MultiCharts vs Beyond Charts: Comparing Backtesting Software for Systematic Trading

If you’re comparing MultiCharts vs Beyond Charts to find the best backtesting software for your trading strategy, here’s the short answer:

MultiCharts is a more powerful and flexible platform for systematic traders who need serious backtesting, portfolio simulation, and broker integration. Beyond Charts, on the other hand, is more focused on technical charting and manual trade planning. If you want to build and test profitable trading systems across multiple markets, MultiCharts is the more capable tool.

Let’s dive deeper.

MultiCharts vs Beyond Charts at a Glance:

Short on time? Here’s how MultiCharts vs Beyond Charts compare side by side.

|

Feature |

MultiCharts |

Beyond Charts |

|

OS Compatibility |

Windows only (Mac via emulator) |

Windows only (Mac via emulator) |

|

Programming |

PowerLanguage (EasyLanguage-compatible) |

BCFL (proprietary scripting) |

|

Broker Integration |

Yes – Multiple brokers supported |

No integration |

|

Backtesting |

Advanced portfolio-level engine |

Basic (not portfolio-based) |

|

Charting |

Strong |

Charting-focused |

|

Strategy Automation |

Supported |

No automation |

|

Cost |

Subscription or lifetime license |

~$595 AUD one-time |

|

Ideal User |

Systematic traders & coders |

Visual chart-based traders |

| Documentation Quality | OK, slightly dated | Actively maintained, modern interface |

| Pricing | One-time license or subscription | Subscription only (US$39.95/mo) |

Platform Overview, Cost & Compatibility

Both MultiCharts and Beyond Charts are Windows-based applications, meaning Mac users will need to use a virtual machine like Parallels or Bootcamp. Wine is not recommended due to instability.

MultiCharts offers both a free trial and multiple pricing models – either a subscription or a one-time license fee. Beyond Charts is a one-time purchase (~AUD $595), also with a free trial period.

However, cost alone shouldn’t drive your decision. You need the right tool for your trading style

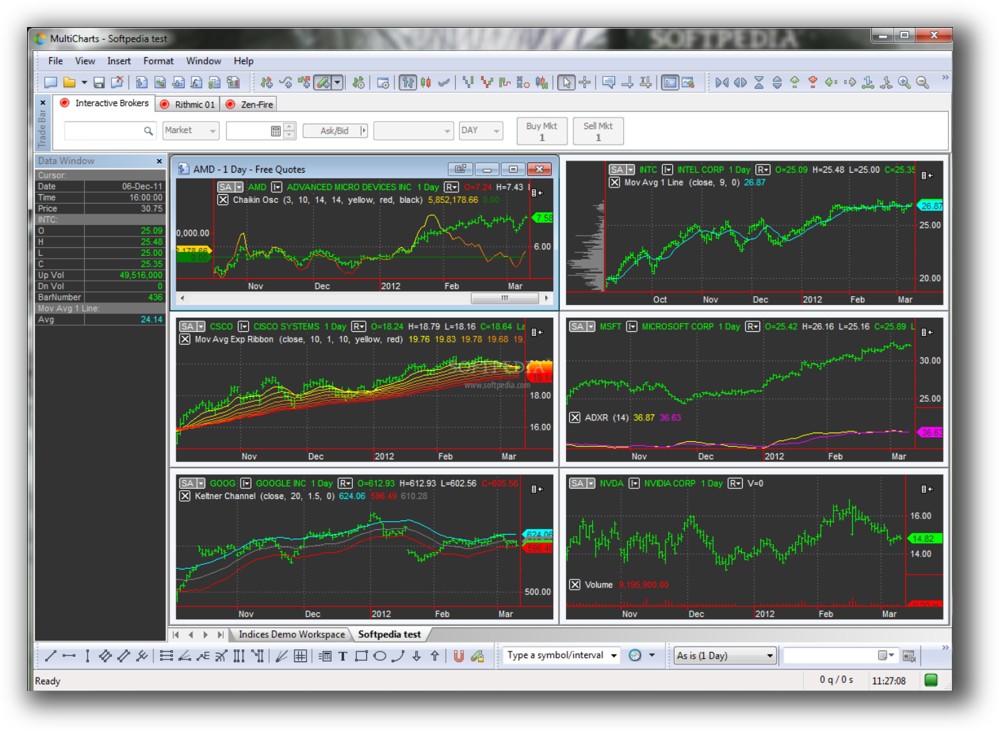

MultiCharts Main View:

Market Access & Data Support in MultiCharts vs Beyond Charts

MultiCharts stands out with extensive multi-broker integration, supporting Interactive Brokers, CQG, OANDA, and more. This makes it easier to test, trade, and automate your systems using real execution data.

Beyond Charts does not offer brokerage integration. It’s intended more for manual trading and chart analysis than for live system execution or brokerage connectivity.

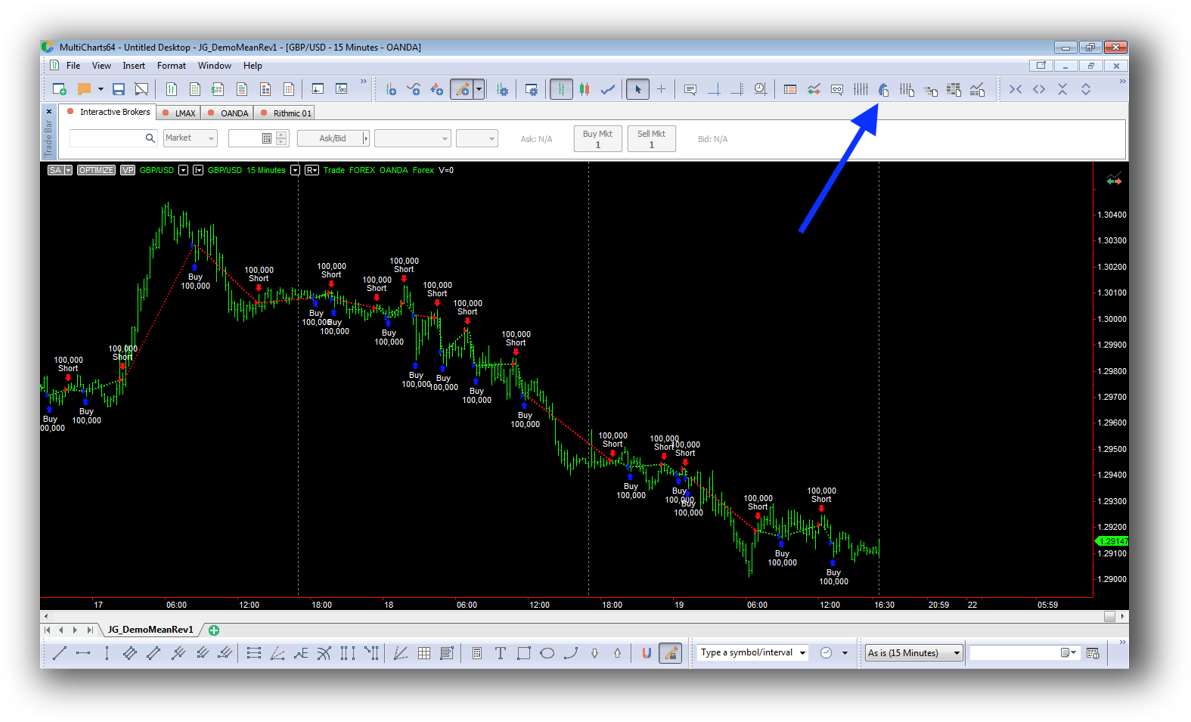

MultiCharts Backtesting Interface:

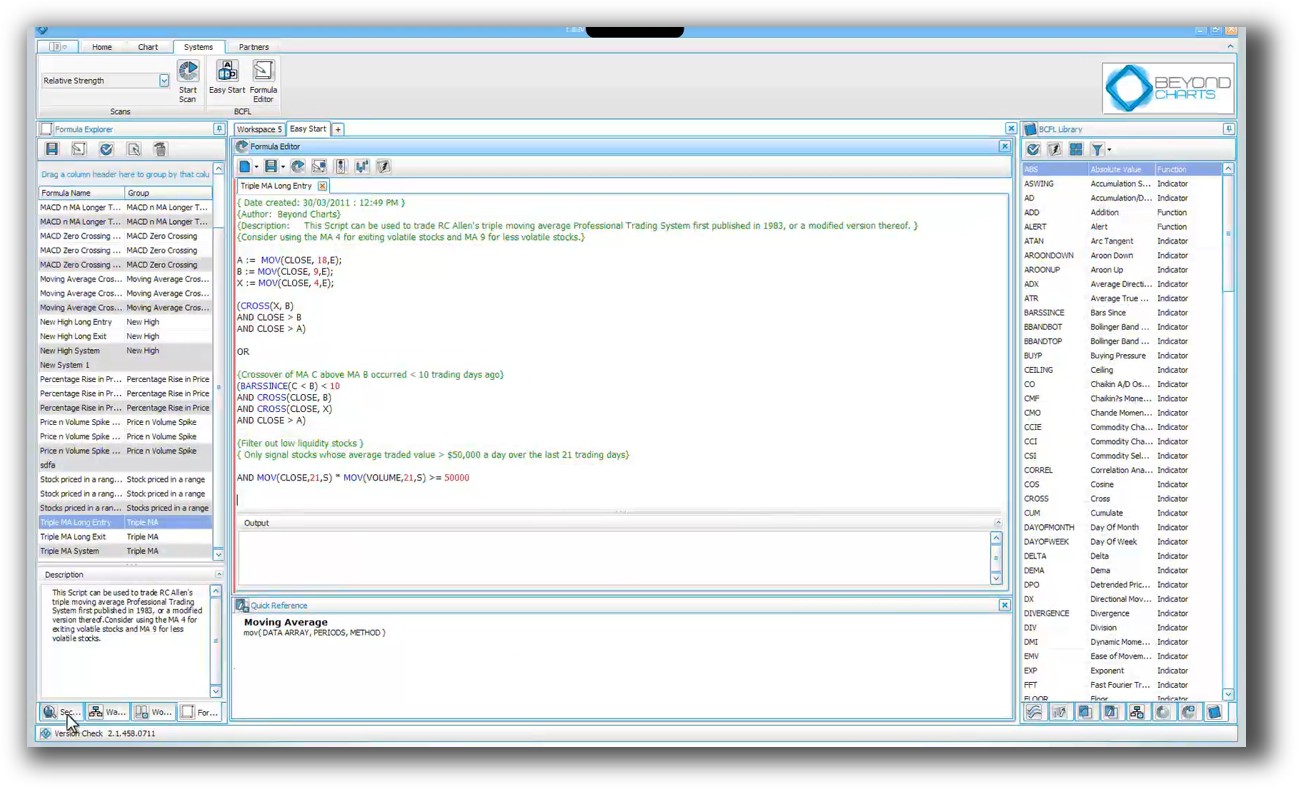

Beyond Charts Backtesting Interface:

Building & Customizing Trading Strategies

With MultiCharts, you can write strategies in PowerLanguage, which is EasyLanguage-compatible, a huge plus if you’re migrating from TradeStation or have existing code. You can also import third-party strategies and manage code modularly.

Beyond Charts uses BCFL (Beyond Charts Formula Language), a custom language that supports some conditional logic and indicator formulas, but lacks the flexibility and ecosystem support of PowerLanguage. There’s no portfolio management or modular strategy building.

For traders focused on systematic trading system development, MultiCharts provides the necessary tools. Beyond Charts is more suited to those looking to visually identify signals.

Check Out: Trading System Development

MultiCharts Code Editor (PowerLanguage):

Beyond Charts Code Editor:

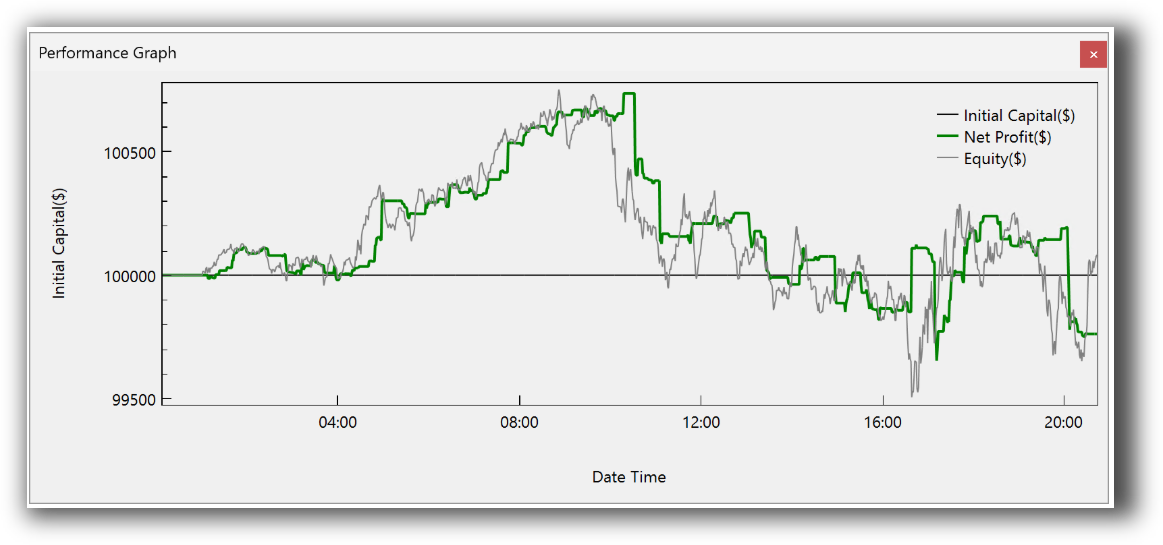

Backtesting Performance, Speed & Realism

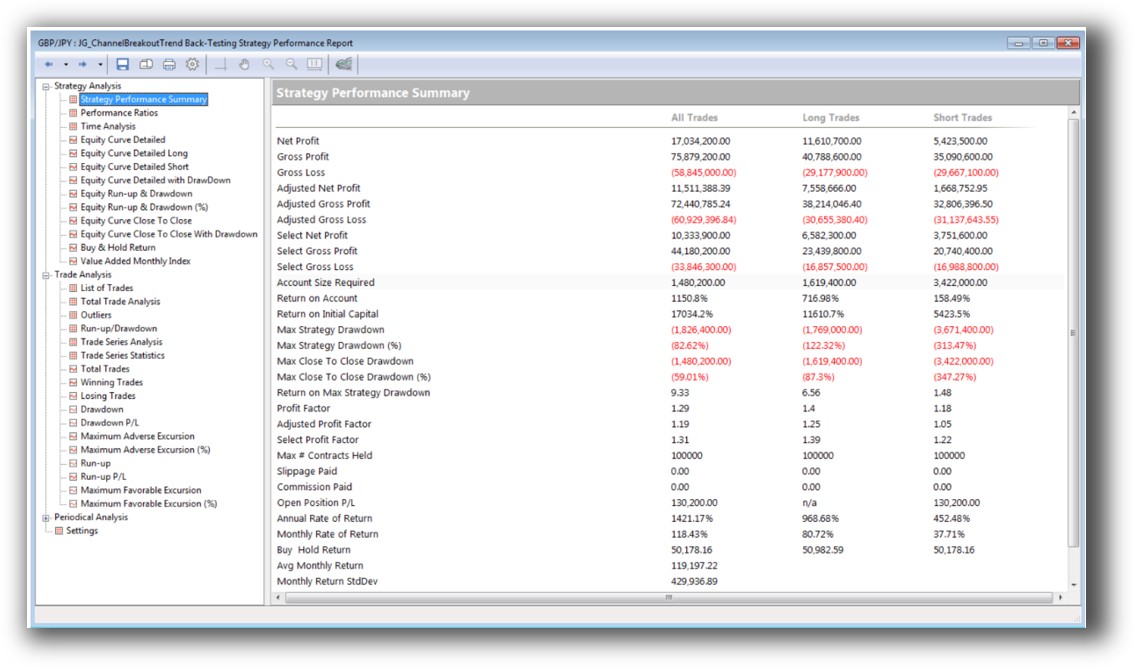

MultiCharts includes a fast and realistic portfolio backtester with slippage, commissions, position sizing, and multi-strategy testing. You can simulate entire portfolios across asset classes, using multiple systems, essential for building confidence in your strategy’s edge.

Beyond Charts offers backtesting, but it is limited to single instruments and lacks portfolio simulation. It’s slower and more restrictive when testing multiple strategies across diversified markets.

In systematic trading, backtesting is your decision engine. Without reliable portfolio-level testing, you’re flying blind.

Check out: Backtesting | Drawdown

MultiCharts Backtest Report:

Beyond Charts Backtest Report:

Strategy Optimization & Stress Testing Tools

MultiCharts supports multi-variable optimization, including walk-forward testing and Monte Carlo simulations. This is essential to avoid curve fitting and to validate that your edge is statistically sound.

Beyond Charts does not include this functionality. Optimization is either extremely basic or unavailable.

If you want to properly perform trading system optimization, MultiCharts is the better choice by a wide margin.

Check Out: Trading System Optimization

MultiCharts Walk-Forward Parameters:

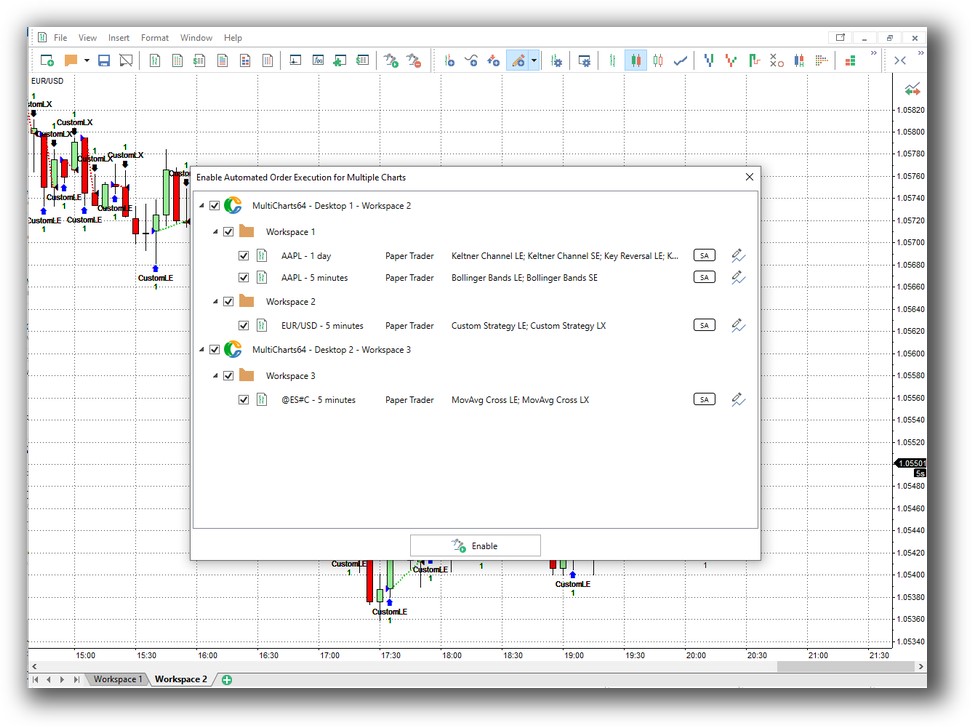

Charting Features, Signal Exploration & Live Execution

Beyond Charts is a charting-focused platform. Its scanning and charting tools are more visual, making it good for discretionary or semi-systematic traders who want to manually browse stocks and signals.

MultiCharts offers charting as well, but it shines more on the system-building side. Execution can be fully automated through supported brokers. You can even set up automated alerts, trading rules, and conditional execution, saving hours of screen time.

If you’re after full automated trading systems, Beyond Charts won’t take you there.

Check Out Order Types | Automated Trading Systems

MultiCharts Automation Set Up:

Support, Documentation & Learning Resources

MultiCharts provides detailed documentation and has a large community thanks to its EasyLanguage roots. It also includes decent customer support and active forums.

Beyond Charts has very limited online documentation and a much smaller user base. The support materials are harder to find and less comprehensive, which can become frustrating as you advance.

For fast implementation, clear support is crucial. That’s one reason RealTest, which has clear and modern documentation, is the preferred backtesting engine for Enlightened Stock Trading systems .

MultiCharts Forum Front Page is illustrated down below:

Beyond Charts Forum Front Page is illustrated down below:

MultiCharts vs Beyond Charts: Which One Should You Use?

If your focus is on building robust, rules-based trading systems, testing them across markets, and scaling up through automation, MultiCharts wins in nearly every critical category.

Choose Beyond Charts only if you’re primarily interested in charting, scanning, and manual signal analysis.

Our Recommendation

At Enlightened Stock Trading, we favor RealTest for systematic traders due to its speed, realism, and ease of use. That said, MultiCharts is a capable second choice, particularly if you’re already comfortable with EasyLanguage or need strong broker integration.

Beyond Charts may feel intuitive for visual traders but lacks the depth required for serious system development, validation, and diversification.

If you want to reduce screen time, eliminate second-guessing, and build confidence with a tested, automated strategy – choose tools that support that goal. Your time is too valuable to waste on software that limits your growth.

Want The Rest of the Puzzle?

Backtesting software is just one piece. The real transformation happens when you align your tools, your systems, and your psychology with your goals.

If you’re tired of chasing tips and want to build wealth systematically, the next step is clear: The Trader Success System.

Inside, you’ll discover:

- Proven trading systems

- A step-by-step backtesting framework

- Position sizing tools

- Automation strategies that let you trade in 30 minutes or less

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)