Below is the list of contents for this Beginners Guide to Bitcoin. You can click to each section or just read the whole article. If you have any questions after reading please leave us a comment at the bottom and we will respond to you and help you out.

Bitcoin what is it?

Bitcoin is a digital or virtual digital currency, which is decentralised, without a central bank or single administrator, that can be sent from user-to-user on the peer-to-peer bitcoin network without the need for intermediaries. Bitcoin was created by the presumed pseudonymous person or persons, Satoshi Nakamoto, who authored the Bitcoin whitepaper and deployed the original implementation in January 2009 as part of the first blockchain database.

How Bitcoin works

Bitcoin is powered by open-sourced/open-protocol software which has become known as blockchain. This ecosystem is essentially a collection of computers (referred to as “nodes” or “miners”) that all run bitcoin’s code and store its blockchain history. The blockchain can be thought of as a collection of blocks in a distributed ledger with each block containing a collection of transactions. Because all the computers running the blockchain have the same list of blocks and transactions, and can transparently see these new blocks being filled with new bitcoin transactions, no one can cheat the system.

Blockchain nodes are an ecosystem of computers

Transactions and balances of Bitcoin tokens are registered on the blockchain (distributed ledger) using public and private “keys.” These keys are long strings of characters linked through the mathematical encryption algorithm that was used to create them. The public key (similar to a bank account number) serves as the address published to the world and to which others may send Bitcoin.

The private key (similar to a PIN or password) should be kept secret and only used to authorize bitcoin transmissions. Bitcoin keys should not be confused with a Bitcoin wallet, which is a physical or digital device that facilitates the trading of Bitcoin and allows users to track ownership of coins. The term “wallet” is quite misleading, as Bitcoin’s decentralised nature means nothing is ever actually stored “in” a wallet, but rather decentrally on a blockchain where the wallet records the transaction or ownership.

Bitcoin was the first digital currency to use peer-to-peer technology to facilitate instant low cost payments globally. The community who own the governing computing power (nodes) and participate in the Bitcoin network have appropriated the name “miners”, akin to mining for gold due to the perceived similarities between Bitcoin and Gold as “a store of value”. These miners compete to ‘confirm’ the transactions on the blockchain and are motivated by rewards (Bitcoin tokens) and transaction fees paid in Bitcoin.

The monetary theory behind Bitcoin, which was born out of the global financial crisis (GFC) and the lack of reprimand for the centralised agencies, is to operate differently from fiat currency. Bitcoin, as opposed to traditional currency, is released at a rate controlling a fixed inflation therefore, this system is intended to maintain inflation stability.

Bitcoin logo

Bitcoin’s logo has changed a number of times since Satoshi Nakamoto’s first effort in 2009 and has now been touted across social media by famous athletes and entrepreneurs, advertised on buses, engraved on physical coins, and plastered across shop windows the world over. The Bitcoin logo is now displayed as slanted B in a jolly orange circle (hex code #F6911D, Pantone 1495 C) which has become a phenomenon and vital tool in promoting the world’s biggest cryptocurrency.

The second version which was updated by Satoshi in February of 2010 commenced using the letter “B” with two vertical strokes.

The third and current version of the symbol is a more minimalist version which is said to have been created by a Bitcoin Forum user “Bitboy” who took it upon himself to improve the original efforts. To this day his actual identity also remains unknown.

Bitcoin symbol (ticker)

As mentioned above, the first version of the logo represented a gold coin engraved with the letters “BC” however, it is thought that to avoid any connection to the classical meaning of “BC” (Before Christ), the currency symbol code was changed to BTC. The BTC symbol is the most renowned and used symbol for Bitcoin however, XBT is also used by some exchanges, such as Kraken and Bitmex (although I believe Kraken has recently changed). XBT satisfies the International Organisation for Standardization (ISO) in ISO 4217. The standard states if a currency is not associated with a particular country, it should begin with an “X”, hence “XBT”. Another example of this is the abbreviation for gold, “XAU”.

Bitcoin vs Ethereum

Ether (ETH), the cryptocurrency of the ethereum network is considered to be the second most popular, and certainly by market capitalisation it is.

While both are powered by the same principles of distributed ledger technology and cryptography, the two differ technically in many ways:

-

- transactions on the Ethereum network may contain executable code, while data affixed to Bitcoin network transactions are generally only for keeping notes.

- block time (an ether transaction is confirmed in seconds compared to minutes for bitcoin).

- the networks are different with respect to their overall goals, bitcoin was created as an alternative to national currencies and thus aspires to be a medium of exchange and a store of value whereas Ethereum was intended as a platform to facilitate immutable, programmatic contracts, and applications via its own currency.

- Further another point of differentiation is that Etherium is supposed to be moving towards a more environmentally sustainably proke-of-stake system of confirmation opposed to the traditional proof-of-work (this will be topic of another article).

The primary focus for etherium was not to compete with bitcoin as an alternative monetary system, but to facilitate and monetise the operation of the ‘smart contract’ and decentralised application (dapp) platform. Both Bitcoin and Etherium have very large followings of supporters purporting that their token is the most revolutionary and therefore, should be the highest priced.

Bitcoin and Etherium are the two most popular crypto protocols

Bitcoin News

Bitcoin usually hits the news headlines for all the wrong reasons and generally is always “after the fact”. Relying on the news to make financial decisions is not recommended. Media outlets are self-serving, seeking only one thing and that is income, which comes from advertising. Therefore, news proprietors are more concerned about “click-bait” or “fear-mongering” articles over reporting truth and fact, not that that has perhaps changed much over time. A few, somewhat reputable websites for all news cryptocurrency are as follows:

Bitcoin Twitter

Bitcoin remains one of the most highly searched and “#tagged” keywords on Twitter or other social media platforms.

Thousands of self-proclaimed experts, overnight guru’s and even professionals take to social media displaying the full range of human emotions including “fear and greed”, FOMO (fear of missing out), extreme passion to outright disdain and everything in between.

Our advice is to ignore most if not all social media activity as it’s usually driven by people with very little idea how to invest or trade sensibly or lure you into paid ‘signals services’. The Trader Success System circumvents both of these issues by leaving emotion on the sidelines while providing a method for developing, backtesting, verifying a positive expectancy system, therefore mitigating the need to seek out others for trading advice, you get to be the professional trader yourself with as little as 15 minutes a day!

Bitcoin whitepaper

The bitcoin white paper is held on the official bitcoin.org website, started by Satoshi Nakamoto and Martti Malmi which is now run as an independent open-sourced project with co-contributors from around the globe, although final authority still remains with a core of co-owners.

Where to buy Bitcoin

Bitcoin is purchased on a cryptocurrency exchange which is a trusted third party that facilitates the purchase or exchange of cryptocurrencies.

Bitcoin exchange

Coinspot is the premier Bitcoin exchange in Australia however, there are others such as BTC Markets, Swyftx and the most liquid exchange worldwide, Binance, has an Australian subsidiary. Importantly, just because Coinspot is commonly used in Australia DOES NOT make it a good exchange for cryptocurrency traders.

Cryptocurrency traders should investigate the trading fees and liquidity (depth of market and spreads) available on each exchange and choose the lowest cost, highest liquidity exchange for trading, provided of course that all security and regulatory requirements are met by the exchange. These requirements are explored in the Crypto Success System.

Other popular global exchanges are Coinbase, Huobi, FTX, KuCoin, Kraken and Bitfinex. You can find a full list of exchanges ordered by daily volume at www.coinmarketcap.com/rankings/exchanges

Bitcoin ATM

Bitcoin ATM’s started popping up in early 2018 under the distribution of Auscoin token and it’s founder Sam Karagiozis, the Auscoin token ICO failed and Karagiozis failed to achieve the target of 1200 ATM’s across the country. Karagiozis’ was arrested in early 2019 with a number of serious allegations.

Nowadays, there are approximately 35 Bitcoin ATM’s across Australia which are concentrated in Melbourne and Sydney. These ATM’s are operated by a company called Cryptolink and it is not known if any of their machines originated as Auscoin machines.

We would consider Bitcoin ATMs to be largely a gimmick because the costs and spreads are typically high compared to trading on highly liquid exchanges and there is really no need to use an ATM given the accessibility of Bitcoin through mobile apps and desktop PC’s.

Bitcoin Trading and Investing

Introduction to Bitcoin Trading

Bitcoin trading is becoming increasingly popular from the professional institutional trader, right down to the overnight youtube expert and everyone in between. Its popularity has arisen because of its ease of access, low cost of entry (low fees) combined with a very volatile nature driving the extremes of human emotions, which can be very profitable for the systematic trader.

Bitcoin Investing is essentially trading over a much longer time frame, with a forward thinking perspective based on some form or technical or fundamental analysis.

Bitcoin technical analysis can be used as a method for determining both trading and investment decisions. Technical analysis involves using price action, price patterns or indicators derived from price and/or volume to arrive at probabilistic conclusions.

Technical analysis efficacy is largely debated however, what is clear is that there are hundreds of so-called technical analysis experts selling ‘signals’ and creating countless youtube videos within the crypto currency space.

We would caution paying attention to any of these ‘chart-artists’ without verifying their historical results in great depth. Given the unregulated nature of the market there are thousands of FURU’s (fake gurus) and so-called “educators” taking advantage of trusting market participants.

The most effective method of trading and investing in Bitcoin and other cryptocurrencies is by using a backtested trading system such as those taught in The Crypto Success System.

Traders that have stood the test of time, Ed Seykoto, Jerry Parker, Larry Hyte etc have done so because they have systematically approached the markets, they are not looking to hit a home run each and every trade, but aiming for long term consistent profitability combined with a psychology of ‘staying in the game” which is what is taught in The Crypto Success System.

Many new traders start with the wrong mind-set, they ask the wrong questions, like “how quickly can I trade for a living”, rather than “what steps do I need to take to be successful at trading”. Beginning traders tend to gravitate to the shiny items and flashing lights, the chart patterns, the slick 1000% overnight profit trading course and the (fake) guru technical analysts on youtube, who really have no idea how to be successful at the markets but are entertaining. The Trader Success System avoids traders to avoid this beginners cycle taking traders step-by-step on how to apply professional level trading methodology and mindset, providing what you need to know, not what sells books.

Bitcoin ETF

A bitcoin ETF or (Exchange Traded Fund) is an investment vehicle that tracks the performance of the underlying asset, that is, Bitcoin. EFT’s typically allow investors to diversify their investments without actually owning the asset themselves. This removes the complex storage and security issues facing many cryptocurrency investors which is seen as a potential deterrence for large institutional investors. While the list of funds attempting to seek SEC approval is increasing every week, currently there are no Bitcoin ETF’s approved. The infamous Winklevoss twin, who are olympic rowers, social media entrepreneurs and founders of the Gemini exchange have had a number of Bitcoin ETF’s rejected by the Securities and Exchange Commission.

Bitcoin Price

How much is bitcoin worth? The current Bitcoin price is:

Bitcoin pricing does slightly vary from exchange to exchange. You can obtain the price of Bitcoin by many ways:

- Searching Google for the current Bitcoin price

- Looking Bitcoin price on Yahoo Finance

- Using TradingView charts to see free and live pricing from many exchanges.

- Visiting the CoinMarketCap) website at www.coinmarketcap.com

Bitcoins highest recorded price to date is approximately $65,100USD which was achieved on the 14th April 2021.

Bitcoin TradingView Charts

Bitcoin live and historical pricing information can be found using TradingView (tradingview.com), which is a premier charting and analysis platform that extends into a social network where traders can share ideas and talk amongst each other. Whilst we don’t necessarily advocate the social side of TradingView, the expansive list of cryptocurrency assets for which it produces data is second to none, at least at this point in time, and it is essentially free (with ads and some limitations). There are also relatively low cost higher level subscriptions which are not required for the Crypto Success System. We draw the historical price data from TradingView for all available tokens on the higher liquidity exchanges which we trade seemlessly for all our historical backtesting purposes.

Bitcoins highest recorded price to date is approximately $65,100USD which was achieved on the 14th April 2021.

Bitcoin in USD

LIke any financial instrument, the price of a bitcoin is determined by supply and demand. Another contributing factor is that there will only ever be a limited number of bitcoins in circulation. New bitcoins are created at a predictable and decreasing rate keeping the level of inflation stable. However, since Bitcoin is in its infancy with a small market compared to many other asset classes, it doesn’t take significant amounts of money to move the market price which causes its high volatility.

-

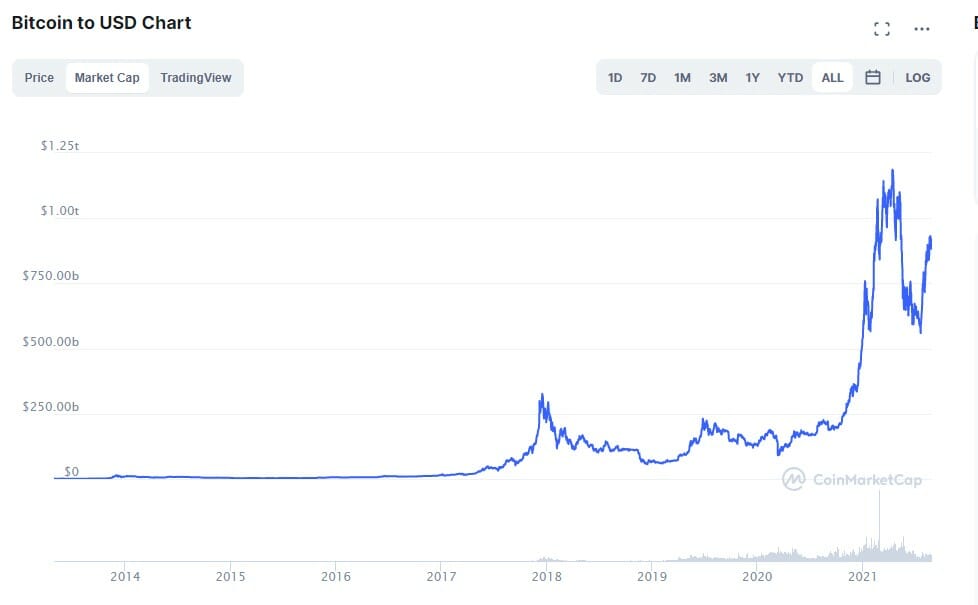

Bitcoin Market Capitalization

At the time of writing, the market capitalisation of Bitcoin is approximately $910 trillion dollars however, the market capitalisation has historically had very wild swings.

Bitcoin FAQ

Is Bitcoin a good investment?

Historically Bitcoin has proven to be a very solid investment, providing high returns to long term investors. However Bitcoin is extremely volatile and peak to trough drawdowns of over 80% are common. This makes Bitcoin extremely challenging as a long term buy and hold investment.

The strong trends do however make Bitcoin a perfect trading instrument for the systematic cryptocurrency trader. At Enlightened Stock Trading we have developed the Crypto Success System which teaches traders how to profit systematically from Cryptocurrency markets like Bitcoin. Trading systems are a highly effective way to invest in bitcoin because they enable you to capture the large trends without sitting through long periods of drawdown and volatility.

Is Bitcoin safe?

The underlying distributed ledger (blockchain) technology behind Bitcoin is inherently safe, the risk usually comes from human interactions, a list of potential safety concerns is listed below:

- Money transferred to a wrong public address than that intended, which results in loss of funds.

- Nefarious character scamming you or determining your private keys.

- Exchange hacks

- Trading losses due to improper or uneducated trading actions.

We cover these in The Crypto Success System.

Is Bitcoin legal in Australia?

Bitcoin is not considered legal tender in Australia however, nor is it illegal or outlawed to own or trade. The Australia Tax Office (ATO) considers the cryptocurrency as an asset and similarly to that of shares any profits made from the investment or trading of Bitcoin is taxable. El SAlvador has recently become the first country in the world to officially class Bitcoin as legal currency.

Will bitcoin rise?

The future of any financial instrument is always uncertain. However, Bitcoin has, over the longer term, maintained a steadily increasing price trajectory albeit a quite volatile one with up to 80% pullbacks. The future price of Bitcoin is will be dependent on many variables, some of which include; usability, adoption (in terms of usability and store of value), regulation and tax effects, competition, its safety and reputation.

Is Bitcoin mining profitable?

In essence, you can still make money mining Bitcoin however, for the average home miner you are very unlikely to recoup the cost of the mining hardware and electricity. Bitcoin mining began as a well-paid exercise in the early stages of Bitcoin existence, if in particular you didn’t sell the Bitcoin till much much later. Earning 50BTC every 10 minutes or so as a block reward in today’s context would be amazing but that is simply no longer the case. In 2020 the third halving occurred which reduced the block reward to 6.25 bitcoins which in today’s price terms is still a lot of money. The issue becomes the fierce and institutional-grade competition, with massive amounts of computing power and very low electricity costs all fighting to solve the algorithmic problem to confirm each block for the block rewards.

High hashrate mining rigs are very expensive

Can you still mine Bitcoins?

Miners are rewarded with 6.25 bitcoins. This number will reduce to 3.125 bitcoins after the next halving in 2024. The reward (plus transaction fees) are paid to the miner who solved the puzzle first. This process repeats approximately every 10 minutes for every mining machine on the network. The difficulty of the puzzle (Network Difficulty) adjusts every 2016 blocks (~14 days) to ensure that on average one machine will solve the puzzle in a 10 minute period. Network difficulty is calculated by the amount of hashrate contributing to the Bitcoin network. So yes, while you can still mine Bitcoin it is far from being cost efficient for the retail miners which is a result of the built-in fixed inflationary protocols in the code.

How much is Bitcoin worth?

At the time of writing, the value of one Bitcoin is show in the quote below:

, and its price can be found by various resources –

https://au.finance.yahoo.com/quote/BTC-USD/

When was Bitcoin created?

Bitcoin was created in 2009 on the back of the global financial crisis (GFC). Bitcoin was created to be a decentralised digital peer-to-peer cash system, but has also attracted crypto-curious investors as a store-of-value currency, comparable to gold. As mentioned, the concept of Bitcoin was published in a white paper written by an anonymous person(s) under the pseudonym Satoshi Nakamoto in 2008. To this day, no one knows the author’s true identity or if it is even a single person, rather than a group of people, which has invoked many conspiracies. Bitcoin officially launched on Jan. 3, 2009.

How many Bitcoin have been mined / How many bitcoin are there?

At the time of writing, there have been approximately 18.8 million Bitcoins mined with a new block reward being released every 10 minutes. The release of Bitcoins has been stipulated in its source code, this stipulation is that it must have a finite supply. Therefore, there will only ever be 21 million bitcoins ever mined and the number of bitcoins released in each of the confirmation blocks is reduced by 50% every four years, termed the Halving. An updated release number of bitcoins can be found at https://www.buybitcoinworldwide.com/how-many-bitcoins-are-there/

Is Bitcoin Dead?

No Bitcoin is not dead, and nor can it be shut down by any government or agency due to its open-sourced and decentralised nature.

The over-exuberance of human emotion, combined with fully globalised social networks, allows investors and traders to excerpt their excessive highs and lows of market behaviour to wider audiences.

The calls of ‘Bitcoin is Dead’ have resonated in the halls of social networks for many years and that will never change due to the fear and greed of market participants. The term FUD has been appropriated to such behaviour, standing for Fear, Uncertainty, and Doubt.

A word of warning though, on the flip side there are many thousands of cryptocurrencies, many of which will not survive, and therefore their future price behaviour can never be predicted.

Can I buy Bitcoin with Credit Card?

Yes, you can most certainly buy bitcoin with a credit card though it is not what we would recommend.

Firstly, it’s never a good idea to invest or trade with money you can’t afford to lose and if you are making investments with your credit card one would certainly hope you have pre-loaded capital onto the card.

The on-ramp for purchasing Bitcoin has certainly become much more streamlined nowadays and with that, you don’t really need to use a credit card.

Fees to purchase Bitcoin from Fiat are also reducing as exchanges are now using wire transfers and on-ramps such as HiveEx and PayID.

What is Bitcoin Mining?

Bitcoin mining is the process by which bitcoin is released into circulation. Generally, mining requires solving computationally difficult puzzles to confirm a new block, which is added to the blockchain.

Bitcoin mining adds and verifies transaction records across the network. Miners are rewarded with some bitcoin; the reward is halved every 210,000 blocks. The block reward was 50 new bitcoins in 2009. On May 11th, 2020, the third halving occurred, bringing the reward for each block discovery down to 6.25 bitcoins.

These miners can be thought of as the decentralised authority enforcing the credibility of the bitcoin network. New bitcoin is released to the miners at a fixed, but periodically declining rate. There is only 21 million bitcoin that can be mined in total. As of June 2021, there are over 18 million bitcoin in existence and less than 3 million bitcoin left to be mined.

Your next Step with Bitcoin Trading and Investing

Now that you have all the background you need, if you want to learn how to make exceptional returns trading Bitcoin and other Cryptocurrencies systematically, your next step is to check out The Crypto Success System.

The Crypto Success System is our online crypto trading course which shows you everything you need to know from start to finish so that you can trade bitcoin and cryptocurrencies profitably and consistently using proven trading systems… all in just 20 minutes a day!

Click the button below to learn more about The Crypto Success System now!

Share This

Share this post with your friends!