NinjaTrader VS Beyond Charts Comparing Backtesting Software for Systematic Trading

If you’re focused on systematic trading, data-driven strategy development, and robust backtesting across multiple markets, NinjaTrader stands out due to its more powerful scripting language, brokerage integration, and broader market access. Beyond Charts can be useful for chart-based discretionary traders, but it lacks the flexibility, performance, and automation that serious systematic traders need.

Now let’s break down why that’s the case.

NinjaTrader VS Beyond Charts at a Glance

Short on time? Here’s how NinjaTrader VS Beyond Charts compare side by side.

|

Feature |

NinjaTrader |

Beyond Charts |

|

Operating System |

Windows only (desktop), limited web/mobile |

Windows only |

|

Cost |

Free base; lease or buy for advanced features |

Paid license (~AUD $595 incl. GST) |

|

Programming Language |

NinjaScript (C#/.NET) |

BCFL (custom formula language) |

|

Drag-and-Drop System Builder |

No |

No |

|

Brokerage Integration |

Yes (futures & FX) |

No |

|

Market Support |

Stocks, Futures, FX, Crypto (via brokers) |

Stocks only (ASX, USA, JSE) |

|

Portfolio-Level Backtesting |

Limited |

No |

|

Charting & Technical Analysis |

Strong |

Moderate |

|

Strategy Automation |

Yes |

Limited / manual execution |

Platform Overview, Cost & Compatibility

NinjaTrader is a mature platform established in 2003. It offers a free entry-level version with essential charting and backtesting tools. Advanced features require a lease or lifetime license. NinjaTrader runs on Windows only, but Mac users can run it through virtualisation software like Parallels or Bootcamp (Wine is not recommended).

Beyond Charts, in contrast, offers a 21-day free trial followed by a one-time purchase model (~AUD $595 incl. GST). It’s Windows-only, with no official Mac support other than workarounds like emulators.

If you’re price-sensitive and want flexibility, NinjaTrader gives you a path to start for free and scale up later. Beyond Charts is more of a “buy once and dive in” model.

NinjaTrader Main View:

Beyond Charts Main View:

Market Access & Data Support in NinjaTrader VS Beyond Charts

NinjaTrader supports:

- Futures, Forex, Stocks, Crypto (via third-party brokers like Interactive Brokers, FXCM, Coinbase)

- Real-time and historical data (NinjaTrader Brokerage + external feeds)

- Custom data handling through NinjaScript

Beyond Charts is more limited:

- Stocks only (ASX, US, JSE)

- No futures or crypto access

- No broker integration or automated data download unless set up manually

For systematic traders aiming for diversified multi-market strategies, NinjaTrader has a clear edge here .

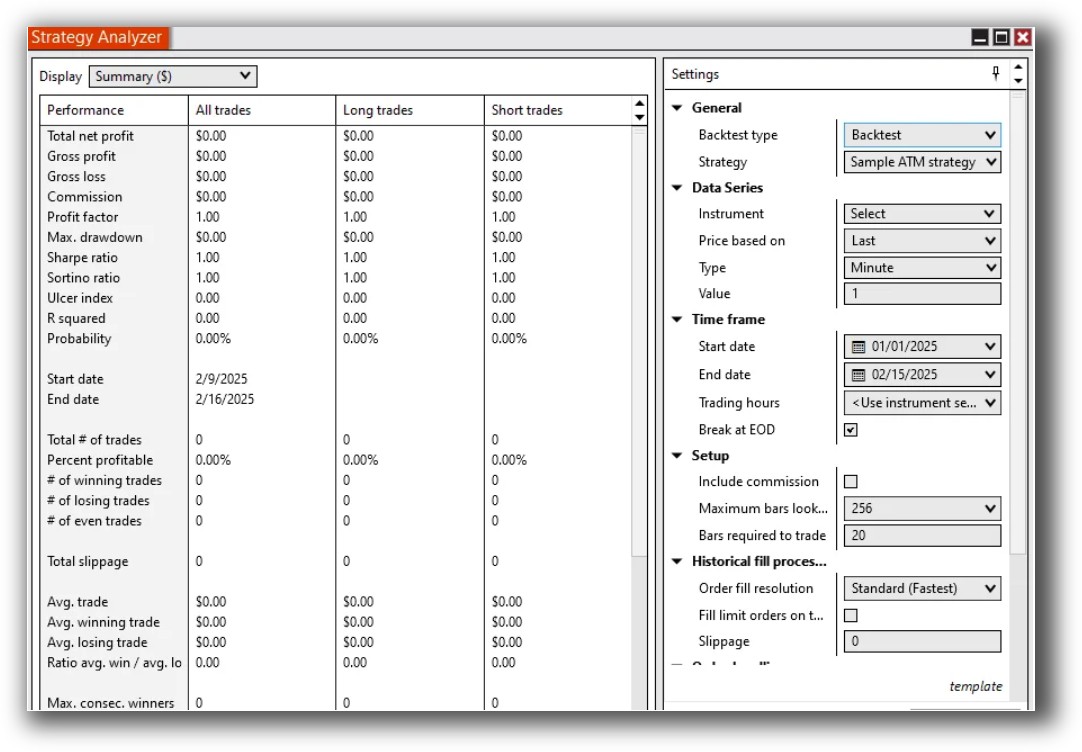

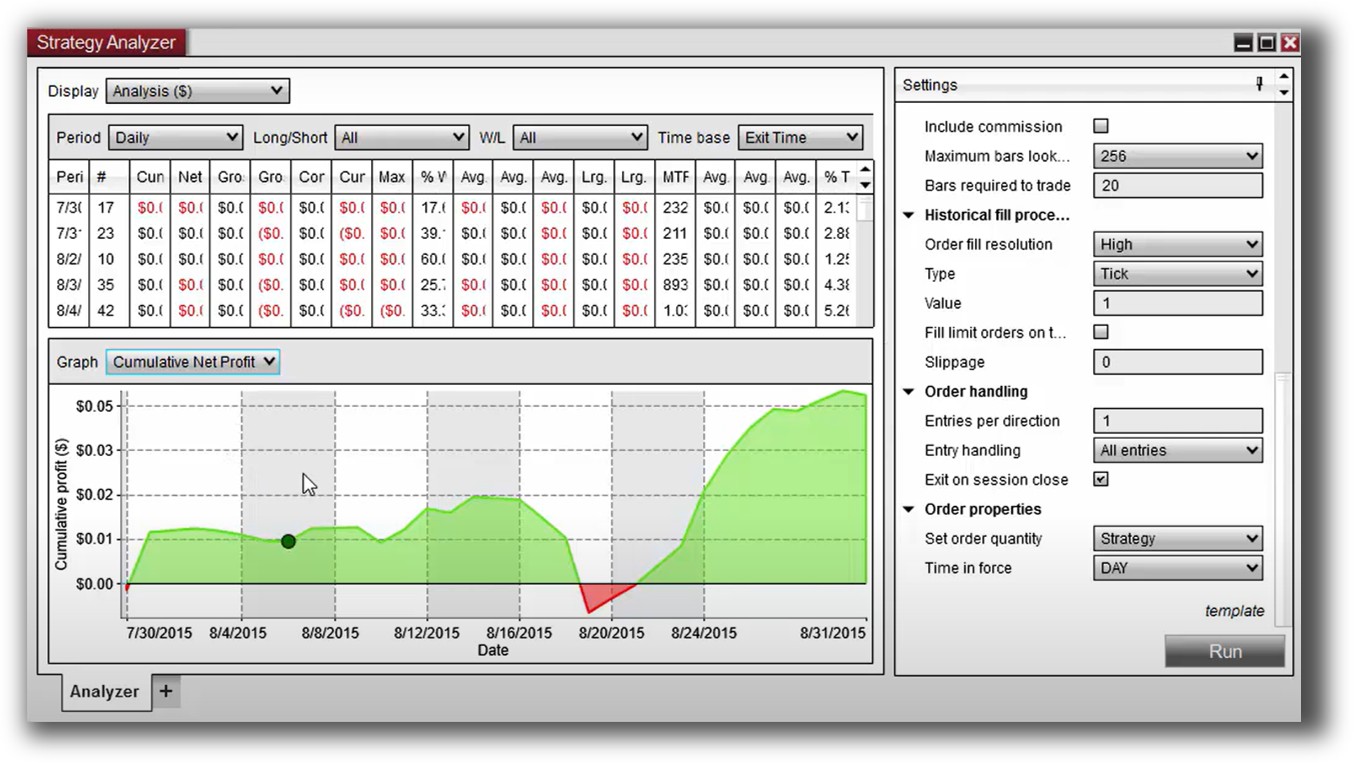

NinjaTrader Backtesting Interface:

Beyond Charts Backtesting Interface:

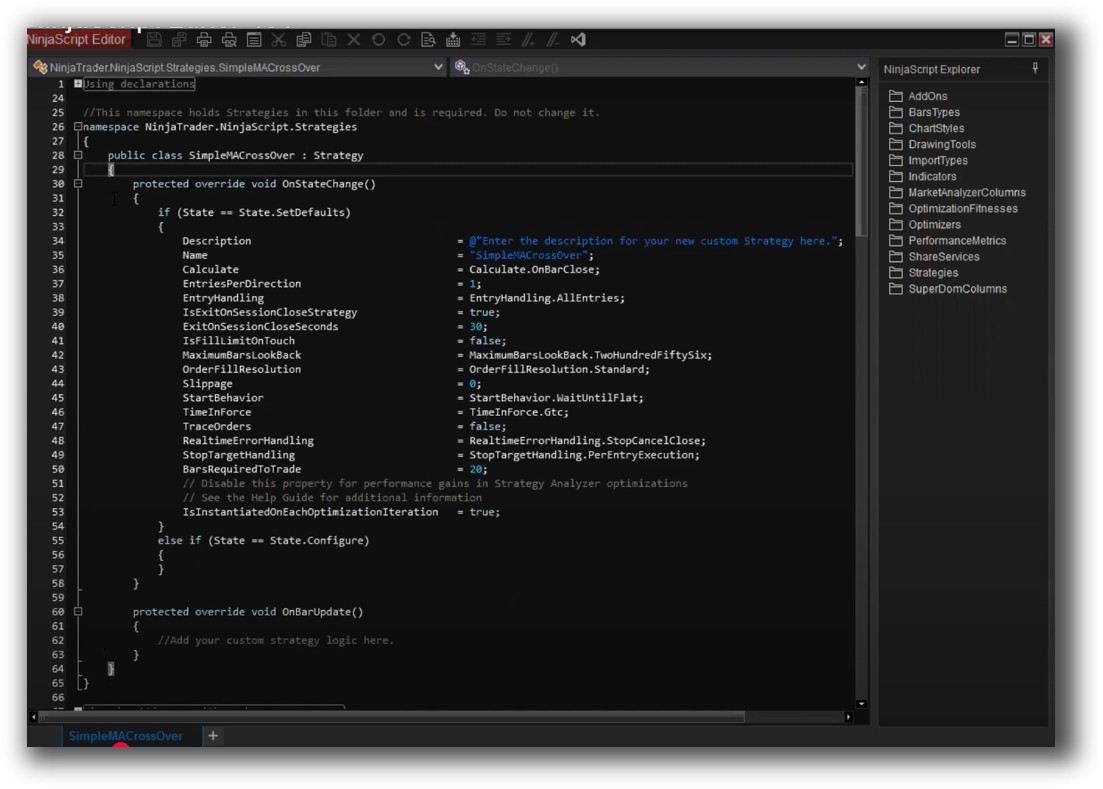

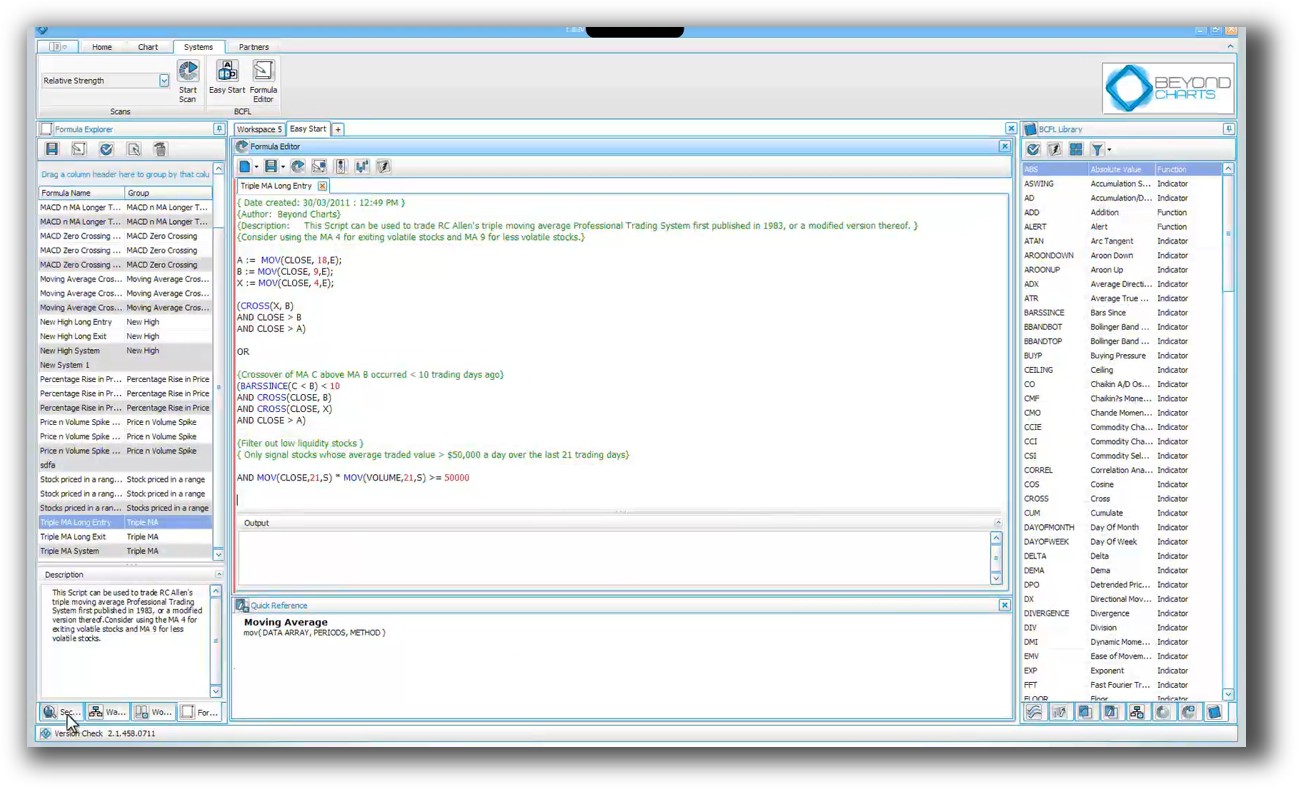

Building & Customizing Trading Strategies

NinjaTrader uses NinjaScript, a full-featured language based on C#. This gives you fine-grained control over entries, exits, filters, position sizing, and execution logic. It does require coding skills, but the flexibility is unmatched.

Beyond Charts uses a proprietary formula language (BCFL). It’s simpler but less powerful. Also, neither platform has drag-and-drop system creation, which means if you’re looking for visual rule-building, you’ll need to look elsewhere, like RealTest or even Amibroker for more advanced customisation.

If your goal is to build strategies aligned to your personality, lifestyle, and drawdown tolerance, NinjaTrader’s scripting flexibility gives you more room to fine-tune .

Check Out: Trading System Development

NinjaTrader Code Editor (NinjaScript Editor):

Beyond Charts Code Editor:

Backtesting Performance, Speed & Realism

This is where things get serious for systematic traders.

NinjaTrader offers:

- Bar-by-bar and tick-based backtesting

- Realistic order fill simulation

- Basic portfolio-level testing (though limited compared to RealTest)

Beyond Charts:

- Offers individual strategy backtesting only

- No true portfolio simulation or walk-forward testing

- Limited realism (slippage, commissions, capital constraints)

If your trading decisions rely on edge validation, stress testing, and realistic assumptions, NinjaTrader is usable — but RealTest remains our internal recommendation due to superior speed, portfolio realism, and simplicity.

Check out: Backtesting | Drawdown

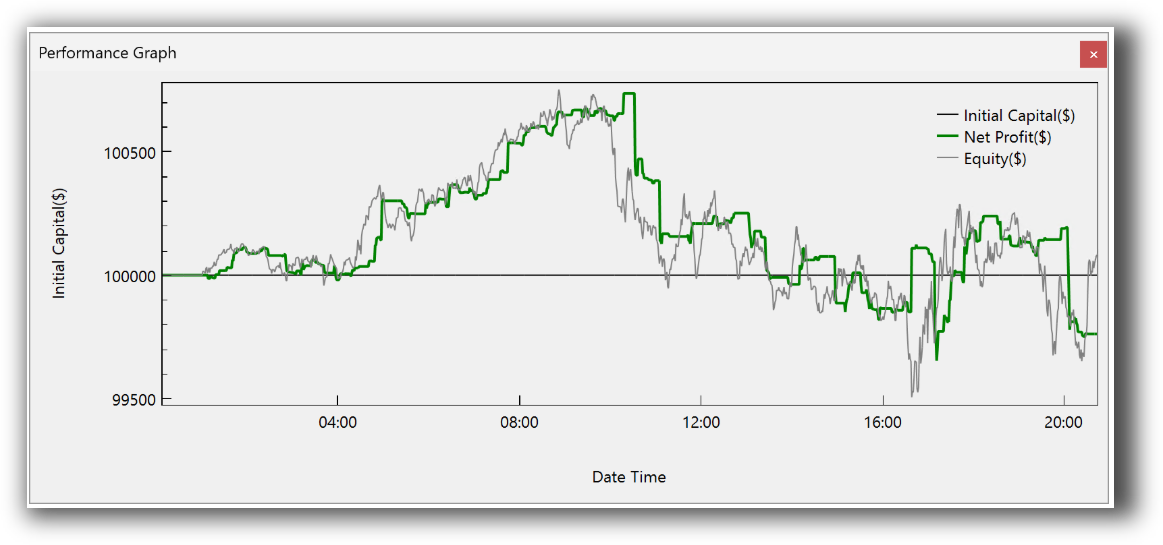

NinjaTrader Backtest Report:

Beyond Charts Backtest Report:

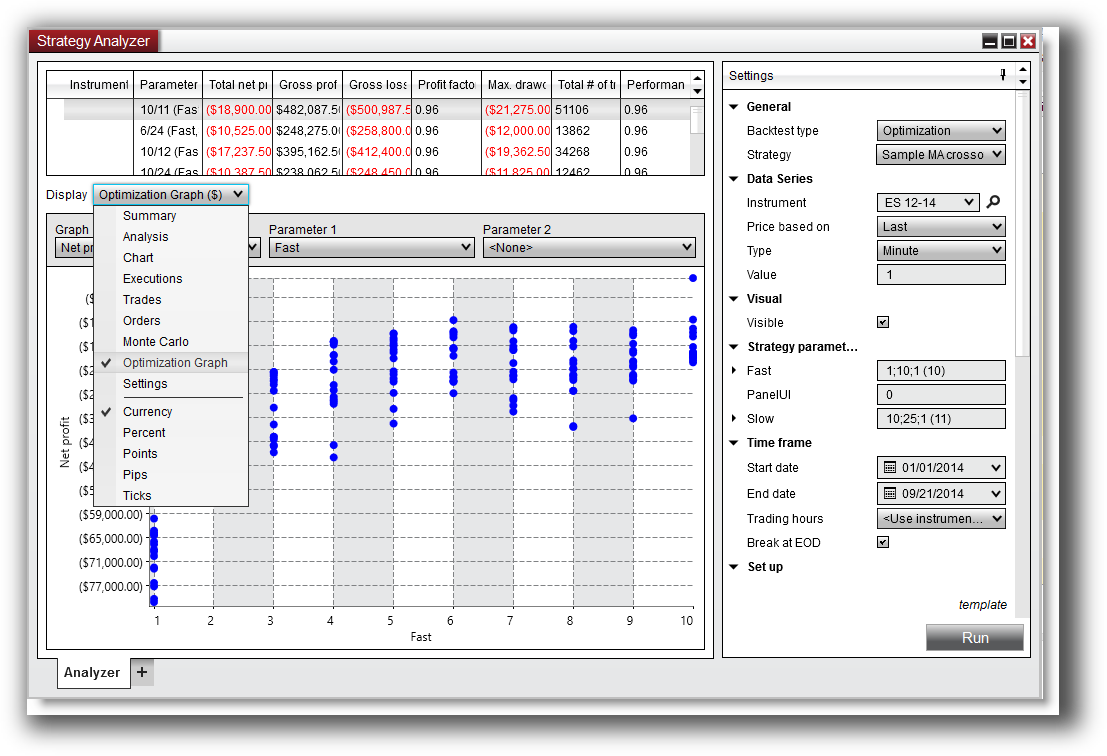

Strategy Optimization & Stress Testing Tools

NinjaTrader includes:

- Parameter optimization

- Basic genetic algorithms

- Walk-forward testing

Beyond Charts offers:

- Some parameter testing features

- No walk-forward testing

- No built-in robustness testing

For traders focused on avoiding curve fitting, optimizing position sizing, and proving strategy stability, NinjaTrader has more robust tools — but it’s not ideal.

Both fall short of RealTest or Amibroker in terms of optimization depth and execution speed. If robustness testing is a priority, you’ll hit limits faster in Beyond Charts.

Check Out: Trading System Optimization

NinjaTrader Optimization Graph:

Charting Features, Signal Exploration & Live Execution

Here’s where Beyond Charts may appeal to visual traders.

Charting:

- NinjaTrader: Solid charting with bar, candlestick, volume profiles, indicators, and drawing tools.

- Beyond Charts: Offers bar, candlestick, point & figure, equivolume, and others.

Scanning:

- NinjaTrader has strategy-based and condition-based scanners

- Beyond Charts includes watchlists, filters, and exploration tools

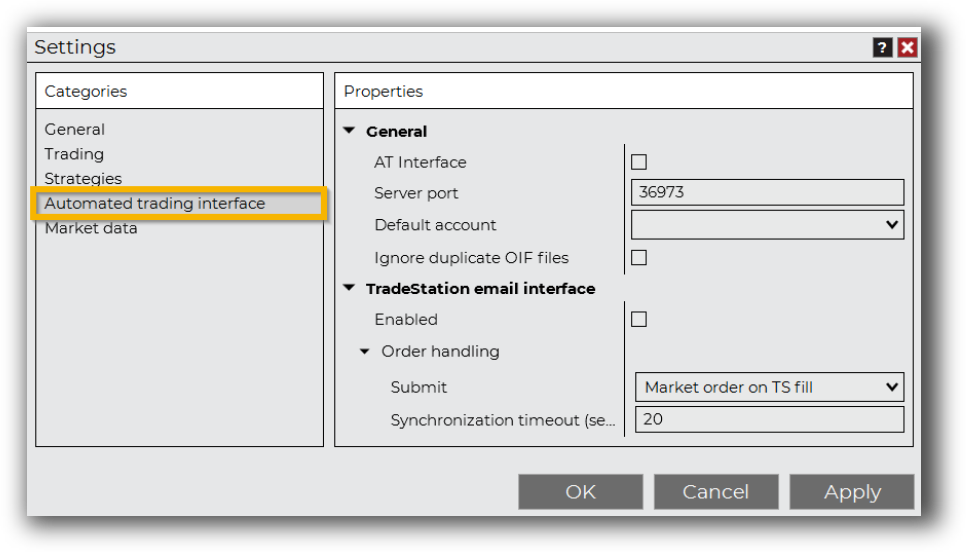

Execution:

- NinjaTrader supports live and simulated trading with full order management.

- Beyond Charts has no broker integration (Signals must be executed manually.)

If you’re trading based on signals generated from your trading systems, manual execution adds a layer of risk and inconsistency — especially in volatile markets.

Check Out Order Types | Automated Trading Systems

NinjaTrader Automation Set Up:

Support, Documentation & Learning Resources

NinjaTrader has:

- A large community

- Video tutorials

- Developer documentation (though not always beginner-friendly)

Beyond Charts:

- Outdated documentation

- Small user community

- Little online support or updates

For traders building their first automated system, documentation makes a big difference. NinjaTrader is far from perfect, but it’s supported. RealTest remains our pick for modern, clear documentation that’s built with system traders in mind.

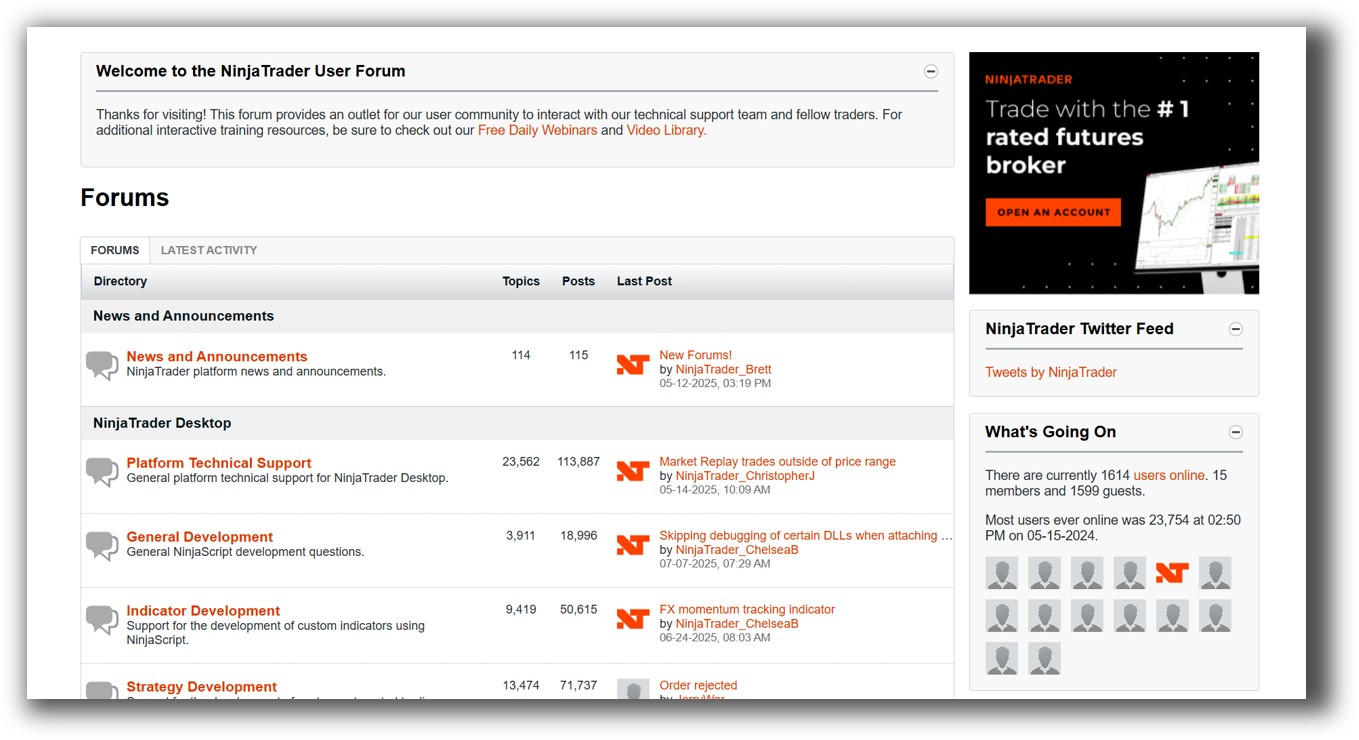

NinjaTrader Forum Front Page is illustrated down below:

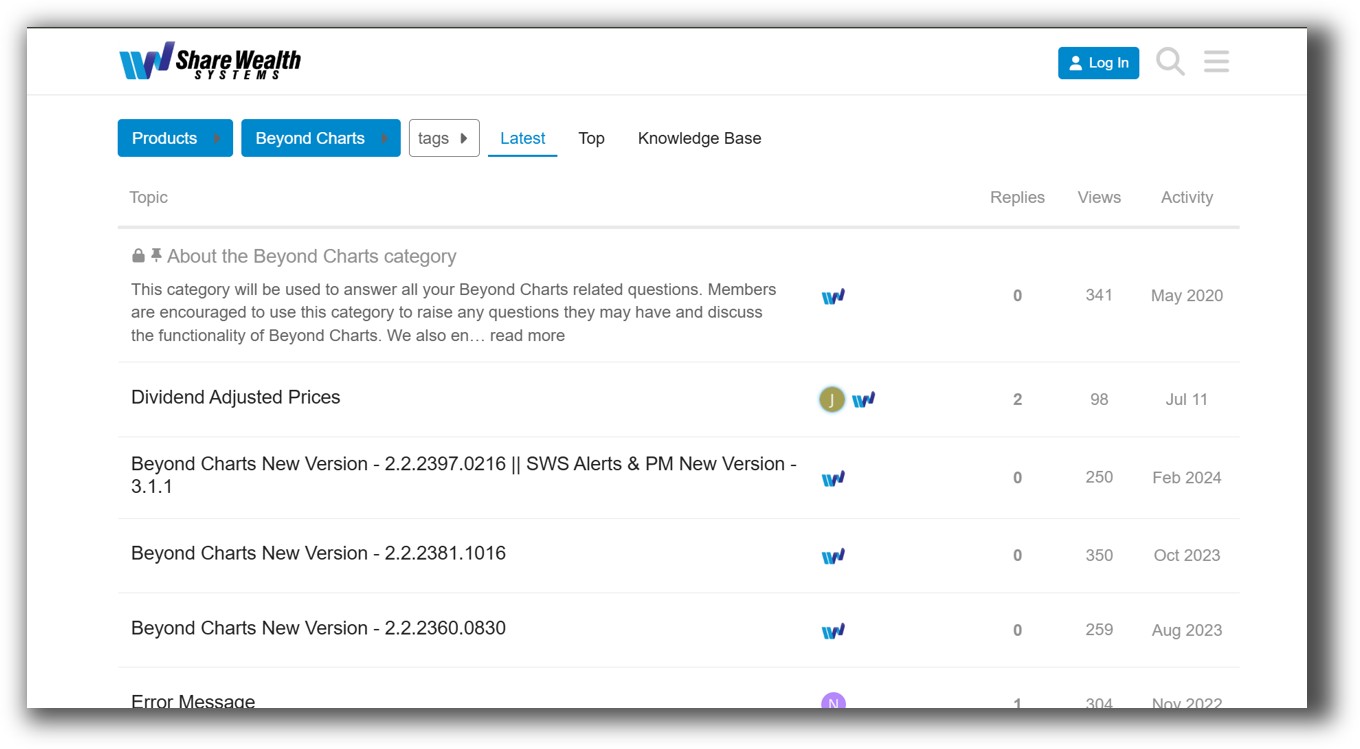

Beyond Charts Forum Front Page is illustrated down below:

NinjaTrader VS Beyond Charts: Which One Should You Use?

NinjaTrader is the better trading software for most systematic traders. It supports a broader range of markets, has a stronger scripting language, integrates with brokers, and offers more realistic backtesting.

Beyond Charts is best suited to visual, chart-focused traders who aren’t automating and don’t need portfolio-level analysis.

| Criteria | Winner |

| Operating System Flexibility | Tie (both limited) |

| Market Access | NinjaTrader |

| Backtesting Accuracy | NinjaTrader |

| Portfolio Simulation | NinjaTrader |

| Charting Tools | Beyond Charts |

| Ease of Use | Beyond Charts |

| Automation & Execution | NinjaTrader |

| Documentation | NinjaTrader |

Our Recommendation

If your goal is to trade systematically, reduce your screen time, and gain confidence in your edge, don’t settle for limited tools. NinjaTrader is usable, but we recommend RealTest for serious system traders due to its:

-

Lightning-fast backtesting

-

Realistic fill modelling

-

Portfolio-level simulation

-

Cleaner interface and setup

If you’re still stuck using discretionary analysis, inconsistent signals, or jumping between tools — it’s time to commit to a proper workflow.

Want The Rest of the Puzzle?

Backtesting software is just one piece. The real transformation happens when you align your tools, your systems, and your psychology with your goals.

If you’re tired of chasing tips and want to build wealth systematically, the next step is clear: The Trader Success System.

Inside, you’ll discover:

- Proven trading systems

- A step-by-step backtesting framework

- Position sizing tools

- Automation strategies that let you trade in 30 minutes or less

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)