RealTest vs MetaTrader-4: Comparing Backtesting Software for Systematic Trading

If you’re serious about building a profitable, systematic trading process, the tools you choose can make or break your progress. Both RealTest and MetaTrader 4 (MT4) are popular among traders – but they serve very different purposes.

So which is better for systematic traders who value speed, accuracy, and internal alignment?

Short answer:

For traders who want to develop, test, and manage robust trading systems with minimal fuss and maximum realism, RealTest is the clear winner.

But if you’re focused primarily on FX trading or want integrated broker execution and charting out of the box, MT4 may still be useful in certain scenarios.

Let’s dig deeper…

RealTest vs MetaTrader-4 at a Glance

Short on time? Here’s how RealTest and MetaTrader-4 compare side by side.

| Feature | RealTest | MetaTrader 4 (MT4) |

| Platform Focus | Backtesting + Systematic Trading | Primarily FX execution + indicator testing |

| Programming | Custom scripting (simple, readable) | MQL4 (complex, C-like) |

| OS Compatibility | Windows only (can use Parallels on Mac) | Windows + Mobile |

| Cost | US$389 once + US$159/year optional updates | Free (via broker) |

| Backtesting Engine | Fast, multi-strategy, portfolio-based | Single strategy, bar-by-bar |

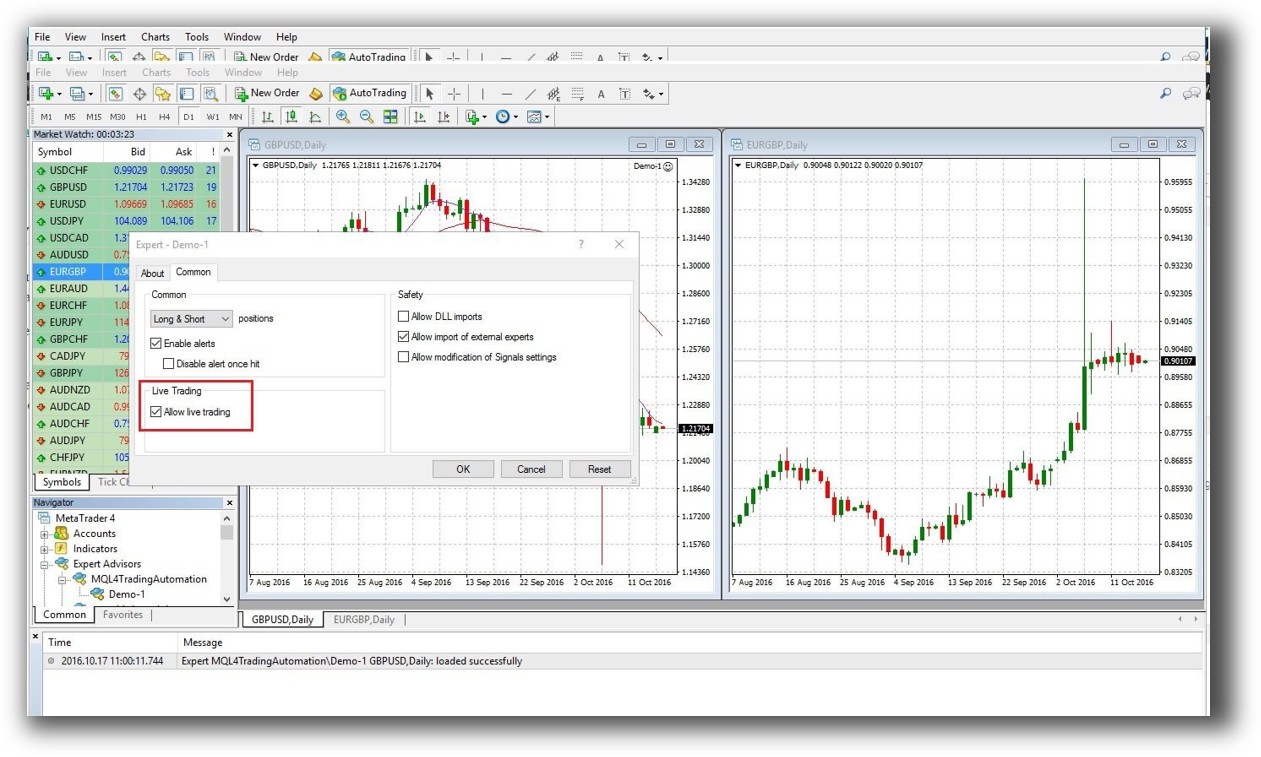

| Automation | Via exported orders, external execution | Full automation |

| Charting | Basic charts | Advanced, real-time charts |

| Ideal User | Systematic stock + crypto trader | FX discretionary/manual trader |

Platform Overview, Cost & Compatibility

RealTest is built specifically for systematic trading – it’s lean, fast, and efficient. You pay a one-time license fee (US $389) with an optional $159/year for ongoing updates. It runs on 64-bit Windows and can be used on Mac via Parallels or similar VM tools.

MT4, on the other hand, is free through most brokers, but you’re locked into the FX/CFD ecosystem. It supports Windows and has mobile apps, but lacks native Mac support without third-party tools.

If you want clean independence from brokers, RealTest is the clear choice.

RealTest Main View:

MetaTrader4 Main View:

Market Access & Data Support in RealTest and Optuma

RealTest is data-source agnostic. It works seamlessly with Norgate Data, CSV files, and other static data formats. This makes it ideal for stock and crypto backtesting.

MT4 is tightly integrated with broker data, which suits FX but makes it difficult to test with historical equity datasets or simulate longer-term portfolio trading systems.

So for stocks, crypto, and multiple market access, RealTest is significantly more flexible.

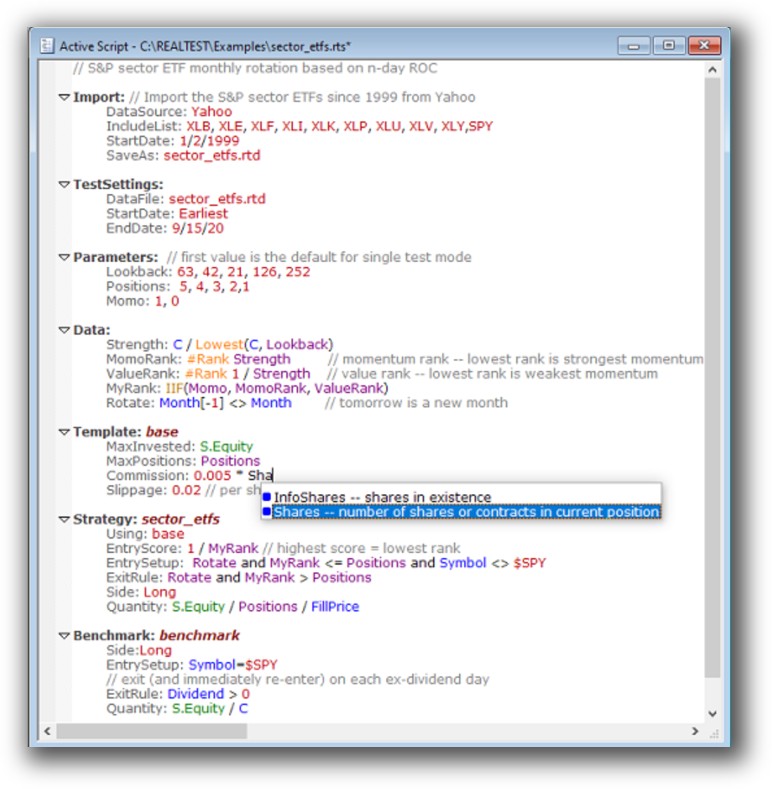

RealTest Backtesting Interface:

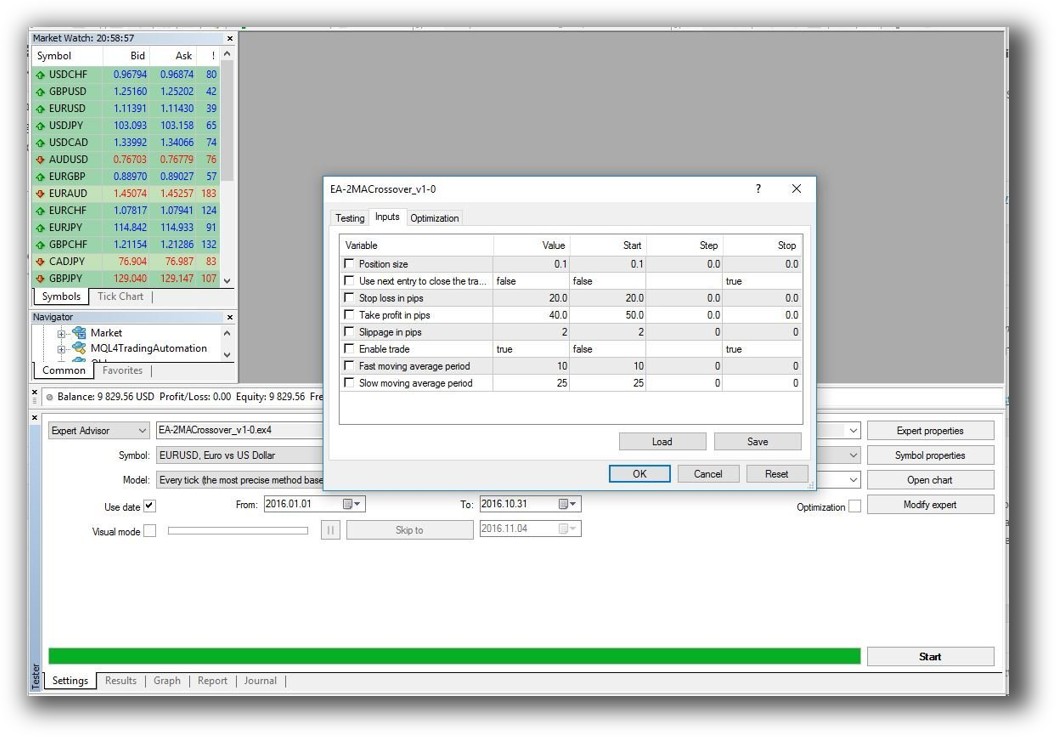

MetaTrader-4 Backtesting Interface:

Building & Customizing Trading Strategies

RealTest uses plain-text scripts that are simple, intuitive, and easy to read. You don’t need to be a coder to build complex ideas. The scripting feels more like “filling out a form” than writing code.

MT4 uses MQL4, which is powerful but complex. Unless you’re already comfortable with C-style syntax and object-oriented programming, expect a steep learning curve.

Most traders don’t want to spend weeks learning a new coding language just to build a rule-based strategy. RealTest removes that friction entirely.

Check Out: Trading System Development

RealTest Code Editor:

MetaTrader-4 Code Editor:

Backtesting Performance, Speed & Realism

This is where RealTest really shines.

RealTest runs multi-strategy, multi-market portfolio backtests with high-speed, high-fidelity simulation. It respects position sizing, cash constraints, and allows for deep control of execution modeling – including slippage, commissions, and portfolio-level dynamics.

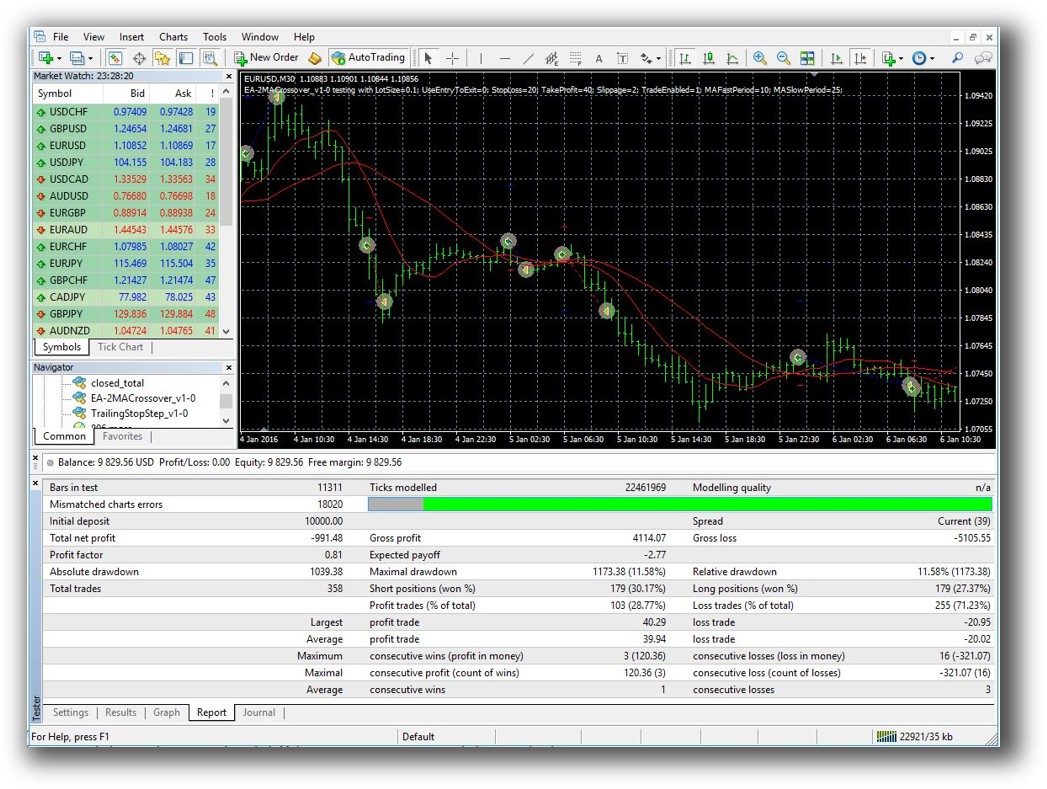

MT4’s backtest engine is single-instrument, bar-by-bar, and typically unrealistic for anything beyond single instrument and indicator testing. Position sizing, portfolio simulation, and drawdown analysis are extremely limited.

If you’re building real systems to trade your actual money, realism matters. RealTest is unmatched here.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

MetaTrader-4 Backtest Report:

Strategy Optimization & Stress Testing Tools

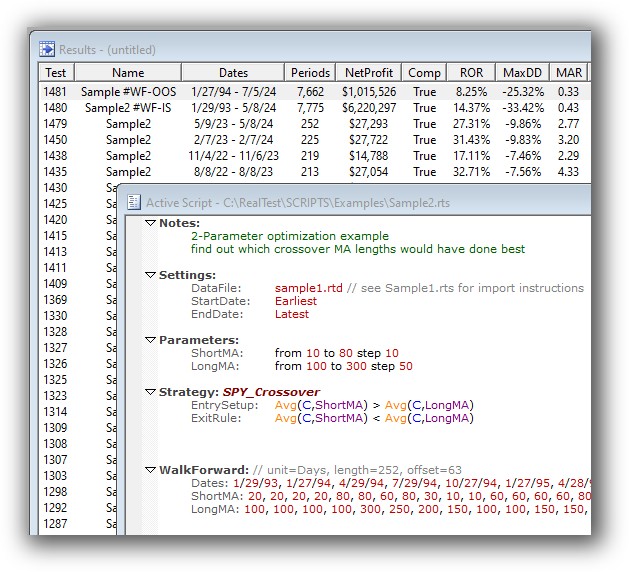

RealTest allows for batch testing, walk-forward analysis, and stress testing with ease. You can adjust parameters and quickly evaluate tradeoffs across a wide array of parameter settings easily.

MT4 has built-in optimization for EAs, but it’s primarily brute-force and not easily usable for stocks or custom datasets. Portfolio-based robustness testing is not a core feature.

You’ll spend more time trying to bend MT4 into shape than actually learning about your system’s robustness.

Check Out: Trading System Optimization

RealTest Walk Forward Testing:

Charting Features, Signal Exploration & Live Execution

Charting: MT4 wins here. Its charting is dynamic, real-time, and packed with indicators. It’s built for visual traders.

RealTest, by contrast, keeps charting minimal by design. Its focus is on rules, testing, and automation – not discretionary decision-making.

Scanning: RealTest can scan and generate signals using its own rules, while MT4 relies on manual scanning or custom EA coding.

Execution: RealTest exports trade orders (e.g. CSV or IBKR format), which you can place manually or automate via external tools.

MT4 has fully integrated execution via brokers – good for automated FX or CFD trading.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

MetaTrader-4 Automation Set Up (Expert Advisor):

Support, Documentation & Learning Resources

RealTest’s documentation is modern, clear, and continuously updated. It’s written with traders in mind – no fluff, no marketing, just practical help.

MT4 documentation is fragmented, dated, and heavily reliant on community forums. Unless you’re comfortable Googling through threads for hours, this can be a bottleneck.

For logical thinkers, clarity matters. RealTest makes it easier to build confidence and trade independently.

RealTest Forum is illustrated down below:

MetaTrader-4 Forum is illustrated down below:

RealTest vs MetaTrader-4: Which One Should You Use?

If your goal is systematic trading of stocks or crypto, with fast backtesting and simple scripting, RealTest is hands-down the better choice.

MT4 still has a role for:

- FX traders who need real-time charting and integrated execution

- Discretionary traders who lean heavily on visual setups

But for data-driven, rule-based, strategy-first traders, MT4 is a frustrating tool to use for system development.

Our Recommendation

At Enlightened Stock Trading, we recommend RealTest to most of our students because it empowers:

- Fast system development

- Realstic backtesting

- Deep confidence through portfolio-level simulation

It’s perfect for analytical minds who want to cut through the noise, test ideas quickly, and spend less time second-guessing and more time compounding.

If you’re stuck in a cycle of inconsistent results, trying to “figure it out” manually – you’re working too hard.

Remember: You’re only one trading system away

Want the Rest of the Puzzle?

Choosing the right backtesting software is a crucial step. But it’s only one part of the journey to becoming a consistent and confident trader.

You also need:

- Complete rule-based systems

- Confidence in your position sizing

- Clear guidance, mentoring, and support

- A method to trade across markets and conditions

That’s exactly what we provide in The Trader Success System

If you’re ready to take control of your trading, stop wasting time, and start building real wealth – check it out now.

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)