Amibroker VS Optuma: Comparing Backtesting Software for Systematic Trading

For serious systematic traders focused on speed, realism, and automation, Amibroker is generally the stronger backtesting software. It’s fast, flexible, and has a proven portfolio-level engine for building and testing trading systems. Optuma, on the other hand, excels in charting, discretionary analysis, and institutional-grade visual tools. But its backtesting and scripting capabilities come with more limitations.

If your goal is to build confidence through systematic trading, not just pretty charts, read on.

Amibroker VS Optuma at a Glance

Short on time? Here’s how Amibroker VS Optuma compare side by side.

|

Feature |

Amibroker |

Optuma |

|

Operating System |

Windows only (Mac via VM) |

Windows desktop; some web/cloud tools |

|

Cost |

One-time license (~US$299+) |

Subscription model (~US$810+/yr) |

|

Backtesting Engine |

Ultra-fast, realistic, portfolio-level |

Basic portfolio testing; slower engine |

|

Programming |

AFL – powerful, proven scripting |

OSL – proprietary, more limited |

|

Charting |

Advanced technical analysis tools |

Institutional-grade visuals |

|

Automation |

Partial (with plug-ins) |

Via IB Gateway; less common usage |

|

Documentation |

Extensive, slightly dated |

Less searchable, some outdated |

Platform Overview, Cost & Compatibility

Verdict: Amibroker wins for affordability, performance, and independence. Optuma may be better suited if you want institutional-style charting.

Amibroker Main View:

Optuma Main View:

Market Access & Data Support in Amibroker VS Optuma

Both platforms support data from Norgate, Interactive Brokers, and other brokers.

Amibroker has stronger user adoption for retail-level historical data via Norgate Data (for ASX, US, and TSX). You can connect to a wide range of market data feeds with full control over update frequency and filtering.

Optuma supports global markets but is geared more toward institutional and discretionary users. Some modules may be locked behind additional paywalls, depending on your subscription tier.

Verdict: Amibroker is more flexible for DIY traders. Optuma may appeal to discretionary analysts with access to institutional feeds.

Amibroker Backtesting Interface:

Optuma Backtesting Interface:

Building & Customizing Trading Strategies

With Amibroker, you write in AFL (Amibroker Formula Language). It’s a clean, expressive scripting language designed for technical traders. It also gives you control over every part of your trading strategy, from signal generation to position sizing.

Optuma uses OSL (Optuma Script Language) which is less well-known. It’s fine for basic logic but lacks the power and flexibility of AFL. Complex system development and signal generation become harder to scale.

Verdict: If you’re serious about learning trading system development, Amibroker gives you more freedom and capability.

Check Out: Trading System Development

Amibroker Code Editor:

Optuma Code Editor (Script Manager):

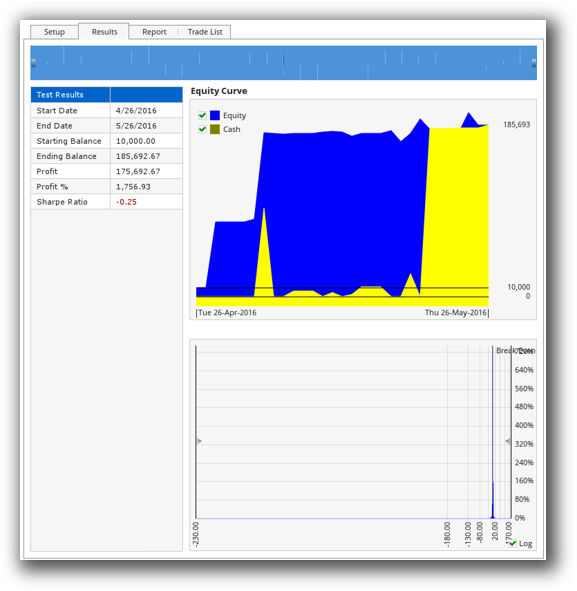

Backtesting Performance, Speed & Realism

This is the make-or-break category.

Amibroker is known for its lightning-fast, portfolio-level backtesting. You can test thousands of symbols across decades of data in minutes. It supports walk-forward testing, Monte Carlo, and custom metrics to help avoid curve fitting.

Optuma does allow portfolio-level testing, but it’s slower, less flexible, and more limited in realism. As a result, it’s more suited for indicator validation than robust systematic backtesting.

Amibroker wins decisively here. This is why it’s used by hedge funds and experienced systematic traders.

Check out: Backtesting | Drawdown

Amibroker Backtest Report:

Optuma Backtest Report:

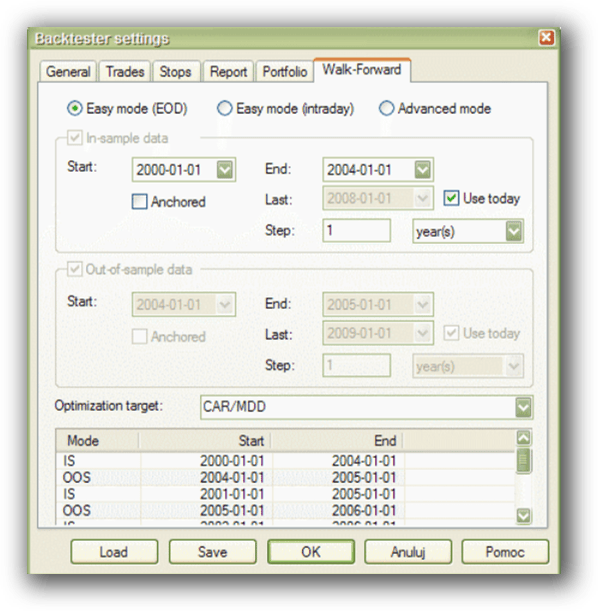

Strategy Optimization & Stress Testing Tools

Amibroker provides a full suite of optimization tools, including brute-force, multi-variable sweeps, and Monte Carlo simulations to stress test your systems. This makes it easier to find stable parameter ranges and test your system’s edge.

Optuma has some optimisation capability, but fewer tools and less control over robustness testing. If you want to simulate noise, randomness, or system stability under different market conditions, you’ll hit limits faster.

Check Out: Trading System Optimization

Amibroker Walk-Forward Tab:

Charting Features, Signal Exploration & Live Execution

Optuma shines here. Its visual interface and custom charting tools are some of the best available. If you’re a discretionary trader or a data visualisation enthusiast, Optuma’s charting engine is impressive.

Amibroker also offers advanced technical analysis and scanning. While not as “pretty” out of the box, it’s highly customisable and integrates cleanly with your scripts and scans.

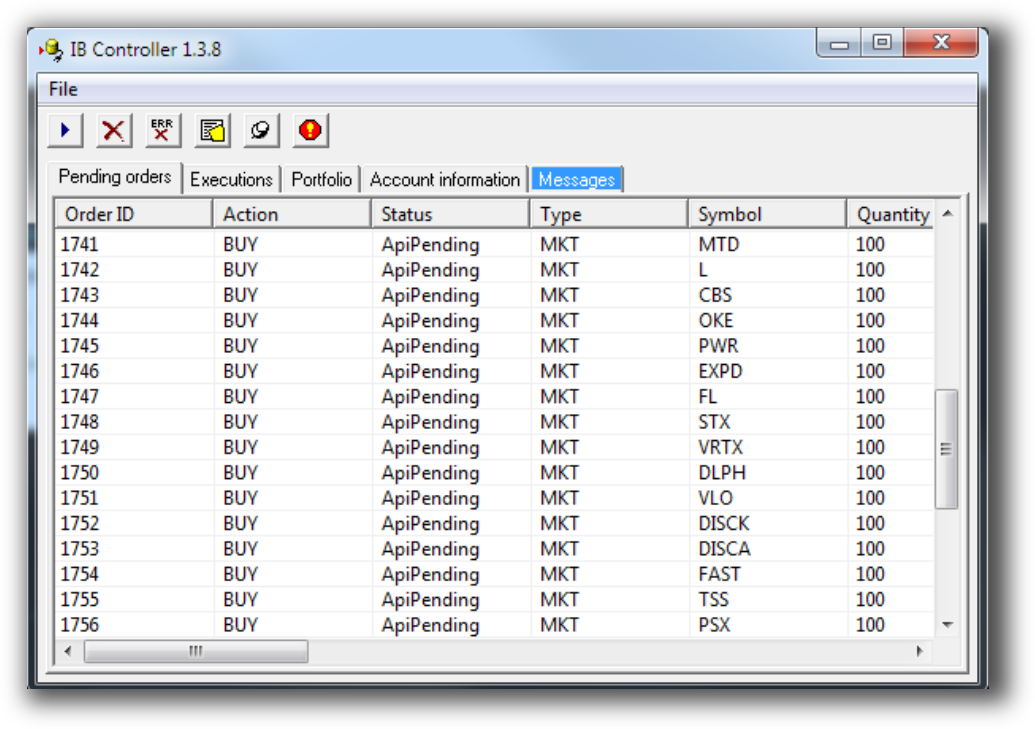

Both platforms can scan markets quickly. Amibroker’s exploration feature is particularly useful for scanning entire exchanges using live signals.

Optuma wins for charting visuals. Amibroker wins for flexibility and integration with automation

Check Out Order Types | Automated Trading Systems

Amibroker Automation Set Up (IB Controller):

Optuma Automation Set Up (Automatic Grouping):

Support, Documentation & Learning Resources

Amibroker has a huge user community, deep forums, third-party books, and years of user-generated content. While the UI feels dated, the learning materials are vast.

Optuma has more polished support, but documentation is often less accessible and geared towards institutional users.

Compared to something like RealTest, which has clean, modern documentation written for systematic traders, both Amibroker and Optuma can feel a bit overwhelming at first.

Verdict: Amibroker has more support from the community. Optuma has better design, but less documentation depth.

Amibroker Forum is illustrated down below:

Optuma Forum is illustrated down below:

Amibroker VS Optuma: Which One Should You Use?

- Amibroker is faster, cheaper, and more powerful for serious systematic traders.

- Optuma is better suited to discretionary traders, visual thinkers, or institutions who prioritise charting over speed or system development depth.

If your goal is to test your trading systems, find an edge, and systemise your approach… Amibroker is the better fit.

Our Recommendation

That’s why Amibroker is the better choice – it aligns with the systematic mindset needed to trade with confidence.

But remember: Tools alone don’t make you profitable. Alignment, process and confidence do.

Want the Rest of the Puzzle?

Amibroker (or any backtesting software) is only one piece of the puzzle. To become a confident, consistent and profitable trader, you need a complete roadmap. That’s exactly what we teach inside The Trader Success System.

Inside, you’ll discover:

-

- How to build and validate trading systems

- How to overcome trading mistakes

- How to master your trading psychology

- How to fit trading into your life in 30 minutes a day

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)