple example on the chart below.

Suppose you start earning money now because you adopt a proven method quickly in the next couple of months — just like what you would learn in the Trader Success System. You compound your trading account over the next 20 years, starting with just $10,000. In that case, you could end up with almost $400,000 in your trading account. But if you spend the next two years trying to learn how to trade on your own, trying different approaches, blowing up your accounts, and then finally, in two years, you figure out how to make money trading. In the next 20 years, your account would only have managed to compound to $266,000. The time value of money when it comes to trading is immense.

Therefore, the first secret to becoming a successful stock trader is finding a mentor to guide you to learn fast. The longer it takes you to learn, the lower your future wealth is going to be.

Second Secret: Take Control and Learn Stock Trading Yourself

The second secret to becoming a successful trader and growing your wealth is to take control of your trading yourself. Many people think that they should outsource their trading or investment decisions to a professional fund manager. A fund manager will undoubtedly tell you that that’s a great idea because that’s their business. They charge you a fee to manage your money for you.

You can get a fund manager who might match the market’s average performance, or you can manage it yourself. If you have a fund manager who reaches the performance of the market minus their fee and compounds that from a $10,000 account over the next 20 years, you can end up with $298,000 in your account. But if you take control of your trading and manage your trading decisions on your own, you implement a simple trading strategy that performs equally well as the fund manager — except you don’t pay the fees. Therefore, your trading account is going to compound to lot higher levels.

Doing it yourself and avoiding the fees that the fund manager charges you is a massive advantage in your favour. The trick is, you’ve just got to learn a profitable trading strategy that you can follow consistently. You’ll outperform the vast majority of fund managers simply because you don’t have to pay the fees, and you get to keep that in your account and get to compound it.

Third Secret:

Trade Longer Term when you Learn Stock Trading

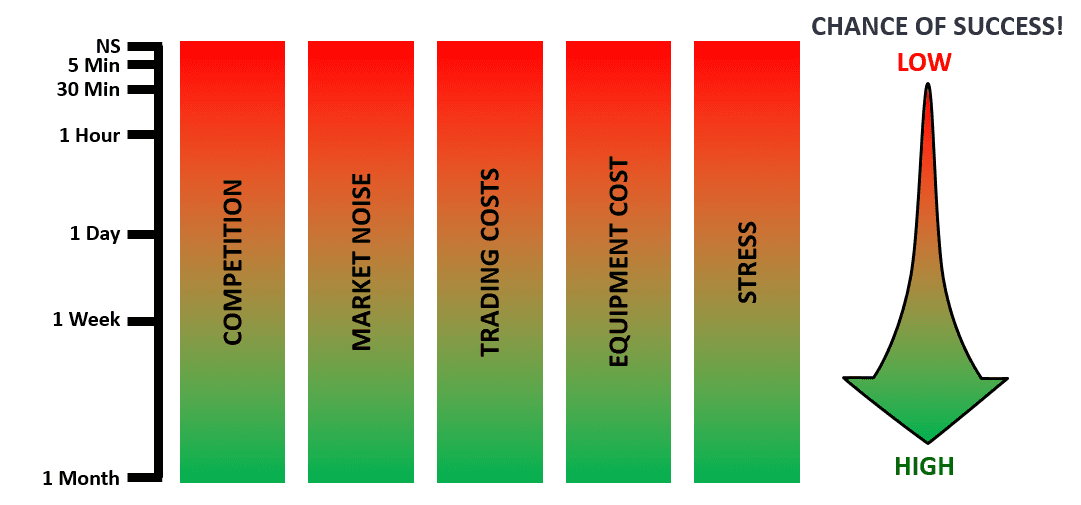

The next secret that most traders miss or misunderstand early in their journey to learn stock trading is about trading frequency. Many new traders come to the markets thinking they want to day trade, get in and get out of the markets quickly, avoid overnight risk, and trade often so they can make more money. It sounds rational and logical until you look at the calculations of the costs of trading so frequently.

Looking at the table above, imagine you have a stock trading system that trades five times per day, and each of those trades costs you $10 per trade. That’ll result in a total commission of $11,000 for the year that you’re going to pay your broker. If you’ve only got a $10,000 account and taking frequently small trades, the total commission payment you’re going to send to your broker to help make your brokerage is 110% of your account. You can’t afford to trade that frequently because you end up spending way too much on commissions, and end up making your brokerage instead of yourself.

Contrast this to a trading system where you’re trading stocks maybe five times a week, and the exact cost per trade of $10 per trade, but the total commission then for the year becomes $2,600. Even as a percentage of a $10,000 account, this is still a pretty high burden, but it’s far less of a hindrance than the five trades per day, which costs you 110% of your account.

The real secret to succeeding in the stock market is to have a profitable method, but make sure it doesn’t trade too often. Have a technique that makes high profits, doesn’t trade all that often, and be reasonably selective. You get the very best trades, and you don’t end up making your broker rich instead of yourself.

Disadvantages of Short Term Stock Trading

Day trading is probably one of the sexiest-sounding and most attractive disciplines. Buying and selling all during the day, moving your money around the market and taking advantage of opportunities as they present themselves interday, looking at news flows and so on. But it’s not all that.

In this section, we’ll talk discuss thoroughly the following disadvantages of short term trading:

- Short Timeframe

- Noise Level In The Market

- Level of Trading Costs

- Equipment Cost

- Stress

1. Short Timeframe

The first challenge is that the shorter your timeframe, the higher your levels of competition are. On very short timeframes — particularly short-term trading intraday, you’ve got to compete with managed funds with prop traders, professional stocks and futures traders, high-frequency trading firms, and many others. The level of competition at the very short-term end of the trading spectrum is intensely high. It’s probably the most competitive environment on earth. Still, if you expand your trading time horizon to daily, weekly, or even monthly trading, the level of competition in the market is far lower. Therefore, you’re able to grab an edge out of the market and trade it consistently high.

2. Noise Level In The Market

The second challenge with the trading short term is the level of noise in the market. The shorter-term your trading system is, the more noise it encounters in the market. On a one-minute chart or a five-minute chart in stocks, there’s a vast amount of noise in the data—far more noise than a tradable signal. But again, if you go to daily, weekly, or even monthly charts, the level of market noise compared to the amount of signal drops dramatically. What that means is your trading systems can be much more profitable.

Trading daily and weekly charts is far easier to get a consistent edge that will last for years or decades than on a five-minute or a 30-minute chart. Any advantage that you’re likely to find on a short-term chart in stocks is going to be very short-lived. The system will decay and die quickly. Therefore, trading daily and weekly gives you a real advantage in the market rather than trading on intraday short-term charts.

3. Level of Trading Costs

The next challenge with short-term trading is the level of trading costs. The shorter-term your trading system is, the higher the burden of commissions is on your account because commissions are paid for on a per-trade basis. The more often you trade, the higher the commission payments you make to your broker, and the higher the profits you’ve got to make just to break even and keep your head above water. Trading longer term, getting bigger profits on each trade, and trading less often reduces your trading costs and makes it far easier to succeed in the long run.

4. Equipment Cost

The fourth consideration around the trading timeframe is your equipment cost. If you’re going to trade short-term, you’ve got to compete with all the hedge funds, prop trading firms, and high-frequency trading firms in which they have invested millions of dollars in computing infrastructure, high-speed internet, and direct connections to the exchanges. Frankly, you, as a private trader, just cannot compete with that. However, contrast this with a private trader who adopts a trading system that trades on a daily chart, weekly chart, or monthly char; all you need is a laptop, a $30 a month data feed, and a trading software like AmiBroker. You can compete and succeed in the long run.

The whole setup is going to cost you very little money. Chances are you already got a computer at home that will run that. All you need to do is buy the AmiBroker software and a data feed and get a system up and running, and you’re on your way to success in the markets. Trading short-term is complicated because chances are, you just don’t have the proper infrastructure in place and probably don’t even have access to the appropriate infrastructure to succeed at the very short-term end of the market.

5. Stress

Finally, the fifth area or consideration for trading timeframes is that of stress. If you’re trading very short-term, you’re making dozens of decisions every single day and you’re watching the market constantly. The level of stress that that imposes on you as the trader is immense.

Trading is a lifestyle pursuit. If you want to have a stressful life, then stare at the markets all day long. But if you’re trading for freedom to reduce your stress and to increase your quality of life, then trading on daily, weekly, or monthly charts are going to give you a far better quality of life than trading on one to five minutes, nanosecond charts, or even 30-minute charts. The longer term you go, the greater your chance of success. Whether you think about competition, market noise, trading costs, equipment costs, or stress in the long-term, end-of-day trading systems are the way for the private trader to succeed.

The Most Common Stock Trading Mistakes

1. Quitting as a result of initial trading system drawdown

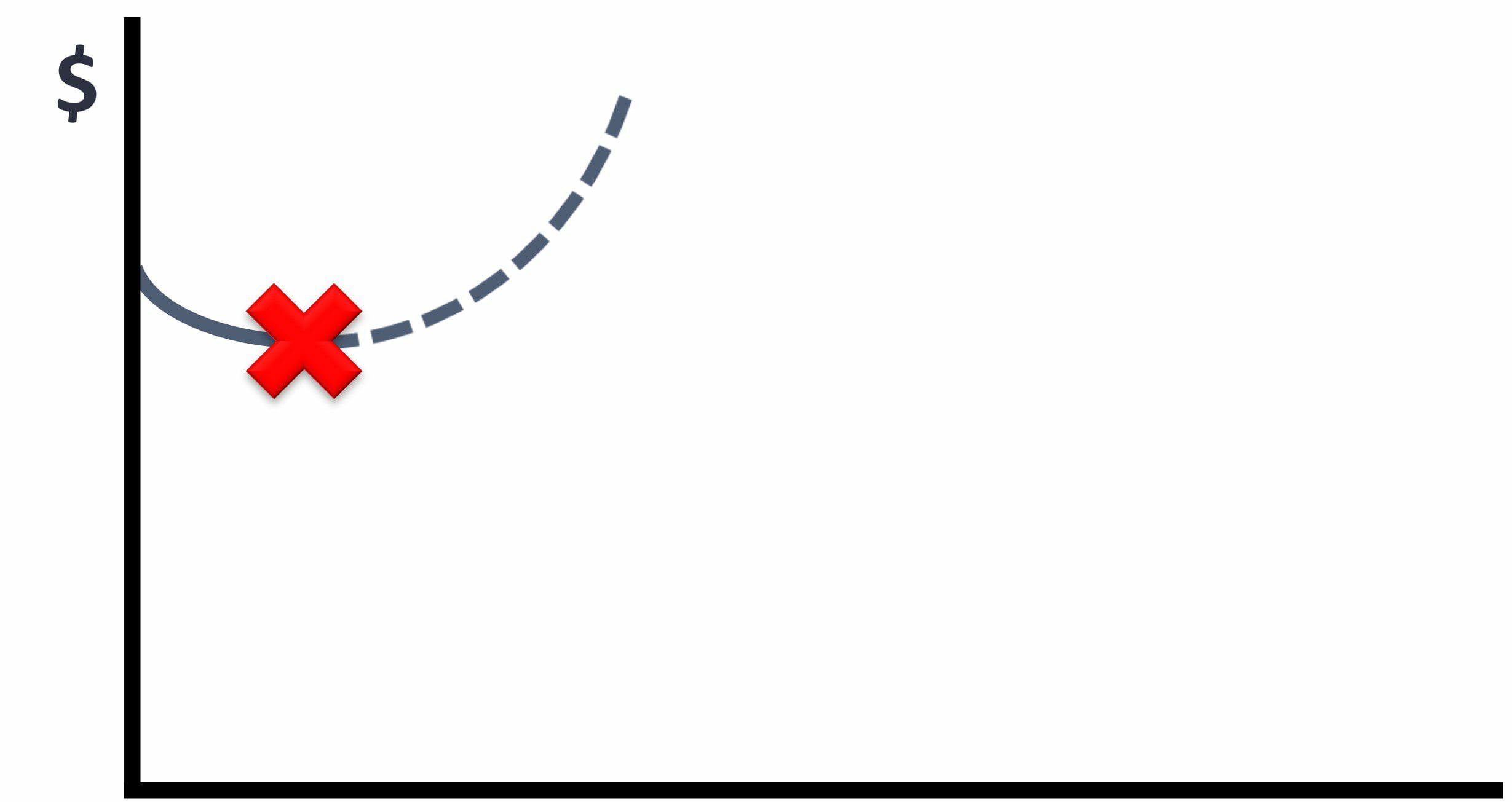

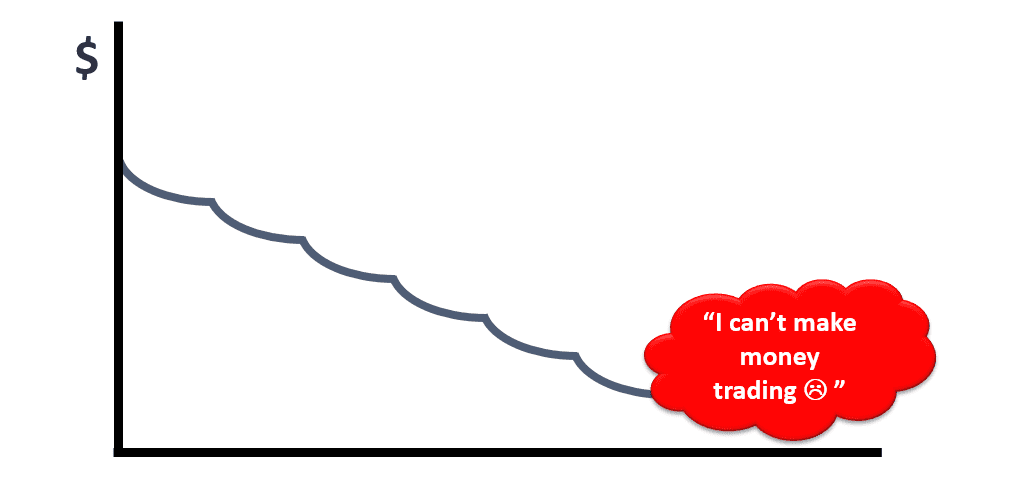

An area where many traders get their approach wrong is when they implement their first trading system. You’ve got no runs on the board if you think about the profit level over time that a trader makes when you start. All you’ve got is some cash in your pocket and some hopes or dreams for a better future. Find a trading system or a strategy and implement it. Implement that strategy, and start trading.

What new traders don’t realize, or what’s very easy to miss as a new trader, is that most new systems will end up having a drawdown before you end up generating profit. It’s called the initial drawdown or the launch drawdown. When you start trading a system or a strategy, often it’s going to take you a while to find that winning trade that drags you up out of your initial drawdown into profit.

In the beginning, most new traders go into this initial drawdown and start freaking out because they’re losing money. They’re not confident enough in their system. They see that it’s losing money, and they quit after they’ve lost maybe 10%-30% of their account. What that does is it eliminates the chance, the possibility of that system moving into profit. The reason you quit as a new trader is that you’re in that initial drawdown, and you don’t have the confidence to see it through. You don’t believe that your strategy is going to start making money.

The new trader goes and quits that first strategy, goes to cache, and then looks for a new trading system. They implement a new trading system or method. The same thing happens again, they go through another initial trade draw, initial drawdown, and they quit because that system’s losing money during the drawdown.

The same thing repeatedly happens because the new trader is looking for the perfect system that makes money from day one from the very first trade. Unless you’ve got confidence in your trading system, imagine that this is an easy trap to fall into. The new trader ends up believing that they can’t make money from trading after trying multiple different methods, losing money on all of them, and quitting all of them. There are counters now down to near zero, and their belief in their ability to make money trading is also near zero.

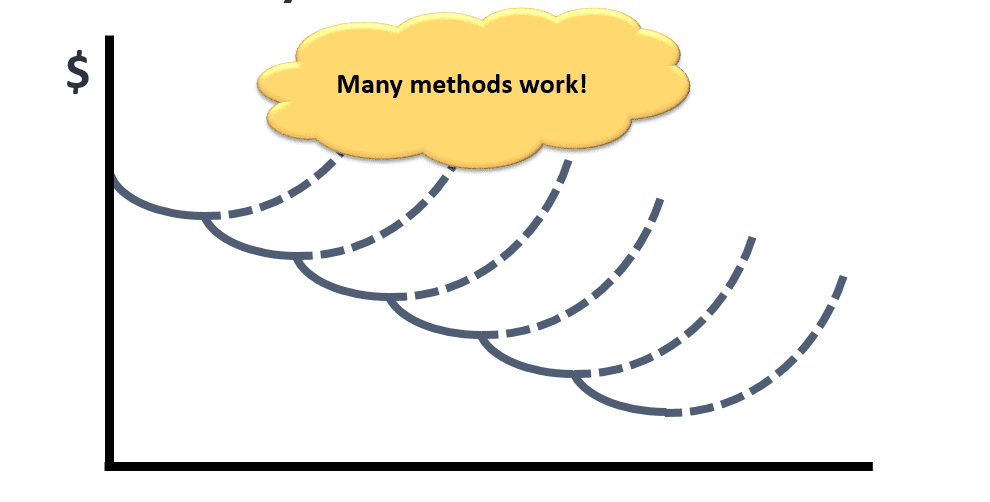

The trick is that you need to understand that many methods can work and build your profit trading stocks in the market, but you have to have the confidence to implement one of those methods and follow through.

Get through that initial drawdown to start making money. In the chart below, any one of the strategies that this hypothetical trade-up tried could have resulted in a huge profit, but they quit before they had a chance to find out.

To succeed as a new stock trader, you need to find the confidence to stick to one strategy that works. Then, see it through that initial drawdown so that you can come out the other side into profit that will allow you to start growing your account finally.

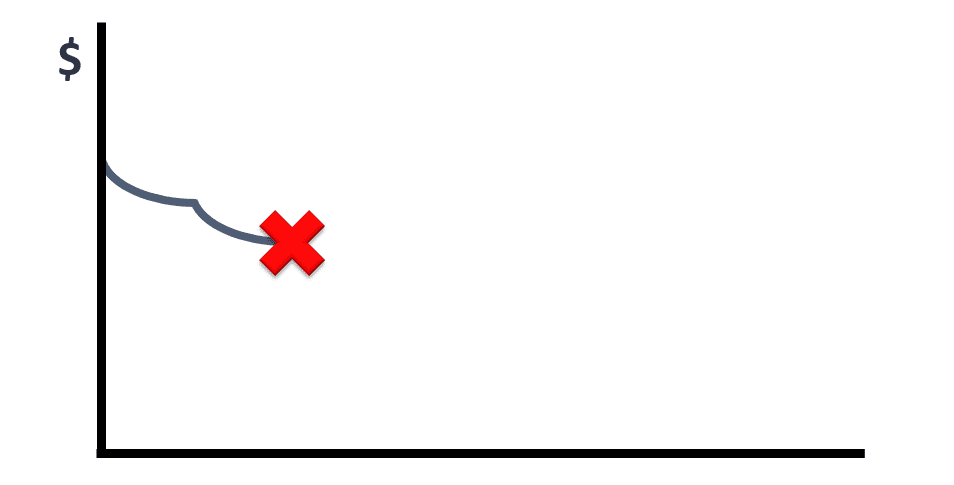

2. Not Willing To Take A Loss

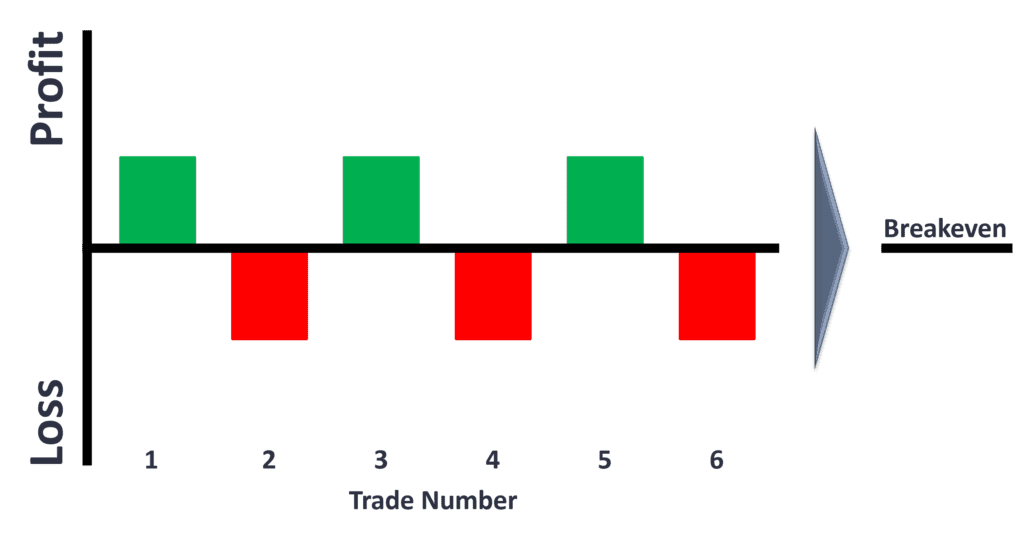

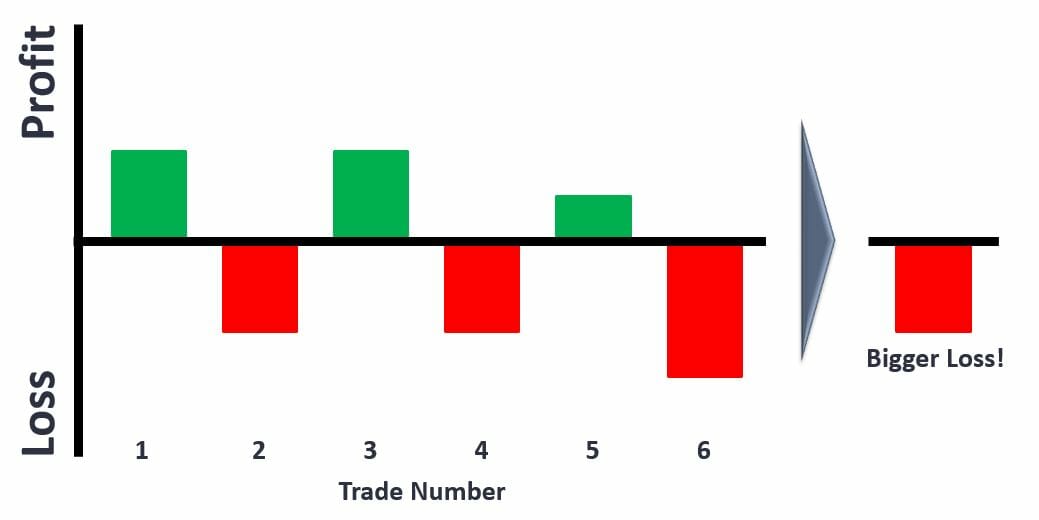

The trick to developing a profitable stock trading system or trading strategy is understanding how profitable trades and losing trades impact your account. In the chart below, if you have a 50/50 win rate, we’ve got three wins and three losses.

The next most significant problem that new traders face is not willing to take a loss. In the chart below, the trader has had evenly sized wins and losses for the last 6 trades. There are 50% winners and 50% losses. All the wins and losses are the exact sizes. If you add up the profits and losses from this hypothetical trading scenario, this system is break even.

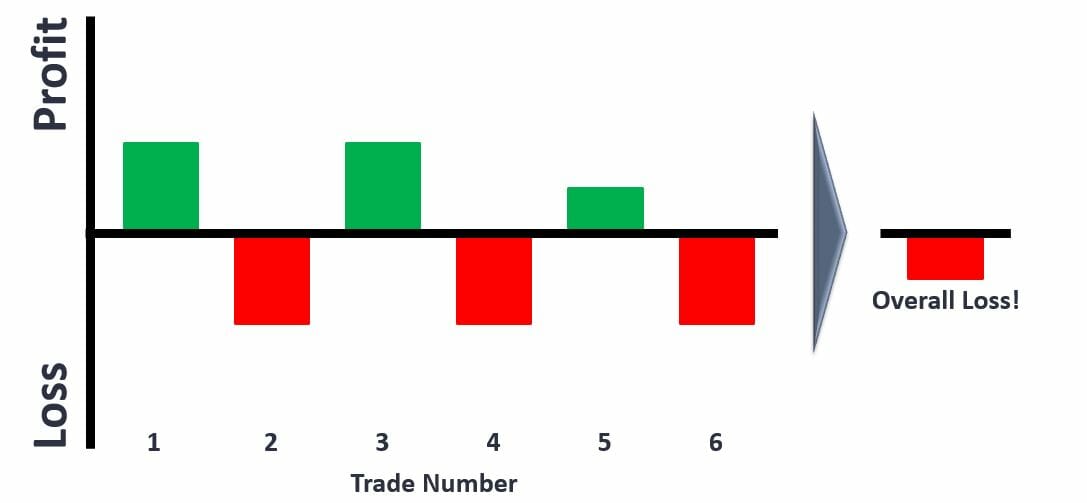

When many traders learn stock trading, the biggest challenge is getting comfortable taking a loss. Instead of closing losing trades early and keeping their loss small, they let that loss get bigger. Hoping that the trade would turn around and come back so that they could be profitable. Instead, what happened is the loss got bigger.

As you can see in the chart below, trade number six has a more significant loss than the other two losing trades on this chart.

When you add all of the wins and losses together in this scenario, you end up with an overall loss. By letting a losing trade get bigger, a breakeven system has turned into an overall loss-making system instead of just taking the loss early and keeping the loss small.

The real problem is that most new traders take their winning trades too soon and let their losing trades grow, hoping that they’ll turn around.

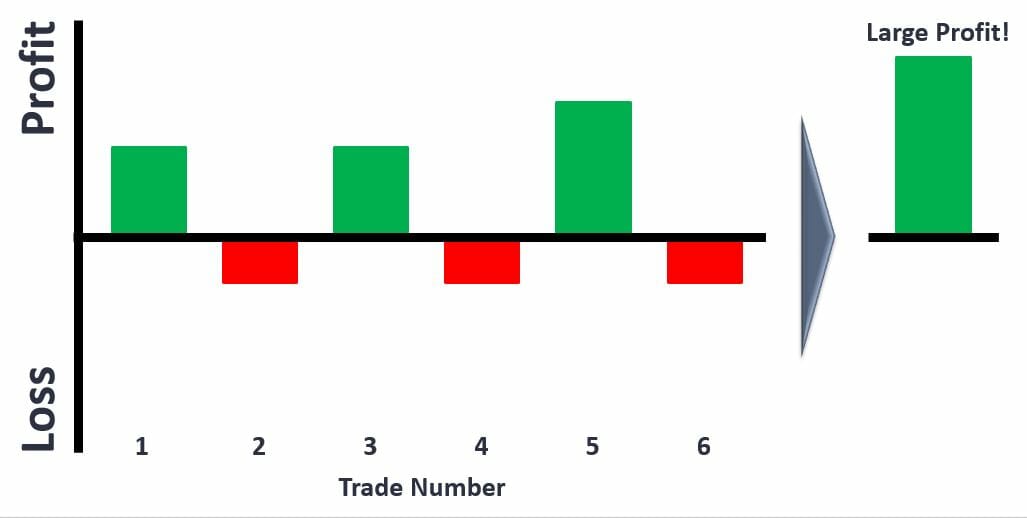

3. New Traders Take Their Winning Trades Too Early

The next stock trading mistake that many beginner stock traders make is banking their profits too early. When new traders think about making money trading, they feel the need to be right on an individual trade and so ‘bank their profits’ early. The temptation to ‘snatch a quick profit’ is huge, but as the image below illustrates, if you take your profits early on winning trades, your overall profitability suffers and you can end up losing money overall.

The trader in this scenario has taken a quick profit on trade number five. That might have made them feel good because they were profitable in the fifth trade, but the trouble is when you add all the profits and losses together now because trade number five is a smaller win. It has turned a breakeven system into an overall loss. To succeed as a trader, we’ve got to make sure we don’t take our winning trades too soon. We’ve got to let our winning trades run.

Unfortunately when they first start to learn stock trading, most new traders bank their profits on winning trades early AND let their losing trades go, hoping they will turn around. Making both of these critical mistakes is extremely bad for your trading profitability. The result is that the new stock trader who takes their winning trades too soon and lets their losing trades run turns a breakeven system into an even bigger losing system.

What a really profitable stock trading system helps you do when you first learn stock trading

Success in the stock market is not driven by whether you are right or wrong on this trade. Instead, success in the stock market is driven by following your trading system and making sure your trading system has an edge so that you’re profitable over many trades. In the following scenario below, if you have a system that lets your winning trades run and grow bigger and bigger, as you can see in trade five, it doesn’t take much to increase your system’s profitability.

In this scenario, the trader has done two things right. They’ve let their winning trades grow so that they’re more extensive. And they’ve cut their losing trades short, so they’ve implemented a stop loss to keep their losing trades small compared to their winning trades. They’ve let their winning trades grow big. This turns a breakeven system into a very profitable stock trading system. The key to success is not right in each trade, but having big winning trades and small losing trades. Even if you’re only right, 40% or 50% of the time, you still have a ton of money.

Most traders try all sorts of different trading systems and rules searching for the magic formula that works. Unfortunately, trying various indicators, jumping from technique to technique, and ever-increasing complexity in your trading causes many problems for your account because the market doesn’t reward complexity. Instead, the market rewards elegant simplicity. What you need to do, if you want to succeed the easy way, is to learn to implement a simple stock trading system with a profitable edge in the market and follow that system consistently every single day.

Avoid the temptation to try the latest or greatest techniques and fiddle with your system rules constantly. To be distracted by tips, advisors, and social media, all of that is the hard way to trading success. You can spend three or four years learning the hard way, trying dozens of different methods, and taking tips and advice from lots of various sources. Or you can take the easy route and implement a profitable stock trading system like those you find in the Trader Success System from day one, which allows you to start making money immediately rather than taking years to figure this out. In conclusion, the quicker you learn, the more time you’ve got to compound your account, and the greater your long-term will be.

How Become a Profitable Stock Trader

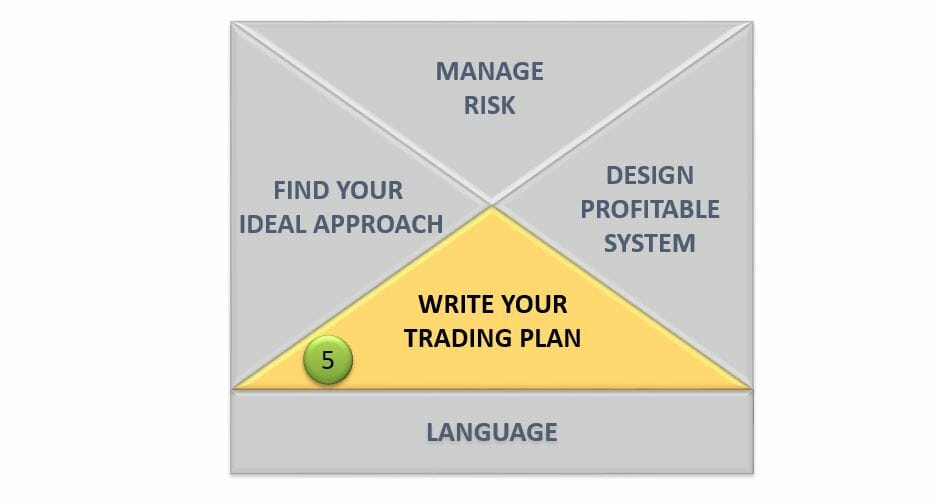

The first step is to learn the language of trading. Suppose you don’t understand the words you’re listening to, the language of the books are using, or the terminology in the stock market. In that case, it’s going to be a very frustrating journey for you because every single thing you read about or someone tells you are going to be hard to understand and implement.

Just like learning a foreign language at the beginning of your trading journey, the level of frustration is high, and the level of competence is low. The trouble with this is high frustration and low competence, which leads to a stressful situation, just like the frustrated trader illustrated in the chart below.

New traders will get so frustrated because they don’t understand the language and the terminology of the markets that they’ll quit before their competence gets high enough to make money.

To succeed and get to the point where you make money stress-free, you’ve got to get your competence that exceeds your frustration level. It typically takes some time, but the trouble is human beings are inherently impatient. When we are frustrated for an extended period as we’re learning something, there’s a higher risk that we’ll end up quitting before we get there. However, you need to realize and remember that the level of competence grows slowly initially, but then you reach a critical point where it accelerates and surpasses your frustration. Then, you start making money in a stress-free way.

To succeed, what you’ve got to do is bring that crossover point forward, so it happens sooner before you get to the point where you want to quit.

The best way to shorten the learning curve is to take a beginner stock trading class that will give you everything you need to start trading profitably from day one.

Get profitable right away, and give yourself time to learn some of the more advanced trading skills. A membership like The Trader Success System will provide you with everything you need to get your competence to a point where you can make money and get your frustration and difficulties under control to learn enough to be a trader. That way, you can start making money and succeeding before you get to the point where you’re so frustrated, want to quit, and give up.

2. Find your ideal approach.

Once you accelerate your learning by learning the language of trading and undertaking a course that teaches you all of the basics of becoming a successful stock trader, the next thing you need to do is to find your ideal approach. This approach fits your personality, your objectives, and your lifestyle.

There are many different ways to make money in the markets. As you can see from the diagram below, you can make money by buying and holding, buying value stocks, and trend following with mean reversion with swing trading, band trading, dividends, and many other methods.

The question is, which is right for you?

When you choose the wrong approach, an approach that doesn’t match your personality, your objectives, and your lifestyle. It will be stressful and difficult for you to follow consistently because it’ll conflict with how you think, feel, and act or your lifestyle.

When I started trading early on, I thought it was a clever idea to try day trading when I still had a full-time job. Because of having a full-time job, I couldn’t implement my trading method correctly and consistently. I made many mistakes and ended up losing $30,000 in three weeks. The approach I was following wasn’t my ideal approach. But when I implemented a long-term trend-following approach, which did match my personality, objectives and lifestyle, I started making money immediately.

What is the ideal approach for you?

Objectives

The first thing you got to think about is your objectives.

- How much capital can you risk?

- How smooth do your returns have to be for you to be comfortable?

- How much risk can you tolerate?

- What returns do you want from your stock trading portfolio?

By answering these questions and understanding the bounds of what is acceptable for you, you can narrow down your trading objectives and find a method that fits within those objectives.

Lifestyle

Second, think about your lifestyle:

- Do you have a job?

- How much time do you want to spend trading?

- Do you need regular dollar income from your trading, or are you doing it to grow your wealth in the long term?

- How much spare time do you have?

- What time of day are you available to do your trading?

Answering questions like this will help you make sure that your method fits your lifestyle. You don’t want to choose a technique that looks excellent and profitable but doesn’t fit your lifestyle. Because if you do, you’re not going to implement that method consistently, and you will lose money. If you’ve got a technique that fits your lifestyle, it’s going to be easier for you to implement that mistake-free.

Personality

Third, is about your personality:

- How do you operate and how do you make decisions?

- Are you a quantitative person?

- Do you need lots of action?

- Are you content to be patient and sit back and wait?

- Do you like to take your time?

- Do you hate being wrong? Or are you okay being wrong as long as you make money?

- How do you want to make decisions?

- Are they fast-paced, quick decisions, or are you slow and considered?

These personality traits are vital. Some trading systems will fit you and your personality, and some trading systems won’t. A trading system that fits you will be far easier to stick to because it will feel natural for you.

If you have a trading system that matches your personality objectives and lifestyle, you’re going to find it easier to implement that system consistently, mistake-free, and therefore profitable.

3. Design a profitable trading system

Once you’ve found your ideal approach, the next thing you need to do is design or find a source of a profitable trading system.

You can build your trading system. Many new traders that I know have spent years tinkering with their trading software, trying to develop their unique trading method. But there’s an easier way. Joining a membership like The Trader Success System gives you trading systems that are already profitable.

But before we go into that, what is a trading system? A trading system is a complete set of rules that tell you when to get in and out of the market.

A trading system consists at its core of several things:

- Setup – the conditions under which you would consider taking a trade

- Entry trigger – the precise moment that you’ll get into the trade

- Exit trigger – the moment you’ll get out of the trade

- Initial stop loss – stops your losses or losing trades from getting too big and protect your account

- Portfolio and risk management rules – these rules define every decision that you need to make in the market. It tells you exactly when to get in and get out, how much to risk on each trade, and how many trades to take at any one time in your portfolio

A complete trading system like those in the Trader Success System has all of these components. They keep you safe, manage your risk, and tell you exactly when to enter and exit the market.

In this hypothetical stock chart below, the setup for this system is that the stock must be moving up firmly and smoothly for several months.

The setup is the stock is in a new uptrend. In this hypothetical example, the precise entry trigger is that the stock price has a dip, a slight pullback, and then starts moving back upwards intensely. A small pause in the trend followed by a trend resumption is the entry trigger in this hypothetical example. In this case, you would want to place a stop-loss, which would be just below the entry price, depending on the level of volatility.

Usually, we link our stop loss width to the volatility of the stock, using an indicator like the true average range. A good stop loss to start with would be four or five times the average true range of that stock on a daily chart. That’ll keep your stop loss outside the daily or the intraday noise, but it will still cut your losses and stop them from getting big.

A great exit to consider starting with is a trailing exit. An exit price trails up behind the share price so that if the share price keeps going up, the exit keeps going up, and stay in the stock. But as soon as the stock stops going up and starts falling, the exit price gets hit, and you get out. It is a classic trailing stop loss exit.

The most common or best example to start with would be a 25% trailing stop. If you enter at $10 a share, the trailing stop starts 25% below that. It’s $7.50. The trailing stop increases as the stop price rises, but it always hangs 25% below the most recent share price. That way, as the price moves up, your profits are progressively locked in as the trade progresses. This trailing stop-loss exit is powerful because it gives you significant wins and minor losses.

4. Manage your Risk

The fourth area for your long-term success is managing your risk. I’ll illustrate these with some civil calculations. Imagine you have $100 in your trading account, and lose 10% of your account. Your account is down to $90.

To recover from $90 to get back to $100, your account now needs to gain 11%. 11% of 90 is 10. So your account brings back from 90 back to 100 by acquiring 11%.

But if your hypothetical hundred dollar account loses 50%, now you’ve got $50 in your account. From the $50 level, you need to make a 100% return to get back to your original $100 account size. It’s much harder to recover from a 50% drawdown than it is to recover from a 10% drawdown.

Now the same is true in reverse. We have to manage the risk on our profits as well.

If you have a hundred dollar account and make a hundred percent return, your account is now at $200, but if you have a 50% loss, your account is back down to a hundred dollars. You’ve got to keep the drawdowns low, and you’ve got to make sure that you don’t lose too much money once you’re up in profit. If you make huge gains and have very steep drawdowns, you end up right back where you started.

If you let your drawdowns get even more significant, then it doesn’t matter how big your gains are. You’re going to end up in a world of pain financially. If you have a $100 account and you make a 100% profit, you now have $200 in your account. But if you lose 75% of that account in a significant drawdown, you’re now down to 50.

In this example, it doesn’t matter how much money you make. The fact that you lost 75% of what you had means you end up losing overall.

Keep your drawdowns low; managing your risk is critical; this is a balance. Don’t take on too much risk in an attempt to grow your account quickly because the significant drawdowns that will inevitably follow will kill your account.

Also, don’t take on too little a risk so that you don’t have your capital exposed to market movements because that will result in minimal profits. You’ve got to balance the desire for an award with the need to protect yourself from drawdown and risk.

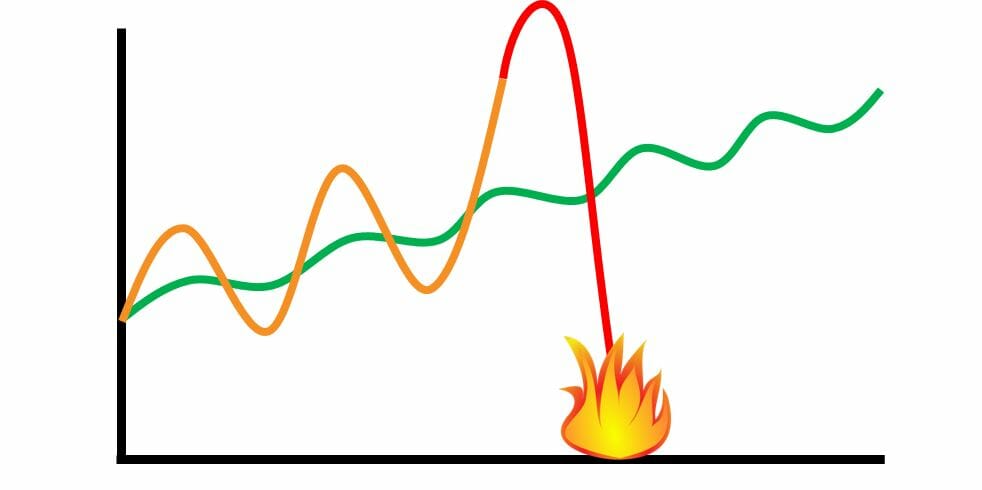

One of the biggest traps traders fall into is finding a method that works, saying, “Oh, wow, look, this trading system is great. I’m making money.” The first thing they do is go and increase the level of leverage or risk or that they’re taking on that trading system.

That increases the volatility of the trading method. In the chart below, when you take an excellent approach, which is shown in green, and you increase the level of leverage on that system, the fluctuations, and drawdown increase, and the level of profit might increase at a point in time.

So you think, “Wow, look how great my profits are. Maybe I should increase my level of risk and leverage even more so I can make even more money.” It’s a common trading psychology problem. When new traders are profitable, they think they’ve figured out the markets and therefore take on more risk, more exposure, more leverage so they can make more money more quickly.

The typical question we ask ourselves as a new trader when we’re up in profits is, “Maybe I should take even more risk and make a fortune sooner?” Inevitably, what follows is a drawdown. If you just increased your risk because you think you figured out how the market works and go into drawdown with your maximum exposure.

That’s how you end up blowing up your account because you got cocky when you were up in profits, so you’ve increased your exposure. As soon as you got into drawdown, you got into drawdown on your biggest exposure. The dollar drawdown is huge, which ends up destroying your account.

It’s far better to stick to the original, more conservative strategy that makes money more slowly and consistently over time but has low drawdowns because that will grow your account without the risk of blowing up. Blowing up your account wastes years of potential compounding because once you’ve blown up your account, you then have to go and save more money to start trading all over again.

In the meantime, if you’d just traded conservatively, followed the system that was slow and steady with low drawdowns, you would be growing your account all the time, be getting further and further ahead, and benefit from those years of compounding that the blown-up trader never gets to experience.

5. Write your trading plan.

The fifth and final secret for succeeding as a trader is to write your trading plan. After you have learned the language, found an ideal approach for you, managed your risk, and designed or sourced a profitable trading system, finally, you need to write a trading plan to define precisely how you’re going to run your trading.

A trading plan is essential because emotions in the heat of the moment determine your decisions if you don’t have a plan. When your trading account is fluctuating, your emotions are up and down like a yo-yo. As a human being, it’s hard to avoid particularly in trading when you see your wealth fluctuate day by day. If you have a good week and your account rises substantially, you’re feeling good and profitable. But, unfortunately, that thrill and greed that follows is going to lead to poor financial decisions.

If you start losing money in your account and go into drawdown, that fear will cause you to make poor financial decisions. The reason is, as a human being, our intelligence goes down as your emotion goes up. It’s driven by the fight or flight mechanism in our body that came about during human evolution. The reason we humans have a fight or flight response is to protect ourselves from the wild animals, from the danger that was going to kill us. When we were cavemen faced with the prospect of being eaten by a saber-tooth tiger, the caveman had to be ready to fight or sprint without thinking about it. Because if you stop to think about how I should handle this dangerous situation, then chances are the saber-tooth tiger would’ve killed you. Therefore our bodies developed a fight or flight response.

When faced with stress or danger, we get adrenaline and cortisol pumped into our system to make our muscles strong and to divert our blood from our vital organs to our muscles so that we can fight or run away and survive. Unfortunately, that evolutionary characteristic of humans makes it very difficult for us to make good decisions under stressful situations.

In the market, there are no saber-tooth tigers, there are no bulls, and there are no bears. There’s no real danger to our health and our life. Still, there are movements in the market that cause stress. Those movements in the market that stress causes our emotions to go up and our intelligence to go down, limiting our ability to make good financial decisions.

How does a trading plan fit into all of this? A trading plan is so powerful because it’s a complete plan that you write in advance before the stressful situation emerges to define exactly what you will do and how you will do it before that situation ever arises.

What Does A Good Trading Plan Cover?

A good trading plan covers eight different areas:

- Your context. It’s all about you, your situation, and how you manage your trading day today.

- Your financial resources. Including how much money you allocate to your trading portfolio. When you take, add more money, when you’ll take money out, what are the triggers to move money in and out of your account.

- Your trading system. What are the rules that you’re following by writing them down? You’ve got a record of it so you don’t have to decide on how you’re making your decisions day today. Instead, you follow the rules that you’re written. Regardless of whether your account is going up or down, you know exactly what to do.

- Your risk management rules. How are you going to manage your risk on each trade? How much exposure you’re going to take on each trade? How much exposure you’ll take into your account? How are you going to manage all aspects of risk in your portfolio? By defining that in advance, you’ll know that you’ve made good risk management decisions because you haven’t made them in the heat of the moment.

- Your cash flow management. It’s about adding and withdrawing money from your trading account. By defining this in advance, you’re not going to find yourself in a situation where you’re making money and all of a sudden. Instead, you decide you’re going to double the size of your trading account just before a massive drawdown. You need a preformed plan that defines exactly when you’ll add or remove money from your trading account

- Your extreme event management. How will you manage extreme situations in the market? Market crashes, electrical failures, financial shocks, and also extreme events in your own life. Sickness, death of a loved one, major family events, major personal events, hospital surgeries, car accidents, anything like that that has a significant impact on your life also has a major impact on your trading. Your trading plan should cover that so that you don’t have to make those big decisions in the heat of the moment.

- Your trading infrastructure. What computer are you using? What’s your backup computer going to be? Where do you get your data from? Do you have a backup data source? Have you backed up all your trading files and formulas? So if something happens, you don’t lose everything. Your trading plan should cover all aspects of your trading infrastructure like this.

- Your self-management, psychology, health and fitness, and ability to trade. When will you trade, and when won’t you? Are there any conditions that will cause you to stop trading? For example, to exit all your positions and go to cache. Your trading plan needs to cover all of these things so that you don’t have to make any of these decisions in the heat of the moment.

By having a complete written trading plan that covers all of these eight areas, you will never make an emotional decision in the market because you’ve pre-made all the major decisions that you need to be successful. That’s why a written trading plan is so important.

What is the quickest and easiest way for you to learn exactly what it takes to make money consistently in the stock market?

If you’re a beginner looking to get started fast, the best way is to learn one or two simple, proven and profitable stock trading systems. Then, learn how and why they work and apply them to the market in your account. That’s exactly what just ONE of the multitude of online courses inside The Trader Success System membership will do for you. Our membership enables you to go on your successful trading journey at your own pace supported by live sessions and a great community of profitable traders on the same journey as you.

If you are a new trader (or even an established trader) looking to get started in systematic trading to start making the money you’ve always dreamed about making in the stock market, then click the link to find out more about The Trader Success System.

If you are an advanced trader then you are probably looking for an advanced stock trading course with a diverse portfolio of stock trading systems covering your local and international markets so you can diversify even better, improve your skills in backtesting and trading system optimization and build a portfolio of profitable stock trading systems fast!

If that sounds like you then the best stock trading course for you can also be found inside the Trader Success System, which contains Enlightened Stock Trading’s advanced share trading course, which teaches you everything you need to know to be a successful systematic stock trader and run a diversified portfolio of stock trading systems so that you can succeed in the market for decades to come. So if that sounds like what you need, click the link to find out more about the Trader Success System. I look forward to helping you achieve your trading goals.

Share This

Share this post with your friends!