Amibroker VS Wealth-Lab: Comparing Backtesting Software for Systematic Trading

If you’re serious about consistent, systematic trading, your choice of backtesting software matters more than you might think.

Between AmiBroker and Wealth‑Lab, both offer powerful capabilities. But which one actually supports faster, more realistic backtests, cleaner execution, and more time-efficient strategy development?

Here’s the quick answer: AmiBroker is better suited for advanced traders who want complete control, fast testing speeds, and deep charting capabilities. Wealth‑Lab, on the other hand, offers a more integrated workflow, beginner-friendly interface, and robust support for automation via brokers like Interactive Brokers.

Let’s break it down so you can decide which is right for your trading journey.

Amibroker VS Wealth-Lab at a Glance

Short on time? Here’s how Amibroker VS Wealth-Lab compare side by side.

|

Feature |

AmiBroker |

Wealth‑Lab |

|

OS Compatibility |

Windows only (Mac via VM) |

Windows only (Mac via VM) |

|

Programming Language |

AFL (Custom formula language) |

C# (WealthScript), drag-and-drop builder |

|

Cost |

One-time license (~$299+) |

Subscription (~$39.95/mo) |

|

Portfolio-Level Backtesting |

Multi-strategy, multi-symbol |

Multi-strategy, multi-symbol |

|

Optimization |

Robust with many options |

Evolutionary, exhaustive, walk-forward |

|

Automation |

Limited, needs 3rd party + scripting |

Built-in with broker extensions |

|

Charting |

Highly advanced, fully customizable |

Basic but functional |

|

Learning Curve |

Steep (manual scripting) |

Easier via builder + modern interface |

|

Documentation |

Outdated, steep learning curve |

More current and well-integrated |

Platform Overview, Cost & Compatibility

AmiBroker is a one-time purchase with a reputation for raw speed and flexibility. But it’s a Windows-only platform and requires scripting via AFL (AmiBroker Formula Language). Mac users can only run it via a VM like Parallels or Bootcamp – Wine is not recommended .

Wealth‑Lab is a subscription-based platform built on C#. It also runs on Windows, with similar VM workarounds for Mac users. It integrates more tightly with brokers out of the box, which is a plus for traders seeking automation with less custom development.

Verdict: Amibroker gives you lifetime value and speed, but Wealth‑Lab is more beginner-friendly out of the box.

Amibroker Main View:

Wealth-Lab Main View:

Market Access & Data Support in Amibroker VS NinjaTrader

Both platforms support global markets, but with some differences in setup and ease:

- AmiBroker relies on external data feeds like Norgate, Interactive Brokers, and Yahoo. Setup is manual but offers flexibility.

- Wealth‑Lab supports real-time and historical data via built-in integrations, including free options and broker feeds.

Verdict: Wealth‑Lab wins for ease of market data setup. AmiBroker is more flexible but less plug-and-play.

Amibroker Backtesting Interface:

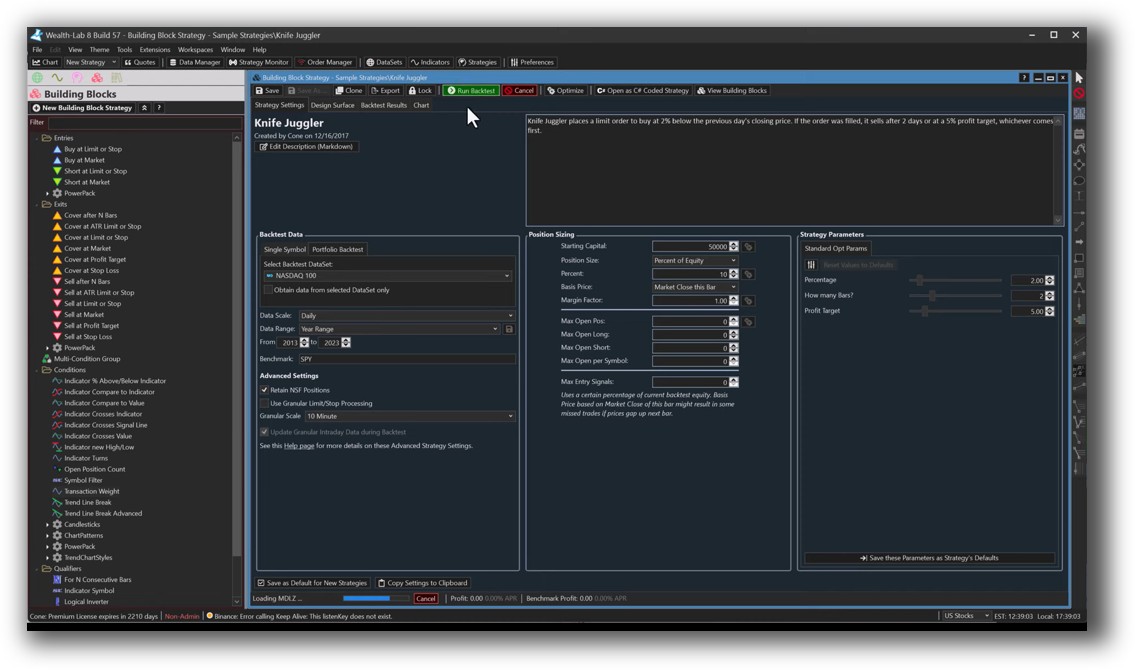

Wealth-Lab Backtesting Interface:

Building & Customizing Trading Strategies

AmiBroker shines if you’re comfortable writing code. The flexibility is massive, but the AFL scripting language has a learning curve. There’s no drag-and-drop builder – you’re either scripting or not trading.

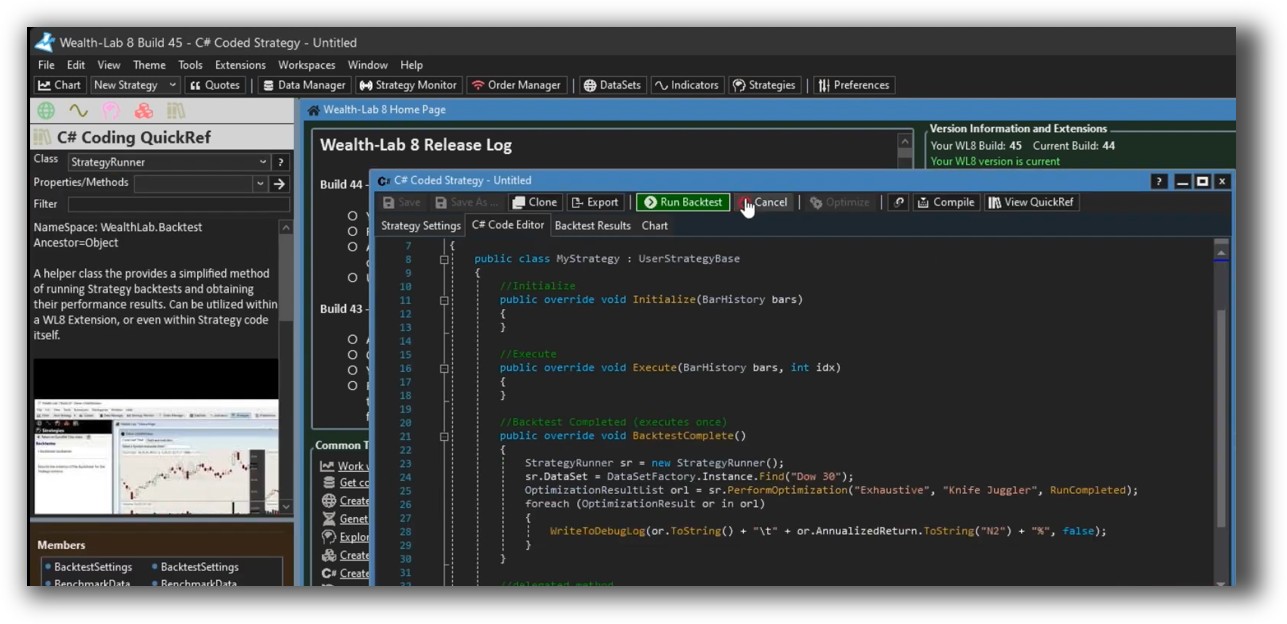

Wealth‑Lab offers both code and no-code workflows. You can use its drag-and-drop Block Builder or get under the hood with C# via WealthScript.

Verdict: Wealth‑Lab is faster to learn and build with. AmiBroker is more powerful for custom strategies if you’re a coder.

Check Out: Trading System Development

Amibroker Code Editor:

Wealth-Lab Code Editor:

Backtesting Performance, Speed & Realism

Here’s where things get serious.

AmiBroker is widely respected for its very fast backtesting engine. It supports realistic position sizing, portfolio-level testing, and simulations over thousands of instruments. You can even simulate slippage and realistic execution delays.

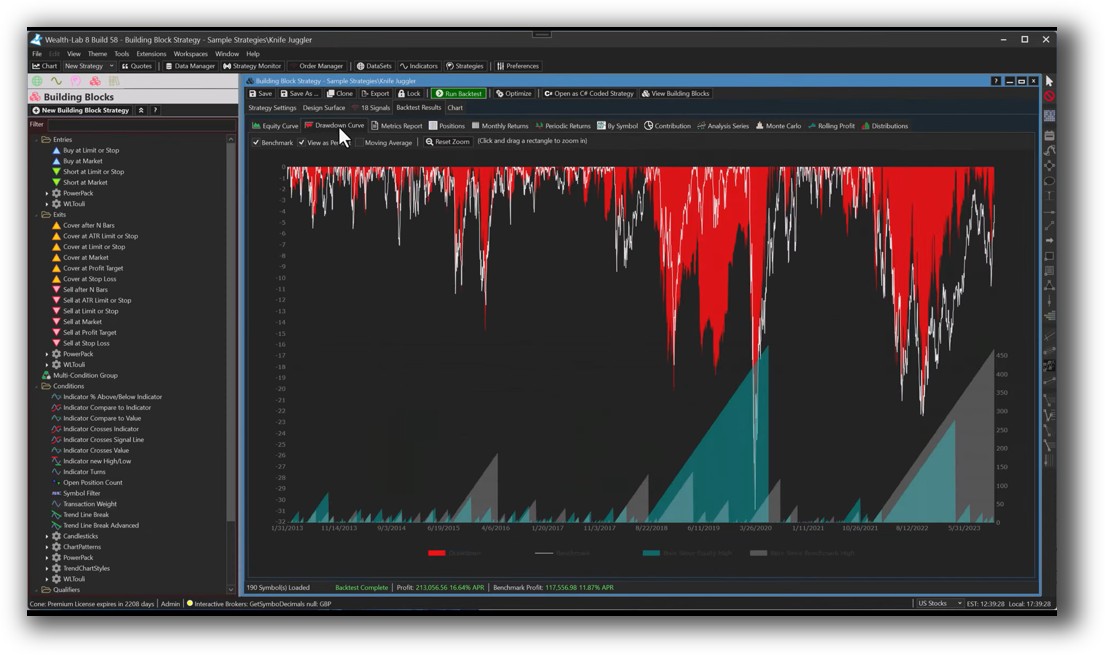

Wealth‑Lab supports portfolio simulation as well, with walk-forward analysis and Monte Carlo testing, but its engine isn’t quite as fast as AmiBroker’s for large universes.

Verdict: For pure backtesting performance and realism, AmiBroker has the edge.

Check out: Backtesting | Drawdown

Amibroker Backtest Report:

Wealth-Lab Backtest Report:

Strategy Optimization & Stress Testing Tools

Both tools offer powerful optimization capabilities:

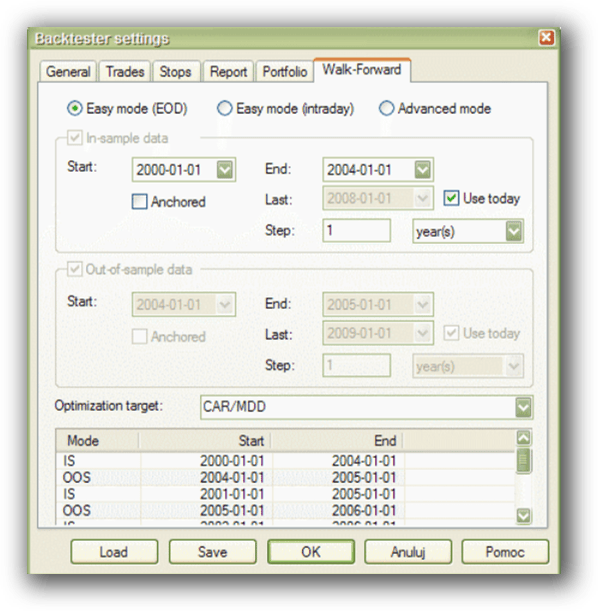

- AmiBroker provides exhaustive, Monte Carlo, genetic algorithms, and out-of-sample testing.

- Wealth‑Lab includes evolutionary optimization, walk-forward, and parameter stability tools.

Verdict: Both platforms are solid. AmiBroker offers more configuration flexibility, but Wealth‑Lab makes robustness testing more approachable.

Check Out: Trading System Optimization

Amibroker Walk-Forward Tab:

Wealth-Lab Walk-Forward Optimization:

Charting Features, Signal Exploration & Live Execution

AmiBroker is in a league of its own for charting. You can build custom indicators, color-code charts, and scan thousands of stocks in seconds.

Wealth‑Lab supports scanning and charting, but it’s more basic and functional rather than beautiful. However, Wealth‑Lab takes the lead on broker integration and trade automation with built-in support for IB, Tradier, and others.

Verdict: Use AmiBroker if deep technical analysis and scanning are core to your workflow. Use Wealth‑Lab if automation is your focus.

Check out Order Types | Automated Trading Systems

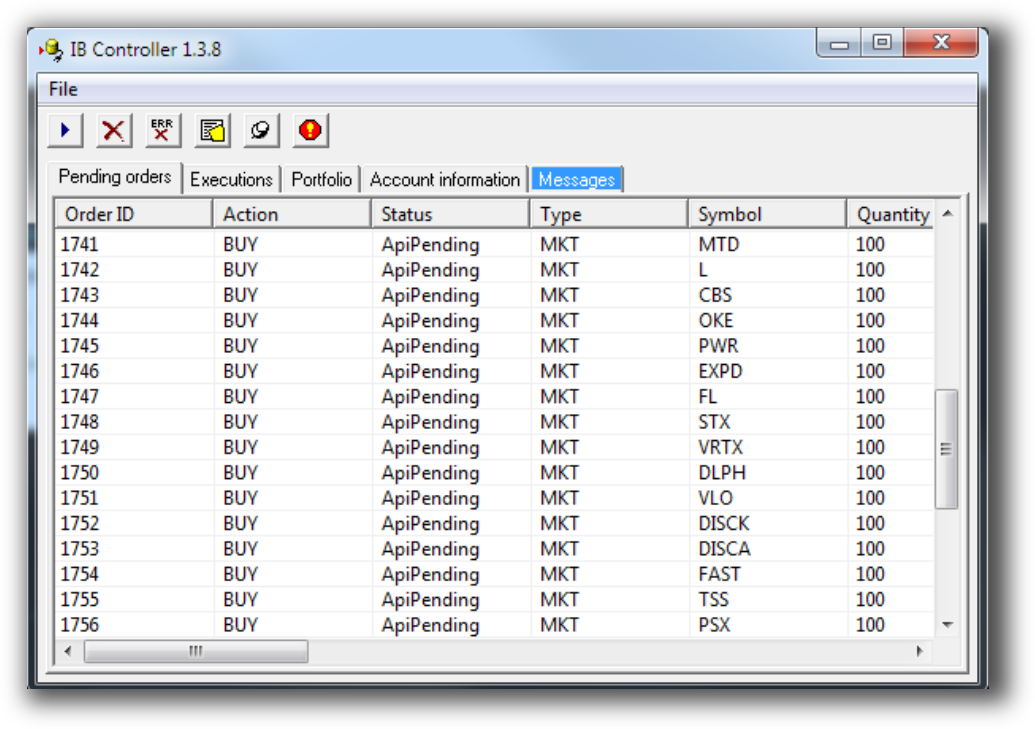

Amibroker Automation Set Up (IB Controller):

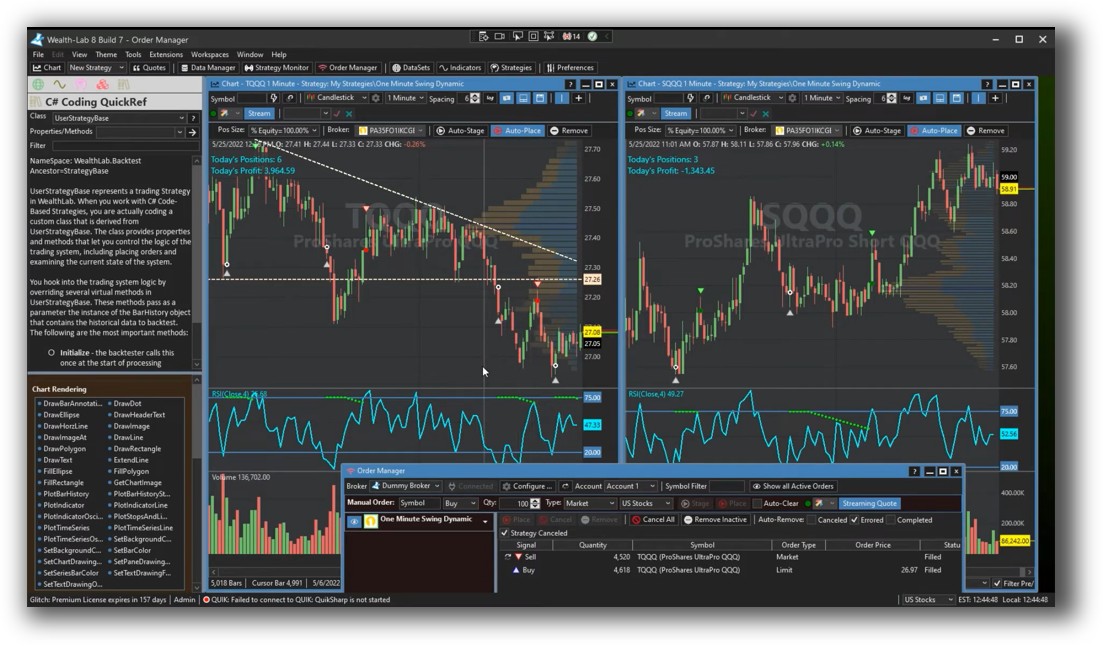

Wealth-Lab Automation Set Up:

Support, Documentation & Learning Resources

AmiBroker’s documentation is deep, but dated. Learning AFL takes effort and much of the community support is in forums, not official channels.

Wealth‑Lab has more current documentation, in-software tooltips, and a more modern interface for learning and support. Its drag-and-drop builder also helps flatten the learning curve.

Verdict: Wealth‑Lab is easier to learn. AmiBroker is better for those willing to invest in mastering the tool.

Amibroker Forum is illustrated down below:

Wealth-Lab Forum/Community is illustrated down below:

Amibroker VS Wealth-Lab: Which One Should You Use?

If you’re analytical, want full control, and aren’t afraid of a bit of code, AmiBroker is the superior backtesting software for speed, customization, and systematic trading.

If you want a smoother start, quicker automation, and support for C# with less manual setup, Wealth‑Lab offers great functionality in a more modern package.

Our Recommendation

At Enlightened Stock Trading, we’ve tested dozens of platforms. While RealTest remains our top choice for serious system traders due to speed, realism and ease of use, AmiBroker is still one of the best options available for charting, scanning and custom strategy development .

Wealth‑Lab may suit traders who want a more integrated experience, especially for broker automation and visual strategy design.

Want the Rest of the Puzzle?

Choosing the right backtesting software is just the start. To eliminate second-guessing, emotional trades, and wasted time, you need:

- A complete trading system that fits you

- A clear workflow from signal to execution

- Real confidence in your system’s edge

That’s what you get in The Trader Success System – our flagship mentoring program designed for smart analytical traders who want structure, not guesswork.

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)