Amibroker VS MetaTrader-4: Comparing Backtesting Software for Systematic Trading

If your priority is robust backtesting, strategy flexibility, and high-speed simulation, Amibroker is the clear winner. MetaTrader 4, on the other hand, is best suited for forex traders who want broker-integrated execution and a built-in platform for algorithmic trading via Expert Advisors (EAs).

Amibroker VS MetaTrader-4 at a Glance

Short on time? Here’s how Amibroker VS MetaTrader-4 compare side by side.

|

Feature |

Amibroker |

MetaTrader 4 |

|

Operating System |

Windows (Mac via VM) |

Windows, iOS, Android |

|

Best For |

Stocks, ETFs, futures |

Forex, CFDs |

|

Programming Language |

AFL (Amibroker Formula Language) |

MQL4 (similar to C) |

|

Backtesting |

Lightning-fast, advanced portfolio simulation |

Slower, single-instrument focus |

|

Charting & Scanning |

Advanced, fully customisable |

Basic to moderate |

|

Automation |

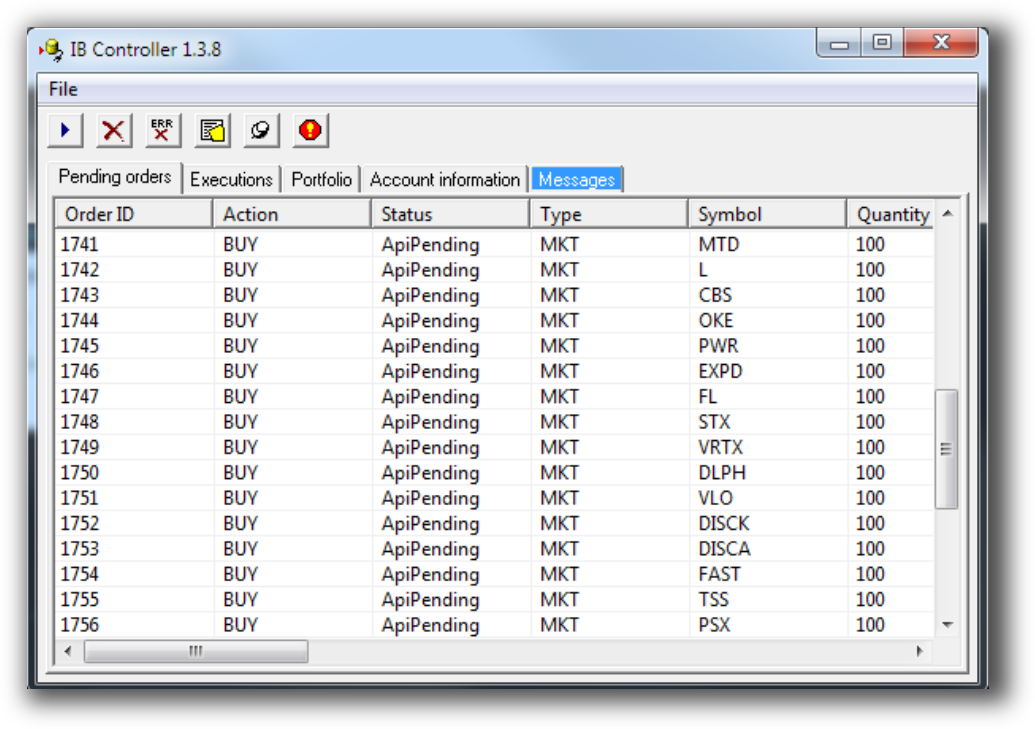

Supported via scripting or IB integration |

Built-in with brokers |

|

Learning Curve |

Steep |

Beginner-friendly |

|

Price |

One-time license (~US$299+) |

Free via brokers |

Platform Overview, Cost & Compatibility

Amibroker is a standalone desktop application built for Windows. Mac users can run it using a virtual machine like Parallels, but it’s not natively supported. The pricing is transparent – a one-time license (Standard or Professional), making it affordable long-term. No recurring subscription fees unless you want updates.

MetaTrader 4 (MT4) is free-to-use and broker-distributed. It’s widely available on Windows, with mobile apps for iOS and Android. There’s no standalone cost, but the catch is you’re tied to a broker for full functionality.

Verdict:

Amibroker offers long-term value and more independence. MT4 is a lightweight entry point, but your tools depend on your broker.

Amibroker Main View:

MetaTrader-4 Main View:

Market Access & Data Support in Amibroker VS MetaTrader-4

Amibroker supports a wide range of global markets, including stocks, ETFs, futures, and even crypto (with third-party data). You can plug in data from Norgate, Interactive Brokers, or any other source with the right feed.

MT4 is primarily designed for Forex and CFDs. Brokers provide market data and instruments – which means you’re limited by what your broker offers. Historical data is often sparse or unreliable.

Verdict:

Amibroker Backtesting Interface:

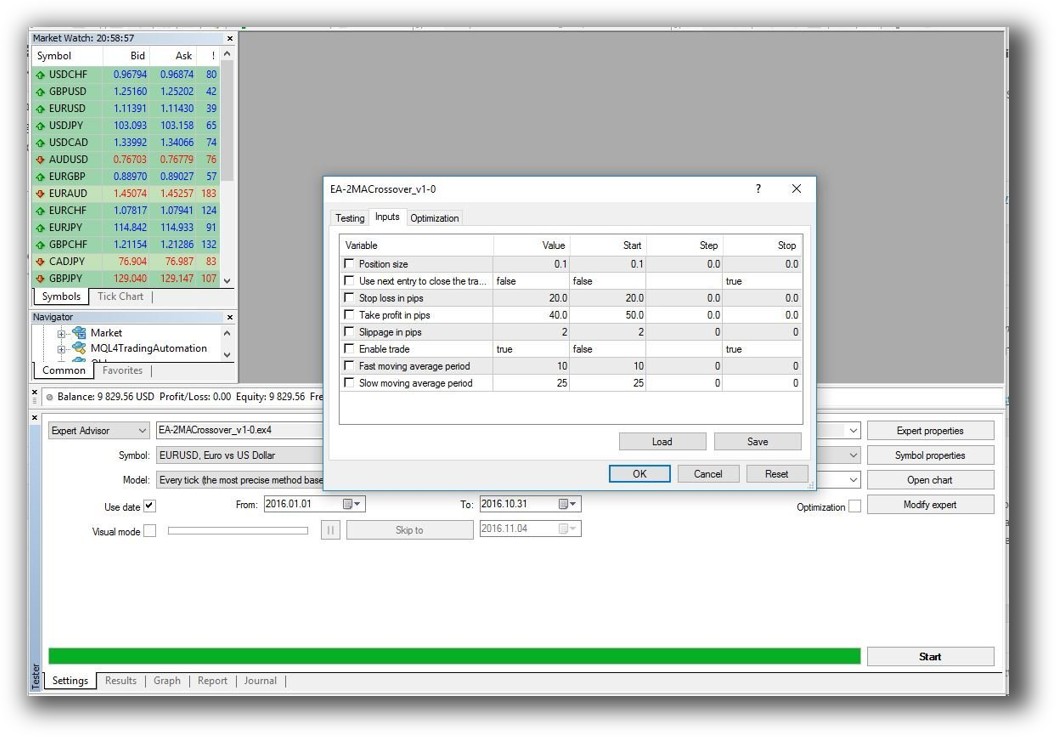

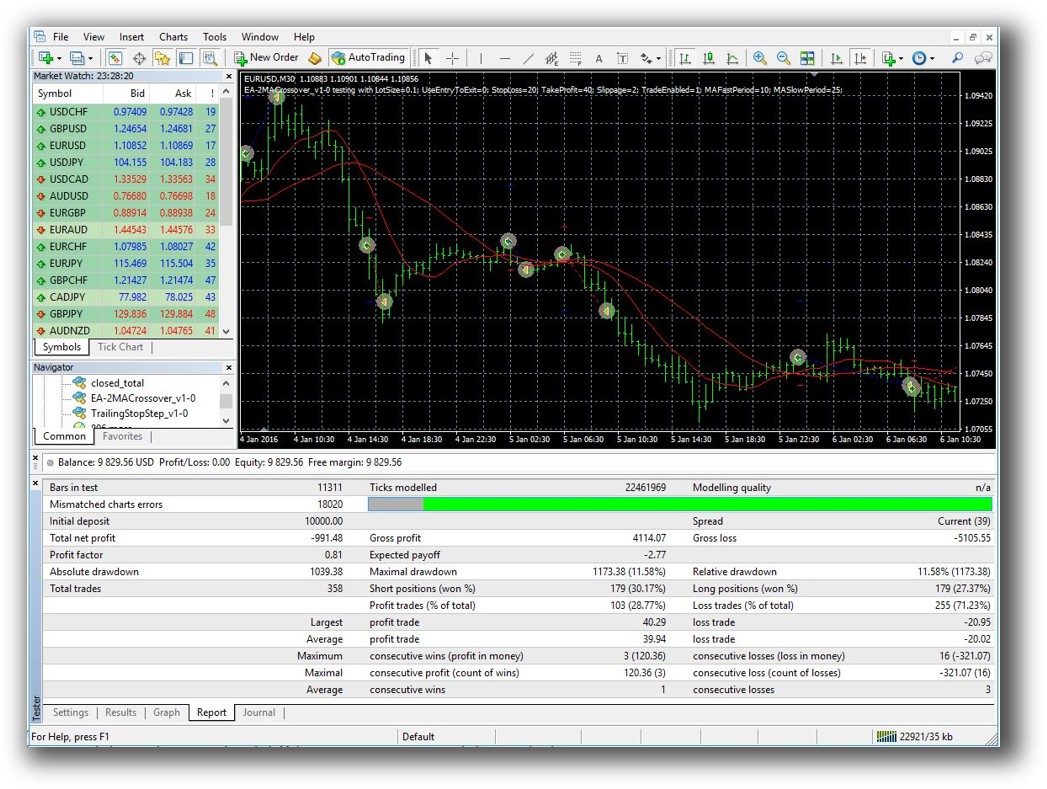

MetaTrader-4 Backtesting Interface:

Building & Customizing Trading Strategies

Amibroker is ideal for systematic traders who build strategies with precise rules. It supports full custom scripting via AFL, which allows total control over entries, exits, position sizing, backtesting, and more.

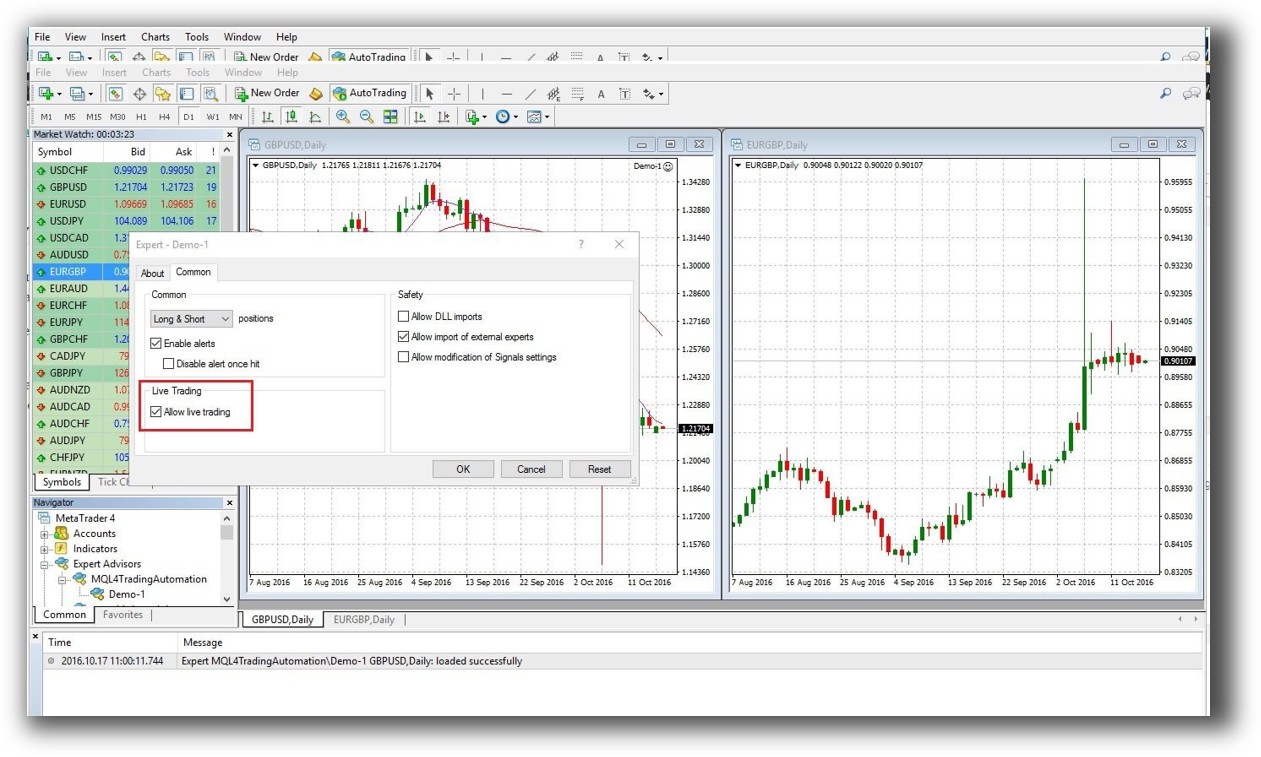

MT4 uses MQL4, which is more programmer-oriented and focused on building Expert Advisors (EAs). Creating multi-strategy portfolios or testing across instruments is cumbersome.

Verdict:

If you want to test multiple trading systems or diversify strategies across timeframes, Amibroker is the better option.

Check Out: Trading System Development

Amibroker Code Editor:

MetaTrader-4 Code Editor (Meta Editor):

Backtesting Performance, Speed & Realism

Amibroker delivers blazing-fast backtesting with true portfolio-level simulation. You can account for cash constraints, multiple positions, commissions, and drawdown. Ideal for building confidence in your edge.

MT4 runs single-instrument strategy tests and is relatively slow. It lacks detailed simulation features and cannot test realistic portfolios natively.

Verdict: Amibroker outperforms hands down if you’re serious about validating your systems realistically.

Check out: Backtesting | Drawdown

Amibroker Backtest Report:

MetaTrader-4 Backtest Report:

Strategy Optimization & Stress Testing Tools

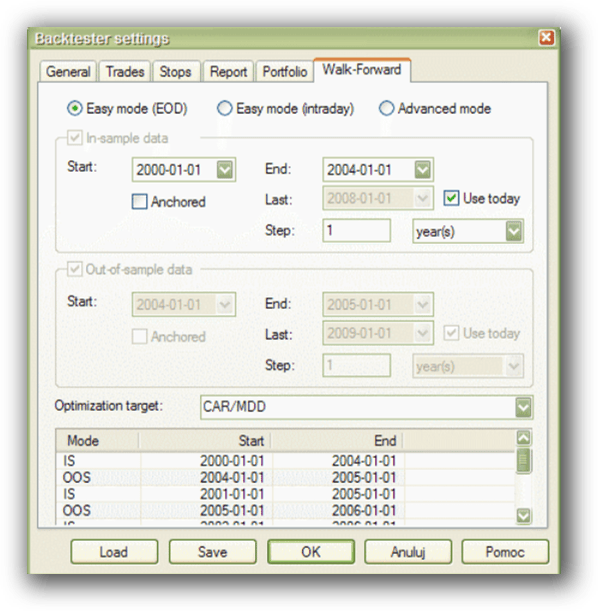

Amibroker has a highly flexible optimizer with multiple objective functions, custom metrics, and walk-forward testing support. You can easily test for curve fitting and parameter sensitivity.

MT4 includes a basic strategy tester, but lacks the tools needed for robust multi-factor optimization or stress testing.

Verdict:

For traders who want to build robust systems that perform across varying conditions, Amibroker is again the leader.

Check Out: Trading System Optimization

Amibroker Walk-Forward Tab:

Charting Features, Signal Exploration & Live Execution

Amibroker is known for its highly customisable charting and scanning capabilities. You can scan thousands of symbols using any indicator or rule set.

MT4 has simple charting and built-in indicators. Scanning is limited unless coded via EAs. Execution is smoother due to broker integration.

Verdict:

If you love technical analysis, scanning custom conditions, and building alerts, Amibroker is more powerful. For quick execution of simple rules, MT4 is simpler.

Check Out Order Types | Automated Trading Systems

Amibroker Automation Set Up (IB Controller):

MetaTrader-4 Automation Set Up (Expert Advisor)

Support, Documentation & Learning Resources

Amibroker has an extensive knowledge base and active user community, but documentation can be dense. AFL has a steep learning curve. This is why many Enlightened Stock Trading students choose it only after learning the right approach to system design.

MT4 is beginner-friendly and well-documented in forums. But much of the content is forex-focused and lacks depth for serious system development.

Verdict:

Amibroker is best for traders who are ready to build serious systems. MT4 suits hobby traders or those automating forex strategies.

Amibroker Forum is illustrated down below:

MetaTrader-4 Forum is illustrated down below:

Amibroker VS MetaTrader-4: Which One Should You Use?

If you’re serious about trading with logic, precision, and repeatability – Amibroker is the superior backtesting software.

MetaTrader 4 serves a purpose for automated forex trading and simple EA testing, but it’s not designed for sophisticated system traders who want to diversify across markets, timeframes, and strategies.

Our Recommendation

Most of them found that Amibroker, paired with a solid education in systematic trading, gave them the tools to:

- Backtest systems properly

- Build confidence in their rules

- Avoid emotional decision-making

- Cut through noise and misinformation

- Trade just 30 minutes a day with full control

Want the Rest of the Puzzle?

Having the best backtesting software is just the first piece.

If you’re tired of inconsistent results and want a structured path to become a confident, consistent trader, then the Trader Success System is your next logical step.

It’s the most comprehensive, step-by-step mentoring program for analytical thinkers who want to master the markets without wasting years on trial and error.

Remember – You’re only one trading system away!

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)