The stock market is a dynamic and constantly changing landscape, subject to a variety of influences that can quickly send waves of change through its financial waters. Amidst this complexity, a powerful yet often overlooked phenomenon emerges year after year: monthly stock market seasonality trends.

Stock seasonality is the understanding that the market does not operate evenly throughout the year; instead, it dances to the rhythm of the calendar, with certain months exhibiting recurring patterns and trends. In this article, we embark on a journey to explore the fascinating world of seasonal trends in the US stock market.

Seasonality in the stock markets resembles the changing seasons in nature; it is a pattern that repeats year after year or month after month in the case of the Ultimo Effect or weekly in the case of the Turnaround Tuesday effect. Seasonal patterns offer savvy investors and traders the opportunity to benefit from predictable edges. These patterns are formed by a complex interplay of factors, including historical returns, economic events, and human behavior, shaping market movement patterns during certain months. By deciphering these seasonal trends, we can gain a deeper understanding of when the stock market historically shines brightest and when it tends to stumble.

Our journey begins by delving into stock market history and examining historical return data that serves as our roadmap. As we navigate through the months and years, we will see how certain periods consistently stand out as under and over performers which might form the basis for a real and tradeable edge. Along the way, we will cover the significance of monthly trends in the stock markets and the profound impact of seasonality on trading decisions, providing a comprehensive overview of how the market’s heartbeat varies from month to month.

Strap in as we embark on this journey to explore the complex dance of the stock market throughout the year.

Understanding Stock Market Seasonality

Much like the changing seasons in nature, the stock market follows its own rhythm, characterized by distinct patterns and trends that repeat throughout the year. This phenomenon, often referred to as the ‘seasonality of the stock market,’ provides profound insights into the ebb and flow of market behavior in the rhythm of the calendar.

Essentially, the seasonality of the stock market is the realization that not all months behave equally in terms of performance. Some months historically deliver remarkable returns, while others may be marked by turbulence or periods of stagnation. Understanding these dynamics provides an advantage to traders that can improve our probability of success.

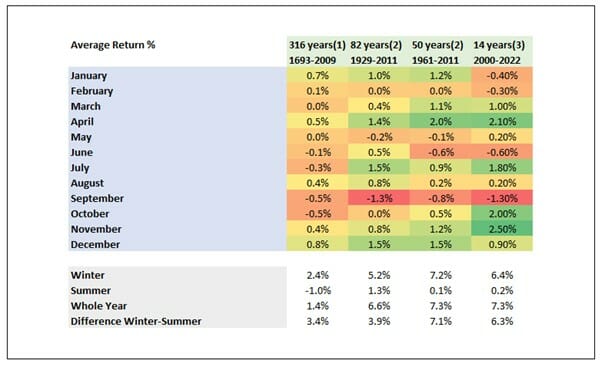

Monthly historical return analysis. Source: (1) Jacobsen‘s Global Financial Data Index, (2) Dow Jones Industrial Average, (3) ishares Dow Jones Industrial Average

We are fortunate that extensive research has already been conducted in this area. The study ‘The Halloween Indicator: Everywhere and all the time,’ authored by researchers Jacobsen and Zhang, provides a historical data analysis that guides us through the market labyrinth, helping us recognize when it is historically strong and when it tends to stumble.

The data in the illustration above demonstrate a remarkable consistency in the difference between seasons in the US Stock Market going back over 300 years! In fact historical analysis has demonstrated that it is possible to achieve the same returns as the market while only being invested during the winter months.

Who wouldn’t want to achieve almost the same return in only half the investment time?

By being invested only in the winter months from October to April, we can achieve a similar annual return as Buy & Hold in only half the time. In other words, the winter months are seasonally very strong for the US Stock Market. Our analysis of historical data clearly shows positive trends for April, July, as well as October and November. These months have consistently proven to be strong performers, characterized by robust gains and optimism. In contrast, September and June have been marked by volatility, stagnation, or even losses. By analyzing these historical returns, individual investors can potentially adjust their strategies to capitalize on favorable periods while exercising caution during challenging times.

In the realm of market wisdom, a saying has stood the test of generations:

Sell in May and go away, but remember to come back after September.

This venerable strategy fascinates financial portals and traders every year. Because it seems to be a straightforward guide to navigating the market seasons based on the analysis above.

Historical Seasonal Stock Patterns guide the way to success

Lets analyse the performance of the market in recent years to see how effective these monthly seasonal patterns have been in the stock market using the SPY (S&P 500 Index ETF) and the QQQ (Nasdaq 100 Index ETF).

Backtesting the simple strategy of being long US stocks only during the winter months (October – April), we see stronger performance than buy and hold with less risk measured by drawdown

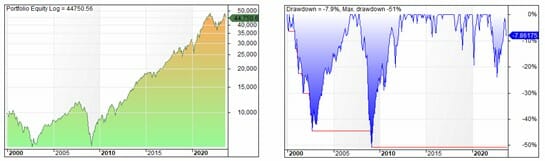

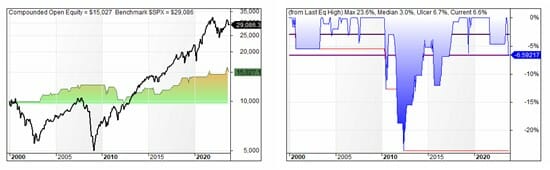

Figure 1: ETF SPY (S&P500) Performance from October to April

- Annual Return: 6.40%

- Exposure: 56.07%

- Risk Adjusted Return: 11.49%

- Max Drawdown: -41.90%

- CAR/MDD: 0.15

- Average Profit Per Trade: 7.30%

Applying this same simple seasonality concept to the Nasdaq stocks we don’t quite match the market index in terms of return, however the risk as measured by drawdown is substantially lower than a buy and hold approach.

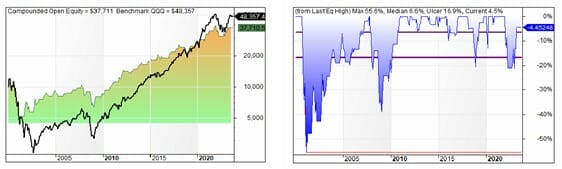

Figure 2: ETF QQQ (NASDAQ100) Performance from October to April

- Annual Return: 5,77%

- Exposure: 56.13%

- Risk Adjusted Return: 10.29%

- Max Drawdown: -55.50%

- CAR/MDD: 0.10

- Average Profit Per Trade: 7.51%

“Sell in May and go away” – the core of this strategy lies in the repeatability of historical market seasonal trends. May has often marked a turning point in the stock market, heralding the onset of a phase of increased volatility and uncertainty. Accordingly, according to this strategy, investors sell their stock holdings in May and stay away from the market, only to return after September. The idea is to avoid historically weaker months in the summer. Because capital protection should be the cornerstone of any investment strategy.

But how bad are the markets during the summer months really?

Let’s reverse our simple sell in May and go away strategy and see how holding during the summer months from May to September perform.

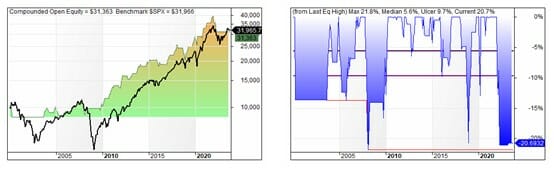

Figure 3: ETF SPY (S&P500) Performance from May to September

- Annual Return: 0.04%

- Exposure: 42.07%

- Risk Adjusted Return: 0.11%

- Max Drawdown: -39.22%

- CAR/MDD: 0.00

- Average Profit Per Trade: 0.66%

As you can see from the figure above, holding only during the summer months in the S&P 500 is a recipe for underperformance and extreme disappointment! Over the last 23 years holding the SPY only during the summer months has barely broken even.

The backtest results of holding the QQQ during the summer months is equally disappointing , drastically underperforming the benchmark and suffering drawdown of over 60%.

Figure 4: ETF QQQ (NADAQ100) Performance from May to September

- Annual Return: 0.56%

- Exposure: 42.37%

- Risk Adjusted Return: 1.32%

- Max Drawdown: -64.21%

- CAR/MDD: 0.01

- Average Profit Per Trade: 1.97%

A picture is worth a thousand words. This also applies to the capital curves of the ETFs SPY and QQQ. Not only is the overall return from our Sell in May and go away (but come back in September) strategy superior, but the interim losses experienced in the past, known as maximum drawdowns, are also lower. Our analysis confirms the importance of the months from October to April, which historically have often been the strongest months in the stock market. These months have seen remarkable market rallies, higher returns, and lower drawdowns.

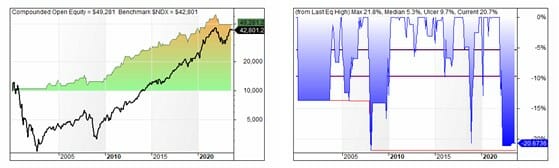

Stockmarket Seasonality clearly beats Buy & Hold

It is worth comparing the above return risk statistics with a Buy & Hold strategy, not only the headline return and drawdown data, but also the equity charts.

Figure 5: ETF SPY (S&P500) Performance Buy & Hold

- Annual Return: 6.51%

- Exposure: 100%

- Risk-Adjusted Return: 6.51%

- Max Drawdown: -50.64%

- CAR/MDD: 0.13

Figure 6: ETF QQQ (NASDAQ100) Performance Buy & Hold

- Annual Return: 6.57%

- Exposure: 100%

- Risk Adjusted Return: 6.57%

- Max Drawdown: -81.09%

- CAR/MDD: 0.08

Our analysis is clear. A simple investment strategy based on the winter seasonality beats Buy & Hold. With an annual return of 6.40% and a max drawdown of -41.90%, this simple strategy achieves a higher risk return adjusted profile with substantially less time in the market. Remember that this analysis did not consider money market rates on cash holdings.

For the NASDAQ100 the data gives us the same conslusion. The winter seasonality strategy beats Buy & Hold. In our analysis we find another interesting fact. Even though, the NASDAQ100 is regarded as a more promising investment, the annual return for the SP500 is the same as for the NASDSAQ100 since 2000. So be aware.

Always do you own analysis and don’t fall for the hype without checking the analysis for yourself!

The simple winter strategy is susceptible to Black Swan events

Despite their out performance, drawdowns during the winter months can still be painfully high. On the positive side, incurred losses have always been recovered in a reasonable time. This does not hold true for the summer months, where losses of -30% and more persist over two decades.

These winter drawdowns would still be emotionally difficult to endure, and premature selling is almost inevitable to all but those with the strongest trading psychology. Understanding these risk factors and historical trends is crucial for risk management. Blindly following the mantra “Sell in May” will inevitably lead to a painful surprise.

The dot.com bubble burst and the financial crisis are two typical examples of unexpected risk factors which can impact a overly simple seasonality based trading strategy such as ‘sell in May and go away’. Both events could not be more different in their nature, yet their impacts on global stock markets were similarly catastrophic and resulted in a large drawdown for our simple strategy.

Therefore, a mature approach is advisable.

Seasonality Strategy Model I: Introducing a simple regime filter

To effectively implement seasonal trading strategies, it is important to have a deep understanding of seasonal patterns as we have seen above. Equally crucial is a deep understanding of how to reduce potential losses. To navigate the complex financial world reliably and consistently over time, we need robust simple solutions.

The simplest and most powerful technical trading rule of all is the simple moving average of price from the past X months. When price is above the moving average a positive trend tends to continue upward and vice versa. This phenomenon is called momentum – a market anomaly extensively covered in scientific studies. As a rule of thumb, a calculation period of 9 to 12 months leads to a strong risk-return ratio. In our further analysis we select 12 months as for this calculation period the momentum effect is most robust (other values may be backtested and optimized to further finetune the results).

The results below demonstrate the performance from holding the SPY ETF long only during the winter months provided the S&P 500 is above the 12 month simple moving average.

Figure 7: ETF SPY (S&P500) Performance Winter & 12 month Moving Average

- Annual Return: 4.80%

- Exposure: 41.29%

- Risk Adjusted Return: 11.63%

- Max Drawdown: -19.38%

- CAR/MDD: 0.25

- Average Profit Per Trade: 7.23%

As you can see, the compound annual return has dropped substantially (now 4.8%), however more interesting is that the exposure time has dropped to just 41.29% and the Risk Adjusted Return has increased to 11.63%pa. The addition of the moving average filter also reduced drawdown dramatically to just 19.38%.

So while this strategy no longer beats buy and hold returns, the risk adjusted return is substantially improved. The same performance enhancement is evident when this new strategy is applied to the QQQ as well (see below).

Figure 8: ETF QQQ (NASDAQ100) Performance Winter & 12 month Moving Average

- Annual Return: 5.39%

- Exposure: 36.51%

- Risk Adjusted Return: 14.75%

- Max Drawdown: -21.84%

- CAR/MDD: 0.25

- Average Profit Per Trade: 9.11%

For completeness we should also check the impact of our simple 12 month moving average filter during the summer months:

Figure 9: ETF SPY (S&P500) Performance from May to September & 12 month Moving Average

- Annual Return: 1.73%

- Exposure: 31.88%

- Risk Adjusted Return: 5.42%

- Max Drawdown: -23.58%

- CAR/MDD: 0.07

- Average Profit Per Trade: 2.50%

Figure 10: ETF QQQ (NASDAQ100) Performance from May to September& 12 month Moving Average

- Annual Return: 3.94%

- Exposure: 30.16%

- Risk Adjusted Return: 13.07%

- Max Drawdown: -17.40%

- CAR/MDD: 0.23

- Average Profit Per Trade: 6.03%

Clearly, we can see that such a simple regime filter improves the risk return profile not only for the winter seasonality, but also for the summer months. Fairly remarkable is the percentage rate of winning trades for the winter seasonality strategy combined with the regime filter. With a rate of 75% of winning trades, the strategy demonstrates some very robust characteristics.

Seasonal trading is a niche within long-term investing. Hence, we need entry points that align with the character of long-term investing. Our simple approach meets these requirements. To summarize the rules of this model: In the period from October to April, a long position is opened when the index is above its 12-month average. This procedure is reviewed monthly. If the index falls below its moving average, the position is sold at the end of the month.

Seasonality Strategy Model II: Taking advantage of past behavior in risky environments

Reducing losses is easier than you think. Another approach to implementing proper risk management is to capitalize on historical drawdown patterns. From a psychological perspective, it makes sense that investors become increasingly irrational after a certain loss. This results in higher uncertainty, which in turn increases the likelihood of larger losses. We can use this recurring behavior to our advantage. In our analysis, we consider a loss of -15% from the peak of the last 12 months. Once this condition is met, we sell our position at the end of the month during the winter months. The process is done on a monthly basis. We also included the results for the summer months.

Figure 11: ETF SPY (S&P500) Performance Winter & -15% Drawdown from its 12 months Highest High

- Annual Return: 5.17%

- Exposure: 43.72%

- Risk Adjusted Return: 11.83%

- Max Drawdown: -19.39%

- CAR/MDD: 0.27

- Average Profit Per Trade: 7.32%

This strategy provides a slight enhancement to the return profile from our earlier strategy of buying during winter months when the index is above the 12 month moving average.

Figure 12: ETF QQQ (NASDAQ100) Performance Winter & -15% Drawdown from its 12 months Highest High

- Annual Return: 6.70%

- Exposure: 43.79%

- Risk Adjusted Return: 15.29%

- Max Drawdown: -21.82%

- CAR/MDD: 0.31

- Average Profit Per Trade: 9.42%

Again, simple risk management tool can improve the risk return profile of the winter seasonality strategy. Whereas the regime filter approach also enhances the summer months, the current managing risk tool shows ambiguous results for the summer months. Overall, we can say, that both approaches improve the simple seasonality strategy.

Seasonality incorporating risk management is the key

In this comprehensive exploration of stock market seasonality and trading strategies, we’ve uncovered a wealth of insights to empower investors and traders in their pursuit of success. At the heart of this journey is the recognition that the stock market is not a monolithic entity but follows a rhythm that mirrors the changing seasons. Understanding these seasonal patterns can be a game-changer for anyone seeking to navigate the dynamic world of finance effectively.

If you want a shorter term seasonality based trading system that can generate profitable trades weekly, check out our Turnaround Tuesday article here to discover how you can find profitable trades on an almost weekly basis!

Share This

Share this post with your friends!