Amibroker VS BeyondCharts: Comparing Backtesting Software for Systematic Trading

If you’re serious about building consistent trading results and tired of clunky tools that slow you down, you’re probably comparing backtesting software like Amibroker and Beyond Charts.

Here’s the short answer: Amibroker is the more powerful option for systematic traders who want full control over strategy development, backtesting speed, and customisation. Beyond Charts offers solid charting for discretionary analysis but lacks the depth and flexibility serious system traders need.

If you want to build robust, rule-based strategies and test them across portfolios efficiently, Amibroker is the better choice.

But let’s dig into the details so you can decide what’s right for your trading workflow.

Amibroker VS BeyondCharts at a Glance

Short on time? Here’s how Amibroker VS BeyondCharts compare side by side.

|

Feature |

Amibroker |

Beyond Charts |

|

Year Released |

1995 |

Not publicly stated |

|

Operating System |

Windows (Mac via VM) |

Windows (Mac via emulation) |

|

Price |

One-time: from US$299 |

~AUD $595 incl. GST |

|

Brokerage Integration |

Yes (IB, semi-automated via plug-ins) |

No brokerage integration ✘ |

|

Programming Language |

AFL (Amibroker Formula Language) |

BCFL (Beyond Charts Formula Language) |

|

Charting |

Advanced, highly configurable |

Strong charting for discretionary trading |

|

Portfolio Backtesting |

Yes (multi-system, multi-market) |

Limited (single symbol only) ✘ |

|

Speed |

Very fast (compiled code execution) |

Slower, less transparent |

|

Documentation |

Extensive community and formal docs |

Dated, less accessible |

Platform Overview, Cost & Compatibility

Amibroker runs on Windows and works well on Mac using a virtual machine like Parallels. It’s a one-time license, starting around US$299 for the standard version and around US$339 for the professional edition.

Beyond Charts, designed in Australia, also runs on Windows and can be emulated on a Mac. It’s priced at AUD $595 including GST, which is comparable but slightly higher for Australian users.

Verdict: Amibroker wins on price flexibility and Mac compatibility via VM. Beyond Charts is accessible for locals, but global users may find better value with Amibroker.

Amibroker Main View:

BeyondCharts Main View:

Market Access & Data Support in Amibroker VS BeyondCharts

Amibroker supports a wide range of data providers including Norgate, Yahoo, eSignal, and Interactive Brokers. This makes it ideal for traders who want multi-market and multi-asset backtesting.

Beyond Charts focuses primarily on EOD data from Norgate and does not support live or intraday data feeds directly.

Verdict: Amibroker is more flexible and scalable for traders who want international market access and automated data feeds.

Amibroker Backtesting Interface:

BeyondCharts Backtesting Interface:

Building & Customizing Trading Strategies

Both platforms use a proprietary scripting language: AFL in Amibroker and BCFL in Beyond Charts.

Beyond Charts allows formula-based rule creation, but the language and system building tools are more constrained.

Verdict: If you want to develop your own trading systems, Amibroker gives you far more power and freedom.

Check Out: Trading System Development

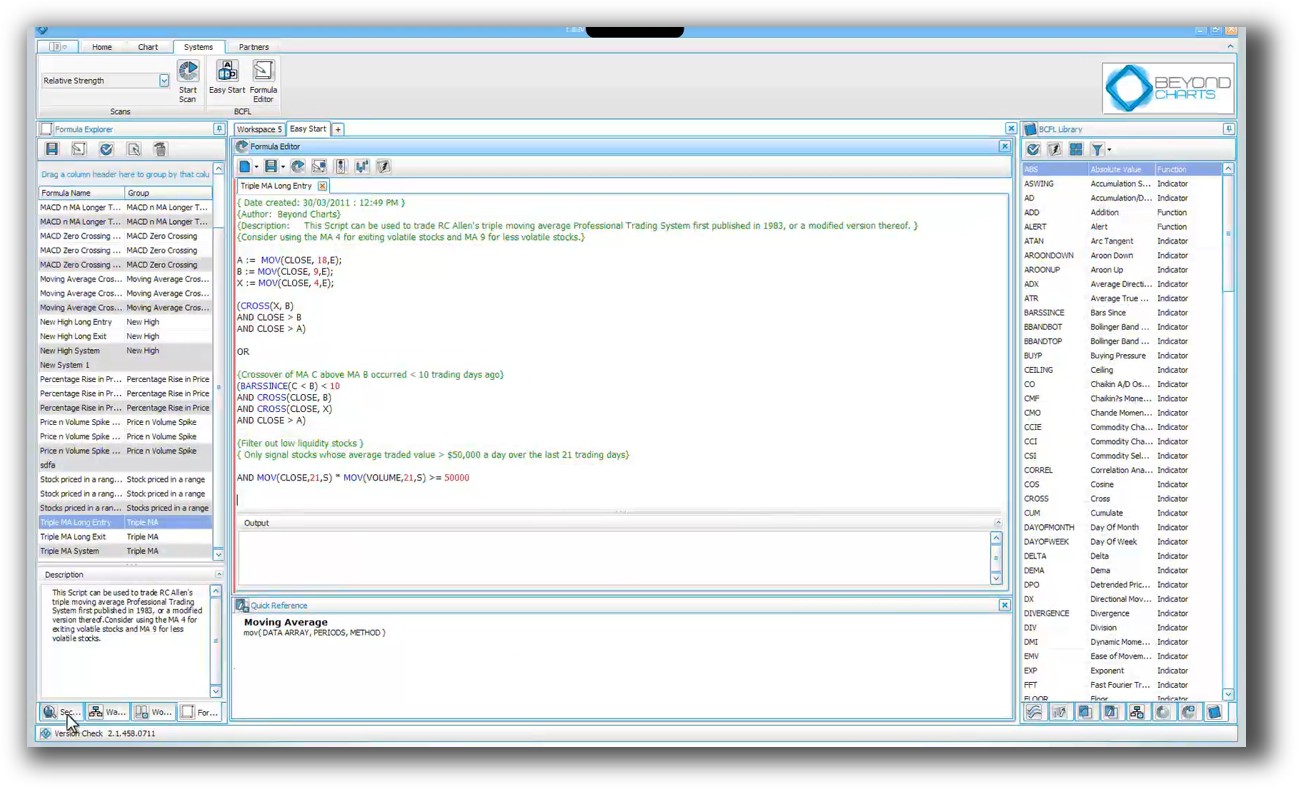

Amibroker Code Editor:

BeyondCharts Code Editor:

Backtesting Performance, Speed & Realism

Amibroker’s backtesting engine is compiled, making it extremely fast. It supports portfolio-level testing, position sizing, capital constraints, slippage, commissions, and multi-system setups. You can test your full portfolio in seconds.

Beyond Charts is limited to single-symbol testing only. There is no support for realistic portfolio simulations.

Verdict: This is a dealbreaker. Amibroker is vastly superior for realistic, efficient backtesting. Beyond Charts is unsuitable for serious system testing.

Check out: Backtesting | Drawdown

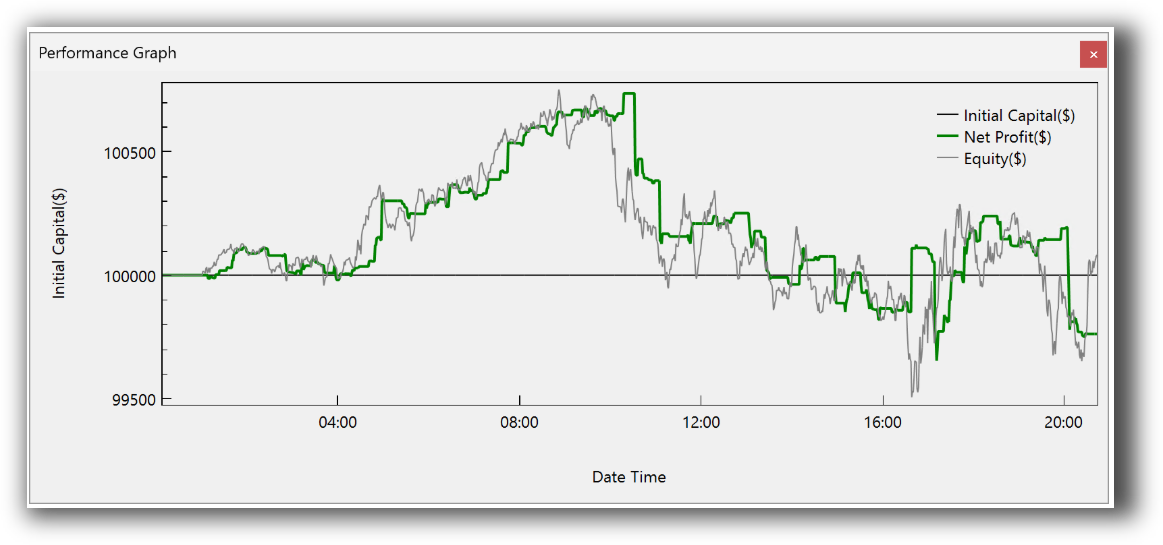

Amibroker Backtest Report:

BeyondCharts Backtest Report:

Strategy Optimization & Stress Testing Tools

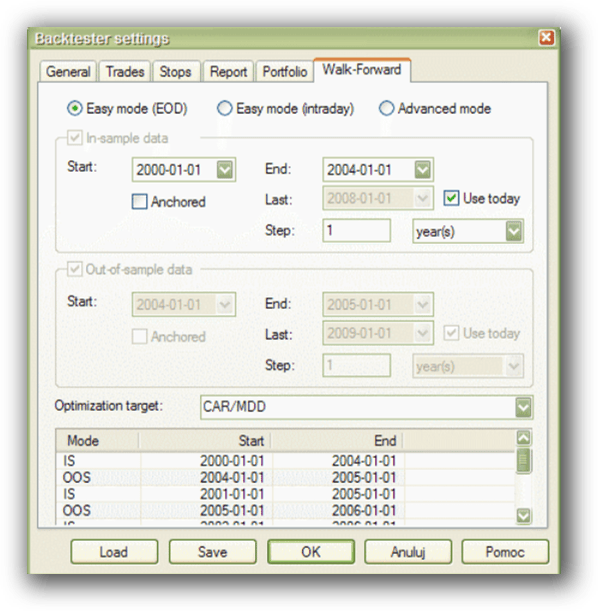

Amibroker includes built-in tools for parameter optimization, walk-forward testing, and Monte Carlo simulations (Pro edition). You can stress test systems and find stable regions of performance, which helps avoid curve fitting.

Beyond Charts offers basic optimization with limited visibility into statistical robustness.

Verdict: Amibroker is the clear winner for traders who care about trading system optimization and robustness.

Check Out: Trading System Optimization

Amibroker Walk-Forward Tab:

Charting Features, Signal Exploration & Live Execution

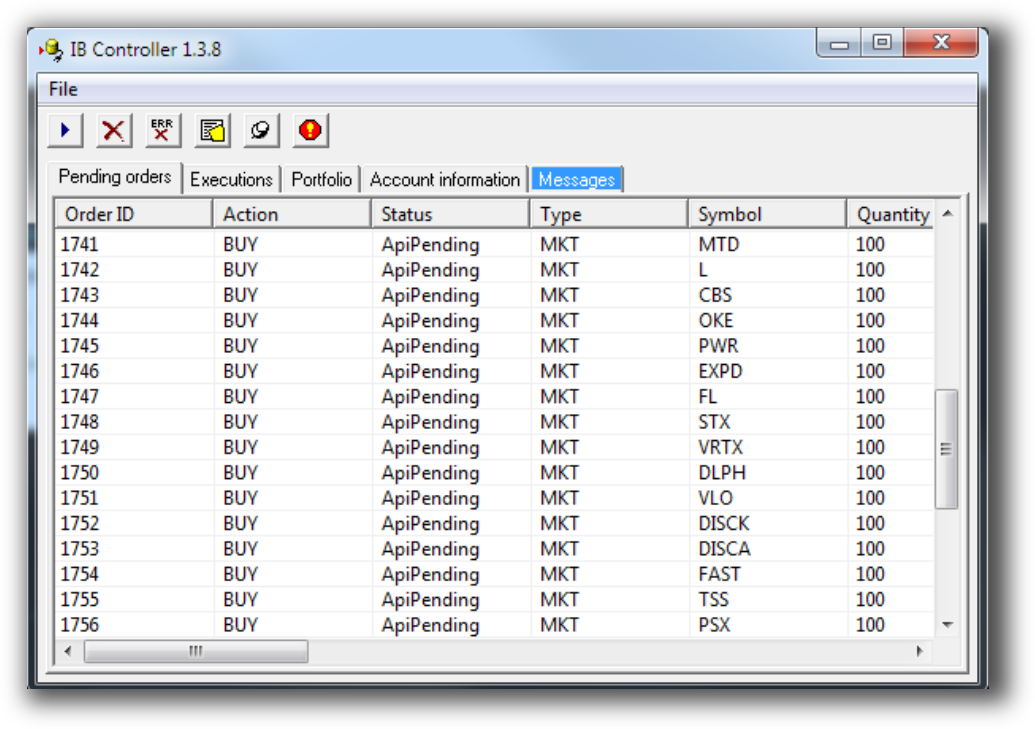

Amibroker is known for highly configurable charting, custom indicators, multi-timeframe analysis, and scanning. It also supports semi-automated execution via Interactive Brokers or other APIs.

Beyond Charts shines in chart aesthetics and simplicity, but it’s primarily built for discretionary traders. There’s no automated execution or portfolio-level scanning.

Verdict: Beyond Charts might suit visual traders early in their journey, but Amibroker is more capable for systematic trend trading, mean reversion, and rule-based scanning.

Check Out Order Types | Automated Trading Systems

Amibroker Automation Set Up (IB Controller):

Support, Documentation & Learning Resources

Amibroker has a deep and active community, extensive official documentation, third-party tutorials, and forums. While the learning curve can be steep, the support resources are extensive if you are willing to spend the time looking for them.

Beyond Charts has limited public documentation and community support. Learning is slower unless you’re already familiar with the platform.

Verdict: Amibroker has better long-term learning resources, especially when supported with mentoring programs like the Trader Success System.

Amibroker Forum is illustrated down below:

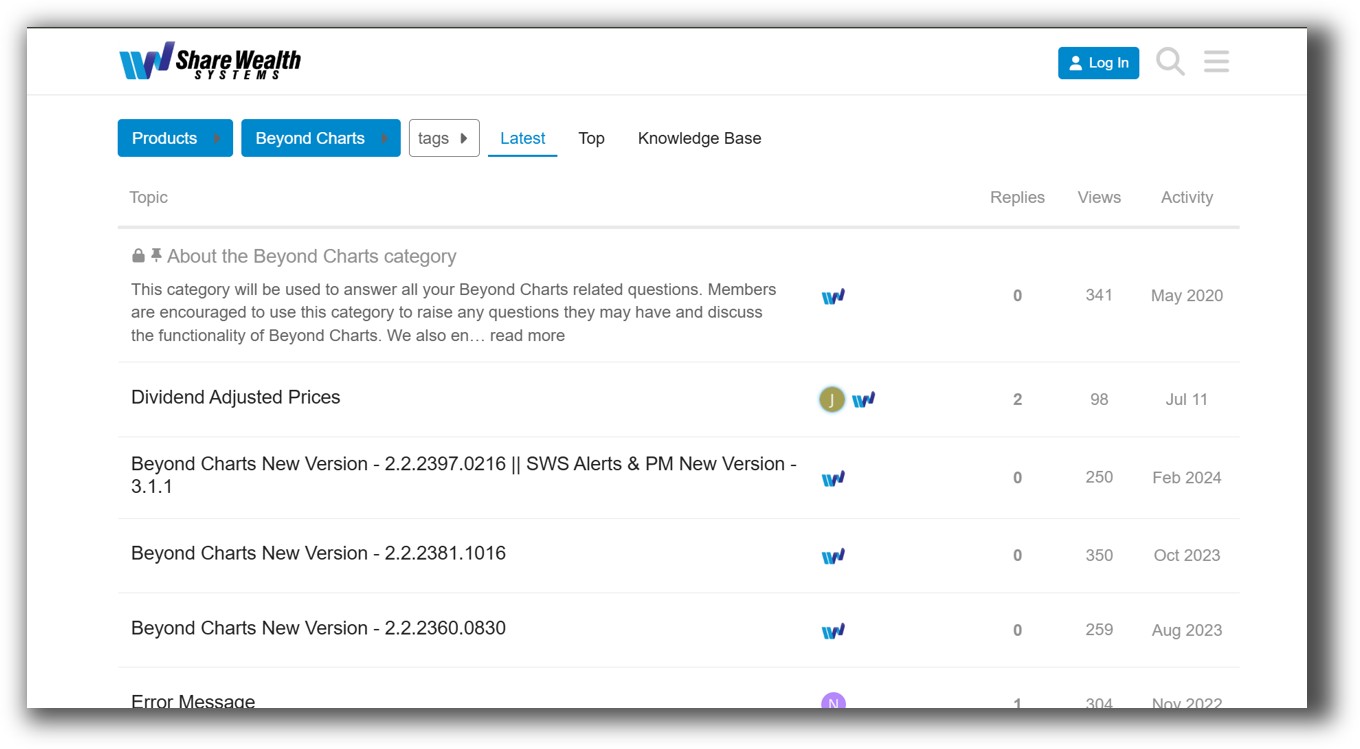

BeyondCharts Forum is illustrated down below:

Amibroker VS BeyondCharts: Which One Should You Use?

If you want to build a repeatable, robust, and scalable trading business, Amibroker is the better platform. It offers powerful backtesting, optimization, automation potential, and workflow efficiency that Beyond Charts simply cannot match.

Our Recommendation

At Enlightened Stock Trading, we use and recommend Amibroker for traders serious about building, testing, and refining their trading strategy.

If you’re ready to move beyond discretionary chaos, and start building a portfolio of strategies with confidence, Amibroker paired with a structured learning path is your best next step.

Beyond Charts may help you get started visually, but you’ll quickly hit its limits when trying to automate or scale your trading.

Further to this, we also strongly support RealTest as a backtesting platform, which offers fast, realistic backtesting that is simpler and better supported than both the above options.

Want the Rest of the Puzzle?

The software is just one piece. Without a proven roadmap, even the best tools won’t get you where you want to go.

If you want to…

- Build a portfolio of profitable trading systems

- Test and deploy them in minutes a day

- Avoid costly mistakes and emotional trades

…then check out The Trader Success System. It’s the most complete path to becoming a confident, profitable, and consistent system trader.

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)