NinjaTrader VS Wealth-Lab Comparing Backtesting Software for Systematic Trading

Short answer: Both are capable, but neither is ideal for serious systematic traders focused on portfolio-level backtesting, speed, and simplicity. If you’re looking for deep realism, faster testing, and clarity in your trading decisions, RealTest is a better fit.

Still, if you’re comparing NinjaTrader and Wealth-Lab for features, here’s what you need to know.

NinjaTrader VS Wealth-Lab at a Glance

Short on time? Here’s how NinjaTrader VS Wealth-Lab compare side by side.

|

Feature |

NinjaTrader |

Wealth-Lab |

|

First Release |

2003 |

2000 |

|

OS Compatibility |

Windows only (full version) |

Windows only |

|

Cost |

Free for basic use; lease or lifetime for advanced |

$39.95/month or $299.95/year |

|

Programming Language |

NinjaScript (C#/.NET) |

WealthScript (C#/.NET), drag & drop |

|

Integrated Broker |

Native |

Via extension (IB, Tradier, Alpaca) |

|

Automation Support |

Yes, integrated |

Yes, via extensions |

|

Charting Quality |

High |

High |

|

Backtesting Speed |

Moderate |

Moderate |

|

Portfolio Backtesting |

Limited (per instrument) |

Supported (single and multi-system) |

|

Support & Docs |

Detailed but complex |

Improved, some legacy docs |

|

Mobile/Web Access |

Web & mobile companion |

Partial via extensions |

Platform Overview, Cost & Compatibility

- NinjaTrader is Windows-based with a modern UI, offering a free version for charting and simulation, but you’ll need to pay (via lease or lifetime license) to unlock advanced features like automated trading.

- Wealth-Lab is also Windows-only, offering a $39.95 monthly subscription or $299.95/year. It includes multi-system backtesting and drag-and-drop tools to build strategies.

Neither platform runs natively on Mac. If you’re on macOS, you’ll need Parallels or a similar VM. Avoid Wine – it’s unreliable for trading software.

NinjaTrader Main View:

Wealth-Lab Main View:

Market Access & Data Support in NinjaTrader VS Wealth-Lab

- NinjaTrader natively supports futures and forex data and acts as a brokerage.

- Wealth-Lab connects to data via extensions – including Yahoo, AlphaVantage, and Norgate (recommended for end-of-day system traders).

Both offer decent market access, but for systematic traders working with stocks across global markets, data via Norgate Data remains essential – and both platforms support it via plugins.

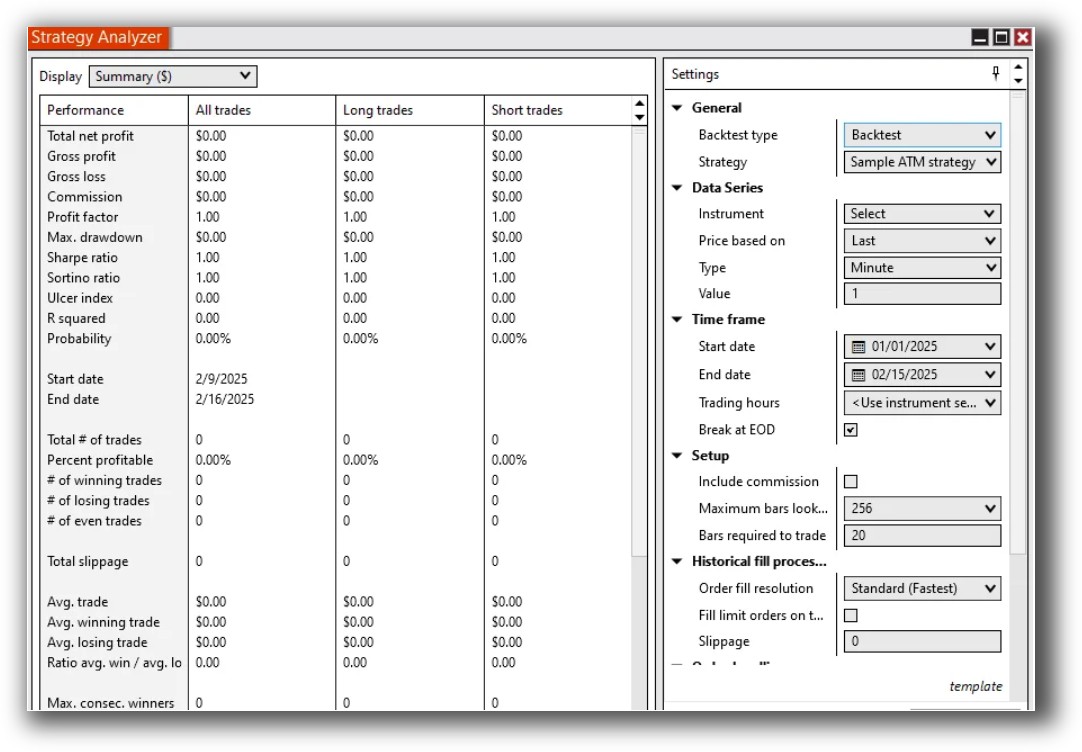

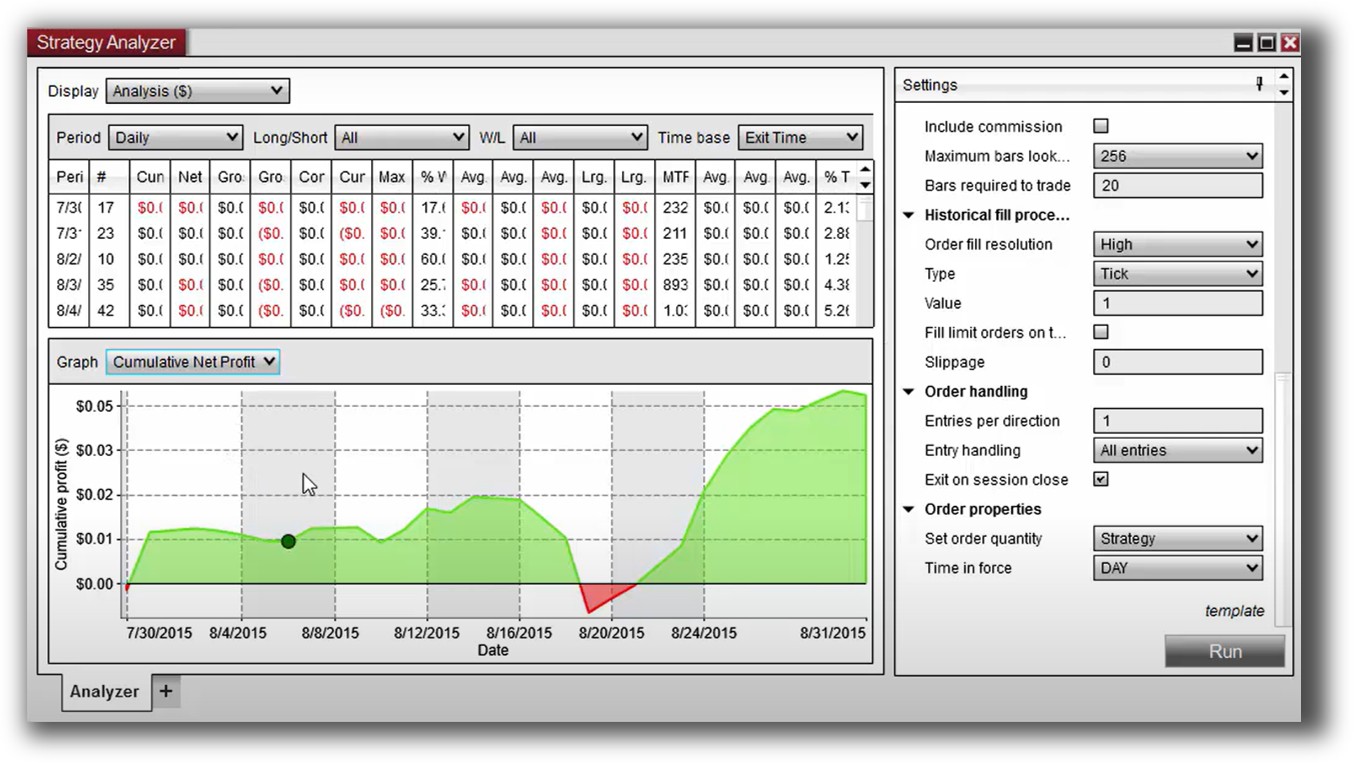

NinjaTrader Backtesting Interface:

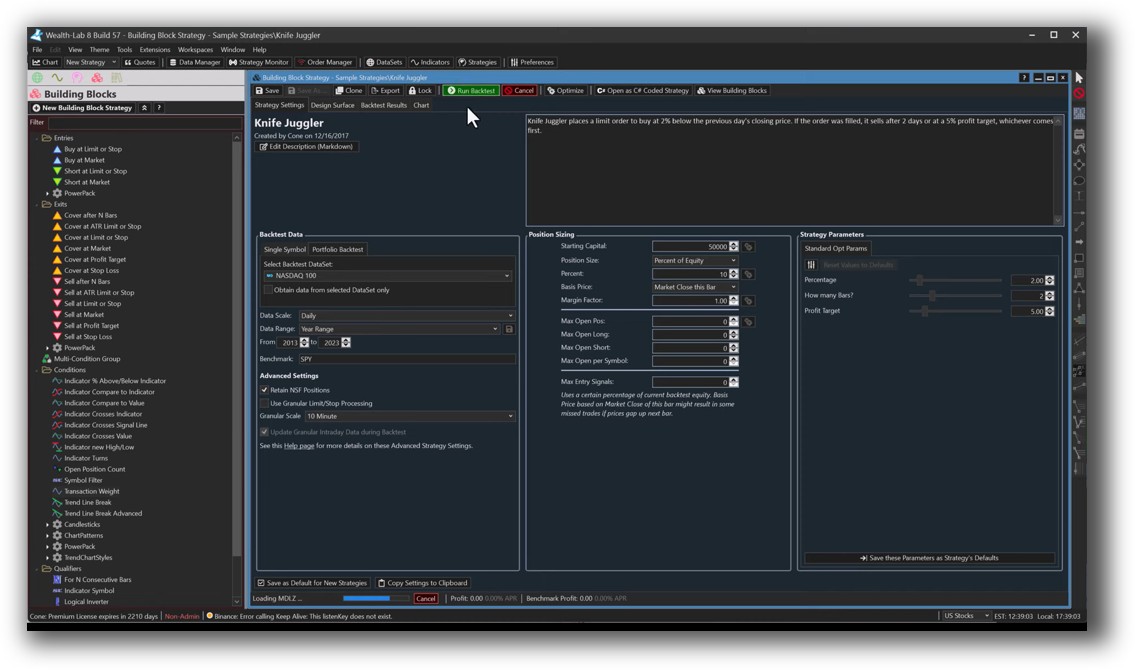

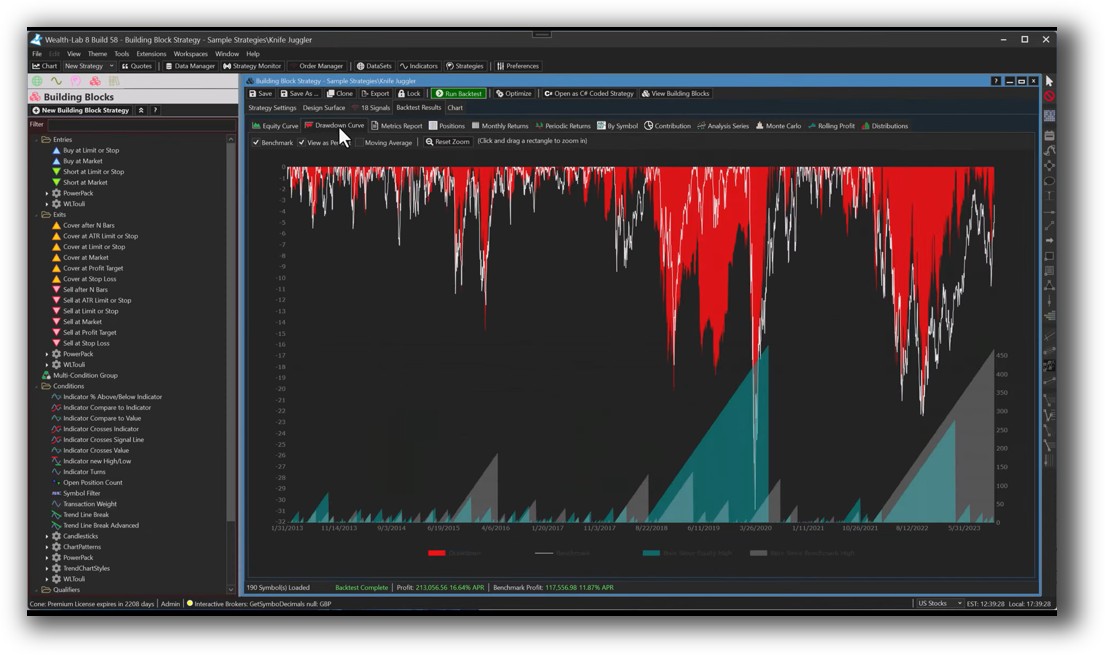

Wealth-Lab Backtesting Interface:

Building & Customizing Trading Strategies

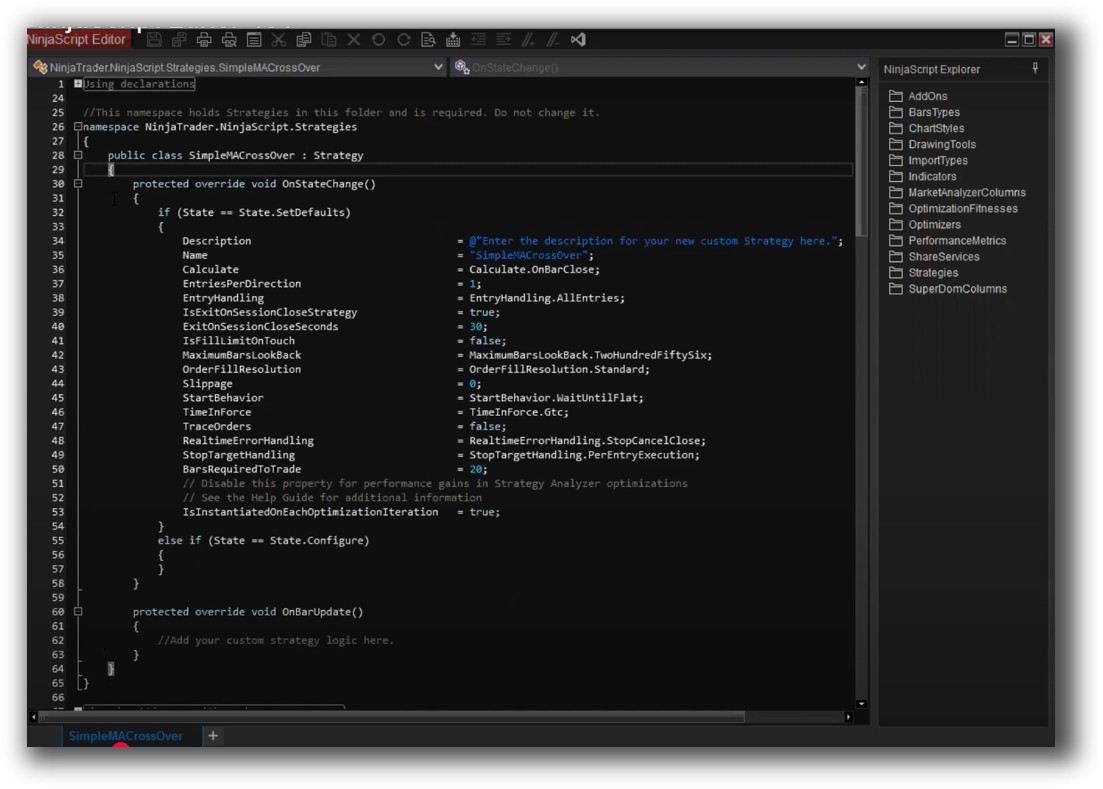

- NinjaTrader uses NinjaScript (C# based) and is focused more on discretionary and intraday traders.

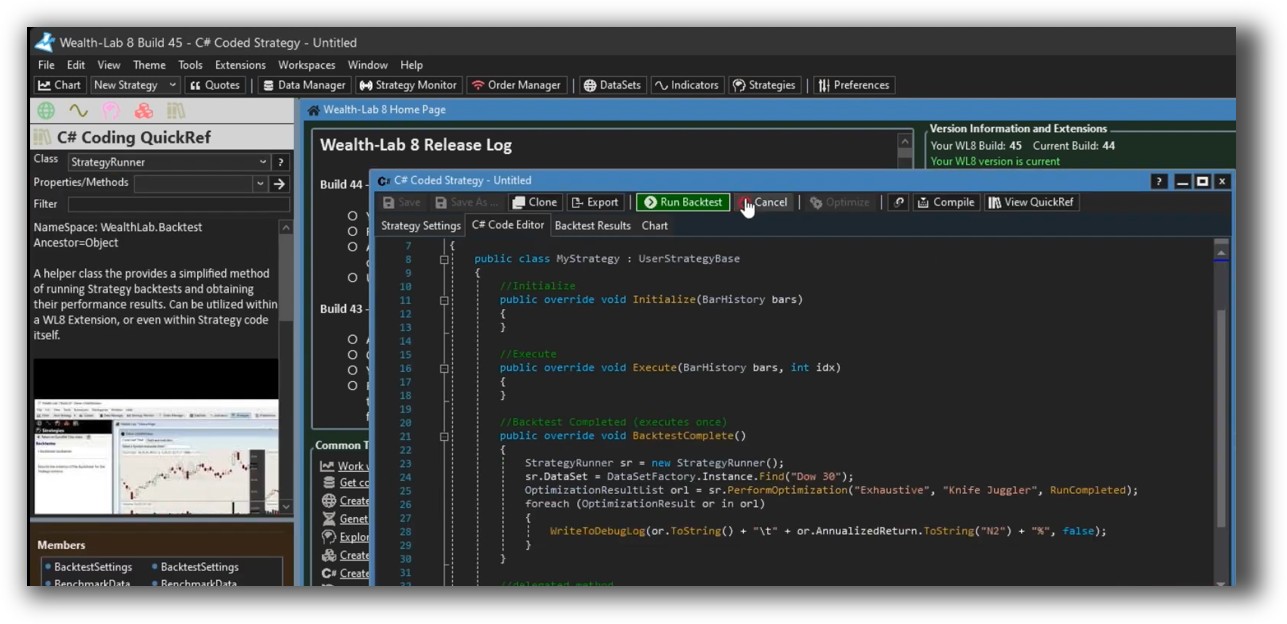

- Wealth-Lab offers more flexibility: code in C# or use a drag-and-drop builder to visually design your trading strategy.

If you’re technical and already fluent in .NET, both will work. But if you want to avoid coding altogether and just test profitable systems quickly, these tools have a learning curve.

Check Out: Trading System Development

NinjaTrader Code Editor (NinjaScript Editor):

Wealth-Lab Code Editor:

Backtesting Performance, Speed & Realism

Here’s where things get serious.

- NinjaTrader’s backtesting engine runs simulations per instrument. Multi-strategy or portfolio-level backtests are not its strong suit.

- Wealth-Lab allows multi-symbol and portfolio-wide testing – even multiple systems at once.

However, neither platform matches RealTest in speed, stability, or portfolio realism. RealTest was built specifically for backtesting entire portfolios with high-fidelity results and no fluff. It avoids the overhead and assumptions baked into older platforms.

If you want to simulate real-world position sizing, entries, exits, and cash exposure – RealTest is still the benchmark.

Check out: Backtesting | Drawdown

NinjaTrader Backtest Report:

Wealth-Lab Backtest Report:

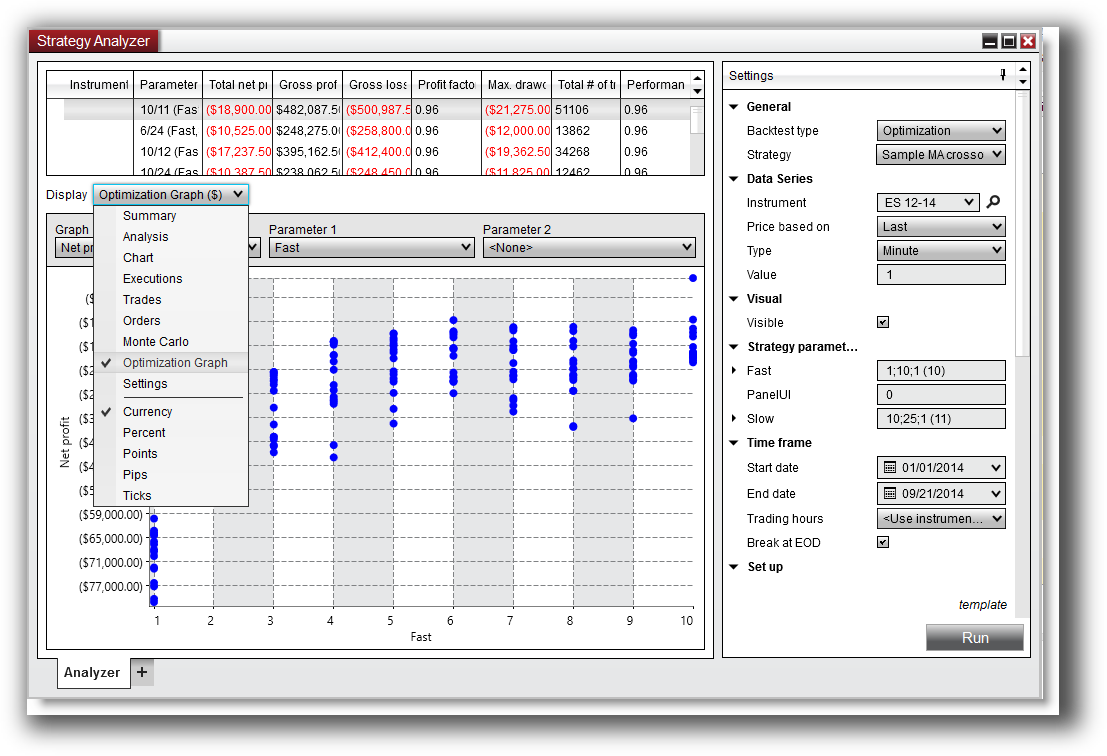

Strategy Optimization & Stress Testing Tools

- NinjaTrader includes walk-forward and parameter optimization tools. However, it’s prone to curve fitting if not used carefully.

- Wealth-Lab offers parameter sensitivity analysis, walk-forward testing, and Monte Carlo simulation, helping you explore strategy robustness.

Both platforms support trading system optimization, but you’ll need to manually watch for unstable peaks and overfitting traps. These tools are powerful – if you know what you’re doing.

Check Out: Trading System Optimization

NinjaTrader Optimization Graph:

Wealth-Lab Walk-Forward Optimization:

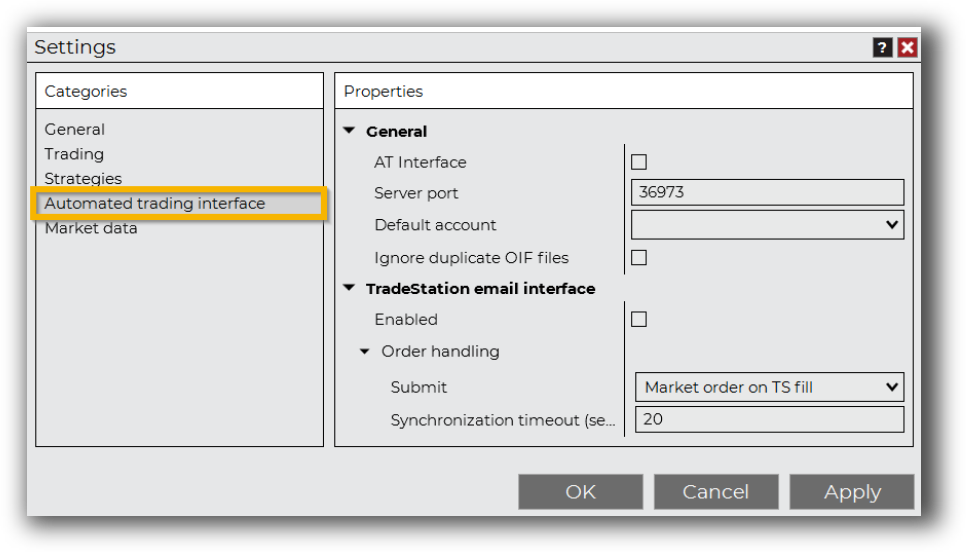

Charting Features, Signal Exploration & Live Execution

- NinjaTrader shines here. Clean charting, smooth visual order placement, and broker integration (especially for futures) make it ideal for traders who want tight execution tools.

- Wealth-Lab offers robust charting too, plus scanning and signal generation across multiple markets. Strategy-based alerts are also supported.

However, neither platform is best-in-class for charting. If you want intricate chart setups or custom visual studies, Amibroker still leads in this space.

Check Out Order Types | Automated Trading Systems

NinjaTrader Automation Set Up:

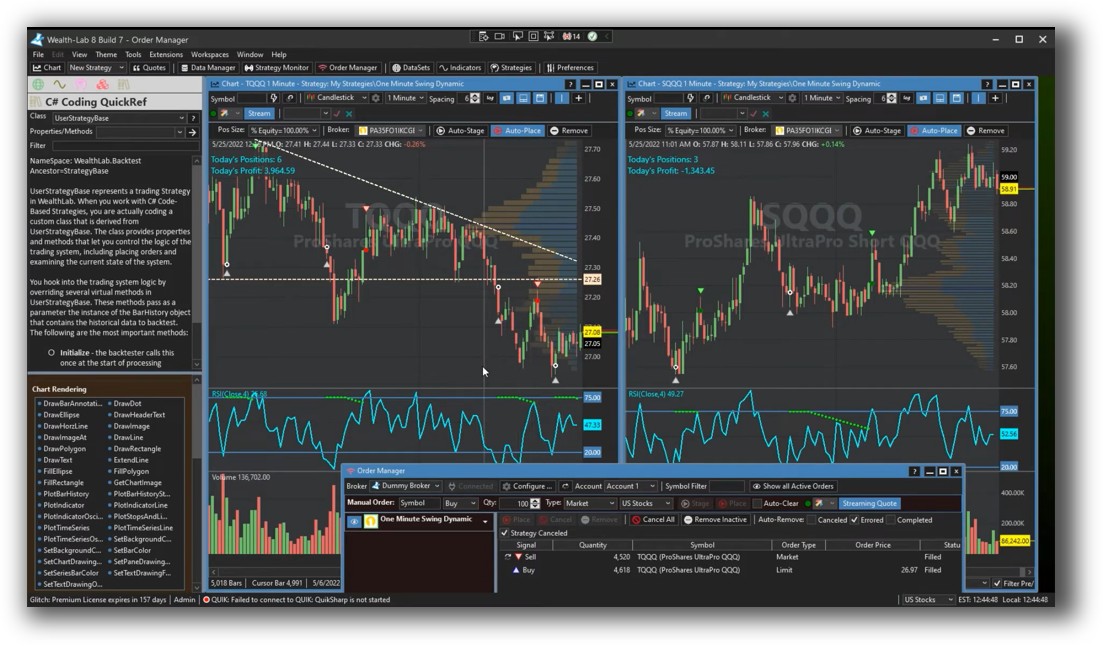

Wealth-Lab Automation Set Up:

Support, Documentation & Learning Resources

- TradeStation: Lots of legacy content, but the platform feels fragmented. Docs often lag behind software changes.

- Wealth-Lab: Regular updates, an active forum, and structured documentation make it easier to learn.

However, if you’re after clear, modern, intuitive documentation, RealTest again outshines both.

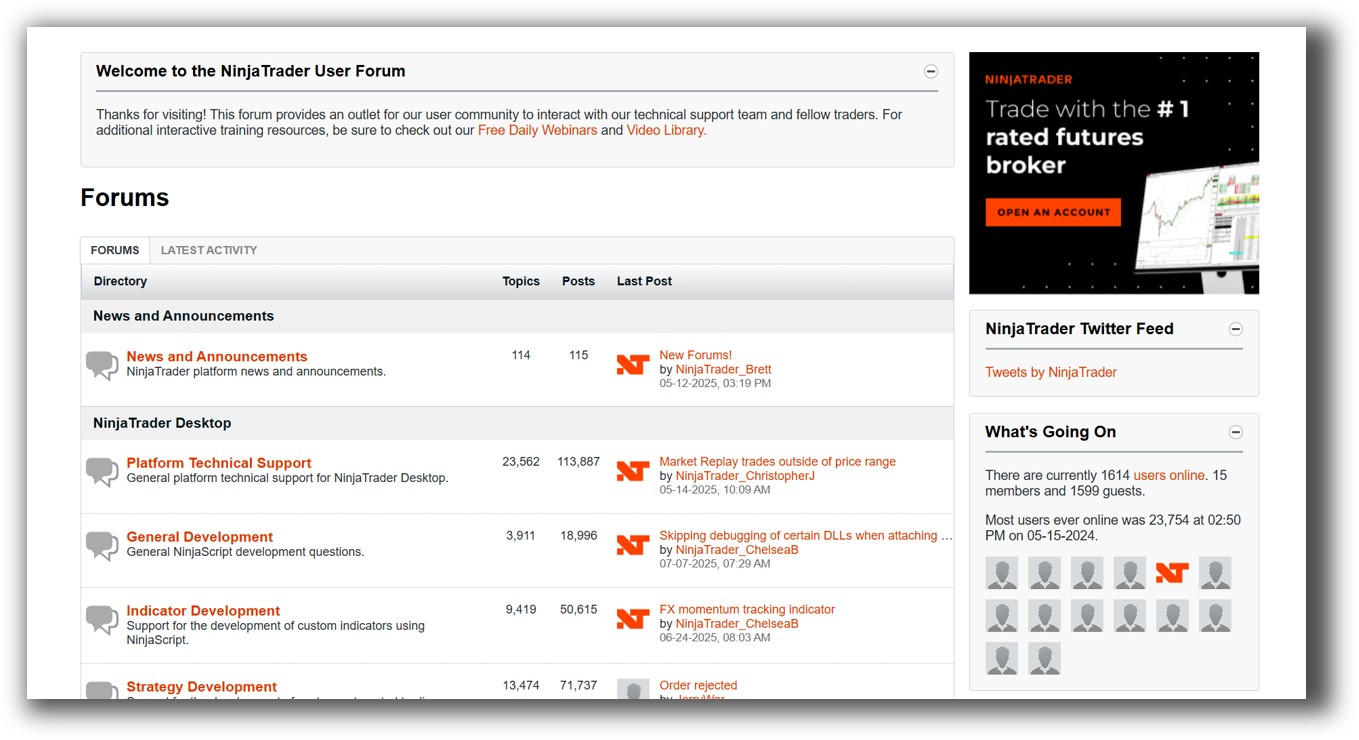

NinjaTrader Forum Front Page is illustrated down below:

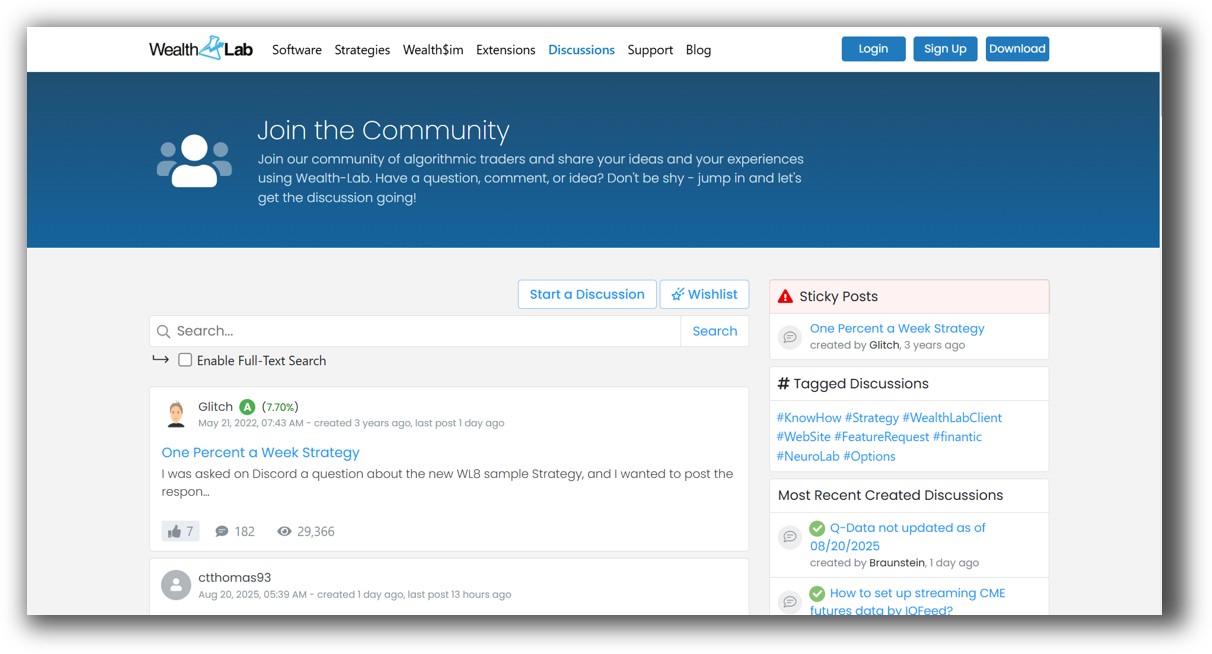

Wealth-Lab Forum Front Page is illustrated down below:

NinjaTrader VS Wealth-Lab: Which One Should You Use?

If you’re an intraday discretionary trader who also wants basic scripting and charting, NinjaTrader gives you tight integration, broker support, and clean charts.

If you’re looking to run full-system backtests, portfolio-level simulation, and multi-strategy workflows with less scripting, Wealth-Lab is more systematic-trading friendly.

But if your goal is serious, realistic, and time-efficient backtesting across portfolios, neither tool is ideal.

Our Recommendation

NinjaTrader and Wealth-Lab both have their strengths, but if you’re focused on becoming a consistent, rules-based trader with a proven edge, you need more than code and charts.

You need software that:

- Tests entire portfolios

- Reflects real execution rules

- Shows you true drawdown

- Gives you confidence to go live

That’s where RealTest comes in.

And software alone isn’t enough. Your real breakthrough comes from learning how to design, test, and trust your trading systems… the right way.

Want The Rest of the Puzzle?

Backtesting software is just one piece. The real transformation happens when you align your tools, your systems, and your psychology with your goals.

If you’re tired of chasing tips and want to build wealth systematically, the next step is clear: The Trader Success System.

Inside, you’ll discover:

- Proven trading systems

- A step-by-step backtesting framework

- Position sizing tools

- Automation strategies that let you trade in 30 minutes or less

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)